-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

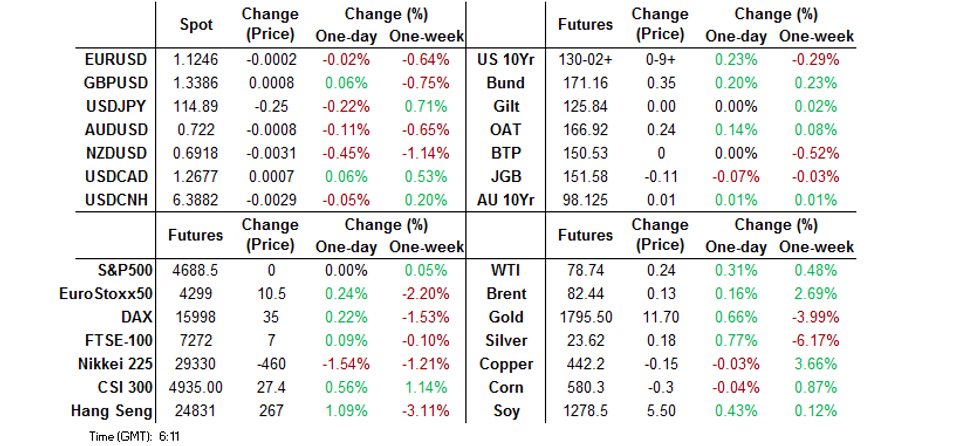

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. Tsys Receive Bid From Japan

- Desks pointed to a Japanese-based bid for U.S. Tsys as Tokyo reacted to the latest round of cheapening in the space after Tuesday's Japanese holiday, allowing Tsys to richen in Asia.

- The RBNZ delivered the widely expected 25bp hike, although OIS priced a ~34% chance of a 50bp move, allowing the NZD to soften post-decision.

