-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Chinese Regulatory Burden Worries Remain Evident

EXECUTIVE SUMMARY

- FED'S HARKER FAVOURS TAPERING 'SOONER RATHER THAN LATER' (NIKKEI)

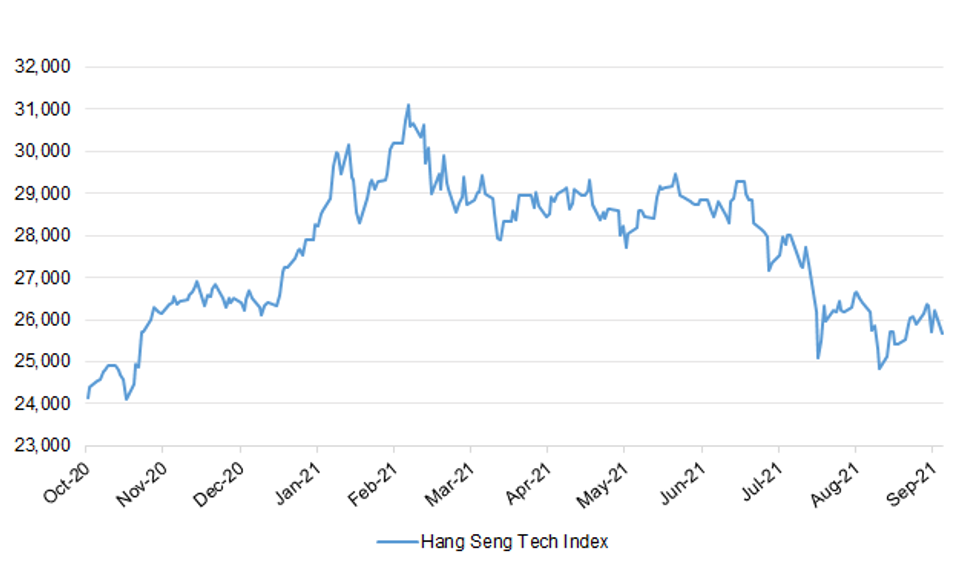

- CHINESE REGULATORY BURDEN CONTINUES TO WEIGH ON TECH NAMES

- UK FISCAL MATTERS AND COVID DEFENCE EYED

- GERMAN ELECTION FRONTRUNNER STANDS FIRM AS MERKEL HEIR STRUGGLES (BBG)

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A scheme for vaccine passports for entry to nightclubs and large events in England will not go ahead, the health secretary has said. Sajid Javid told the BBC: "We shouldn't be doing things for the sake of it." He said the government had looked at the evidence, adding: "I'm pleased to say we will not be going ahead." It was thought the plan, which came under criticism from venues and some MPs, would be introduced at the end of this month. (BBC)

CORONAVIRUS: Downing Street has insisted that vaccine passports are still a "first-line defence" against a winter wave of Covid-19 after the health secretary said plans to introduce them had been scrapped. No 10 said checks on the vaccine status of people going to nightclubs and other crowded events remained a crucial part of the government's winter Covid plan due to be unveiled by the prime minister tomorrow. They will no longer be introduced automatically at the end of this month, however, after pressure from Tory MPs and the hospitality sector. When he outlines options to deal with a potential third wave this winter Boris Johnson is expected to warn that mandatory facemasks could be reintroduced and work from home guidance reinstated. (The Times)

CORONAVIRUS: Double-jabbed travellers will no longer have to take expensive PCR Covid tests when returning to the UK, the Government is poised to announce. Officials are working towards scrapping the requirement for green and amber list countries before the half-term holidays next month, The Mail on Sunday can reveal, providing a huge boost for millions of holidaymakers and the beleaguered travel industry. Travellers will no longer need Covid tests before leaving for Britain, while the unpopular PCR tests currently required on the second day after arrival will be replaced by cheaper lateral flow tests. (Mail On Sunday)

CORONAVIRUS: The prime minister is expected to repeal some powers of the Coronavirus Act as he sets out the government's plan for managing COVID-19 over the autumn and winter. (Sky)

CORONAVIRUS: Plans for Covid vaccinations for 12- to 15-year-olds across the UK are to be announced by the government this week, with a mass inoculation programme beginning in schools within two weeks, the Observer has been told. New proposals for a Covid booster programme are also expected to be set out on Tuesday, but it is thought ministers may be backing away from plans for Covid passports in confined settings such as nightclubs amid opposition from some Tory MPs. (Observer)

CORONAVIRUS: Figures suggest that workers started to return to city centre desks last week, with Pret a Manger hailing a comeback for takeaway sandwiches and coffee. With some firms offering free food and gifts to tempt staff back, one barometer of activity around central London offices recorded an increase of almost 5%. Data experts Springboard said that between Tuesday and Friday, footfall was 4.9% up on the previous week, based on its London office block tracker. Comparisons for the first full week back at work since school holidays ended in England are distorted by the August bank holiday. (Guardian)

