-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Geopolitical Tensions Remain Evident

EXECUTIVE SUMMARY

- OFFICE OF INSPECTOR GENERAL TO REVIEW WHETHER FED OFFICIALS' TRADING ACTIVITY BROKE ETHICS RULES OR THE LAW (CNBC)

- U.S. WILL USE ALL STEPS NECESSARY TO DEFEND ITS ECONOMIC INTERESTS AGAINST CHINA, TOP TRADE OFFICIAL SAYS (CNBC)

- TAIWAN SAYS NEEDS TO BE ON ALERT TO 'OVER THE TOP' CHINA (RTRS)

- RBA ON HOLD, FLAGS UNCERTAINTY, LIAISON POINTS TO POSITIVES RE: JOBS

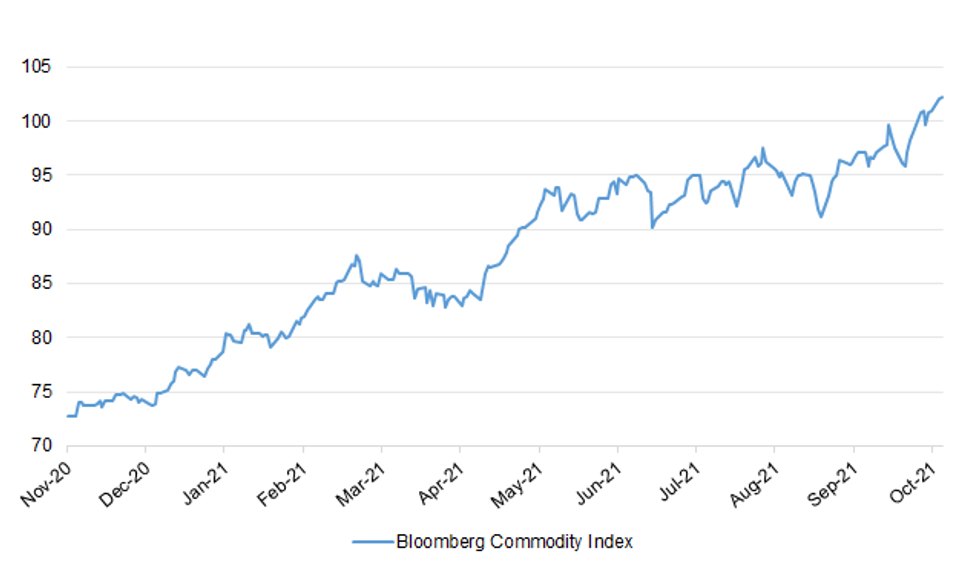

Fig. 1: Bloomberg Commodity Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: One in five forecourts in London and the South East of England are still without fuel, the body that represents independent fuel sellers has said. The Petrol Retailers Association (PRA) said there had been a "marked improvement" across the rest of the UK thanks to "steady deliveries". But conditions in the South East are "still challenging", the PRA said. The improvement in supplies has led to forecourt firm EG Group to remove its £30 cap on buying fuel at its sites. It said purchases were returning to normal levels in the majority of places, apart from the south of England. However, the company, which has about 400 sites in the UK, added it expected supply issues to ease "in the coming days" due to the military driving tankers to restore supplies. (BBC)

BREXIT: MNI BRIEF: EU Seeks "Pragmatic" Northern Ireland Solution

- The EU is continuing to seek "pragmatic" solutions to the problems facing implementation of the Northern Ireland Protocol, an EU diplomat said, in response to comments made by the UK's chief Brexit negotiator Lord Frost that London was prepared to invoke the emergency Article 16 clause to suspend the agreement. "If I understand correctly, the comments were made at a political conference of the Tory party," the source said."We stick to our line, we are looking for a pragmatic way of solving the problems of the Northern Ireland Protocol." A Commission source echoed the theme, telling MNI: "Nothing new on our side, we are continuing to find solutions to the problems that matter most to people in Northern Ireland" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: Only 27 fuel tanker drivers from the EU have applied to work in Britain under the government's emergency scheme to tackle the petrol crisis, ministers have been told. It means only a fraction of the 300 visas available for HGV drivers in the fuel industry are set to be taken up in a setback to efforts to replenish supplies. The failure to identify more drivers has infuriated Downing Street after it agreed to the demand by oil companies to fast-track applications. The figure calls into question wider plans to recruit a further 4,700 haulage drivers from later this month to alleviate the pressure on deliveries before Christmas. They will be issued work visas lasting until March. (The Times)

