-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Seemingly Closer To Clampdown On U.S. Equity Listings

EXECUTIVE SUMMARY

- PFIZER SHOT OFFERS PARTIAL OMICRON SHIELD IN STUDY (BBG)

- FED TO REPLACE TRANSITORY WITH CONDITIONAL PRICE OUTLOOK (MNI)

- CONGRESSIONAL LEADERS OPEN WAY FOR DEAL TO RAISE US DEBT CEILING (FT)

- CHINA FIRMS’ U.S. LISTING TO SLOW IN SHORT TERM (ECONOMIC DAILY)

- CHINA TO TIGHTEN RULES FOR TECH COMPANIES SEEKING FOREIGN FUNDING (FT)

- BOE MEETING LIVE TO CONSIDER HIKE DESPITE OMICRON (MNI)

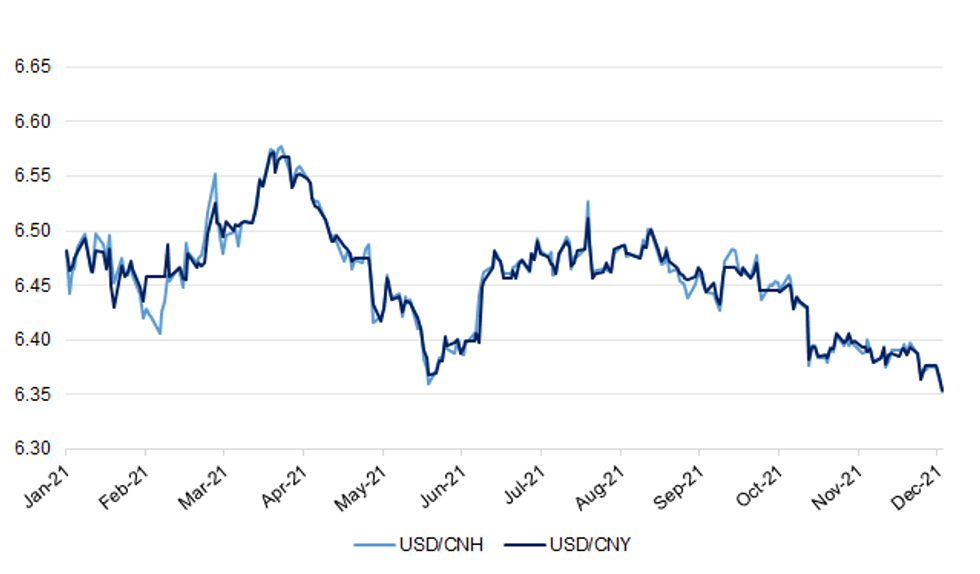

Fig. 1: USD/CNH & USD/CNY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Early signs suggest the Omicron Covid variant is more transmissible than the current Delta strain, No 10 has said. But the prime minister's official spokesman added it was still too early to draw conclusions - and any impact caused by Omicron would also depend on whether it caused severe illness. There are currently 437 confirmed cases of Omicron in the UK, figures show. Earlier, Wales' health minister said they were expecting a significant wave of Omicron that would peak in January. In Scotland, Covid rules are going to be reviewed daily as Omicron cases rise, and First Minister Nicola Sturgeon has urged employers to let staff work from home until at least the middle of January where possible. Scientists believe Omicron could spread more easily than Delta, and could out-compete Delta to become the dominant variant in the UK. But much is still unknown, and it could still take weeks to understand how severe illness from the variant is and what it means for the effectiveness of vaccines. (BBC)

CORONAVIRUS: New work from home plans are being drawn up by the Government as Boris Johnson considers tougher measures to slow the spread of the omicron variant. Officials working on Covid policy have carried out modelling on the economic impact of urging people to work from home over the Christmas and New Year period, The Telegraph understands. Vaccine passports could also be introduced, prompting a Cabinet split on Tuesday over whether to adopt them. The restrictions are being considered after Mr Johnson told ministers there were "early indications" that omicron was spreading quicker than delta, the variant currently dominant in the UK. (Telegraph)

ECONOMY: The Treasury has warned that high public sector pay settlements could lead to permanently higher prices and interest rates. It said this could also mean less spending on key public sector services. The official economic submission to pay review bodies for over 2 million public sector workers comes as unions warn that the Government needs to more than match inflation rates. The inflation rate is heading above 4 or 5% in the coming months. Today's document is an attempt to argue the current high rates of inflation are a temporary phenomenon that should not form the basis of public sector pay awards. The setting of wages in the public sector should instead "have regard" to the government and the Bank of England's inflation target of 2%. (BBC)

BOE: MNI INSIGHT: BOE Meeting Live To Consider Hike Despite Omicron

- Investors are betting that a December rate hike by the Bank of England has become much less likely since the emergence of Covid’s Omicron variant, but guidance for an increase “over coming months” remains in place, while Monetary Policy Committee members have avoided giving any steer as to whether they are more likely to act at next week's meeting or in February - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Boris Johnson is facing a furious backlash after footage emerged of Number 10 officials joking and laughing about a Christmas party in Downing Street last year during a time of strict COVID restrictions. In a video recording of what is reported to be a rehearsal for a TV media briefing, senior Number 10 aides were filmed talking and laughing about a Christmas party. They also jokingly referred to a "business meeting" and a "cheese and wine" event. The footage, obtained by ITV News, is said to be from 22 December last year - four days after an alleged Christmas party took place in Number 10. (Sky)