FISCAL: Council tax bills will have to rise for millions of households next year to pay for social care despite Boris Johnson's tax raid, ministers fear. This would mean families facing a "double whammy" of tax hikes as the 1.25 percentage point increase in National Insurance is due to come into force at the same time as the council tax rises in April next year. Town halls are likely to need extra cash because most of the money raised from the manifesto-busting increase goes to the NHS over the next three years before being diverted into social care in 2024. Ministers privately believe that average council tax rises of at least five or six percent will be levied next year to help meet the shortfall. (Telegraph)

FISCAL: Sajid Javid said on Sunday there should be no new tax rises before the next election after a grassroots backlash over last week's tax raid. (Telegraph)

FISCAL: The UK chancellor faces a further backlash over tax hikes for the corporate sector, with claims that he is risking business investment and taking the "easy option" of turning to companies to fund higher public spending. Tony Danker, head of the CBI, will say in a speech he is "deeply worried" the government thinks that taxing business will not have any consequences for growth. Meanwhile Lord Nick Macpherson, the most senior official at the Treasury from 2005-2016, agreed that the chancellor was to some extent taking the "easy option" in raising taxes on companies, not individuals. (FT)

FISCAL: Boris Johnson's National Insurance increase could result in the breakdown of families and deter companies from hiring new staff and increasing wages, according to the Government's own analysis. (Telegraph)

BREXIT: Northern Ireland could see "instability, uncertainty and unpredictability" if there is an attempt to renegotiate the post-Brexit agreement, the European Commission's vice president has warned. Maros Sefcovic said the Northern Ireland Protocol must be "properly implemented", but admitted both sides would have to compromise. His warning came after DUP leader Sir Jeffrey Donaldson said his party may quit Stormont if its demands are not met. (Sky)

BREXIT: New border checks on European Union goods entering the UK are on the brink of being delayed for the second time amid concerns they could fuel further disruption for supermarkets and shops in the run-up to Christmas. (Telegraph)

ECONOMY: Up to 660,000 jobs could be at risk if the UK fails to reach its net-zero target as quickly as other nations, the Trade Union Congress (TUC) has warned. The government has pledged to cut carbon emissions by 78% by 2035. But the TUC fears many jobs could be moved offshore to countries offering superior green infrastructure and support for decarbonisation. The union body is calling for an £85bn green recovery package to create 1.2 million green jobs. TUC research from June shows the UK is currently ranked second last among G7 economies for its investment in green infrastructure and jobs. (BBC)

ECONOMY: The U.K. faces "permanent shortages" of popular food and drink items due to a labor shortfall, according to an industry chief. A lack of workers in the food supply chain, in part caused by Brexit and the coronavirus pandemic, means Britons can no longer expect to find whatever they want on supermarket shelves or in restaurants, said Ian Wright, head of the Food and Drink Federation. (BBG)

POLITICS: Boris Johnson's manifesto-busting tax rises this week could cost dozens of Tory MPs their seats at the next general election and reverse the Conservative gains made in Red Wall seats in 2019. A poll for The Telegraph found Mr Johnson has risked swapping a general election landslide, forecast as recently as May, with a hung Parliament after breaching a manifesto pledge and increasing National Insurance to pay for the NHS and social care. The findings came after it emerged that Cabinet ministers were facing a hostile reception from the Tory party's grassroots when they returned to their constituencies this weekend because of the tax hikes. (Telegraph)

POLITICS: Boris Johnson has outlined his vision for a decade in power as colleagues say he wants to be prime minister for longer than Margaret Thatcher. He said he was determined to address the "catastrophic" economic mistakes of the past 40 years and use Brexit to rectify inequalities across the country. Setting out his pitch for the 2024 election for the first time, he said voters would be able to see his "great, great project" of levelling up making progress across Britain. "It's going to take a while, it's going to take ten years," he said. Johnson will frame the next election around Brexit and has warned that Britain would "slump back" into following EU laws and regulations under Labour. (The Times)

HOUSING: The biggest shake-up of planning laws for 70 years is set to be abandoned after a backlash from voters and Tory MPs in southern England. Reforms designed to help ministers hit a target of 300,000 new homes annually by the middle of the decade will be watered down, The Times understands. The government had intended to rip up the planning application process and replace it with a zonal system, stripping homeowners of their rights to object to new houses. It said that councils would also be given mandatory housebuilding targets. Robert Jenrick, the housing secretary, will announce a more limited set of changes. Tory MPs blamed the planning overhaul for their party's shock defeat by the Liberal Democrats at the Chesham & Amersham by-election. (The Times)