EUROPE

INFLATION: The acceleration of euro zone inflation, driven energy prices, is mostly temporary and price growth will slow down again next year as forecast by the European Central Bank and the European Commission, euro zone finance ministers agreed on Monday. Paschal Donohoe, who chaired the talks of the ministers in Luxembourg, told a news conference said there was also agreement that the inflation spike was not an argument against the transition to renewable sources of energy under the EU's ambitious plan of reducing CO2 emissions to zero by 2050. (RTRS)

FRANCE: French economic growth will return to around 1.4% a year as public investment to spur the recovery from the Covid pandemic offsets the damage from a sharp recession, according to long-term government forecasts. President Emmanuel Macron's government expects stronger growth rates in the short term as activity catches up with pre-crisis levels around the end of this year. As that surge fades, a 100 billion-euro ($116 billion) stimulus plan should ensure growth potential stabilizes at around 1.35%, a social-economic report published Monday shows. (BBG)

IRELAND: Activity in Ireland's service sector was unchanged in September from the previous month as a sharp post-lockdown rebound levelled off, but growth in the quarter is still likely to be the strongest for 15 years, a survey found on Tuesday. The AIB IHS Markit Purchasing Managers' Index (PMI) remained at 63.7 last month. It has been above 60 for five consecutive months after falling as low as 36.2 in January, when the economy was back in a COVID-19 lockdown that has now been almost fully unwound. (RTRS)

U.S.

FED: The Federal Reserve said it is working with the Office of Inspector General in its review of 2020 trading activity by a handful of central bank officials to determine if those transactions met ethics standards and did not break any laws. The addition of the Inspector General's office adds weight to a growing controversy at the Fed after a series of financial disclosures showed that Vice Chair Richard Clarida, Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren all made significant financial transactions in 2020. (CNBC)

FED: Sen. Elizabeth Warren on Monday urged the Securities and Exchange Commission to investigate whether three Federal Reserve leaders violated insider trading rules in 2020, when they bought and sold assets as the central bank ramped up efforts to save the U.S. economy from economic turmoil. Warren, who sits on the congressional committee that oversees the Fed, pressed SEC Chairman Gary Gensler to look into "ethically questionable transactions" made by Fed Vice Chair Richard Clarida and regional Presidents Robert Kaplan and Eric Rosengren. (CNBC)

FISCAL: A CNN reporter tweeted the following on Monday: "On a call with progressives, President Biden said the top line for the social safety net package should come down from $3.5 trillion to somewhere between $1.9-$2.2T. A source familiar with the call said Biden thought that was the range Sens. Manchin & Sinema would accept." (MNI)

FISCAL: President Joe Biden on Monday blamed Republicans for blocking efforts to raise or suspend the U.S. borrowing limit and avert a dangerous first-ever default on the national debt. The president slammed the GOP for what he described as hypocritical behavior: adding nearly $8 trillion to the U.S. debt during the Trump administration and later refusing to pay for already-approved tax cuts and spending. Biden said that Republican leaders rejected a White House request that they forgo a filibuster and allow Democrats to pass legislation to raise the ceiling with a simple majority instead with a 60-vote margin. (CNBC)

FISCAL: Democrats have a new deadline to enact President Joe Biden's economic agenda. The party will try to pass both a bipartisan infrastructure bill and a broader investment in social programs by the end of October, Senate Majority Leader Chuck Schumer, D-N.Y., told his caucus in a letter Monday. The party aims to approve the plans before the Oct. 31 expiration of major transportation funding programs, which the infrastructure legislation would renew. (CNBC)

