-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Manchin Blocks BBB, Omicron-Related Restriction Worry Widens

EXECUTIVE SUMMARY

- MANCHIN SAYS HE WON'T VOTE FOR BUILD BACK BETTER ACT (CNN)

- DUTCH GO INTO CHRISTMAS LOCKDOWN OVER OMICRON WAVE (BBC)

- TWO-WEEK UK OMICRON CIRCUIT BREAKER WOULD BAN MEETINGS INDOORS (TIMES)

- BORIS JOHNSON CONSIDERS PLEA TO LIMIT HOUSEHOLD MIXING AT CHRISTMAS (TELEGRAPH)

- PM JOHNSON PRESSURED BY FROST RESIGNATION, POLLs & TORIES FLOUTING COVID RESTRICTIONS

- PBOC CUTS 1-YEAR LPR FIXING BY 5BP

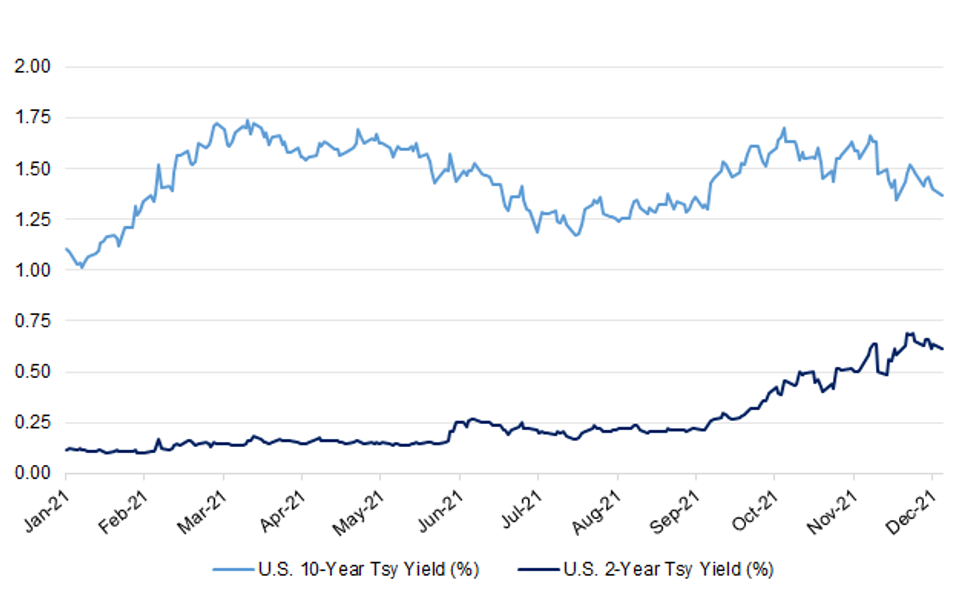

Fig. 1: U.S. 2- & 10-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: England is “almost certain” to be suffering hundreds of thousands of omicron variant cases a day, the U.K.’s top scientific advisers said as they urged the government to act within days to prevent hospitals being overrun. “The earlier interventions happen, the greater the effect they will have,” the scientists said. (BBG)

CORONAVIRUS: Boris Johnson is considering urging the public to limit household mixing over Christmas, as he risks a new row with his Cabinet. The Telegraph understands that the Prime Minister has been presented with three options drawn up by officials for further restrictions to curb the spread of omicron. The lowest level of intervention would see families asked to limit indoor contacts, without legal enforcement. However, Mr Johnson is also weighing up option two, which would mandate curbs on household mixing, the return of social distancing and an 8pm curfew on pubs and restaurants. Option three is the return to full lockdown. However, Cabinet ministers warned on Sunday that such regulations would not be "stomached" by ministers. (Telegraph)

CORONAVIRUS: Meeting other people indoors would be banned for two weeks after Christmas under plans being drawn up for a “circuit breaker” to slow Omicron. Ministers are due imminently to present proposals under which England would return to restrictions last seen in April after models suggested that this could halve a peak of hospital admissions that might otherwise break the NHS. However, Boris Johnson has not yet approved the plans and insisted yesterday that he was not “closing things down”. More measures before Christmas have not been ruled out but Johnson is reluctant to toughen restrictions after the rebellion against plan B this week by 100 of his MPs and the North Shropshire by-election defeat. (The Times)

CORONAVIRUS: Health Secretary Sajid Javid refused to rule out stronger U.K. Covid-19 rules before Christmas. When asked whether he could rule out a so-called circuit-breaker lockdown within days, he said that there are no guarantees in this pandemic and that everything needs to be kept under review. “It’s time to be more cautious. We know this thing is spreading more rapidly,” Javid told BBC News on Sunday. (BBG)

CORONAVIRUS: Rishi Sunak is one of at least ten cabinet ministers who are resisting calls by scientific advisers for new coronavirus restrictions to be introduced before Christmas by questioning the accuracy of official modelling. (The Times)

CORONAVIRUS: The Mayor of London has declared a "major incident" due to the rapid spread of the Omicron coronavirus variant in the capital. Sadiq Khan said Omicron is now the "dominant variant" in London and was having an impact on staff absences in the emergency services across the city. (BBC)