SCOTLAND: The Scottish National party's autumn conference has called for a second referendum on independence from the UK to be held as soon as health data show that a "full, normal, and energetic" campaign would be safe. While effectively endorsing the insistence of SNP leader Nicola Sturgeon that a vote must be held only after the coronavirus crisis has passed, the resolution — passed overwhelmingly by delegates to the online meeting — will add to pressure on the Scottish first minister to set out how she will decide when to proceed. "This decision should be determined by data-driven criteria about the clear end to the public health crisis, which would allow a full, normal and energetic referendum campaign," the resolution read. (FT)

EUROPE

CORONAVIRUS: Europe has emerged as the biggest vaccine-producing continent in the world and makes enough doses in less than a month to administer third shots to its population, EU Commissioner Thierry Breton said. Europe "is the world's pharmacy," he said Sunday in an interview on CNews. The region and the U.S. need to do more to get vaccines to Africa, he said, in part because of the importance of heading off new viral variants. Breton cited European initiatives to help Senegal, South Africa and Rwanda to manufacture vaccines. The fight against emerging Covid-19 variants is crucial, he said. (BBG)

EU/FISCAL: The EU will examine whether its debt reduction rule needs to be overhauled given the surge in public debt burdens during the Covid crisis, a senior Brussels policymaker said, as the debate over reform of the union's controversial Stability and Growth Pact begins to intensify. Valdis Dombrovskis, executive vice-president at the European Commission, said the EU would look at concerns that the commission's existing regime was not "realistic" given the big rise in many member states' debt-to-GDP ratios during the Covid-19-induced slump. A forthcoming commission consultation would also look at calls for certain public investments to be granted more favourable treatment under the debt and deficit rules, he said on Saturday. (FT)

EU: Angela Merkel will work to resolve the conflict between Poland and the European Union over the application of the rule of law, the outgoing German chancellor said, addressing a rocky relationship after the neighboring country slipped away from the trading bloc mainstream during her 16-year tenure. "I will try to engage personally in solving the issues", Merkel said in what was probably her last official visit to Warsaw after meeting with Polish Prime Minister Mateusz Morawiecki on Saturday. (BBG)

GERMANY: Finance Minister Olaf Scholz's Social Democrats widened their lead over Germany's conservatives to a record 6 percentage points in a weekly poll, setting the stage for the country's second election debate on Sunday. Support for the Social Democrats increased 1 point to 26% in the Insa poll for Bild am Sonntag, while Chancellor Angela Merkel's Christian Democratic-led bloc stagnated at 20% and the Green party declined 1 point to 15%. (BBG)

GERMANY: Two weeks before Germany goes to the polls in a watershed election, center-left frontrunner Olaf Scholz fended off attacks over his track record as finance minister to consolidate his position as the most likely successor to Chancellor Angela Merkel. Scholz's rival from Merkel's conservative bloc, Armin Laschet, tried to use the second of three televised debates on Sunday night to get back in the race, dredging up controversies involving the Social Democrats' candidate and highlighting a raid last week on the finance ministry. (BBG)

FRANCE: Agnes Buzyn, France's health minister when the global COVID-19 pandemic erupted, was on Friday indicted for "endangering the lives of others". The indictment was handed out by prosecutors of the Court of Justice of the Republic (CJR), as part of their investigations into the handling of the health crisis by the French government. It came hours after she was interviewed by prosecutors. Prior to her interview, she had told reporters that it was "an excellent opportunity for me to explain myself and to set the record straight." (AFP)

GREECE: The Greek government raised its growth estimate for 2021, with the country set to repeat the economic performance not seen in about two decades. (BBG)

SNB: The Swiss National Bank's negative interest rates remain essential to prevent a rise in the franc that thwart economic growth, Vice President Fritz Zurbruegg told Sonntagszeitung in an interview. Although the SNB will raise borrowing costs when necessary, "at the moment we need the negative interest rates due to the situation globally," he said. "If we were to hike interest rates now, the franc would appreciation markedly, economic growth would slow and joblessness would increase." (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Austria at AA+; Outlook Stable

- S&P affirmed Luxembourg at AAA; Outlook Stable

- S&P affirmed Malta at A-; Outlook Stable

- S&P affirmed Portugal at BBB; Outlook Stable

U.S.

