-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Headlines Observed Ahead Of Thanksgiving

EXECUTIVE SUMMARY

- FED DISCUSSED FASTER QE TAPER IN NOV MEETING MINUTES (MNI)

- ECB'S SCHNABEL: EURO ZONE NOT FACING "STAGFLATION" (RTRS)

- UK DIALS DOWN BREXIT THREAT WHILE PROGRESS IS MADE IN EU TALKS (BBG)

- BOK HIKES, SIGNALS MORE TO COME, AVOIDS TIMETABLE (BBG)

- OPEC PANEL FORECASTS SPR MAY MASSIVELY SWELL OIL SURPLUS (BBG)

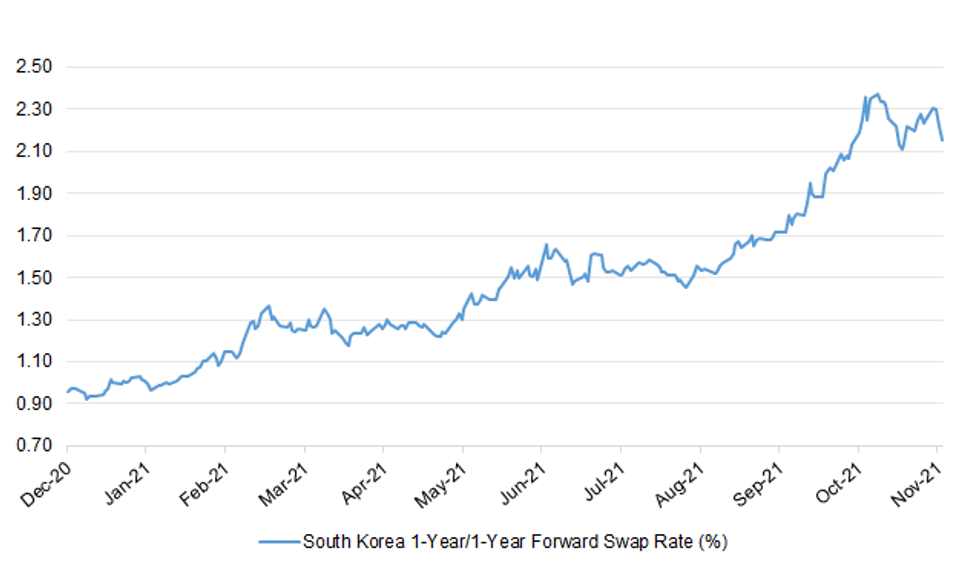

Fig. 1: South Korea 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: British Prime Minister Boris Johnson told his Irish counterpart Micheal Martin on Wednesday that significant gaps remain between Britain and the European Union on trading arrangements for Northern Ireland. (RTRS)

BREXIT: There is still "quite a big gap" between the EU and the UK in the dispute over Northern Ireland's post-Brexit trade rules, Minister for Foreign Affairs Simon Coveney has said. The Minister told the Seanad Brexit committee that there was "a lot at stake over the next few weeks" given the potential "carryover" for the EU-UK trade deal to be affected if the London government decides to suspend parts of the Northern Ireland protocol over the row. The EU has warned that the protocol and trade agreement were "inextricably linked" and that it would respond "very robustly" to the suspension of parts of the protocol under Article 16. Brussels would regard this "as a fairly serious breach of good faith," said Mr Coveney. "That is the last place any of us want to be, particularly in Ireland or in the UK," he said. (Irish Times)

BREXIT: The U.K. will continue negotiating with the European Union over Northern Ireland because it considers progress is being made, the latest sign that a further breakdown in post-Brexit relations with the bloc is not imminent. Britain will hold off suspending parts of the Brexit divorce deal relating to Northern Ireland for as long as talks with the EU remain constructive, according to two people familiar with the matter. Though Boris Johnson's government still considers that trade disruption in the region justifies suspending the accord, it still prefers a negotiated settlement, the people said. (BBG)

POLITICS: Rishi Sunak is increasingly frustrated with Boris Johnson's "chaotic" No 10 operation, his allies said last night. The chancellor believes that there needs to be greater professionalism after a succession of damaging Tory rebellions and government reversals. The fallout landed on the Treasury this week as Liam Booth-Smith, Sunak's chief of staff, was accused of briefing that there was "a lot of concern in the building about the PM". The claim has been denied by the Treasury but allies believe that Sunak will need to protect Booth-Smith because senior figures in Downing Street are "gunning for him". They highlighted the fact that Sajid Javid quit as chancellor after No 10 attempted to remove his advisers. (The Times)

