-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Another Soft Batch Of Chinese Economic Data

EXECUTIVE SUMMARY

- JOE BIDEN'S SUGGESTION OF SUMMIT WITH XI JINPING FALLS ON DEAF EARS (FT)

- CHINESE ECONOMIC ACTIVITY DATA MISSES EXPECTATIONS

- CHINA ROLLS OVER CNY600BN OF MATURING MLF

- CHINA TO ROLL OUT TARGETED SUPPORT FOR SMALL EXPORTERS (CSJ)

- CHINA BROKERS DROP YUAN FORECASTS TO AVOID REGULATORS' IRE (RTRS)

- FRYDENBERG INDICATES POST-ELECTION RBA REVIEW (AFR)

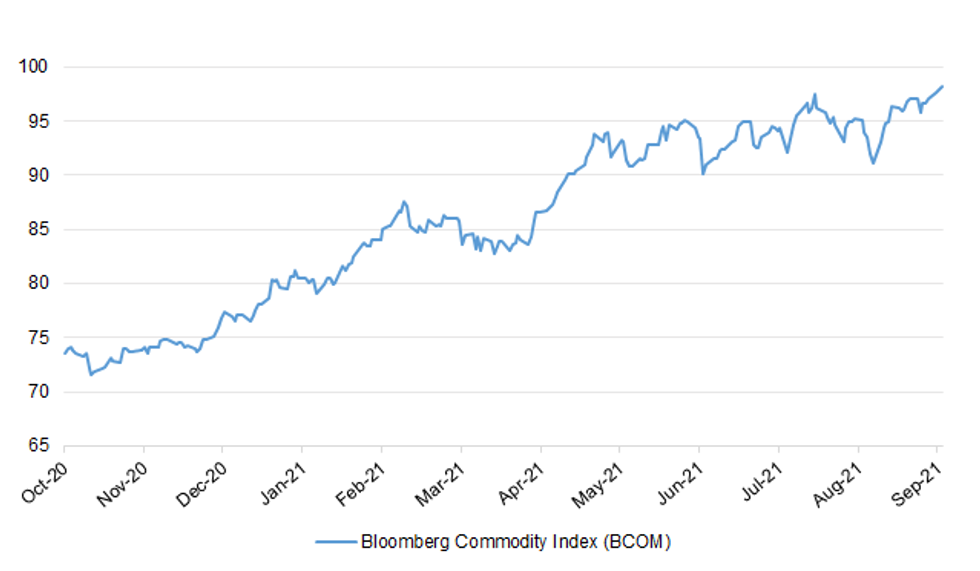

Fig. 1: Bloomberg Commodity Index (BCOM)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson should "go hard and go early" with coronavirus restrictions this winter if there is a surge in cases, the chief scientific adviser has said. Sir Patrick Vallance said that the UK was at a "pivot" and warned that ministers would need to change course rapidly if cases rose quickly this winter. The prime minister has published his coronavirus plan for autumn and winter setting out his "Plan B" to protect the NHS. It includes mandatory vaccine passports, compulsory facemasks and advice that people should work from home. Speaking at a Downing Street press conference, Vallance said: "Things are flattish at the moment — if they go up quickly then you've got to go early in terms of getting on top of it. (The Times)

FISCAL: Boris Johnson's £12bn tax increase to pay for health and social care has cleared the Commons. MPs voted 307 to 251, a majority of 56, to approve the Health and Social Care Levy Bill. Ten Conservatives rebelled to oppose the legislation: John Baron (Basildon and Billericay), Christopher Chope (Christchurch), Philip Davies (Shipley), Dehenna Davison (Bishop Auckland), Richard Drax (South Dorset), Ben Everitt (Milton Keynes North), Marcus Fysh (Yeovil), Craig Mackinlay (South Thanet), Esther McVey (Tatton), and John Redwood (Wokingham). (Sky)

FISCAL: Rishi Sunak has been urged not to begin preparations to move the 200-year-old dates governing the tax year until at least 2023 over fears that the move would cost billions of pounds and cause an IT meltdown. The Office of Tax Simplification (OTS), an advisory group, argued that the last day of the tax year on April 5 should be moved either to March 31 or to December 31, but not for at least two years for fear of clashing with other big government IT projects. (The Times)

BOE: MNI INSIGHT: Rate Squeeze Would Limit BOE Bond Runoff

- The Bank of England's balance sheet is likely to stay elevated for the foreseeable future, as emerging details of its newly-modified tightening strategy indicate that reductions of its stock of gilts may have to stop at a hard-to-determine point when the drain on central bank reserves starts to push market interest rates uncomfortably high, MNI understands.

