-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: China Evergrande Questions In The Air

EXECUTIVE SUMMARY

- HOPSON TO BUY 51% OF EVERGRANDE M'MENT UNIT FOR HK$40BN (CAILIAN)

- BIDEN'S TOP TRADE ADVISOR WILL SAY CHINA ISN'T COMPLYING WITH PHASE 1 DEAL (CNBC)

- FED'S CLARIDA TRADED INTO STOCKS ON EVE OF POWELL PANDEMIC STATEMENT (BBG)

- ECB'S VISCO: PRICE INCREASES SHOULD BE ONLY TEMPORARY (BBG)

- UK FISCAL MATTERS CLOUDY AS TORY PARTY CONFERENCE GETS UNDERWAY

- JAPAN TO HOLD GENERAL ELECTIONS ON OCT. 31 (NIKKEI)

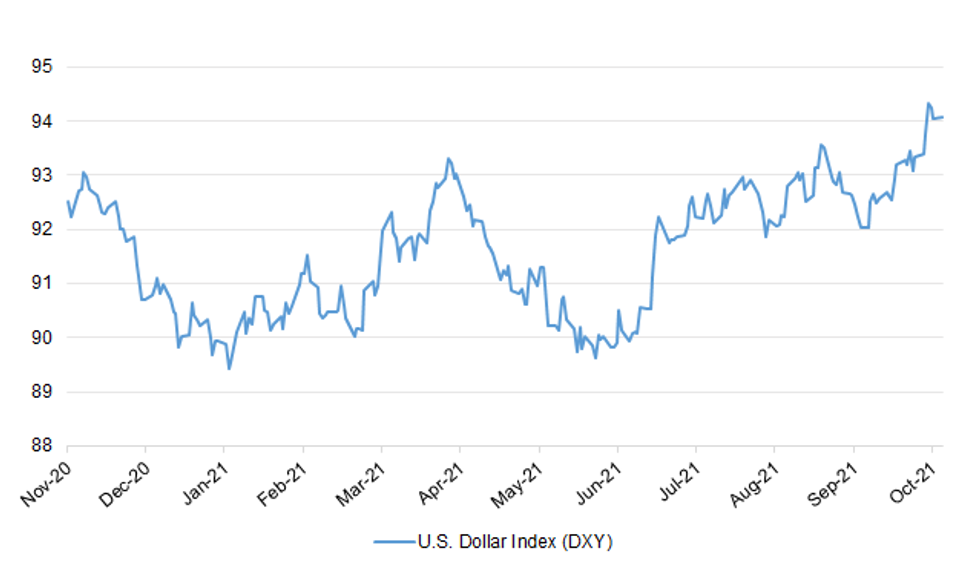

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Global trade Draconian Covid-19 travel restrictions are to be lifted on dozens of major overseas destinations within days, as Boris Johnson prepares to announce plans to bring society and the economy back to "normality" following the worst of the pandemic. The Telegraph understands that the 54 countries on the Government's "red list" will be slashed to as few as nine this week - with South Africa, Brazil and Mexico all expected to be opened up to quarantine-free travel in time for the October half-term break. (Telegraph)

CORONAVIRUS: The health secretary, Sajid Javid, has told care home staff to "get out and get another job" if they don't have Covid vaccinations amid warnings that making jabs mandatory will see up to 100,000 workers quitting the sector. In the clearest signal yet that the government will not back down, Javid said he was not prepared to "pause" a requirement for care home staff to be fully vaccinated by November 11. He told the BBC Radio 4 Today programme: "If you want to work in a care home, you are working with some of the most vulnerable people in our country, and if you cannot be bothered to go and get vaccinated, then get out and go and get another job. (Sunday Times)

ENERGY: Armed forces personnel will begin delivering petrol to garages across the UK from Monday, the government says. Almost 200 servicemen and women, 100 of them drivers, will provide "temporary" support to ease pressure on stations. Ministers have also announced that up to 300 overseas fuel tanker drivers will be able to work in the UK immediately until the end of March. There have been long queues at petrol stations this week after a shortage of drivers disrupted fuel deliveries. (BBC)

ENERGY: Gasoline and diesel shortages persisted in London and south east England on Sunday, where 22% of forecourts had no fuel available and 60% had both types available, the Petrol Retailers Association (PRA) said on Sunday. (RTRS)

ENERGY: Boris Johnson should recall Parliament to pass new laws to sort out fuel and food shortages, says Labour's leader. Sir Keir Starmer says "emergency action" is needed to speed up visas for 5,000 extra HGV drivers. The prime minister - who will be in Manchester next week at the Tory conference - said the UK supply chain was "very resilient". And he accused the haulage industry of being too reliant on low-paid migrant workers. There have been long queues at petrol stations this week after a shortage of drivers disrupted fuel deliveries. (BBC)

POLITICS: Labour has not enjoyed a poll bounce in the immediate aftermath of its party conference despite the government being blamed by most of its own voters over the fuel shortage crisis. Senior figures in Keir Starmer's team were satisfied by the outcome of last week's conference, believing the Labour leader was able to show the public that he was shifting the party away from the Corbyn era and focusing his attack on Boris Johnson as a figure not serious enough to govern competently. However, the latest Opinium poll for the Observer found that the Tory lead remained intact. It found that the narrow Conservative lead had increased by one point to 39%. The party's rating actually fell by one percentage point, but Labour's rating fell two points to 35%. The Lib Dems were on 8%, up a point on the last poll. (Observer)

