-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Another Sino-U.S. Call

EXECUTIVE SUMMARY

- LIU HE AND YELLEN DISCUSS ECONOMY AND COOPERATION ON CALL (BBG)

- MODERN LAND CHINA SAYS IT DID NOT REPAY PRINCIPAL, INTEREST ON MATURING BOND (RTRS)

- FACEBOOK BOOSTS BUYBACK FACILITY, NASDAQ 100 E-MINI OUTPERFORMS

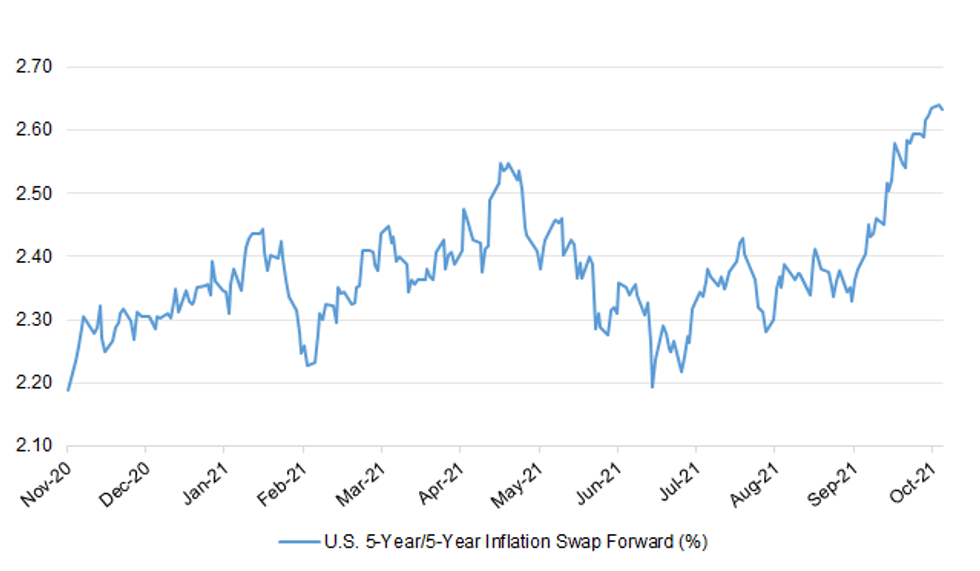

Fig. 1: U.S. 5-Year/5-Year Inflation Swap Forward (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Coronavirus hospital admissions are "highly unlikely" to come close to levels seen earlier this year, according to government advisers who are increasingly confident of avoiding the worst feared winter scenario. Modelling shown to the government includes few projections in which the NHS is put under pressure from the coronavirus similar to that in January this year. Most suggest that over the winter the number of Covid admissions to hospital should be comparable with or lower than present levels. However, Sage scientists still believe that hospitals could be "under considerable" strain if there are simultaneously large outbreaks of other respiratory infections. (The Times)

BREXIT: MNI: Signs Of Compromise In EU-UK Talks On Northern Ireland

- European officials said EU-UK talks aimed at easing difficulties around the implementation of the Northern Ireland Protocol have been "constructive and intensive," with sources telling MNI they have been encouraged by the readiness of both sides to explore potential compromises. Talks will continue this week, with further meetings between EU Commissioner Maros Sefcovic and UK Brexit Minister David Frost to try to iron out remaining differences, with the role of the European Court of Justice and the primacy of EU law within the single market being the biggest sticking point - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: France is preparing to implement a go-slow strategy for customs checks on shipments to and from Britain ahead of Christmas in an escalation of the post-Brexit war over fishing rights, officials fear. (Telegraph)

ECONOMY: Motorists face a winter of rising fuel prices, they were warned last night, after the cost of petrol hit a record high. Prices at the pumps rose to 142.94p for a litre of petrol, meaning that a typical family car costs about £15 more to fill up than a year ago. (The Times)

ECONOMY: The haulage industry has urged Boris Johnson to step up "lacklustre" efforts to tackle a shortage of 100,000 HGV drivers, telling him to act now on supply chains or face a Christmas crisis. Bosses of multiple trade bodies and businesses in the trucking and food industries have written to the prime minister saying not enough had been done to resolve the crisis and urging him to intervene personally. They said measures intended to plug the gap, including a temporary three-month visa for HGV drivers, "simply do not go far enough to tackle the crisis and protect the UK economy in the months ahead". "Without further action, this will only get worse, particularly as we begin the countdown to Christmas," they added. (Guardian)

