-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: E-Minis Tick Higher In Asia Ahead Of Chinese Holiday

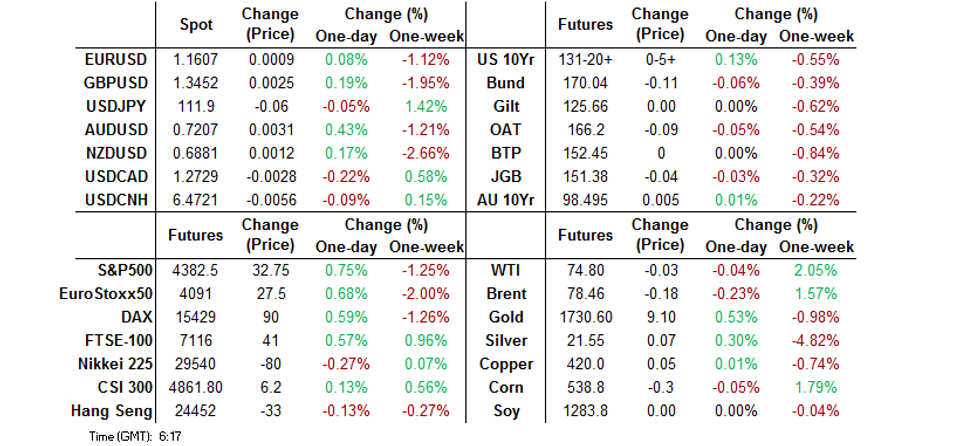

- E-minis nudged higher overnight, perhaps aided by stronger than expected non-manufacturing PMI data out of China, although there was a lack of additional meaningful headline flow, and China's manufacturing PMI readings were not as positive.

- Iron ore surged with short-term production issues at one Australian site and pre-holiday demand in China cited.