BREXIT: Boris Johnson's government has been forced to delay imposing checks on EU goods entering the UK until mid-2022 as it attempts to stop Brexit further exacerbating supply chain problems. The move means British exports to the EU are subject to full checks, while imports into the UK by European competitors are mostly free of paperwork and border controls. "It's ironic," said one EU diplomat. "They talked about taking back control, but they are letting products into Britain without any controls at all. That's fine with us." (FT)

BREXIT: Bank of England Governor Andrew Bailey issued a fresh broadside over the European Union's post-Brexit plans on clearinghouses, warning any upheaval risked a "real threat" to financial stability. Speaking in a pre-recorded interview for a Bloomberg conference examining London's future as a financial center, Bailey urged the EU to decide sooner rather than later whether the city's dominant clearinghouses can take business from clients inside the bloc, ahead of a temporary waiver lapsing in June 2022. (BBG)

ECONOMY: The prime minister has put Michael Gove in charge of "fixing" Britain's food supply chains, quipping that he "doesn't want to have to cancel Christmas again". Industry leaders have warned that consumers should prepare for permanent shortages in supermarkets because of a lack of lorry drivers and food-processing workers, which disrupts "just-in-time" supply chains. Archie Norman, the chairman of Marks and Spencer, told LBC this week that supermarkets were facing a "perfect storm", adding it was going to be a "bumpy ride" before Christmas. Boris Johnson has appointed Gove, Cabinet Office minister, to lead a cross-governmental group to rapidly increase the number of HGV drivers and work with food suppliers. The National Economic Recovery Taskforce (Logistics), will co-ordinate government departments responsible for the food chain. (The Times)

POLITICS: The traditional "first past the post" voting system is to be restored for all elections in England, The Telegraph can disclose, to make metro mayors, police and crime commissioners more accountable to their voters. (Telegraph)

M&A: Rishi Sunak has given his blessing to a multibillion-pound trend that has seen foreign private equity firms snap up British businesses, describing the buying spree as "good news" for the economy. The chancellor was speaking at the launch of Treasury Connect, an event intended to bring together fast-growing tech businesses with investors and politicians to spur innovation in areas such as fintech and life sciences. Addressing a trend in which overseas buyers target UK firms, with supermarket Morrisons set to be the latest to fall, Sunak said: "We've always been an economy that benefits from investment in it. "I would view it as a sign of confidence in the UK. It's good news for our economy." (Guardian)

EUROPE

ITALY: The Italian government is planning to use public funds to reduce the impact of surging gas prices on consumers' electricity bills, according to people familiar with the matter. Prime Minister Mario Draghi's administration has already spent about 1.2 billion euros ($1.4 billion) to mitigate the spike in power prices in the second quarter and is set to continue using the same mechanism, the people said, asking not to be identified discussing private conversations. That intervention cut the increase in electricity prices to 9% compared with 20% before the state stepped in. (BBG)

NETHERLANDS: The Dutch government on Tuesday announced they are easing COVID-19 restrictions and will introduce a "corona" pass showing proof of vaccination to go to bars, restaurants, clubs or cultural events. (RTRS)

U.S.

FISCAL: White House economic adviser Brian Deese said House Democrats had made "major progress" with their efforts to increase taxes on corporations and the wealthy to offset the cost of President Joe Biden's domestic agenda -- despite the proposal falling short of some measures originally proposed by the administration. The package offered by Democrats on the Ways and Means Committee is "not everything that the president called for, but gets at the core issues we face in our tax code," Deese said Tuesday during an interview on Bloomberg Television's "What'd You Miss." "I think we're seeing major progress over the last couple of days in bringing forward the tax reform agenda that the president outlined earlier this year," Deese said. (BBG)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) on Tuesday said that Republicans will vote in unison to defeat any government funding bill that would also raise the nation's debt ceiling. "Republicans are united in opposition to raising the debt ceiling," McConnell declared when asked after a GOP conference meeting whether any Republicans would vote for a funding stopgap that expands the federal government's borrowing authority, which is expected to be exhausted in October. McConnell explained that Republicans oppose raising the debt ceiling "not because it doesn't need to be done" but because doing so would pave the way for Democrats to pass a $3.5 trillion human infrastructure bill that would undo much of former President Trump's 2017 tax cut. (The Hill)

FISCAL: Senate Majority Leader Chuck Schumer urged the U.S. business community on Tuesday to start weighing in on the dangers of not raising the debt ceiling to avoid a government default. "This is risky business and dangerous business" that Senate Republicans are engaging in, Schumer, a Democrat, told reporters at the Capitol. (RTRS)

CORONAVIRUS: Pfizer said it expected to apply in November for US authorisation of its Covid-19 vaccine for children aged between six months and five years old as it races to expand eligibility for the jab. The vaccine, developed in partnership with BioNTech, was the first to be authorised for use in children aged 12 and over, and Pfizer had already said it planned to apply for a green light from the US Food and Drug Administration for children aged between five and 11 years old in early October. On Tuesday, Pfizer offered the first glimpse of its intended timeline for authorisation of the jab in infants as young as six months old. Frank D'Amelio, chief financial officer, told an industry conference the company hoped to "go file" for this age group in November. (FT)