FISCAL: Sen. Joe Manchin (D-W.Va.) said on Monday that Democrats should raise the debt ceiling through reconciliation if they have to, ruling out nixing the legislative filibuster to do so. "They shouldn't rule out anything. We just can't let the debt ceiling lapse. We just can't," Manchin told reporters, asked about Democratic leadership ruling out using reconciliation, a budget process that lets them bypass the filibuster, to increase the nation's borrowing limit. Asked if he was saying Democratic leadership should raise the debt ceiling under reconciliation, Manchin added: "Whatever they have to do, absolutely." (The Hill)

CORONAVIRUS: The U.S. Food and Drug Administration authorized a rapid at-home test from closely held Acon Laboratories Inc. on Monday, a move the regulator said should double the country's capacity to run such tests in the coming weeks. The emergency-use authorization comes at a time that many consumers are finding the products are scarce at pharmacies and online. The Flowflex Covid-19 Home Test doesn't require a prescription for use. Acon plans to make more than 100 million of the tests monthly by the end of the year, and twice that by February, according to the FDA. Home-testing products already available are made by companies including Abbott Laboratories and Quidel Corp. (BBG)

CORONAVIRUS: Doctors across Kansas are concerned the state is at risk of a new wave of infections due to low vaccination rates and mask use, the Topeka Capital-Journal reported Monday. Small and rural hospitals in Kansas are struggling to locate transfer beds for critically ill patients at larger and better equipped facilities, the newspaper said. Finding a bed after hours on the phone is "like a radio show where the seventh caller gets the prize" said Jonathan Pike, a physician at Great Bend Family Medicine. (BBG)

OTHER

GLOBAL TRADE:U.S. Trade Representative Katherine Tai slammed China's unfair trade practices and vowed to protect U.S. economic interests in a speech Monday, adding that the Biden administration will rally allies in order to push back on the world's second-largest economy. "Our objective is not to inflame trade tensions with China," Tai said in an address to an audience at the Center for Strategic and International Studies, a Washington-based think tank. "But above all else, we must defend to the hilt our economic interests and that means taking all steps necessary to protect ourselves against the waves of damage inflicted over the years through unfair competition," said Tai, the nation's top trade official. During her address, Tai confirmed a CNBC report last week saying that the Biden administration believed that Beijing has not complied with the phase one trade deal. (CNBC)

GLOBAL TRADE:MNI BRIEF: Ireland To Announce Thursday On OECD Tax Talks

- Irish Finance Minister Paschal Donohoe said Monday that he would make a statement Thursday on the Irish government's position in OECD talks towards a global minimum corporate tax. Donohoe added that talks with the EU on the tax had made progress recently and that the Irish Cabinet would discuss the issue on Thursday. Ireland has to make its position clear on whether it is ready to raise its 12.5% current corporate tax rate to the minimum allowed in the global negotiations of 15% - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA/TAIWAN: Taiwan needs to be on alert for China's "over the top" military activities which are violating regional peace, Premier Su Tseng-chang said on Tuesday, after 56 Chinese aircraft flew into Taiwan's air defence zone on Monday, the highest ever. (RTRS)

U.S./CHINA/TAIWAN: U.S. State Department's comments expressing concerns on China's military activity near Taiwan have sent an "extremely erroneous and irresponsible" signal, China's Ministry of Foreign Affairs spokeswoman Hua Chunying says in a statement. China will take any actions to crush plans for Taiwan independence, and is determined to protect its sovereignty and territorial integrity. (BBG)

CHINA/TAIWAN: Military tension around Taiwan increased on Monday as China sent a record 52 warplanes into the country's air defence identification zone after the US and five of its allies held a large naval exercise east of Taiwan. The incursion, announced by Taiwan's defence ministry on Monday night, included 36 fighters and 12 nuclear-capable bombers. It marked the third time in four days that the People's Liberation Army set a new record for flying into Taiwan's air buffer zone, bringing the total number of such flights to 145 since Friday. Taiwanese officials said that although it appeared the Chinese military aircraft that entered its air defence buffer zone on Monday were engaged in an exercise aimed at the US and its allies, the scale of the PLA's activity near Taiwan had reached a dangerous level. "This is getting close to the brink of conflict," one senior official told the Financial Times. (FT)

FRANCE/TAIWAN: Taiwan welcomes a French delegation led by French senator Alain Richard this week, the foreign ministry's spokeswoman Joanne Ou says at briefing in Taipei. (BBG)