FED: Federal Reserve Bank of Philadelphia President and CEO Patrick Harker told Nikkei in an interview that he is supportive of moving toward a tapering process "sooner rather than later." There is no lack of demand in economy but there are supply issues, he says. People are worried about child or elder care and fearful to go back to the workplace. Says monetary accommodation does not affect supply but demand. Once the taper process starts the Fed should let it run between eight to 12 months, he says Harker forecasts interest rates will be raised late 2022 or early 2023. (BBG)

FISCAL: Sen. Joe Manchin on Sunday said he would not vote for the $3.5 trillion budget bill, adding that there's "no way" to meet the September 27 deadline set by Democrats, during an interview on CNN's "State of the Union." "There's no way that we can get this done by the 27th if we do our job," the West Virginia Democrat said. Manchin's comments come as lawmakers work to approve the measure which would invest in climate policy and expand social programs, including child care and health care, without the support of Republicans, who have opposed the proposed tax increases to fund it. (BBG)

FISCAL: House Democrats plan to pass a stopgap spending bill the week of Sept. 20 to wave off the threat of a government shutdown at month's end. Majority Leader Steny Hoyer (D-Md.) privately told Democrats of the plan on Friday, according to sources on the call. Party leaders are eyeing Dec. 10 as a possible end date for a continuing resolution to keep the government open beyond Sept. 30, although the length of that patch has yet to be finalized. (POLITICO)

FISCAL: House Democrats are set to propose raising the corporate tax rate to 26.5%, people familiar with the matter said, among other plans that fall short of President Joe Biden's ambitions in a bid to help improve chances of passing a major social-spending package. Democrats on the House Ways and Means Committee plan to put forward an increase in the business rate that's currently 21%, offering less than the 28% Biden sought, the people said on condition of anonymity because the measures aren't public yet. The top rate on capital gains would rise from 20% to 25%, instead of the 39.6% Biden proposed that would have been equal to a new top rate on regular income, the people said. While the numbers are still subject to change before the proposal is officially released, such scaled-back plans would amount to an acknowledgment that even higher rates would have a tough time getting through Congress. (BBG)

CORONAVIRUS: Top U.S. health officials believe that Pfizer Inc's COVID-19 vaccine could be authorized for children aged 5-11 years old by the end of October, two sources familiar with the situation said on Friday. The timeline is based on the expectation that Pfizer, which developed the shot with Germany's BioNTech, will have enough data from clinical trials to seek emergency use authorization (EUA) for that age group from the U.S. Food and Drug Administration (FDA) towards the end of this month, the sources said. They anticipate the FDA could make a decision on whether the shot is safe and effective in younger children within three weeks of the EUA submission. (RTRS)

CORONAVIRUS: U.S. Solicitor of Labor Seema Nanda held a virtual meeting with the U.S. Chamber of Commerce's chief policy officer and other business lobbyists Friday, seeking to garner their support for an upcoming rule to require vaccinations or vaccine testing at much of the private sector. It was one of at least three briefings the U.S. Labor Department held Friday for union leaders and employer associations, according to people familiar with the calls. (BBG)

CORONAVIRUS: Governor Asa Hutchinson of Arkansas, a strong proponent of the Covid-19 vaccines, said President's Joe Biden's announcement of federal mandates last week only "hardens the resistance" to taking the vaccine. "This is an unprecedented assumption of federal mandate authority that really disrupts and divides the country," the Republican governor said NBC's "Meet the Press. "It increases the division in terms of vaccination when we should all be together trying to increase the vaccination uptake." Nebraska Governor Pete Ricketts, also a Republican, called the mandates "an egregious overreach of federal authority" and said that attorneys general of several states are conferring about legal action. "So many people told me they're just going to be fired if they're forced to take the vaccine," Ricketts said on "Fox News Sunday." "This is really going to create huge problems for all small businesses and for our American workers." (BBG)

CORONAVIRUS: Alabama quietly shifted its rules earlier this summer to require parental consent for anyone younger than 19 to receive the vaccine at state-run clinics in public schools. AL.com reported. Generally, children older than 14 can consent to routine medical treatment, AL.com reported, but the state's Department of Public Health changed the rules after complaints from several legislators that children were being vaccinated without parents' consent. Medical officials were quoted as worrying that the change may further depress the rate of vaccination in Alabama, one of the lowest in the U.S. (BBG)

EQUITIES: Facebook executives have been meeting with senior Biden administration officials in recent weeks as the social media giant tries to assuage concerns about its controversial cryptocurrency project, but the effort is running into some of the same fears from regulators that have plagued it for more than two years. (Washington Post)

OTHER

GLOBAL TRADE: The number of container ships waiting to enter the largest U.S. gateway for transpacific trade swelled to another pandemic record and the average wait jumped to more than eight days, adding delays and costs during peak season for companies to rebuild inventories. (BBG)

GLOBAL TRADE: The U.S. has submitted an initial offer to the European Union to resolve a three-year dispute over steel imported from the bloc, paving the way for a solution by a year-end deadline. (BBG)

GLOBAL TRADE: Huawei has been accused of "infiltrating" a Cambridge University research centre after most of its academics were found to have ties with the Chinese company. Three out of four of the directors at the Cambridge Centre for Chinese Management (CCCM) have ties to the company, and its so-called chief representative is a former senior Huawei vice-president who has been paid by the Chinese government. (The Times)