POLITICS: Conventional political wisdom would have it that there is nothing like a petrol crisis to undermine the public's faith in their elected leaders. When the pumps last ran dry in 2000 it was the only point during Blair's first term that William Hague took a lead in the opinion polls. Yet on the eve of the Conservative conference focus groups and polling conducted for The Times suggest that the wisdom needs to be rethought. Despite the petrol crisis, a manifesto-breaking tax rise, increasing energy costs, Covid and Brexit, voters seem more enamoured of Boris Johnson than ever. (The Times)

POLITICS: More people view Labour as the party that will keep taxes low for them than those who think the same of the Conservatives, according to a poll that exposes the scale of the cost of living crisis facing Britain. (Telegraph)

POLITICS: Boris Johnson has pledged the Conservatives will "change and improve" the economy after the pandemic. The PM said the country cannot "go back to how things were" before Covid. He has accused the haulage industry of being too reliant on low-paid immigration, amid shortages at petrol stations. (BBC)

POLICY: A group of senior Conservative MPs has broken ranks to openly question how Boris Johnson can deliver on his promise to increase prosperity in poorer parts of the UK while at the same time raising taxes for working people and cutting benefits. As the prime minister arrived in Manchester on Saturday night for his party's first full conference since its thumping 2019 election win, Johnson insisted he was ready to take the "big, bold decisions on the priorities people care about – like on social care, on supporting jobs, on climate change, tackling crime and levelling up". (Observer)

POLICY: Boris Johnson has not ruled out a further relaxation of immigration rules to help ease the UK's fuel and supply shortages - but the prime minister insisted he does not want to see a return to "a lot of low-wage immigration". Amid the continuing queues at petrol stations across the country, the government has said 300 fuel tanker drivers will be able to come to the UK from overseas "immediately" under a bespoke temporary visa which will last until March. (Sky)

FISCAL: Prime Minister Boris Johnson has refused to rule out further tax rises. Mr Johnson defended his government's recent decision to raise National Insurance contributions, telling Andrew Marr that while he is a "fierce opponent" of unnecessary tax rises, the pandemic had forced difficult decisions. (BBC)

FISCAL: Boris Johnson has said that he is "acutely conscious" of the precarious finances of local authorities amid calls to allow them to increase council tax to pay for social care. The prime minister said the government would ensure local authorities can cover the increasing costs of social care as he acknowledged that their finances have been "depleted" during the pandemic. Local authorities have warned that they need an extra £2.6 billion a year merely to sustain present levels of social care and have said that in the absence of central government funding council tax will have to increase by 9 per cent next year to help plug the gap. (The Times)

FISCAL: Boris Johnson was given a public warning on Sunday from senior Tories not to hike taxes at the Budget later this month after he repeatedly failed to rule out an increase. (Telegraph)

FISCAL: Boris Johnson and Rishi Sunak have struck a secret deal to cut taxes before the next general election in exchange for spending restraint now. In a breakthrough in the troubled relations between the prime minister and chancellor, Johnson has accepted the government must be fiscally responsible to build up a war chest. The prime minister agreed that new spending in this autumn's spending review, published this month, must be matched by cuts elsewhere or tax rises to pay for it, rather than letting government borrowing rise further. Details of the private pact come on the eve of the Tory party conference in Manchester, where cabinet ministers will outline fresh details of how taxpayers' money will be spent. (Sunday Times)

FISCAL: Chancellor Rishi Sunak has urged Tory MPs to back his efforts to keep public spending under control in this month's Budget, with some Conservatives and economists believing fiscal discipline now could provide space for pre-election tax cuts. Sunak is under mounting pressure from Labour and some Tory MPs to increase support for households to avoid a cost of living crisis this autumn, while ministers are demanding more money to help public services recover from the coronavirus crisis. But Sunak has told colleagues that further increases in spending — beyond what is already planned — will result in more tax rises. (FT)

FISCAL: Rishi Sunak is drawing up plans to extend his Covid business loans scheme amid fears Britain's economic recovery could be hamstrung by labour shortages and soaring cost pressures. (Telegraph)

FISCAL: Nadhim Zahawi, the Education Secretary, should set aside nearly £6 billion to help children and students from poorer backgrounds catch up on missed teaching during the Covid pandemic, more than 100 heads of academy trusts have said. (Telegraph)

ECONOMY: Staff shortages are rippling out from the haulage, farming and hospitality sectors to almost all parts of the economy, putting "severe pressure" on medium-sized business across the UK, a new survey has warned. More than a quarter of the 500 firms polled said the lack of staff was putting pressure on their ability to operate at normal levels, with reduced stock – due to the resulting supply chain disruption – hurting their business. While some firms had considered cutting production, others were planning to raise prices, leading to concerns over rising inflation as the Christmas trading period approaches. Nearly a fifth said they were increasing wages to attract new staff, while others were introducing extra perks to lure workers. (Guardian)

BREXIT: Prime Minister Boris Johnson has said he believes the Northern Ireland Protocol could "in principle work" if it was "fixed". But he also did not rule out triggering Article 16 if the EU failed to come up with plans to deal with current issues. Mr Johnson's comments came in an interview with BBC News NI. He also talked about the government's controversial legacy proposals, which seek to end all Troubles-related prosecutions before 1998. Mr Johnson insisted he did not want to "deny" anyone justice but felt it was time for Northern Ireland to "move on". The prime minister said he wanted the EU to come to the table with serious proposals to fix the Northern Ireland Protocol. (BBC)

BREXIT: Lord Frost will on Monday issue a threat to the EU that the UK is prepared to trigger Article 16 unless the bloc agrees to replace the controversial Northern Ireland Protocol. (Telegraph)