U.S./CHINA/TAIWAN: The Biden administration is in private communication over Chinese actions with regard to Taiwan, the White House said on Monday, after Taiwan's defense ministry reported that China's air force had sent aircraft into its air defense zone. (RTRS)

CORONAVIRUS: Purchases of PCR tests in China's Hubei Province surged months before the first official reports of a novel coronavirus case there, according to a report from researchers in the U.S., the U.K. and Australia. (Nikkei)

JAPAN: New Japanese Prime Minister Fumio Kishida said on Tuesday that he received a "strong" message from President Joe Biden about the United States' commitment to defending the disputed East China Sea islets known as the Senkaku Islands in Japan. In phone talks on Tuesday morning that lasted roughly 20 minutes, the allies also confirmed their cooperation toward achieving a free and open Indo-Pacific, Kishida told reporters at the prime minister's official residence. The call came a day after Kishida called a parliamentary election for Oct. 31 and vowed to bolster the country's response to the pandemic. He was voted in by lawmakers on Monday as the nation's new prime minister. "We confirmed that we would work together toward the strengthening of the Japan-US alliance and free and open Indo-Pacific," Kishida said. "We also confirmed we would work closely on issues related to China and North Korea." (CNBC)

JAPAN: Japan's new economy minister Daishiro Yamagiwa said on Tuesday the government will take all necessary measures to support the economy, which remains hard-hit due to the impact of the coronavirus pandemic. "We will manage economic and financial policy in a flexible manner without hesitation," Yamagiwa told reporters at his inaugural press conference. He also called for discussions about the country's economic growth strategy and reducing income inequality. (RTRS)

RBA: The Reserve Bank has held official interest rates steady and remained committed to its gradual wind back of its quantitative easing program as it waits on large parts of the economy to re-open from COVID-19 lockdown. At its regular monthly meeting today, the RBA board held the official cash rate at 0.1 per cent where it has been since November last year. The decision was in line with market expectations and forecasts from economists. (Sydney Morning HErald)

AUSTRALIA: International tourists won't be welcomed back to Australia until next year, with the return of skilled migrants and students given higher priority, the prime minister said on Tuesday. Prime Minister Scott Morrison said Australia was expected to reach the vaccination benchmark on Tuesday at which the country could begin to open up: 80% of the population aged 16 and older having a second shot. Last week, he outlined plans to allow vaccinated citizens and permanent residents to fly overseas from November for the first time since an extraordinarily tough travel ban took effect in March last year. But Morrison on Tuesday said that after Australians, the next priority would be skilled migrants and international students entering Australia before tourists. (MarketWatch)

AUSTRALIA: Dominic Perrottet will become the 46th premier of New South Wales after he won a party room vote on Tuesday. Sparked by the resignation of Gladys Berejiklian on Friday, the vote confirmed Perrottet as the new Liberal party leader, easily beating a challenge by the planning minister, Rob Stokes, to win 39 votes to five. The NSW Liberal party whip, Adam Crouch, confirmed the vote, saying Perrottet had been elected leader while the Penrith MP, Stuart Ayres, had been elected deputy unopposed. (Guardian)

AUSTRALIA/CHINA: China has started unloading a small number of Australian coal shipments despite an unofficial import ban, analysts said, in a move underscoring the intensity of the power crunch facing the world's second-largest economy. Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, said a handful of Australian cargoes waiting outside Chinese ports since a ban came into force a year ago had headed into berth last month and draft change had been observed, indicating that the coal had been unloaded. He said 450,000 tonnes of coal had been discharged. Energy research company Kpler also said a total of five vessels waiting offshore had discharged 383,000 tonnes of Australian thermal coal into China last month. (FT)

NEW ZEALAND: New Zealand said on Tuesday that it will start using COVID-19 vaccine certificates as proof of inoculation at large events and other high-risk settings from next month, as the country battles the spread of the Delta variant. (RTRS)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a weakening in business confidence in the September quarter, despite demand in firms' own business holding up. A net 8 percent of businesses expect a deterioration in general economic conditions over the coming months – a turnaround from the net 9 percent expecting an improvement in the previous quarter. This weakening in sentiment was despite demand remaining solid, with a net 29 percent of businesses reporting an increase in their own trading activity in the September quarter. This QSBO survey was taken over the period 2 August to 27 September 2021. Hence, it captures some of the impacts from the latest COVID-19 community transmission and lockdown on businesses in New Zealand. (NZIER)