EUROPE

EU: The European Union's drug regulator said it has concluded in its review that Moderna's Covid-19 booster vaccine may be given to people aged 18 years and above, at least six months after the second dose. It is the second Covid-19 booster vaccine to be approved in the EU. "This follows data showing that a third dose of Spikevax given 6 to 8 months after the second dose led to a rise in antibody levels in adults whose antibody levels were waning," the European Medicines Agency (EMA) said. (Straits Times)

FRANCE: French President Emmanuel Macron's approval rating falls 2 points to 40%, according to latest poll by Odoxa and Dentsu Consulting for LCP, Public Senat and the regional press. French PM Jean Castex's approval rating drops 3 points to 37%. (BBG)

FRANCE: From factories to cut up fish to facilities to fashion cutting-edge connected components, France's efforts to lure industry back to the country are paying dividends, according to the finance ministry. In the year since France kicked off spending under its "France Relaunch" Covid recovery program, the state has helped finance 624 projects to re- shore production or build new capacity on French soil that could have been located elsewhere. That public money has created or protected a total of 77,000 jobs in industry, the government said in estimates published Monday. (BBG)

ITALY/BTPS: Italy plans to sell up to EU2 billion ($2.32 billion) of 0% bonds due Aug. 1, 2026 in an auction on Oct. 28. Italy plans to sell up to EU3.75 billion ($4.35 billion) of bonds due June 1, 2032 in an auction on Oct. 28. Italy plans to sell up to EU1.25 billion ($1.45 billion) of floating bonds due April 15, 2029 in an auction on Oct. 28. (BBG)

SWEDEN: Riksbank Governor Stefan Ingves and his deputy directly hold stock in Swedish companies whose bonds have been bought by the central bank's asset-purchase program, an overlap that some ethics experts say shouldn't be allowed. Both Ingves and First Deputy Governor Cecilia Skingsley own shares in a number of firms whose corporate debt is eligible for acquisition under a quantitative-easing initiative they unveiled last year, according to their most recently released filings submitted to parliament. The holdings are mostly in large publicly-traded companies, and each of their portfolios totals about half a million kronor ($58,000). Ingves is the only official to have reported a change in share ownership in the past two years, relating to a single holding of SAS stock. (BBG)

U.S.

FISCAL: President Joe Biden held out hope on Monday for an agreement on his major spending plans before he attends a climate summit in Scotland, while the White House said Democratic negotiators were closing in on a deal. "Let's get this done. Let's move!" said Biden. (RTRS)

FISCAL: "There are a few issues still out there. But we're working each one of them," Schumer told reporters after the meeting. (RTRS)

FISCAL: Senator Joe Manchin said Monday Democrats should be able to reach a deal this week on a framework for President Joe Biden's economic agenda, though significant details still need to be worked out before any legislation is written. The comment is the best sign for Biden's domestic agenda in months of intra-party wrangling over tax and spending increases. A deal could allow the House this week to pass a $550 billion infrastructure bill, which progressives have held up until there's a firm agreement on the broader package, which includes spending on social programs and measures to address climate change. (BBG)

FISCAL: Democrats also made significant progress in addressing long-simmering disputes over how to pay for the package. But Biden's top aides signaled a willingness to concede one of this top priorities — a plan to raise rates on corporations and wealthy Americans, which would have unwound the tax cuts enacted under President Donald Trump in 2017. Instead, Biden began exploring other measures targeting the ultrawealthy, specifically to assuage Sinema, who opposes rate increases. She has labored alongside the likes of Sen. Elizabeth Warren (D-Mass.) in recent days on what could be a new wealth tax on billionaires. Speaking to reporters, Warren said they are having "productive conversations," adding generally about the package: "I think we will find a way to get all 50 Democrats on board." (Washington Post)

FISCAL: "In a package that's supposed to be about giving everybody a shot to get ahead, it would be a big mistake, from both a policy and a political perspective, not to ask billionaires to pay a fair share," said Senate Finance Committee Chairman Ron Wyden (D-Ore.) in a statement Monday. "The Billionaires Income Tax is about fairness and showing the American people taxes aren't mandatory for them and optional for the wealthiest people in the country," Wyden said. "No working person in this country thinks it's right that billionaires can pay no taxes for years on end, and sometimes never at all." (The Times)

