-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Inaction Results In YCT Tantrum

EXECUTIVE SUMMARY

- WHITE HOUSE: "REALISTIC" TO GET SPENDING DEAL DONE BY THURSDAY (RTRS)

- DEMOCRATS CLASH ON BILLIONAIRE TAX AS NEAL REJECTS SENATE PLAN (BBG)

- EVERGRANDE, BONDHOLDERS' ADVISERS TAKE STEP TOWARD DEBT TALKS (BBG)

- FRANCE DETAINS BRITISH TRAWLER AS FISHING RIGHTS ROW INTENSIFIES (SKY)

- BOJ ON HOLD, WON'T HESITATE TO CONSIDER MORE EASING (MNI)

- ACGB APR-24 YIELD SURGES ABOVE 50BP AS RBA HOLDS OFF ON BUYING

- RBA'S DEBELLE: LITTLE BIT MORE INFLATION WELCOME, NOT A LOT MORE (BBG)

Fig. 1: ACGB Apr-24 Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The travel red list and hotel quarantine are set to be scrapped under plans, to be considered by ministers on Thursday, to ease restrictions in face of the declining Covid threat from abroad. Ministers will meet to consider removing the final seven countries from the red list. Any traveller returning from them is currently required to quarantine in a UK hotel for 10 days at a cost of £2,285 per person. Sources said it was "almost certain" that they would lift the restrictions on Panama, Colombia, Venezuela, Peru, Ecuador, Haiti and the Dominican Republic. (Telegraph)

FISCAL: Rishi Sunak will hit the airwaves to sell his budget later, after it was warned that the chancellor's economic set piece will leave the poorest families "far worse off". Having vowed to build "a stronger economy for the British people" after the coronavirus crisis in his address on Wednesday, Mr Sunak will face questions about his plans for the nation's finances in a series of broadcast interviews. MPs will also get the chance to give their views, with the budget debate continuing in the Commons. (Sky)

BREXIT: The U.K. government hit back at France over its proposed retaliatory measures in a dispute over fishing access, as post-Brexit tensions between the two countries rose further. "France's threats are disappointing and disproportionate," 10 Downing Street said in a statement Wednesday, after a French government spokesman said they may disrupt the flow of trade with Britain and energy supplies to the Channel Islands due to a lack of fishing licences given to French boats since Brexit. "The measures being threatened do not appear to be compatible with the trade and cooperation agreement and wider international law," Downing Street said, referring to the post-Brexit trade deal signed on Christmas Eve last year. The measures "will be met with an appropriate and calibrated response." (BBG)

BREXIT: France has detained a British trawler and given a verbal warning to another fishing in waters off its coast, the French government has said In a tweet the the French Maritime Ministry said: "This Wednesday, two English ships were fined during classic checks off Le Havre. "The first did not comply spontaneously: verbalization. "The second did not have a licence to fish in our waters: diverted to the quay and handed over to the judicial authority." It is the latest twist in an increasingly bitter dispute between Britain and France over fishing rights. (Sky)

GILTS: A mammoth cut to Britain's plans to issue government debt was structured to minimise market disruption as far as possible and maintain a steady supply of bonds to investors, the head of the country's debt agency told Reuters on Wednesday. Gilt prices shot higher after the Debt Management Office (DMO) said it planned to issue 194.8 billion pounds ($267.5 billion) of bonds in the current 2021/22 financial year, 57.8 billion pounds less than its previous remit. A Reuters poll of primary dealers of gilts had pointed to a far smaller reduction of 33.8 billion pounds. (RTRS)

EUROPE

PORTUGAL: Portugal's parliament rejected the minority Socialist government's 2022 budget bill on Wednesday as the hard left sided with the conservative opposition, in a move likely to trigger snap elections in coming months. (RTRS)

SWITZERLAND: Swiss National Bank Governing Board Member Andrea Maechler says the franc is highly valued. On the role of the central bank in the fight against climate change: "Our goal is not to make the world greener. That's not our mandate". SNB has large portfolio of green bonds; bought because of risk/return profile.

U.S.