EUROPE

EU: The EU is unlikely to approve Poland’s application for tens of billions of euros in pandemic-recovery financing before the end of the year, the commission’s executive vice-president has said, in a sign of the gulf that remains between the two sides over judicial independence. The European Commission was also unlikely to be ready to agree by December 31 on a bid by Hungary for its own slice of the EU’s €800bn Next Generation funding, added Valdis Dombrovskis, executive vice-president of the commission. The two countries both submitted bids for the recovery funds in May, but EU approval of the plans has been severely delayed because of deep differences over the rule of law. Brussels is pushing both nations to sign up to reforms that address longstanding EU legal concerns, as part of the milestones and targets they must agree to under the recovery programmes. Diplomats have in recent weeks perceived signs of progress in dialogue between the commission and Warsaw, even as Hungary’s plan remains stuck. But speaking after meetings of finance ministers on Tuesday, Dombrovskis played down the chances of any imminent deals. “The work is ongoing . . . It is unlikely that we can finalise this work still this year,” he said. “Movement on the substance is what really determines the speed. As soon as we are there in the substance, we can move forward.” (FT)

FRANCE: French economic activity will continue to rise in December, despite another wave of the Covid-19 pandemic and fresh uncertainty over the omicron variant, according the Bank of France. Completed at the end of last week, the central bank’s monthly survey of 8,500 firms is the first indicator of how businesses in the euro area’s second-largest economy are faring since the new coronavirus strain emerged. Based on their responses, the bank estimates economic activity was 0.5% above pre-crisis levels in November and will be 0.75% higher this month. That means output for the whole fourth quarter will also expand by almost 0.75%. (BBG)

FRANCE: Valerie Pecresse has seen a surge in support since France’s Republicans chose her to be their candidate in next year’s presidential election, with two new polls showing her coming second after President Emmanuel Macron. Pecresse, who won the conservative party ballot on Saturday, also appears to stand a chance of beating Macron in the second round of April’s election. She jumped 11 points to 20%, behind Macron who would get 23%, in an Elabe poll for BFM TV of first-round voting intentions published late on Tuesday. Should Macron and Pecresse both qualify for the second round, she would win with 52%, according to the Elabe poll. (BBG)

ITALY/BTPS: Italy plans to sell up to EU6 billion ($6.75 billion) of bills due Dec. 14, 2022 in an auction on Dec. 10. (BBG)

SWEDEN: Swedish apartment prices rose by 6% in November from a year earlier, while house prices increased by 14%, according to statement from Svensk Maklarstatistik. Apartment prices rose 1% on a 3-month basis and were unchanged m/m. House prices fell 1% on a 3-month basis and were unchanged m/m. (BBG)

NORWAY: Norway is tightening restrictions again to try to regain control of the spread of the omicron variant and prevent an overloading of an hospital system already struggling with other types of illness as winter sets in. Social distancing and limiting the number of guests in private homes to 10 is recommended again, while bars and restaurants must stop selling alcohol at midnight and face masks are now mandatory where a meter’s distance can’t be maintained, Prime Minister Jonas Gahr Store told reporters on Tuesday. (BBG)

U.S.

FED: MNI: Fed To Replace Transitory With Conditional Price Outlook

- The Federal Reserve next week will likely remove the word "transitory" from its post-meeting statement in describing the current bout of historically high inflation in favor of more conditional language, but will largely retain the underlying message that prices are expected to fall over time, former Fed staffers told MNI. The evolution in the Fed's communications will also be accompanied by updated economic forecasts showing higher prices that will only gradually fall back to target in 2023 rather than in 2022, the ex-officials said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: U.S. President Joe Biden plans to put forward more nominees for open positions on the Federal Reserve Board by the end of the month, the White House said on Tuesday. "We hope to have those soon, and we continue to hope to have those out to you this month," Press Secretary Jen Psaki said. (RTRS)

CORONAVIRUS: A U.S. district court in Georgia halted the Biden administration’s vaccine mandate for federal contractors on Tuesday, writing that the president likely exceeded his authority. The U.S. District Court for the Southern District of Georgia said the Associated Builders and Contractors, a trade group that represents the construction industry, are likely correct that President Joe Biden exceeded his authority under the Procurement Act when he issued the mandate. (CNBC)

FISCAL: Congressional leaders have struck a deal that paves the way to raise the federal government’s borrowing limit and avert a looming crisis over the US debt ceiling. The Democrat-controlled House of Representatives is expected on Tuesday evening to pass a measure that would allow the Senate to raise the debt ceiling by a simple majority vote, bypassing the upper chamber’s 60-vote “filibuster” threshold. Democrats control the Senate by the narrowest of margins, 50-50, with Kamala Harris, vice-president, able to cast a tiebreaking vote. (FT)

FISCAL: The House took a first step Tuesday toward preventing a possible default on U.S. debt. The chamber passed a bill that would allow the Senate to raise the country’s borrowing limit with a simple majority vote. Lawmakers attached the provision to legislation that would prevent automatic Medicare cuts set to take place at the end of the year. The measure will head to the Senate. It will need 10 Republican votes to pass and go to President Joe Biden’s desk. (CNBC)

FISCAL: At least two GOP senators who helped advance the debt ceiling agreement in October said they were either opposed or likely to be “no” votes. “I wouldn't vote for it,” said Sen. Richard Shelby (R-Ala.), who helped advance a short-term debt hike earlier this year. “I just think we ought to keep our word with the base.” Sen. Mike Rounds (R-S.D.), another one of the 11 GOP senators, said that he was “leaning” toward opposing the deal. “I just think they can do it with reconciliation,” he said. “They've known that from day one.” (The Hill)