FISCAL: The U.K. Treasury said it will do “whatever it takes” to support hospitality and other businesses hit by mass cancellations as households voluntarily isolate before Christmas, but stopped short of announcing any new measures. (BBG)

FISCAL: Chancellor Rishi Sunak and his team has held meetings with business leaders as pressure mounts on the government to provide assistance to companies impacted by the Omicron variant. Mr Sunak cut short his trip to the US to hold more talks with business chiefs in response to the fresh COVID crisis on Friday. (Sky)

FISCAL: Rishi Sunak is considering a range of measures, from a fresh emergency VAT cut for the hospitality and tourism industry, to additional cash boosts for businesses, after firms were hit by the "unofficial lockdown" resulting from the Government's Covid-19 advice. (Telegraph)

FISCAL: A BBC reporter tweeted the following on Friday: “Treasury sources have played down the idea of a new fund - or furlough equivalent - being introduced in the coming days, as some have called for. Chancellor held more talks with businesses today about support already on offer.” (MNI)

FISCAL: Rishi Sunak has just 24 hours to commit to a package of support for businesses or risk the permanent closure of 10,000 pubs and restaurants, industry chiefs have warned. (Telegraph)

FISCAL: London’s subway network secured a funding extension from the U.K. government as a slump in passenger numbers triggered by the coronavirus crisis compounds an already perilous financial situation. Support that was due to expire Friday will continue through Feb. 4, Transport for London said in a statement, adding that it’s grateful for the lifeline but that a more enduring settlement still needs to be negotiated. (BBG)

BREXIT/POLITICS: Foreign secretary Liz Truss has been tasked with overseeing the UK’s relations with the EU after Brexit minister Lord David Frost resigned on Saturday evening, citing worries over the government’s “direction of travel”. The appointment of Truss during such an intense period of negotiations with Brussels comes as Eurosceptic Tory MPs fear that prime minister Boris Johnson is capitulating on post-Brexit trade arrangements in Northern Ireland. It is understood Johnson is no longer seeking the immediate axing of the European Court of Justice from its role in enforcing the Northern Ireland protocol. Frost had been a vocal critic of the ECJ. (FT)

BREXIT/POLITICS: Conservative MPs are split over the resignation of Brexit Minister Lord Frost, who left his post on Saturday. The peer told Boris Johnson he had "concerns about the current direction of travel" of the government, including over Covid policy, urging the PM to avoid introducing "coercive measures". Tory backbenchers who share his views have called his exit a "disaster". But others in the party said it offered a chance to "press the reset button" in negotiations with the EU. (BBC)

BREXIT: The EU’s Brexit negotiator has called for a strategic partnership with the UK to tackle key issues including climate change and European security, saying that a resolution of the dispute over Northern Ireland would “re-establish political trust”. Maros Sefcovic, a European Commission vice-president, said London and Brussels should seek to resolve the “politically sensitive issues” over the Northern Ireland protocol early in the new year and before campaigning begins for the regional assembly’s May elections. Speaking to the Financial Times on Friday, the day before UK Brexit minister Lord David Frost’s resignation became public, Sefcovic welcomed the UK’s “more constructive” approach in the past two weeks. London dropped a demand for the European Court of Justice to lose its role in enforcing the protocol and signalled further compromises, which some political observers believe prompted Frost’s decision to quit. (FT)

BREXIT: The Irish government does not expect the resignation of British Brexit minister David Frost to delay progress in talks on the Northern Ireland trade rules as he was just representing the views of the British government, a senior minister said. (RTRS)

BREXIT: The French government has called on Boris Johnson to use David Frost’s resignation as Brexit minister to “rebuild trust” with the EU amid uncertainty over the prime minister’s approach in the new year. Clément Beaune, France’s EU affairs minister, who had a series of run-ins with the prime minister’s pugnacious minister, suggested that Downing Street should use the moment to reset the troubled relationship. He said: “We had difficult relations but we always continued the dialogue. I send my best with respect to David Frost after his resignation. It is time for the British government to rebuild a climate of trust with France and the EU in the interest of all.” (Guardian)

BREXIT: The difficulties of relocating staff during a pandemic has postponed some finance jobs from moving out of London and into the European Union, according to EY. “Travel restrictions over the last two years have challenged the practicalities of relocation,” said Omar Ali, head of financial services for Europe, the Middle East, India and Africa at EY. (BBG)

POLITICS: Senior Tories have urged Boris Johnson to make changes following a huge by-election defeat for the Conservatives. Ex-Conservative leader Iain Duncan Smith said No 10 needed discipline while another senior Tory said the PM needed to get "a bit of a bloody grip". (BBC)

POLITICS: Boris Johnson has been warned he has “one last chance”, amid speculation that letters of no confidence in him will be submitted following the Tories’ thumping by-election defeat. (Telegraph)

POLITICS: Rapidly rising prices and tax increases in the spring, followed by a drubbing for the Tories in May’s local elections, will mark the beginning of the end of Boris Johnson’s premiership, senior Conservative MPs now believe. After Johnson suffered a massive rebellion by his backbenchers over Covid rules in the Commons on Tuesday and a humiliating byelection loss to the Liberal Democrats in the previously safe Conservative seat of North Shropshire two days later, the prime minister is being told he has only three to four months to turn things around or risk being ousted. (Observer)