EUROPE

ECB: The euro zone is not at risk of stagflation, or a period of high inflation coupled with stagnating economic growth, European Central Bank board member Isabel Schnabel said on Wednesday. "I personally don't see that we are in a stagflationary situation or that we are approaching a stagflationary situation," Schnabel told a lecture. "We do see relatively high inflation but we do not see stagnation," Schnabel said. "Actually, most economies are growing quite strongly, much faster than what we call potential growth." (RTRS)

ECB: Central Bank governor Gabriel Makhlouf said on Wednesday he was "worried today" about the impact rising prices are having on Irish households, but patience was the "right response" to inflationary pressures as the economy emerges from the pandemic crisis. "I am very, very conscious that inflation today is impacting on households across the country," Mr Makhlouf said. However, the governor told an Oireachtas committee that it was "not so much a question of time" before policymakers take action such as increasing interest rates, but more a case of being vigilant in case temporary supply "blockages" – which cause inflation and have in turn been caused by surges in consumer demand – show no signs of being repaired. (Irish Times)

ECB: MNI INTERVIEW: ECB Needs Limited, Flexible PEPP Successor - Kazaks

- The successor to the European Central Bank's Pandemic Emergency Purchase Programme should be limited in size and duration but used flexibly, Bank of Latvia Governor Martins Kazaks told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The World Health Organization is urging the public to practice Covid mitigation tactics – including masking and distancing – regardless of vaccination status as cases surge across Europe heading into the holiday season. Some countries and communities have been lured into a "false sense of security" that the pandemic's over and the vaccinated are fully protected against Covid, WHO Director-General Dr. Tedros Adhanom Ghebreyesus told reporters during an update Wednesday in Geneva. (CNBC)

GERMANY: Germany passed the threshold of 100,000 Covid-19 deaths, with the latest wave of the pandemic still pushing new infections higher and hospitals in some hotspots under severe pressure. Since the pandemic took hold at the beginning of last year, 100,119 people have died from the virus, according to the latest data from the RKI public-health institute. RKI also reported a record 75,961 new Covid-19 cases. Germany's death toll is still lower than in the U.K., France or Italy, which each passed 100,000 some time ago. The U.S. has recorded the most fatalities with more than 770,000, following by Brazil with over 610,000, according to the Bloomberg Covid-19 Tracker. Earlier, Olaf Scholz, who will succeed Angela Merkel as chancellor, said his coalition government would consider vaccine mandates for people who work with vulnerable groups. Merkel asked members of the new coalition to impose a two-week lockdown but officials refused, according to a report by Bild newspaper. (BBG)

GERMANY: Olaf Scholz's Social Democrats won the right to nominate the successor to Bundesbank President Jens Weidmann as part of their coalition accord with the Greens and Free Democrats, according to people familiar with the deal. (BBG)

ITALY: Prime Minister Mario Draghi's government has approved new curbs targeting mainly unvaccinated people in a bid to shield Italy from a surge of coronavirus cases elsewhere in Europe. Only those with proof of inoculation, a certificate known as the "super green pass," will be permitted to access venues such as restaurants, cinemas and theaters. The unvaccinated will still be allowed to enter their workplace after testing negative for the virus. The rules which were approved during a cabinet meeting on Wednesday will apply starting from Dec. 6, according to a government statement. "I hope we will have a good Christmas, it will be for those that are vaccinated, and I hope next year will be normal for all," Draghi said during a press conference in Rome. (BBG)

SWEDEN: Even by the messy standards of Swedish politics over recent months, Wednesday was a turbulent day in the Stockholm parliament. After just seven hours as Sweden's first female prime minister, Magdalena Andersson resigned on Wednesday evening after her budget failed to win enough lawmaker support to be passed, with parliament instead backing a spending plan penned by her adversaries — the center-right Moderate Party and Christian Democrat Party and the far-right Sweden Democrats. The Greens, the junior party in Andersson's Social Democratic Party-led coalition, then quit the government, saying the opposition budget did not contain enough of their policies. (POLITICO)

U.S.