FISCAL: Senator Manchin says inflation 'unknown' is bigger problem than the need for Biden's Build Back Better plan. Key moderate senator's remarks come as the Democratic-run Senate aims to pass the big social-spending and climate package by Christmas Democratic Sen. Joe Manchin of West Virginia on Tuesday continued to express concerns about President Joe Biden's Build Back Better plan, citing high U.S. inflation. Federal Reserve officials are now say saying inflation is "not transitory and they're hoping it'll reduce, and we don't know -- we'll have to wait and see," Manchin said at The Wall Street Journal's CEO Council Summit. "The unknown we're facing today is much greater than the need that people believe in this aspirational bill that we're looking at. And we've got to make sure we get this right. We just can't continue to flood the market as we've done," he added. (MarketWatch)

BANKS/POLITICS: President Biden's pick to head one of the country's most powerful banking regulators is dropping out of consideration for the post, according to a statement from Biden that accepted the withdrawal. Saule Omarova, nominated to lead the Office of the Comptroller of the Currency, faced a tough path to confirmation — with opposition from Republicans and moderate Democrats. The withdrawal means that the OCC — charged with overseeing lenders whose assets make up two-thirds of the banking system's total — will continue on without a permanent head for the foreseeable future. (Axios)

LIBOR: The U.S. House plans to vote Wednesday on a measure that aims to protect $16 trillion of financial contracts from legal chaos when dollar Libor expires, according to Majority leader Steny Hoyer’s office. (BBG)

OTHER

GLOBAL TRADE: At the beginning of October, when most of China shuts down for the Golden Week holidays, the factories run by Apple's most important suppliers usually go into overdrive. This is the week when Foxconn, Pegatron and others ramp up production to 24 hours a day, employing shift after shift of workers to pump out newly launched models of Apple's iPhone in time to capture holiday season demand. But it was different this year; workers got time off, not overtime. For the first time in more than a decade, iPhone and iPad assembly was halted for several days due to supply chain constraints and restrictions on the use of power in China, multiple sources with knowledge of the situation told Nikkei. (Nikkei)

GLOBAL TRADE: Auto companies, original equipment manufacturers have said the microchip shortage is somewhat better and certainly not getting worse, U.S. Commerce Secretary Gina Raimondo says. (BBG)

U.S./CHINA: Chinese firms’ listings in the U.S. will slow in the short term as the U.S. SEC audit rules are making it harder for them to issue shares there, the Economic Daily says in a front-page commentary. But China and U.S. regulators are actively engaged in talks on cross- border audit cooperation and they are trying to resolve legacy problems as soon as possible. Commentary reiterates China Securities Regulatory Commission’s earlier statement that the regulator respects companies’ choices on where to list their stocks. (BBG)

U.S./CHINA: The world needs to be on guard for the U.S. exporting its economic crisis as it is forced to speed up the tapering by uncontrolled inflation and appearing unable to help boost its economic growth, the state-run Global Times said in a commentary. China’s decision to cut reserve requirement ratios on Monday ahead of the anticipated tapering by the Federal Reserve highlights its ample room for economic stability in rivalry with the U.S., the newspaper said. China’s liquidity release may be a preparation to hedge the potential capital gap and manage the anticipated shock by future U.S. monetary tightening, the Global Times said. (MNI)

UK/CHINA: Britain is considering approving a limited Government attendance at the Beijing Olympics that would stop short of a full-on diplomatic boycott, The Telegraph understands. An outright ban on ministerial and diplomatic representation at the Winter Games still remains a possibility, however, as options are weighed up in Whitehall. The United States announced earlier this week that no American officials will travel to the sporting event, which begins on February 4 and will last 18 days. New Zealand and Lithuania are among other countries that have also announced their refusal to deploy ministers to the Games, although their athletes will still participate. International campaigners have urged nations to stage a diplomatic boycott in protest at China’s violation of human rights, including the ongoing persecution of the Muslim Uighur minority. (Telegraph)

AUSTRALIA/CHINA: Australian officials will not attend the Beijing Winter Olympics, in a formal boycott of the Games over China's human rights abuses against Uyghur minorities in the country. The US this week confirmed it would not send any diplomats or officials to the Games, while still allowing its athletes to compete. Prime Minister Scott Morrison said Australian athletes would compete at the Games despite the diplomatic boycott. He said it should come as "no surprise" that Australia would boycott the event, citing the breakdown in the relationship with China in recent years. "I'm doing it because it's in Australia's national interest," he said. "It's the right thing to do." The boycott will include both politicians and diplomats. The Games begin in February next year. The ABC has confirmed the boycott will extend to Australian officials who are already in China. (ABC)

GEOPOLITICS: US lawmakers included a range of efforts to push back against China and Russia in a massive annual defence bill released on Tuesday, including US$300 million for Ukraine’s military and a statement of support for the defence of Taiwan. The fiscal 2022 National Defence Authorisation Act, or NDAA, authorises US$770 billion in military spending, including provisions such as a 2.7 per cent pay increase for the troops, reforms of the military justice system to combat sexual assault and initiatives to address geopolitical threats. The NDAA, which normally passes with strong bipartisan support, is closely watched by a broad swathe of industry and other interests because it is one of the only major pieces of legislation that becomes law every year and because it addresses such a wide range of issues. (SCMP)

