-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - November 2024

MNI POLITICAL RISK - Trump Initiates Tariff Negotiations

MNI EUROPEAN MARKETS ANALYSIS: USD Bid As EUR/USD Breaks $1.1300

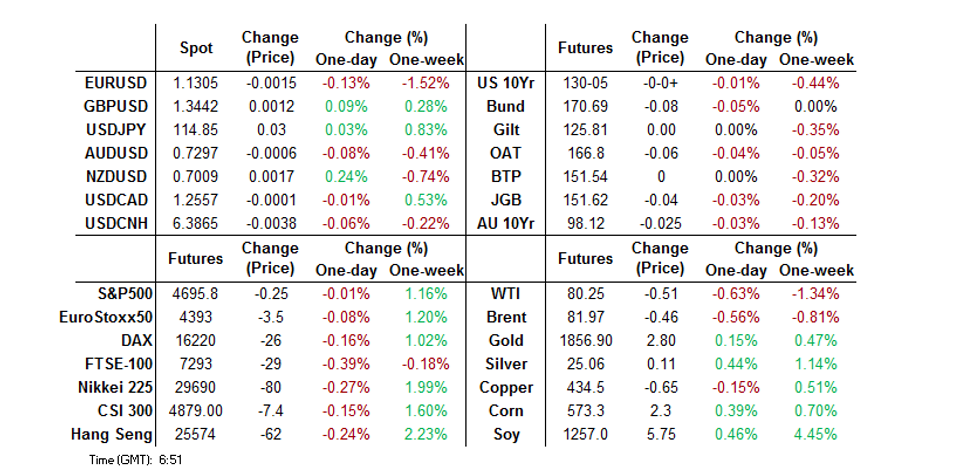

- The DXY registered a fresh YtD high as stops and option related flow pushed EUR/USD to $1.1264 , before a subsequent recovery saw $1.1300 reclaimed.

- Odds of a second term for Fed Chair Powell continue to take a hit, although he remains the betting favourite.

