-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Assets Hit By New COVID Strain

- The discovery of a new, aggressive COVID strain in Africa pressured risk assets overnight,

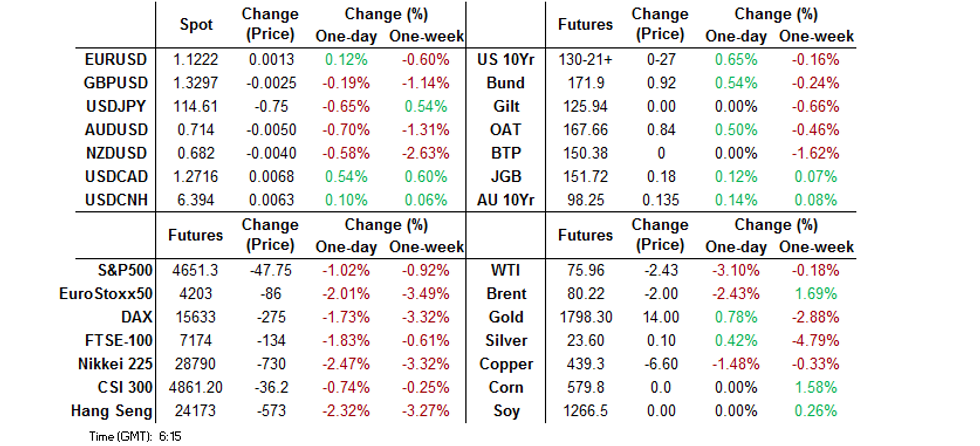

- This left JPY atop the G10 FX performance table, with the belly of the U.S. Tsy curve leading the bid, while S&P 500 e-minis hover just above initial support.

- Broader reaction to the new COVID strain will be eyed, while U.S. market hours will be curtailed in the wake of yesterday's Thanksgiving holiday (this will also thin out broader liquidity).

BOND SUMMARY: Core FI Bid On New COVID Variant

Core FI markets have been underpinned by the broader risk-off dynamic in the wake of the discovery of a new, aggressive COVID variant in Africa, with TYZ1 sitting at fresh session highs at typing, +0-24+ at 130-19. Cash Tsy trade sees outperformance in the belly, with 5s richening by ~9.0bp. This comes as some of the recent hawkish Fed repricing gets wound out of markets on the COVID news, as Eurodollar futures trade as much as 13.0 ticks higher on the day, with the reds outperforming. This dynamic has allowed the 2-/5-/10-Year butterfly to move back from recent highs (a reminder that the belly is the most susceptible part of the curve when it comes to Fed repricing and speculation surrounding tapering matters), while the 5-/30-Year spread has ticked away from the YtD, post-COVID vol. flats registered on Wednesday. A reminder that U.S. exchanges will observe altered trading hours on Friday, with early closures surrounding the Thanksgiving holiday weekend.

- JGB futures +16, while cash JGBs have richened by 0.5-2.0bp, with 7s (pointing to a futures-driven bid) and 40s (perhaps on a continued wind back in worry re: issuance requirements to finance the impending fiscal stimulus package) outperforming on the curve. On the issuance front, Uruguay will conduct a 3-/5-/7-/10-/15-Year multi-tranche round of JPY issuance, which is set to price on Thursday 2 Dec, while a multi-tranche round of corporate issuance from Rakuten priced this morning. There hasn't been much attention afforded to news reports pointing to PM Kishida pushing for a 3% rise in corporate wages across Japan, given the broader risk-off dynamic. Participants still await formal details re: the issuance program surrounding the impending fiscal stimulus package, which should cross at some point today.

- Aussie bond futures shunted higher at the close, registering fresh session highs, potentially pointing to a closing of shorts to limit risk over the weekend. YM finished +11.5, with XM +13.5. There was no reaction in the space to the much firmer than expected domestic retail sales data, with focus squarely on the broader risk-off dynamic. Pricing at the latest round of ACGB Nov-25 supply was firm, with the weighted average yield printing 0.88bp through prevailing mids (per Yieldbroker), although the cover ratio slid below 2.50x. Note that the uptick in issuance size muddies the direct comparability of the latter a little, but looking back at the previous auction results, the 12 Nov auction of the line drew nearly A$3.0bn more in bids, it would seem that the recent issuance dynamic may have limited bidding amounts. AOFM issuance remains brisk next week (vs. recent norms), with a A$300mn dip in ACGB supply vs. this week's levels, while Note issuance remains at A$5bn.

FOREX: "Variant Of Serious Concern" Inspires Flight To Safety

The discovery of a heavily mutated variant of Covid-19 in South Africa inspired a rush into safe haven currencies. Scientists are still working to shed some light on the likely consequences, but there is concern that the new variant could dodge immunity and a leading South African researcher called it "clearly very different" from previous strains.