FED: MNI: Higher Inflation To Drive Fed To Redefine Full Employment

- Federal Reserve officials could concede by mid-next year that unemployment and workforce participation rates may not recover to pre-pandemic levels, declaring the maximum employment objective of the Fed's dual mandate met and clearing the way for interest rates to lift off zero if inflation stays uncomfortably high, former senior officials and a regional Fed adviser told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: White House spokeswoman Jen Psaki said on Wednesday that it is still realistic for congress to get a deal on U.S. President Joe Biden's signature spending agenda by Thursday. Biden is expected to depart on an overseas trip on Thursday that will include the United Nations Climate Change Conference in Scotland. (RTRS)

FISCAL: The head of the House tax-writing committee said a proposal to put a levy on the assets of billionaires won't be part of negotiations on President Joe Biden's social-spending bill, injecting new uncertainty into how Democrats will pay for the president's agenda. Ways and Means Chair Richard Neal said Wednesday that there isn't support for the billionaire tax to get it through Congress. He said the House is discussing with the Senate instead inclusion of a 3% surtax, on top of the top income rate, for those earning more than $10 million. (BBG)

CORONAVIRUS: Moderna Inc's COVID-19 vaccine could start to be used in children and teens in the United States within weeks, its chief executive said in an interview ahead of the Reuters Total Health conference, which will run virtually from Nov. 15-18. Moderna CEO Staphane Bancel said based on dialogue with the U.S. Food and Drug Administration, he believes his company's COVID-19 vaccine will be authorized for 12- to 17-year-olds in the next few weeks. Moderna plans to apply for separate U.S. regulatory clearance in children ages 6 through 11 "very soon," Bancel said, adding that he is hopeful that age group could start receiving Moderna's shots by the end of this year. (RTRS)

CORONAVIRUS: U.S. states have placed initial orders of COVID-19 vaccines for children and millions of doses will be shipped as soon as health regulators authorize their use, the White House said on Wednesday. (RTRS)

CORONAVIRUS: California Governor Gavin Newsom, who received Johnson & Johnson's single-dose vaccine in April, got Moderna Inc.'s shot as a booster Wednesday. He urged eligible residents to get boosters as soon as possible, warning of the prospects of a winter surge in virus cases. He pointed to data last year, when California had a relatively low case rate in October, only to see infections triple in November and again in December. "This is an incredibly important time," he said at a press briefing Wednesday. "We know the ticket out of this pandemic is getting these booster shots and getting the unvaccinated vaccinated. And we still have more work to do." (BBG)

POLITICS: Democrats hold a substantial early voting lead in the hotly contested Virginia governor's race between former Democratic Gov. Terry McAuliffe and Republican Glenn Youngkin. But Republicans could close that gap on Election Day in less than a week. At least 667,012 Virginians have submitted early ballots for the gubernatorial election taking place on Nov. 2, according to the latest data from Democratic data firm TargetSmart. That's more than triple the number of early voters in 2017. Nearly 55% of those voters so far are likely Democrats, while 30% are likely Republicans, according to TargetSmart. Voters do not register by party in Virginia but TargetSmart predicts partisanship based on data from previous elections. (CNBC)

OTHER

GLOBAL TRADE: Vice Commerce Minister Wang Shouwen told a briefing in Beijing that China has lowered tariff rates as promised when joining World Trade Organization 20 years ago and fulfilled all its accession commitments. Chinese state-owned enterprises don't enjoy special treatment; they compete fairly with other market entities. China is open to subsidy negotiations at WTO and ready to take more action to liberalize investment, ministry official Yan Dong says. (BBG)

GLOBAL TRADE: A requirement for federal workers and contractors to be fully vaccinated -- which would affect a number of transportation companies that work with the U.S. government -- won't exacerbate a backlog of shipping and deliveries, according to the Biden administration. "The requirements for federal workers and contractors will not cause disruption," Jeff Zients, President Joe Biden's coronavirus response coordinator, said at a Wednesday briefing for reporters. Organizations that have instituted vaccine mandates have seen overwhelming compliance, and those who refuse will go through education and counseling before any enforcement, Zients added. (BBG)

GLOBAL TRADE: GM and Ford expect the impact of the chip squeeze to linger through next year, and possibly even 2023. Ford chief financial officer John Lawler said that while the automaker expects "the scope and severity" of the shortage to diminish, "the constraints on the chips will remain fluid through 2022, and they could extend into 2023". General Motors chief executive Mary Barra said that while she expected the worldwide semiconductor shortage to ease somewhat by the end of this year, the carmaker will feel the impact through the first half of 2022. "We think [the shortage] will get better toward the end of the year, but I have to tell you, it still continues to be somewhat volatile," Barra said.