FED: MNI: Fed Discussed Faster QE Taper in Nov Meeting Minutes

- The Federal Reserve debated speeding up tapering asset purchases at its November meeting as policymakers considered how soon they may need to raise interest rates to combat rising inflation, minutes from the meeting showed. "Some participants preferred a somewhat faster pace of reductions that would result in an earlier conclusion to net purchases," the report said. "Some participants suggested that reducing the pace of net asset purchases by more than $15 billion each month could be warranted so that the Committee would be in a better position to make adjustments to the target range for the federal funds rate, particularly in light of inflation pressures." Since then, several Fed officials have come out in favor of a faster taper - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in October was 2.6 percent. According to the BEA, the overall PCE inflation rate was 5.0 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.1 percent on a 12-month basis. (Dallas Fed)

CORONAVIRUS: Michigan lawmakers wrote President Joe Biden to "urgently request" help in combating a Covid-19 outbreak that's overwhelming the state's health system. (BBG)

OTHER

U.S./CHINA: The Biden administration added a dozen Chinese companies to its trade blacklist on Wednesday citing national security as well as foreign policy concerns. Eight technology entities based in China were added to the list for their alleged role in assisting the Chinese military's quantum computing efforts and acquiring or attempting "to acquire U.S. origin-items in support of military applications." (CNBC)

UK/CHINA: The UK is to overhaul its development investment arm in a move designed to counterbalance China's influence in emerging countries by offering "alternatives" to taking on "strings-attached debt". Liz Truss, UK foreign secretary, will launch British International Investment (BII) on Thursday, a body that will leverage private capital to invest in countries across Asia, Africa and the Caribbean, offering an alternative to Chinese loans, which are seen by some in the west as a tool to spread Beijing's influence. The BII is a revamped version of the government's Commonwealth Development Corporation Group, which has been historically criticised for investing in purely commercial projects, such as hotels and shopping centres, and for concentrating on more advanced economies. (FT)

GEOPOLITICS: A visiting U.S. delegation made clear to both leading presidential candidates in Honduras' Nov. 28 election that Washington wants the country to maintain its long-standing relations with Taiwan, a senior State Department official said on Wednesday. The official, speaking on condition of anonymity, also said Washington has warned Honduras and other Central American nations of the risks to them of China's approach to the region. (RTRS)

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr speaks in interview with Radio New Zealand Thursday, after raising the official cash rate by a quarter percentage point to 0.75% on Wednesday. Reiterates plan to raise cash rate to about 2.5% in "slow, steady steps," with ability to assess along the way "if we're still on the right path and if we're going fast enough." Says economy is growing above its potential rate. Has no regrets about loosening monetary policy during the pandemic. "I have no regrets at all. We have done what has been necessary," but now it's time to reduce stimulus. Inflation expectations remain anchored Will carefully manage down bond holdings acquired in quantitative easing program. (BBG)

NEW ZEALAND: Judith Collins, leader of New Zealand's opposition National party, has been toppled after months of poor polling and a shock move to strip a political rival of his portfolios. MPs voted to end Collins' leadership at a crisis caucus meeting on Thursday. The meeting was prompted after Collins demoted Simon Bridges, a former party leader and one of her rivals. Late on Wednesday night, she stripped Bridges of all of his portfolios, citing an inappropriate comment made by Bridges in 2017 in front of a female colleague– where Bridges says he discussed "old wives tales" about how he and his wife might produce a female child. Collins described the comment as "serious misconduct". (Guardian)

BOK: Bank of Korea Governor Lee Ju-yeol said interest rates are still accommodative after two hikes since August, suggesting further tightening is in the pipeline as inflation risks mount in the recovering economy. The board considered the price pressures building in the economy and financial imbalances when it decided to raise rates by 25 basis points to 1% on Thursday, Lee said at a press briefing. The central bank revised up its inflation outlook to 2.3% for this year and 2% for 2022, expecting price gains will exceed, or at least hover around, its target through next year. "With this hike, the policy rate is still below the neutral level, the real rate is still negative, and there's plenty of liquidity," Lee said. "It's natural that we normalize the rate, which has been excessively low, as the economy recovers."