NEW ZEALAND: A major review of New Zealand's electoral law being launched by the Government will consider changes to the voting age, funding of political parties, and length of parliament's three-year terms. Justice Minister Kris Faafoi announced on Tuesday morning the Government would undertake a sweeping review of many aspects of the country's electoral law prior to the 2026 election. A number of "targeted changes", including transparency around political donations and the ability for Māori to switch between the Māori and general electoral rolls, will be acted on before the 2023 election. "Much has changed since the 1950s, but most of our electoral law hasn't and the basic structure of the Act is 60 years old, when voting was based on walking to your local polling station, and filling out a piece of paper on election day itself," Faafoi said. (Stuff NZ)

RBNZ: MNI INTERVIEW: RBNZ To Hike 25bps, Former Official

- A former leading Reserve Bank of New Zealand official said that the central bank will move ahead with a 25-basis point rate hike on Wednesday and could follow up with another increase in November - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: The Bank of Mexico's cycle of rate hikes is not yet over and one or two increases are likely forthcoming amid concerns about inflation, though any monetary policy moves will depend on incoming data, Deputy Governor Jonathan Heath said on Monday. (RTRS)

MEXICO: Mexico's inflation spike is owed to "transitory" and "external" factors, central bank deputy governor Gerardo Esquivel said in a report co- authored with Julio Leal and Raquel Y. Badillo dated Oct. 4 and published by the Autonomous University of Yucatan. (BBG)

BRAZIL: Central bank predicts inflation will peak in September 2021 and prices should fall after, the bank's President Roberto Campo Neto said during an online event. Central bank is looking to 2022 as a relevant horizon, he said. Central bank will closely monitor price increases for services and energy. Central bank will not comment on Petrobras' pricing policy, he said. "I have personally said that I am against a subsidy policy, I like policies that are closer to the market price." Asked about his investments abroad, Campos Neto reinforced that all his investments are declared to Brazilian authorities. (BBG)

MIDDLE EAST: The U.S. welcomes the news of direct communication between longtime Middle Eastern rivals Saudi Arabia and Iran, a Biden administration official told CNBC on Monday, at a time when tensions are high in the region and Iran's recently-elected government has not held back in expressing its animosity toward the West. "Our regional partners, first of all, like the UAE, are absolutely critical to us as partners in economics, in regional security, in mutual cooperation," Jennifer Gavito, deputy assistant secretary for Iran and Iraq at the State Department's Bureau of Near Eastern Affairs, told CNBC's Dan Murphy in Dubai. (CNBC)

ENERGY: The U.S. Department of Justice is investigating suspected manipulation of energy pricing benchmarks published by S&P Global Platts, expanding the agency's crackdown on misconduct in the global commodities market, according to four people familiar with the matter. (RTRS)

OIL: Canada on Monday formally invoked a 1977 treaty with the United States to request bilateral negotiations over Enbridge Inc's Line 5, escalating a long-running dispute over one of Canada's major oil export pipelines. (RTRS)