CORONAVIRUS: The Biden administration will allow all international travellers to enter the US as long as they have received any vaccine authorised by the World Health Organization, even the relatively untested Chinese-made Sinovac and Sinopharm jabs, from November 8. Joe Biden, the US president, on Monday signed a presidential proclamation detailing the country's new international travel rules, which will replace the patchwork of blanket bans that has been in place since the beginning of the pandemic. (FT)

EQUITIES: The U.S. Department of Justice (DOJ) has accelerated its two-year-old antitrust probe on Apple Inc in the last several months, increasing the likelihood of a lawsuit, the Information reported on Monday. (RTRS)

EQUITIES: Facebook Inc. posted slower sales growth in the latest quarter and warned that Apple Inc.'s app-privacy rules are continuing to create uncertainty for the social-media company. Facebook's ad sales, its primary revenue source, saw slower growth in the first full quarter since Apple in April started requiring apps to ask users whether they want to be tracked. That change has made it harder for advertisers to target their ads at the right audience and get information regarding how well their ads performed. (WSJ)

OTHER

GLOBAL TRADE: Shipping backups at big U.S. ports, and the resulting goods shortages and price surges, are not likely to resolve themselves until well into 2022, according to economists and some business leaders who have spoken recently. Some 77 ships are waiting outside docks in Los Angeles and Long Beach, carrying $24 billion of goods looking to find their way into the American ecosystem, according to Goldman Sachs. (CNBC)

U.S./CHINA: Secretary of the Treasury Janet Yellen discussed macroeconomic and financial developments in the U.S. and China with Chinese Vice Premier Liu He in a virtual meeting. They recognized that developments in the two economies have important implications for the global economy. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida said he plans to draw up urgent proposals on economic priorities as soon as early November, after a Sunday election for the powerful lower house of parliament. Kishida was speaking at the first meeting of his panel on "new capitalism" that he has said is aimed at encouraging wider distribution of the fruits of growth. Kishida says to set up panels on social security and digital garden cities, and discuss public sector pay. (BBG)

BOJ: The Bank of Japan is seen standing pat on stimulus this week and forecasting a delayed recovery, just days before national elections that could weaken new Prime Minister Fumio Kishida's grip on parliament. All but one of 49 economists surveyed by Bloomberg see the central bank keeping its negative interest rate and asset buying plans unchanged Thursday. Some 47% said Kishida will come under pressure to deliver a bigger economic aid package if the ruling Liberal Democratic Party loses its simple majority in Sunday's vote. (BBG)

RBA: An expected review of the Reserve Bank of Australia should aim for greater transparency and a board that includes monetary policy experts, a webinar has been told. Such an examination is expected after the next federal election with both major parties endorsing a call by the Organisation for Economic Cooperation and Development for a review. A panel of economists on a Grattan Institute webinar agreed a review now would be timely as the economy recovers from the pandemic. "There is a case to made that the Reserve Bank probably hasn't done as well as it could have in the last decade," the institute's economic policy program director Brendan Coates said. (AAP)

AUSTRALIA: Australia is eager to start quarantine-free travel with Singapore as soon as possible, Trade and Tourism Minister Dan Tehan said. "We are very keen to see that laneway open as soon as we possibly can," Tehan said in a Bloomberg Television interview Tuesday. "I'll be doing everything I can to make sure we get that lane open." Hopes of quarantine-free travel between the two nations were raised last week when Australian Prime Minister Scott Morrison said he expected borders to open more quickly. (BBG)

AUSTRALIA: Australia's Queensland has announced that international students will be allowed back into the state to study in 2022. They will be required to be fully vaccinated and to quarantine at a new government facility at Wellcamp, Premier Annastacia Palaszczuk said. The state recorded two new Covid-19 cases in the community on Tuesday. Australia's most populous state, New South Wales, posted 282 cases and its second-most populous, Victoria, had 1,510. (BBG)

