-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: Records Will Be Broken

EXECUTIVE SUMMARY

- FED QUICKENS TAPER, SEES THREE 2022 HIKES (MNI)

- CENTRAL BANK "SUPER THURSDAY" IS ON, FOCUS TURNS TO ECB, BOE & NORGES BANK

- UK CHIEF MEDICAL ADVISER: RECORDS "WILL BE BROKEN" AS OMICRON SURGES (Telegraph)

- PUTIN AND XI CEMENT PARTNERSHIP IN FACE OF WESTERN PRESSURE (RTRS)

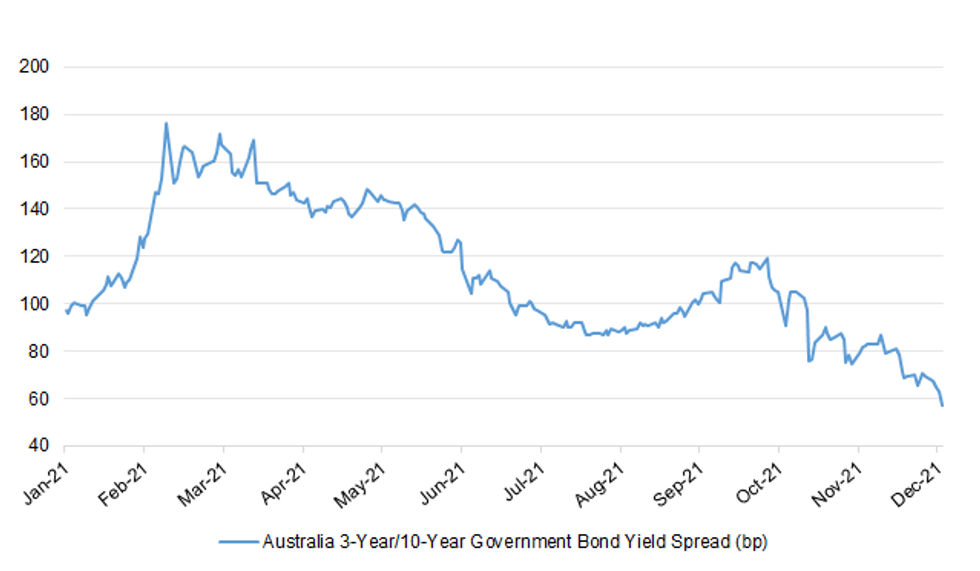

Fig. 1: Australia 3-Year/10-Year Government Bond Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The UK has recorded the highest number of daily Covid-19 cases since the beginning of the pandemic, with 78,610 reported on Wednesday. The previous record was 68,053 on 8 January - when the UK was in lockdown. (BBC)

CORONAVIRUS: Coronavirus records will continue to be broken over the coming weeks amid a surge in omicron cases, Professor Chris Whitty has warned. The Chief Medical Officer for England said that Britons needs to be "realistic" and that "records will be broken a lot in the next few weeks as rates continue to grow". "It looks as if delta which has been with us for a while is still flat, and the growth is omicron," he said. "So what we've got is two epidemics, on top of one another, an existing delta epidemic, roughly flat, and a very rapidly growing omicron epidemic on top of it." (Telegraph)

CORONAVIRUS: Dr David Nabarro, special envoy on COVID-19, is providing an update from the World Health Organisation on the Omicron variant. Speaking to Sky News, he said: "We're concerned that people are dismissing Omicron as mild. Even if Omicron does cause less severe disease the sheer number of cases will once again overwhelm health systems. Dr Nabarro insisted this is a "very serious situation," adding "today is just the beginning of an extraordinary acceleration". Dr Nabarro added he has "never been more concerned that I am tonight" at any other point in the pandemic. "Not just about the UK, but about the world," he said. "I want to stress the absolute number of people who are going to get infected, some of whom will be people who have had double vaccination, this absolute number is going to lead to an already massively stressed health system... being further overloaded." (Sky)

CORONAVIRUS: The national chief for the Covid vaccination programme has warned the NHS cannot become a vaccination service every few months. Emily Lawson, who is leading the NHS’ Covid jab campaign, also told healthcare staff in a briefing on Wednesday: “I have fed back to the Department of Health yesterday that I think realistically we don’t have the capacity to do anything else new over the next two-and-a-half weeks.” (Independent)

CORONAVIRUS: As Omicron continues its rapid spread, the UK Health Security Agency has announced it will double the availability of home delivery of Covid test kits to 900,000 a day by Saturday so that more people can get lateral flow or PCR tests delivered to their door. (Guardian)