- The JPY caught a bid and comfortably outperformed its G10 peers, closely followed by its safe haven peer CHF. USD/JPY retreated below the Y115.00 figure, while the Japanese government assured that no cases of the new variant have been found in Japan.

- High-beta currencies went offered as Covid jitters resurfaced. AUD/USD plunged through support from Sep 29 low of $0.7170 and printed its worst levels in three months, as the AUD lagged all of its G10 peers. Across the Tasman, the NZD faltered for the sixth day in a row.

- EM FX space drew attention in light of idiosyncratic developments. USD/ZAR surged to its highest point in a year, as the spread of the new variant inspired speculation that South Africa could be hit by another deadly wave of infections.

- Separately, USD/MXN extended gains and showed at a one-year low, after Pres Obrador tapped a little-known Finance Ministry official with no experience in monetary policy to be the next Banxico chief.

- Thursday's Thanksgiving holiday may have limited liquidity across the broader FX space.

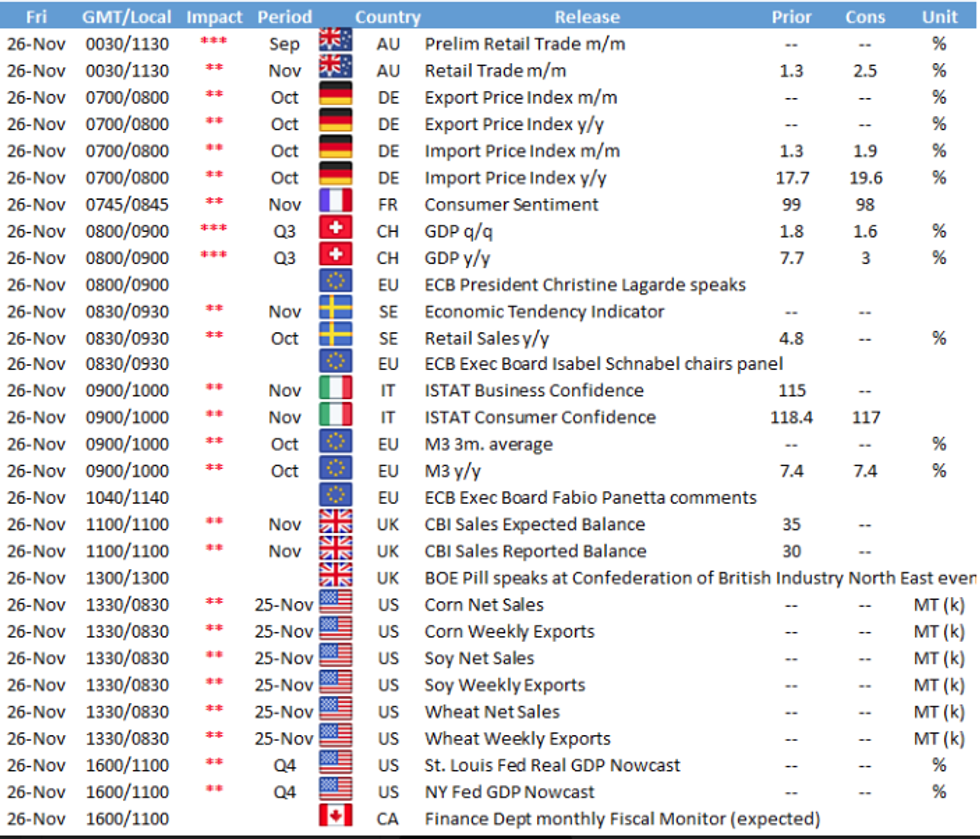

- The data economic docket is rather thin today, while central bank speaker slate features ECB's Lagarde, de Guindos, Lane, Visco, Schnabel, Centeno & Panetta, BoE's Pill & Riksbank's Ohlsson.

FOREX OPTIONS: Expiries for Nov26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E503mln), $1.1275-80(E612mln), $1.1380-1405(E598mln), $1.1500-14(E1.1bln)

- USD/JPY: Y113.65-80($1.3bln), Y115.50($582mln)

- GBP/USD: $1.3400(Gbp963mln)

- AUD/USD: $0.7200(A$524mln), $0.7240-50(A$597mln)

- USD/CAD: C$1.2520-25($1.8bln), C$1.2545-55($2.9bln)

- USD/CNY: Cny6.3750-60($500mln), Cny6.4000($650mln), Cny6.4550-55($1.2bln)

ASIA FX: Virus Angst Undermines Asia EM Currencies

Risk aversion triggered by concerns over a heavily mutated variant of the Covid-19 virus spreading across South Africa applied pressure to broader EM FX space. Hong Kong confirmed two cases of the new variant; one was an inbound traveller from South Africa, while the other was a person from an opposite room in a managed quarantine hotel.

- CNH: Spot USD/CNH edged higher but struggled to break out of yesterday's range. The yuan fixing fell virtually in line with sell-side estimate.