GLOBAL TRADE: European lawmakers can't agree on which big tech firms to target in new proposals, jeopardizing a deadline to vote on digital rules later this year. As part of the shake up, Silicon Valley giants will be handed a list of what they need to do to dodge hefty fines under the Digital Markets Act. The proposals come after years of aggressive antitrust enforcement did little to curb growing market shares for Google, Apple Inc., Facebook Inc. and Amazon.com Inc. in Europe. (BBG)

U.S./CHINA/TAIWAN: The leader of Taiwan, the island thrust into the center of rising tensions between the United States and China, said the threat from Beijing is growing "every day," as for the first time she confirmed the presence of American troops on Taiwanese soil. Speaking with CNN in an exclusive interview Tuesday, President Tsai Ing-wen said Taiwan, which is located fewer than 200 kilometers (124 miles) away from China's southeastern coast, was a "beacon" of democracy that needed to be defended to uphold faith worldwide in democratic values. "Here is this island of 23 million people trying hard every day to protect ourselves and protect our democracy and making sure that our people have the kind of freedom they deserve," she said. "If we fail, then that means people that believe in these values would doubt whether these are values that they (should) be fighting for." (CNN)

EU/CHINA: The Italian government blocked the acquisition of seeds producer Verisem BV by China-owned Syngenta AG as Mario Draghi's government increases protection of strategic sectors. The government used its so-called Golden Power legislation to halt the deal to buy Verisem, which specializes in the production of vegetable seeds, according to a document seen by Bloomberg News. (BBG)

G20: The United States is calling for quicker progress on restructuring the debts of highly indebted countries under the Common Framework agreed last year by the Group of 20 economies and the Paris Club, a senior Treasury official said Wednesday. G20 member China, in particular, had dragged its heels in some cases, the official told reporters ahead of G20 health and finance ministers in Rome on Friday. "The Common Framework process is going slowly, in part because of China's inability to make some decisions on common framework countries," the official said. "So we're urging the processes to be speeded up." (RTRS)

BOJ: MNI BRIEF: BOJ On Hold, Won't Hesitate To Consider More Easing

- The Bank of Japan board kept policy steady as expected with the economy largely continued moving in line with the baseline scenario despite persistent downside risks to the economy and prices. The BOJ will keep the target for the overnight interest rate at -0.1%. The BOJ also left forward guidance for the policy rates, indicating the policymakers are vigilant against the spread of Covid-19, although the state of emergency has been lifted. "For the time being, the BOJ will closely monitor the impact of Covid-19 and will not hesitate take additional easing measures if necessary, and also it expects short- and long-term interest rates to remain at their present or lower levels" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Prime Minister Fumio Kishida says he wants to implement support measures to address rising oil prices. Kishida says fuel costs including gasoline and kerosene are a "major problem" and he wants to support peoples' lives based on "various measures" implemented in the past. (BBG)

JAPAN: A magnitude 4.6 earthquake struck southern Ibaraki prefecture, near Tokyo, at 9:55am local time, causing shaking in the capital. Quake struck at depth of ~50 km and caused shaking of 4 in parts of Ibaraki and 3 in parts of Tokyo on the seven-point Japanese shindo scale. No tsunami warning issued. (BBG)

RBA: Reserve Bank of Australia Deputy Governor Guy Debelle says policy settings are designed to generate faster inflation than has been seen in the past five or six years. "A little bit more inflation is welcome but a lot more inflation is not welcome". Debelle, in response to a question on 3Q inflation, noted prices were driven mainly by fuel and housing construction costs. (BBG)

AUSTRALIA: Australia eased its Covid-19-related travel advice for several countries, including the U.S., Britain and Canada, as it prepares to reopen its borders next week for the first time in more than 18 months. Australia will lift its outbound travel ban for fully vaccinated residents from Nov 1 following a strong uptake of Covid-19 vaccines, as Sydney and Melbourne, its biggest cities, look to welcome overseas travellers without quarantine. Under the updated travel advice framework, the "do not travel" advisory, put in place for all destinations in March last year, has been removed. But no destination will be set lower than "level 2 - exercise a high degree of caution". (Straits Times)

