-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Ambiguous RBA Guidance Weighs On AUD

- The RBA dumped its YCT mechanism, as expected, although the ambiguous forward guidance that it adopted disappointed when compared to aggressive market pricing re: cash rate hikes. This weighed on the AUD and supported ACGBs post-decision, with Governor Lowe pointing to the potential for no hikes until '24.

- Equities generally traded lower in Asia.

- ECB speak headlines the broader economic docket today.

BOND SUMMARY: RBA At The Fore In Asia

There hasn't been much in the way of domestic headline flow for U.S. Tsys to absorb, outside of the Chairman of the House Rules Committee, McGovern, noting that a House panel is likely to meet on Wednesday re: discussions surrounding President Biden's spending plan. More widely, the post-RBA bid in ACGBs has provided a bid for the space, while the lockdown of just under 20 schools in the Chinese capital of Beijing may have exposed some nerves. TYZ1 has hit fresh session highs in recent trade, before easing back a touch, last trading +0-07 at 130-28, while cash Tsys run little changed to 2.0bp richer across the curve, unwinding the early, modest cheapening and more, with bull steepening in play as the front end leads the rally. Flow was headlined by a block buy of TYZ1 (+1,250), while the short end saw a screen lift of the 0EZ1 99.625/99.375/99.125 put fly (+7.5K). There is nothing in the way of notable domestic releases scheduled on Tuesday, which will allow participants to zero in on Wednesday's FOMC meeting.

- The JGB curve has seen some twist steepening, with paper out to 20s little changed to 2.0bp richer as the belly outperforms, while 30s and 40s have seen cheapening of 0.5-1.0bp, perhaps pointing to some worry re: the impact of the impending supplementary budget on long end issuance. Technical steepener interest may also be present, after the likes of the 10-/30-Year yield spread tagged a multi-month low in recent sessions. The space has firmed a little in afternoon trade after BoJ Rinban ops covering 1- to 5- & 10- to 25-Year paper revealed a downtick in cover ratios vs. the prev. ops, while the broader bid in core FI market post-RBA likely provided further support. This allowed futures to firm, last +7 on the day.

- The RBA dropped its YCT mechanism, as expected, adopting a more open-ended round of forward guidance re: the cash rate alongside that move, with a subsequent press conference from Governor Lowe pointing to optionality when it came to a '23/'24 rate hike. This provided a disappointment vs. hawkish market pricing, which was already well in advance of the prior RBA guidance. Wage growth remains at the fore of the Bank's thought process, even with underlying inflation now seen within the target band over the entirety of the Bank's forecast horizon. The front end led the bid that eventually took hold after the initial post-RBA vol. (which was aided by thinned liquidity surrounding the Melbourne Cup). That left YM +6.5 and XM +1.5 come the close, with the early bear steepening morphing into bull steepening.

FOREX: AUD Takes Drubbing After RBA Statement

The RBA's monetary policy decision rattled AUD, as policymakers left the cash rate unchanged but scrapped their ACGB Apr '24 yield target. The Reserve Bank said that they are "prepared to be patient," as inflation "remains low in underlying terms."

- AUD/USD went offered but yesterday's low of $0.7486 provided a durable layer of resistance. AUD/NZD plunged to a one-week low, approaching its 50-DMA.

- The yen outperformed amid heightened demand for safe haven currencies, as U.S. e-mini futures lost ground.

- Japan's FinMin Suzuki stressed the importance of currency stability and noted that officials will continue to monitor FX markets.

- Swiss CPI and a suite of m'fing PMIs from several Eurozone countries headline the global data docket today. Speeches are due from ECB's Enria, Elderson & de Cos.

FOREX OPTIONS: Expiries for Nov2 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1570-85(E529mln), $1.1750(E574mln), $1.1795-00(E838mln), $1.1815-20($980mln)

USD/JPY: Y104.85-00($618mln)

GBP/USD: $1.3100(Gbp1.2bln), $1.3150(Gbp911mln)

EUR/GBP: Gbp0.8900(E2.2bln-EUR puts), Gbp0.9000(E1.5bln)

AUD/USD: $0.7140-45(A$1.9bln)

USD/CAD: C$1.3300($662mln)

USD/CNY: Cny6.65($770mln)

ASIA FX: Softer Than Expected PBOC Fix Ignored

The Asia-Pac session provided little in the way of notable cues for Asia EM space, keeping most USD/Asia crosses in tight ranges.

- CNH: Offshore yuan was trapped in a narrow range, despite a softer than expected PBOC fix, which came in 23 pips above sell-side estimate. Elsewhere, a former PBOC official noted that the central bank has limited easing room.

- KRW: Spot USD/KRW traded on a slightly softer footing, which may have been a function of overnight greenback weakness. South Korea's CPI inflation accelerated to the fastest pace in a decade.

- IDR: Spot USD/IDR continued to creep higher after punching through its 50-DMA yesterday amid fairly limited local headline flow.

- MYR: Spot USD/MYR was rangebound, with participants awaiting the next monetary policy decision from BNM. The announcement is slated for tomorrow.

- PHP: Spot USD/PHP advanced, ticking away from its 50-DMA, as onshore Philippine market reopened after a long weekend. OCTA Research Group backed lowering the Alert Level in Metro Manila to Level 2.

- THB: The baht firmed a tad as Thailand's daily Covid-19 cases fell to the lowest levels in four months and the nation reopened its borders to vaccinated tourists from selected low-risk countries.

- SGD: USD/SGD slipped ahead of the release of Singapore's PMI for the month of October.

EQUITIES: Stocks Generally Softer In Asia Hours

Tuesday's Asia-Pac session was much more sedate than Monday's offering, with most of the major regional benchmark indices ticking lower.