- KRW: Spot USD/KRW took out a layer of resistance located around the KRW1,191 figure. South Korea's daily Covid-19 cases stayed under 4,000 today, but critical cases hit a new record, with the gov't set to unveil measures to strengthen social distancing on Monday.

- IDR: The rupiah went offered in reaction to broader defensive feel, with spot USD/IDR hitting best levels in almost three weeks. Local headline flow was relatively light.

- MYR: Spot USD/MYR surged to its highest point since Jul 2020 and a recently completed double bottom formation may have exacerbated the ringgit's plight. Director-General of Health noted that Malaysia is monitoring the development of the new variant. Elsewhere, Malaysia's CPI accelerated to +2.9% Y/Y in October from +2.2% prior, narrowly beating median estimate of +2.8%.

- PHP: Risk-off flows and a reminder from BSP Gov Diokno that an RRR cut by the end of his term remains on the table sapped strength from the Philippine peso early on, but the currency trimmed some losses.

- THB: The baht led losses in Asia EM basket and is poised to register the largest weekly loss against the greenback among regional currencies. Local officials said they are monitoring risk from the new variant but are not changing border rules yet. Comments from Thailand's economic officials were seemingly overshadowed by the prospect of a disruption to the key tourism industry.

EQUITIES: New COVID Variant Weighs

It has been pretty much one-way traffic during Asia-Pac trade, with equity markets pressured by the discovery of a new, aggressive COVID variant in Africa. The S&P 500 e-mini contract has found a bit of a base at 4,650, after shedding 1%. Our technical analyst has flagged the formation of a bearish shooting star pattern in the wake of Monday's price action. Tuesday's low is located just below today's base, providing the initial point of technical support. Those of a bullish disposition need to see fresh all-time highs in the contract, which would negate the significance of Monday's technical formation.

- A quick reminder that U.S. markets will be subjected to a shortened trading session on Friday, owing to the Thanksgiving weekend. This will thin out broader liquidity.

- In terms of the regional backdrop, all of the major equity indices are comfortably lower on the day, with the Nikkei leading the way, shedding ~3%. The Hang Seng Tech Index has seen extra pressure creep in on the back of a BBG source report which suggested that "Chinese regulators have asked Didi Global Inc.'s top executives to devise a plan to delist from U.S. bourses." The sources noted that "the country's tech watchdog wants management to take the company off the New York Stock Exchange because of concerns about leakage of sensitive data." Still, the sources highlighted that no final decision re: the matter has been made. With the possibility for some backtracking evident.

EQUITIES: E-Minis Pressured By New COVID Strain

The previously flagged discovery of the new COVID variant in Africa has pressured risk assets in Asia-Pac dealing, leaving the S&P 500 e-mini contract ~1.0% lower on the day, surviving a couple of tests of 4,650 thus far. Could the Santa rally/buy the dip mentality be at risk? That probably depends on the scale of restrictions implemented across the globe and any tweaks to the major central bank views if the variant begins to spread more widely and any potential lockdowns/restrictions become more entrenched, although any delay of a reduction in central bank stimulus would of course provide additional liquidity vs. current expectations i.e. a cushion for equities.

- While the unrelenting march higher in U.S. equities has been in play since the central banks turned on the support taps back in March '20, our technical analyst notes that attention remains on Monday's reversal lower, whereby the contract registered a bearish shooting star candle. Initial support is seen at Tuesday's low (4,649.00), with a break through the Nov 10 low (4,625.25) required to confirm the technical top. Bulls need to force a fresh all-time high, which would negate the signal and confirm the resumption of the uptrend.

GOLD: Bid On Broader Risk-Off Theme

Gold has benefitted from the broader safe haven bid witnessed in Asia-Pac trade, adding the best part of $10/oz, to trade just shy of $1,800/oz at typing. The wider market reaction to the discovery of an aggressive new COVID strain in Africa will be the headline market driver ahead of the weekend, although shortened trading hours in the U.S. will continue to limit broader market liquidity. From a technical perspective, bulls need to reclaim the 20-day EMA to begin to reassert control. Conversely, to the downside, key support is located at the Nov 3 low ($1,759.0.oz).

OIL: Hit By COVID Worry

WTI & Brent crude oil futures have been battered by the discovery of the new COVID variant in Africa, with broader risk appetite and worries over any related hit to crude demand weighing. WTI is $2.50 lower vs. Wednesday's settlement, while Brent is ~$2.10 worse off. This of course builds on the demand-side worries generated by the imposition of tighter COVID restrictions across several European nations in recent days. A quick reminder that the OPEC+ group will meet next week, with plenty of speculation already doing the rounds re: the potential for a tweak in the group's oil output policy in the wake of the recent coordinated inventory release from some of the large oil consuming nations (some source reports have pointed to the likelihood of no change in production, while others have suggested that the group will continue to lift oil output, as planned).

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.