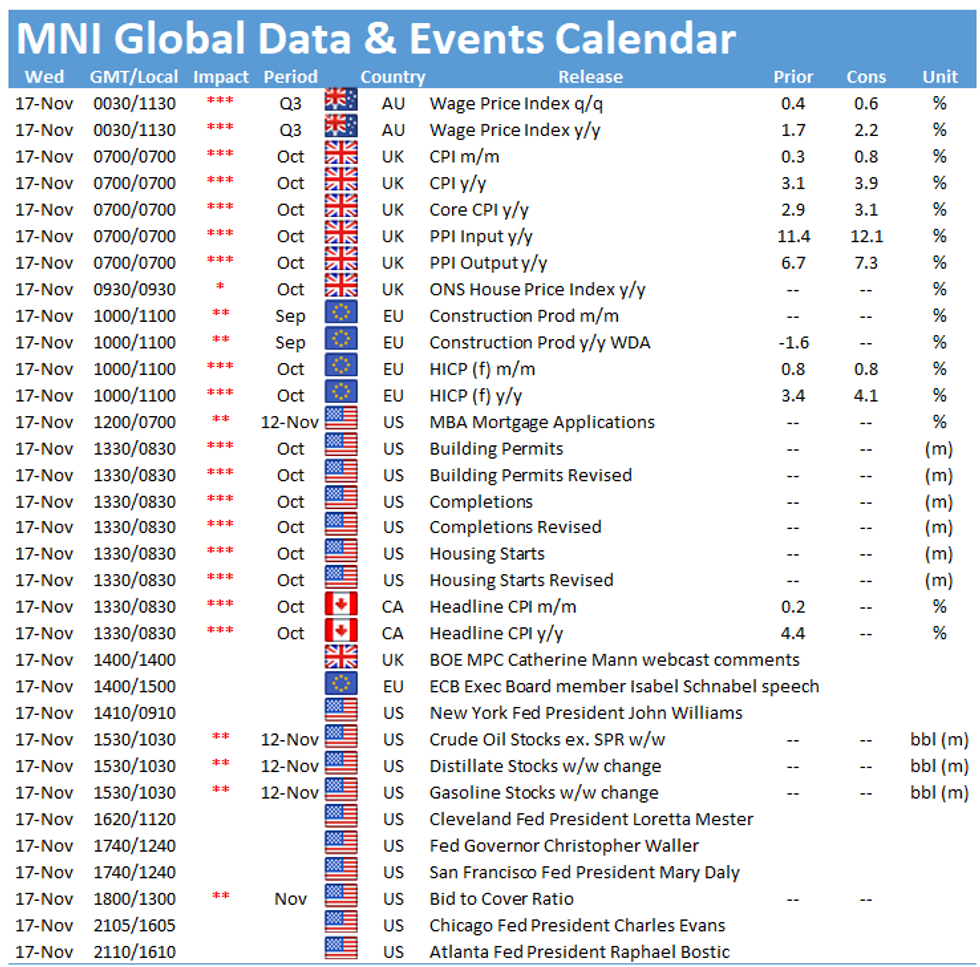

- Inflation data from the EZ, UK and Canada takes focus from here. the central bank speaker slate features a slew of Fed, ECB, BoE & Norges Bank members.

BOND SUMMARY: Broader Based Moves

TYZ1 showed though Tuesday's low during Asia-Pac hours, before recovering from worst levels, to last print -0-01 at 130-04+, with the cash Tsy space running ~0.5bp cheaper across the curve at typing. An uptick in the USD helped to apply modest pressure. Macro headline flow was light overnight, with ACGB gyrations shaping early two-way price action. Wednesday's NY docket will see the release of housing starts and building permits data, 20-Year Tsy supply and Fedspeak from Williams, Bowman, Waller, Mester, Daly, Evans & Bostic.

- JGB futures tracked the broader impetus in core global FI markets, last -3. The major cash JGB benchmarks are -/+0.5bp on the day. The offer/cover ratios witnessed in the latest round of BoJ Rinban operations were as follows: 1- to 3-Year: 3.02x (prev. 2.83x), 5- to 10-Year: 1.84x (prev. 2.35x), 25+-Year: 4.15x (prev. 5.79x). This would have provided little, if any, trading impetus in the early part of the Tokyo afternoon.

- The ACGB space squeezed higher in the wake of Australia's Q3 wage price data, which failed to provide any upside surprise, printing in-line with broader expectations (+0.6% Q/Q, +2.2% Y/Y). The firming on the back of the in-line print was likely facilitated by the well-documented aggressive market positioning when it comes to the RBA hiking cycle (when compared to the Bank's own forward guidance). A reminder that the RBA has continually pointed to the likelihood that wages will need to rise by 3+% Y/Y to foster the inflationary outcome that it desires. The space eased away from highs as Tsys came under modest cheapening pressure and the impetus from the data release faded. The curve exhibited a twist steepening pattern, with YM +3.0 & XM -2.5. Pricing of A$700mn of 10-Year issuance from Australia Pacific Airports may have applied some pressure to XM.

FOREX: Greenback Extends Gains, Aussie Gets Wounded By Wage Price Data

The DXY was on a tear, ripped through the 96.00 figure and printed a fresh 16-month high. The greenback was able to build on Tuesday's gains inspired by strong economic data released out of the U.S. Its most recent leg higher coincided with a dip in EUR/USD, which pierced the psychological $1.3000 level for the first time since mid-2020, with talk of the triggering of stop-loss orders doing the rounds.

- The AUD lagged behind all of its G10 peers after local Q3 wage price data failed to provide any upside surprise and matched consensus (+0.6% Q/Q & +2.2% Y/Y). The RBA had previously flagged that wages will need to rise at +3% Y/Y to generate the desired inflationary outcome.

- Across the Tasman, the NZD held firm as PM Ardern announced that the border around Auckland will be removed on Dec 15, in time for the Christmas period. 1-week implied volatilities of NZD crosses surged ahead of the RBNZ's monetary policy announcement scheduled for next Wednesday.

- Inflation data from the EZ, UK and Canada take focus from here. Central bank speaker slate features a slew of Fed, ECB, BoE & Norges Bank members.

FOREX OPTIONS: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390(E914mln), $1.1450-70(E735mln), $1.1490-05(E1.9bln)

- USD/JPY: Y115.00($558mln)

- EUR/GBP: Gbp0.8445(E839mln)

- AUD/USD: $0.7300(A$722mln)

- USD/CAD: C$1.2500($551mln), C$1.2540-50($905mln)

ASIA FX: Dollar Appreciation Keeps Lid On EM FX

A round of upbeat economic data released out of the U.S. on Tuesday continued to lend support to the greenback, allowing it to outperform all regional currencies save for the yuan.