AUSTRALIA/CHINA: Australia stands ready to provide coal to China if an unofficial ban is lifted, Trade Minister Dan Tehan says. "Australia obviously has been a very reliable trading partner with China, especially sources of energy," Tehan says in Bloomberg Television interview Tuesday. "Australia was a reliable supplier of coal to China. We stand ready to continue to provide good, clean coal to China to help with its energy crisis". (BBG)

NEW ZEALAND: Prime Minister Jacinda Ardern says the Government will mandate the Covid-19 vaccine for any worker of a business that requires a vaccine certificate at entry. Ardern on Tuesday afternoon said Cabinet had decided to place the mandate on businesses, meaning restaurants, cafés, gyms, and other "close proximity" businesses which choose to operate with greater freedoms, while requiring vaccine certification, will have to comply. "The more people who are vaccinated the safer we all are. That gives us options, and the ability to keep people safe without having to use some of the more blanket restrictions that we've used in the past," Ardern said. (Stuff NZ)

NEW ZEALAND: Fonterra on Tuesday raised the forecast range for the price it pays farmers for milk in the 2021-22 season, citing a below-average increase in global supply and firm demand. The New Zealand-based dairy giant said higher feed costs had slowed U.S. production, dragging down global supply below-average levels. Demand in key diary market China has eased in the past couple of months, but other regions have offset that decline, the company said. Fonterra raised the midpoint of its farmgate milk price range to NZ$8.4 per kilogram of milk solids (kgMS), 40 cents higher than before. The overall range was increased to between NZ$7.90 and NZ$8.90 per kgMS, from NZ$7.25 to NZ$8.75 kgMS. (RTRS)

RBNZ: New Zealand central bank Governor Adrian Orr said climate change could lead to a prolonged period of faster inflation that requires a monetary policy response. "Some of the price pressures we will see will lead to quite sustained, higher generalized prices," Orr told a virtual press briefing Tuesday in Wellington after the Reserve Bank released a report on climate change. "We're already seeing that in food prices globally and energy prices, transport, at present." (BBG)

RBNZ: The Reserve Bank of New Zealand will develop a guidance note on climate change risk management for banks, insurers and non-bank deposit takers, plan a climate change scenario-based bank stress test, and is working towards "fully embedding" climate risks into its core functions of financial stability and monetary policy. These points are made in a climate change report released by the Reserve Bank on Tuesday. (Interest.co.nz)

SOUTH KOREA: The government will temporarily cut fuel taxes by 20 percent starting next month to cope with inflation concerns amid rising oil prices, the chief policy maker of the ruling Democratic Party (DP) said Tuesday. Rep. Park Wan-joo, who heads the DP's policy planning committee, said the government and the ruling party have agreed to a plan to lower taxes on gasoline, diesel and liquefied petroleum gas (LPG) butane by 20 percent, the largest-ever cut, for six months from Nov. 12 to April 30. "The government's previously planned a 15 percent cut, but it accepted our proposal of 20 percent cut at the meeting," Park said after a meeting with Finance Minister Hong Nam-ki. (Yonhap)

SOUTH KOREA: South Korea will enforce stricter lending rules based on borrowers' repayment capability at an earlier date than initially scheduled to curb soaring household debt that has emerged as one of the most serious potential risks on the economy. The current 60% debt service ratio applied to non-banking loans will be tightened to 50% in January next year, which will lead to a reduction of loans to those seeking to borrow. Loans for home rentals, however, will not be subject to the government's tightened lending rules until the end of this year as part of efforts to supply credit for those in actual need of borrowing. (Yonhap)

CANADA: Justin Trudeau will unveil a major overhaul of his cabinet on Tuesday to address problem files such as defence and he is also changing his senior staff as he begins a second minority mandate that will look to deliver on key pledges on the environment and housing. Some of the Liberal government's most high-profile ministers are expected to be on the move, with new ministers coming in the health, defence and environment portfolios, sources say. Veteran Liberal MP Marc Garneau is also expected to be moved out of the Global Affairs portfolio, the sources said. The 72-year-old veteran Liberal was the first Canadian astronaut to fly in space and he launched an unsuccessful bid for the 2013 Liberal leadership. Defence Minister Harjit Sajjan is expected to be given a new portfolio after six years in charge of the Canadian military and as the Forces contend with a growing crisis of confidence over its ability to protect victims of sexual harassment and hold perpetrators accountable. (Globe & Mail)