CORONAVIRUS: The Department of Health and Human Services has changed how it is allocating an in-demand Covid-19 treatment, as the delta variant stokes a surge in infections and hospitalizations. Hospitals and other care providers will no longer be able to order their own supply of monoclonal antibody therapies, according to a Sept. 13 update posted on the HHS website. Instead, the federal government will determine how much of the drugs to ship to each state and territory based on Covid-19 case numbers and use of the treatments locally. (BBG)

CORONAVIRUS: Ohio Governor Mike DeWine said he'd impose a mask mandate in schools in response to a 2,000% increase in coronavirus cases among school-aged children since early August and hospitals getting overwhelmed, but the state legislature -- controlled by his Republican colleagues -- would just repeal it. DeWine pleaded with state schools to require masks for students and staff at a press conference on Tuesday with members of the Ohio Children's Hospital Association, saying the data is clear there's a higher level of Covid-19 in the almost half of school districts that don't require masks. "If I could put on a statewide mandate, if the health department could do it, we would do it," he said. (BBG)

TSYS: MNI BRIEF: SEC's Gensler Considering Treasury Central Clearing

- Central clearing of the USD22 trillion Treasury market is one option for reform following last year's dash for cash, SEC Chair Gary Gensler told Senators at a Tuesday hearing. "We will seek to consider some of the recommendations that external groups, like the Group of Thirty and Inter-Agency Working Group for Treasury Market Surveillance, have offered around potential central clearing for both cash and repo Treasuries," he said. "I would hope we can bring more resilience through central clearing in that market and also bringing the principal trading firms, the high-frequency trading firms into that remit."

POLITICS: California Gov. Gavin Newsom has easily defeated a recall effort led by Republicans and fueled by frustrations over his handling of the Covid-19 pandemic, according to a vote projection by the Associated Press. With 59% of the state's precinct's partially reporting, 66.8% of California voters chose to keep the Democrat in office and 33.2% opted to remove him. (WSJ)

EQUITIES: Apple unveiled the latest smartphone model, the iPhone 13, as well as a new watch and iPad on Tuesday. (CNBC)

EQUITIES: Microsoft Corp. on Tuesday announced that its board of directors declared a quarterly dividend of $0.62 per share, reflecting a 6 cent or 11% increase over the previous quarter's dividend. The dividend is payable Dec. 9, 2021, to shareholders of record on Nov. 18, 2021. The ex-dividend date will be Nov. 17, 2021. The board of directors also approved a new share repurchase program. authorizing up to $60 billion in share repurchases. The new share repurchase program, which has no expiration date, may be terminated at any time. (PR Newswire)

OTHER

GLOBAL TRADE: Chinese telecommunications giant Huawei said it is expanding its team of scientists even as the company has lost revenue in the wake of U.S. sanctions. It's a bet that doubling down on research can help China build up its own technologies, now that the U.S. under President Joe Biden's administration is bent on competing with Beijing and kept restrictions on the Chinese company's access to semiconductor technology from the U.S. Huawei CEO Ren Zhengfei claimed at an internal meeting in early August that the company has paid its expanding workforce on time, despite pressure from the U.S., according to materials released Wednesday. Many Chinese companies often defer pay for employees, or force resignations without compensation packages. (CNBC)

GLOBAL TRADE: Mismatch in supply and demand for goods will continue as Covid outbreaks constrain manufacturing capacity and ability to ship products, UPS International President Scott Price says in a Bloomberg TV interview. Inventory is stressed by manufacturing shutdowns in Asia ahead of peak holiday season as countries deal with Covid. "It's going to be a challenging season and I think ordering early would be wise." (BBG)

U.S./CHINA: Joe Biden suggested he hold a face-to-face summit with Chinese president Xi Jinping during a 90-minute call last week but failed to secure an agreement from his counterpart, leading some US officials to conclude that Beijing is continuing to play hardball with Washington. The US president proposed to Xi that the leaders hold the summit in an effort to break an impasse in US-China relations, but multiple people briefed on the call said the Chinese leader did not take him up on the offer and instead insisted Washington adopt a less strident tone towards Beijing. (FT)

UK/CHINA: The UK parliament's two Speakers have banned the Chinese ambassador from attending a reception in the Houses of Parliament in a move that risks further damaging ties between London and Beijing. Sir Lindsay Hoyle, the Speaker of the Commons, and Lord John McFall, the Lord Speaker in the upper house, both said they were preventing Zheng Zeguang from entering parliament amid wider outrage over human rights abuses in China. The announcement comes as Sino-UK relations remain frosty over British concerns that range from the persecution of Uyghur Muslims and surveillance to Beijing's crackdown in Hong Kong. Zheng had been due to give an address to the All-Party Parliamentary Group (APPG) for China at 7pm on Wednesday at the Terrace Pavilion, a glamorous venue looking out on to the river Thames. (FT)

CORONAVIRUS: Roche Holding AG sees a high likelihood that Covid-19 will become seasonal and endemic, with 200 million to 500 million new infections each year. The disease probably won't become another "common cold," Barry Clinch, global head of infectious disease clinical development for the Swiss drug giant, said on a conference call with analysts. Roche will keep working on Covid treatments and diagnostics because it believes there will be a need for them, he said. The virus will "become easier to manage over time" but will "still need management," Clinch said. An optimistic scenario where cases plummet is less likely, as is a pessimistic one where constant mutations make the disease unpredictable, he said.