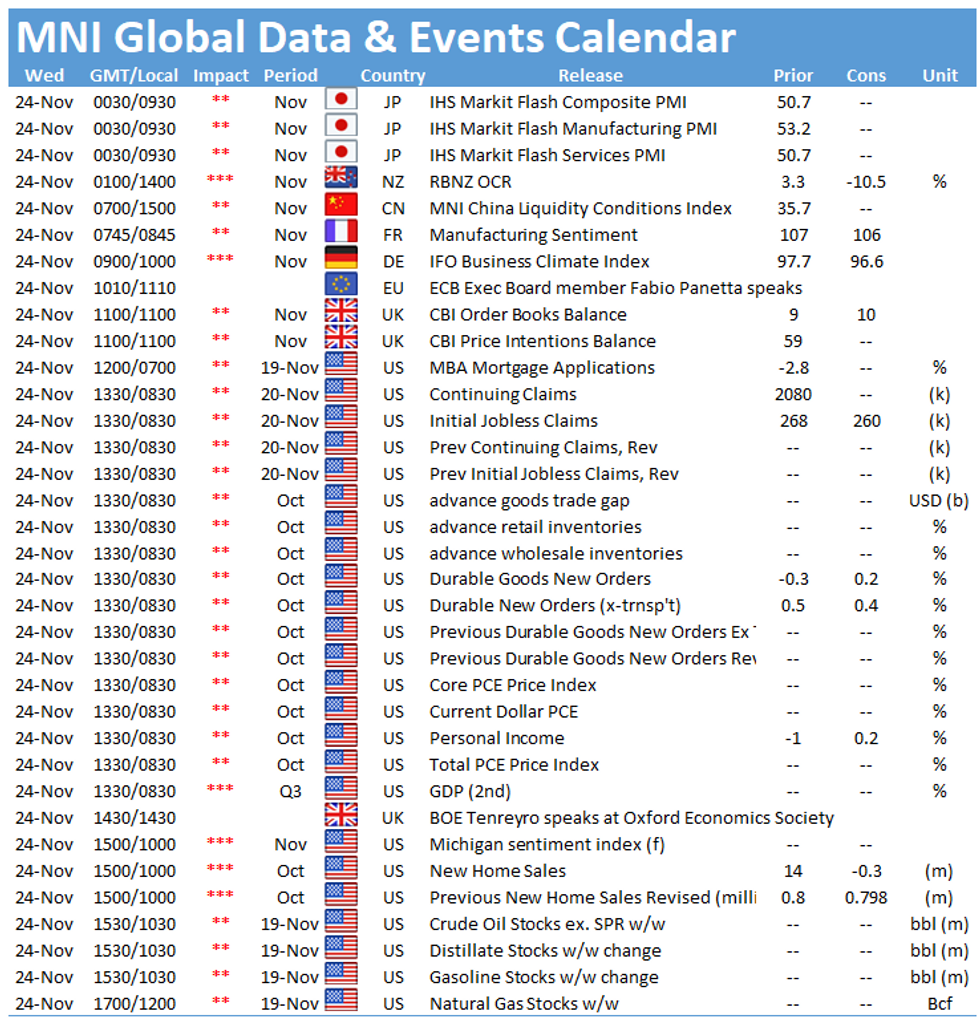

- ECB & BoE speak headline the European docket on Thursday, with a Thanksgiving-driven crimping of the U.S. week resulting in a data heavy session. The minutes from the FOMC's latest monetary policy decision will headline during NY hours ahead of the Thanksgiving break.

BOND SUMMARY: Desks Point To Japanese Demand For U.S. Tsys

TYZ1 moved higher in Asia, last +0-10 at 130-03, with the spill over from the latest RBNZ monetary policy decision supporting, while desks flagged demand out of Japan as participants reacted to the recent Tsy cheapening as Tokyo returned from Tuesday's holiday. Cash Tsys run 2.5-4.0bp richer across the curve as a result, with bull flattening in play. A 5K block sale of TYZ1 129.50 putts headlined on the flow side, while screen interest in upside EDZ4 exposure via 3EZ1 98.375/98.625 & 3EZ1 98.50/99.00 call spread buying was observed. Futures roll activity supported broader volume. NY hours will see the release of the minutes from the FOMC's most recent monetary policy decision, the PCE suite, weekly jobless claims data, the second GDP estimate for Q3, durable goods data and new home sales, as well as the final UoM sentiment reading for Nov.

- Tokyo morning trade initially saw a modest extension lower for JGB futures as local participants caught up to broader market developments as they returned from holiday, although the contract recovered from session lows as a bid crept into the U.S. Tsy space and domestic equity markets sold off. That left the contract -11 at the bell, while cash JGB trade sees the major benchmarks sit flat to 1bp cheaper across the curve. The offer/cover ratios from today's BoJ Rinban operations were as follows: 1- to 3-Year: 3.02x (prev. 3.02x), 3- to 5-Year: 1.67x (prev. 2.80x), 5- to 10-Year: 1.87x (prev. 1.84x). Local headline flow was light, outside of Japanese Finance Minister Yamagiwa pointing to a focus on all market pertinent matters when it comes to the recent movements in the JPY and confirmation that the country will be participating in the coordinated oil stockpile release from some of the major oil consuming nations.

- Aussie bonds looked through local data, with the bid in Tsys and post-RBNZ fallout in NZ bonds driving matters. The space richened even as the RBNZ delivered the widely 25bp expected OCR hike as markets had priced a ~34% chance of a 50bp hike ahead of the decision. That left YM +2.5 and XM +1.0 at the bell, more than reversing overnight/early Sydney losses, while the IR strip was flat to +7 through the reds.

FOREX: Kiwi Goes Offered After 25bp OCR Hike, Risk-Off Flows Kick In

The RBNZ raised the OCR by 25bp in a back-to-back move and forecast a more aggressive tightening campaign in a bid to tame surging inflation. Their move matched broader expectations, but the kiwi dollar went offered as some more hawkish participants had anticipated a 50bp hike (market pricing had been pointing to a ~33% chance of such a scenario), with the MPC not scheduled to meet again until February.

- NZD/USD faltered past the $0.6900 mark, printing worst levels since Oct 6. AUD/NZD crossed above its 50-DMA, narrowing in on key resistance from Nov 16 high.

- Broader risk-off sentiment rubbed some salt into the kiwi's wound, while sapping strength from other high-beta currencies.

- USD/JPY peeked above yesterday's high, printing levels not seen since 2017, before pulling back as the yen took the lead in G10 FX space. A downtick in U.S. e-mini futures lent support to JPY as Japanese markets reopened after a public holiday.

- German Ifo Survey takes focus in Europe, while the U.S. docket is headlined by the second reading of GDP as well as core PCE & weekly initial jobless claims.

- Comments are due from ECB's Schnabel & Panetta as well as BoE's Tenreyro, while the FOMC will publish the minutes from their most recent monetary policy meeting.