POLITICS: No prominent Tories the FT spoke to on Sunday said a leadership challenge was imminent. However, Frost is a popular figure in the party and his concerns reflect growing disquiet on the Tory backbenches. (FT)

POLITICS: At least one Cabinet minister has made it clear they will resign if Boris Johnson introduces another full lockdown to combat the spread of the omicron variant. (Telegraph)

POLITICS: Number 10 has defended a photo which appears to show Boris Johnson and staff relaxing and drinking in the Downing Street garden at a time of tough social restrictions in May 2020. The picture, first published by The Guardian, shows the prime minister, his wife Carrie, and colleagues with wine and cheese. Nineteen people were present and there were "spirits and pizza inside and outside the building", the newspaper reported. It happened at a time when people were still being asked to remain two metres apart, even outdoors, and being urged to "stay at home as much as is possible". Schools did not reopen for another fortnight, while pubs and restaurants remained closed until early July. Downing Street insists the picture shows a "staff meeting". "As we said last week, work meetings often take place in the Downing Street garden in the summer months. On this occasion there were staff meetings following a No10 press conference," said a spokesman. "Downing Street is the prime minister's home as well as his workplace. The prime minister's wife lives in Number 10 and therefore also legitimately uses the garden." Sky News has been unable to independently confirm the details of the report. (Sky)

POLITICS: The UK's top civil servant has stepped aside from his role leading an inquiry into Downing Street lockdown parties, after it emerged an event was held in his own office. Simon Case had been due to report on claims Covid rules were broken at events for staff last year. (BBC)

POLITICS: The Prime Minister admitted voters were “frustrated” after weeks of allegations about sleaze and lockdown rule breaking in Downing Street. Mr Johnson is facing a wake-up call after polling showed the country has doubts about his leadership. Research for the Daily Express carried out on Thursday put the Conservatives four points behind Labour on 34 nationally. Just over half the public, 53 percent, said they lacked confidence in Mr Johnson as Prime Minister, although the figure dropped to 31 percent among those who voted for the Conservatives in 2019. The Savanta ComRes study found 52 percent of adults believe Mr Johnson is handling the pandemic badly but among Tory voters, 55 percent back his response. Younger voters were most unhappy with his approach but 41 percent of the over 55s were supportive. (Daily Express)

POLITICS: Fewer than half of Conservative voters now think the Government is competent, and almost three quarters of the country think ministers cannot relate to the public, a poll for The Telegraph has found. (Telegraph)

ECONOMY: Household savings are to soar next year as more than a third of people prepare to tighten their purse strings amid a surge in inflation, a Telegraph survey reveals. (Telegraph)

EUROPE

ECB: The European Central Bank will adjust its monetary policy if upside risks to inflation materialize, said Governing Council member Robert Holzmann. The Austrian central bank chief said projections still pointed to price growth slowing to the ECB’s 2% target by the end of 2022, despite the risk of a faster pace in the short run. “When this sharp decline isn’t there, other colleagues will certainly make a revision and we’ll change our monetary policy,” Holzmann said Saturday on Austria’s Oe1 public radio. On Thursday, the Frankfurt-based institution confirmed it would wind down its pandemic bond-buying program but temporarily expand an older one to ease the transition. (BBG)

ECB: The European Central Bank risks underestimating the threat posed by inflation and falling too far behind global peers in confronting soaring prices, Governing Council member Pierre Wunsch said. (BBG)

GERMANY: Germany’s virus cases are only a few weeks past their peak, but Health Minister Karl Lauterbach said the country is already headed for a fifth wave after registering a “critical number” of omicron infections. The nation is administering booster shots faster than most of Europe, and won’t enact a lockdown comparable to that in the Netherlands before Christmas, Lauterbach told ARD on Sunday. He said that restrictions on travel from the U.K. were an important step, but that he’s also pushing for travelers to be obliged to take a further PCR test on arrival. Germany could get a better handle on the pandemic if it made vaccinations mandatory, Lauterbach said. (BBG)

GERMANY: Health officials from German states called on the country’s federal government to designate the U.K. as a virus variant area and require stricter testing of travelers. People who are six years or older should have to show a negative PCR test conducted within 48 hours before their departure from variant regions, according to Bavarian Health Minister Klaus Holetschek. The requirement would also apply if travelers are changing planes at a German airport, he said after leading a meeting with colleagues from other states on Saturday. (BBG)

FRANCE: French officials will curb outdoor revelry on New Year’s Eve in a bid to limit Covid-19 infections that risk overwhelming hospitals, Prime Minister Jean Castex said. (BBG)

FRANCE: French President Emmanuel Macron looks likely to face Valerie Pecresse in an April election runoff, according to a poll showing support for the Republican candidate is growing. Macron has 24% of voting intentions for the first round of next year’s presidential election while Pecresse has 17%, according to the Ipsos-Sopra Steria survey published Saturday by Sciences Po political research center CEVIPOF, the Jean Jaures Foundation and Le Monde. (BBG)

FRANCE: The French economy is set to emerge from the Covid pandemic with trend inflation significantly closer to 2%, something monetary authorities had unsuccessfully battled to achieve since the global financial crisis more than a decade ago. According to updated forecasts from the country’s central bank, consumer price growth will settle at around 1.5% in 2023 and 2024, after the effect of surging energy prices tails off next year. Stripping out energy and food, the rate in the euro area’s second largest economy would be 1.7% in those two years compared to around 0.7% in the seven years preceding the pandemic. (BBG)