AUSTRALIA: Australians aged 18 and over who have received two doses at least six months ago are now eligible to have a booster shot, according to a joint statement from Prime Minister Scott Morrison and Health Minister Greg Hunt. Vaccines will be available to eligible people starting on Nov. 8. (BBG)

NEW ZEALAND: New Zealand will begin scaling back one of its key Covid-19 defenses by easing border restrictions for fully vaccinated people arriving from overseas. The amount of time travelers will have to spend in government-run hotel quarantine facilities will be halved to 7 from 14 days from Nov. 14, Covid-19 Response Minister Chris Hipkins said in a news conference in Wellington on Thursday. Home isolation will be introduced in the first quarter of 2022, he said. (BBG)

NEW ZEALAND: Christchurch will remain in alert level 2 despite one of the two positive Covid-19 cases working as a truck driver while infectious for more than three days. During a press conference on Thursday afternoon, Covid-19 Response Minister Chris Hipkins said the two unvaccinated individuals were from the suburb of Bishopdale. They had no major exposure events, and nine close contacts across three households had been identified and were self-isolating. The minister said the Government would continue to monitor the situation, and locations of interest would be put up on the Ministry of Health website as they became available. (Stuff NZ)

BOK: The Bank of Korea will cut the size of monetary stabilization bond issuance to 6.6t won in November, down by 2.4t won from its previous plan. The central bank plans to increase size of buy-back to 5t won in November, 1t won more than it had planned. The changes are expected to boost 3.4t won of investment capacity for bond investors, which could improve sentiments and ease bond yield volatility. (BBG)

MEXICO: Mexico's government will take over responsibility for payments on debt issued by state-owned Petroleos Mexicanos, the oil producer's chief executive said, sparkling a rally in the company's overseas bonds. President Andres Manuel Lopez Obrador has told Pemex that the company isn't allowed to issue any more bonds and therefore his administration would take over amortization payments, CEO Octavio Romero said in a briefing to legislators Wednesday. The Finance Ministry didn't immediately comment on Romero's statements, and the details of the government's plan weren't clear. "The president has given us instruction that we can no longer issue bonds,"Romero said. "Due to that, Pemex won't be the one in charge of debt amortizations, but it will be the federal government. This is a huge support that will be given to this great company, because it will prevent it from going further into debt." (BBG)

BRAZIL: Without enough votes to approve an amendment to the constitution, Brazil's lower house postponed to Nov. 3 the attempt to vote on the so-called PEC dos precatorios, which makes room in the budget to allow the government to pay for its new social program, (BBG)

BRAZIL: Brazil's former President Luiz Inacio Lula da Silva would still win a 2022 runoff vote against President Jair Bolsonaro, but Bolsonaro increased his voting intentions to 37.4% in Oct. from 35.3% in Sept., according to a Modalmais and Futura Inteligencia survey. (BBG)

BRAZIL: Brazil's treasury could raise up to 3 billion reais ($538.60 million) through its 5G auction next week if all available frequencies are sold, Abraão Balbino, chief of telecoms regulator Anatel, said on Wednesday. Fifteen companies and groups presented the required documentation on Wednesday to register for the auction, set for Nov. 4, including Vivo, Claro and Tim. (RTRS)

IRAN: France, Britain, and Germany (E3) have not received an invitation to meet Iran and stand ready for a meeting, but regret the Iranian negotiator declined to meet them during a European visit. "We received no such invitation. We stand ready to meet as E3 at earliest possible convenience, and regret Iran declined our proposal to do so today while ABK (Ali Bagheri Kani) was in Europe," the source said. (RTRS)

MIDDLE EAST: Saudi Arabia is seeking Washington's help in bolstering its defences as it comes under intense U.S. pressure to end a blockade of Yemeni ports that its Houthi enemies say is an obstacle to ceasefire talks. The U.S., Saudi Arabia's main security ally, has been pressing the coalition to fully open access to the Houthi-held ports and the airport, and also pushed the Houthis to end offensives and engage in diplomacy. But Riyadh first wants U.S. weapons to help the kingdom strengthen its defence systems following Houthi attacks on its territory with military drones and ballistic missiles. (RTRS)