GEOPOLITICS: Saudi Arabia's embassy in France said on Tuesday that the person arrested in Paris and linked to the murder of Jamal Khashoggi had nothing to do with the case and should be released immediately. The embassy reaffirmed that the Saudi judiciary had already issued verdicts over the Khashoggi case and the people convicted were all serving sentences. (RTRS)

CORONAVIRUS: Omicron’s ability to evade vaccine and infection-induced immunity is “robust but not complete,” said the research head of a laboratory at the Africa Health Research Institute in South Africa. In the first reported experiments gauging the effectiveness of Covid-19 vaccines against the worrisome new strain, researchers at the institute found that the variant could partially evade the vaccine produced by Pfizer Inc. and BioNTech SE. Still, its evasion wasn’t complete and a booster shot could provide additional protection, Alex Sigal said in an online presentation on Tuesday. (BBG)

CORONAVIRUS: Top US scientist Anthony Fauci said Tuesday that while it would take weeks to judge the severity of the new Covid-19 variant Omicron, early indications suggested it was not worse than prior strains, and possibly milder. Speaking to AFP, President Joe Biden's chief medical advisor broke down the knowns and unknowns about Omicron into three major areas: transmissibility, how well it evades immunity from prior infection and vaccines, and severity of illness. The new variant is "clearly highly transmissible," very likely more so than Delta, the current dominant global strain, Fauci said. Accumulating epidemiological data from around the world also indicates re-infections are higher with Omicron. (AFP)

BOJ: MNI BRIEF: BOJ Amamiya Warns Of Uncertain Spending

- Bank of Japan Deputy Governor Masayoshi Amamiya on Wednesday warned of uncertainty for a smooth recovery of private consumption, prolonged supply-side constraints and the outlook for overseas economies - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI INSIGHT: BOJ Wary On Investments Abroad, Loans At Home

- Bank of Japan officials are concerned that Japanese funds and banks face a double whammy risk of falling values for equity investments abroad and domestic loan defaults by companies in the services sector, particularly restaurants, on continued pandemic disruptions and a likely U.S. Fed interest rate tightening cycle next year, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan is likely to narrow the scope of its Covid aid, but keep it in place for longer in an attempt to focus the measures on businesses that still need help, says a former top official. “A partial extension is possible,” said Eiji Maeda, who led the central bank’s pandemic crisis response before stepping down from his post as executive director in May last year. “Funding is becoming an issue that’s focused on some businesses and some sectors. It’s no longer an issue for monetary policy, which addresses the overall economy.” With the aid scheduled to expire at the end of March, Maeda expects a decision on its fate as soon as next week’s BOJ meeting. (BBG)

JAPAN: Japan is considering blocking large companies from some taxincentives if they don’t raise wages by a sufficient amount, Nikkei reports, without attribution. Large firms that don’t “consistently” raise wages by ~1% or more from year earlier levels won’t be allowed to apply for corporate taxrelief on some research and development costs. Guidance will be published in government and ruling party’s annual tax review due to be released soon. (BBG)

SOUTH KOREA: South Korea will consider expanding home treatment of COVID-19 patients, a health official said on Wednesday, as both new daily infections and severe cases hit record highs, putting hospital capacity under strain. (RTRS)

NORTH KOREA: The United States remains committed to engaging with North Korea diplomatically despite having no success so far, White House policy coordinator for Asia Kurt Campbell said Tuesday. "To date, we have not had success, but we are still determined to put our best foot forward with respect to diplomacy," Campbell told reporters after taking part in a forum hosted by the Chey Institute for Advanced Studies, a think tank run by South Korean conglomerate SK Group. His remarks come amid a prolonged suspension in dialogue between the U.S. and the North. (Yonhap)

MEXICO: Mexico’s central bank is unlikely to speed up the pace of monetary tightening at next week’s board meeting, according to Deputy Finance Minister Gabriel Yorio. The bank, known as Banxico, has hiked its key interest rate by a quarter point in each of its past four meetings and isn’t likely to deliver a half-point increase in the last decision of the year, Yorio said Tuesday at a panel organized by Eurasia Group. Yorio, who attends board meetings in a non-voting capacity, said that tighter monetary policy has had a clear impact on inflation expectations but probably won’t influence consumer prices in the short term. (BBG)

BRAZIL: Brazil’s lower house speaker Arthur Lira and Senate head Rodrigo Pacheco announced an agreement to sign on Dec. 8 the common text of precatorios’ bill approved by Congress. Remaining part of the text will be attached to another bill that lower house will analyze on Dec. 14. If approved by lower house, bill will have to be analyzed by the Senate. Part of the text already approved opens a room bigger than 60b reais to pay 400 reais in social aid under the Auxilio Brasil program. (BBG)

BRAZIL: Brazil will have to raise interest rates in 2022, which is likely to be a tough year because of inflation, Economy Minister Paulo Guedes told in a virtual event hosted by Eurasia Group. 2022 deficit will be reduced despite social spending, he added. Govt will fight for the court-ordered payments bill known as precatorios, Guedes said, citing optimism on Congress’ understanding on the importance of the bill. It’s technically acceptable to review spending cap. Petrobras is not included in the list of privatizations planned for this first administration. State-run company should join the so-called Novo Mercado segment at Brazil’s B3 stock exchange, which requires the highest governance standards, he added. (BBG)