BREXIT: Ministers are to make a decision by the end of next month on whether to suspend the Northern Ireland Brexit deal unilaterally. Brandon Lewis, the Northern Ireland secretary, said yesterday that the UK had shown "good faith" by not triggering Article 16 of the Northern Ireland protocol so far. This keeps Northern Ireland inside the European Union's single market and customs union and has infuriated unionists in the province by imposing checks and restrictions on goods crossing the Irish sea. Senior government sources said that unless Brussels was prepared to engage in a "serious negotiation" over the protocol in the coming weeks the government would have no choice but to suspend the deal by December. (The Times)

BREXIT: Triggering Article 16 to override parts of the Northern Ireland Protocol would be a "hugely problematic backward step", Ireland's foreign minister has said. Simon Coveney said it would be a "huge mistake" as attempts are made to build trust between the negotiating teams. But he said it was unlikely the UK government would take the step. It comes after a BBC News NI interview with the prime minister during which he did not rule out triggering Article 16. (BBC)

BREXIT: France will pressure Brussels to take a tougher line against the UK in negotiations over the Northern Ireland Protocol as it escalates its row with Britain over fishing after Brexit. (Telegraph)

EUROPE

ECB: European Central Bank Executive Board member Isabel Schnabel says policy makers are determined to deliver inflation in line with the institution's 2% goal. "Our commitment to act as necessary to fulfil our mandate should never be questioned – neither in crises nor in more usual times." "Unusual crises require unusual responses -- this is the core of the proportionality principle, which underpins all our policies." "This, in turn, implies that we will continue to adapt our tools as appropriate going forward, as the economy enters calmer waters." (BBG)

GERMANY: Germany's leading political parties launched competing rounds of exploratory coalition talks on Sunday, aimed at winning over potential political partners to form the next government as Chancellor Angela Merkel's 16-years at the helm draw to a close. Both the Social Democrats, who won the largest vote share in last week's closely contested election, with about 25.7 per cent of the ballots cast, and Merkel's Christian Democrats, who suffered their worst election result with 24.1 per cent, aim to woo the third- and fourth-place parties — the Greens, with 14.8 per cent of the vote, and the pro-business Free Democrats (FDP), with 11.5 per cent. (FT)

GERMANY: Germany's Greens plan to put to a membership vote the choice of forming a governing coalition with the Social Democrats or the Conservatives, a top party official said. The vote will be held online and will take less than two weeks, party manager Michael Kellner said Saturday at a party convention in Berlin. (BBG)

ITALY: Mayoral elections take place in over 1,000 towns and cities in Italy on Sunday and Monday, in the first electoral test for Prime Minister Mario Draghi since he took office in February. A low turn-out is expected on both days, but nonetheless the results from major cities such as Rome, Milan, Naples and Turin are eagerly awaited, as well as those in smaller centres. Key questions include whether the centre-left can win in some of the more high-profile contests, as well as the performance of the far right. A lot is at stake for Democratic Party (PD) leader Enrico Letta, who is running in a parliamentary by-election in the Tuscan city of Siena. Former Prime Minister Giuseppe Conte, who took over as the leader of the populist 5-Star Movement in August, has been campaigning hard. (Euronews)

ITALY: Italy's new car sales fell 32.73% y/y in September, according to The Italian Transport Ministry. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- S&P affirmed France at AA; Outlook Stable

U.S.

FED: The Federal Reserve's conditions for raising interest rates could be met by the end of 2022, Cleveland Fed Bank President Loretta Mester said on Friday, adding that she expects inflation to come back down to the central bank's target next year. "I think we'll see progress in the labor market and progress on inflation coming back down," Mester said during a virtual panel organized by the Shadow Open Market Committee, repeating an outlook she shared last week. (RTRS)

FED: MNI INTERVIEW: Higher Pay for US Job Switchers Likely to Last

- Higher wages for U.S. workers moving to new jobs are here to stay, Atlanta Fed economist John Robertson told MNI, with companies desperate to find staff and the supply of available employees held back by childcare shortages and fears of contracting Covid at work - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Vice Chair Richard Clarida traded between $1 million and $5 million out of a bond fund into stock funds one day before Chair Jerome Powell issued a statement flagging possible policy action as the pandemic worsened, his 2020 financial disclosures show. Clarida's trades, described in forms filed with the government ethics office, show the shifting of the funds out of a Pimco bond fund on Feb. 27, 2020, and on the same day buying the Pimco StocksPlus Fund and the iShares MSCI USA Min Vol Factor exchange-traded fund in similar dollar ranges. For the year, he listed five transactions. (BBG)

ECONOMY: MNI INTERVIEW: Scarcity Fear is Creating Artificial Demand-ISM

- Companies fearing shortages and stalled deliveries are placing extra orders to make sure they don't run out of products, suggesting manufacturers may eventually suffer a wave of cancelations and an inventory glut, ISM survey chief Tim Fiore told MNI.

ECONOMY: The Trimmed Mean PCE inflation rate over the 12 months ending in August was 2.0 percent. According to the BEA, the overall PCE inflation rate was 4.3 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 3.6 percent on a 12-month basis. (Dallas Fed)

FISCAL: MNI BRIEF:US Treasury Has $173B in Extraordinary Measures Left

- The Treasury Department Friday released a report showing that the agency sees USD173 billion in "extraordinary measures" remaining - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Biden, meeting with House Democrats on Capitol Hill on Friday, indicated they must further delay a final vote on a $1.2 trillion bipartisan infrastructure bill and scale back his $3.5 trillion social spending package to around $2 trillion range if either is to pass, lawmakers told Axios. Biden made clear he wants to keep the two packages linked together and that he is optimistic there can be an agreement. (Axios)