CORONAVIRUS: World Health Organization officials called again for wealthy nations to stop distributing Covid vaccine booster doses in hopes of making more doses available for poorer countries with lagging immunization rates. The WHO lacks sufficient scientific data to condone the widespread use of boosters, Director-General Tedros Adhanom Ghebreyesus said at a press briefing Tuesday. The organization has worked to address vaccine inequities since last winter, asking world leaders Sept. 8 to impose a moratorium on third doses through the end of the year to redirect surplus vaccines to low-income nations. World Health Organization officials called again for wealthy nations to stop distributing Covid vaccine booster doses in hopes of making more doses available for poorer countries with lagging immunization rates. (CNBC)

JAPAN: Japanese source reports suggest that at least five out of seven major factions in the ruling Liberal Democratic Party will allow their members to vote according to their own preferences in the upcoming election of party president. Sources told Jiji that the Hosoda faction, the largest faction in the party, convened yesterday and decided to allow a conscience vote. Yomiuri suggested that faction chairman Hosoda leaned towards supporting Sanae Takaichi and Fumio Kishida. Former PM Abe, who wields considerable influence over the group, supports Takaichi, who does not belong to any faction. The second-largest Aso faction holds a general meeting on Thursday and is set to "basically support" Taro Kono and Fumio Kishida, as per a Yomiuri report. They will resign from faction discipline, even as Kono is a member of the group. The Takeshita, Nikai and Ishihara factions also have their general meetings slated for Thursday and are expected to inform their members that they will be free to vote according to personal preferences. The Ishiba faction gathers today, with their leader poised to confirm that he will not run in the election. A number of source reports noted that Ishiba may declare his support for Kono, but the position of his faction will be hammered out today. According to a Jiji report circulated this morning, support from Ishiba could drive a wedge between Kono and the influential Abe/Aso duo. Ishiba has been known as a rare outspoken critic of the Abe administration. Unsurprisingly, the Kishida faction decided to rally behind their leader, according to the aforementioned Yomiuri piece. The campaign for LDP leadership election formally starts this Friday. (MNI)

JAPAN: Jiji reports that the Tanigaki group within LDP has backed Fumio Kishida in the LDP leadership race but allowed its members to vote for other candidates if they so wish. The Tanigaki group is a minor faction originally led by Sadakazu Tanigaki, who was LDP President before Shinzo Abe and retired from politics in 2016 due to serious injury. Former Defence Minister Gen Nakatani of the Tanigaki group said last week that he would support Kishida would seek to persuade his faction colleagues to follow suit. The group consists of around 20 lawmakers, although some of them belong to other groups as well. (MNI)

RBA: Treasurer Josh Frydenberg is open to an independent review of the Reserve Bank of Australia, following calls from the OECD for a probe into why the bank has consistently failed to meet its economic targets. Such a review would include looking at the key lessons from the COVID-19 crisis, implications for interest rates being stuck at historic lows of 0.1 per cent, the bank's inflation target, and its board structure and transparency. The Australian Financial Review understands Mr Frydenberg is seriously considering a review, but any such move would not be announced until after the federal election, due later this year or early the next year. (Australian Financial Review)

AUSTRALIA: Qantas has confirmed with Yahoo Finance the exact dates when it expects Australians will be able to travel to popular destinations in the US, UK, Asia and more. Qantas has scheduled flights to London, Los Angeles, Vancouver, and Singapore to commence from 18 December, a spokesperson revealed to Yahoo Finance. (Yahoo Finance)

AUSTRALIA/NEW ZEALAND: Australia said all flights to be classified as Red Zone flights until this time, according to a statement. A further review of the travel arrangements will be undertaken on Sept. 21; All passengers on flights originating from New Zealand will need to go into 14 days of supervised hotel quarantine on arrival in Australia. (BBG)

NORTH KOREA: North Korea has fired two ballistic missiles into the East Sea, South Korea's Joint Chiefs of Staff (JCS) confirmed, according to Yonhap News. The JCS had earlier announced that an unidentified projectile had been fired. The Japanese Coast Guard also reported an object was fired, and that it may have been a ballistic missile. Ballistic missile tests contravene UN resolutions designed to curb the North's nuclear activities. South Korea and Japan gave no further details. (BBC)