U.S./CHINA/TAIWAN: The Biden administration is moving towards allowing Taipei to change the name of its representative office in Washington to include the word "Taiwan", a move likely to trigger an angry response from Beijing. Multiple people briefed on internal US discussions said Washington was seriously considering a request from Taiwan to change the name of its mission in the US capital from "Taipei Economic and Cultural Representative Office" (Tecro) to "Taiwan Representative Office". Kurt Campbell, White House Asia adviser, has backed the change, according to two people with knowledge of the discussions. One said the request had wide support inside the National Security Council and from state department Asia officials. (FT)

GEOPOLITICS: Japan's defence ministry said on Sunday that a submarine believed to be from China was spotted in waters near its southern islands, as maritime tensions persist in the Pacific. (RTRS)

CORONAVIRUS: President Joe Biden will announce his next steps to boost the global vaccine supply before this year's United Nations General Assembly begins, U.S. Surgeon General Vivek Murthy said. Biden is weighing a multilateral meeting ahead of the UN leaders' sessions aimed at vaccine supply, and has said he will announce new vaccine measures this month. Murthy told CNN on Sunday that the announcement will precede the UN sessions. "The president will be making announcements ahead of the UN General Assembly about additional measures that we're taking to help vaccinate the world," Murthy said on CNN's "State of the Union." The session at which world leaders address the UN begins on Sept. 21. Biden said on Thursday that he'd make the announcement, though hasn't yet signaled what it will be. (BBG)

CORONAVIRUS: Israel is making preparations to ensure it has sufficient vaccine supply in case a fourth round of Covid-19 shots is needed, the country's top health official said on Sunday. "We don't know when it will happen; I hope very much that it won't be within six months, like this time, and that the third dose will last for longer," Health Ministry Director General Nachman Ash said in an interview with Radio 103FM. (BBG)

JAPAN: Taro Kono continues to lead in public opinion polls about who should succeed PM Suga, according to the latest surveys commissioned by the Nikkei/TV Tokyo and Asahi Shimbun. The Nikkei/TV Tokyo poll conducted on September 9-11 found that 27% of respondents picked Kono as the "right person" to become the next LDP leader and Prime Minister. He outperformed former Defence Minister Shigeru Ishida (17%) and former Foreign Minister Fumio Kishida (14%), while former Internal Affairs Minister Sanae Takaichi ranked fifth with 7%. In the Asahi poll conducted on September 11-12, Kono was chosen by 33% of respondents. Ishiba was the runner-up with 16%, Kishida ranked third with 14%, while Takaichi came fourth with 8%. Kono, Kishida and Takaichi are the only LDP members who have publicly voiced their intention to join the race so far. Earlier press reports suggested that Ishida will likely decide not to run, while Jiji cited sources noting that he will likely back another candidate. Kono was the frontrunner in two other surveys commissioned by Kyodo and Yomiuri a week earlier. His strong performance in opinion polls may be a boon for his bid to become next LDP leader, as the ruling party needs to regain public confidence after a plunge in the approval ratings of PM Suga. Campaigning for the LDP election is due to start this Friday, with the vote count slated for September 29. (MNI)

BOJ: MNI INSIGHT: BOJ Eyes Company Pricing Plans As Lockdowns Ease

- Bank of Japan officials see inflation expectations hinging on price-setting strategies by companies after Covid-19 restrictions ease with a mix of responses by sector likely, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: The delta-strain outbreak centered in Sydney is showing signs of peaking as New South Wales state begins easing some restrictions and remains on track to inoculate more than 70% of its adult population by mid-next month. The state recorded seven deaths and 1,257 new infections overnight, pushing its seven-day moving average of daily cases to the lowest since Wednesday, according to Bloomberg calculations. When 70% of the adult population is inoculated, NSW authorities plan to reopen the state more fully. (BBG)

AUSTRALIA: Australia's airports have raised concerns about the government's travel reopening plans, the Sun-Herald and Sunday Age newspapers reported, warning that insufficient lead time and clarity could lead some international airlines to pull out of the country. The Australian Airport Association has said that some carriers are "already drawing down capacity," according to the newspapers. (BBG)

NEW ZEALAND: New Zealand's largest city Auckland will remain in lockdown to beat the spread of the Delta variant of the coronavirus, Prime Minister Jacinda Ardern said on Monday. Auckland will remain in the strict Alert level 4 lockdown until midnight on Sept. 21, after which it will move to alert level 3, Ardern said in a news conference. (RTRS)

NEW ZEALAND: The latest NZIER Consensus Forecasts show a downward revision to the near-term outlook for the New Zealand economy but an upward revision for the subsequent year. The latest community outbreak of COVID-19 is likely to have driven these revisions, as the recent lockdown reduces economic activity for the coming year. However, the expectation is for a rebound in demand from 2022. There is a wider than usual range of forecasts for the growth outlook, partly reflecting the difference in timing when forecasts were finalised. (NZIER)