FISCAL: House progressives looking for ways to rescue President Joe Biden's stalled domestic agenda opened the door to scaling back some of the more ambitious social spending by having those programs expire rather than be permanent. "One of the ideas out there is to fully fund what we can fully fund, but instead of funding it for 10 years, fund it for five years," said Representative Alexandria Ocasio-Cortez, a New York Democrat and leading progressive voice, on CBS's "Face the Nation." (BBG)

FISCAL: Nancy Pelosi has given her warring party one more month to pass a $1.2tn infrastructure bill after the party failed to come to an agreement on Joe Biden's spending plans despite a week of frantic negotiations on Capitol Hill. The Democratic speaker of the House of Representatives wrote to Democratic Congressional colleagues on Saturday morning urging them to pass the bipartisan bill, which forms a central part of the US president's legislative agenda. Members of the House passed an emergency measure on Friday to continue funding for federal road programmes for another 30 days. That measure was due to be put to a vote in the Senate on Saturday in order to avert 3,500 federal transport workers being immediately furloughed. But Democrats have not yet agreed over whether to pass the larger infrastructure measure - something Pelosi said on Saturday she wanted to happen before the end of the month. (FT)

FISCAL: U.S. Senate Majority Leader Chuck Schumer said on Sunday the goal would be to get both an infrastructure bill and a multi-trillion-dollar social spending bill passed in the next month, overcoming divisions between moderate and progressive Democrats. "Our goal is to get it done in the next month, both bills, get them passed," Schumer told reporters. "We need unity in both our caucuses in the House and Senate to get both done. If we get it done in the next 30 days, I think it will be a very -- a great help to everybody in the country." (RTRS)

CORONAVIRUS: Chief White House medical adviser Anthony Fauci said on Sunday that it was "too soon to tell" whether people should avoid gathering for Christmas this year in the midst of the ongoing COVID-19 pandemic. Fauci told CBS "Face the Nation" host Margaret Brennan that it was "just too soon to tell" if Americans would need to limit the size and scope of their holiday celebrations as was recommended last year. "We've just got to concentrate on continuing to get those numbers down and not try to jump ahead by weeks or months and say what we're going to do at a particular time," Fauci said. (The Hill)

CORONAVIRUS: North Dakota hospitals are reaching "critical levels," Governor Doug Burgum said Friday in a statement with medical officials from across the state. "Right now, stepping into a hospital in North Dakota is like stepping into an alternate reality," said Joshua Ranum, vice president of the North Dakota Medical Association. "Our hospitals are at a redline capacity and will likely be that way for several more weeks." (BBG)

CORONAVIRUS: California will require students attending school in person to get vaccinated for Covid-19 following full approval by the Food and Drug Administration, Gov. Gavin Newsom announced on Friday. Newsom's latest order, the first of its kind nationwide, will roll out in two phases for students learning in-person. The mandate will first take effect for students ages 12 and over following full approval by the FDA for that entire age group. (CNBC)

CORONAVIRUS: Alaska invoked emergency crisis-care protocols at 20 hospitals, which allows for rationing medical care in what is now the U.S. state hardest hit by the virus. The declaration includes several facilities that have already adopted the standards. (BBG)

CORONAVIRUS: Despite having the highest vaccination rates in the country, there are constant reminders for most New England states of just how vicious the delta variant of COVID-19 is. Hospitals across the region are seeing full intensive care units and staff shortages are starting to affect care. Public officials are pleading with the unvaccinated to get the shots. Health care workers are coping with pent-up demand for other kinds of care that had been delayed by the pandemic. (AP)

CORONAVIRUS: U.S. Food and Drug Administration advisers will meet this month in separate sessions to discuss booster doses for recipients of the Moderna Inc. and Johnson & Johnson Covid-19 vaccines and Pfizer Inc. shots for kids ages 5 to 11. The FDA's vaccine advisory committee of outside experts will meet Oct. 14 and 15 to discuss boosters for Moderna and J&J shots, the agency said in a statement Friday. (BBG)

CORONAVIRUS: The U.S. Food and Drug Administration will likely extend the expiration date for millions of unused doses of Moderna's vaccine, NBC News reported, citing an email sent by the Centers for Disease Control and Prevention to state health officials and health-care providers. The Moderna extension is likely to add two months to the shots' shelf life, NBC says, citing two unidentified sources. The CDC told states that the FDA wouldn't grant any more extensions to expiring J&J shots after having already extended their shelf life in July from 4.5 months to 6 months. (BBG)

OTHER

GLOBAL TRADE: U.S. Trade Representative Katherine Tai will announce Monday that China is not complying with the so-called phase one trade deal reached under former President Donald Trump's administration, sources familiar with the matter told CNBC's Kayla Tausche. Under the agreement, China was supposed to purchase an additional $200 billion in U.S. goods over a two-year period, but the nation has not lived up to that pledge, sources said. The announcement will represent some of the Biden administration's most forceful pushback against China. Tai will deliver remarks Monday on her review of China trade policy in Washington. It is unclear how the USTR will respond. Sources told CNBC that the USTR is evaluating potential actions against China for its non-compliance, including possible additional tariffs. (CNBC)

GLOBAL TRADE: Joe Biden's commerce secretary has warned that protecting American steel is a matter of national security, adopting predecessor Donald Trump's position as European and US officials race to avoid an escalation in tariffs later this year. (FT)

GLOBAL TRADE: The semiconductor chip shortage that is hamstringing the production of products ranging from cars and computers to appliances and toothbrushes will extend into 2022 and potentially beyond that, the CEO of semiconductor company Marvell Technology said. "Right now, every single end market for semiconductors is up simultaneously; I've been in this industry 27 years, I've never seen that happen," said Marvell CEO Matt Murphy during a CNBC Technology Executive Council event on Thursday. "If it stays business as usual, and everything's up and to the right, this is going to be a very painful period, including in 2022 for the duration of the year." (CNBC)