ENERGY: President Vladimir Putin on Wednesday told the head of Kremlin-controlled energy giant Gazprom, Alexei Miller, to start pumping natural gas into European gas storage once Russia finishes filling its own stocks, which may happen by Nov. 8. Gas markets in Asia and Europe have sky-rocketed this year, with benchmark Dutch gas hub spot prices jumping by 365% since the start of the year, fuelled by low inventories and surging demand as economies recover from the COVID-19 crisis. "As soon as we finish pumping (gas) into the UGS (underground gas storage) in Russia, we will start pumping our Gazprom's gas into European UGS," Miller told Putin. (RTRS)

EQUITIES: Samsung Electronics Co. third-quarter profit exceeded analysts' estimates after a prolonged semiconductor shortage boosted prices of memory and system chips that go into computers and mobile devices. Net income rose to 12.06 trillion won ($10.3 billion) in the three months ended September. Analysts predicted 11.54 trillion won on average, according to estimates compiled by Bloomberg. Samsung disclosed preliminary numbers earlier this month, including a more than 25% increase in operating profit. The world's biggest maker of memory chips and smartphones has benefited from strong demand as the global economy recovers from the Covid-19 pandemic, with rising semiconductor prices providing an added boost. Still, memory-chip prices may start to cool this quarter as customers are less anxious to place new orders after stockpiling inventories. (BBG)

CHINA

EVERGRANDE: Advisers representing China Evergrande Group and a group of its offshore bondholders have taken what's often a first step toward negotiations as the embattled developer faces a cash crunch. The ad hoc bondholder group's advisers are seeking to exchange information with the company, including the status of various projects, liquidity and asset valuation, after earlier outreach attempts were rebuffed. Since then, Evergrande's cash problems have deepened after it scrapped talks to sell a stake in its property-management arm. (BBG)

YUAN: The Chinese yuan may not maintain its strength seen in October, but will likely fluctuate under the longer-term prospect of higher U.S. interest rate and China losing its export dominance, the China Securities Journal reported citing analysts including Guan Tao, the chief global economist of BOC International. China's export advantage may not continue as the pandemic-hit global supply chain recovers and diverts some orders to other economies, reducing its trade surplus, Guan was cited saying. The Federal Reserve may slow the pace of its balance sheet expansion by year-end, pushing up interest rates and drawing funds back to the U.S. from emerging markets, the newspaper said citing Cheng Qiang, the chief analyst at CITIC Securities. (MNI)

INFLATION: China's recent vegetable price surge will have limited impact on consumer inflation as its weighting in CPI is low. Pressures on vegetable price rise will ease after the Chinese New Year holiday in Feb. (BBG)

FISCAL: China's move to defer some tax payments for small manufacturing firms for three months will help stabilize the economy, ease companies' capital shortages and stabilize employment, The Paper said following a State Council measure to postpone CNY200 billion tax payments. With rising commodity prices, SMEs face operational difficulties operating, the newspaper said. Coal and heating companies can also enjoy deferred tax payments worth CNY17 billion in Q4 to help resolve operational difficulties, the newspaper said. Separately, China also extended tax exemptions on bond interests for foreign investors until the end of 2025, a move to stabilize foreign investment amid the Evergrande Group's debt crisis. (MNI)

BANKS: The China Banking and Insurance Regulatory Commission approved Bank of Liaoshen to merge with Yingkou Coastal Bank and Bank of Liaoyang, and to assume their effective assets, all liabilities, business, branches and employees as more smaller banks are being merged and reorganized, the Economic Daily reported. In this way, smaller banks can use bond issuance, private placement, equity reorganization, asset securitization, as well as the introduction of strategic investors and new management to fully expose risks, and vigorously reduce non-performing assets, the newspaper said. It can also reduce the cost of competition among multiple banking entities in the region, the newspaper added. (MNI)

CORONAVIRUS: China reported 23 new local confirmed Covid-19 infections on Oct. 27 in Gansu, Inner Mongolia, Beijing, Ningxia, Heilongjiang, Shandong and Sichuan, the National Health Commission said in a statement. Another 11 local asymptomatic cases were reported in Shandong, Heilongjiang, Beijing and Yunnan. Nationwide, China reported 54 infections on Wednesday, the most in a single day since the latest outbreak began last week. (BBG)