FOREX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1195-00(E1.3bln), $1.1225-35(E775mln), $1.1300(E999mln), $1.1330(E799mln), $1.1400(E1.8bln), $1.1500(E4.2bln)

- USD/JPY: Y113.50($1bln), Y113.67-70($647mln), Y113.95-15($2.2bln), Y114.40-50($554mln), Y115.00-10($1.5bln), Y115.50-60($1.4bln)

- AUD/USD: $0.7200-15(A$568mln), $0.7270-75(A$819mln)

ASIA FX: Asia FX Trade Mixed, Baht Sinks

The baht led losses in otherwise mixed trade, with participants on the lookout for fresh broader catalysts.

- CNH: Spot USD/CNH was trapped within the confines of yesterday's range, while the yuan fixing was only marginally softer than expected.

- KRW: Spot USD/KRW operated in close proximity to recent highs. Premier Kim warned that the Covid-19 situation in Seoul metropolitan area is "urgent" and asked officials to ramp up countermeasures, as South Korea's daily infections and critical cases spiked to record highs.

- IDR: The rupiah slipped against the dollar. Bank Indonesia Governor Warjiyo pledged a "pro-stability" monetary policy and a "pro-growth" macroprudential policy.

- MYR: Spot USD/MYR rallied to its highest point since Aug 25. Malaysia announced that Sarawak will hold a state election on Dec 18.

- PHP: The Philippine peso held firm. Pres Duterte urged officials to do what it takes to ensure that the Nov 29 - Dec 1 vaccination drive goes as planned.

- THB: The baht brought up the rear in Asia EM basket, with spot USD/THB punching through its 50-DMA. There was plenty of central bank rhetoric to digest, but little in the way of notable insight there, albeit MPC minutes highlighted that economic recovery remains fragile and uncertain. Some linked baht weakness the reassessment of outlook for the local tourism industry amid the re-tightening of Covid-19 restrictions in several locations around the globe.

US: Thanksgiving Holiday Exchange Schedules

A reminder that the U.S. will observe the Thanksgiving holiday on Thursday. This will impact trading hours in the latter part of the week. Trading schedules for the major U.S. exchanges can be found below.

EQUITIES: Mixed In Asia

The Nikkei 225 struggled on Wednesday as the IT sector weighed. This comes after the tech space underperformed on Wall St. on Tuesday, with the NASDAQ 100 slipping as Tsy yields moved higher (the S&P 500 & DJIA lodged marginal gains on the day). E-minis nudged lower during early Asia-Pac hours, shedding somewhere in the region of 0.3%. While there was a clear lack of notable headline flow during Asia-Pac hours, most pointed to the potential for a swifter Fed tapering timeline as an early drag on equities. The space then recovered as U.S. Tsys richened, with the contracts now flat to a touch higher on the day. Chinese & Hong Kong equities pushed higher in early afternoon trade.

GOLD: Holding Sub-$1,800/oz

A narrow Asia-Pac session sees spot gold trade little changed, dealing just above $1,790/oz. This comes after a move and close below $1,800/oz on Tuesday, as our weighted U.S. real yield monitor moved higher, although gold pulled back from intraday cheaps as the monitor moved back from best levels of the day. From a technical perspective, yesterday's break below the Nov 5 low exposes key support in the form of the Nov 3 low ($1,759.0/oz). The minutes from the latest FOMC monetary policy decision & U.S. PCE data provide the highlights ahead of the impending U.S. Thanksgiving holiday.

OIL: Modest Gains In Asia As Consumer Inventory Release Underwhelms

WTI & Brent futures sit ~$0.30 above their respective settlement levels at typing, with Tuesday's official confirmation of the coordinated stockpile release from some of the major oil consuming nations underwhelming the market. The benchmarks have built on Tuesday's gains, with the structure of the aforementioned releases (mostly short-term swap-tied/pre-announced) failing to inspire bears, while participation of parties to the deal, excluding the U.S., disappointed. A surprise headline crude build in the weekly API inventory estimates provided some brief downward pressure in post-settlement trade, before Asia-Pac hours saw a shallow boost for prices. DoE inventory data headlines on Wednesday, ahead of the U.S. Thanksgiving holiday. Broader focus falls on next week's OPEC+ gathering, with an eye on any response to the aforementioned move from the major oil consumers.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.