GLOBAL TRADE: A smart assembly line for the manufacturing of nanometer mono-crystalline copper, the first of its kind in the country, became operational in Pingyang county in Wenzhou, East China's Zhejiang Province on Saturday, according to Chinese state broadcaster, signaling that a key material in chipmaking has entered mass production locally. (Global Times)

GLOBAL TRADE: The cost of shipping between China and the U.S. plunged this week after hitting record highs in early September as the off-season approaches, a power crunch slows Chinese manufacturing and speculators rush to sell their hoarded shipping spots. An executive with a Shanghai freight company said Thursday that the cost of shipping a 40-foot container from China to the U.S. West Coast dropped nearly half in the previous four days, going from about $15,000 to just over $8,000. The spot rate for shipping to the East Coast had fallen by more than one-quarter from over $20,000 to less than $15,000. Prior to the pandemic, the rate was usually around $1,500. The cost of shipping has skyrocketed since the start of the pandemic. On the demand side, U.S. consumers stuck at home spent more on durable goods, such as gym equipment and furnishings. (Nikkei)

GLOBAL TRADE: Irish Finance Minister Paschal Donohoe is traveling to Brussels to discuss "tax issues" as pressure mounts to reach a deal on a global minimum rate for companies. Donohoe will meet with European Competition Commissioner Margrethe Vestager on Monday before chairing a meeting of the finance ministers of the euro area in Luxembourg, the Irish Finance Ministry said in a statement. (BBG)

GLOBAL TRADE: Spain has vowed that it and other European countries will press ahead with plans to introduce a minimum corporate tax of 15 per cent under a groundbreaking global pact led by the OECD, even if equivalent measures fail in the US. In an interview with the Financial Times, María Jesús Montero, budget minister, said it was unacceptable that some groups in Spain paid as little as 6 per cent corporate tax while smaller companies paid 19 per cent, adding that "you can't have this regressive fiscal engineering". (FT)

U.S./CHINA/TAIWAN: The U.S. called on China to halt its "provocative" pressure on Taiwan after a record number of daily incursions by Chinese warplanes, saying the military actions are destabilizing and risk leading to "miscalculations." "The U.S. commitment to Taiwan is rock solid and contributes to the maintenance of peace and stability across the Taiwan Strait and within the region," State Department spokesman Ned Price said in a statement on Sunday. (BBG)

GEOPOLITICS: It appears to be the biggest leak of offshore data yet, revealing the secrets of how the rich, powerful and famous stash their cash and avoid paying tax. We've seen similar investigations in the past, but they've all focused on material leaked from one corporation. The Panama Papers for instance, and they've been revealing enough. But the so-called Pandora Papers comprise leaks from 14 different corporations involving 12 million documents that it has taken 600 journalists a year to sift through. Amongst the allegations, investigators claim Czech prime minister Andrej Babis used offshore companies to buy a $22m chateau in the French Riviera with two swimming pools and a cinema. Mr Babis has responded to the allegations, tweeting: "I have never done anything illegal or wrong, but that does not prevent them from trying to denigrate me again and influence the Czech parliamentary elections." (Sky)

CORONAVIRUS: Ugur Sahin, co-founder and chief executive officer of Germany's BioNTech SE, which developed the first Covid-19 vaccine together with Pfizer Inc., said new strains will emerge that can evade booster shots and the body's immune defenses, requiring the development of updated vaccine formulas. (BBG)

JAPAN: Fumio Kishida, president of Japan's ruling Liberal Democratic Party and soon to become prime minister, has decided to dissolve the lower house later this month to hold general elections on Oct. 31, Nikkei has learned. (Nikkei)

JAPAN: Japan will compile a large extra budget immediately after a looming general election to ease the economic blow of the pandemic and boost long-term growth in key areas, a ruling party heavyweight said on Sunday. (RTRS)

JAPAN: Japan's Health Ministry is in talks to procure Merck's antiviral pill molnupiravir with an aim to approving its use within this year, Nikkei reported without attribution. The ministry will consider fast-track approval of the treatment if Merck files for approval in Japan. (BBG)

BOJ: In his final press conference as finance minister, Taro Aso says he once suggested to Governor Haruhiko Kuroda that the Bank of Japan ought to consider lowering its 2% inflation target. The target was set by the BOJ and the government, with Aso as a main participant, just before Kuroda took the helm at the bank in 2013. The governor has never wavered from the goal even as some lawmakers began to worry that it hamstrung the central bank, especially because inflation is so closely tied to global energy markets. "I told Kuroda that hitting the target would be very hard given this big drop in oil prices," Aso told reporters without specifying when the discussion took place. "But he said 'that's the goal, so I will do what I can to meet it.' (BBG)

AUSTRALIA: Victoria recorded 1,377 new Covid-19 infections Monday, down from a record on Saturday, and a further four deaths. Melburnians -- some of the most locked down people in the world throughout the pandemic -- are set to be released from restrictive stay at home orders by Oct. 26 if 70% of the Victoria population is fully vaccinated. Of the state's 6.6 million people, 3.7 million have had at least one dose. (BBG)

AUSTRALIA: Australia's New South Wales state, which includes Sydney, issued new guidelines for businesses, saying they will be responsible for taking reasonable measures to stop unvaccinated people entering their premises. (BBG)

NEW ZEALAND: New Zealand's Delta variant outbreak spread beyond the largest city of Auckland, prompting Prime Minister Jacinda Ardern on Sunday to put additional regions into a snap lockdown. (RTRS)