ITALY: Italy is reviewing a package of new measures to slow a surge in Covid cases during the Christmas holidays in a bid to avoid drastic measures taken by other European countries. Mario Draghi’s government will meet on Dec. 23 to discuss possible options including requiring masks outdoors, shortening the validity of the Covid certificate and possibly also requiring vaccinated people as well as unvaccinated people to take Covid tests to access large events, according to people familiar with the matter. (BBG)

SPAIN: Spanish Prime Minister Pedro Sanchez has convened a meeting with regional leaders to decide on new measures to halt the rapid spread of Covid-19 across the country. In a televised address on Sunday, Sanchez said the leaders will analyze the evolution of the pandemic in an extraordinary online meeting scheduled for Wednesday. “We need to review the situation and evaluate measures for the coming weeks,” Sanchez said. (BBG)

NETHERLANDS: The Netherlands has announced a strict lockdown over Christmas amid concerns over the Omicron coronavirus variant. Non-essential shops, bars, gyms hairdressers and other public venues will be closed until at least mid-January. Two guests per household will be allowed - four over the holidays. Prime Minister Mark Rutte said the measures were "unavoidable". (BBC)

AUSTRIA: Austria will enforce stricter entry criteria starting next week to limit the spread of the omicron variant, including a negative Covid-19 test for anyone who hasn’t gotten a booster shot. Only people who have been vaccinated or have recently recovered from the virus will be allowed to enter starting Monday, the Health Ministry said in a statement Friday. Residents can return home, but face a 10-day quarantine if they aren’t vaccinated. (BBG)

PORTUGAL: Portuguese Prime Minister Antonio Costa’s Socialists led center-right opposition party PSD by a narrower margin of 7.2 percentage points in a survey of voter intentions, newspaper Jornal de Negocios reported. Costa, who is halfway through a second four-year term, will face an early election on Jan. 30 after parliament rejected his minority Socialist government’s 2022 budget on Oct. 27. The Socialists took 36% of the vote in the 2019 election. The survey indicated 29.4% support for the Socialists, a decrease of 5.3 percentage points from the previous poll carried out in November. It indicates 22.2% backing for PSD, a decline of 2.8 percentage points. (BBG)

IRELAND: Ireland will close bars and restaurants at 8 p.m. from Sunday and cut capacity at indoor and outdoor events in a bid to slow the spread of the omicron variant. While takeaway and delivery services will remain open, hospitality, cinemas, sports and cultural gatherings must end early until Jan. 30, Irish Prime Minister Micheal Martin said. Omicron now accounts for about 35% of new cases, Martin said, and warned of a “very significant wave” over the Christmas period. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Lithuania at A; Outlook Stable

U.S.

FED: The Federal Reserve could raise interest rates as early as March in the face of “alarmingly high inflation”, according to a senior US central bank official. Christopher Waller, a Fed governor, on Friday endorsed the central bank’s decision this week to accelerate how quickly it scales back its asset purchase programme so that the stimulus ends altogether several months earlier than initially outlined in November. The revised schedule would bring the stimulus to an end in March, soon after which the Fed should raise interest rates, he said at an event hosted by the Forecasters Club of New York. (FT)

FED: MNI BRIEF: Fed Could Start Runoff Earlier Next Summer - Waller

- Federal Reserve Governor Christopher Waller said Friday the central bank could start running off assets from its balance sheet by early summer, potentially only one or two meetings after it lifts its short-term interest rate from zero - on MNI MainWire and email now, for more details please contact sales@marketnews.com - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Citing high U.S. inflation and a job market that's nearing its full potential at least while the COVID-19 pandemic continues, Federal Reserve policymakers on Friday laid out a case for raising interest rates soon after the central bank ends its bond-buying program in March. (RTRS)

FISCAL: Democratic Sen. Joe Manchin of West Virginia said he's a no on the Build Back Better Act, effectively ending negotiations on this version of legislation that would expand the nation's social safety net. Manchin has always been a key holdout for the legislation, sharing concerns over certain provisions of the massive tax and spending bill and how it may exacerbate soaring inflation in the country. "And I cannot vote to continue with this piece of legislation. I just can't. I've tried everything humanly possible. I can't get there," he said on "Fox News Sunday." "This is a no on this legislation. I have tried everything I know to do. And the President has worked diligently. He's been wonderful to work with. He knows I've had concerns and the problems I've had and, you know, the thing that we should all be directing our attention towards the variant, a Covid that we have coming back at us in so many different aspects in different ways, it's affecting our lives again." (CNN)

FISCAL: Psaki said it’ll be up to Manchin to explain why families need to pay more for insulin, why parents need to pay more for child care and why the Child Tax Credit won’t be extended. “The fight for Build Back Better is too important to give up. We will find a way to move forward next year,” Psaki said. (BBG)

FISCAL: House Speaker Nancy Pelosi says she’s hopeful lawmakers can reach an agreement on the Build Back Better Act so that the legislation comprising President Joe Biden’s economic agenda can pass “as soon as possible next year,” according to a letter to colleagues. (BBG)

