-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: The Day After CPI

- The soft Australian labour market report wasn't quite as bad as the headline figures suggested. The uptick in the unemployment rate was partially driven by an uptick in the participation rate, which reflected more people looking for work as COVID restrictions in NSW were about to wind down. Job ads data, the subsequent removal of COVID restrictions in NSW & Victoria (after the sample period covering the data release) and the latest ABS payrolls print had most pointing to the potential for positive readings in the coming months (albeit with the potential for volatility).

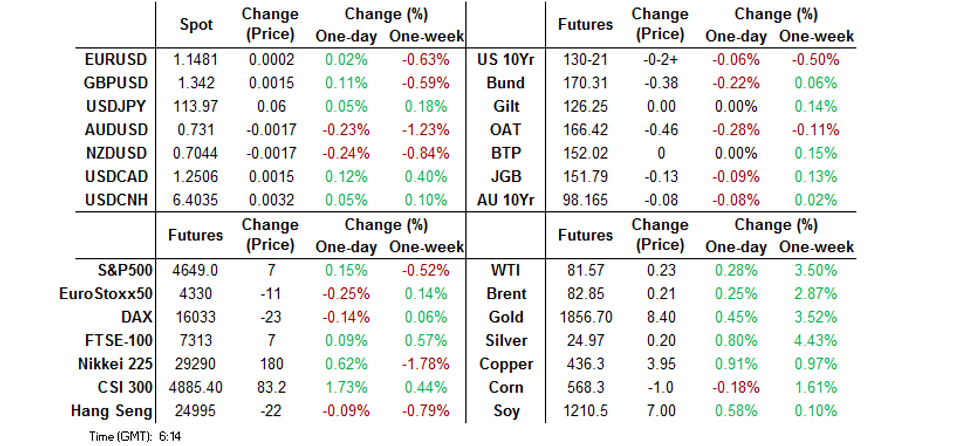

- Core markets stuck to fairly contained ranges in Asia. Cash Tsys are closed for the observance of the U.S. Veterans Day holiday.

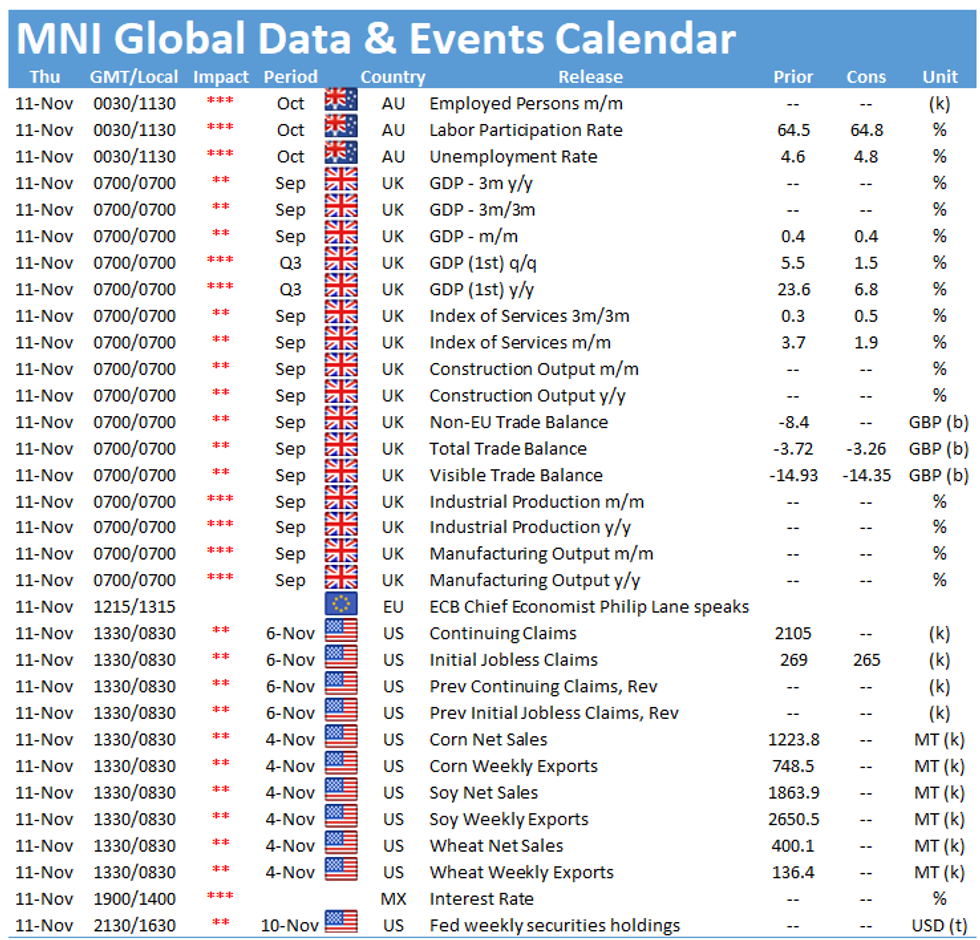

- UK GDP data and a raft of central bank speak headlines the broader docket on Thursday, while the Veterans Day holiday in the U.S. is set to thin out liquidity.

BOND SUMMARY: Core FI Off Lows In Asia, Cash Tsys Closed

TYZ1 had a look through Wednesday's low before recovering, last -0-02+ at 130-21+ vs. worst levels of 130-15. Initially, the spill over from the U.S. session, an uptick in Chinese equities and second round weakness in the ACGB space weighed. Cash Tsys will not trade on Thursday owing to the observance of the Veterans Day holiday. Downside interest has headlined on the flow side in the STIR space, with screen buying of 0EX1 99.00 puts seen (~15K lots lifted in total thus far).