NEW ZEALAND: New Zealand extended the lockdown in Auckland as community transmissions of coronavirus continued in the nation's largest city. Residents cannot leave and are asked to remain at home when possible for at least another week. Some rules around outdoor activities were eased. Prime Minister Jacinda Ardern also laid out a road map that would allow the restrictions to be gradually lessened in the coming weeks, provided it is safe to do so. (BBG)

RBNZ: The Shadow Board has become divided over its views on what should happen with monetary policy at the October Monetary Policy Review. This is due to the ongoing lockdown in Auckland to contain the COVID-19 community outbreak and heightened uncertainty over the economic outlook. Shadow Board members in the business community highlighted the negative impact of the latest lockdown on businesses, with small to medium businesses hit particularly hard. This led to some Shadow Board members calling for monetary policy to be left unchanged at the upcoming meeting. In contrast, other Shadow Board members continued to see tightening of monetary policy as appropriate given the intense inflation pressures in the New Zealand economy. These inflation pressures reflect both strong demand and acute supply pressures. Besides the increase in broader inflation pressures, some Shadow Board members also highlighted the surge in asset prices that have resulted from monetary policy being too loose. (NZIER)

TURKEY: Faced with rampant inflation ahead of the general elections scheduled for 2023, Turkish President Recep Tayyip Erdogan has tasked agricultural cooperatives with reining in price increases. "Markets run by Agricultural Credit Cooperatives are convenient in terms of prices and quality," Hurriyet newspaper cited Erdogan as saying in Istanbul on Sunday. "We have ordered that about 1,000 such markets be opened nationwide." Such a move will help "balance the market," he said. (BBG)

MEXICO: Mexico's central bank sees no immediate need for a more aggressive interest rate increase of 50 basis points but remains data dependent as it seeks to fight persistent inflation, according to Deputy Governor Irene Espinosa. "If necessary we are open to that but we are basically data dependent," Espinosa told Bloomberg Television's Shery Ahn in an interview Friday, when asked if the bank would consider a half-point hike. "At this point we don't foresee that as something that is immediate but of course this is something where we cannot commit." (BBG)

MEXICO: Mexico is weighing a bill to change the country's constitution to boost state control of the electricity industry, a move that would jeopardize billions of dollars of investments by private power generators and could lead to international lawsuits by energy firms. The bill, unveiled Friday by President Andres Manuel López Obrador, could face a hard time in Mexico's Congress, where Mr. López Obrador's leftist party lacks the two-thirds majority needed to change the constitution. (WSJ)

RUSSIA: Russia's unemployment rate fell to a two-year low in August and retail sales beat analyst forecasts, but real wages grew slower than expected in July, indicating Russia's economic rebound may not be entirely smooth, data showed on Friday. (RTRS)

RUSSIA: Rosstat data also showed retail sales, the gauge for consumer demand, rose 5.3% year-on-year in August, above a 4.7% increase predicted by the Reuters monthly economic poll. Data for July was revised up to a 5.1% increase from a 4.7% rise. (RTRS)

NORTH KOREA: North Korea has warned the U.N. Security Council against criticizing the isolated country's missile program, in a statement Sunday that included unspecified threats against the international body. During an emergency closed-door meeting of the top U.N. body Friday, France circulated a proposed statement that expresses concern over North Korea's missile launches and calls on it to fully implement council resolutions that ban its ballistic missile firings. On Sunday, Jo Chol Su, a senior North Korean Foreign Ministry official, warned the U.N. council it "had better think what consequences it will bring in the future in case it tries to encroach upon the sovereignty" of North Korea. (AP)

NORTH KOREA: North Korea has restored communication lines with the South, months after it cut a cross-border hotline. The move comes days after the country's leader Kim Jong-un said he was willing to restore communication as a conditional olive branch. However, Pyongyang also said the restoration of their relationship was dependent on the "attitude of South Korean authorities". (BBC)

IRAN: Iran's foreign minister said on Saturday that U.S. officials tried to discuss restarting nuclear talks last month, but he insisted Washington must first release $10 billion of Tehran's frozen funds as a sign of good will. Iran has rejected direct talks with the United States, and indirect talks on reviving a 2015 nuclear accord aimed at keeping Iran from being able to develop a nuclear weapon stopped in June. (RTRS)

IRAN: Saudi Arabia's talks with regional rival Iran are still at an "exploratory stage," Saudi Foreign Minister Faisal Bin Farhan Al Saud told reporters in Riyadh. The two countries, which haven't had formal diplomatic ties since 2016, held their fourth meeting on Sept. 21, Bin Farhan said in a joint press conference with the European Union's top envoy, Josep Borrell. "The fourth round already took place, in Sept 21, and these talks are still in exploratory phases," Bin Farhan said. "We hope these talks will resolve the issues stuck between the two countries and we are seeking to attain it." (BBG)

EQUITIES: Asia has had its best third quarter on record for initial public offerings, even with Hong Kong turning quiet as many firms put listing plans in the regional powerhouse on hold amid China's sweeping regulatory clampdown. Thanks to blockbuster deals in markets like South Korea and India, first-time share sales in the region raised $56 billion in the three months through Sept. 30, the most ever for such a period, data compiled by Bloomberg show. (BBG)

OIL: OPEC and its allies meet on Monday to debate how much oil to release into the red hot market, where supply disruptions and recovering demand from the coronavirus pandemic have pushed oil above $80 per barrel. The oil price rally to a three-year high is exacerbated by an even bigger increase in gas prices, which have spiked 300% and have come to trade close to an equivalent of $200 per barrel due to supply shortages and low production of other fuels. The Organization of the Petroleum Exporting Countries and allies led by Russia, known as OPEC+, agreed in July to boost output by 400,000 barrels per day every month until at least April 2022 to phase out 5.8 million bpd of existing cuts. Four OPEC+ sources told Reuters last week producers were considering adding more than that deal envisaged, but none gave details on how much more, or when supply would increase. The nearest month any increase could occur is November since OPEC+'s last meeting decided the October volumes. (RTRS)