SOUTH KOREA: The Bank of Korea said the shutdown of businesses, lower job-market participation and other economic fallout from the pandemic have pushed the country's potential growth rate below its previous estimate. South Korea's potential growth rate for 2021-2022 is estimated at 2%, the central bank said in research note Monday. For 2019-2020, the rate was seen at 2.2%, lower than the 2.5-2.6% estimated in the central bank's 2019 paper. (BBG)

TURKEY: Hundreds of people gathered in Istanbul to protest against the government's vaccination campaign and other measures to contain the coronavirus pandemic, including the requirement to wear face masks in all public areas. Maskless protesters at a square in Maltepe district listened to a number of heated speeches, including that of Abdurrahman Dilipak, a columnist at Islamic news outlet Yeni Akit, and called for the resignation of Turkey's health minister. (BBG)

BRAZIL: Turnout at protests across Brazil against President Jair Bolsonaro on Sunday was far smaller than rallies the president called earlier this week, underscoring that pressure from the streets remains insufficient to drive efforts seeking his impeachment. Many of those protesting dressed all in white, as instructed by political groups that organized the demonstrations in at least 19 states. There was a notable absence of leftist political parties, which diminished turnout. (AP

SOUTH AFRICA: South African President Cyril Ramaphosa eased coronavirus lockdown restrictions in a bid to revive an economy reeling from the effects of the pandemic and a week of deadly riots in July. The move to virus alert level 2 from level 3 comes as the third wave of Covid-19 infections drop and will allow for greater activity in an economy seen contracting in the third quarter because of the unrest. "While the third wave is not yet over, we have seen a sustained decline in infections across the country over the last few weeks," Ramaphosa said Sunday in a televised speech. "With the decline of infections across all provinces, the Ministerial Advisory Committee on Covid-19 has recommended an easing of restrictions." (BBG)

IRAN: The U.N. nuclear watchdog signaled progress in talks with Iranian officials in Tehran over access to the country's expanding program, yet prospects for reviving the crippled atomic deal with world powers remain unclear. Tehran said International Atomic Energy Agency inspectors would be able to replace damaged surveillance cameras and memory cards at atomic sites following a "constructive" meeting with IAEA Director General Rafael Grossi on Sunday. "We managed to rectify the most urgent issue, which was the imminent loss of knowledge," Grossi said at a press briefing following his return to Vienna. "Now we have a solution." (BBG)

IRAN: World powers seeking to renew nuclear talks with Iran must impose sanctions on Tehran to prod it to reach an agreement, Israeli Defense Minister Benny Gantz said on Sunday. (BBG)

MIDDLE EAST: The districts of Rahaba and Mahliyah in the oil-rich province of Marib have been recaptured from government forces, Houthi military spokesman Yahya Saree said in a statement on Saturday. During the offensive Yemen's Iran-backed Houthi rebels said 151 were killed, wounded or captured from the government forces, which were backed by 37 air strikes by Saudi-led coalition fighter jets. The Houthis have been launching a broad offensive since February in a bid to recapture the strategic Marib. Government forces didn't immediately comment. (BBG)

OIL: Royal Dutch Shell Plc is gearing up to restart oil pipelines off the U.S. Gulf Coast, potentially moving the region's top driller one step closer to restoring some production shut by Hurricane Ida. Most of the pipelines will be ready to operate within a week, according to a person familiar with the matter, who asked not to be named because they are not authorized to discuss the plan publicly. Shell declined to comment. The conduits need to be up and running before restoring millions of barrels a day of oil production from offshore platforms that have been offline since Idaheaded for Louisiana last month. But the pipeline restarts don't necessarily mean output will follow. (BBG)

CHINA

POLICY: Beijing wants to break up Alipay, the 1bn plus-user superapp owned by Jack Ma's Ant Group, and create a separate app for the company's highly profitable loans business, in the most visible restructuring yet of the fintech giant. Chinese regulators have already ordered Ant to separate the back end of its two lending businesses, Huabei, which is similar to a traditional credit card, and Jiebei, which makes small unsecured loans, from the rest of its financial offerings and bring in outside shareholders. Now officials want the two businesses to be split into an independent app as well. The plan will also see Ant turn over the user data that underpins its lending decisions to a new credit scoring joint-venture which will be partly state-owned, according to two people familiar with the process. (FT)

POLICY: China's industry ministry has told technology companies including Alibaba Group Ltd and Tencent Holdings Ltd to stop blocking each other's website links from their platforms, the 21st Century Business Herald said Saturday. (RTRS)

POLICY: Beijing should strengthen efforts to control the expansion of technology companies because the development of internet platforms leads to a "winner takes all" dynamic, which increases inequality and slows economic growth, an advisor to China's central bank said. (BBG)