- JGB futures saw a marginal extension of their overnight weakness as U.S. Tsy futures came under some pressure, before recovering, last dealing 13 ticks below settlement levels. Cash JGBs ran little changed to 1bp cheaper across the curve. Note that much firmer than expected domestic PPI data was witnessed, although there wasn't much in the way of tangible reaction post-release.

- Aussie bond futures rallied on the surprise fall in headline employment and larger than expected uptick in the unemployment rate in the latest domestic labour market report. However, the rally was capped as the report wasn't quite as bad as the headline figures suggested, with the space drifting back to cheaps as a result, before recovering later in the day. The uptick in the unemployment rate was partially driven by an uptick in the participation rate, which reflected more people looking for work as COVID restrictions in NSW were about to wind down. Job ads data, the subsequent removal of COVID restrictions in NSW & Victoria (after the sample period covering the data release) and the latest ABS payrolls print had most pointing to the potential for positive readings in the coming months (albeit with the potential for volatility). YM -12.5 & XM -8.0 at the bell, with bear flattening the theme throughout the day.

FOREX: Caution Dominates Amid Reflection On Inflation Dynamics, Aussie Jobs Data

The AUD reversed initial gains after the release of Australia's most recent jobs market report. The unemployment rate climbed more than expected, as full-time job losses resulted in a surprise contraction in total employment. Market reaction may have been limited by the fact that the uptick in the unemployment rate was partly driven by wider participation, as lockdown restrictions were eased across Australia.

- The greenback was in demand, following the release of U.S. CPI data on Wednesday, which showed that inflation accelerated to the fastest pace in more than two decades. The DXY extended gains to best levels since Jul 23, 2020, but rejected the 95.00 figure.

- Inflation worry translated into a broader cautious feel, which became evident even as regional headline flow was relatively subdued. High-beta G10 FX traded on a softer footing as a result.

- Cable probed the water below the $1.3400 figure for the first time since Dec 2020, ahead of the release of preliminary Q3 GDP report and monthly economic activity indicators out of the UK.

- Apart from aforementioned UK data, speeches from ECB's Makhlouf, Lane, Schnabel & de Cos as well as BoE's Mann take focus from here. The U.S. observes a public holiday.

FOREX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-70(E1.6bln), $1.1580(E566mln), $1.1650(E605mln)

- USD/JPY: Y113.00-20($1.8bln), Y113.25-45($1.5bln), Y113.50-60($1.7bln), Y113.70($1.5bln)

- AUD/USD: $0.7330-40(A$845mln)

ASIA FX: U.S. CPI Report Reverberates Across Asia

The Asia-Pacific reacted to Wednesday's market impetus generated by a beat in U.S. CPI, as the rate of inflation reached a multi-decade high. Resultant demand for the greenback underpinned USD/Asia crosses.

- CNH: A stronger greenback prompted USD/CNH to nudge higher and the PBOC resumed pushbacks against any redback strength, as they delivered another softer than expected yuan fixing.

- KRW: The won retreated and underperformed all of its regional peers, catching up with overnight market reaction to U.S. inflation data. USD/KRW printed a fresh three-week high before trimming gains. BoK Gov Lee warned that the central bank sees heightened uncertainty going forward.

- IDR: The rupiah sold off sharply, as onshore Indonesian markets absorbed spillover from U.S. inflation report. Local headline flow was relatively thin, with comments from top economic officials awaited.

- MYR: Spot USD/MYR had a look above its 50-DMA for the first time since Aug 27 and printed a new three-week high.

- PHP: The peso traded on a softer footing, even as the government said they are looking into relaxing some border restrictions.

- THB: Spot USD/THB crept higher. The BoT yesterday left their benchmark policy rate unchanged, in line with consensus.

EQUITIES: Little Changed On Thursday

The major Asia-Pac equity indices trade either side of unchanged. China's CSI 300 was the outperformer as mainland property developers benefitted from reports that pointed to Evergrande making a previously missed round of bond coupon payments late on Wednesday, before the grace period re: the payments elapsed. The sector gained a further round of tailwinds from a WSJ report which suggested that "Chinese regulators, wary of financial risks spreading as a result of their crackdown on property lending, are considering easing the rules to let struggling developers sell off assets to avoid defaults and hits to the broader economy." U.S. e-mini futures flatlined, with Tesla CEO Musk once again stealing the headlines as he revealed that he has shed ~$5bn worth of his holdings in the company (~$1bn of which covered tax obligations re: options under a pre-announced plan, with the remaining amount seemingly coming on the back of the well-discussed weekend Twitter poll that he ran on the matter).

GOLD: Flat In Asia After Break Higher

Spot gold is little changed, dealing around $1,850/oz. A reminder that bullion surged on Wednesday, as participants reacted to a firmer than expected round of U.S. CPI data, with a technical bull trigger broken in the process. Real yields did recover from session lows, which meant that gold peaked just below $1,870/oz (a firmer USD also helped bullion away from highs). The next level of technical resistance is located at the June 14 high ($1,877.7/oz).

OIL: Modestly Higher

WTI & Brent futures sit ~$0.30 above settlement levels.

- There is continued focus on the debate surrounding the potential for the U.S. to release some of its SPR holdings. Citi were the latest to weigh in on that particular matter, pointing to the potential for as much as 60mn bbl being released from the SPR.

- A reminder that the two major benchmarks shed over $2.00 apiece on Wednesday, with the move lower aided by a headline build in crude stocks in the latest weekly DoE inventory data, which went against the headline crude drawdown seen in the API estimates. Elsewhere, a firmer USD applied some weight. We also saw U.S. Sec. of State Blinken suggest that Russia could and should alleviate some of the pressure re: the well-documented energy crunch.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.