BRAZIL: President Jair Bolsonaro is getting closer to having a role in making gasoline and diesel less expensive for Brazilian drivers after a key senate panel advanced a bill that aims to stabilize fuel prices. The Senate Committee on Economic Affairs on Tuesday approved proposed legislation that would allow the government to establish price bands for fuel, and to tax oil exports progressively – with levies getting higher, the higher the price of crude -- to protect domestic supplies. The bill also calls for a stabilization fund to help reduce price volatility. Bolsonaro has been on a tug of war with state-controlled Petroleo Brasileiro SA over surging fuel prices as the country struggles with double-digit inflation ahead of a presidential election next year. (BBG)

RUSSIA: President Joe Biden warned Russian President Vladimir Putin on Tuesday that the U.S. and its allies would respond with “strong” measures to an attack on Ukraine, as tensions surge over Moscow’s massing of troops on its border. During a two-hour video call with Putin, Biden told the Russian leader that the U.S would send defensive materiel to Ukraine “above and beyond” what the U.S. already has sent if Russia invades, National Security Advisor Jake Sullivan told reporters. Biden also threatened “strong economic measures” in case of attack. Putin pushed back, blaming NATO for the increase in tensions through its “dangerous efforts” to expand ties with Kyiv and ratchet up its military potential on Russia’s borders, the Kremlin said in a statement that described the talks as “frank and businesslike.” The Russian leader reiterated that Moscow wants binding security guarantees that the U.S.-led alliance won’t take in new members to the east or station offensive weapons close to Russia. (BBG)

RUSSIA: President Joe Biden warned Russian President Vladimir Putin on Tuesday that the U.S. and its allies would take “strong” measures to respond to an attack on Ukraine, as tensions surge over Moscow’s massing of troops on the border of the Eastern European nation. During a two-hour video call with Putin, Biden “told President Putin directly that if Russia further invades Ukraine, the United States and our European allies would respond with strong economic measures,” National Security Advisor Jake Sullivan told reporters in Washington. (BBG)

RUSSIA: The U.S. will push Germany to agree to stop the contested Nord Stream 2 gas pipeline if Russian President Vladimir Putin invades Ukraine, according to documents seen by Bloomberg and people familiar with the plans. President Joe Biden’s administration is seeking a commitment from the new German government that it would halt the project under such circumstances, one of the people said, asking not to be identified talking about confidential discussions. (BBG)

RUSSIA: The Kremlin said on Tuesday it expected no immediate breakthroughs in strained U.S.-Russia relations after President Vladimir Putin held virtual talks with Joe Biden on Tuesday but said the two leaders would keep engaging on practical matters. Biden warned Putin on Tuesday the West would impose "strong economic and other measures" on Russia if it invades Ukraine, while Putin demanded guarantees NATO would not expand further eastward. "It's hard to expect any sudden breakthroughs, but the presidents demonstrated their willingness to continue practical work and begin discussing sensitive issues that seriously concern Moscow," Kremlin aide Yuri Ushakov said after the two-hour talks. (RTRS)

RUSSIA: Ukraine is grateful for U.S. President Joe Biden's support and urges Russia to use diplomatic means to ease regional tensions, an adviser to President Volodymyr Zelenskiy's chief of staff said on Tuesday. In the first official remarks by Kyiv after Biden spoke to Russian President Vladimir Putin, adviser Mykhailo Podolyak said the Biden-Putin call had not produced "sensations". "We are grateful to President Biden for his unwavering support for Ukraine's sovereignty and territorial integrity," he said in a statement. "We support President Biden's call on the Russian leader to return to diplomatic instruments and ensure de-escalation in our region. We will continue to coordinate with the American side to achieve concrete results in the interests of Ukraine." (RTRS)

SOUTH AFRICA: The daily number of people admitted to hospital in South Africa with Covid-19 more than doubled on Tuesday from a day earlier. According to the National Institute for Communicable Diseases 383 people have been admitted to hospital with the disease in the last 24 hours compared with 175 in the preceding period. Of the 13,147 new cases recorded 64% were in Gauteng, the province that includes Johannesburg and Pretoria, compared with 70% of the 6,381 cases the day earlier, according to a statement from the NICD. The positivity rate of tests was 24.9% on Tuesday, down from 26.4% the day earlier. Over the 24 hours 27 deaths due to Covid-19 were recorded, taking the total confirmed death toll in the country since the pandemic began to 90,002. (BBG)

IRAN: France's foreign minister said on Tuesday he expected nuclear talks between Iran and world powers to resume on Thursday, but after last week he had not been encouraged and feared Iran's new negotiating was trying to gain time. "The elements today of the discussion that re-started are not very encouraging because we have the feeling the Iranians want to make it last and the longer the talks last, the more they go back on their commitments ... and get closer to capacity to get a nuclear weapon." He said talks were likely to resume on Thursday despite no advances last week, but he hoped things would take a positive turn otherwise it could lead to a "serious situation". (RTRS)

IRAN: Iran's Foreign Ministry spokesman said on Tuesday that U.S. sanctions on individuals and entities in Iran will not create leverage and are "anything but seriousness & goodwill." "Washington fails to understand that 'maximum failure' and a diplomatic breakthrough are mutually exclusive," Saeed Khatibzadeh added on Twitter. The United States on Tuesday imposed sanctions on more than a dozen people and entities in Iran, Syria and Uganda, accusing them of being connected to serious human rights abuses and repressive acts. (RTRS)