- CNH: USD/CNH went offered in early trade, but recouped losses as the greenback regained poise. China's Vice Pres Wang noted that the nation "cannot develop in isolation from the world" and therefore will "expand opening up."

- KRW: The won led losses in the Asia EM basket, pressured by the market impact of solid U.S. data released overnight. South Korean FinMin Hong pledged to step up efforts to stabilise domestic housing market without providing details.

- IDR: Spot USD/IDR gapped higher at the reopen and extended gains thereafter, in a move driven primarily by USD strength. The gov't said they will use state cash reserves to buy INDOGBs in the market amid continued foreign outflows.

- MYR: Spot USD/MYR climbed to a 1-month high on the back of broader market impetus, as local headline flow provided no notable catalysts.

- PHP: Spot USD/PHP crept higher, approaching its 50-DMA. Domestic political goings-on took focus, while participants prepared for tomorrow's BSP MonPol decision.

- THB: Spot USD/THB inched higher on broader dollar strength.

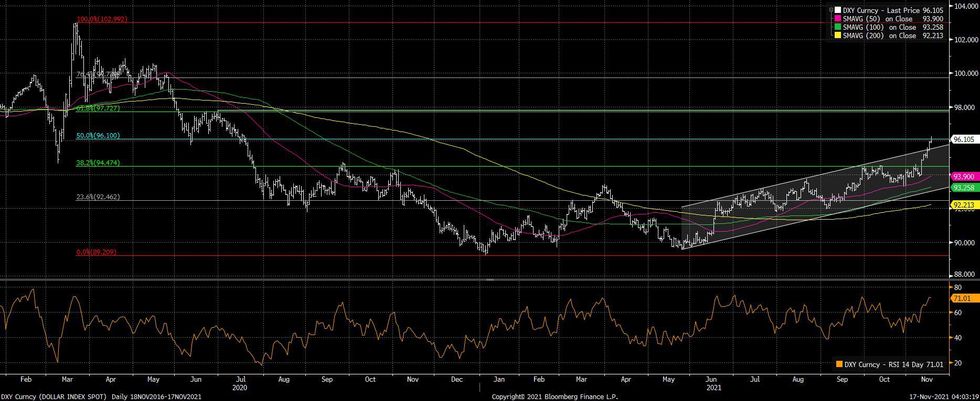

USD: DXY Looking Above Key Resistance

The latest round of broad USD strength, facilitated by EUR/USD tumbling below $1.1300, has resulted in the DXY moving to the highest level witnessed since Jul '20.

- Tuesday saw the DXY register a convincing break above the upper confines of the bull channel drawn off the May 25 lows. The subsequent USD strength witnessed in Asia-Pac trade has allowed the DXY to look above the 50% retracement of the move from the Mar '20 high to the Jan '21 lows (96.100). A clean, sustained break through here would give bulls room to focus on the 61.8% retracement of the same move (97.727).

- Note that the DXY has moved into overbought territory, with the 14-day RSI above the 70 level. Any retracement back below the 70 line is seen as a bearish threat from a technical perspective.

- The latest round of USD strength of course follows a firmer than expected round of U.S. CPI data for the month of October (registered last week), while the broader set of U.S. economic data releases has also outperformed in recent times, with Citi's U.S. economic surprise index improving to levels not witnessed since June '21. OIS currently fully price a 25bp Fed hike by the end of the central bank's Jul '22 meeting.

