-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Questions Over RBA Policy Dominate Overnight

- RBA inaction when it came to the enforcement of its YCT mechanism saw the yield on the bond covered by its target surge above 0.50% (target is 0.10%), leading to widespread questions re: the future of the YCT scheme ahead of next week's RBA decision.

- The BoJ left its monetary policy settings unchanged, with the usual dovish dissent present. The Bank trimmed its GDP & CPI forecasts for the current FY.

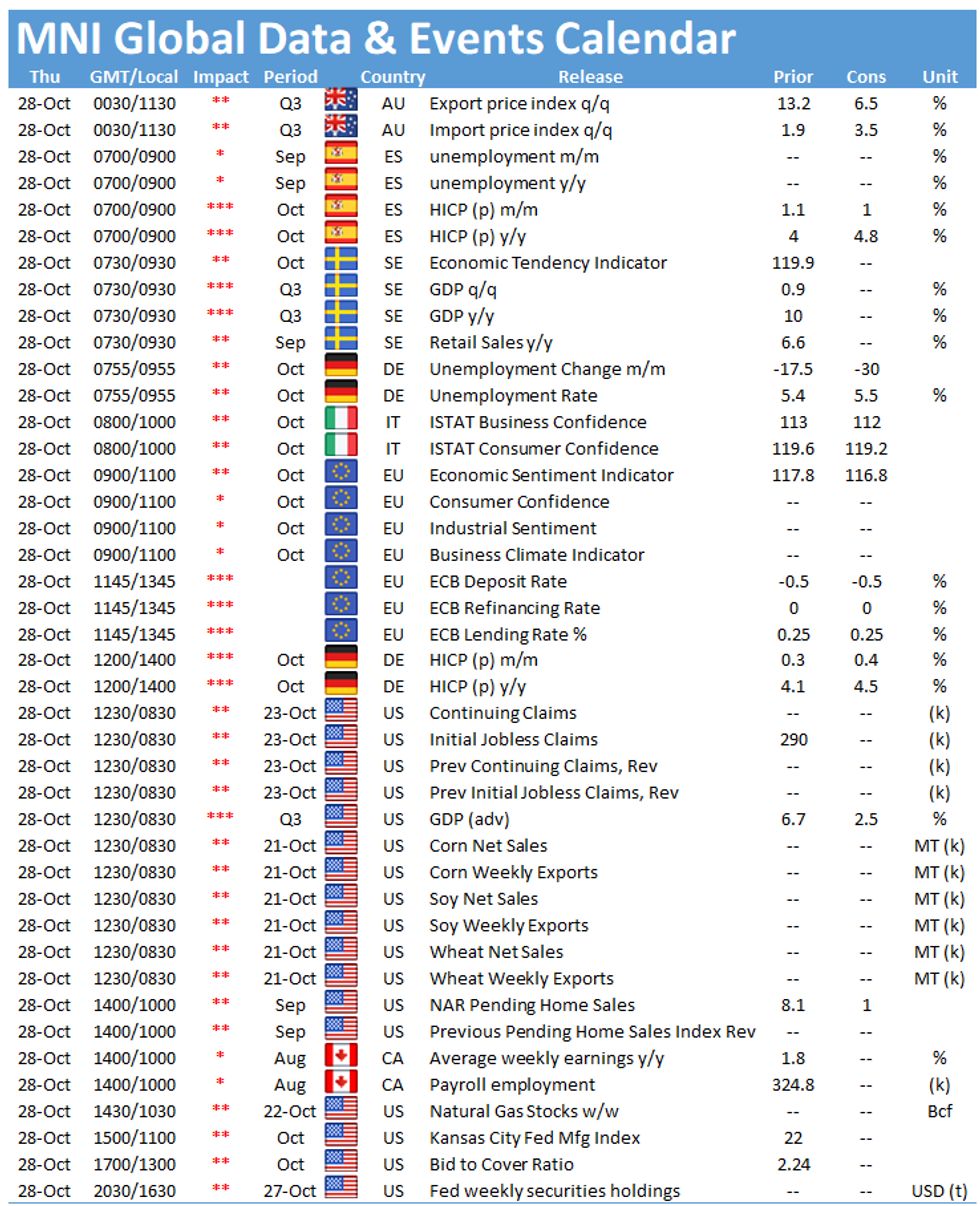

- The latest ECB monetary policy decision headlines the broader docket today, with U.S. GDP data also due.