TURKEY: The U.S. State Department said on Monday it believed it was best to pursue dialog with Turkey after Ankara and the West defused a diplomatic crisis sparked by the Turkish president's call for the expulsion of 10 ambassadors, including the U.S. envoy. "The Biden administration seeks cooperation with Turkey on common priorities and, as with any NATO ally, we will continue to engage in dialog to address any disagreements," State Department spokesman Ned Price told reporters. "We believe the best way forward is through cooperation on issues of mutual interests." (RTRS)

TURKEY: President Recep Tayyip Erdogan dropped his demand for 10 Western ambassadors to be expelled from Turkey, deescalating a diplomatic row that had shaken the lira and was set to bring Ankara's ties with key partners to the brink of collapse. Erdogan said the envoys, including the U.S. ambassador, had issued a statement to undo the "slander" caused by their earlier joint demand for Turkey to release a businessman and government critic who's been in jail for four years. "Our intention is never to cause a crisis," he said in televised comments after a cabinet meeting in capital on Monday. "It's about protecting our country's sovereign rights." Before Erdogan stepped back from the brink, the U.S. embassy said in a statement on Twitter that it complies with international conventions barring envoys from interfering in the domestic affairs of host countries. (BBG)

BRAZIL: Media reports on studies for the privatization of Petrobras today were misleading, Coelho, the govt whip, said in an interview. Once the privatization of the postal service is approved, then we will have the opportunity to build a proposal for Petrobras, with its own concepts, Bezerra said, adding studies are currently underway at the Economy Ministry. Senator also stressed that both the "timing and content" of the proposal have not yet been defined by the govt. (BBG)

BRAZIL: Petrobras asked its controlling shareholder, through a letter sent to Brazil's Economy Ministry, about govt plans or studies for company's share sale, according to a filing. Petrobras said it will inform the market about facts once the govt replies. (BBG)

IRAN: Iran and the European Union will hold talks in Brussels on Wednesday designed to clear the way for a wider diplomatic push to revive the 2015 nuclear deal, the Islamic Republic's lead negotiator said. Deputy Foreign Minister Ali Bagheri Kani said in a series of tweets that he'll meet EU's deputy foreign policy chief Enrique Mora, adding that other signatories to the accord should "call out" the U.S. on its sanctions record. Tehran is "determined to engage in negotiations" that would remove sanctions, he said. (BBG)

IRAN: Iran is expanding its enrichment of uranium beyond the highly enriched threshold of 20% purity at a Natanz plant where it is already enriching to 60%, but the new activity does not involve keeping the product, the U.N nuclear watchdog said on Monday. The move is likely to help Iran refine its knowledge of the enrichment process - something Western powers generally condemn because it is irreversible - but since this time the product is not being collected it will not immediately accelerate Iran's production of uranium enriched to close to weapons-grade. (RTRS)

IRAN: The Biden administration is discussing potential next steps with partners in the Middle East and Europe if Iran doesn't return to negotiations in Vienna, U.S. Iran envoy Rob Malley told reporters in a conference call on Monday. (Axios)

OIL: Russia expects OPEC+ to raise its output by 400,000 barrels per day (bpd) at the Nov. 4 meeting, as previously agreed, Deputy Prime Minister Alexander Novak told Reuters on Monday. Novak also said he expects oil demand to reach a pre-pandemic level by the end of next year but said it was difficult to predict if oil prices will hit record highs as gas prices have done. "Demand (for oil) can decline as there is still uncertainty. We also see there is yet another pandemic wave spreading across the world," Novak said. (RTRS)

CHINA

POLICY: China has been transparent in projects under the Belt and Road initiative, Deng Boqing, vice chairman of China International Development Cooperation Agency, says at a briefing in Beijing. Some Belt and Road projects were impacted by the Covid-19 outbreak, but China didn't halt the initiative. China will continue to provide help to nations under the Belt and Road initiative with no political conditions attached. (BBG)

PBOC: The PBOC will orderly carry out climate risk stress tests to respond to any financial stability issues, and improve the green financial system including the establishment of a carbon pricing mechanism, the Shanghai Securities Journal reported citing a speech by PBOC Deputy Governor Liu Guiping. China's coal-based energy and power structures are difficult to fundamentally change in the short term, so financial support cannot be simply withdrawn from the traditional sector too quickly, the newspaper cited Liu as saying. Financial institutions should continue to supply projects meeting the standards of reducing or substituting coal consumption, and seek the orderly exit of projects that fail to meet environmental requirements, said Liu. (MNI)