TURKEY: Turkey central bank raises reserve requirement ratios for foreign currency deposits by 200 basis points, according to decree published in Official Gazette. Reserve requirement ratio for FX deposits/participation funds up to one year maturity raised to 23% from 21%, ratio for those with one year or longer maturity raised to 17% from 15%. Reserve requirement ratio for precious metal depo accounts up to one year maturity raised to 24% from 22%, ratio for those with one year or longer maturity raised to 20% from 18%. The changes will go into force as of Sept. 17. (BBG)

BRAZIL: Brazil's FX balance should be between 3.80-4.20 reais per USD, Economy Minister Pasulo Guedes said, adding that political noise prevents the rate normalization, O Globo newspaper reports, citing his speech during the BTG Pactual event. Guedes cited the crisis between different branches of power as an example of the ongoing political noise. (BBG)

BRAZIL: Brazil's income tax reform bill will be significantly modified by Senators, O Estado of S. Paulo newspaper reported citing people close to the Senate head Rodrigo Pacheco. Pacheco aims for a more mature reform that encompasses controversial themes discussed by senators. Text will not go straight to the Senate floor, unlike what happened at the lower house. The bill will first be analyzed by the Justice and Security Committee, according to the media outlet. (BBG)

BRAZIL: Brazil's Congress concluded the proceedings concerning the decree that limits the removal of content posted on social media after the proposal was sent back to the govt, Senate President Rodrigo Pacheco said in a speech. Decree creates considerable legal uncertainty for agents. The Brazilian Lawyers Association and the General Prosecutors Office were against the measure, Pacheco added. Congress is already discussing analytical and deliberative efforts on a project linked to internet transparency. (BBG)

BRAZIL: Brazil's right-wing political parties DEM and PSL plan to merge and create the largest lower house caucus with 81 members, Estado of São Paulo newspaper reported without citing how it obtained the information. The parties' idea is to use the structure to attract a presidential candidate in 2022 to compete with President Jair Bolsonaro and former President Luiz Inacio Lula da Silva. The new party, which still has no defined name, would have most money from electoral fund. The two parties aim to submit plan to define a merger by the end of the month, but there's still resistance among DEM members. (BBG)

IRAN: Iran's top international negotiator, Abbas Araghchi, has been replaced by a hard-line critic of the 2015 nuclear deal as world powers press Tehran and Washington to quickly revive the ailing accord after months of stalled talks. Ali Bagheri Kani will take over from Araghchi as deputy foreign minister for political affairs effective immediately, following a reshuffle announced by the Ministry of Foreign Affairs in a statement Tuesday. Araghchi will be retained as an adviser to Foreign Minister Hossein Amirabdollahian. It's unclear whether Bagheri Kani will also assume Araghchi's more critical role of chief negotiator in efforts to revive the nuclear accord, which were put on hold after the election of President Ebrahim Raisi in June. (BBG)

MARKETS: Citigroup Inc. Chief Financial Officer Mark Mason said third-quarter trading will probably decline by a percentage in the low to mid teens from a year earlier. The forecast for revenue from trading stocks and fixed-income products compares with the 15% slide analysts in a Bloomberg survey had been expecting. The bank is seeing bright spots in equities, especially within its prime business, Chief Financial Officer Mark Mason said at a conference hosted by Barclays Plc Tuesday. Wall Street's biggest trading floors have been contending with a sharp drop in volatility in recent months that has hampered activity across asset classes. This quarter's results also pale in comparison to the same period in 2020, when markets were rocked by the onslaught of the coronavirus pandemic. (BBG)

OIL: More than 39% of the U.S. Gulf of Mexico's production of crude and natural gas remained shut on Tuesday, the regulator Bureau of Safety and Environmental Enforcement (BSEE) said. Nicholas made landfall in Texas on Monday and was to reach Louisiana on Wednesday, bringing more floods and heavy rains to the Gulf's oil facilities. (RTRS)

OIL: The gasoline-producing fluidic catalytic cracker (FCC) is expected to remain shut until the end of September at TotalEnergies SE's 225,500-barrel-per-day (bpd) Port Arthur, Texas, refinery, said sources familiar with plant operations. Most units at the refinery remain shut following an unplanned plantwide outage on Thursday, one day before the large crude distillation unit (CDU) and coker were scheduled to shut for a planned overhaul, the sources said. The overhaul began over the weekend. (RTRS)

CHINA

ECONOMY: China is set to roll out targeted support for small exporters. The measures will aim at supporting small and medium-sized exporters to weather uncertainties in oversea demand and global economic recovery, China Securities Journal reports, citing vice commerce minister Ren Hongbin. Uncertainties of global trade also stem from supply chain risks such as chip shortage, Ren said. Small exporters are also struggling with rising raw materials and freight costs, which in some cases have even exceeded the value of goods to be shipped, Ren said. (BBG)

