-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

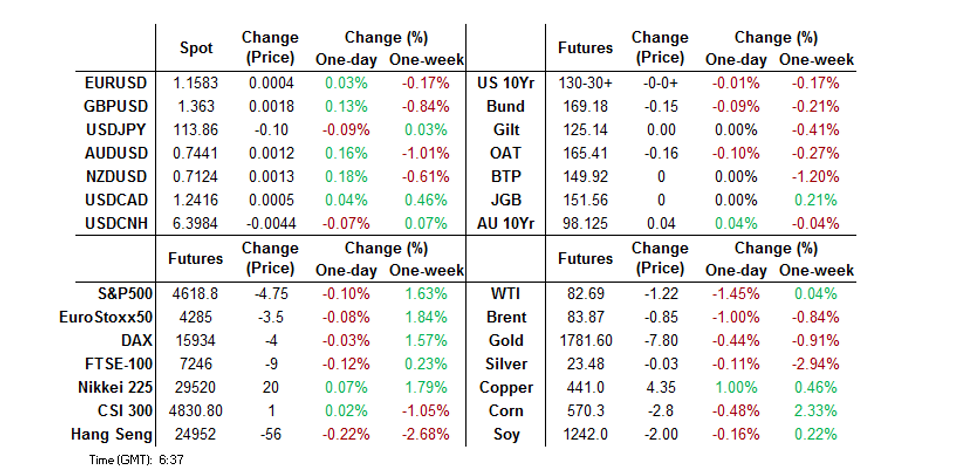

MNI EUROPEAN MARKETS ANALYSIS: Fed Tapering Announcement Imminent

- A larger than expected fall in the NZ unemployment rate and adjustments on the PBoC liquidity front (less of a net drain via OMOS vs. Monday & tuesday) dominated headlines overnight.

- Focus is squarely on today's FOMC decision which is expected to result in a $15bn/month tapering announcement, while most of the attention is set to fall on the Fed's communication surrounding inflation dynamics and any further signals on the rate hike outlook.

BOND SUMMARY: Off Asia Lows, Japanese Holiday Limits Price Action & Volumes

The cocktail of a Japanese holiday and proximity to Wednesday's FOMC decision has made for light Tsy trade in Asia, with a little over 40K TYZ1 contracts changing hands thus far. That particular contract last deals +0-00+ at 130-31+, with a downtick in oil & bid in ACGBs helping the move away from early session lows, while TYZ1 proved resilient to the pullback seen in ACGBs late in the Sydney day. A reminder that the Japanese holiday means that cash Tsys will not open for trade until London hours. Looking ahead to the NY session, ADP employment data is due to hit (ahead of Friday's NFP print). Elsewhere, the latest FOMC decision is expected to result in a $15bn/month tapering announcement, while most of the attention is set to fall on the Fed's communication surrounding inflation dynamics and any further signals on the rate hike outlook. The final point of note comes in the form of the Treasury's quarterly refunding announcement.

- It didn't take long for a bid in ACGBs to come back into play, as the follow through from yesterday's RBA decision continues to be observed, reversing the early Sydney trans-Tasman driven softening, which came on the back of the larger than expected downtick in NZ unemployment. The internals surrounding the latest round of ACGB Nov-31 supply weren't the strongest in recent memory (as fleshed out in an earlier bullet), but the auction still passed smoothly enough in the grander scheme of things, which provided another likely aid for the bid. YM +2.5 & XM +4.0 at the close, after fading back from best levels and failing to test their respective overnight highs. 10s led the rally in the cash ACGB space. The IR strip settled unchanged to 15bp richer through the reds, with IRZ2 leading the bid there.

FOREX: Kiwi Bolstered By NZ Jobs Data, Pre-FOMC Flows Aid Yen

New Zealand's jobs report for Q3 exceeded expectations, cementing the case for tighter monetary policy. The data reflected an increasingly tight labour market, as the unemployment rate plunged past the level forecast by the RBNZ in their latest MPS and landed close to the all-time low. The unexpected uptick in participation was easily absorbed by a surge in hiring, with employment growth surpassing estimates. NZD crosses trimmed some gains, as some of the post-data hawkish RBNZ repricing got unwound, but remained the best performer in G10 FX space.

- The DXY conceded some ground with today's monetary policy decision from the FOMC looming large. U.S. policymakers are widely expected to start scaling back pandemic-era stimulus.