OIL: Iraq's oil minister said on Sunday that oil prices reaching $100 a barrel will not be sustainable and that OPEC wants stable markets. Ihsan Abdul Jabbar added in a TV interview with Skynews Arabia that he is working on a programme to raise the country's oil production capacity to 8 million barrels, calling it a balanced capacity. Abdul Jabbar also said that Iraq aims for its gas production to reach 4 billion cubic feet before 2025. (RTRS)

CHINA

CREDIT: Hopson Development plans to acquire a 51% stake in Evergrande Property Services for more than HK$40b, Cailian reports, citing unidentified people. (BBG)

CORONAVIRUS: The National Health Commission under China's State Council, the cabinet, has sent a working group to instruct the epidemic prevention work in Yili prefecture, Northwest China's Xinjiang Uygur Autonomous Region, after two silent cases were detected there on Sunday. Two asymptomatic COVID-19 cases were found in Horgos, a port city administrated by Yili prefecture of Xinjiang, which borders Kazakhstan, during a regular nucleic acid testing conducted every three days in accordance with an order from the national health commission, the Xinjiang Daily reported. (Global Times)

CORONAVIRUS: Chinese regulators remained on high alert for new Covid-19 flareups during the week-long National Day holiday. The National Health Commission sent a team on Monday to Ili of Xinjiang, the China Central Television reported, after two asymptomatic infections were found a day earlier. The two cases were detected after routine testing that is conducted every three days locally. They have been quarantined for medical observation, Xinjiang's local health authority said late Sunday. The far west region of Xinjiang was the center of one of China's largest Covid outbreaks last year. (BBG)

OVERNIGHT DATA

JAPAN SEP MONETARY BASE +11.7% Y/Y; AUG +14.9%

JAPAN SEP MONETARY BASE END OF PERIOD Y663.5TN; AUG Y661.3TN

AUSTRALIA SEP MELBOURNE INSTITUTE INFLATION +2.7% Y/Y; AUG +2.5%

AUSTRALIA SEP MELBOURNE INSTITUTE INFLATION +0.3% M/M; AUG 0.0%

MARKETS

SNAPSHOT: China Evergrande Questions In The Air

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 296.63 points at 28482.64

- ASX 200 up 83.557 points at 7269.1

- Shanghai Comp. is closed

- JGB 10-Yr future up 6 ticks at 151.63, yield down 1.6bp at 0.046%

- Aussie 10-Yr future down 0.5 tick at 98.480, cash ACGBs are closed

- U.S. 10-Yr future -0-01+ at 132-04, yield up 1.03bp at 1.474%

- WTI crude down $0.22 at $75.66, Gold down $0.15 at $1760.86

- USD/JPY up 1 pip at Y111.06

- HOPSON TO BUY 51% OF EVERGRANDE M'MENT UNIT FOR HK$40BN (CAILIAN)

- BIDEN'S TOP TRADE ADVISOR WILL SAY CHINA ISN'T COMPLYING WITH PHASE 1 DEAL (CNBC)

- FED'S CLARIDA TRADED INTO STOCKS ON EVE OF POWELL PANDEMIC STATEMENT (BBG)

- ECB'S VISCO: PRICE INCREASES SHOULD BE ONLY TEMPORARY (BBG)

- UK FISCAL MATTERS CLOUDY AS TORY PARTY CONFERENCE GETS UNDERWAY

- JAPAN TO HOLD GENERAL ELECTIONS ON OCT. 31 (NIKKEI)

BOND SUMMARY: Early Bid Cools A Little, Tight Ranges In Play

T-Notes held to a contained 0-05 range during overnight dealing, last trading -0-01+ at 132-04 after ticking back from early highs. There was no reaction to Chinese reports pointing to the latest round of details surrounding the continued reshuffle of troubled Chinese property developer Evergrande, while questions surrounding the company's debt obligations continued to swirl. Downside exposure headlined on the flow side, with a 5.0K screen lift of TYX1 130.50 puts seen overnight. Monday's U.S. docket will be headlined by Fedspeak from Bullard, with final durable goods data also due.

- The 7- to 10-Year sector of the JGB curve led the richening (~1.5bp firmer on the day) as the space played catch up to U.S. Tsys, while futures last deal 6 ticks above Tokyo settlement levels, a touch shy of their intraday peak. Local political headlines continue to dominate, with a recent Nikkei source report noting that "Fumio Kishida, president of Japan's ruling Liberal Democratic Party and soon to become prime minister, has decided to dissolve the lower house later this month to hold general elections on October 31." Elsewhere, outgoing Finance Minister Taro Aso has noted he had suggested that the BoJ lower its 2% inflation goal in previous rounds of discussion with BoJ Governor Kuroda. Today's BoJ Rinban operations drew the following offer/cover ratios: 1- to 3-Year: 2.57x (prev. 2.75x), 3- to 5-Year: 2.64x (prev. 1.99x), 10- to 25-Year: 3.03x (prev. 2.07). Focus now moves to tomorrow's 10-Year JGB auction.