CORONAVIRUS: President Joe Biden is set to warn the nation of the perils of remaining unvaccinated against the coronavirus in a planned speech Tuesday as the omicron variant takes hold in the U.S. and the nation experiences a surge in cases. “We are prepared for the rising case levels, and @POTUS will detail how we will respond to this challenge,” White House Press Secretary Jen Psaki said on Twitter. “He will remind Americans that they can protect themselves from severe illness from Covid-19 by getting vaccinated and getting their booster shot when they are eligible.” (BBG)

CORONAVIRUS: President Joe Biden’s chief medical adviser has warned of mounting “stress” on the US hospital system as new coronavirus cases tied to the highly transmissible Omicron variant start “raging” through America and the world. “Our hospitals, if things look like they’re looking now, in the next week or two, are going to be very stressed with people,” Anthony Fauci, the director of the National Institute for Allergies and Infectious Diseases, told ABC on Sunday. “We have so many people in this country who are eligible to be vaccinated who have not yet been vaccinated. And that’s going to be a real problem for stress on the hospital system,” he added. (FT)

CORONAVIRUS: New York City Mayor Bill de Blasio called on the federal government to step up supplies of tests and treatments to the city amid a spike in infections caused by the omicron variant. “We are feeling the omicron wave especially hard right now but we know it’s going to be all over the country,” de Blasio said. “This whole country needs go on a war footing to fight back.” New infections in New York City have tripled over the last month. The seven-day average of new cases reported on Sunday was 5,731, a number de Blasio called “really shocking.” New York state has broken records for new infections for the last three days, reporting 22,478 new cases on Sunday. (BBG)

CORONAVIRUS: California issued an advisory Friday recommending that travelers from other states or countries should be tested three to five days after arrival. The provision isn’t mandatory, as was the case with many restrictions on travel early in the pandemic. (BBG)

CORONAVIRUS: A federal appeals court has reinstated the Biden administration’s vaccine and testing requirement for private businesses that covers about 80 million American workers. The ruling by the 6th U.S. Court of Appeals in Cincinnati lifted a November injunction that had blocked the rule from the Occupational Safety and Health Administration, which applies to businesses with at least 100 workers. (CNBC)

BONDS: Top-rated U.S. corporations are expected to sell less debt next year, a bright spot for a high-grade market that faces a wide array of risks in 2022 as the lower supply coupled with strong demand can help sustain valuations. Most of the biggest banks are forecasting that sales will be down about 5% to 10% from 2021’s $1.4 trillion, meaning the money that keeps pouring into the corporate bond market will have fewer new securities to buy. That could help keep risk premiums which are already low by historical standards stay about where they are, according to fund managers and syndicate professionals. (BBG)

OTHER

FISCAL: House Speaker Nancy Pelosi says she’s hopeful lawmakers can reach an agreement on the Build Back Better Act so that the legislation comprising President Joe Biden’s economic agenda can pass “as soon as possible next year,” according to a letter to colleagues. (BBG)

CORONAVIRUS: A growing body of preliminary research suggests the Covid vaccines used in most of the world offer almost no defense against becoming infected by the highly contagious Omicron variant. All vaccines still seem to provide a significant degree of protection against serious illness from Omicron, which is the most crucial goal. But only the Pfizer and Moderna shots, when reinforced by a booster, appear to have success at stopping infections, and these vaccines are unavailable in most of the world. (New York Times)

CORONAVIRUS: Covid will become an endemic disease as early as 2024, Pfizer executives said Friday, meaning the virus will transition from a global emergency to a constant presence causing regional outbreaks across the world — much like the flu. “We believe Covid will transition to an endemic state, potentially by 2024,” Nanette Cocero, global president of Pfizer Vaccines, said during an investor call Friday. (CNBC)

CORONAVIRUS: Moderna Inc.’s Europe Chief Dan Staner told Italian newspaper La Repubblica that its vaccine adapted to the omicron variant is still in the laboratory testing phase and no decision has been made yet on producing it. While it takes less than three months to produce an updated shot for omicron, the timing will depend on what information regulators require to grant approvals. “The only quick solution to counter omicron today is the third dose,” Staner told the newspaper. (BBG)

JAPAN: Prime Minister Fumio Kishida said Saturday Japan will extend its tight entry rules until at least early next year to prevent the spread of the omicron variant of the coronavirus. (Kyodo)

JAPAN: Japan is set to propose a 107 trillion yen ($944 billion) budget for fiscal 2022, with the pandemic response and rising social security costs again driving the total to a record high. (Nikkei)

AUSTRALIA: Prime Minister Scott Morrison has called a snap National Cabinet meeting for tomorrow with growing concerns about the Omicron COVID variant. State and Territory leaders were not due to meet with the prime minister until February of next year but were informed late last night of the meeting to be held on Tuesday. “The purpose of it was just simply to give everybody an update on the most recent information that we have and to share the information that the states and territories have,” Mr Morrison said. The prime minister claims it is more of an “informal” meeting. (Sky)