OIL: Iraq's oil minister said that his country policy in OPEC is based on reservations about the unjustified increase in production, ministry of oil quoted him as saying on Tuesday. Ihsan Abdul-Jabbar added that the contract signed with France's Total would generate more than $85 billion in profits for Baghdad over 20 years. Total will build four giant energy projects in southern Iraq under a $27 billion deal signed in Baghdad on September. (RTRS)

OIL: Non-OPEC member Kazakhstan is keen to raise its oil output but is committed to comply with the pace set under an OPEC+ agreement, Murat Zhurebekov, first vice-minister of energy, said on Tuesday. Kazakhstan is currently producing 12% under its 1.7 million barrels per day capacity (bpd), Zhurebekov told Reuters on the sidelines of the World Petroleum Congress in Houston, adding that reaching maximum levels "wouldn't happen overnight." OPEC+, which comprises of the Organization of the Petroleum Exporting Countries and allies, including Kazakhstan, last week rolled over a previous plan to increase output in January by 400,000 bpd, despite fears a U.S. release from crude strategic reserves and the new Omicron coronavirus variant would lead to an oil price rout. "We are keen to raise production, like other producing countries are, but we are sticking with the status quo," Zhurebekov said. "Increasing production depends on the situation of the pandemic, we will have to wait and see". (RTRS)

OIL: U.S. crude output is forecast to fall 100,000 barrels per day to 11.18 million bpd in 2021, according to a monthly report from the Energy Information Administration, which is a smaller decline than the drop of 150,000 bpd forecast last month. U.S. crude output is then expected to rise 670,000 bpd to 11.85 in 2022, below the 770,000 bpd increase forecast last month. (RTRS)

OIL: American Petroleum Institute says there are serious conversations underway about reimposing a ban on U.S. oil exports. (RTRS)

CHINA

PBOC: The PBOC made a 25-bps cut to relending to support SMEs and the rural sector, another loosening after a 50bps RRR cut on Monday, so further policy rate cut may be less likely in the short term, the China Securities Journal reported citing analysts. The RRR cut is expected to drive down the Loan Prime Rate without affecting the medium-term lending facility rate, which will help conserve policy room, the newspaper said citing Wang Qing, an analyst with Golden Credit Rating. MNI noted that LPR will be released on Dec. 20. (MNI)

FISCAL: China Special Bond Sales Seen Staying Near Record In 2022

- China's special bonds in 2022 are in focus to boost the economy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY/POLICY: China will emphasize growth next year, keep monetary and fiscal policies stable with a looser leaning, while focusing on expanding domestic demand and promoting consumption, the Economic Information Daily said in an editorial. China may keep its deficit ratio around this year’s 3.2% as well as maintain the scale of new local government special bonds around 2021’s CNY3.65 trillion, the newspaper said. The top priority will be stimulating spending and investment with more consumption vouchers and measures to encourage car and home appliance sales expected, the newspaper said. The slow real estate sector may improve as construction of affordable housing accelerates, forming the focus of real estate investment next year, the newspaper said. (MNI)

EQUITIES/POLICY: China is preparing a blacklist that is expected to tightly restrict the main channel used by start-ups to attract international capital and list overseas, in a bid to limit the role of foreign shareholders in the country’s next generation of tech companies. The blacklist will target new companies in sensitive sectors that use so-called variable interest entities to run their China businesses, according to four people familiar with the matter. They did not expect the changes to apply to existing companies. VIEs are a legal structure that has been used for decades by Chinese tech groups — including industry leaders Alibaba and Tencent — to circumvent foreign investment restrictions and raise billions of dollars from international investors. (FT)

KAISA: Kaisa Group Holdings Ltd.’s creditors have yet to receive payment on a $400 million dollar bond maturing Tuesday, putting the company on the brink of becoming the second major Chinese developer to renege on debt obligations this week. Two holders of Kaisa’s bond due Dec. 7 said they hadn’t received payment as of 9 p.m. in New York on Tuesday. The holders spoke on condition of anonymity to discuss private investments. Kaisa, the third-largest issuer of dollar notes among Chinese developers, didn’t immediately respond to requests for comment. There is no grace period on the bond’s principal payment, according to the prospectus. (BBG)

KAISA: Trading in shares of embattled Chinese developer Kaisa Group Holdings was suspended on Wednesday, according to the Hong Kong stock exchange. The suspension comes after a source with direct knowledge of the matter said Kaisa was unlikely to meet its $400 million offshore debt deadline on Tuesday. Non-payment by Kaisa would push the 6.5% bond of Kaisa, China's largest holder of offshore debt among developers after Evergrande, into technical default, triggering cross defaults on its offshore bonds totalling nearly $12 billion. (RTRS)