- Aussie bond futures meandered to the beat of the broader tone, with NSW and the ACT out on holiday, resulting in the closure of cash ACGB trade. The local COVID situation once again failed to provide any real impetus for the space. YM & XM both -0.5 at typing.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.05tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y150bn worth of JGBs with 10-25 Years until maturity

EQUITIES: Evergrande Dents Sentiment

Equity indices in the Asia-Pac time zone are in the red, giving back early gains and then some after sentiment took a hit following Evergrande headlines. There were reports that China Evergrande's Hong Kong equity listing, along with its property management unit's listing, will be suspended. There were also reports that Evergrande is a guarantor of a US$-denominated bond issued by Jumbo Fortune Enterprises. This $260mn bond matured yesterday (October 3), with the payment falling due today. The Hang Seng led the move lower, shedding ~2%, and other bourses in the region dropped into negative territory. U.S. e-mini futures gave up their early gains and now trade ~0.2% softer on the session.

- Liquidity was thinned today by market holidays in China and South Korea and widespread holiday's in Australia. Looking ahead Monday's U.S. docket will be headlined by Fedspeak from Bullard, with final durable goods data also due. Further ahead focus in the coming week turns to the nonfarm payrolls release for September, which could seal the Fed's intentions to taper asset purchases ahead of the end of 2021. Rate decisions from the Australian and Indian central banks are also due.

OIL: Softens Ahead Of OPEC+ Meeting

Crude futures have come off Friday's closing highs in a holiday thinned Asia-Pac session. WTI remains below Tuesday's high of $76.67. Dips are considered corrective and a bullish theme remains intact. The recent break of resistance at $73.58,the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards the psychological $80.00 level further out. On the downside, firm support is seen at $73.58. As a reminder JPMorgan joined other sell-side outfits looking for further resilience in energy prices over the winter months as they upped their year-end Brent forecast to $84/bbl from $78/bbl previously. Markets look ahead to the OPEC+ meeting today, the group is expected the ratify the 400k bpd output boost agreed in July, though the upbeat assessment of demand given previously could result in a higher addition.

GOLD: Early Uptick Unwound

Spot had a limited look through last week's high in early Asia-Pac dealing before pulling back to trade little changed around the $1,760/oz mark at typing, with our weighted U.S. real yield monitor and the DXY moving away from their respective early Asia lows. Meaningful technical resistance is located at the Sep 22 high ($1,787.4/oz), while initial support is seen at the Sep 29 low ($1,721.7/oz). U.S. labour market matters headline the broader docket this week, with ADP due Wednesday and NFPs slated for Friday.

FOREX: Covid Headwinds Dent Kiwi

The kiwi went offered as New Zealand locked down parts of the Waikato district south of Auckland, including the nation's fourth-largest city of Hamilton. Officials detected two community cases of Covid-19 in the region but struggled to connect them to the Auckland outbreak. The news resulted in the trimming of hawkish RBNZ bets as participants prepare for Wednesday's monetary policy decision from the Reserve Bank. The move in implied odds of a hike to the OCR was modest but added to uncertainty ahead of the this week's MPC meeting. The OIS strip now prices an ~80% chance of a 25bp hike to the OCR this week, down from Friday's ~83%.

- The emergence of two mysterious cases outside of Auckland threw officials a curveball on the day when the Cabinet convened to review the Alert Level in New Zealand's largest city. Auckland remained at Alert Level 3 but PM Ardern outlined a plan for the gradual easing of restrictions.

- Geopolitical angst surrounding the largest-ever incursion by Chinese warplanes into Taiwan's air defence zone generated a mild risk-off impulse in early trade, which dissipated without much delay. Most major FX crosses oscillated within tight ranges, as market holidays in China, South Korea and Australia limited activity in the Asia-Pac region.

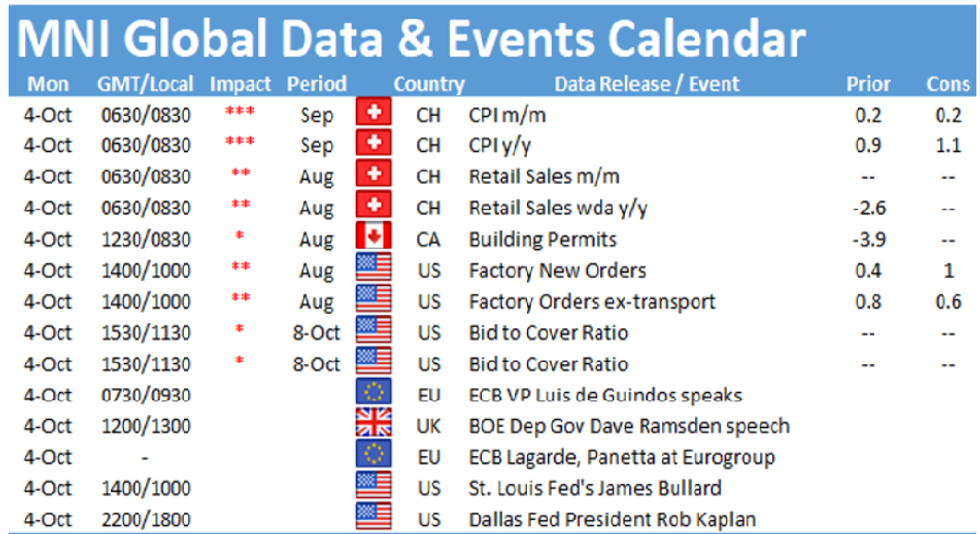

- U.S. factory orders & final durable goods orders as well as comments from Fed's Bullard, ECB's de Guindos & Makhlouf, BoE's Ramsden and Norges Bank's Olsen take focus from here.

FOREX OPTIONS: Expiries for Oct04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E854mln), $1.1530-40(E801mln), $1.1560-75(E687mln), $1.1600(E884mln), $1.1650(E807mln), $1.1700-15(E2.2bln), $1.1740-55(E1.4bln)

- USD/JPY: Y111.25-30($710mln)

- AUD/USD: $0.7250(A$742mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.