OVERNIGHT DATA

JAPAN SEP TOKYO CPI +0.3% Y/Y; MEDIAN -0.1%; AUG -0.4%

JAPAN SEP TOKYO CORE CPI +0.1% Y/Y; MEDIAN +0.2%; AUG 0.0%

JAPAN SEP TOKYO CORE-CORE CPI -0.1% Y/Y; MEDIAN -0.1%; AUG -0.1%

JAPAN SEP, F JIBUN BANK SERVICES PMI 47.8; FLASH 47.4

JAPAN SEP, F JIBUN BANK COMPOSITE PMI 47.9; FLASH 47.7

The Japanese services economy faced a sustained downturn in demand conditions at the end of the third quarter. Latest PMI data signalled further declines both business activity and new orders, though the rates of reduction eased from August's lows. Panel members highlighted the extension to state of emergency restrictions amid the latest wave of COVID-19 infections continued to dampen output and demand further. Despite this, service providers increased staffing levels for the second successive month in anticipation of a future rise in demand. Moreover, firms were increasingly optimistic that activity would rise, as positive sentiment reached a three-month high. Overall private sector activity saw a sustained, albeit softer decline in September, led by a slower decline in the larger service sector. At the same time, manufacturing output and new orders were both in decline for the first time since late-2020. Businesses in the Japanese private sector also noted the strongest cost pressures for 13 years, as supply chain disruption continued to dampen domestic and global activity. Price rises were notably sharp for raw materials, staff and fuel. Regardless of this, firms were optimistic that an eventual end to the pandemic would occur within the coming 12 months, and provide a broadbased boost to demand and activity. As a result, IHS Markit expects the economy to grow 2.5% in 2021. (IHS Markit)

AUSTRALIA AUG TRADE BALANCE +A$15.077BN; MEDIAN +A$10.100BN; JUL +A$12.650BN

AUSTRALIA AUG EXPORTS +4% M/M; MEDIAN -3%; JUL +5%

AUSTRALIA AUG IMPORTS -1% M/M; MEDIAN +1%; JUL +4%

AUSTRALIA SEP ANZ JOB ADVERTISEMENTS -2.8% M/M; AUG -2.7%

ANZ Australian Job Ads fell 2.8% m/m in September, the third consecutive monthly decline, but was still 21.9% higher than the pre-pandemic level. This is consistent with our expectation that the measured unemployment rate will only lift a little above 5% later this year. (ANZ)

AUSTRALIA SEP, F MARKIT SERVICES PMI 45.5; FLASH 44.9

AUSTRALIA SEP, F MARKIT COMPOSITE PMI 46.0; FLASH 46.0

The recent contraction of the Australian service sector eased in September according to the latest IHS Markit Australia Services PMI. Furthermore, even as new orders and business activity remained in contraction, business sentiment remained positive while employment levels returned to expansion. Price pressures however worsened in September, sustaining the double whammy on the service sector alongside the COVID-19 disruptions that had affected services to a far greater extent compared to manufacturing. "IHS Markit expects the Australian economy to grow by 3.3% in 2021 with vaccination rates expected to hit targets into end 2021 to provide a recovery in economic activity following the strict COVID-19 containment measures seen in Q3 2021. (IHS Markit)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 104.6; PREV. 103.7

Consumer confidence increased by 0.9% last week as NSW recorded a substantial drop in new COVID cases. People are optimistic but sentiment is still some way below its long-run average. With Sydney and Melbourne headed towards re-opening in the next few weeks, confidence increased in both cities by 4.4% and 1.5% respectively. The rise in Melbourne was dampened by a fall in regional Victoria of -4.1%. Confidence also declined in Adelaide (-2.1%), Brisbane (-9.0%) and Perth (-6.2%). Inflation expectations remained elevated at its recent pandemic-high. (ANZ)

NEW ZEALAND SEP ANZ COMMODITY PRICE INDEX +1.5% M/M; AUG -1.6%

MARKETS

SNAPSHOT: Geopolitical Tensions Remain Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 591.36 points at 27858.1

- ASX 200 down 33.038 points at 7246

- Shanghai Comp. is closed

- JGB 10-Yr future down 8 ticks at 151.53, yield down 0.3bp at 0.051%

- Aussie 10-Yr future down 3 ticks at 98.455, yield up 2.5bp at 1.515%

- U.S. 10-Yr future -0-05 at 131-29+, yield up 1.38bp at 1.493%

- WTI crude up $0.22 at $77.84, Gold down $11.3 at $1757.99

- USD/JPY up 26 pips at Y111.20

- OFFICE OF INSPECTOR GENERAL TO REVIEW WHETHER FED OFFICIALS' TRADING ACTIVITY BROKE ETHICS RULES OR THE LAW (CNBC)

- U.S. WILL USE ALL STEPS NECESSARY TO DEFEND ITS ECONOMIC INTERESTS AGAINST CHINA, TOP TRADE OFFICIAL SAYS (CNBC)