ECONOMY: China's economy is showing signs of a further slowdown with car and housing sales dropping again this month even as exports continue their strong performance. That's the outlook from Bloomberg's aggregate index of eight early indicators for October. Economic growth was already lower last quarter, partly due to a higher base of comparison from a year ago, but also dragged down by power shortages, repeated Covid outbreaks, and turmoil in the housing sector. (BBG)

CREDIT: Developer Modern Land (China) Co Ltd said on Tuesday that it had not repaid principal and interest on a bond that matured Oct. 25 due to "unexpected liquidity issues". In a filing to the Singapore Exchange, Modern Land said that it was assessing the financial condition and cash position of the group, and expects to engage independent financial advisors soon for an overall plan. Trading of the company's shares and debt securities will remain halted until further notice, it said. The company last week ended an attempt to seek bondholder approval to extend the maturity of its 12.85% senior notes due 2021. (RTRS)

EQUITIES: China will accelerate the resolution of issues related to the audit and supervision of companies' overseas listings and strengthen cross-border investment monitoring, the Shanghai Securities Journal reported citing a speech by Fang Xinghai, deputy chairman of the China Securities Regulatory Commission. The aim is to improve domestic issuance and listings for overseas entities along with regulations on overseas listings, so that Chinese companies can make better use of both the domestic and international capital markets, said Fang. China will improve and expand the Shanghai-Shenzhen-Hong Kong Stock Connect, Shanghai-London Stock Connect, and China-Japan ETF Connectivity, as well as further opening the futures market, Fang was cited as saying. (MNI)

SOE BONDS: Many provinces in China including Hebei, Henan and Guangxi have set up, or are prepared to establish, credit guarantee funds to help resolve risks of state-owned enterprise bonds, the 21st Century Business Herald reported. Such funds are mainly sourced from local finances, SOEs and financial institutions, and will provide credit guarantees and short-term liquidity support for up to three months to SOEs to avoid bond defaults, the newspaper said citing an unnamed insider. The establishment of such funds can help to improve local credit environment, though the final effect could still be limited by the attitude of the government, the management model and size of the fund, the newspaper said citing analysts. (MNI)

ENERGY: China's top economic planner is studying to establish a coal market price mechanism which allows prices to float based on benchmark prices, the National Development and Reform Commission says in a statement. The mechanism will take into consideration cost, profit of the coal industry and market change. NDRC may ban making excessive profit from coal and aims to guide coal prices to be stable at reasonable range. (BBG)

OVERNIGHT DATA

JAPAN SEP PPI SERVICES +0.9% Y/Y; MEDIAN +1.1%; AUG +1.0%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 106.8; PREV. 107.0

The notable development this week is a 0.3ppt rise in 'weekly inflation expectations' to 5.0%. This is the subindex's highest value since December 2014. The rise in average petrol prices of more than 10% nationally in the past two weeks likely had an impact on household perceptions of price increases. Consumer confidence softened 0.2% nationally even though Melbourne opened up after more than two months in lockdown. Confidence was up in the city by 1.2% and also across Victoria (1.5%). Sentiment remained positive in Queensland (0.7%) and South Australia (10.4%) but the overall outlook was dampened due to a fall in confidence in New South Wales (-1.8%) and Western Australia (-5.9%). (ANZ)

SOUTH KOREA Q3, P GDP +4.0% Y/Y; MEDIAN +4.3%; Q2 +6.0%

SOUTH KOREA Q3, P GDP +0.3% Q/Q; MEDIAN +0.6%; Q2 +0.8%

CHINA MARKETS

PBOC INJECTS NET CNY190BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operations lead to a net injection of CNY190 billion after offsetting the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, so to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1700% at 09:25 am local time from the close of 1.9823% on Monday.

- The CFETS-NEX money-market sentiment index closed at 53 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3890 TUES VS 6.3924

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3890 on Tuesday, compared with the 6.3924 set on Monday.

