-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY Erases Election Rally

MNI US OPEN - RBNZ Cuts 50bps, OCR Forecast Slightly Higher

MNI China Daily Summary: Wednesday, November 27

MNI EUROPEAN MARKETS ANALYSIS: USD Mixed, Oil Bid

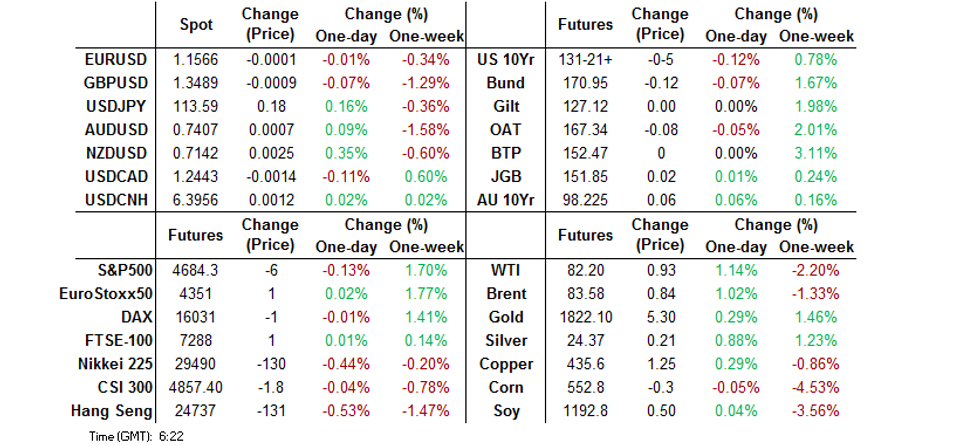

- The JPY found itself at the bottom of the G10 FX pile, even as equities struggled to garner upward momentum during Asia-Pac hours, while the USD traded mixed across G10.

- Core FI markets came under some light pressure, moving away from Friday's post-NFP peaks, while crude oil futures pushed higher.

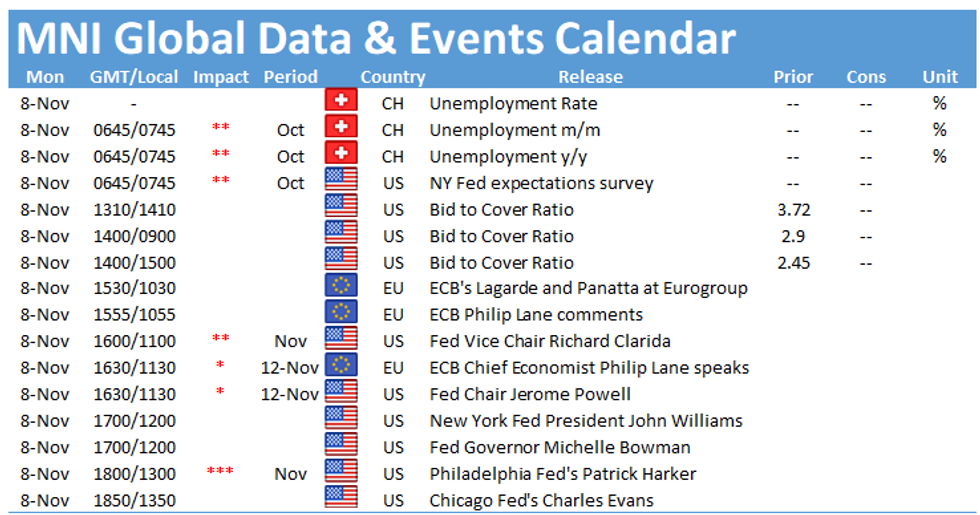

- Fedspeak from Powell & Clarida headlines the broader economic docket on Monday.

BOND SUMMARY: Core FI Back From Friday Highs

Asia-Pac hours saw core fixed income markets pressured by the trifecta of higher oil prices, a wider than expected Chinese trade surplus (firmer than exp. exports & softer than exp. imports), as well as the passage of the Build Back Better and infrastructure spending plans in the U.S. on Friday.

- A round of TYZ1 lifts (4K block and ~3K subsequently on screen) helped the Tsy space find a bit of a base mid-way through the Asia-Pac session. TYZ1 runs -0-04+ at 131-22 at typing, off lows and within the confines of 0-06+ overnight range, while the major cash Tsy benchmarks sit 0.5-1.5bp cheaper across the curve. A raft of Fedspeak, headlined by Chair Powell & Vice Chair Clarida, in addition to 3-Year note supply from the Tsy, headline the local docket on Monday.

- JGB futures sit at unchanged levels after giving back their overnight gains on the aforementioned dynamics, while the domestic fiscal burden continues to dominate headline flow. Cash JGBs run 0.5bp richer to 1.0bp cheaper across the curve, with 20s providing the weak point on the day. 30-Year JGB supply headlines the local docket on Tuesday.