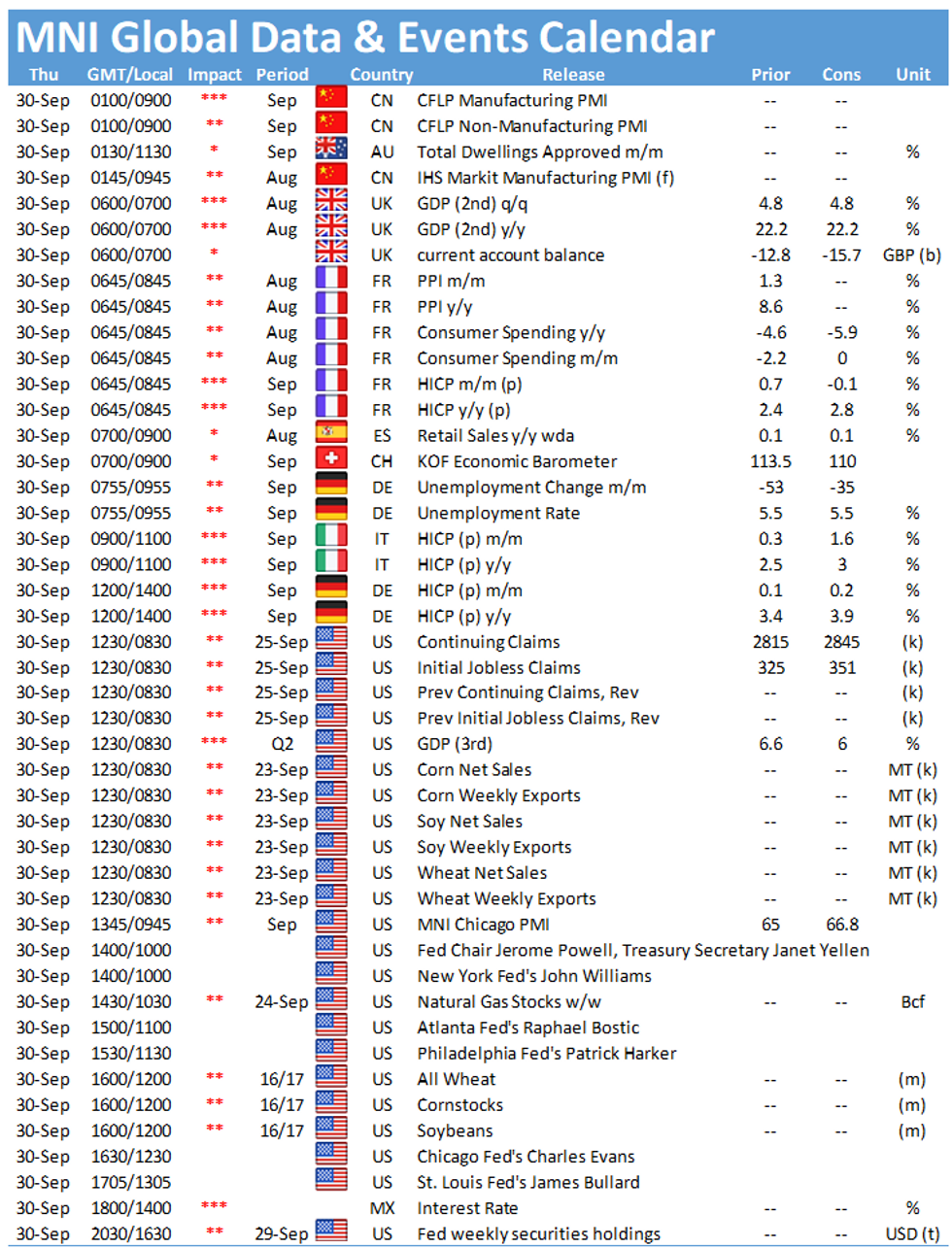

- Fedspeak will headline again on Thursday, with U.S. wekkly jobless claims data and the latest MNI Chicago PMI print also due.

BOND SUMMARY: Contained Core FI In Asia

Core fixed income markets struggled for anything in the way of meaningful direction in Asia-Pac dealing, with the latest round of Chinese manufacturing PMI data providing little to no impetus, although a firmer than expected official non-manufacturing PMI print may have provided a cap for core FI markets overnight (note that the better-than-expected print was seemingly driven by price increases and business expectations). A reminder that China is set to start a week-long holiday on Friday, while Hong Kong markets will also be closed on Friday, but return on Monday.

- An uptick in e-minis has seen T-Notes move off highs to last trade +0-05 at 131-20, sticking within a narrow 0-04 range. Cash Tsys run little changed to 0.5bp cheaper across the curve. Senate Majority Leader Schumer pointed to a bipartisan deal to keep the government funded until December 3, although the hurdles to increased fiscal spending and debt ceiling worries remain evident. A raft of Fedspeak headlines during NY hours, with weekly claims data and the latest MNI Chicago PMI print also due.

- JGBs ticked higher at the re-open, playing catch up to the late NY uptick in Tsys, but faded through the afternoon, with the contract last dealing -8, potentially hampered by worry surrounding the spending plans of a Kishida government. Cash trade sees yields run little changed to ~1.0bp richer, with 5s outperforming on the curve. There is some speculation that the Q4 Rinban plan (released after hours today) may see the BoJ cut the size of its Rinban purchases covering JGBs out to 10s. The latest 2-Year JGB auction was easily digested, with the BoJ's monetary policy settings underscoring takedown despite the headwinds outlined ahead of the auction, as we suggested would be the case. There was a marginal shortening of the price tail, with the cover ratio nudging lower but holding above the 6-auction average.

- ACGBs looked to the broader impetus, but stuck to contained ranges, with YM -1.0 and XM +0.5 at typing. Australian Treasurer Frydenberg outlined a ~A$27bn narrowing of the commonwealth fiscal deficit for FY20/21 when compared to projections made in the May budget. Elsewhere, Victoria's COVID case numbers continued to surge.