MARKETS

SNAPSHOT: Another Sino-U.S. Call

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 520.17 points at 29120.12

- ASX 200 up 0.901 points at 7441.9

- Shanghai Comp. up 3.017 points at 3612.88

- JGB 10-Yr future down 9 ticks at 151.14, yield down 0.3bp at 0.105%

- Aussie 10-Yr future down 2.5 ticks at 98.160, yield up 2.5bp at 1.813%

- U.S. 10-Yr future -0-02 at 130-16, yield up 1.06bp at 1.641%

- WTI crude up $0.08 at $83.84, Gold down $5.25 at $1802.5

- USD/JPY up 23 pips at Y113.94

- LIU HE AND YELLEN DISCUSS ECONOMY AND COOPERATION ON CALL (BBG)

- MODERN LAND CHINA SAYS IT DID NOT REPAY PRINCIPAL, INTEREST ON MATURING BOND (RTRS)

- FACEBOOK BOOSTS BUYBACK FACILITY, NASDAQ 100 E-MINI OUTPERFORMS

BOND SUMMARY: Core FI Biased A Touch Lower Overnight

Core fixed income markets saw some modest cheapening in Asia-Pac hours, with a phone call between U.S. Tsy Sec Yellen & Chinese Vice Premier Liu He pointing to loose agreements re: the need for a certain degree of coordination between Sino & U.S. economic and political policy albeit with the U.S. airing some grievances) resulting in very modest risk-on price action. Elsewhere, Facebook's $50bn boost to its share buyback scheme supported the e-mini space in the early rounds of dealing.

- TYZ1 is -0-02 at 130-16 as a result, while cash Tsys run up to ~1.5bp cheaper across the curve, with the belly leading the downtick. Tuesday's NY dealing will be headlined by 2-Year Tsy supply. Elsewhere, new home sales data, the latest Richmond Fed m'fing survey and conference board consumer confidence print will hit. We also note that the fiscal back and forth within the Democratic Party continues, although progress in the matter has been touted by several quarters.

- The JGB curve saw some light twist flattening during the Tokyo morning, while futures shed 8 ticks on the modest risk positive price action witnessed elsewhere. Local news flow remains relatively light, headlined by PM Kishida noting that he plans to draw up his economic policy proposals in November (there is the small issue of the upcoming lower house elections to contend with, which will be held over the coming weekend). Kishida's comments pointed to focus on social security, digital garden cities and public sector pay.

- Sydney trade sees YM -4.0 & XM -3.0, with pressure building in the space ahead of the bell and the modest overnight gains now completely unwound. The move has gathered steam as futures move through their respective overnight lows. Perhaps a degree of position squaring ahead of tomorrow's local Q3 CPI print is exacerbating the move.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y935bn of JGBs from the markets:

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y60bn worth of JGBis

EQUITIES: Tech Tailwinds

Early risk positive flows saw a light extension on the back of headlines pointing to a call between U.S. Tsy Secretary Yellen and Chinese Vice Premier Liu He re: economic, bilateral and global cooperation, with Chinese media noting that the two agreed that coordination between Sino & U.S. policy is important. Meanwhile, the U.S. Tsy noted that Yellen "frankly raised issues of concern. Secretary Yellen noted that she looks forward to future discussions with Vice Premier Liu."

- The initial bid came on the back of after-hours reports revealing a mixed round of earnings & guidance from tech giant Facebook, although it was the company's announcement of a potential $50bn boost to its share buyback scheme dominated matters and has led to NASDAQ 100 outperformance in the e-mini space. This built on Monday's Tesla-driven outperformance for the tech space.

- The move moderated a little, leaving the Nikkei 225 to outperform, while the Hang Seng & CSI 300 operated around neutral levels come the lunch bell.

- Note that Monday saw a sharp reversal in the early net selling when it came to northbound Hong Kong- China Stock Connect flows, with the measure reverting to marginal positive come the bell, recording a 5th straight day of net buying in the process.

OIL: Stable In Asia After Pullback From Cycle Highs

WTI & Brent crude futures sit ~$0.20 & ~$0.30 above their respective settlement levels, with the mild risk positive backdrop (outlined elsewhere) providing light support for the space in Asia-Pac hours. This comes after a sharp pullback from fresh cycle highs on Monday, following news that Iran and the EU will meet in Brussels on Wednesday, with the goal of the meeting being to open the way to a wider push to revive the 2015 Iranian nuclear accord. This applied pressure to the space after the latest leg of bullish price action came on the back of OPEC+ rhetoric that we outlined previously (Russia added to that particular line of mood music on Monday). The benchmark futures curves remain in a deep state of backwardation. API crude inventory estimates headline on Tuesday.