POLICY: China's industry ministry has told technology companies including Alibaba Group Ltd and Tencent Holdings Ltd to stop blocking each other's website links from their platforms, the 21st Century Business Herald said Saturday. (RTRS)

ECONOMY: China's economy may enter a slower-growth phase after the pandemic as the recovery in consumer demand will take time, said Wu Ge, the chief economist of Changjiang Securities and a former researcher at the People's Bank of China in an interview with Yicai.com. As the debt levels of the government and the society at-large continue to rise, the core of the entire economy including interest rates will trend lower, Wu said. China is still implementing countercyclical adjustment measures despite claims otherwise by policymakers, as indicated by increased sales of special-purpose LGBs and high-frequency data on lending, Wu said. China is expected to take more monetary measures as part of its countercyclical adjustment through possibly greater lending, social financing, said Wu. Monetary policy tends to be an overall-scale issue, even as policymakers said they want to target helping small businesses, as stabilizing the economy is the biggest help to SMEs, and only on this basis, can the innovative and targeted injections take effect, said Wu. (MNI)

ECONOMY: China is expected to stimulate a weakening economy by more policy measures to increase investment, demand and support to businesses, Yicai.com said in an analysis of Wednesday's release of August indicators. Industrial output is projected to slow to 5.8% affected by the pandemic, flooding, restricted production and chip shortages, Yicai said citing economists' forecast. Infrastructure investment may disappoint as only CNY488 billion LGBs backed by infrastructure were issued, while CNY664 billion had been anticipated, Yicai said. The policy makers have made the "cross-cycle adjustment" the keyword in H2, including faster credit expansion at the end of last month and greater government-led investments, said the newspaper. (MNI)

PROPERTY: China should increase the "management of expectations" and guidance of the property market so that the planned credit expansion doesn't again flow into the properties market, according to a commentary published by China Securities Journal, written by Dong Ximiao, analyst at Merchants Union Consumer Finance. The central bank had indicated plans to counter a slowdown in lending by pre-issuing loans planned for next year in the second half, which could be misinterpreted by the property market as a shift away from prudence, Dong wrote. Banks should improve support and services for boosting rental properties and partner with local government to develop a healthier housing market, Dong said. (MNI)

CORONAVIRUS: Another 22 cases of Covid-19 were reported in China's Fujian province, where the National Health Commission sent a special team. The new outbreak comes less than a month after China quelled its most widespread resurgence of the coronavirus since the initial Wuhan outbreak. Some 15 of the new cases reported for Sept. 12 were in Putian, where local authorities have already advised residents not to leave the city without good reason such as seeking medical treatment, according to the Xinhua News Agency. Amid the concern, traders pushed down the shares of Hong Kong-listed travel firm Trip.com by as much as 7.7% on Monday, putting it among the worst-performing technology companies. (BBG)

OVERNIGHT DATA

JAPAN Q3 BSI LARGE ALL INDUSTRY +3.3% Q/Q; Q2 -4.7%

JAPAN Q3 BSI LARGE M'FING +7.0% Q/Q; Q2 -1.4%

JAPAN AUG PPI +5.5% Y/Y; MEDIAN +5.6%; JUL +5.6%

JAPAN AUG PPI 0.0% M/M; MEDIAN +0.3%; JUL +1.1%

NEW ZEALAND SEP, P BUSINESS CONFIDENCE -6.8; AUG -14.2

NEW ZEALAND SEP, P ACTIVITY OUTLOOK 18.2; AUG 19.2

The preliminary ANZ Business Outlook data for September saw most forward looking activity indicators hold up well. Business confidence rose and own activity expectations were relatively flat. Employment and investment intentions slipped slightly but remain at solid levels, while expected profitability dipped more meaningfully, with a net 13% of firms expecting lower profits. This partly reflects the fact that cost pressures remain extreme, with a net 82.7% of firms reporting higher costs (versus 85% last month). Capacity utilisation, which normally correlates pretty well with GDP, was remarkably robust, easing only slightly from 19 to 16%. Compared to the same month a year ago, lockdown has of course seen reported activity plummet. But while the 36 point fall is large, it's remarkable that only a net 4% of businesses reported lower activity versus a year ago. This series troughed at -63% in the level 4 lockdown last year. Similarly, a net 14% of firms are still reporting higher employment than a year ago, whereas in April last year a net 31% reported having fewer staff (it eventually troughed in June at -37%). (ANZ)

NEW ZEALAND AUG FOOD PRICE INDEX +0.3% M/M; JUL +1.3%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:23 am local time from the close of 2.1761% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday vs 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4497 MON VS 6.4566

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly lower for a third trading day at 6.4497 on Monday, compared with the 6.4566 set on Friday.