ENERGY: The National Development and Reform Commission (NDRC) said it was looking into the costs and profitability of the coal sector in an effort to work out a mechanism to guide prices to move within a reasonable range. The NDRC was also considering including coal in a "prohibiting exorbitant profits" category. The new mechanism would be based on a benchmark price plus a floating range, after taking into account costs, reasonable margins and market changes, it said. "The mechanism shall be linked to the marketisation of the thermal power sector ... and those who do not strictly follow the mechanism will be severely punished," the commission said. (RTRS)

OVERNIGHT DATA

JAPAN SEP RETAIL SALES -0.6% Y/Y; MEDIAN -2.4%; AUG -3.2%

JAPAN SEP RETAIL SALES +2.7% M/M; MEDIAN +1.5%; AUG -4.0%

JAPAN SEP DEPT STORE, SUPERMARKET SALES -1.3% Y/Y; MEDIAN -3.3%; AUG -4.7%

AUSTRALIA Q3 EXPORT PRICE INDEX +6.2% Q/Q; MEDIAN +6.5%; Q2 +13.2%

AUSTRALIA Q3 IMPORT PRICE INDEX +5.4% Q/Q; MEDIAN +3.4%; Q2 +1.9%

SOUTH KOREA SEP RETAIL SALES +8.2% Y/Y; AUG +6.4%

SOUTH KOREA SEP DISCOUNT STORE SALES -13.3% Y/Y; AUG -5.5%

SOUTH KOREA SEP DEPT STORE SALES +24.3% Y/Y; AUG +13.0%

CHINA MARKETS

PBOC INJECTS NET CNY100BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operations lead to a net injection of CNY100 billion after offsetting the maturity of CNY100billion reverse repos, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:27 am local time from the close of 2.2867% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 41 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3957 THURS VS 6.3856

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3957 on Thursday, compared with the 6.3856 set on Wednesday.

MARKETS

SNAPSHOT: RBA Inaction Results In YCT Tantrum

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 233.58 points at 28862.8

- ASX 200 down 22.31 points at 7426.4

- Shanghai Comp. down 33.305 points at 3529

- JGB 10-Yr future up 13 ticks at 151.37, yield down 1bp at 0.090%

- Aussie 10-Yr future down 6.0 ticks at 98.105, yield up 5.5bp at 1.866%

- U.S. 10-Yr future -0-09+ at 130-28, yield up 1.05bp at 1.552%

- WTI crude down $1.40 at $81.26, Gold up $4.38 at $1801.17

- USD/JPY down 30 pips at Y113.53

- WHITE HOUSE: "REALISTIC" TO GET SPENDING DEAL DONE BY THURSDAY (RTRS)

- DEMOCRATS CLASH ON BILLIONAIRE TAX AS NEAL REJECTS SENATE PLAN (BBG)

- EVERGRANDE, BONDHOLDERS' ADVISERS TAKE STEP TOWARD DEBT TALKS (BBG)

- FRANCE DETAINS BRITISH TRAWLER AS FISHING RIGHTS ROW INTENSIFIES (SKY)

- BOJ ON HOLD, WON'T HESITATE TO CONSIDER MORE EASING (MNI)

- ACGB APR-24 YIELD SURGES ABOVE 50BP AS RBA HOLDS OFF ON BUYING

- RBA'S DEBELLE: LITTLE BIT MORE INFLATION WELCOME, NOT A LOT MORE (BBG)

BOND SUMMARY: ACGBs In The Driving Seat Again On RBA Inaction

ACGB price action applied some pressure to U.S. Tsys in Asia hours, although sharply lower crude oil prices provided some cushion, leaving TYZ1 -0-09 at 130-28+. Cash Tsys run unchanged to ~3.0bp cheaper across the curve, with bear flattening in play. The short end dominated on the flow side, with relatively sizeable EDZ3 upside exposure sought via screen trades (2EZ1 98.75/99.00 call spread lifted vs. 2EZ1 98.00 puts and outright 2EZ1 98.625 call lifts). 7-Year Tsy supply, Q3 GDP and weekly jobless claims data are all due during NY dealing.

