-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: Evergrande's Late Coupon Payment Doesn't Generate Lasting Market Reaction

- China Evergrande makes late payment of a coupon on US$ bond before grace period elapses, avoiding default. Focus quickly moves to similar payment that needs to be made next week.

- RBA enforces YCT mechanism for first time since Feb after repo move doesn't do what was needed.

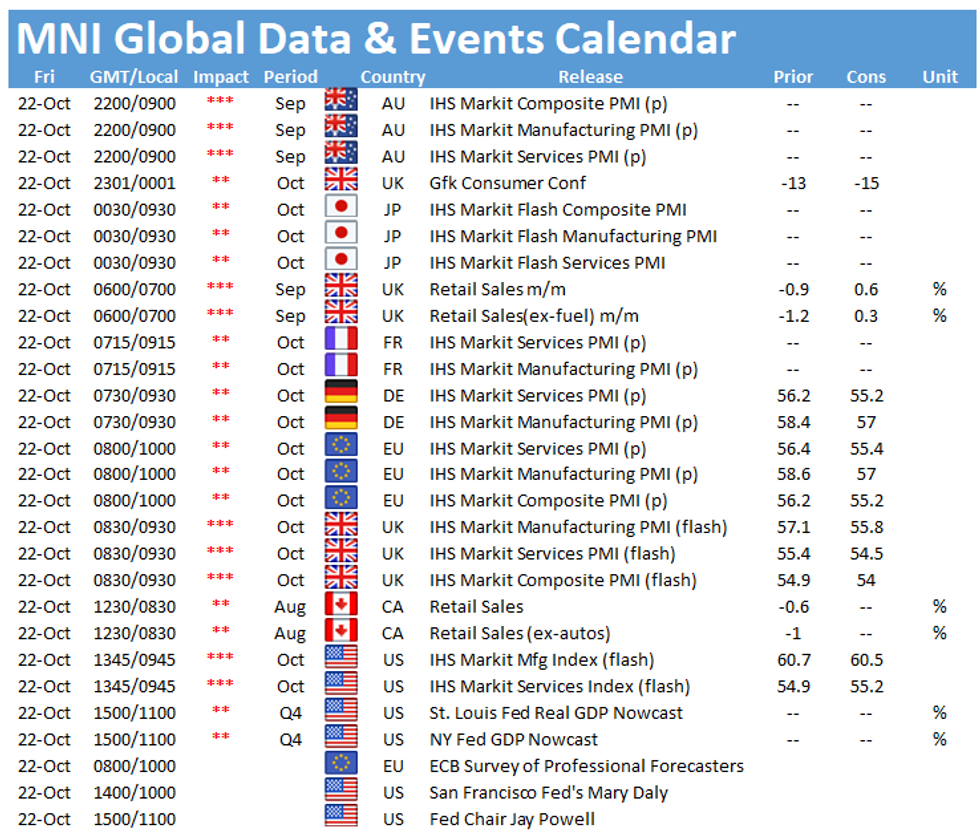

- Flash PMIs as well as Fedspeak from Powell & Daly ahead of the Fed's blackout period headlines on Friday.

BOND SUMMARY: Not Much Relief From Evergrande Making Late Coupon Payment, RBA Enforces YCT

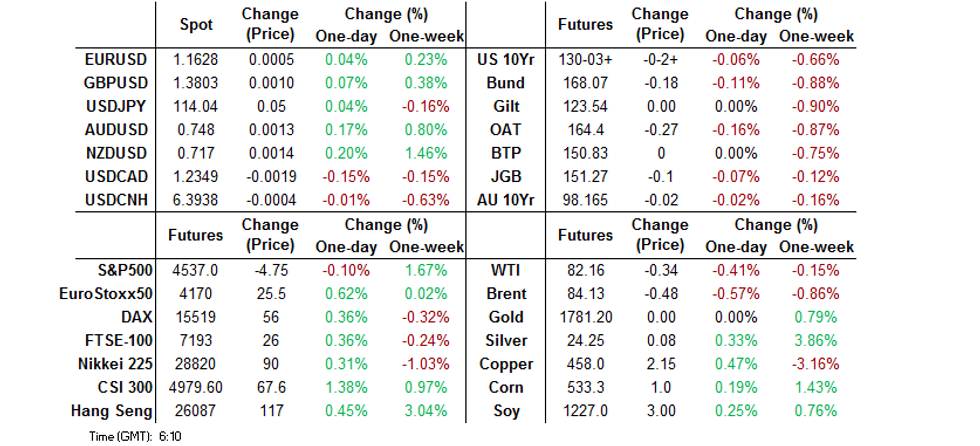

TYZ1 trades -0-02 at 130-04, shy of the peak of its 0-06 Asia range, while cash Tsys firmed by 0.5-2.5bp, bull flattening in the process. The move represented a pullback from the late NY lows which were inspired by breakeven dynamics (Asia hours saw NY Fed President Williams stress that long-term inflation expectations are "in line with 2%") and another round of FOMC hike repricing, which saw 10-Year yields top out just ahead of their mid-May highs. The previously outlined repayment of a missed coupon on a US$ bond issued by China Evergrande within the 30-day grace period provided some very modest & brief pressure for Tsys, although markets quickly switched focus to a similar missed payment that needs to be fulfilled late next week. Flash PMIs from Europe & the UK will headline ahead of Friday's NY session. Elsewhere, we will hear from Fed's Powell & Daly ahead of the Fed's pre-meeting blackout period.

- JGB futures sit 9 ticks lower on the day, following the broader ebb & flow of core FI markets. The cash curve has been subjected to some twist steepening pressure, while swap rates have pulled back from their early peaks. Y300bn of multi-tranche green issuance from NTT finance headlined the corporate issuance slate.