AUSTRALIA: Greg Hunt says it is unlikely Australia will follow the Netherlands and impose significant lockdowns to suppress surging Omicron infections. Asked on Sunday about the prospects of fresh statewide lockdowns given the new restrictions in the Netherlands, the federal health minister told reporters in Canberra the circumstances in Europe were quite different to Australia. “They’re going into the depths of winter with a vastly higher case rate, and sadly, having had a vastly higher loss of life,” Hunt said. “We’re going into summer, we have one of the highest vaccination rates in the world, and a very different set of circumstances. “We don’t see that’s a likely situation in Australia. (Guardian)

CANADA: Canada is re-tightening its border as it braces for Omicron with measures that will affect communities along the frontier. Justin Trudeau’s government announced Friday that it will again require all returning travelers who spend fewer than 72 hours outside of Canada to produce a pre-arrival, negative PCR test result. The rule, which Canada eased Nov. 30, will be back in force Dec. 21. (POLITICO)

CANADA: Ontario became the latest Canadian province to reinstate strict capacity limits on restaurants, shops and holiday gatherings as the spread of the omicron variant accelerated across the country. “Friends, this variant is unlike anything we’ve ever seen and if we don’t take every single precaution we can, the modeling tells a scary story,” Ontario Premier Doug Ford said. (BBG)

TURKEY: President Recep Tayyip Erdogan pledged to continue interest rate cuts that have made the Turkish lira the world’s worst performing currency over the past three months, referring to Islamic proscriptions on usury as a basis for his new policy push. “What is it? We are lowering interest rates. Don’t expect anything else from me,” Erdogan said Sunday in televised comments from Istanbul. “As a Muslim, I’ll continue to do what is required by nas,” Erdogan said, using an Arabic word used in Turkish to refer to Islamic teachings. (BBG)

TURKEY: A major Turkish business association called on President Recep Tayyip Erdogan’s government to abandon its current economic policies, citing recent market turmoil as proof that the experimental model is bound to fail. A series of interest rate cuts by Turkey’s central bank have weakened the lira and spurred a strong demand for hard currency, destabilizing the entire economy, the group, Tusiad, said in a statement on Saturday. (BBG)

RUSSIA: Switzerland said it extradited a Russian IT specialist with Kremlin ties to the U.S., where he faces charges of insider trading. Swiss courts rejected multiple appeals to free Vladislav Klyushin, who worked with the Kremlin and Russian government ministries. He was detained in March on a request by U.S. federal prosecutors after stepping off a private jet at Sion, Switzerland, on his way to a skiing holiday with his family. (BBG)

RUSSIA: Germany could block the Nord Stream 2 natural gas pipeline if Russia escalates the conflict with Ukraine, Frankfurter Allgemeine Sonntagszeitung cited Economy Minister Robert Habeck as saying in an interview. “Any further military aggression has to be met with sharp consequences,” Habeck told the newspaper. “We can’t rule anything out.” (BBG)

ENERGY: Russia’s gas shipments through a major transit route to Germany are set to remain capped on Monday, potentially worsening Europe’s energy crunch just as a cold snap arrives in the region. Just a fraction of pipeline space was booked in auctions on Sunday to flow gas into Germany through Belarus and Poland, according to data from the Regional Booking Platform. The bookings signal supplies via the Yamal-Europe link could remain limited on Monday after plunging over the weekend. Reduced gas flows would exacerbate Europe’s energy crunch, which has already prompted metal smelters and fertilizer producers to curb output. If Russian gas giant Gazprom PJSC doesn’t reserve extra capacity at numerous within-day auctions overnight, that will force Europe to withdraw even more gas from its already deplete storage sites. (BBG)

OIL: Libya may introduce contracts with private oil companies that would give bonuses to those that meet targets and penalize those that don’t, as the OPEC member tries to raise output to 1.4 million barrels a day by mid-2022. (BBG)

CHINA

PBOC: MNI BRIEF: PBOC Cuts Key Lending Rate

- The People's Bank of China lowered its one-year benchmark Loan Prime Rate (LPR) by 5 basis points on Monday, in a move that is largely expected by the market following a second RRR cut this year that took place this month. The five-year LPR was kept unchanged at 4.65%, according to a statement on the central bank's website. The previous LPR cut took place in April 2020 following the initial coronavirus outbreak, which saw GDP contracted 6.8% in Q1. Then the one-year LPR was cut by 20 bps and the five-year by 10 bps, both the biggest cuts since the LPR mechanism was reformed in August 2019 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: China faces limited impact from the imminent tightening policies by the Federal Reserve even as the two governments’ bond yields continue to narrow, Guan Tao, the global chief economist at Bank of China International, wrote in the 21st Century Business Herald. The yuan continued to surge against the dollar despite two rounds of RRR cuts by the PBOC this year, lending evidence of the currency’s strength, said Guan, a former PBOC official. China has laid political support for faster growth next year, which will allow it to be more resilient to external impact, said Guan. China should allow the yuan’s exchange rate to be more flexible and have freer movement both ways, which helps absorb internal and external impacts, said Guan. To keep the exchange rates more stable, China should develop its forex market and further widen connections with external markets, Guan wrote. (MNI)

POLICY: China will welcome next year’s CPC 20th Congress with “exceptional result” by upholding a stable and healthy economic environment, peaceful social environment and clean and just political environment, the People’s Daily said in an editorial on its homepage. China has many macroeconomic tools and large policy space at disposal, such as the 0.5 pp RRR cut and CNY1.46 trillion special-purpose bonds introduced since December, said the daily, which also touted the country’s economic achievements this year. China must seek progress while maintaining stability, prevent large economic swings, and ensure different policies are coordinated, said the CPC's official newspaper. (MNI)