FOREX: Greenback Gets Winded After Climbing To Cycle High

The greenback turned its tail and the DXY ticked away from a new one-year high registered in the course of Wednesday's upswing, which resulted in a failed attack at the 38.2% retracement of the 2020 - 2021 sell-off.

- AUD caught a bid amid a jump in iron ore prices and improvement in broader risk tone evidenced by upticks in all three main U.S. e-mini futures. The rest of major commodity-tied currencies (NZD, CAD, NOK) followed suit and generally firmed a tad.

- Offshore yuan gained some ground against the greenback following the release of China's PMI data. Official figures showed that the m'fing sector slipped into contraction for the first time since Feb 2020 but the non-m'fing sector unexpectedly returned into expansion, while Caixin M'fing PMI recovered more than forecast, returning to the breakeven 50 level.

- European data highlights include final UK GDP as well as EZ & German jobs market reports, while in NY hours focus will turn to the third reading of U.S. GDP, weekly jobless claims and MNI Chicago PMI.

- There is plenty of central bank rhetoric coming up today. The speaker slate is headlined by Fed Chair Powell, who will appear along Tsy Sec Yellen in front of the House Financial Services Committee.

FOREX OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E511mln), $1.1650-54(E621mln), $1.1700(E1.8bln)

- USD/JPY: Y110.00($1.3bln), Y110.30-40($1.5bln), Y111.00($775mln)

- GBP/USD: $1.3640-50(Gbp1.2bln)

- AUD/USD: $0.7200-10(A$643mln)

- USD/CAD: C$1.2675($520mln), C$1.2740-55($2.2bln)

- USD/CNY: Cny6.4490($826mln)

ASIA FX: Yuan Rises Despite Mfg PMI Miss

The greenback paused its recent rally heading into month- & quarter-end. Risk sentiment was mixed, the won was the worst performer while offshore yuan posted the best returns on the day.

- CNH: Offshore yuan is stronger, data showed manufacturing PMI slipped into contraction for the first time since May 2020, while non-manufacturing unexpectedly rose into expansion, the Caixin manufacturing PMI print also rose.

- SGD: Singapore dollar has strengthened slightly, coming off Wednesday's closing lows.

- TWD: Taiwan dollar is weaker, on track for a third day of declines. CBC Gov Yang spoke on a range of subjects earlier, he noted that the economy may grow 6% this year but said this depends on trade and domestic consumption growth.

- KRW: Won is weaker, but off worst levels seen at the open where it touched a 2021 low. . Data earlier showed industrial output fell 0.7% M/M against a rise of 0.3% expected the print means that industrial output, retail sales and investment declined in August, the first time since May that all the metrics declined together.

- MYR: Ringgit fell, FinMin Aziz said there is room remaining in monetary policy to provide additional support o the economy is needed.

- IDR: Rupiah is weaker, but still on track for a quarterly gain. Looking ahead, Indonesia's monthly CPI and Markit M'fing PMI will be published tomorrow.

- PHP: Peso declined, Philippine unemployment rate jumped to 8.1% in August from 6.9% recorded in July amid tighter Covid-19 restrictions implemented in Metro Manila that month and an expansion in participation

- THB: Baht is lower, the Bank of Thailand voted unanimously to leave their benchmark interest rate on hold Wednesday. This represented a shift from last month's meeting, when two MPC members had voted to trim the policy rate by 25bps.

ASIA RATES: China O/N Repo Rate Jumps Ahead Of Holiday

- INDIA: Yields mixed in early trade. Markets look ahead to today's GSAP operation, the final bond purchase in the current quarter. The RBI plans to buy INR 150b of 7.26% 2029, 6.1% 2031, and 6.64% 2035 bonds, and as part of its new twist arrangement will sell an equivalent amount of 8.15% 2022, 8.08% 2022, and 8.13% 2022 bonds. Traders will also await a decision if the nation's bonds will be included in the FTSE Russell's bond index, an announcement is expected this week. There is also some data on the docket today, fiscal deficit and current account figers will be released. Elsewhere there were reports yesterday that India aims to narrow its budget deficit to 6.3% of GDP this fiscal year, 0.5ppts lower than initially targeted, thanks to improving revenues.