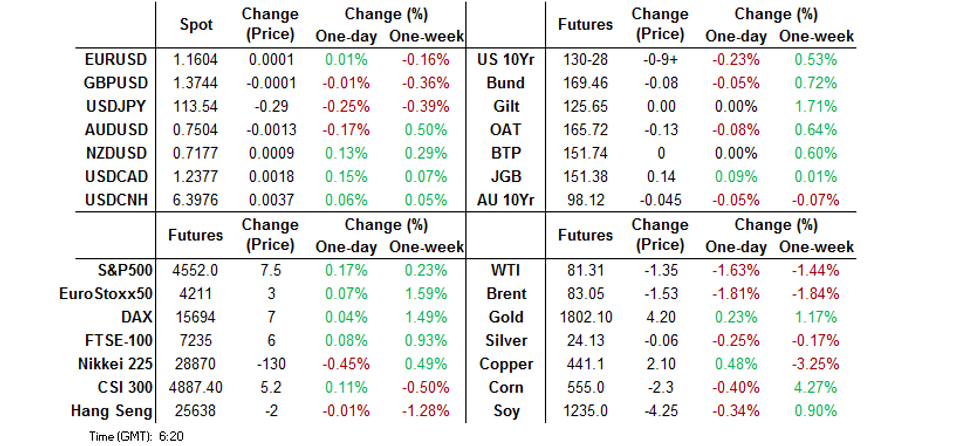

BOND SUMMARY: ACGBs In The Driving Seat Again On RBA Inaction

ACGB price action applied some pressure to U.S. Tsys in Asia hours, although sharply lower crude oil prices provided some cushion, leaving TYZ1 -0-09 at 130-28+. Cash Tsys run unchanged to ~3.0bp cheaper across the curve, with bear flattening in play. The short end dominated on the flow side, with relatively sizeable EDZ3 upside exposure sought via screen trades (2EZ1 98.75/99.00 call spread lifted vs. 2EZ1 98.00 puts and outright 2EZ1 98.625 call lifts). 7-Year Tsy supply, Q3 GDP and weekly jobless claims data are all due during NY dealing.

- JGB futures looked to the ebbs and flow elsewhere, initially extending the overnight rally before pulling back as core FI came under pressure, last +12. Cash JGB trade saw yields run little changed to ~1.0-2.0bp lower on the day, with outperformance for 7s on the overnight bid in futures, while 40s benefitted from the NY flattening in U.S. Tsys. To summarise, there were no surprises when it came to the latest BoJ monetary policy decision, with monetary policy settings unchanged and the now standard dovish dissent from Kataoka present. CPI projections for the current FY were marked lower, with the same holding true for the Bank's GDP projection (the next FY is expected to see a slightly faster clip of GDP growth as a result). The language deployed surrounding the economy was very matter of fact, once again providing no surprises.

- ACGBs were subjected to a fresh round of pressure as the RBA failed to step in to buy ACGB Apr-24, with the yield on that line now topping 0.50% as a result (the RBA has a 0.10% target for the yield on that specific bond). This triggered plenty of conversation re: the future of YCT ahead of next week's RBA meeting. YM's overnight weakness extended as a result, -24.5 last, with XM dragged lower on the move, to last trade -6.5, as the curve was subjected to further flattening pressure. The cash 3-/10-Year ACGB yield curve now sits at levels not seen since November '20. Elsewhere, RBA Deputy Governor Debelle pointed to a want for a little, not a lot, more inflation, in addition to stressing the Bank's desire for higher wage growth.

JAPAN: End Of The Run Of Weekly Net Purchases Of Foreign Bonds

Modest net flows were witnessed across the spectrum in the latest round of Japanese weekly international security flow data. Of note, Japanese investors ended their 7-week streak of net purchases of foreign bonds, lodging the first round of weekly net sales seen since late August in the process. Elsewhere, Japanese investors lodged the 6th straight round of weekly net purchases of foreign equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -604.5 | 1225.4 | 1956.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 120.5 | 65.4 | 830.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -372.7 | 624.6 | -1147.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 229.7 | 958.3 | 1870.9 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: Softer Commodity Complex Keeps Lid On AUD

The Australian dollar retreated alongside iron ore futures amid expectations of reduced demand from China, which outweighed the steepening of implied RBA tightening path inspired by Australia's strong core CPI outturn reported yesterday. AUD/USD ticked away from stiff resistance located around the 50% retracement of the Feb - Aug sell-off/200-DMA at $0.7557/59.