ECONOMY: Chinese companies are laying off tens of thousands of workers as Beijing’s regulatory clampdowns weigh on the technology, education and property sectors, which in many cases offered higher salaries than other industries and helped drive economic growth. Video-streaming services are cutting staff. Companies that offer tutoring are reducing teachers and shutting down apps, and real-estate agents have been let go as China’s housing market slows. (WSJ)

CORONAVIRUS: China urged residents of the country’s higher-risk Covid areas not to travel unless necessary as the country goes into new year and spring festival holidays. High-risk workers including those at customs, medical facilities and imported frozen-food factories should also avoid traveling during the holidays unless they have to leave the place of employment for longer than 14 days, the National Health Commission said at a press conference Saturday. All travelers are required to have had Covid tests 48 hours before departing, according to the commission. (BBG)

PROPERTY: China encourages “quality companies” to step up acquisition and purchase of property projects based on market-oriented principle, Cailian reports, citing a notice from PBOC and CBIRC. The regulators also encourage financial institutions to provide services to such acquisitions to help dissolve risks. The authority held a meeting with some property developers and commercial banks to discuss the matter. Report didn’t name any company. (BBG)

SOES: China has focused its state sector reforms on rare-earth and coal mining consolidation this year, as a three-year action plan for refashioning state-owned enterprises (SOEs) has been 70 percent completed and is destined to be basically accomplished before next year’s 20th Communist Party of China (CPC) National Congress, according to the state assets regulator. With SOE mergers in notably strategically significant sectors on a rising trend, the state sector, heading toward higher efficiency and improved earnings, would buttress the Chinese economy in the face of multiple headwinds over the coming year, experts said. (Global Times)

CREDIT: Kaisa Group Holdings Ltd. has appointed Houlihan Lokey (China) Ltd as financial adviser and Sidley Austin as legal adviser after missing multiple offshore debt payments. The financial adviser will evaluate Kaisa’s liquidity and explore all feasible solutions, the company said in a stock exchange filing on Monday. Kaisa said it hasn’t received any notice regarding acceleration of repayment by holders, and has been in talks with holder representatives about a comprehensive debt restructuring plan. The company’s shares resumed trading on Monday for the first time since Dec. 8. (BBG)

OVERNIGHT DATA

NEW ZEALAND NOV TRADE BALANCE -NZ$864MN; OCT -NZ$1.302BN

NEW ZEALAND NOV EXPORTS NZ$5.86BN; OCT NZ$5.36BN

NEW ZEALAND NOV IMPORTS NZ$6.73BN; OCT NZ$6.66BN

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY10 billion via 14-day reverse repo with the rate unchanged at 2.2% and 2.35% respectively on Monday. This operation has injected net CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1450% at 09:40 am local time from the close of 2.1143% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3933 MON VS 6.3651 FRIDAY

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3933 on Monday, compared with 6.3651 set on Friday.

MARKETS

SNAPSHOT: Manchin Blocks BBB, Omicron-Related Restriction Worry Widens

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 607.87 points at 27937.81

- ASX 200 down 11.774 points at 7292.2

- Shanghai Comp. down 24.32 points at 3607.787

- JGB 10-Yr future up 13 ticks at 152.24, yield down 0.8bp at 0.041%

- Aussie 10-Yr future up 4.5 ticks at 98.405, yield down 4.6bp at 1.54%

- U.S. 10-Yr future up 0-10+ at 131-16, yield down 3.9bp at 1.3631%

- WTI crude down $2.65 at $68.21, Gold up $5.90 at $1804.07

- USD/JPY down 19 pips at Y113.44

- MANCHIN SAYS HE WON'T VOTE FOR BUILD BACK BETTER ACT (CNN)

- DUTCH GO INTO CHRISTMAS LOCKDOWN OVER OMICRON WAVE (BBC)

- TWO-WEEK UK OMICRON CIRCUIT BREAKER WOULD BAN MEETINGS INDOORS (TIMES)

- BORIS JOHNSON CONSIDERS PLEA TO LIMIT HOUSEHOLD MIXING AT CHRISTMAS (TELEGRAPH)

- PM JOHNSON PRESSURED BY FROST RESIGNATION, POLLs & TORIES FLOUTING COVID RESTRICTIONS

- PBOC CUTS 1-YEAR LPR FIXING BY 5BP

BONDS: Core FI Bid On U.S. Fiscal Woes & Omicron Worry

A combination of deeper omicron worry (centring on Europe, in the wake of a lockdown in the Netherlands & the UK, as speculation mounts re: circuit breaker restrictions after Christmas) and U.S. Democratic Senator Manchin’s move to effectively block President Biden’s Build Back Better scheme weighed on risk appetite in Asia, supporting core FI markets. Note that the PBoC’s latest 1-Year LPR fixing moved 5bp lower, surprising most economists. There isn’t anything in the way of notable tier 1 risk events slated during the remainder of Monday’s session, which will leave headlines & broader risk appetite at the fore.