CANADA: Canadian Prime Minister Justin Trudeau said on Wednesday he is "extremely concerned" by increases in the cost of living caused by high inflation, adding that Liberal government policies should help address the issue. (RTRS)

CANADA: MNI: Freeland Says Austerity Fiscal Update Won't Fix Inflation

- Canadian Finance Minister Chrystia Freeland said Wednesday she will present a fiscal update soon and called inflation a global phenomenon that can't be fixed by a further shift to austerity, after presenting legislation to wind up major Covid-19 relief checks by May. "The inflationary environment we are seeing in Canada today is very much being experienced around the world," Freeland said in response to a question from MNI about potentially scaling back future fiscal stimulus. "Those are not made-in-Canada factors, and so it follows logically that looking for a made-in-Canada answer when those are the drivers is to be looking for the wrong tools" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOC: Canada Finance Minister Chrystia Freeland says she has "many views" about the Bank of Canada's inflation-targeting regime--such as whether it should stick tightly to aiming for 2% CPI or whether it should take into account other factors, such as full employment, when setting interest rates. She, however, declined to elaborate at a press conference when asked about renewing the inflation mandate, which is supposed to happen by the end of this year, or in just over five weeks. It is "an important economic moment," she says. At the press conference, Freeland revealed she spoke earlier today with ECB President Christine Lagarde about inflation trends. Canada's annual inflation rate is at its highest level in about 18 years. (Dow Jones)

TURKEY: Turkish state-owned banks sold U.S. dollars amid heightened demand for foreign exchange on Wednesday, people familiar with the matter said. The sales come a day after the lira's historic plunge and mark a rare appearance by state banks in the market. The lira rallied sharply on the day, surging as much as 10%. Turkey's policy of foreign-exchange sales came to an end last year amid dwindling foreign reserves. The amount sold by lenders was less than it used to be, said the people, who asked not to be identified. State banks don't comment on interventions in the foreign-exchange market. In January last year, then central-bank governor Murat Uysal said government- owned lenders have been carrying out transactions in line with regulatory limits and may continue to be active in the currency market. (BBG)

TURKEY: Central bank Governor Sahap Kavcioglu and banking regulator head Mehmet Ali Akben will meet chief executives of some commercial lenders on Thursday, following days of volatility in the lira, Dunya newspaper reports, without saying how it obtained the information. (BBG)

MEXICO: Victoria Rodriguez, the deputy finance minister for spending tapped by President Andres Manuel Lopez Obrador to lead the central bank, said she's committed to complying with Banxico's autonomy. Rodriguez spoke in a video posted on Twitter by Finance Minister Rogelio Ramirez de la O. Rodriguez said she's committed to combating inflation and to not touch international reserves. Ramirez de la O said Rodriguez is an honest, competent official respected by the ministry. (BBG)

BRAZIL: Ex-judge Sergio Moro is consolidating his position as an alternative to the right-left polarization that's so far expected to grip Brazil's presidential election next year -- if he can make it to the runoff. The man who became famous for jailing Brazil's political and business elite during the so-called Carwash graft probe saw his poll numbers rise substantially in the first major survey of voting intention published after he joined a political party and informally threw his hat into the ring. (BBG)

BRAZIL: Brazil's health regulator recommends the federal government to require a Covid-19 vaccination certificate from travelers crossing the country's land borders, a measure that antagonizes the president's desire to lift all restrictions, Folha de S.Paulo newspaper reports, citing authorities. (BBG)

BRAZIL: Brazilian lawmaker Marcelo Aro, the rapporteur of the bill that creates the so-called Auxilio Brasil social program, decided to no longer link the program to the CPI index in order to gain support for his text, he told Bloomberg. Government was against the CPI indexation, according to Aro. Lower House speaker Arthur Lira said he will vote on social aid bill in a session scheduled for Thursday at 9am. (BBG)

IRAN: Time is running out for the U.N. atomic watchdog to gain access to re-install cameras at a centrifuge-parts workshop in Iran, as the agency will soon be unable to guarantee equipment is not being diverted to make atom bombs, its chief said on Wednesday. (RTRS)

IRAN: Iran's foreign minister Hossein Amirabdollahian said on Wednesday he had reached an agreement on continuing cooperation with the International Atomic Energy Agency chief Rafael Grossi, and a meeting will be held soon to finalise the text. (RTRS)

IRAN: Israeli officials are urging the White House not to strike a partial nuclear deal with Iran, warning it would be a gift to the new hard-line government in Tehran and stoking a growing public rift with the Biden administration over Iran's nuclear program. Senior Israeli officials say they fear that Washington is setting the stage for a "less-for-less" deal that would offer Tehran partial sanctions relief in exchange for freezing or winding back parts of their nuclear work. The tension comes as nuclear talks are set to resume on Monday, with expectations low that the 2015 nuclear deal—which the Trump administration withdrew from—can be fully revived. (WSJ)

