-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - CNH Slippage Puts Rate in Range of Record Lows

MNI China Daily Summary: Tuesday, December 31

MNI EUROPEAN MARKETS ANALYSIS: DXY A Touch Further Off Highs, USD/TRY Above 10.00

- U.S. Tsy yields marginally lower, with the DXY a shade softer into Europe. PBoC liquidity management garnered most of the overnight attention.

- USD/TRY registered another fresh all-time high after crossing above the TRY10.00 mark on Friday, with the potential for heightened cross-border tensions between Turkey & Syria, as well as continued worry re: looser CBRT policy, weighing on the TRY.

- Participants are already rolling their focus to the late Monday call between U.S. President Biden & Chinese counterpart Xi, although a White House official has told CNBC that the meeting "is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners." As a result, most see little room for any real positive developments. Further afield BoE comments (Bailey & Haskel) & ECB speak (de Guindos) will draw attention on Monday.

BOND SUMMARY: Core FI A Touch Firmer On The Day

The very light overnight bid in U.S. Tsys has been driven by the front end of the curve, with the belly leading, richening by ~1.5bp on the session, while the longer end of the curve is little changed on the day. The only round of major macro headline flow has centred on the Chinese liquidity situation, which saw the PBoC inject CNY1tn of MLF, matching the amount of MLF that was set to roll off in November (this may have supported broader core global FI). TYZ1 last +0-07+ at 130-24+. The space also looked through the latest round of Chinese economic activity data (which was firmer than exp.). Empire manufacturing data presents the highlight of a very limited domestic docket on Monday. Focus is already on the late Monday call between U.S. President Biden & Chinese counterpart Xi, although a White House official has told CNBC that the meeting "is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners." As a result, most see little room for any real positive developments.

- The belly of the JGB curve has outperformed, richening by as much as ~2bp on the back of the softer than expected GDP print (business capex and consumer spending data both disappointed) and broader impulse in the core global FI space. Meanwhile, 20+-Year paper sits flat to 1bp cheaper on the back of issuance worries in the wake of the previously flagged Nikkei report which pointed to the potential for a larger than expected fiscal support package in Japan, resulting in some twist steepening on the curve. Futures +8 as a result of the firmer belly outlined above.

- In addition to the broader bid in the core FI space evident on Monday (perhaps linked to the previously outlined Chinese liquidity dynamic), several desks have pointed to international value hunting as a driver behind the outperformance in ACGBs, with the compression of the Australia/U.S. 10-Year yield spread adding further weight to that argument. Market pricing re: the RBA's rate path remains aggressive vs. the Bank's own forward guidance, while the negative RBA purchase adjusted net ACGB supply dynamic and record levels of excess liquidity in the Australian banking system continue to facilitate demand. YM +6.5 & XM +2.0 at the close, with the 3- to 5-Year zone leading in cash ACGB trade. Note that the RBA's overnight cash rate settled at 0.04% today, after months of printing at 0.03%., potentially on a lack of "traded" activity and expert judgement.

FOREX: DXY Marginally Lower Overnight

There was a distinct lack of notable headline catalysts observed in Asia-Pac hours, with a very modest downtick in U.S. Tsy yields helping the DXY away from its early session high, leaving the USD at the bottom of the G10 FX table.

- The latest round of monthly Chinese economic activity data beat expectations, although house price data came in on the softer side, offering an offset (and a deepening headwind for the troubled property developer sector). There was no direct reaction to the PBoC's move to inject CNY1tn via MLF, as it matched the amount of MLF that will mature this month (such a move was widely expected), although that may have aided the modest bid in the U.S. Tsy space. USD/CNH was pretty steady, with the CFETS RMB measure grinding towards its all-time high, while the PBoC's USD/CNY mid-point fixing was in line with broader expectations.

- USD/TRY registered another fresh all-time high after crossing above the TRY10.00 mark on Friday, with the potential for heightened cross-border tensions between Turkey & Syria, as well as continued worry re: looser CBRT policy, weighing on the TRY.

- Participants are already rolling their focus to the late Monday call between U.S. President Biden & Chinese counterpart Xi, although a White House official has told CNBC that the meeting "is about setting the terms of an effective competition where we are in the position to defend our values and interests and those of our allies and partners." As a result, most see little room for any real positive developments. Further afield BoE comments (Bailey & Haskel) & ECB speak (de Guindos) will draw attention on Monday.

FOREX OPTIONS: Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1375(E553mln), $1.1580-00(E1.3bln)

- USD/JPY: Y113.95-00($519mln), Y114.75($570mln)

- AUD/USD: $0.7267-80(A$600mln)

EQUITIES: Mixed Performance In Asia

Equity markets lacked clear direction in Asia-Pac trade, with positive inputs in the form of Chinese liquidity management and firmer than expected Chinese economic activity data at least partially countered by softer Chinese house price data (a headwind for the troubled property sector). Elsewhere, China's newest equity exchange, focused on SMEs, saw several of the new listings go limit up. The major regional indices trade either side of unchanged in Asia, while U.S. e-mini futures ticked away from their early Asia highs, to last print little changed.

GOLD: Resistance Defined

Gold was capped by the Nov 10 high back on Friday, when a lower DXY and dip in our weighted U.S. real yield metric supported bullion, although spot has drifted away from the resistance zone established last week ($1,868.7/oz), last dealing a handful of dollars lower at $1,858/oz. A break through $1,868.7/oz would expose the June 14 high ($1,877.7/oz). Initial support comes in at the Nov 10 low ($1,822.4/oz). Market-based U.S. inflation dynamics and Fedspeak will likely drive bullion throughout this week.

OIL: SPR, Will They Or Won't They?

Continued focus on the U.S. ability to release holdings from its SPR facility continue to draw focus, applying some modest pressure to WTI & Brent futures early this week, with both metrics running ~$0.70 below Friday settlement levels at typing. The Biden administration has noted that the SPR is one of several tools that it has at its disposal, but higher gas prices have started to weigh on the President's approval rating.

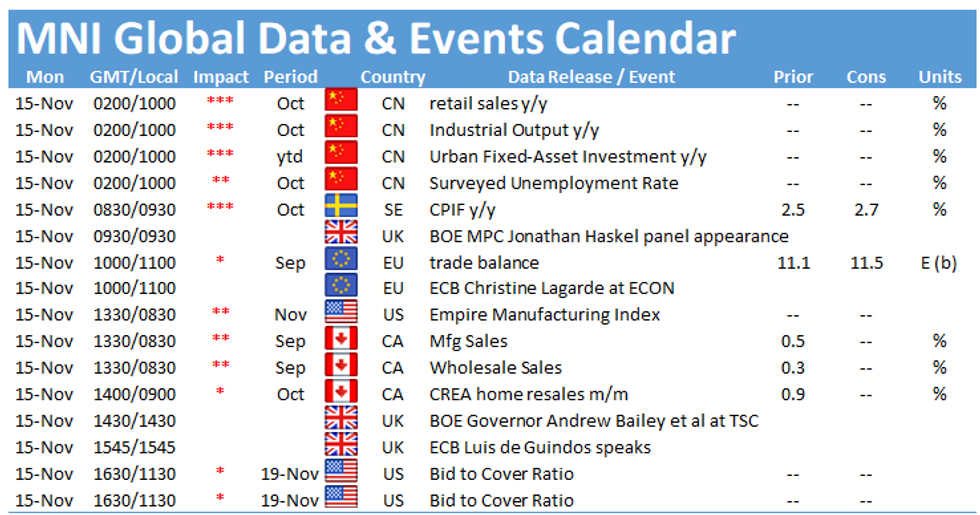

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.