-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: USD Bid, Bonds Struggle, Inflationistas Rejoice

- NZ CPI data and comments from BoE Governor Bailey fan the inflationary flames.

- Chinese GDP data provides a marginal miss.

- Central bank speak from the FOMC, ECB & BoE headlines the broader docket today.

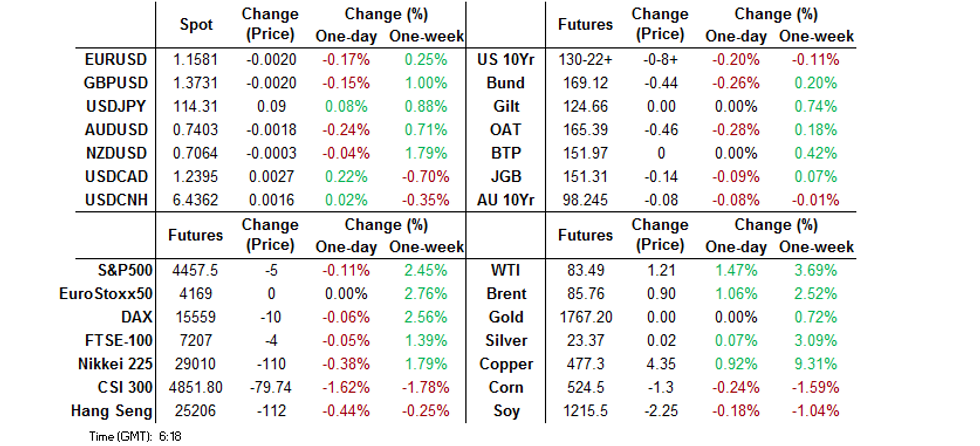

BOND SUMMARY: Cheapening Apparent

Spill over from Friday's NY trade and stronger than expected CPI data out of New Zealand created some notable pressure for core FI markets during Asia-Pac hours. While there were some spurts of demand, a convincing bid never really came in, with weakness extending as we moved through the overnight session. Marginally softer than expected Chinese Q3 GDP data (accompanied by mixed monthly economic activity data) failed to provide a bid for core FI, with plenty of worry re: the Chinese economy already observed in recent weeks/months. BoE Governor Bailey also fanned rate hike speculation in the UK over the weekend, which would have provided some downward impetus.

- T-Notes breached cluster support on the sell off, to last trade -0-09+ at 130-21+, while the belly represented the weakest point of the cash Tsy curve, as the broader benchmarks cheapened by 2.5-4.0bp on the day. NY hours will see the latest round of U.S. industrial production data, which will be supplemented by Fedspeak from Quarles & Kashkari.

- JGB futures have trickled lower early this week, with the offshore impulse and lack of domestic risk events evident on Monday allowing dealers to extend on the weakness seen during the second half of Friday's Tokyo trade, which spilled into the overnight session. Futures last -15, just off early lows, and still some way above the next area of technical support (the month-to-date lows located at 150.18). The 7- to 20-Year zone of the cash JGB curve represents the weak point, cheapening by ~1bp thus far. Super-long swap spreads have seen some widening, pointing to payside flows helping the broader weakness.

- The trans-Tasman impetus from the previously flagged NZ CPI print accentuated the bear flattening witnessed overnight, leaving YM -18.0, trading through a couple of notable technical support levels, while XM sits 8.5 ticks lower on the day. Positive developments surrounding the wind back of COVID restrictions in NSW, Victoria & Queensland were also noted.

FOREX: Kiwi Holds Firm After CPI Beat, Despite Return Of Mild Cautious Feel

The kiwi went bid after New Zealand's Q3 CPI data poured fuel on fears of an inflationary blowout. Headline inflation rate printed at +4.9% Y/Y, the fastest pace in a decade, overshooting the RBNZ's projection from their latest MPS (+4.1%) as well as consensus forecast (+4.2%) and estimates of all economists surveyed by BBG. The release boosted RBNZ tightening bets and the OIS strip now prices ~37bp worth of OCR hikes at the Reserve Bank's next monetary policy meeting, while BNZ said they see the odds of a 50bp hike in November at "just a tad under 50:50."

- The RBNZ released their preferred metric of core inflation after the main inflation report hit the wires. Sectoral factor model inflation accelerated to +2.7% Y/Y in Q3, moving further above the mid-point of the Reserve Bank's target range.

- NZD/USD briefly showed above a key layer of resistance from the 200-DMA/descending trendline drawn off Feb 2021 high, but struggled to make much headway beyond there and trimmed gains.

- Strong domestic inflation data allowed NZD to withstand pressure applied to the broader high-beta FX space by negative risk sentiment. The kiwi's Antipodean cousin AUD led losses in G10 FX space as a result.

- Sterling showed a modicum of strength in early trade, after BoE Gob Bailey said that the central bank will "have to act" to tame inflation, but gave away initial gains as defensive flows kicked in.

- Safe havens USD and JPY traded on a firmer footing as mildly cautious mood took hold. USD/JPY went offered into the Tokyo fix but recouped losses later on, oscillating in close proximity to multi-year highs printed last Friday.

- The yuan looked through a mixed bag of China's quarterly GDP data and monthly economic activity indicators.