- TAIWAN SAYS NEEDS TO BE ON ALERT TO 'OVER THE TOP' CHINA (RTRS)

- RBA ON HOLD, FLAGS UNCERTAINTY, LIAISON POINTS TO POSITIVES RE: JOBS

BOND SUMMARY: JGB Auction Sees Lowest B/C Since 2015

T-Notes head into the European open softer after oscillating around neutral levels through the Asia-Pac session. Headline flow was light through the session, a political impasse over the debt ceiling remains US President Biden urged Republican senators to "get out of the way" and let Democrats suspend the nation's debt limit. T-Notes dropped to fresh session lows after e-minis regained some poise having spent the early part of the session on the slide. T-Notes last -0-05+ at 131.29, cash Tsys ~1bp to ~2bp cheaper, with flattening in play as the belly leads the weakness. ISM Services PMI will headline the US data calendar on Tuesday.

- JGB's are firmer, the 10-Year ticking higher through the session as equities softened, a hangover from the drop on Wall Street. The latest round of Tokyo CPI failed to impact the space. The 10-Year auction saw the lowest price lower than forecast, though bid/cover did slip from the previous auction and hit the lowest since 2015. It appears questions surrounding the future path of Japanese fiscal policy have deterred investors. 10-Year future up 2 ticks having come off session highs post auction.

- Aussie bonds meandered lower, largely ignoring the RBA's unchanged rate announcement. The latest RBA statement didn't really offer much, with the theme of economic uncertainty on the back of the COVID-19 situation remaining evident, in addition the uneven impact of the virus on different sectors of the economy. YM down 0.5 ticks, XM down 1.5 ticks heading into European hours.

JGBS AUCTION: Japanese MOF sells Y2.0978tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0978tn 10-Year JGBs:

- Average Yield 0.049% (prev. 0.023%)

- Average Price 100.50 (prev. 100.75)

- High Yield: 0.052% (prev. 0.025%)

- Low Price 100.47 (prev. 100.73)

- % Allotted At High Yield: 78.6986% (prev. 77.9744%)

- Bid/Cover: 2.452x (prev. 3.357x)

EQUITIES: Technical Corrections In Asia

The spill over from Wall St. dragged regional equity markets lower during Asia-Pac trade, with the likes of the Nikkei 225, KOSPI & the TAIEX entering technical correction territory. Liquidity in the Asia-Pac session was thinner than usual with Chinese markets still on holiday. Oil prices remain high following yesterday's OPEC+ announcement which added fuel to the fire over inflation concerns. The Nikkei 225 is providing the weak point amongst the regional majors, running ~3% below Monday's closing levels at typing. The negative sentiment also weighed on e-minis early on, though the losses were recovered as the session wore on and US futures now trade with minor gains.

OIL: Creeps Higher

Crude futures have crept higher in Asia-Pac trade, extending Monday's rally. WTI and Brent crude futures ripped higher Monday, with both oil benchmarks touching a fresh cycle best at $78.38/bbl for WTI and $82/bbl for Brent. The price action followed a much anticipated OPEC+ meeting, at which markets speculated that the group could front-load their planned output hikes to bring November production higher by 800,000bpd - double the previously agreed pace. This didn't come to pass, with OPEC+ sticking to the script and sending a message that the group will tolerate restrained output in exchange for high prices. This leaves the rally off the August lows intact, with WTI targeting $79.53 initially ahead of psychological resistance at the $80/bbl handle.

GOLD: Firmer USD Applies Light Pressure In Asia

A modest uptick in the DXY pushed spot bullion away from Monday's high during Asia-Pac trade, with the latter last dealing ~$5/oz softer just above $1,760/oz. This comes after a pullback in the DXY and a move away from intraday highs for our weighted U.S. real yield monitor supported bullion into the NY close. The technical picture hasn't really changed since yesterday, with the well-defined lines in the sand remaining intact.

FOREX: Greenback Takes Lead, Kiwi Takes Hit

The greenback garnered some strength in Asia as regional liquidity remained thinned out by market holidays in China. Risk sentiment was wobbly in the wake of Monday's Wall Street rout, with several Asian equity benchmarks entering technical correction.