OVERNIGHT DATA

JAPAN Q3, F GDP -0.9% Q/Q; MEDIAN -0.8%; FLASH -0.8%

JAPAN Q3, F GDP ANNUALISED -3.6% Q/Q; MEDIAN -3.1%; FLASH -3.0%

JAPAN Q3, F GDP NOMINAL -1.0% Q/Q; MEDIAN -0.6%; FLASH -0.6%

JAPAN Q3, F GDP DEFLATOR -1.2% Y/Y; MEDIAN -1.1%; FLASH -1.1%

JAPAN Q3, F GDP PRIVATE CONSUMPTION -1.3% Q/Q; MEDIAN -1.1%; FLASH -1.1%

JAPAN Q3, F GDP BUSINESS SPENDING -2.3% Q/Q; MEDIAN -3.9%; FLASH -3.8%

JAPAN Q3, F INVENTORY CONTRIBUTION % GDP 0.1%; MEDIAN 0.3%; FLASH 0.3%

JAPAN Q3, F NET EXPORTS CONTRIBUTION % GDP 0.0%; MEDIAN 0.1%; FLASH 0.1%

JAPAN OCT BOP CURRENT ACCOUNT BALANCE +Y1.1801TN; MEDIAN +Y1.2749TN; SEP +Y1.0337TN

JAPAN OCT BOP CURRENT ACCOUNT BALANCE ADJ +Y1.0259TN; MEDIAN +Y999.2BN; SEP +Y762.7BN

JAPAN OCT BOP TRADE BALANCE BOP BASIS +Y166.7BN; MEDIAN +Y128.8BN; SEP -Y229.9BN

JAPAN NOV ECO WATCHERS SURVEY CURRENT 56.3; MEDIAN 57.4; OCT 55.5

JAPAN NOV ECO WATCHERS SURVEY OUTLOOK 53.4; MEDIAN 57.7; OCT 57.5

JAPAN NOV BANK LENDING INCL-TRUSTS +0.6% Y/Y; OCT +0.9%

JAPAN NOV BANK LENDING EX-TRUSTS +0.5% Y/Y; OCT +0.8%

JAPAN NOV BANKRUPTCIES -10.36% Y/Y; OCT -15.86%

SOUTH KOREA NOV BANK LENDING TO HOUSEHOLDS TOTAL KRW1,060.9TN; OCT KRW1,057.9TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:28 am local time from the close of 2.1519% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday vs 56 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3677 WEDS VS 6.3738

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3677 on Wednesday, compared with 6.3738 set on Tuesday.

MARKETS

SNAPSHOT: China Seemingly Closer To Clampdown On U.S. Equity Listings

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 407.82 points at 28862.58

- ASX 200 up 91.501 points at 7405.4

- Shanghai Comp. up 31.762 points at 3627.193

- JGB 10-Yr future up 3 ticks at 152.07, yield down 0.5bp at 0.051%

- Aussie 10-Yr future up 2.5 ticks at 98.370, yield down 2.8bp at 1.620%

- U.S. 10-Yr future +0-03+ at 130-14, yield down 0.85bp at 1.465%

- WTI crude down $0.35 at $71.70, Gold up $6.65 at $1790.78

- USD/JPY down 10 pips at Y113.50

- PFIZER SHOT OFFERS PARTIAL OMICRON SHIELD IN STUDY (BBG)

- FED TO REPLACE TRANSITORY WITH CONDITIONAL PRICE OUTLOOK (MNI)

- CONGRESSIONAL LEADERS OPEN WAY FOR DEAL TO RAISE US DEBT CEILING (FT)

- CHINA FIRMS’ U.S. LISTING TO SLOW IN SHORT TERM (ECONOMIC DAILY)

- CHINA TO TIGHTEN RULES FOR TECH COMPANIES SEEKING FOREIGN FUNDING (FT)

- BOE MEETING LIVE TO CONSIDER HIKE DESPITE OMICRON (MNI)

BOND SUMMARY: Core FI Firms A Little In Asia

U.S. Tsys garnered an early, modest bid in Asia-Pac trade, aided by Australia declaring a political boycott of the Beijing Winter Olympics & some cross-market spill over from strong ACGB supply. Still, firmer regional equities & e-minis tempered the bid (on hopes re: the severity of omicron and the Chinese policy easing dynamic). That leaves TYH2 +0-02+ at 130-13, off the peak of its 0-06+ overnight range. Cash Tsys run 0.5-1.5bp richer across the curve. 10-Year Tsy supply headlines the U.S. docket on Wednesday, with JOLTS job data also due.

- JGB futures hit the bell +3. The contract showed lower at the re-open on the broader impulse witnessed in U.S. Tsys overnight (JGB futures once again experienced a relative degree of resilience in overnight trade), before edging away from worst levels. Cash JGBs were flat to 1.0bp richer when compared to yesterday’s closing levels, with 5s lagging ahead of tomorrow’s 5-Year JGB auction. Local news flow has been limited in the grander scheme of things, with comments from Cabinet Secretary Matsuno and BoJ Deputy Governor Amamiya pointing to continued caution re: the omicron COVID strain, with a lack of notable, fresh information evident re: their respective policy areas. BoJ Rinban operations saw the following offer/cover ratios: 1- to 3-Year: 3.60x (prev. 3.36x), 5- to 10-Year: 1.62x (prev. 2.80x).

- Aussie bond futures moved away from their early Sydney lows through the day, aided by the aforementioned Australian diplomatic boycott of the Chinese winter Olympics and well-received ACGB supply. Today’s ACGB Nov-31 auction saw the weighted average yield price 0.85bp through prevailing mids (per Yieldbroker), while the cover ratio printed at a more than solid 4.48x. This was a firm auction by recent standards. The former was supported by well-known background matters (negative RBA-adjusted net supply, international relative value appeal and record levels of excess liquidity in the domestic banking system), while the latter was likely boosted by the fact that this is the final AOFM ACGB auction of calendar ’21. A quick reminder that this line showed up as borrowed via the RBA’s SLF earlier this week (~A$220mn), although this retreated back to A$0 as of Tuesday. A widening collateral shortage may have boosted demand. Elsewhere, the Christmas issuance hiatus will result in a deepening of the negative RBA purchase-adjusted dynamic (see auction preview bullet for more on that). This may have provided another source of demand at the auction. A spike higher in futures was observed later in the session (no headline flow apparent), with the contracts going out near late Sydney highs as the curve twist flattened, YM -0.5 & XM +2.5. Some bad execution in the IB strip skewed the optics re: RBA rate hike pricing (see earlier bullet for more on that), while the bid in bonds dragged the IR strip off lows. A reminder that STIRS & YM saw overnight/early Sydney pressure on the back of the previously flagged hawkish article from RBA watcher Terry McCrann.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y880bn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y430bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov ‘31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 1.6800% (prev. 1.8390%)