- Broader defensive flows and fallout from a softer commodity complex were also in play, denting the high-beta pack. That being said, the kiwi proved resilient, and AUD/NZD snapped a three-day winning streak.

- JPY garnered some strength as participants were after safe havens. USD/JPY moved lower and last trades at Y113.61 with sizeable option expiries with strikes at Y113.00 ($1.5bn) and Y113.70-90 ($2.3bn) coming up at today's NY cut.

- The BoJ left their monetary policy settings unchanged, with the now standard dovish dissent from Kataoka. Nothing in the decision or accompanying rhetoric provided any material surprise.

- The ECB pick up the monetary policy baton later today and their announcement will be followed by a presser with Pres Lagarde. The data docket features German unemployment & flash CPI as well as U.S. GDP & jobless claims.

FOREX OPTIONS: Expiries for Oct28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E1.5bln), $1.1620-30(E811mln), $1.1650-65(E695mln)

- USD/JPY: Y113.00($1.5bln), Y113.70-90($2.3bln)

- AUD/USD: $0.7475(A$975mln), $0.7505(A$502mln)

- USD/CAD: C$1.2360-80($1.8bln)

- USD/CNY: Cny6.3900($805mln)

ASIA FX: Risk-Sensitive Asia FX Struggle

Risk aversion dominated in Asia, sapping some strength from most Asia EM currencies, albeit this general risk-off impetus gradually moderated.

- CNH: USD/CNH rose to CNH6.4045 and trimmed gains thereafter. The PBOC set their central USD/CNY mid-point at CNY6.3957, 8 pips above sell-side estimate. It was the seventh weaker than expected fixing in a row, albeit some of the earlier misses were very marginal.

- KRW: The won faced headwinds from the broader risk-off feel, despite a beat in Samsung Q3 profits driven by the company's buoyant chip business. Meanwhile, South Korea's daily Covid-19 case count topped 2,000 for the first time in 20 days, with the country set to begin its "return to normalcy" from next week.

- IDR: The rupiah also lost ground on the back of wider defensive flows. There was little in the way of local headline flow to challenge fallout from the risk-off big-picture narrative. USD/IDR rose to its best levels in two weeks.

- MYR: USD/MYR lost shine in the Asia afternoon, after the release of upbeat local trade data. Malaysia's monthly trade surplus stood at MYR26.10bn in September, little changed from the month before, amid above-forecast growth in both imports and exports.

- THB: The baht firmed with participants awaiting updated forecasts from Thailand's Finance Ministry.

- PHP: The peso was slightly weaker. Econ Planning Chief Chua signalled that the current rate of inflation is disconcerting but saw a strong potential for GDP growth in Q3.

- SGD: USD/SGD reversed its initial gains. The MAS released their twice-yearly macroeconomic outlook, noting that global supply chain disruptions and upward pressure on wages can stay with us for longer than expected.

EQUITIES: Modest Downtick In Asia

The downtick witnessed during Wednesday's Wall St. dealing spilled into Asia-Pac hours, applying modest pressure to the major regional indices although none of the major Asia-Pac indices shed more than 1.0%, with inflationary worry on the lips of participants during Thursday's session. Stronger than expected earnings from tech giant Samsung Electronics provided some protective cushion for the KOSPI, which was close to neutral. The major e-mini contacts sit ~0.1% above yesterday's settlement levels, with Apple set to report after hours on Thursday.

GOLD: Back Above $1,800/oz

A downtick in our weighted U.S. real yield monitor supported bullion on Wednesday, as did a modest downtick in the DXY (which finished off lows), with the bid in bullion extending in Asia-Pac dealing, even with U.S. Tsy yields and the DXY little changed/a touch higher overnight. That leaves spot dealing a handful of dollars higher, peeking above the $1,800/oz mark. The technical overlay that we outlined on Wednesday remains in play.

OIL: Wednesday's News Flow Weighs In Asia

WTI and Brent crude oil futures were under pressure overnight, shedding ~$1.50 vs. their respective settlement levels, as hope surrounding Iran-EU talks and momentum from Wednesday's bearish headline crude inventory build in the DoE dataset applied pressure. Note that the benchmarks both lost the best part of $2.00 during Wednesday trade.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.