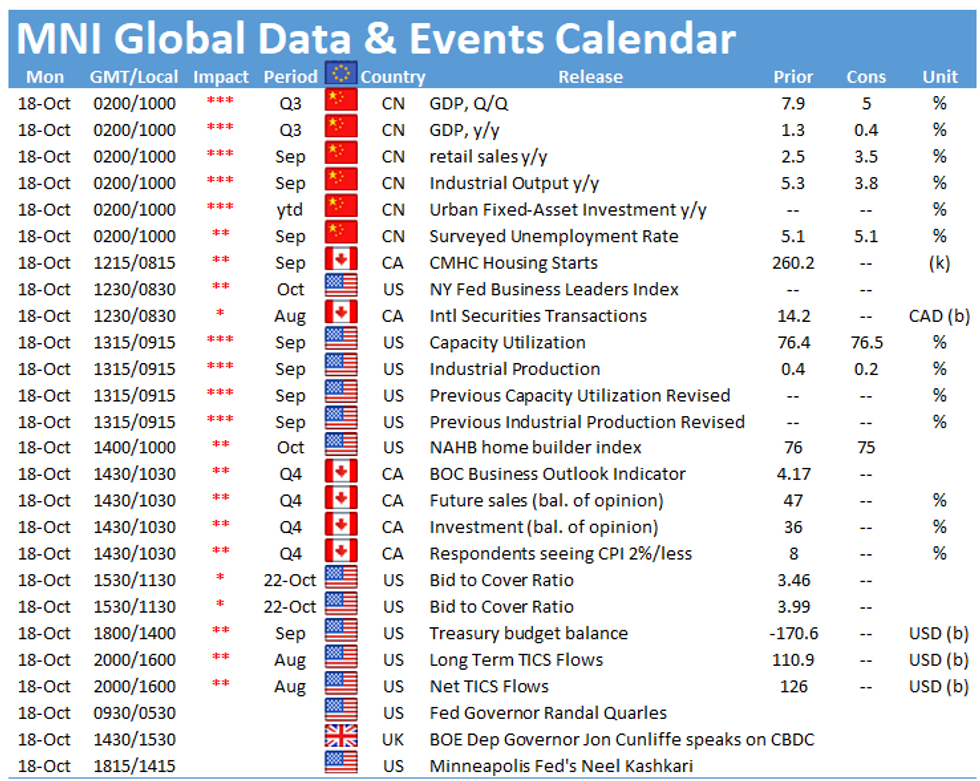

- Today's economic docket includes speeches from Fed's Quarles & Kashkari, ECB's de Cos & BoE's Cunliffe as well as U.S. industrial output & Canadian housing starts.

FOREX OPTIONS: Expiries for Oct18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-20(E757mln), $1.1655(E551mln)

- AUD/USD: $0.7425(A$640mln)

- USD/CAD: C$1.2450($740mln)

ASIA FX: Yuan Looks Through Mixed Data Out Of China

USD/Asia generally firmed as China's mixed economic data provoked little in the way of market reaction. GDP growth printed virtually in line with expectations, which came alongside a beat in retail sales and a miss in industrial output.

- CNH: USD/CNH treaded water, paying little attention to domestic data. The PBOC fix matched today's sell-side estimate. Over the weekend, PBOC Gov Yi played down potential for any systemic spillover from the Evergrande saga.

- KRW: The won underperformed in the Asia EM basket, despite continued decline in South Korea's daily Covid-19 cases.

- THB: Spot USD/THB advanced, with BoT stealing the limelight today. The Bank admitted intervening in FX markets to curb baht volatility and support economic recovery.

- PHP: Spot USD/PHP crept higher. BSP Gov Diokno sided with "team transitory" and suggested that Bankgo Sentral would rather wait too long with tightening policy than hike interest rates prematurely.

- IDR: Spot USD/IDR moved away from a fresh cycle low. Indonesian FinMin Indrawati said that she expects a narrower budget deficit in 2021 than had been previously anticipated, as Indonesia's tax reform, higher commodity prices and economic recovery should boost state revenue.

- MYR: The ringgit traded on a softer footing, the gov't signalled that they will crack down on anti-vaxxers and might impose restrictions on those who choose not to take a jab.

- SGD: USD/SGD moved with the broader impetus. The annual growth rate in Singapore's non-oil domestic exports topped expectations, while electronic exports growth was a tad slower than projected.

EQUITIES: Chinese Equities Struggle

Chinese mainland equities led the weakness witnessed across most of the major Asia-Pac indices, as the CSI 300 index shed over 1.0%, with worry surrounding Evergrande contagion weighing on the property sector, even as the PBoC continued to play down worry re: the systemic impact surrounding the China Evergrande situation (some read this as a signal from policymakers that a bailout would not be forthcoming). Mixed Chinese economic data did little to support the space, with the same holding true for sell-side calls re: a lower likelihood of PBoC easing in Q421. U.S. e-minis trade either side of unchanged, with the NASDAQ struggling the most owing to the uptick in U.S. Tsy yields. Some pointed to weekend comments from BoE Governor Bailey & the latest NZ CPI reading as another negative for equities i.e. via inflationary pressures.

GOLD: Flat

Bullion has experienced a flat start to the week, with spot last dealing little changed, a touch shy of $1,770/oz, after sticking within the well-defined lines in the sand over the past couple of weeks. The latest uptick in U.S. Tsy yields and the broader DXY has done little for the space, with inflation worry perhaps generating some regional demand in Asia-Pac hours.

OIL: A Fresh Week Sees A Fresh Rally

WTI prints $1.25 above settlement levels, while Brent is the best part of $1.00 better off. The well-documented energy supply issues continue to drive demand for oil-based products, contributing to tighter markets and fresh multi-year highs for crude futures.

- In terms of OPEC+ matters, BBG sources pointed to 115% compliance during the month of September re: the OPEC+ pact. Elsewhere, the Iraqi oil ministry noted that oil prices > $80bbl represent "a positive indicator," although a spokesperson for the ministry alluded to the need for long term stability in prices.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.