EQUITIES: China fully supports companies that choose Hong Kong as a primary listing venue, says Shen Bing, director-general of the Department of International Affairs at the China Securities Regulatory Commission, at a forum hosted by the Securities and Futures Commission in Hong Kong. The unique advantages of H.K. as a financial center remain; we are "very certain" that H.K. will play a strong role. H.K. has a special role for international circulation, helping Chinese firms to locate resources globally, and the international community to look at investments in Chinese assets. China doesn't think delisting from the U.S. is a good thing for the companies, for global investors or for the China-U.S. relationship. CSRC is working hard to resolve the audit oversight impasse with our U.S. counterpart, communication is smooth and open. (BBG)

OIL: OPEC expects that oil stockpiles released by consuming nations could massively swell the surplus in global markets. The projections from OPEC's advisory body -- the Economic Commission Board -- come a week before the group and its allies meet to decide whether to increase production. Some delegates from the Organization of Petroleum Exporting Countries and its partners have indicated they could cancel an output hike scheduled for January if inventories deployed by the U.S. and others overwhelm the market. The ECB's projections would bolster the case of countries lobbying for such a pause. The excess in world markets would expand by 1.1 million barrels a day in January and February to 2.3 million and 3.7 million a day, respectively, if 66 million barrels are injected over the two-month period, according to a document obtained by Bloomberg. (BBG)

OIL: China, the world's largest crude importer, was non-committal about its intentions to release oil from its reserves as requested by the United States, while OPEC producers were not considering changing tactics in light of the U.S. action, according to three sources in the group. (RTRS)

OIL: Kuwait said it's fully committed with the OPEC+ agreement and will participate in the upcoming OPEC+ alliance ministerial virtual meeting that is scheduled early December, state-run KUNA reported, citing a statement issued by the oil ministry. Kuwait supports the teamwork within the frame of the OPEC+ agreement. (BBG)

OIL: A wide-reaching Canadian regulatory decision on the contracting of Enbridge's Mainline pipeline network into the US is coming on Nov. 26, potentially upending the crude oil and NGL transportation system for the first time in 70 years. (Platts)

CHINA

PBOC: The People's Bank of China is likely to boost liquidity through the end of the year by more reverse repurchases and increased medium-term lending facilities, the Economic Information Daily said citing analyst Wang Qing of Golden Credit Rating, who commented following the central bank's CNY50 billion net injection on Wednesday. The PBOC may also cut lenders' reserve requirement ratios by the end of the year should it want to release dovish pro-growth signals, further promote the rebound of credit and social financing and reduce the economy's costs of financing, said the newspaper owned by Xinhua News Agency. (MNI)

FISCAL: China should accelerate the issuance of this year's remaining local government special bonds and set up the issuance quota and distribution plan for next year appropriately, according to a Xinhua News Agency's statement following a Wednesday meeting chaired by Premier Li Keqiang. Local governments should promote the construction of well planned projects and strive to have the projects materialized early next year, the meeting said. The central government prohibits the misuse of funds on building renewals and leaving the funds unused, the meeting said. (MNI)

FISCAL: The Chinese economy is expected to have a stable start next year with fiscal policies playing a bigger role, China Securities Journal reported, citing analysts. Policies have already been tuned to meet demand for stable economic growth following recent downward pressure on the economy, paper reported, citing Lian Ping, economist with Zhixin Investment. Fixed-asset investment is expected to remain generally stable next year, consumption growth to recover towards the end of 2022, while exports are likely to remain relatively high growth rate, it reported, citing Zhu Jianfang, economist with Citic Securities. While land sale proceeds might fall, local governments should issue more special bonds to help fund investment projects, Zhu said, adding fiscal policy may play a bigger role compared with monetary policy next year. (BBG)

ECONOMY: China may set a GDP growth target next year at 5.5%, a rate that was achieved in Q2 and the highlight of 2021, with 5% being the floor, Ming Ming, the deputy director at Citic Securities research institute, wrote in the 21st Century Business Herald. Investment will be a key measure next year as the government pursues loose credit, stabilizing leverage and stabilizing growth, with the pace of growth in infrastructure and manufacturing investment likely to accelerate and prioritized, Ming said. While 5% is likely the pace registered this year, the top leadership has expressed a more pro-growth wish, so policy makers likely want to arrest the current downward slide, said Ming. China's exports may slow next year while consumption has limited room to expand, said Ming. (MNI)