- High Yield: 1.6800% (prev. 1.8425%)

- Bid/Cover: 4.4830x (prev. 3.2750x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 70.4% (prev. 27.8%)

- Bidders 42 (prev. 57), successful 9 (prev. 22), allocated in full 1 (prev. 17)

EQUITIES: Mostly Bid In Asia

Regional equity indices & U.S. e-mini futures have mostly traded higher, as the impact of reduced worry re: the mortality threat posed by omicron and the combination of realised/potential for further policy easing in China continues to filter through into markets. A positive lead from Wall St. also helped set the tone for Asia-Pac trade, with the Nikkei 225, CSI 300 & ASX 200 all adding over 1%. The exception to the broader rule was the Hang Seng, which logged incremental losses as reports pointed to the impending tightening of restrictions when it comes to offshore financing for new Chinese tech firms (note that this isn’t a new concept). U.S. e-mini futures added 0.2-0.4%.

OIL: Tight In In Asia

A tight range for WTI & Brent crude futures in Asia-Pac hours, with both operating ~$0.25 below their respective settlement prices after pulling back from best levels during Tuesday’s NY session.

- There wasn’t much, if any, trading impulse in the wake of the weekly API inventory estimates. The release reportedly revealed a larger than expected drawdown in headline crude stocks, alongside a build in stocks at the Cushing hub, a larger than expected build in gasoline stocks and a shallower than expected build in distillate stocks.

- Matters surrounding the omicron COVID strain remain in the driving seat when it comes to intraday price movements.

GOLD: Jobbing The Range

Spot last deals a handful of dollars higher at $1,790/oz, sticking to a tight range in Asia-Pac hours. Gold has firmed at the margin over the last 24 hours or so, with our weighted U.S. real yield monitor moving a little lower over that horizon (within the confines of the recent range), while the DXY’s move away from Tuesday’s peak allowed gold to build a base. Familiar technical parameters remain in place, with broader focus on Friday’s U.S. CPI reading.

FOREX: Greenback Softens, Yuan Rallies In Risk-Positive Environment

Offshore yuan surged to its best levels since 2018 on the back of expectations of further policy easing out of China and improving global risk environment. Fresh headline flow failed to provide much in the way of notable catalysts in Asia-Pac hours, with familiar risk-on factors taking centre stage as a result.

- The DXY retreated as the greenback underperformed all of its G10 peers. Cash U.S. Tsy yields fell across the curve amid improving market sentiment.

- AUD and NOK gained some ground, while NZD and CAD struggled. The Antipodean cross AUD/NZD printed its best levels since Oct 29.

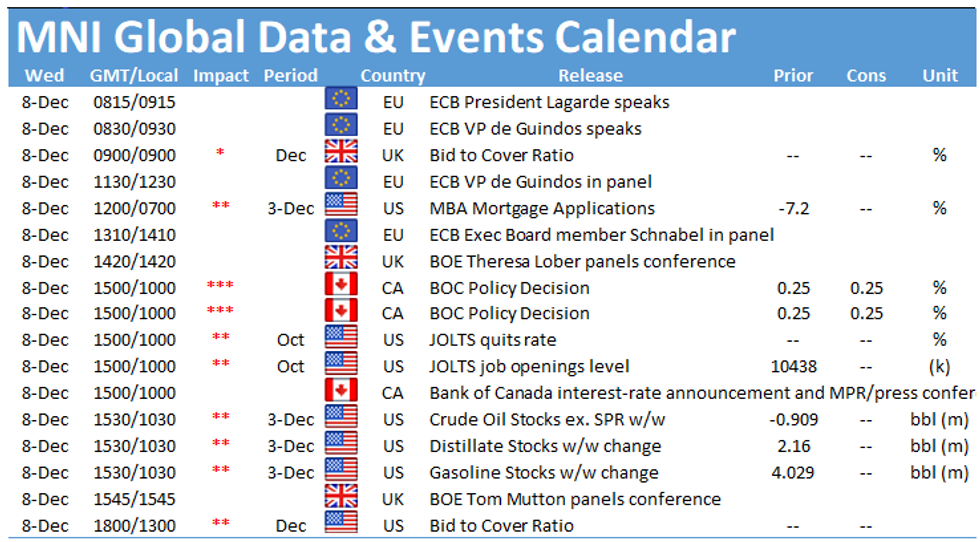

- The BoC will deliver their monetary policy decision today, while speeches are due from ECB's Lagarde, de Guindos & Schnabel.

FOREX OPTIONS: Expiries for Dec08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1290-05(E522mln), $1.1350-60(E572mln)

- USD/JPY: Y113.00-05($563mln), Y113.80($524mln), Y114.25($550mln)

- USD/CNY: Cny6.3300($910mln), Cny6.4000-10($1.2bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.