ECONOMY: China's growth in exports may begin to cool in Q3, adding pressure to a slowing economy, as western countries' demand has likely peaked and that last year's base of comparison was higher than in the first half, wrote Wu Ge, the chief economist at Changjiang Securities and a former PBOC official, in an article on Yicai.com. Global manufacturing PMI is weakening after a rapid recovery and consumption and real estate investment in the U.S. have started to decline from a previous peak, said Wu. The consumer demand in western developed countries has shifted to services from consumer goods, Wu said. (MNI)

YUAN: Brokerages in China have dropped detailed currency forecasts from their research notes, or have restricted access to them, underlining the growing sensitivity in the financial sector to a regulatory clampdown on speculative investment. (RTRS)

POLICY: China's leaders have repeatedly expressed its "unwavering support" for the development of private businesses and it may be wrong to assume that recent changes in market regulations indicated an anti-business policy shift, the 21st Century Business Herald said in a commentary. Policymakers are trying to create a fairer competition environment as the economy matures and as external markets also change, which result in production overcapacity, so business owners should improve corporate governance, seek innovation and boost competitiveness, said the newspaper, referring to the government crackdowns on properties, tutoring and online businesses. The government should also apply quantifiable rules and avoid leaving the market room for misunderstanding, said the newspaper. (MNI)

BONDS: Chinese investors will soon have a new channel to purchase debt overseas, the nation's latest effort to further open its tightly controlled capital flows. China will launch the Southbound Bond Connect program in Hong Kong on Sept. 24, according to industry participants who were informed of the plan and who asked not to be identified as they were not authorized to speak publicly. The official announcement could come as early as Wednesday, the people said. The People's Bank of China declined to comment when contacted by Bloomberg on Wednesday. (BBG)

CREDIT: Numerous sectors could be exposed to heightened credit risk if Chinese property developer Evergrande were to default, says Fitch Ratings. We believe a default would reinforce credit polarisation among homebuilders and could result in headwinds for some smaller banks, although we believe the overall impact on the banking sector would be manageable. (Fitch)

OVERNIGHT DATA

CHINA AUG INDUSTRIAL OUTPUT +5.3% Y/Y; MEDIAN +5.8%; JUL +6.4%

CHINA AUG INDUSTRIAL OUTPUT YTD +13.1% Y/Y; MEDIAN +13.5%; JUL +14.4%

CHINA AUG RETAIL SALES +2.5% Y/Y; MEDIAN +7.0%; JUL +8.5%

CHINA AUG RETAIL SALES YTD +18.1% Y/Y; MEDIAN +18.9%; JUL +20.7%

CHINA AUG FIXED ASSETS EX RURAL YTD +8.9% Y/Y; MEDIAN +9.0%; JUL +10.3%

CHINA AUG PROPERTY INVESTMENT YTD +10.9% Y/Y; MEDIAN +11.3%; JUL +12.7%

CHINA AUG UNEMPLOYMENT 5.1%; MEDIAN 5.1%; JUL 5.1%

CHINA AUG NEW HOME PRICES +0.16% M/M; JUL +0.30%

JAPAN JUL CORE MACHINE ORDERS +11.1% Y/Y; MEDIAN +14.8%; JUN +18.6%

JAPAN JUL CORE MACHINE ORDERS +0.9% M/M; MEDIAN +2.5%; JUN -1.5%

JAPAN JUL TERTIARY INDUSTRY INDEX -0.6% M/M; MEDIAN +0.3%; JUN +2.2%

AUSTRALIA SEP WESTPAC CONSUMER CONFIDENCE INDEX 106.2; AUG 104.1

AUSTRALIA SEP WESTPAC CONSUMER CONFIDENCE +2.0% M/M; AUG -4.4%

The resilience of consumer sentiment in a period when Australia's two major cities have been locked down and the economy has been contracting is truly remarkable. The Index is still comfortably above the reads seen over the five years prior to the pandemic and is only 0.9% below its June print just prior to Sydney's move into lock-down. Indeed, the latest month has seen confidence in NSW lift 5.3% to 106.4 while confidence in Victoria held steady at 104.1 despite the state moving back into another extended lock-down since early August. Reads above 100 mean optimists comfortably exceed pessimists in both states. Sentiment also posted a strong 8.4% gain to 111.6 in Queensland, after the state moved out of its most recent lock-down in late August. The improving vaccine situation appears to be a key factor behind these results. (Westpac)

NEW ZEALAND Q2 BOP CURRENT ACCOUNT BALANCE -NZ$1.396BN; MEDIAN -NZ$1.750BN; Q1 -NZ$3.189BN

NEW ZEALAND Q2 CURRENT ACCOUNT GDP RATIO YTD -3.3%; MEDIAN -3.3%; Q1 -2.5%

SOUTH KOREA AUG UNEMPLOYMENT 2.8%; MEDIAN 3.5%; JUL 3.3%

CHINA MARKETS

PBOC INJECTS CNY10BN REVERSE REPO AND CNY600BN 1Y MLF WEDS

The People's Bank of China (PBOC) conducted CNY600 billion through one-year medium-term lending facility (MLF) and CNY10 billion via 7-day reverse repos with the rate unchanged at 2.95% and 2.20% respectively on Wednesday. The operation left liquidity unchanged given it netted off the equivalent reverse repos and MLF maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2097% at 09:25 am local time from the close of 2.2884% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Tuesday vs 54 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4492 WEDS VS 6.4500

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4492 on Wednesday, compared with the 6.4500 set on Tuesday.