EVERGRANDE: A flurry of large trades in China Evergrande Group Thursday suggested a large institutional holder agreed to a 20% discount to offload the stock. Seven block trades -- totaling 300 million shares -- crossed before the open of regular cash trading in Hong Kong. The orders were all priced at HK$2.23 apiece, indicating they were part of the same block agreement. That compares with Wednesday's closing price of HK$2.78. (BBG)

PROPERTY: The government of Chengdu, capital of southwestern province of Sichuan, has rolled out a series of measures to support local developers, according to a statement by the local housing authority. Chengdu will expand credit support for developers and homebuyers and ease restrictions on developers' use of proceeds from pre-sales. Chengdu becomes the first major Chinese city to take such moves. The authority will work with financial institutions to increase credit quota for developers and accelerate loan approval. Government will also accelerate approval of application by developers to start sales. (BBG)

INSURERS: China's regulator asks insurance companies to rectify problems found in a comprehensive risk check in 1H, Shanghai Securities News reports, without citing anyone. The rectifications include avoiding illegal use of funds-related transactions, consolidating asset quality and mitigating risks. (BBG)

CREDIT: Chinese developer Kaisa Group Holdings Ltd. began an exchange offer for at least $380 million of bonds to avert a default during the nation's real estate cash crunch. The builder has offered to exchange at least 95% of its $400 million 6.5% note maturing Dec. 7 for new notes with the same coupon maturing June 2023. If the offer to bondholders fails, the developer may not be able to repay bonds and could consider a debt restructuring, it said in a stock exchange filing on Thursday. Kaisa is the latest real estate firm trying to shore up its finances as a debt crisis originally centered on China Evergrande Group engulfs the industry. The liquidity crunch follows a government campaign to reduce leverage in the sector, and has been made worse by a slump in home sales and prices. (BBG)

ENERGY: China's coal stockpile at power plants at end-Nov. is expected to be more than 152m tons at same time of last year and hit historic high, National Development and Reform Commission says in a statement on official Wechat account. Coal supply for power generation and heating can be well guaranteed in winter and spring. Coal stockpile at power plants was 147m tons as of Nov. 23. (BBG)

EQUITIES: Online brokerage Futu Holdings, known as "China's Robinhood," attempted to reassure anxious clients on Wednesday that it would not close accounts and will focus on expanding its presence in Hong Kong and Singapore after Beijing increased pressure on the industry, sending its shares tumbling. (Nikkei)

CORONAVIRUS: China reported only two new domestic symptomatic infections on Thursday, both from a town near the border with Myanmar, effectively marking the end of the broadest resurgence the country has to deal with since the initial outbreak in Wuhan nearly two years ago. No new cases were found in the northeastern port of Dalian, the last hotspot in an outbreak that started among elderly tourists in the northwest in mid-October and that spread to more than two thirds of the mainland China's 31 provinces. (BBG)

OVERNIGHT DATA

JAPAN OCT PPI SERVICES +1.0% Y/Y; MEDIAN +0.9%; SEP +0.9%

JAPAN SEP, F LEADING INDEX 100.9; FLASH 99.7

JAPAN SEP, F COINCIDENT INDEX 88.7; FLASH 87.5

JAPAN OCT NATIONWIDE DEPT STORE SALES +2.9% Y/Y; SEP -4.3%

JAPAN OCT TOKYO DEPT STORE SALES +4.9% Y/Y; SEP +0.7%

JAPAN OCT, F MACHINE TOOL ORDERS +81.5% Y/Y; FLASH +81.5%

AUSTRALIA Q3 PRIVATE CAPITAL EXPENDITURE -2.2% Q/Q; MEDIAN -2.0%; Q2 +3.4%

NEW ZEALAND OCT TRADE BALANCE -NZ$1.286BN; SEP -NZ$2.206BN

NEW ZEALAND OCT TRADE BALANCE 12 MTH YTD -NZ$4.920BN; SEP -NZ$4.105BN

NEW ZEALAND OCT EXPORTS NZ$5.35BN; SEP NZ$4.36BN

NEW ZEALAND OCT IMPORTS NZ$6.64BN; SEP NZ$6.57BN

CHINA MARKETS

PBOC NET INJECTS CNY50BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Thursday. The operation has led to a net injection of CNY50 billion after offsetting the maturity of CNY50billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.3216% at 09:30 am local time from the close of 2.2374% on Monday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday vs 40 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3980 THURS VS 6.3903

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3980 on Thursday, compared with 6.3903 set on Wednesday.