POLITICS: A Conservative loss in the North Shropshire byelection would be “an absolute disaster” for Boris Johnson and would prompt calls for a complete shake-up of the Downing Street operation, Tory MPs have said ahead of the crucial vote on Thursday. Such are the low expectations following a bruising series of weeks for the prime minister that even a narrow win in the usually ultra-safe Tory seat would be viewed as a relief, they added. (Guardian)

POLITICS: The North Shropshire by-election is now a “coin toss” between the Liberal Democrats and the Conservatives, Ed Davey has claimed. Speaking on the eve of the contest, the Lib Dem leader urged Labour and Green voters to “lend us their support” to defeat Boris Johnson’s party by backing their candidate Helen Morgan. (Independent)

BREXIT: The public do not share the UK government’s appetite for perpetual conflict with the EU and more people see the bloc as a key future partner than the US, according to a report on post-Brexit foreign policy. “The Johnson government seems to need the perennial fights of a permanent Brexit,” the report, by the European Council on Foreign Relations (ECFR) thinktank, said, warning that its approach was “eroding the UK’s capacity to cooperate with the EU”. At the same time, it said, “the British public do not have any particular animus towards the EU” and while they do “value British sovereignty and independence, they would support a foreign policy that worked cooperatively with the bloc”. (Guardian)

EUROPE

EU: The lightning spread of Omicron in Europe and elsewhere has added a sense of urgency to an EU summit Thursday, with leaders struggling to present a united, bloc-wide approach. Projections that the mutated and highly infectious Covid strain could be dominant in the EU as early as next month have pushed the issue to the top of the agenda and ignited fears of a health crisis. The summit will also tackle other big topics pressing hard on EU capitals, in particular the Russian military build-up that could presage an invasion of Ukraine. (AFP)

EU: There is a "very high" risk the Omicron variant of COVID-19 will become dominant in Europe by early next year and lead to a growing number of hospital admissions and deaths, the European Union's public health body said on Wednesday. The European Centre for Disease Prevention and Control (ECDC) said in a report that the Omicron variant of concern (VOC) was likely to overtake Delta within the first two months of 2022. (RTRS)

GERMANY/RUSSIA: Russia ordered the killing in broad daylight in a Berlin park of a former Chechen militant, a German court found on Wednesday, sentencing the agent who carried out the 2019 act of "state terrorism" to life imprisonment. Germany summoned the Russian ambassador after the ruling, telling him that two of his embassy's 101 diplomatic staff would be expelled, Foreign Minister Annalena Baerbock said. (RTRS)

GERMANY: German chancellor Olaf Scholz has warned of the threat posed by extreme anti-vaccine campaigners, hours after police launched raids over a suspected violent “anti-vax” plot against the leader of the state of Saxony. “There is a lot of talk about the alleged division of society. I would like to point out that our society is not divided,” Scholz told the Bundestag on Wednesday, as he presented the new German coalition’s government plan. “We will not put up with a tiny minority of uninhibited extremists trying to impose their will on our entire society.” (FT)

FRANCE: Emmanuel Macron all but declared he will fight to keep his job on national television some four months before France’s presidential election. The French leader rarely grants long televised interviews to the national media. But as the campaign of his conservative rival Valerie Pecresse gains momentum and the April vote nears, he decided to appear on the mostwatched national TV channel to defend his track record. In a 2.5 hour long interview on TV channel TF1, he pivoted from the economy and pension reform to the coronavirus pandemic and radical Islam. All the while, he tried to show a softer, more humble side. “My values aren’t the values of a president of the rich,” the former banker said on Wednesday, in an attempt to finally shake off a moniker he gained when he scrapped a wealth tax soon after taking office in 2017. “I have learnt a lot of things, and I’m more sensitive to certain things than before.” (BBG)

ITALY: Italy has made it obligatory for people arriving from other EU countries who are unvaccinated for COVID-19 to spend five days in quarantine via an order signed by Health Minister Roberto Speranza, amid concern about the spread of the Omicron variant. Furthermore, people who are vaccinated will have to take a test for the coronavirus to confirm they are negative before departing, as of Thursday and until January 31. (Ansa)

LITHUANIA/CHINA: Lithuania's diplomatic delegation to China left the country on Wednesday in a hastily arranged exit, diplomatic sources said, as relations soured further over Taiwan, which opened a de facto embassy in Vilnius last month. (RTRS)