- TYH2 is threatening a clean break above technical resistance at the Dec 3 high/bull trigger (131-16) into European hours, trading +0-11+ at on the day at typing, printing 131-17. Cash Tsys run 3.0-4.5bp richer, with 5s leading as the wings of the curve lag. Eurodollar futures have seen some bull flattening, running flat to 6.0bp firmer through the reds.

- JGB futures unwound their overnight losses, finishing Tokyo trade +13. Cash trade saw 7s lead the rally, with the major benchmarks running 0.5-1.5bp richer on the day. BoJ Governor Kuroda failed to introduce any new points of discussion in his latest address to parliament (stressing that now is not the time to normalise policy, pointing to outcome-based monetary policy re: inflation, as opposed to a date-based process).

- Aussie bond futures finished just shy of best levels, with YM +4.0 & +4.5. Cash ACGB trade saw most of the major benchmarks richen by 4-5bp. EFPs pushed wider on the day, with 3s leading the way. Bills were 2-4 firmer through the reds. Australian PM Morrison has called a snap National Cabinet meeting for Tuesday, with focus on the dissemination of up-to-date information on Omicron. It would seem that Morrison has played down the importance of the meeting. Note that various state & federal level officials sounded relatively relaxed re: the matter over the weekend, given the onset of the summer season & high vaccination rate in place in Australia.

EQUITIES: Asia Provides Soft Start To The Week

The combination of U.S. Democratic Senator Manchin delivering a roadblock for President Biden’s Build Back Better scheme & increased omicron worry (centring on Europe & the UK) weighed on risk appetite during Asia-Pac hours. This pushed all of the major regional equity indices lower, adding to the burden of a negative lead from Wall St. The Nikkei 225 was the weakest index among the major regional benchmarks, shedding ~2%. Meanwhile, U.S. e-mini futures lost ~0.8-1.0%, trading below their respective Friday troughs in the process. A 5bp cut in the latest PBoC 1-Year LPR fixing failed to boost risk appetite.

GOLD: Hovering Around $1,800/oz

A flat start to the week for bullion, with spot last dealing just above the $1,800/oz mark, little changed on the day. Our weighted U.S. real yield monitor continues to hold a little shy of the levels observed around last week’s FOMC decision (which represented a multi-month high). Meanwhile, Friday saw the broader USD recover to trade a little shy of Wednesday’s peak, which applied pressure to gold. This meant that bulls failed to force a break of the initial technical resistance level at the Nov 26 high ($1,815.6/oz). Initial support is located at the bull channel base drawn off the Aug 9 low. Note that ETF holdings of gold have ticked back towards the recent lows, but still remain elevated by a historical standard.

OIL: Pressured By Omicron Worry & U.S. Fiscal Dynamic

Omicron worry (dominated by a lockdown in the Netherlands and the potential for a deepening of restrictions across broader Europe & the UK) weighed on crude to start the week, as demand fears notched higher. Meanwhile, U.S. Democratic Senator Manchin’s choice to effectively block President Biden’s Build Back Better scheme weighed further on risk appetite. This combination leaves WTI & Brent futures ~$2.00 below Friday’s settlement levels as of typing.

FOREX: Omicron Worry & U.S. Fiscal Roadblock Weigh On Risk

Greater worry re: omicron (punctuated by a lockdown in the Netherlands and fears re: wider containment measures across Europe & the UK) coupled with U.S. Democratic Senator Manchin’s decision to effectively block President Biden’s Build Back Better plan dented risk appetite in Asia. The PBoC delivered a 5bp cut in its 1-Year LPR fixing (which took most by surprise, even after various state-owned media outlets ran commentary pieces alluding to chances of such a move in recent days) which failed to support risk appetite, even as Beijing tipped its hat further towards pro-growth policies.

- This left the JPY atop the G10 FX table, as you would expect in such an environment, although all of the major FX crosses held within their recently observed ranges.

- The combination of the dent in broader risk appetite and another monthly trade deficit for New Zealand weighed on the kiwi, which found itself at the bottom of the G10 FX pile. NZD/USD sits at ~$0.6720, ~30 pips softer on the day.

- The broader backdrop & some idiosyncracies weighed on GBP. Continued political woes for PM Johnson (the resignation of Brexit Minister Lord Frost, growing discontent with the PM from within his own party, trailing the Labour party in opinion polls & further signs of Tory officials, including himself, potentially flouting some of the COVID restrictions that have been in place) in addition to the prospect of announcements re: deeper COVID restrictions in the coming days (Health Sec. Javid did not rule out such a move before Christmas, while the Times has pointed to a 2-week circuit breaker post-Christmas, whereas the Telegraph pointed to the potential announcement of warnings for household mixing over the Christmas period) dominated weekend press reports.

- There isn’t anything in the way of meaningful economic data releases to note on Monday, which will leave headline flow/broader risk appetite at the fore.

FX OPTIONS: Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E625mln), $1.1300(E916mln), $1.1335-55(E1.1bln), $1.1400(E1.4bln)

- USD/JPY: Y113.65-75($726mln), Y114.10-25($741mln), Y115.00($1.2bln)

- AUD/USD: $0.7100(A$686mln), $0.7200-05(A$1.6bln); $0.7240-50(A$1.5bln)

- USD/CAD: C$1.2800-20($690mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2021 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 20/12/2021 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 20/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/12/2021 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.