MARKETS

SNAPSHOT: Another Soft Batch Of Chinese Economic Data

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 124.72 points at 30537.9

- ASX 200 down 9.196 points at 7427.9

- Shanghai Comp. up 11.262 points at 3673.864

- JGB 10-Yr future up 11 ticks at 151.85, yield down 1.5bp at 0.036%

- Aussie 10-Yr future up 4.3 ticks at 98.762, yield down 4.1bp at 1.212%

- U.S. 10-Yr future -0-02+ at 133-17, yield up 0.17bp at 1.285%

- WTI crude up $0.43 at $70.89, Gold down $1.07 at $1803.42

- USD/JPY down 7 pips at Y109.62

- JOE BIDEN'S SUGGESTION OF SUMMIT WITH XI JINPING FALLS ON DEAF EARS (FT)

- CHINESE ECONOMIC ACTIVITY DATA MISSES EXPECTATIONS

- CHINA ROLLS OVER CNY600BN OF MATURING MLF

- CHINA TO ROLL OUT TARGETED SUPPORT FOR SMALL EXPORTERS (CSJ)

- CHINA BROKERS DROP YUAN FORECASTS TO AVOID REGULATORS' IRE (RTRS)

- FRYDENBERG INDICATES POST-ELECTION RBA REVIEW (AFR)

BOND SUMMARY: Mixed Performance For Core FI In Asia, Tsys Lagged

Tsys looked through an FT report which noted that U.S. President "Biden suggested he hold a face-to-face summit with Chinese president Xi Jinping during a 90-minute call last week but failed to secure an agreement from his counterpart, leading some US officials to conclude that Beijing is continuing to play hardball with Washington." Meanwhile, softer than expected Chinese economic activity data provided a very modest bid which didn't last. That left T-Notes within the confines of a narrow 0-03 range overnight, last -0-02+ at 133-17, while cash Tsys are virtually unchanged across the curve. An FV/WN block flattener (-9,409 FV vs. +1,362 WN) headlined on the flow side in Asia. NY trade will see the release of lower tier data, headlined by the Empire manufacturing and industrial production readings.

- JGB futures sit 10 ticks higher on the day, aided by softer offer/cover ratios in the latest round of BoJ Rinban operations covering 1- to 10-Year JGBs. Cash JGBs sit little changed to ~1.5bp richer across the curve, with the 3- to 10-Year zone outperforming, aided by the Rinban ops, while the longer end was a little more subdued ahead of tomorrow's 20-Year JGB supply. Local news flow remains centred on the political space. Elsewhere, headlines pointed to the potential for a multi-tranche round of corporate supply from Softbank.

- Most of the early bid in the ACGB space held with little in the way of outright explanations offered/observed re: the move higher. YM +2.2, XM +4.0, while the longer end of the cash ACGB curve has firmed by ~4.5bp. On the re-opening front, a Yahoo Finance interview has confirmed that "Qantas has scheduled flights to London, Los Angeles, Vancouver, and Singapore to commence from 18 December." This is in line with rough timelines that had been outlined previously, resulting in no tangible market impact. We also saw Treasurer Frydenberg point to the potential for an RBA review post-election after such suggestions were made by the OECD.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.325tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Major Regional Indices Tick Lower In Asia, E-Minis Little Changed

The Hang Seng provided the focal point of Asia-Pac trade yet again, with Macau's increased supervision over gambling companies weighing on the casino sector, deflecting some of the focus from the headwinds that the tech space is currently facing. Softer than expected Chinese economic activity data for the month of August didn't help broader risk sentiment, with e-minis giving back the bulk of their early gains, while the major Asia-Pac indices trade up to 1% softer on the day, with the Hang Seng leading the way lower. Note that U.S. tech giant Microsoft announced a stock buyback plan which could reach $60bn in size. The company also increased the size of its regular dividend at the same time.

OIL: API Aids The Bid In Asia, Outweighing Soft Chinese Economic Data

WTI & Brent have added ~$0.50 vs. settlement levels, aided by the larger than expected drawdowns in headline crude, gasoline & distillate inventories in the latest round of weekly API estimates, which were supplemented by a drawdown in stocks at the Cushing hub. A softer than expected round of Chinese economic data provided some headwinds for crude in Asia-Pac hours, resulting in fresh sessions lows, before a relatively swift bounce played out.

- This comes after crude finished at virtually unchanged levels on Tuesday. The size of China's sale of crude from its strategic reserves, slated for September 24, was smaller than many had feared (7.38mn bbl), although the spectre of further potential sales looms large.