US

FED: MNI: Fed Quickens Taper, Sees Three 2022 Hikes

- The Federal Reserve will reduce its bond buying more quickly, ending the program in March, and officials signaled three interest rate hikes next year, a hawkish decision that acknowledged simmering inflation pressures can no longer be described as transitory - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Wednesday that currently available booster shots work against the omicron variant of Covid-19 and do not need to be adjusted to fight the new, highly contagious strain of the virus at this time. “Our booster vaccine regimens work against omicron,” Fauci told the public during a White House Covid update on Wednesday. “At this point, there is no need for a variant-specific booster.” Fauci said the primary two-dose vaccination series from Pfizer and BioNTech is significantly compromised by omicron, but still offers considerable protection against severe disease. Protection from the two-dose vaccine against infection dropped to 33% compared with 80% before the emergence of omicron. However, two doses are still 70% effective at preventing hospitalization in omicron patients in South Africa, Fauci said. (CNBC)

FISCAL: Democratic negotiations with centrist Sen. Joe Manchin (D-W.Va.) over President Biden’s sweeping climate and social spending bill are close to melting down as Manchin appears to be backing out of an earlier deal with the White House to extend the child tax credit for one year. Manchin is now floating the idea of extending the child tax credit for multiple years so that the cost of a proposal that is likely to be extended by Congress in the future is fully reflected in the Build Back Better bill, which is now officially projected to cost roughly $2 trillion over 10 years. “Manchin is trying to back out of a deal with the White House,” said one Democratic source familiar with the negotiations between Manchin and Biden. “Manchin earlier agreed to a one-year extension of the child tax credit. They shook on it.” (Hill)

FISCAL: The Senate voted 89-10 on Wednesday to approve the National Defense Authorization Act (NDAA), sending the $770 billion, must-pass legislation to President Biden's desk after weeks of delay. Why it matters: The annual bill provides funding and sets policy for the Pentagon. It's been passed by Congress on a bipartisan basis every year for the past six decades. (Axios)

POLITICS: Senate Democrats are escalating pressure on Sen. Joe Manchin (D-W.Va.) to get behind using the “nuclear option” to change the filibuster and break a months-long stalemate on voting rights legislation. The flurry of talks — including dedicating a closed-door caucus lunch to the issue despite a public focus on passing President Biden’s climate and social spending bill — comes as Democrats are facing intense pressure to pass election legislation though there isn’t yet a clear path forward. (Hill)

POLITICS: A majority of Georgia's Republican state senators quietly sent former Sen. David Perdue a letter last month asking him not to run for governor, Axios has learned. Weeks later, Perdue forged ahead and announced his primary challenge to incumbent Gov. Brian Kemp. (Axios)

SEC: The U.S. Securities and Exchange Commission on Wednesday proposed tightening a legal safe harbor that allows corporate insiders to trade in a company's shares and other rules to improve the resilience of money market funds. The agency also unveiled measures to increase transparency around share buybacks and the complex derivatives at the center of New York-based Archegos Capital Management's meltdown this year. The slew of long-awaited changes marks a milestone for SEC Chairman Gary Gensler, who has outlined an ambitious agenda to crack down on corporate wrongdoing, improve corporate governance and address inequities in the markets. The changes, which are subject to public consultation, will affect a swathe of corporate America, from publicly traded companies and their top executives to banking groups and asset managers including BlackRock, Vanguard, Fidelity and Goldman Sachs. (WaPo)

OTHER

GEOPOLITICS: Russia and China should stand firm in rejecting Western interference and defending each other's security interests, presidents Vladimir Putin and Xi Jinping agreed in a video call on Wednesday. Their conversation, eight days after Putin spoke to U.S. President Joe Biden in a similar format, underscored how shared hostility to the West is bringing Moscow and Beijing closer together. Kremlin aide Yuri Ushakov told reporters that Xi had offered support to Putin for his push to obtain binding security guarantees for Russia from the West, saying he understood Moscow's concerns. (RTRS)

GEOPOLITICS: Ukrainian President Volodymyr Zelenskyy urged European Union leaders on Wednesday to swiftly impose new sanctions on Russia before it invades his country, and warned that acting after any conflict would be far too late. Speaking to reporters in Brussels, Zelenskyy said Ukraine stands ready to enter into talks with Russia to ease tensions, but that Russian President Vladimir Putin does not so far appear willing to come to the table. The EU’s 27 national leaders will weigh how best to prevent a Russian invasion at a summit on Thursday. A statement drafted for their meeting, seen by The Associated Press, warns that “any further military aggression against Ukraine will have massive consequences and severe cost in response.” (AP)

CORONAVIRUS: The Omicron variant has been found to multiply about 70 times quicker than the original and Delta versions of coronavirus in tissue samples taken from the bronchus, the main tubes from the windpipe to the lungs, in laboratory experiments that could help explain its rapid transmission. The study, by a team from the University of Hong Kong, also found that the new variant grew 10 times slower in lung tissue, which the authors said could be an indicator of lower disease severity. (Guardian)