MARKETS

SNAPSHOT: Chinese Regulatory Burden Worries Remain Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 73.85 points at 30308.49

- ASX 200 up 5.373 points at 7412

- Shanghai Comp. up 3.624 points at 3706.734

- JGB 10-Yr future down 2 ticks at 151.80, yield down 0.3bp at 0.045%

- Aussie 10-Yr future down 3.1 ticks at 98.764, yield up 3.1bp at 1.253%

- U.S. 10-Yr future +0-01 at 133-06, yield down 0.85bp at 1.333%

- WTI crude up $0.30 at $70.01, Gold up $3.58 at $1791.13

- USD/JPY up 3 pips at Y109.97

- FED'S HARKER FAVOURS TAPERING 'SOONER RATHER THAN LATER' (NIKKEI)

- CHINESE REGULATORY BURDEN CONTINUES TO WEIGH ON TECH NAMES

- UK FISCAL MATTERS AND COVID DEFENCE EYED

- GERMAN ELECTION FRONTRUNNER STANDS FIRM AS MERKEL HEIR STRUGGLES (BBG)

BOND SUMMARY: Narrow Ranges, Light Support From Chinese Tech Worry

Another regulatory-driven dip in Chinese tech equity listings provided incremental support for the U.S. Tsy space during overnight dealing. T-Notes +0-01+ at 133-06+ into European hours, sticking within the confines of a narrow 0-04 range, while cash Tsys print little changed to ~1.0bp richer on the day, with some very modest flattening in play. Comments from Philadelphia Fed President Harker ('23 voter) re: tapering had no real impact on the space. Monday's broader docket is quite limited when it comes to notable economic releases, so it will be a case of headline/flow watching.

- A muted Tokyo session has seen JGB futures drift away from overnight cheaps, printing -3 last, while cash JGB trade sees the major benchmarks trade little changed to ~1.0bp richer on the day. Headline flow has been light since the Tokyo re-open, with plenty of speculation surrounding the local political sphere continuing to do the rounds. Local PPI data was marginally softer than expected, while the quarterly BSI survey saw an uptick in the large firm metrics.

- Cash ACGBs played catch up to Friday's overnight moves, steepening as a result, while futures stuck to tight ranges, leaving YM +0.8 and XM -3.2 at typing. Semi-government paper headlined A$ issuance, with corporate and SSA deals also noted.

EQUITIES: Chinese Regulatory Worries Hamper Equities Again

The Hang Seng struggled during Monday's Asia-Pac session, shedding ~2.0% as Chinese tech names were pressured in the wake of press reports pointing to another increase in regulatory scrutiny across several sectors. The likes of Tencent and Alibaba were at the fore in the reports. The move managed to provide some very modest pressure for U.S. e-minis, which ticked away from their early highs, while the remainder of the major Asia-Pac indices traded either side of unchanged.

OIL: U.S. Supply Picture Supports Crude

The continued slow restoration of U.S. crude supply in the Gulf of Mexico in the wake of Hurricane Ida supported crude futures in early trade this week, with WTI & Brent adding ~$0.40 to their respective settlement levels as a result. Elsewhere, reports suggested that the oil rich Yemini areas of Rahaba and Mahliyah were retaken by the Houthi group. Positive developments surrounding the IAEA & Iran re: mentoring Iran's centrifuge workshops & uranium mines may have tempered the gains a little, although prospects surrounding the revival of the broader monitoring deal remain unclear. Looking ahead to Monday, OPEC's monthly oil market report will provide some interest for participants.

GOLD: Holding Steady

The defensive tone surrounding the Chinese tech space seemed to provide support for bullion during the first Asia-Pac trading session of the week, although the move has been somewhat limited, with spot continuing to operate within the confines of the recently observed range, leaving an unchanged technical overlay in space. Spot gold last deals a handful of dollars higher on the day, just above $1,790/oz, after an uptick from session lows.

FOREX: Yuan Slips Amid China's Regulatory Action, Oil-Tied FX Edge Higher

An uptick in crude prices lent a modicum of support to high-beta oil-tied FX, in spite of an FT report pointing to China's plans to break up Ant Group's Alipay and comments from PBOC advisor, who signalled the need to prevent monopolies in the tech sector. The loonie led gains in G10 FX space, ahead of NOK, while most major crosses held relatively tight ranges.

- USD/CNH edged higher today, as chatter surrounding China's regulatory actions provided a mild headwind for the yuan. The PBOC set their central USD/CNY mid-point at CNY6.4497, 5 pips shy of sell-side estimate.

- The global data docket is fairly empty today, while central bank speaker slate features Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Sep13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1975-85(E1.1bln)

- AUD/USD: $0.7350-60(A$629mln)

- NZD/USD: $0.6990-10(N$697mln), $0.7088(N$705mln)

- USD/CNY: Cny6.4500($580mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.