- NZIER's Quarterly Survey of Business Opinion showed that New Zealand businesses turned net pessimistic about the economy in Q3, which pulled the rug from beneath NZD. The survey is closely watched by the RBNZ, who will deliver their monetary policy decision tomorrow.

- Across the Tasman, the RBA threw no curveballs, leaving their policy settings unchanged. AUD posted a marginal downtick after the announcement, holding a familiar range as participants scrutinised Gov Lowe's statement.

- AUD/NZD crept higher as the Antipodean cousins diverged, but yesterday's extremes remained intact. Worth noting that A$2.1bn worth of options with strikes at NZ$1.0410 expire at today's NY cut.

- The global data calendar is headlined by U.S. ISM Services Index today, with a number of Services PMIs from elsewhere & Canadian trade balance also due. Central bank speaker slate includes ECB's Lagarde & Holzmann, Fed's Quarles and Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Oct05 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.80-00($1.1bln), Y112.00($823mln)

- AUD/NZD: N$1.0410(A$2.1bln)

- AUD/USD: $0.7450(A$728mln)

- USD/CAD: C$1.2615-25($2.0bln)

- USD/CNY: Cny6.4620($1.0bln)

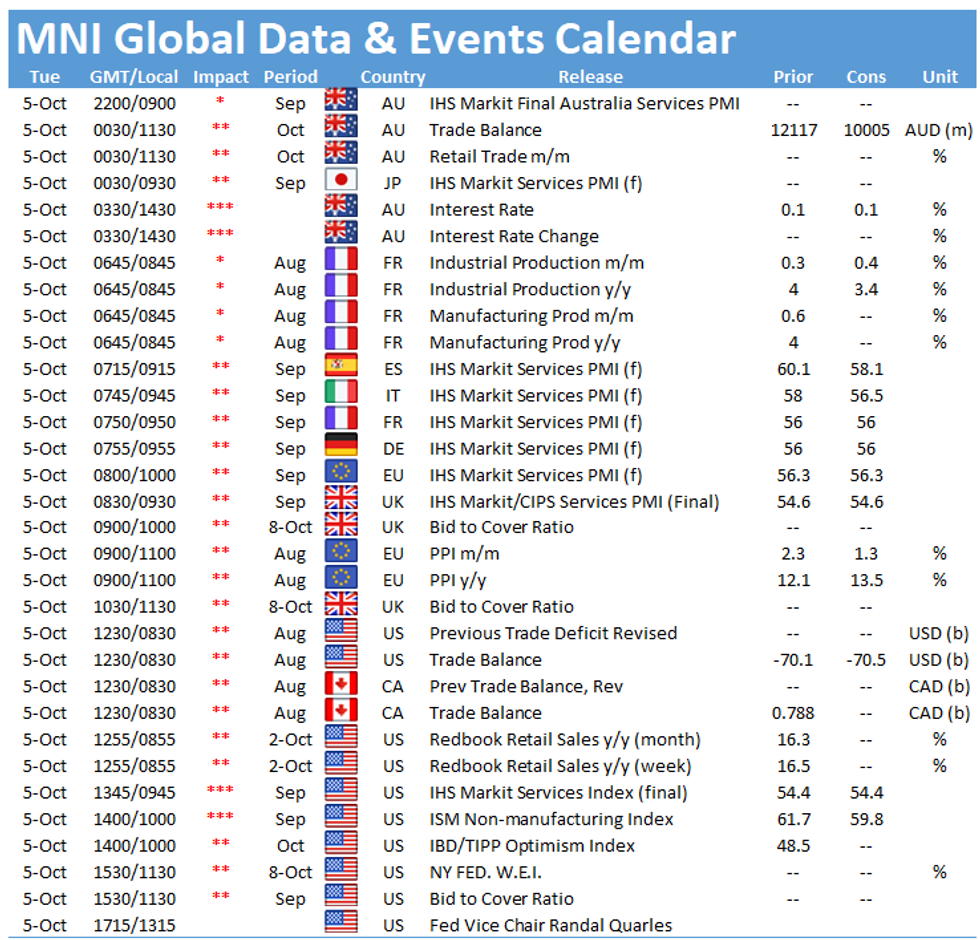

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.