CORONAVIRUS: The World Health Organization on Wednesday cautioned against treating the omicron Covid variant as a mild strain, warning that the virus will also cause severe illness. “We know that people infected with omicron can have the full spectrum of disease, from asymptomatic infection to mild disease, all the way to severe disease to death,” Maria Van Kerkhove, the WHO’s Covid-19 technical lead, told the public during a question and answer session. (CNBC)

CORONAVIRUS: Sanofi and GlaxoSmithKline said on Wednesday they expect data from late-stage clinical trials of its booster dose of their COVID-19 vaccine candidate in the first quarter, instead of this year, another delay for the potential shot. The news came as the French and British partners said preliminary data from trials showed the single-dose booster provided strong immune responses. (RTRS)

JAPAN/CHINA: Japanese Prime Minister Fumio Kishida said Thursday he has no plans to attend the Beijing Olympics in February. (Kyodo)

RBA: The Reserve Bank of Australia sat down in recent weeks to set out three options for tapering its government bond buying program in early 2022, one of which is exiting quantitative easing entirely at its first policy meeting for the year in February. RBA Governor Philip Lowe said in a speech Thursday the board would consider coming employment, inflation and consumer spending data to determine its actions in February, adding that all options to taper were premised on there being no further shocks to the economy. Other options for the RBA in February include reducing its current pace of government bond buying from $4 billion Australian dollars per week with the intention of ending QE in May. The remaining option would see the RBA taper in February and then review the program again in May. "We have made no decision yet. Much will depend upon the news we receive between now and when we meet in February," Mr. Lowe said. While the RBA looks certain to end QE in the first half of 2022, Mr. Lowe stuck to his view that the conditions needed to raise interest rates won't be present next year. "The Reserve Bank Board will not increase the cash rate until actual inflation is sustainably in the 2%-3% target range," Mr. Lowe said. "We are still a fair way from that point. In our central scenario, the condition for an increase in the cash rate will not be met next year," he said. (WSJ)

AUSTRALIA: The federal government has squirrelled away up to $16 billion in spending decisions to be unveiled between now and the federal election in a mid-year budget update which shows only a $2.3 billion improvement to the bottom line over four years, before a deterioration in deficits over the medium term. The Mid-Year Economic and Fiscal Outlook, released on Thursday, also forecasts unemployment to fall sustainably below 5 per cent and wages growth to outstrip inflation over the four-year forward estimates. Wages are forecast to grow by 11.25 per cent between this financial year and 2024-25, while inflation is tipped to grow by 10.25 per cent. In the May budget, inflation and wages were both forecast to rise by 9 per cent over the four-year forward estimates period. (AFR)

RBNZ: Sarah Owen, Kate Kolich and Greg Smith will join the RBNZ as assistant governors, the central bank says in emailed statement. (BBG)

NEW ZEALAND: Experts are urging the Government to delay opening the border, restrict passengers from the UK, and reconsider allowing Covid-19 patients to isolate at home after New Zealand's first case of Omicron was detected. Director-General of Health Dr Ashley Bloomfield confirmed on Thursday the case had flown from Germany via Dubai and Auckland and was in the Sudima managed isolation and quarantine (MIQ) facility in Christchurch. All passengers on the person's flight to New Zealand had been deemed a close contact and were now staying on the same floor of MIQ. (Stuff)

BOK: South Korea's central bank said Thursday that the country's consumer inflation is expected to run at the 2 percent range next year as global supply bottlenecks, high oil prices and rebounding consumption could drive up the overall price levels. The Bank of Korea (BOK) also forecast that consumer inflation will run higher than the bank's target for "a considerable" period as demand-pull inflationary pressure will drive up prices of goods and services. "Going forward, the consumer prices are expected to hover over our inflation target for a considerable period as demand-side inflationary pressure will be higher amid economic recovery," the BOK said in a report. (Korea Times)

SOUTH KOREA: South Korea will reduce the maximum private gathering size to four people nationwide and restore a 9 p.m. curfew on restaurant and cafe business hours, Prime Minister Kim Boo-kyum said Thursday, as the government rolled back its "living with COVID-19" scheme amid surging infections. Under the new measures, which will be in effect from Saturday until Jan. 2, the use of restaurants and cafes will be restricted to up to four vaccinated people per visit. Those who have not been vaccinated will be able to use the facilities alone or request take-out or delivery, Kim said. (Yonhap)

TAIWAN: Taiwan hopes for progress on trade talks with the European Union next year when France takes over the bloc's presidency, and democracies must work together in the face of authoritarianism, President Tsai Ing-wen told French lawmakers on Thursday. The EU in September pledged to seek a trade deal with Taiwan, part of its formal strategy to boost its presence in the Indo-Pacific and counter China's rising power. (RTRS)