- The Nikkei 225 lost some steam after yesterday's politically-inspired bid, while mainland Chinese equities struggled as the PBoC continued to withdraw month end liquidity provisions. Some noted that the impact surrounding the recent Chinese PMI releases continues to be felt. Finally, COVID-related lockdowns have been imposed on just under 20 schools in Beijing, which may represent another source of pressure.

- The Hang Seng was the exception to the broader rule, with the tech space rallying as participants looked to pick up beaten down Chinese names. Some also suggested that the unwind of shorts in the sector helped fuel gains.

- E-mini futures sit around 0.2% lower after the space backed away from fresh record highs as we moved through Monday trade.

GOLD: Familiar Levels

Gold continues to oscillate within the boundaries of the recently observed range, struggling for a real sense of direction ahead of this week's notable event risk. Spot is last little changed at $1,790/oz after drawing support from a weaker USD on Monday, which outweighed the impulse from a downtick in our weighted U.S real yield monitor. The technical picture remains unchanged.

OIL: Modest Gains For Crude In Asia, OPEC+ Dynamic Eyed

WTI & Brent futures sit ~$0.25 above their respective settlement levels, building on Monday's uptick, with focus on the upcoming OPEC+ summit (scheduled to take place on Thursday). Monday saw Kuwait become the latest participating nation to back the current policy implemented by the group of crude producers. The unanimity when it comes to OPEC+ will have supported crude prices on Monday, as would have a softer USD and fresh record highs for U.S. equities, although the major Wall St. indices did pull back from best levels of the day, which allowed crude to pare some of its own intraday gains. Meanwhile, the latest RTRS survey noted that "the increase in OPEC's oil output in October fell short of the rise planned under a deal with allies, as involuntary outages in some smaller producers offset higher supplies from Saudi Arabia and Iraq." OPEC crude production rose by ~190K bpd per the survey (vs. the 254K increase allotted to the group within the 400K bpd rise agreed by OPEC+ nations). Tuesday's focus will fall on the latest round of API inventory estimates.

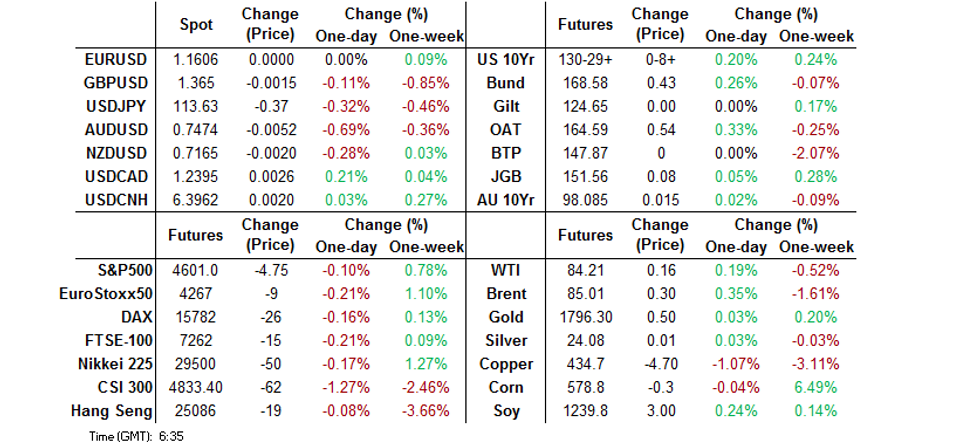

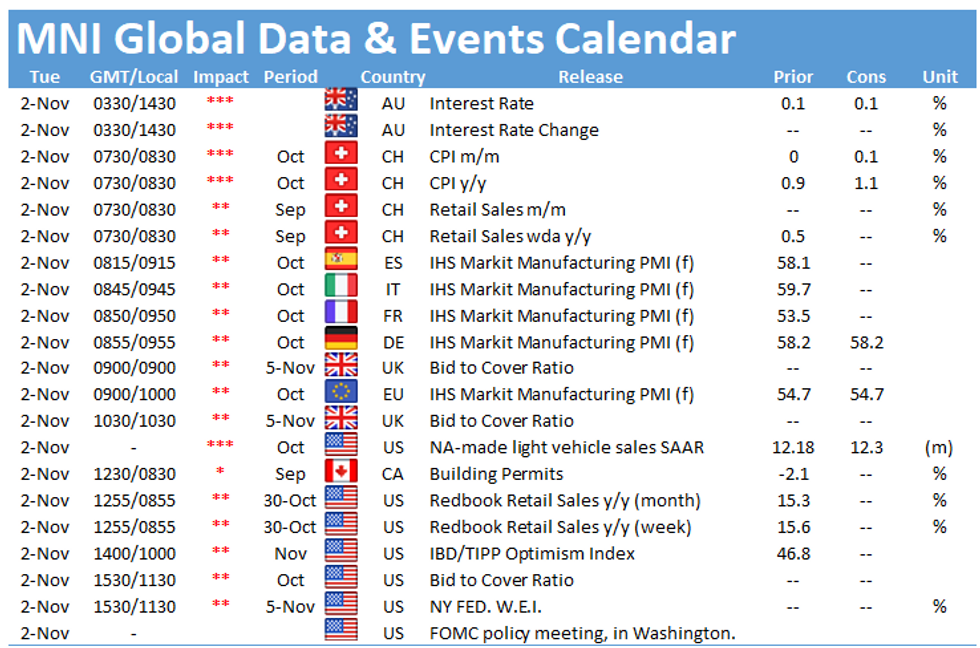

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.