- JGB futures looked to the ebbs and flow elsewhere, initially extending the overnight rally before pulling back as core FI came under pressure, last +12. Cash JGB trade saw yields run little changed to ~1.0-2.0bp lower on the day, with outperformance for 7s on the overnight bid in futures, while 40s benefitted from the NY flattening in U.S. Tsys. To summarise, there were no surprises when it came to the latest BoJ monetary policy decision, with monetary policy settings unchanged and the now standard dovish dissent from Kataoka present. CPI projections for the current FY were marked lower, with the same holding true for the Bank's GDP projection (the next FY is expected to see a slightly faster clip of GDP growth as a result). The language deployed surrounding the economy was very matter of fact, once again providing no surprises.

- ACGBs were subjected to a fresh round of pressure as the RBA failed to step in to buy ACGB Apr-24, with the yield on that line now topping 0.50% as a result (the RBA has a 0.10% target for the yield on that specific bond). This triggered plenty of conversation re: the future of YCT ahead of next week's RBA meeting. YM's overnight weakness extended as a result, -24.5 last, with XM dragged lower on the move, to last trade -6.5, as the curve was subjected to further flattening pressure. The cash 3-/10-Year ACGB yield curve now sits at levels not seen since November '20. Elsewhere, RBA Deputy Governor Debelle pointed to a want for a little, not a lot, more inflation, in addition to stressing the Bank's desire for higher wage growth.

JAPAN: End Of The Run Of Weekly Net Purchases Of Foreign Bonds

Modest net flows were witnessed across the spectrum in the latest round of Japanese weekly international security flow data. Of note, Japanese investors ended their 7-week streak of net purchases of foreign bonds, lodging the first round of weekly net sales seen since late August in the process. Elsewhere, Japanese investors lodged the 6th straight round of weekly net purchases of foreign equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -604.5 | 1225.4 | 1956.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 120.5 | 65.4 | 830.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -372.7 | 624.6 | -1147.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 229.7 | 958.3 | 1870.9 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Modest Downtick In Asia

The downtick witnessed during Wednesday's Wall St. dealing spilled into Asia-Pac hours, applying modest pressure to the major regional indices although none of the major Asia-Pac indices shed more than 1.0%, with inflationary worry on the lips of participants during Thursday's session. Stronger than expected earnings from tech giant Samsung Electronics provided some protective cushion for the KOSPI, which was close to neutral. The major e-mini contacts sit ~0.1% above yesterday's settlement levels, with Apple set to report after hours on Thursday.

OIL: Wednesday's News Flow Weighs In Asia

WTI and Brent crude oil futures were under pressure overnight, shedding the best part of $2.00 vs. their respective settlement levels, as hope surrounding Iran-EU talks and momentum from Wednesday's bearish headline crude inventory build in the DoE dataset applied pressure. Note that the benchmarks both lost the best part of $2.00 during Wednesday trade.

GOLD: Back Above $1,800/oz

A downtick in our weighted U.S. real yield monitor supported bullion on Wednesday, as did a modest downtick in the DXY (which finished off lows), with the bid in bullion extending in Asia-Pac dealing, even with U.S. Tsy yields and the DXY little changed/a touch higher overnight. That leaves spot dealing a handful of dollars higher, peeking above the $1,800/oz mark. The technical overlay that we outlined on Wednesday remains in play.

FOREX: Softer Commodity Complex Keeps Lid On AUD

The Australian dollar retreated alongside iron ore futures amid expectations of reduced demand from China, which outweighed the steepening of implied RBA tightening path inspired by Australia's strong core CPI outturn reported yesterday. AUD/USD ticked away from stiff resistance located around the 50% retracement of the Feb - Aug sell-off/200-DMA at $0.7557/59.

- Broader defensive flows and fallout from a softer commodity complex were also in play, denting the high-beta pack. That being said, the kiwi proved resilient, and AUD/NZD snapped a three-day winning streak.

- JPY garnered some strength as participants were after safe havens. USD/JPY moved lower and last trades at Y113.61 with sizeable option expiries with strikes at Y113.00 ($1.5bn) and Y113.70-90 ($2.3bn) coming up at today's NY cut.

- The BoJ left their monetary policy settings unchanged, with the now standard dovish dissent from Kataoka. Nothing in the decision or accompanying rhetoric provided any material surprise.

- The ECB pick up the monetary policy baton later today and their announcement will be followed by a presser with Pres Lagarde. The data docket features German unemployment & flash CPI as well as U.S. GDP & jobless claims.