INDONESIA: Indonesia has confirmed its first case of omicron variant of the coronavirus and detected five other probable cases in the capital Jakarta and the eastern city of Manado. A cleaning worker at Wisma Atlet in Jakarta was found to have the omicron variant when tested on Dec. 15, Health Minister Budi Gunadi Sadikin said in a Thursday briefing. Whole genome sequencing is being carried out on two other cases found in the same facility that’s dedicated for coronavirus handling, with the result expected in three days. There’s no sign yet of a community transmission, Sadikin added. (BBG)

SOUTHEAST ASIA: The Philippines and Cambodia on Wednesday (Dec 15) reported their first cases of the Omicron variant, fuelling unease across Asia and further dimming hopes of a recovery as the new year approaches. Health officials in Manila said they found two travellers - one from Japan who arrived on Dec 1 and another from Nigeria the day earlier - carrying the Omicron variant. Both were asymptomatic. (Straits Times)

BOC: MNI STATE OF PLAY: BOC Says Hikes Becoming More Data Dependent

- Bank of Canada Governor Tiff Macklem said Wednesday he's becoming more dependent on the regular flow of data as the pandemic hit to the economy recedes and output returns to its full potential, while declining to say if hot inflation means undoing the half-point rate cuts made to manage deeper risks as the pandemic broke out - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BRAZIL: President Jair Bolsonaro’s government is kicking out the International Monetary Fund’s permanent representative to the country as complaints about the institution’s economic estimates escalated into a diplomatic spat. Economy Minister Paulo Guedes said on Wednesday Brazil won’t recognize the IMF’s office starting from June 30, when the current representative is due to be replaced. He cited the country’s performance during the pandemic as an example of the institution’s failures: gross domestic product shrank about 4% in 2020, way less than the Fund’s estimated contraction of more than 9%. (BBG)

TURKEY: Turkish President Recep Tayyip Erdogan removes Deputy Treasury and Finance Ministers SakirErcan Gul and Mehmet Hamdi Yildirim, according to a decree published by Official Gazette. Erdogan appoints Mahmut Gurcan and Yunus Elitas as new deputy finance ministers. (BBG)

TURKEY: Turkey extends tax advantage on lira deposit accounts until end of March 2022, according to decree in Official Gazette. (BBG)

MIDDLE EAST: The assassination of Iranian commander Qasem Soleimani in January 2020 seemed like the height of U.S.-Israel cooperation, but it actually became a major point of tension between the allies. Behind the scenes: Donald Trump expected Israel to play a more active role in the attack, and he griped that then-Prime Minister Benjamin Netanyahu was "willing to fight Iran to the last American soldier,” according to a former senior Trump administration official. Trump himself told me, “Israel did not do the right thing." (Axios)

CHINA

PBOC: China’s Loan Prime Rates, the benchmark lending rates, are likely to be lowered by 5 basis points next Monday, given that banks’ borrowing costs have dropped significantly after two RRR cuts and partial refinancing interest rate cuts, the China Securities Journal reported citing Zhang Jiqiang, chief fixed income analyst at Huatai Securities. The central bank kept the rate of medium-term lending facility, the anchor of LPR, unchanged on Wednesday as it intends to signal prudent monetary policy stance has not changed. PBOC is still likely to cut MLF rate in the first half of next year to revive growth, the newspaper said citing Wang Qing, chief macro analyst with Golden Credit Rating. (MNI)

ECONOMY: China is expected to see greater and concerted efforts in the first quarter to boost growth and implement its goal of stability, after November indicators showed slowing demand and output, Yicai.com reported. The annual local government special bonds are expected to be kept above CNY3 trillion, and several provinces have received quotas early, which will facilitate early issuances next year to be used to boost investment and consumption, Yicai said. Several ministries are also taking measures to address weakening demand and some industrial output, reflected in slowing Nov retail sales and auto production. China is actively pushing for building large-scale solar and wind electricity bases, investing in transportation and upgrading manufacturing, logistics and digital communication, it said. (MNI)

ECONOMY: China announced new measures to boost support for small businesses, with the central bank guaranteeing more loans and discounted credits. The PBOC will inject more funding to local lenders, amounting to 1% of the outstanding loans they hold, the State Council said following a meeting on Wednesday. China will turn a CNY400 billion SME refinancing program onto a rolling basis and will increase the amount if necessary, the government said. China will also increase support for manufacturing through further cutting taxes and fees, including bigger research cost deductions and more VAT rebates, it said. China will also increase support for foreign firms setting up high-end production and research centres, it said. (MNI)

EQUITIES: The Chinese government has been expanding its practice of taking minority stakes in private companies beyond those specialising in online news and content to firms possessing large amounts of key data, two people with knowledge of the matter said. It has made a de facto special management stake or "golden share" arrangement with Full Truck Alliance Co Ltd, a Chinese platform arranging trucking services, according to one of the people. Troubled Didi Global Inc has also been in talks about a golden share for its core ride-hailing business, a third source with direct knowledge of the matter said. (RTRS)