- SOUTH KOREA: Futures lower in South Korea; 3-Year contract down 7 ticks while the 10-Year down 39 ticks. Sentiment in the Asia-Pac region is mixed, but South Korean assets are seeing risk on trade. Finance Minister Hong spoke earlier and said that global inflation was a growing concern and that household debt needs to be curbed as it is a risk to the economy. Ahead of a meeting with BoK Governor Lee, Hong said he would discuss pre-emptive market stabilisation steps and would discuss financial imbalance issues. Data earlier showed industrial output fell 0.7% M/M against a rise of 0.3% expected the print means that industrial output, retail sales and investment declined in August, the first time since May that all the metrics declined together.

- CHINA: The PBOC injected CNY 100bn via 14-day reverse repos on the final trading session before an extended break. China will observe a weeklong holiday starting tomorrow, with mainland markets returning on Friday Oct 8. The overnight repo rate jumped 85bps to 2.20%, matching the PBOC's prevailing 7-day rate, while the 7-day repo rate has fallen 28.25bps to 2.2634%. Futures are lower, the 10-year contract down around 14 ticks and touching session lows. As a reminder manufacturing PMI slipped into contraction for the first time since Feb 2020, while non-manufacturing unexpectedly rose into expansion, the Caixin manufacturing PMI print also rose.

- INDONESIA: Yields higher, curve flattens. There has been little in the way of domestic catalysts today. Looking ahead, Indonesia's monthly CPI and Markit M'fing PMI will be published tomorrow.

EQUITIES: Mixed Session Ahead Of China Holiday

A mixed day for equity markets in the Asia-Pac time zone; as a reminder China will observe a weeklong holiday starting tomorrow, with mainland markets returning on Friday Oct 8. Hong Kong returns on Monday Oct 4. Markets in Hong Kong came under pressure, shedding over 1%, tech shares were out of favour after a negative lead from the Nasdaq. Markets in mainland China are higher, data earlier showed official manufacturing PMI slipped to contraction for the first time since May 2020, but official non-manufacturing PMI and Caixin manufacturing PMI both rose. Markets in Japan lost ground, a reshuffle of the Nikkei and uncertainty ahead of new leadership kept investors on the sidelines; former foreign minister Fumio Kishida was appointed as new leader of the LDP. Markets in Australia topped the performance tables, mining stocks getting a boost as iron ore rallies with Chinese steel mills stocking up ahead of the holiday. In the US futures are higher, e-mini Nasdaq leading the way higher after the index declined yesterday. Central bank speaker events remain frantic, with Fed's Powell appearing again in front of lawmakers as well as speeches from Williams, Bostic, Harker, Evans and Bullard.

GOLD: Bears In Control

Our weighted U.S. real yield monitor has stabilised and sits a little shy of Wednesday's highs, with the DXY trading ever so slightly softer after Wednesday's rally saw it tap a ~1-Year peak. This has allowed spot gold to add ~$5/oz, operating just above $1,730/oz. Gold bottomed out at $1,721.7/oz, which now acts as initial support. A break below there would open the way to the Mar 31 low ($1,678.0/oz).

OIL: Lower, But On Track For Monthly Gain

Crude futures slightly lower in Asia-Pac trade on Thursday, but sticking to Wednesday's range so far. A particularly solid session for the greenback worked against commodity markets yesterday, USD strength kept a lid on the still-bullish energy contracts, resulting in Brent and WTI circling just below recent cycle bests. Despite the edge off highs for oil, dips are considered corrective and a bullish theme remains intact. Last week's break of $73.58, the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards $80.00 further out. Both benchmarks still on track for monthly gains, thanks I part to disruptions in the Gulf of Mexico from Hurricane Ida. Inventory data yesterday showed headline crude tockpiles rose by 4.6m bbls, the first increase since the week ending July 30. Gasoline and distillate stockpiles increased last week

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.