- The yen gained on defensive flows ahead of the FOMC announcement. Japanese markets were shut in observance of a local public holiday.

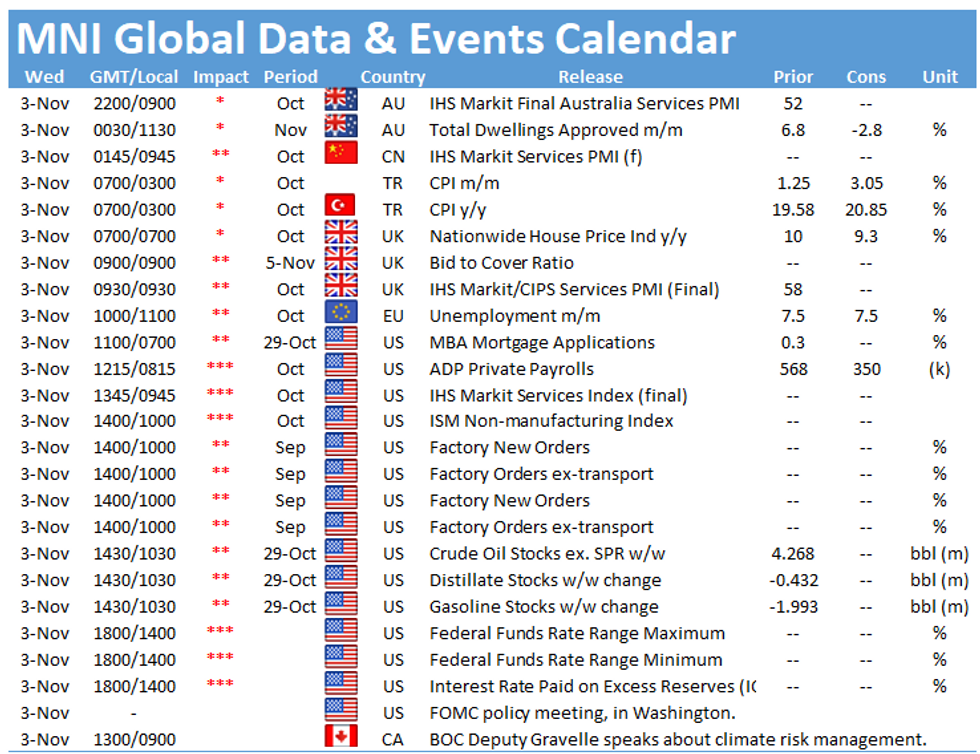

- Today's data highlights include U.S. ADP employment change, factory orders & durable goods orders and a suite of Services PMIs from across the globe. Speeches are due from BoE's Bailey, RBA's Debelle & a suite of ECB members.