FOREX OPTIONS: Expiries for Oct28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.5bln), $1.1620-30(E811mln), $1.1650-65(E695mln)

- USD/JPY: Y113.00($1.5bln), Y113.70-90($2.3bln)

- AUD/USD: $0.7475(A$975mln), $0.7505(A$502mln)

- USD/CAD: C$1.2360-80($1.8bln)

- USD/CNY: Cny6.3900($805mln)

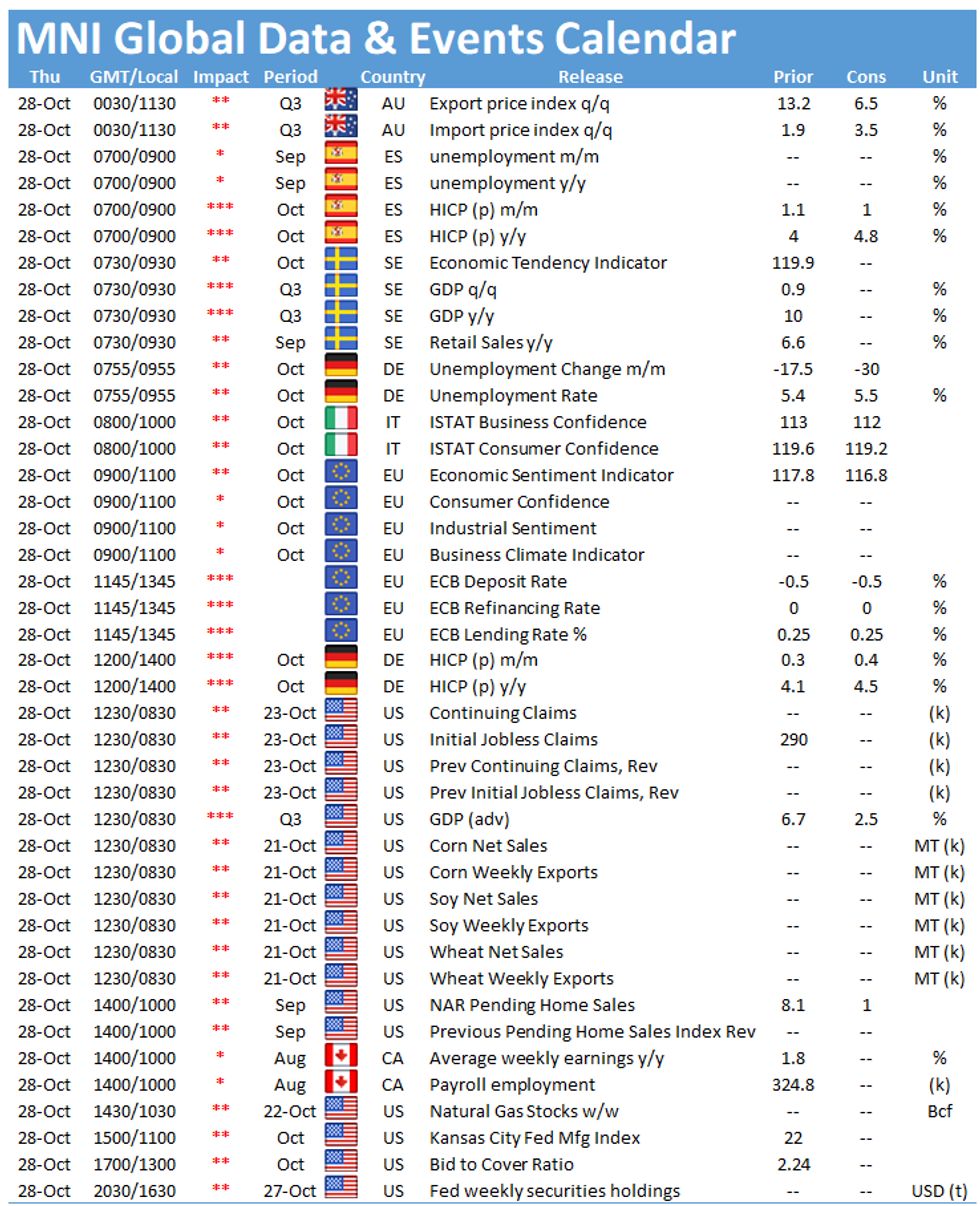

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.