OVERNIGHT DATA

JAPAN NOV TRADE BALANCE -Y954.8BN; MEDIAN -Y600.3BN; OCT -Y68.5BN

JAPAN NOV TRADE BALANCE ADJ -Y486.8BN; MEDIAN -Y320.8BN; OCT -Y418.3BN

JAPAN NOV EXPORTS +20.5% Y/Y; MEDIAN +21.0%; OCT +9.4%

JAPAN NOV IMPORTS +43.8% Y/Y; MEDIAN +40.0%; OCT +26.7%

JAPAN DEC, P JIBUN BANK M'FING PMI 54.2; NOV 54.5

JAPAN DEC, P JIBUN BANK SERVICES PMI 51.1; NOV 53.0

JAPAN DEC, P JIBUN BANK COMPOSITE PMI 51.8; NOV 53.3

The latest Flash PMI data showed that the Japanese private sector recovery was sustained in December, rounding off the best quarterly performance since Q4 2018. However, both manufacturers and services companies signalled softer rates of output and new order growth compared to November, to suggest a softening of momentum. Cost pressures also remained more acute at manufacturers, with average input prices rising rapidly amid reports of higher material costs and supplier shortages. Increased employment at goods producers also contributed to greater cost burdens, and helped to offset a further decline in service sector staff numbers. Business confidence towards the year ahead weakened across both manufacturing and service sectors as concerns over supply chains, rising costs and the unpredictable nature of the pandemic (including new strains) pushed overall optimism down to the lowest in four months. (IHS Markit)

AUSTRALIA NOV UNEMPLOYMENT RATE 4.6%; MEDIAN 5.0%; OCT 5.2%

AUSTRALIA NOV EMPLOYMENT CHANGE +366.1K; MEDIAN +200.0K; OCT -56.0K

AUSTRALIA NOV FULL-TIME EMPLOYMENT +128.3K; OCT -47.2K

AUSTRALIA NOV PART-TIME EMPLOYMENT +237.8K; OCT -8.8K

AUSTRALIA NOV PARTICIPATION RATE 66.1%; MEDIAN 65.5%; OCT 64.6%

AUSTRALIA DEC CONSUMER INFLATION EXPECTATION +4.8%; NOV +4.6%

AUSTRALIA DEC, P MARKIT M'FING PMI 57.4; NOV 59.2

AUSTRALIA DEC, P MARKIT SERVICES PMI 55.1; NOV 55.7

AUSTRALIA DEC, P MARKIT COMPOSITE PMI 54.9; NOV 55.7

The Australian economy maintained growth at a strong rate in December, according to the IHS Markit Flash Australia Composite PMI, though the growth momentum eased from November with some pent-up demand having been unleashed. Supply issues meanwhile persisted, with lead times continuing to lengthen and reports of shortages persisting. This led to a surge in price pressures for private sector firms and affected business confidence alongside lingering COVID-19 concerns for private sector firms. While some of the inflationary pressures may be attributed to the reopening effect, it will be worth watching for any drag on business activity into the new year. The climb in employment levels was also a positive sign with private sector firms across both the manufacturing and service sectors hiring at faster rates in December. That said, instances of labour shortages had continued to surface while service providers also widely cited rises in wages contributing to higher input costs. (IHS Markit)

AUSTRALIA NOV RBA FX TRANSACTIONS GOV'T -A$896MN; OCT -A$757MN

AUSTRALIA NOV RBA FX TRANSACTIONS MARKET +A$866MN; OCT +A$723MN

AUSTRALIA NOV RBA FX TRANSACTIONS OTHER +A$1.174BN; OCT -A$2.750BN

NEW ZEALAND Q3 GDP -0.3% Y/Y; MEDIAN -1.4%; Q2 +17.9%

NEW ZEALAND Q3 GDP -3.7% Q/Q; MEDIAN -4.1%; Q2 +2.4%

NEW ZEALAND NOV NON-RESIDENT BOND HOLDINGS 57.1%; OCT 56.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2038% at 09:27 am local time from the close of 2.1904% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 56 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3637 THURS VS 6.3716

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3637 on Thursday, compared with 6.3716 set on Wednesday.