- YM & XM sit 2.0 & 3.0 below yesterday's settlement levels, in the top half of their respective ranges, but shy of their Sydney peaks. Action in the ACGB space saw the RBA defend the 0.10% yield target on ACGB Apr-24 for the first time since Feb, buying $A1.0bn of the line after hiking repo costs (the cost of shorting) back on Monday failed to weigh on yields. The line last yields ~0.12% after challenging 0.18% early on.

FOREX: Temporary Respite For Evergrande Received With Optimism

The mood music turned optimistic after Chinese state media reported that Evergrande had paid a missed coupon on its Mar '22 dollar bond. The real-estate giant wired the payment just days ahead of the expiration of a 30-day grace period and thus averted a formal default. The news was received with a sigh of relief, even as the payment does not solve the firm's longer-term troubles.

- Spot USD/CNH went offered in response to headlines surrounding the Evergrande situation but quickly recouped losses. The rate oscillates around neutral levels as we type.

- Antipodean currencies led commodity-tied FX higher but trimmed gains thereafter. AUD/USD and NZD/USD remained within the confines of their Thursday ranges.

- For the record, the RBA stepped in to defend its yield target for the first time since Feb but the Aussie dollar was unfazed.

- JPY underperformed at the margin amid limited demand for safe haven currencies. Japan's core CPI rose for the first time in 18 months, albeit its growth rate registered at a modest level of +0.1% Y/Y. Still, BBG noted that core inflation would be closer to +1.4% Y/Y if the impact of trimmed mobile phone fees was discounted.

- PMI reports from across the globe take focus from here alongside UK & Canadian retail sales data. Speeches are due from Fed's Powell, Williams & Daly, ECB's Villeroy & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Oct22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E788mln), $1.1650(E648mln)

- USD/JPY: Y113.50($500mln), Y114.25-45($1.6bln)

- GBP/USD: $1.3700(Gbp558mln)

ASIA FX: Evergrande Kicks Default Can Down The Road

Spillover from Thursday's cautious risk tone moved onshore Asia EMFX in early trade, albeit headlines signalling that Evergrande paid a missed dollar bond interest provided some reprieve. That being said, participants were cognisant of the fact that the company has merely pulled back from the brink as further coupon payments loom large.

- CNH: Offshore yuan see-sawed in reaction to the Evergrande news. It appreciated in the initial reaction, only to shed those gains promptly thereafter. Evergrande's payment came just days ahead of Saturday's expiry of a grace period, after which a missed payment would force a formal default.

- KRW: USD/KRW moved higher, as relief provided by headlines surrounding China's embattled real-estate giant was brief and limited. South Korea confirmed plans to cut fuel tax and LNG tariff amid lingering inflation concerns, with details to be announced next week.

- IDR: The rupiah was the worst performer in Asia EM basket. It is the most risk-sensitive currency in the region alongside KRW. The government's decision to tighten air travel rules ahead of the year-end holiday season may have further undermined the IDR, even as the new curbs were modest by pandemic-era standards.

- MYR: The ringgit fluctuated around unchanged levels. Malaysia's CPI inflation accelerated a tad to +2.2% Y/Y in September from +2.0% recorded in August. It beat consensus estimate of +2.1% but was within the forecast range.

- PHP: The peso went offered, even as the Philippine Health Dept suggested that restrictions in Metro Manila could be eased "soon." Yesterday's comments from the BSP were digested, but truth be told, they provided little in the way of fresh insights.

- THB: Thai markets were closed in observance of a public holiday.

EQUITIES: Evergrande Makes Delayed Coupon Payment, Light Rally, Next Hurdle Eyed

The major regional equity indices trade little changed to marginally firmer in Asia, with news that China Evergrande has deployed the funds to prevent an official default on the initial missed coupon payment on one of its US$ bonds providing light support. Note that the relief rally was only limited, with the payment not changing the long-term dynamic surrounding the troubled firm. A similar payment needs to be made come the end of next Friday to avoid default on another missed coupon payment.

- Questions surrounding the fiscal impasse in Washington DC & President Biden reaffirming support for Taiwan in any instances re: Chinese aggression also limited any rally.

- E-minis were mixed. They generally recovered from worst levels on the back of the aforementioned Evergrande news. The DJIA was a touch firmer, while the S&P 500 hovers around neutral levels. Meanwhile, the NASDAQ 100 trades nearly 0.5% lower on the day. The underperformance for that contract stemmed from guidance from Intel after the company warned that margins are set to be lower than current levels for 2-3 years (although gross margin is set to hold above 50%).

GOLD: Stuck Between The Lines In The Sand

Gold coiled on Thursday, with the impact from the downtick in our weighted U.S. real yield monitor nullified by the uptick in the USD, although the former, coupled with some subsequent richening for U.S. Tsys may have provided light support for bullion in Asia-Pac hours. Spot gold last deals a handful of dollars higher just below $1,790/oz, with the technical pattern that we have outlined on several occasions this week still in play.

OIL: Crude Nudges Lower

WTI & Brent futures sit ~$0.30 below their respective settlement levels after Thursday saw the benchmarks shed ~$0.90 & ~$1.20 apiece. Both metrics operate comfortably above their respective Thursday lows.

- To recap, the initial cooling in the bid in U.S. equities allowed crude to ease from best levels on Thursday, before a firmer USD came to the fore, adding fresh pressure even as equities recovered from lows. Most attributed at least some of the move to a little bit of exhaustion after the recent rally to fresh cycle highs. Note that the move in U.S. breakevens may have aided crude's recovery from lows late in the day.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.