GOLD: Back Above $1,800/oz

To recap, the widening of U.S. breakevens outstripped movements in nominal yields on Monday (with the Tsy curve seeing some light twist steepening), resulting in a downtick for our weighted U.S. real yield monitor, ultimately supporting gold prices, with spot closing above $1,800/oz. The risk positive price action surrounding the recently revealed Yellen-Liu call (with both the ensuing market reaction and details re: the call proving to be limited) and post-earnings dynamics surrounding tech giant Facebook have applied some light pressure, but spot hasn't really tested the $1,800/oz, printing a touch above the round number, a handful of dollars softer on the day. The technical backdrop remains as it was this time yesterday.

FOREX: Liu/Yellen Talks Boost Sentiment

Risk appetite received a boost after news wires ran headlines pointing to a phone call between Chinese Vice Premier Liu and U.S. Tsy Sec Yellen, who had a "pragmatic, candid and constructive" conversation and agreed to keep communications. While there was little substance in official communique surrounding the call, its general tone was positive, which buoyed market sentiment.

- The yuan caught a bid in reaction to news about Sino-U.S. talks. USD/CNH bottomed out at CNH6.3755 and trimmed losses, but remained in negative territory.

- The Antipodeans led gains in G10 FX space, while the yen was the main underperformer. JPY crosses were bought over the Tokyo fix, with another uptick driven by the risk-on impetus provoked by the Liu/Yellen call.

- The global data docket is fairly thin today, while speeches are due from ECB's Villeroy & de Cos. The Fed are in their policy blackout.

FOREX EXPIRIES: Expiries for Oct26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.4bln), $1.1720-30(E849mln)

- USD/JPY: Y114.00($590mln), Y114.50($1.1bln)

- AUD/USD: $0.7400(A$561mln)

- USD/CAD: C$1.2400($670mln)

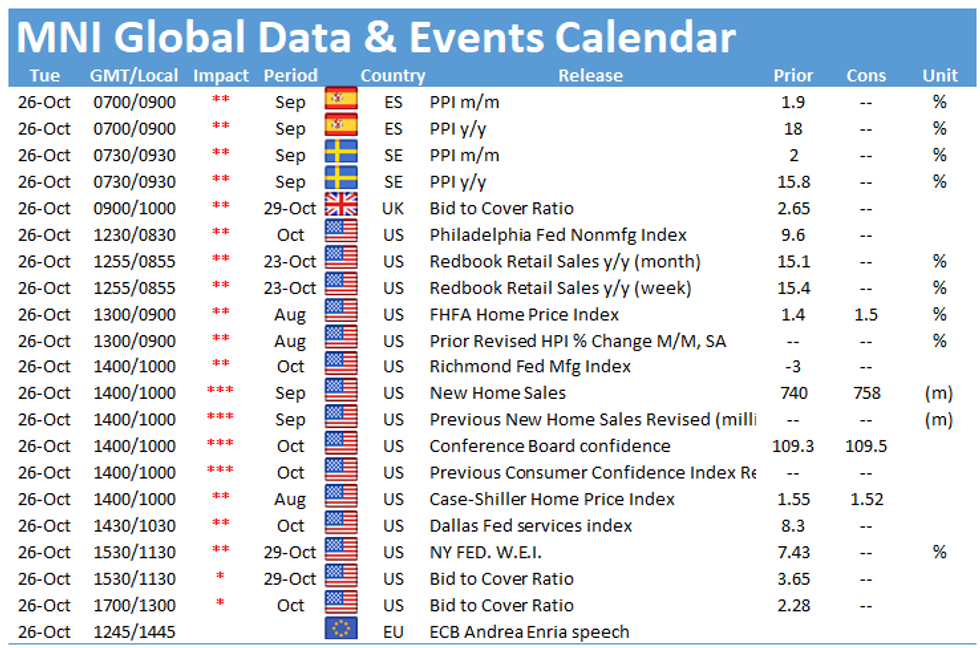

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.