MARKETS

SNAPSHOT: Records Will Be Broken

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 605.49 points at 29065.21

- ASX 200 down 31.382 points at 7295.7

- Shanghai Comp. up 17.407 points at 3665.211

- JGB 10-Yr future up 4 ticks at 152.11, yield down 0.7bp at 0.046%

- Aussie 10-Yr future down 0.5 ticks at 98.375, yield up 0.6bp at 1.566%

- U.S. 10-Yr future +0-04+ at 130-19+, yield down 0.51bp at 1.451%

- WTI crude up $0.78 at $71.65, Gold up $6.34 at $1783.28

- USD/JPY up 11 pips at Y114.15

- FED QUICKENS TAPER, SEES THREE 2022 HIKES (MNI)

- CENTRAL BANK "SUPER THURSDAY" IS ON, FOCUS TURNS TO ECB, BOE & NORGES BANK

- UK CHIEF MEDICAL ADVISER: RECORDS "WILL BE BROKEN" AS OMICRON SURGES (Telegraph)

- PUTIN AND XI CEMENT PARTNERSHIP IN FACE OF WESTERN PRESSURE (RTRS)

BOND SUMMARY: Core FI Regain Poise, RBA Musings Drive ACGBs

The spillover from Wednesday's FOMC monetary policy decision applied a modicum of pressure to core FI in Asia-Pac hours, albeit main contracts clawed back losses later in the session as Omicron worry and Sino-U.S. tensions resurfaced.

- T-Notes recovered from their Asia-Pac session low of 130-11+ and currently trade +0-04 at 130-19, even as U.S. e-mini futures remain marginally in the green. Cash Tsy curve runs a tad flatter, with yields last seen unch. to -1.0bp. Eurodollar futures trade 0.5-3.0 ticks through the reds. Local data highlights on Thursday include industrial output, housing starts, building permits & weekly jobless claims.

- Initial weakness in JGB futures disappeared after the Tokyo lunch break, which resulted in a rebound to a fresh session high of 152.10. The contract last trades at 152.09, 2 ticks above Wednesday's settlement. Cash JGB curve bull flattened at the margin. The MoF sold Y1.1992tn 20-Year JGBs, with lowest bid topping the forecast level, which may have provided some support to the space. JGBs ignored Japanese data, which showed that trade deficit widened in November, albeit exports growth accelerated for the first time since May.

- RBA Gov Lowe outlined three scenarios of terminating bond purchases in 2022, while stressing that any decisions on QE will be unrelated to interest rate action. The Governor suggested that meeting the inflation target is still a "fair way" off, with rate hikes unlikely to materialise next year. This supported ACGBs in early trade, before they plunged on the back of a stellar labour market report released out of Australia, with all key metrics beating expectations. A surge in consumer inflation expectations to near-decade highs helped add fuel to hawkish RBA bets. ACGB yields shot higher in reaction to the jobs data, with 3-year yield gaining the most. Correction ensued, as broader core FI space lost momentum, which leaves cash ACGB yields trading +6.3bp to -1.3bp across a flatter curve. YM sits -8.1 (off lows) & XM -2.0 (near opening levels). Bills trade 2-12 ticks lower through the reds. Worth noting that Australian Treasury predicted a further tightening in the labour market going forward.

JGBS AUCTION: Japanese MOF sells Y990.6bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y990.6bn 20-Year JGBs:

- Average Yield 0.452% (prev. 0.464%)

- Average Price 100.86 (prev. 100.64)

- High Yield: 0.455% (prev. 0.466%)

- Low Price 100.80 (prev. 100.60)

- % Allotted At High Yield: 73.0359% (prev. 23.9612%)

- Bid/Cover: 3.658x (prev. 3.781x)

JGBS AUCTION: Japanese MOF sells Y3.4981tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.4981tn 3-Month Bills:

- Average Yield -0.1128% (prev. -0.1164%)

- Average Price 100.0303 (prev. 100.0316)

- High Yield: -0.1098% (prev. -0.1068%)

- Low Price 100.0295 (prev. 100.0290)

- % Allotted At High Yield: 77.3480% (prev. 41.7651%)

- Bid/Cover: 4.470x (prev. 3.926x)

FOREX: Post-FOMC Impulse Evaporates, AUD Seesaws On RBA Speak & Jobs Data

Commodity currencies traded on a softer footing, while the DXY blipped higher, in a marginal reversal of post-FOMC moves. Omicron concerns and Sino-U.S. tensions came back into focus, as the dust settled after yesterday's announcement from the Fed, who accelerated asset purchase taper and projected three rate hikes next year.

- AUD seesawed between gains and losses as the latest comments from Reserve Bank chief and Australia's blowout Nov jobs market report fed into RBA repricing. Gov Lowe noted that "we are still a fair way from" the point where the Board could raise the cash rate, which is not expected to happen next year. He outlined three scenarios for ending bond purchases in 2022, but stressed that decisions on QE will have no implications for interest rate moves. Lowe's remarks were weighed against strong labour market data, with all key metrics smashing expectations, as well as an uptick to consumer inflation expectations which reached near-decade highs.