MARKETS

SNAPSHOT: Familiar Headlines Observed Ahead Of Thanksgiving

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 226.83 points at 29529.49

- ASX 200 up 7.861 points at 7407.3

- Shanghai Comp. down 0.38 points at 3592.248

- JGB 10-Yr future down 2 ticks at 151.56, yield up 0.2bp at 0.085%

- Aussie 10-Yr future down 1.0 tick at 98.115, yield up 1.0bp at 1.870%

- U.S. 10-Yr future -0-01 at 129-25+, cash Tsys are closed

- WTI crude unch. at $78.39, Gold up $4.17 at $1792.78

- USD/JPY down 5 pips at Y115.38

- FED DISCUSSED FASTER QE TAPER IN NOV MEETING MINUTES (MNI)

- ECB'S SCHNABEL: EURO ZONE NOT FACING "STAGFLATION" (RTRS)

- UK DIALS DOWN BREXIT THREAT WHILE PROGRESS IS MADE IN EU TALKS (BBG)

- BOK HIKES, SIGNALS MORE TO COME, AVOIDS TIMETABLE (BBG)

- OPEC PANEL FORECASTS SPR MAY MASSIVELY SWELL OIL SURPLUS (BBG)

BOND SUMMARY: Tight Asia Session For Core FI

The lack of macro headline flow and the Thanksgiving holiday-hampered nature of the session (when it comes to both liquidity and a shortened trading day for futures/closure for cash Tsys) has resulted in a narrow round of trade for TYZ1 thus far. The contract last deals -0-01 at 129-25+, operating within the confines of a 0-03+ range.

- JGB futures trade 3 ticks below settlement levels, in a limited Tokyo session. Yields out to 20s are ultimately within 0.5bp of yesterday's closing levels, mostly biased lower on the day, with 30s and 40s richening by ~1.0-1.5bp as the market shrugged off the apparent relatively tame issuance requirements surrounding the fiscal support package if press reports are to be believed. Mixed demand metrics were observed in the latest 40-Year JGB auction, which produced a high yield that was below wider expectations. Elsewhere, the cover ratio was a little softer vs. what was seen at the previous 40-Year auction, printing at the lowest level witnessed at a 40-Year auction since Aug '15. Still, 40s outperformed on the curve on the aforementioned issuance expectations.

- Aussie bond futures experienced a lacklustre session with YM -4.5 and XM -1.0 at the bell, looking through local data releases (a marginally softer than exp. private capex print for Q3, accompanied with negative revisions for Q2 and an uptick in 21/22 capex exp., as well as another uptick in ABS payrolls). The cash curve bear flattened after the U.S. Tsy-linked bid (from Wednesday trade) in the long end faded as we moved through the day. Swap spreads & EFPs tightened again after yesterday's aggressive narrowing from extremes. The initial tightening of spreads was seemingly facilitated by a combination of spill over from post-RBNZ rate market dynamics across the Tasman and a slight moderation in the usage of the RBA's SLF, with the latter pointing to slightly less worry re: collateral shortage in the ACGB space.

JGBS AUCTION: Japanese MOF sells Y599.4bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y599.4bn 40-Year JGBs:

- High Yield: 0.725% (prev. 0.770%)

- Low Price 99.15 (prev. 97.62)

- % Allotted At High Yield: 91.4874% (prev. 40.9523%)

- Bid/Cover: 2.367x (prev. 2.525x)

EQUITIES: E-Minis Nudge Higher, Asia Mixed

There was a lack of notable movement in the major regional equity indices during Thursday's Asia-Pac session, with some modest outperformance for the Nikkei 225 as it regained some of yesterday's losses. U.S. e-mini futures added 0.2-0.3% overnight, which came in the wake of the major Wall St. indices finishing flat to a touch higher on Wednesday. There was distinct lack of notable macro headline flow, with the U.S. Thanksgiving holiday set to crimp broader liquidity into the weekend. The only real point of note came via a 300mn block sale of shares in embattled property developer China Evergrande, which crossed before the Hong Kong open and was conducted at a 20% discount to yesterday's closing price, pointing to an institutional investor dumping their holdings.

OIL: Crude Flat In Asia

WTI & Brent crude futures sit at virtually unchanged levels after essentially finishing flat on Wednesday.