Fig. 1: DXY Index

Source: MNI – Market News/Bloomberg

Source: MNI – Market News/Bloomberg

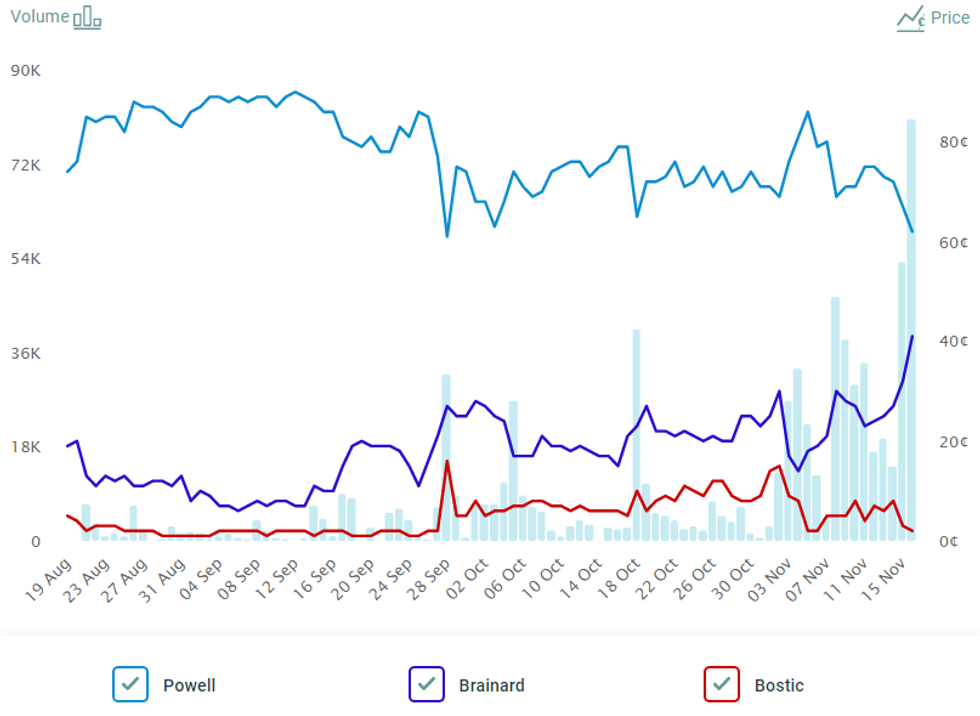

FED: Odds Of A Second Term For Powell Take Another Hit, Still The Favourite

The betting market odds re: current Fed Chair Powell being offered the opportunity to serve a second term took another hit on Tuesday, narrowing as the odds surrounding President Biden picking current Fed Governor Lael Brainard received another boost.

- To recap, Tuesday saw Biden tell reporters that he would make an announcement on the matter in the next four days. A BBG source later suggested that the announcement may slip into next week, while pointing to a 2-horse race between Powell & Brainard (in line with broader expectations). The BBG source noted that "Biden considers them both strong options and respects them both." The continued neck-and-neck race (at least in press portrayals) is continuing to erode Powell's early frontrunner status.

- Senate Banking Committee Chairman Sherrod Brown flagged a sense of certainty when it came to the chances of confirmation of either of the leading candidates.

- Democratic Senator Joe Manchin has noted that he will speak with Powell in the next few days.

Fig. 1: Odds re: Whom Will The Senate Next Confirm As Chair Of The Federal Reserve?

Source: PredictIt

Source: PredictIt

EQUITIES: Asia-Pacific Equities Nudge Lower

The major Asia-Pac equity indices were little changed to modestly lower on Wednesday. Australia's ASX 200 was pressured by the banking sector after CBA's latest earnings report missed expectations. The latest uptick in U.S. Tsy yields will not have aided Asia-Pac equities. U.S. e-minis are little changed vs. settlement levels.

GOLD: Stagnant Overnight After Tuesday's Softening

Gold has looked through the latest leg of USD strength, which became evident in Asia-Pac hours, last dealing little changed, just above $1,850/oz.

- To recap, Tuesday saw a simultaneous uptick in the broader DXY and our weighted U.S. real yield monitor, which weighed on gold, dragging spot back from the fresh multi-month highs that were registered in the early part of the NY morning.

- Technical resistance remains intact at the June 14 high ($1,877.7/oz). A break there would expose the June 8 high ($1,903.8/oz). Initial support is seen at the Nov 10 low ($1,822.4/oz).

OIL: Crude A Little Softer In Asia, Joint Sino-U.S. Inventory Release Inbound?

A downtick in regional equities and a firmer USD combined to weigh on crude futures during Asia-Pac hours, leaving WTI & Brent ~$0.70 below their respective settlement levels. A shallower than expected build in headline crude stocks, per the latest API weekly estimate, provided no lasting impact on the space, with participants choosing to focus on the previously flagged headwinds, in addition to reports which pointed to the potential for a joint oil stockpile release between the U.S. and China (which the U.S. has seemingly pushed for, although China has not committed to such action, per the SCMP).

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.