- Elsewhere, restart issues surrounding crude production in the U.S. Gulf remain evident.

- Tuesday also saw confirmation that Russia's plan to lift crude production in September had gone into play, with output levels witnessed in the first couple of weeks of the month nudging higher vs. August's levels.

- The weekly DoE crude inventory data headlines on Wednesday.

GOLD: Back Above $1,800/oz

The softer than expected U.S. CPI print (and related perceptions surrounding the knock-on impact for Fed monetary policy settings) allowed gold to recover from worst levels of the day on Tuesday, with our weighted U.S. real yield monitor ultimately finishing little changed on the day. The same held true for the broader USD (as measured by the DXY), despite a brief round of USD weakness post-CPI, which was subsequently unwound. The technical overlay remains as it was, with spot last dealing at virtually unchanged levels just shy of $1,805/oz.

FOREX: Chinese Data Spoil Mood, Spark Limited Risk-Off Reaction

Risk appetite took a modest hit after the release of China's underwhelming economic activity indicators, with slowdown in retail sales growth proving particularly pronounced. USD/CNH extended gains to fresh session highs but in the grand scheme of things the price reaction was very limited. The pair had earlier crept higher, with the PBOC fixing slightly softer than estimated.

- Below-forecast Chinese data sent the Antipodeans to session lows but then recouped the bulk of losses.

- The yen registered some gains into the Tokyo fix and remained among the best G10 performers, along its safe haven peer CHF.

- AUD/JPY attacked the psychological Y80.00 barrier and printed its worst levels since Aug 30, before retracing most of its downswing.

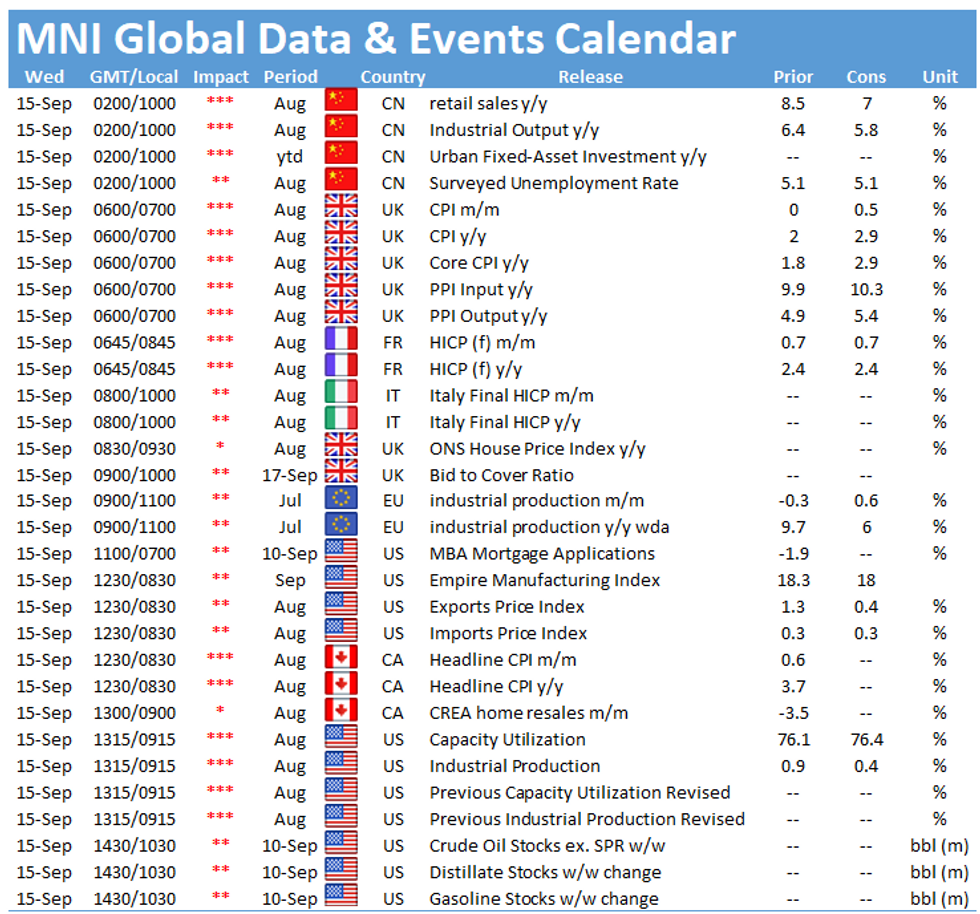

- Participants look ahead to inflation data from the UK and Canada, U.S. Empire M'fing and industrial output, as well as comments from ECB's Lane and Schnabel.

FOREX OPTIONS: Expiries for Sep15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E647mln), $1.1820-30(E1.0bln), $1.2000(E1.1bln)

- USD/JPY: Y109.60-80($1.5bln), Y110.00($686mln)

- USD/CAD: C$1.2750($660mln), C$1.2795-00($988mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.