- NZD was the worst performer in G10 FX space, printing worst levels after Stuff reported that New Zealand found its first case of the Omicron coronavirus variant in a managed isolation facility. New Zealand's Q3 GDP data were shrugged off, even as the quarterly contraction of 3.7% was smaller than expected by sell-side analysts (-4.1%), let alone the RBNZ's projection from the latest Monetary Policy Statement (-7.0%).

- The Fed inaugurated this week's crowded central bank marathon, set to resume later today with the announcements from the ECB, BoE, Norges Bank and several EM institutions (click the name of a bank to see our preview). Separately, flash PMI readings from the EZ as well as U.S. weekly jobless claims & industrial output take focus on the data front.

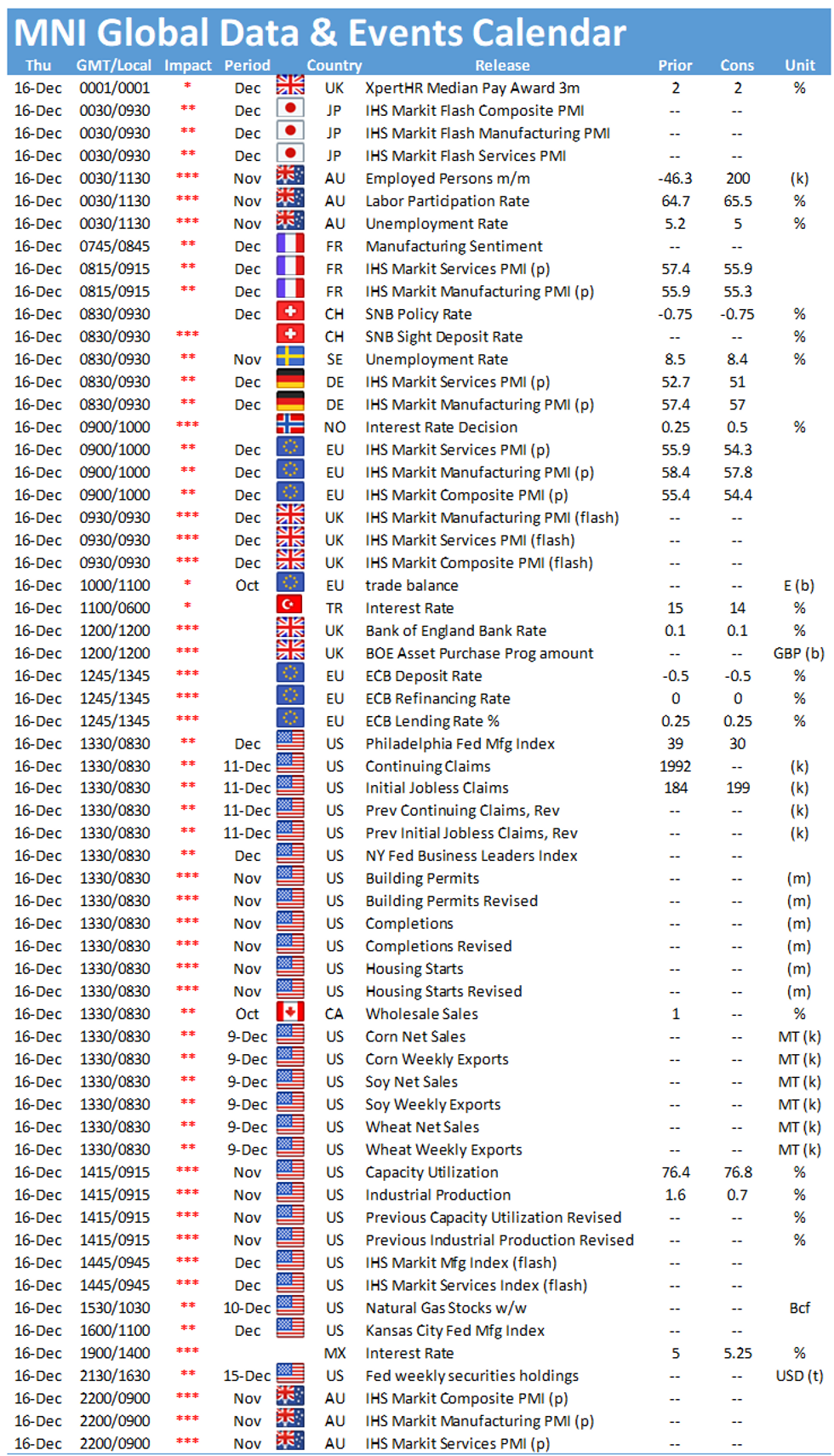

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.