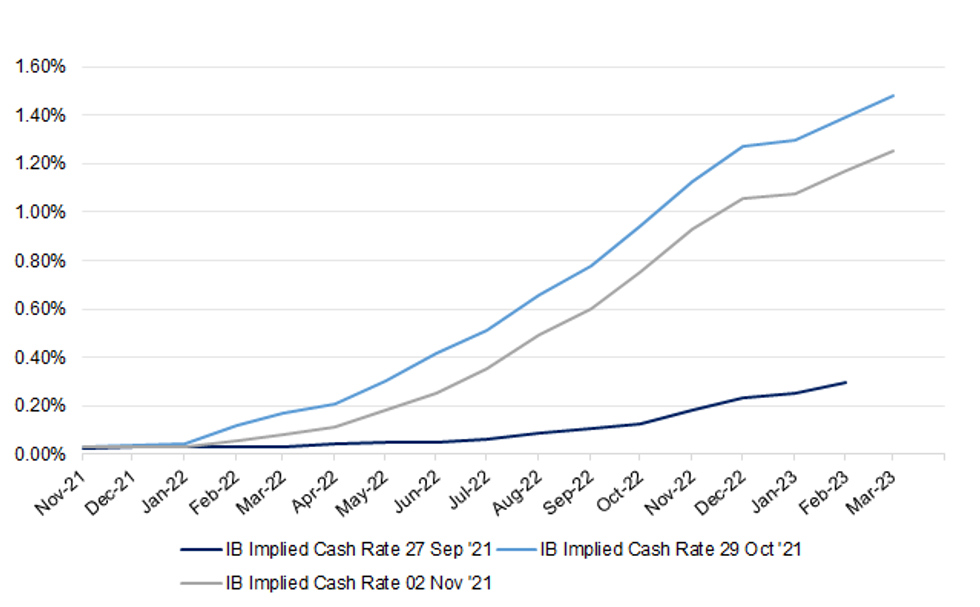

STIRS: Dovish RBA Forward Guidance Sees Further Partial Unwind Of Hike Premium

The fresh, ambiguous forward guidance deployed by the RBA at the end of yesterday's monetary policy decision, coupled with Governor Lowe's choice to reveal situations which could result in cash rate liftoff in '23 or '24, provided a dovish outcome vs. market pricing, which we suggested was overly aggressive ahead of the RBA decision. A reminder that the Governor also deemed the recent repricing to reflect a rate hike in early '22 an overreaction to a stronger than expected underlying inflation print in Q321.

- The first 15bp rate hike is now priced come the end of May '22, per the IB strip (based on 15bp of tightening being priced vs. the current effective cash rate of 0.03%). Meanwhile, ~122bp of tightening is priced come the end of Mar '23. This compares with a 15bp hike being almost fully priced by the end of Mar '22 back on Friday, while Friday's settlement levels pointed to 145bp of tightening through Mar '23. Pricing remains very aggressive when compared to RBA guidance, assuming inflation doesn't overshoot the Bank's expectations and its reaction function does not change.

Fig. 1: Recent Implied Cash Rate Shifts In The IB Strip

Source: MNI - Market News/ASX/Bloomberg

Source: MNI - Market News/ASX/Bloomberg

ASIA FX: Won Leads Asia EM FX Lower Ahead Of FOMC Decision, Yuan Holds Firm

The mood music turned more cautious ahead of the announcement of U.S. Fed's monetary policy decision today. Most USD/CNH crosses crept higher as a result, but the yuan remained resilient.

- CNH: USD/CNH edged lower, unfazed by the PBOC's apparent discomfort with a heavier exchange rate. China's central bank set their USD/CNY mid-point at CNY6.4079, 11 pips above sell-side estimate.

- KRW: The won went offered, pressured by a defensive feel ahead of FOMC policy announcement. PM Kim pushed back against the proposal of ruling party presidential candidate to extend another round of universal cash handouts.

- IDR: USD/IDR extended gains to a one-month high, approaching its 200-DMA. Broader market impetus was in the driving seat.

- MYR: USD/MYR firmed in Asia-Pac trade, with participants preparing for the upcoming monetary policy decision from BNM. Most (if not all) watchers expect Bank Negara to stand pat.

- PHP: USD/PHP advanced, even as officials approved lifting general curfew in Metro Manila, effective tomorrow.

- THB: USD/THB crept higher. Thai Dep PM Suttanapong noted that the economy has bottomed out and started to recover.

EQUITIES: Equities Marginally Mixed In Asia

Chinese & Hong Kong equities continued to soften on Wednesday, although losses in the benchmark indices were limited. Focus remains on the net draining of the month-end liquidity provisions deployed by the PBoC, although today's net drain was a little smaller than that seen on Monday & Tuesday, as the central bank upped its gross intraday OMO injection via reverse repos.

- The fallout from Tuesday's dovish RBA decision and an uptick in iron ore supported the ASX 200.

- U.S. e-mini futures are little changed after another round of record highs were lodged on Tuesday.

GOLD: Rangebound Ahead Of Key Event Risk

Spot remains anchored within the recently observed range ahead of Wednesday's key FOMC (the first of several major macro risk events slated for the week), last dealing liltte changed around the $1,785/oz mark. Initial support comes in at the Oct 29/18 lows ($1,772.0/1,760.4/oz), while resistance is seen at the Oct 22 high ($1,813.8/oz).

OIL: Headline API Inventory Build Weighs

A larger than expected headline crude stock build in the weekly API inventory estimates has applied pressure to crude in post-settlement and overnight dealing, leaving WTI & Brent futures over $1.00 softer at typing. The headline build was accompanied by a surprise, albeit modest, uptick in distillate stocks and a shallower than expected drawdown in gasoline stocks. There was also a marginal drawdown in stocks at the Cushing hub.

- This comes after the benchmark contracts finished little changed on Tuesday.

- Speculation re: OPEC+'s ability to a continue to lift crude production in line with its plans (+400K bpd/month) seems to have intensified in recent days.

- Elsewhere, Tuesday saw Iran flag a significant improvement in oil sales, with the country's exports of oil by-products set to resume in the coming weeks.

- DoE inventory data headlines on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.