- ACGBs lacked any meaningful local catalysts, leaving the space to track broader gyrations, with YM +7.0 & XM +6.0 come the bell. The weekend saw news that Australia hit its target of having 80% of 16+-Year olds fully vaccinated against COVID, with PM Morrison also noting that the border will open to foreign workers before Christmas. Issuance provided some points of interest; TCV launched a syndicated benchmark sized tap of its Nov '34 line, which is set to price on Tuesday, while Westpac mandated for a 5-tranche round of US$-denominated issuance.

FOREX: Yen, Sterling Lose Ground

The yen went offered despite the absence of any major headline catalysts, with broader awareness of policy outlook divergence between the BoJ and its major peers lingering in the background. BBG trader sources pointed to leveraged short-covering in USD/JPY amid an uptick in U.S. Tsy yields. The rate extended gains over the Tokyo fix.

- Sterling showed some weakness amid continued escalation in the UK-EU stand-off over the Northern Ireland protocol.

- Commodity-tied FX found some poise as crude oil traded on a firmer footing. The NZD led gains as New Zealand eased restrictions in Auckland and confirmed that its largest city is on track to exit lockdown by month-end.

- USD/CNH operates on a slightly firmer footing, even as China's trade surplus surged to a record amid robust overseas demand for Chinese goods. Imports growth was slower than expected.

- A dearth of notable data releases today will be compensated by central bank rhetoric from Fed's Powell, Clarity, Harker, Bowman & Evans, ECB's Lane & Makhlouf as well as BoE's Bailey.

ASIA FX: Most USD/Asia Crosses Soften, But USD/CNH Holds Firmer

Most Asia EM FX traded with a modest bullish bias, albeit USD/CNH struggled for any topside impetus.

- CNH: Spot USD/CNH operated above neutral levels, even as China posted a record monthly trade surplus over the weekend. The PBOC resumed weaker yuan fixings and set their central USD/CNY mid-point at CNY6.3959, 22 pips above sell-side estimate.

- KRW: KRW gave away its opening gains. Latest polling pointed to mounting headwinds for South Korea's ruling Democratic Party ahead of the 2022 presidential election.

- IDR: Spot USD/IDR tumbled after Bank Indonesia said last Friday that they expect a stronger rupiah and signalled readiness to enforce stability in FX markets.

- MYR: Malaysia eased Covid-19 curbs across a number of states, while the federal gov't lifted a mandatory charge on inbound foreign travellers. The ringgit appreciated.

- PHP: Spot USD/PHP went offered and printed its worst levels in more than six weeks. The City of Manila abandoned its face shield mandate.

- THB: The baht was among the best performers in the Asia EM basket. Thailand reported the fewest Covid-19 deaths since Jun 29.

EQUITIES: Tesla Steals The Limelight, Again

The major regional equity indices traded little changed to marginally softer during the first Asia-Pac session of the week. Participants looked for leaks surrounding the latest Chinese policymaker gathering in Beijing, although they were not forthcoming. Elsewhere, a net liquidity injection via PBoC OMOs (the first since the turn of the month), did little to boost broader risk appetite. Meanwhile, U.S. e-mini futures edged lower, with the NASDAQ 100 contract leading the way after Tesla CEO Musk ran a Twitter poll over the weekend, effectively asking if he should shed 10% of his equity holding in the company. The poll answered in the affirmative, after he noted that he "will abide by the results of this poll, whichever way it goes." Musk used the recent tax debate as his reasoning for launching the poll and it remains unclear if/when he will shed any of his holdings.

GOLD: Little Changed After Post-NFP Move Higher

The post-NFP move lower in U.S. real yields and the DXY has mostly held during Monday's Asia-Pac session (at least if we use our weighted U.S. real yield monitor for the former), leaving gold little changed, just shy of $1,820/oz in spot dealing, after Friday's uptick. Bulls are squarely focused on the Sep 3 high/bull trigger ($1,834.0/oz), while bears need to take out the Nov 3 low ($1,759.0/oz) to reassert themselves. The upcoming raft of Fedspeak (including Chair Powell & Vice Chair Clarida on Monday) provides the immediate area of focus, with Wednesday's U.S. CPI release also eyed.

OIL: Friday's Rally Extends

WTI & Brent sit the best part of $1.00 above their respective settlement levels, albeit a little shy of their Asia-Pac peaks. Early trade saw regional participants adjust to Friday's news flow and price action, after a softer USD, news that Saudi Aramco has hiked its OSPs to all buyers and an uptick for the major equity indices on Wall St. combined to support crude at the backend of last week. The benchmarks still sit someway shy of their recent highs, with participants now assessing the chances of the deployment of U.S. SPR stock to fight off the upward momentum in crude, with President Biden stressing that the country has the capability to act after OPEC+ failed to comply with his request re: larger increases in supply last week.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.