- The European COVID situation continues to cloud the demand side, while the question of what will OPEC+ do to counter the recently outlined coordinated stockpile release from some of the major oil consuming nations? lingers on the supply side.

- On the latter, some source reports have suggested that the OPEC+ group will choose not to implement the previously outlined 400K bpd uptick in production when it convenes next week. However, it would seem not all of the participating nations are onboard with such a move, with separate source reports pointing to no plan to deviate from the previously prescribed plan re: upping production. We also saw OPEC's advisory body (the Economic Commission Board) suggest that the aforementioned and well-documented stockpile release from the major consuming nations could result in a notable swelling of surplus in global oil markets.

- Elsewhere, the latest weekly DoE inventory dataset, released Wednesday, revealed a "surprise" headline crude build, akin to what was seen in the API estimate the evening before.

GOLD: Holding Below $1,800/oz

Gold has stuck to a narrow range in Asia, with spot last dealing little changed, just above $1,790/oz. Wednesday saw an incremental breach of Tuesday's low, but gold never threatened to test key support in the form of the Nov 3 low ($1,759.0/oz), with our weighted U.S. real yield monitor pulling back from best levels of the day (as the cash Tsy curve twist flattened), allowing bullion to recover from worst levels, while consolidating below the $1,800/oz marker. A quick reminder that broader markets will be thinned out for the remainder of the week, owing to the Thanksgiving holiday in the U.S.

FOREX: USD Falters On Thanksgiving Day, NZD Remains Under Pressure

The DXY moved away from a 16-month high as the greenback underperformed at the margin during a fairly slow Asia-Pac session. Participants assessed familiar themes, with activity limited the Thanksgiving holiday in the U.S.

- The initial bid in NZD evaporated later in the session. The kiwi had a firmer start and extended recovery from yesterday's lows, but these gains proved short-lived. The kiwi lags the G10 pack alongside the USD as we type.

- AUD/NZD extended gains after charting a double bottom pattern, consolidating above its 100-DMA. The aforementioned bullish structure was completed on Wednesday, when the pair closed above its 100-DMA for the first time since mid-Oct.

- The Riksbank will deliver their monetary policy decision today, while their colleagues from the ECB will publish the minutes of their most recent policy meeting. Speeches are due from a raft of ECB & BoE members. The final reading of German GDP headlines the data docket.

FOREX OPTIONS: Expiries for Nov25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1350(E545mln)

- USD/JPY: Y114.15-25($1.0bln), Y114.95-00($1.0bln), Y115.50($745mln)

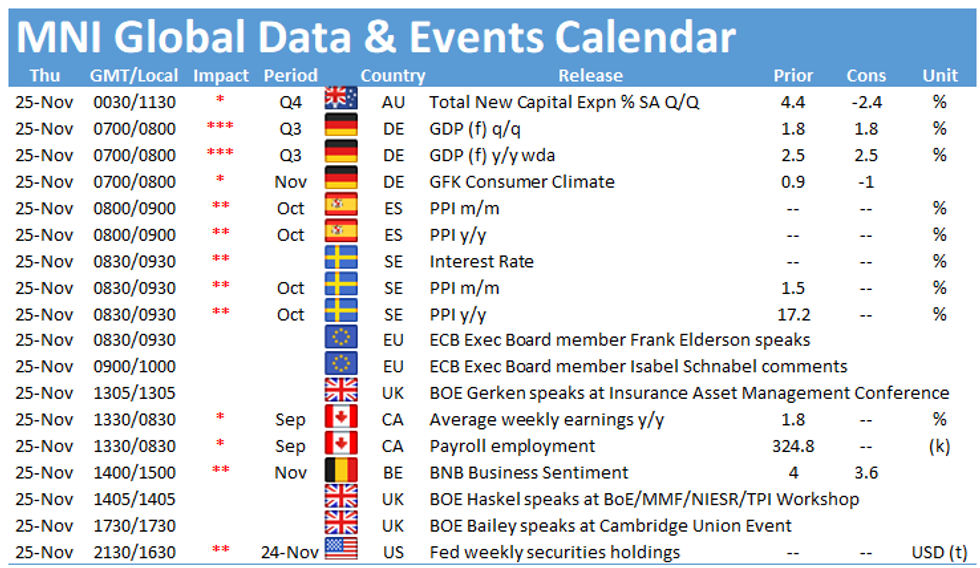

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.