-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI EUROPEAN OPEN: Headline Watching Ahead Of Christmas

EXECUTIVE SUMMARY

- BIDEN: "SEN. MANCHIN AND I ARE GOING TO GET SOMETHING DONE" (AXIOS)

- UK PM JOHNSON: NO NEW RESTRICTIONS IN ENGLAND BEFORE CHRISTMAS (BBC)

- UK REDUCES COVID-19 SELF-ISOLATION TO 7 DAYS FOR MOST IN ENGLAND (RTRS)

- GERMANY IMPOSES TIGHTER CURBS AS NATION BRACES FOR OMICRON (BBG)

- OXFORD & ASTRAZENECA LAUNCH WORK ON OMICRON-TARGETED VACCINE (FT)

- TURKISH CENTRAL BANK TO SUPPORT FX DEPOSIT CONVERSION TO LIRA DEPOSITS (RTRS)

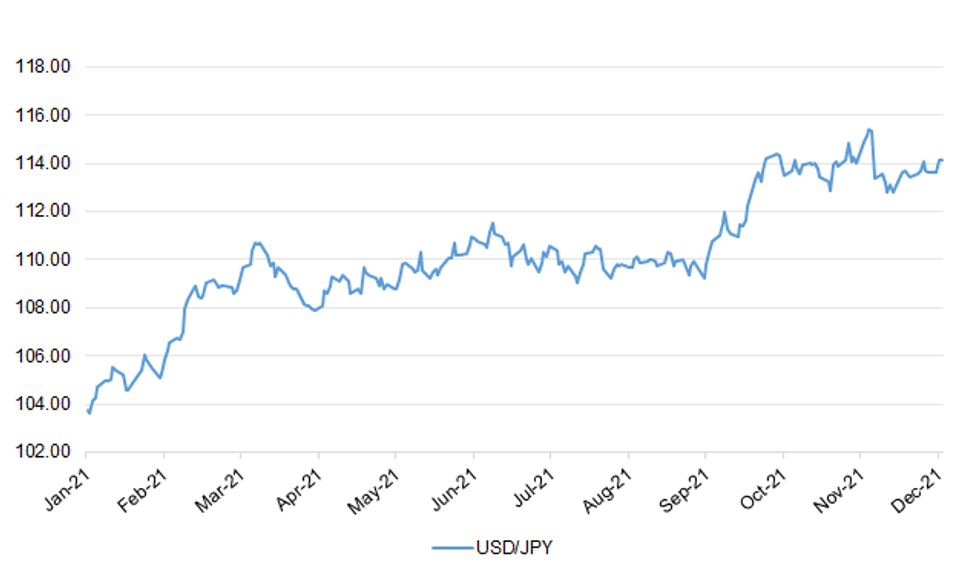

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: No new Covid restrictions will be brought in for England before Christmas, the prime minister has said. But Boris Johnson said ministers "can't rule out" any further measures after 25 December, with Omicron spreading at a speed never seen before. He added the government would continue to closely monitor the data and would "not hesitate to act" after Christmas if needed. (BBC)

CORONAVIRUS: The British government said that from Wednesday it was reducing the COVID-19 self-isolation period to seven days from 10 days for people in England who get a negative result on a lateral flow test two days in a row. (RTRS)

FISCAL: Pubs, restaurants and theatres have cautiously welcomed new government grants to help them deal with a collapse in consumer confidence caused by Omicron. But others, including beauty salons and nightclubs, said the package was merely scratching the surface. Hospitality and leisure firms can apply for grants of up to £6,000 per premises as they face a sharp drop in bookings. There's also £30m more for the arts and £100m for councils to help small firms. But the Federation of Small Businesses warned that the success of the package would be "measured by how quickly this new, urgently needed support reaches those in need". (BBC)

ECONOMY: U.K. employer confidence plunged to the lowest level since the nation was still under lockdown earlier this year as the spread of the omicron variant and uncertainty about inflation and labor shortages dimmed the outlook. The Recruitment and Employment Confederation said its measure of business sentiment returned to negative territory between September and November for the first time since the three months through April. Consumers are choosing to stay away from shops and restaurants amid concerns over omicron, hurting trade at a vital time of the year. Chancellor Rishi Sunak Tuesday announced a billion pounds ($1.3 billion) of support for U.K. hospitality businesses struggling with slumping demand, as he declined to rule out further curbs to tackle the fast-spreading strain. In brighter news, REC’s survey showed firms’ confidence in making hiring and investment decisions continued to increase, while more than half of employers said they had seen no change in the availability of candidates for roles. (BBG)

POLITICS: The Conservatives have slumped to their lowest poll rating since Boris Johnson prorogued parliament in the autumn of 2019. The prime minister’s personal approval ratings are now similar to those faced by Theresa May in the week before she was forced to resign, a YouGov poll for The Times has found. Labour has opened up a six-point lead after a bruising couple of weeks for the prime minister in which Tory backbenchers inflicted the largest rebellion of his premiership, one of his closest allies resigned from the cabinet and the Conservatives were defeated by the Liberal Democrats in the North Shropshire by-election. The YouGov poll puts Labour on 36 per cent, down one point, ahead of the Tories on 30 per cent, down two. (The Times)

EUROPE

FISCAL: EU member states will still need to offer “credible” plans to cut their debts even if they are allowed extra leeway to make green investments, a top EU official said, in a challenge to countries wanting to loosen the union’s spending rules. Brussels is looking at potential reforms to the EU’s stability and growth pact, the bloc’s fiscal rule book. One idea is a green “golden rule” to allow environmental spending to be stripped out of member states’ deficits when assessing compliance with the pact. Advocates say doing so would spur the EU’s green transition. Valdis Dombrovskis, European Commission executive vice-president, indicated he was willing to consider the idea, but said budgetary incentives for green spending had to be twinned with a commitment to continue reducing overall debt burdens. (FT)

GERMANY: German Chancellor Olaf Scholz pushed through tighter social-distancing restrictions to stave off the threat of a “massive” surge of the omicron Covid-19 variant just as families gather for the Christmas holidays. The latest measures, which add to existing curbs that mainly affect the unvaccinated, include limiting gatherings to 10 people starting Dec. 28. The restrictions, which Scholz negotiated with regional leaders on Tuesday, also apply to those who are inoculated or have recovered from the virus. “We can’t close our eyes to the next wave that’s beginning to appear in front of us,” Scholz told reporters in Berlin after meeting the country’s 16 state premiers. The chancellor said Germans should celebrate Christmas, but cautiously. (BBG)

FRANCE: France will pass a law transforming its health pass needed to exercise some professions and to go to cinemas and bars into a "vaccination" pass in the first half of January, the government said on Tuesday. (RTRS)

SPAIN: The Spanish government’s budget for 2022 will be sent back to Congress after the Senate changed the bill to include more aid to bolster local languages, delaying the approval of the spending plan. The surprise reversal for Prime Minister Pedro Sanchez adds pressure on his government to seek final approval of the bill in the lower house before the end of the year. The government is confident it has enough support to pass the bill next week in Congress, according to a spokeswoman of the prime minister’s office. Government ally Esquerra Republicana and the main opposition party Partido Popular voted to add 1.6 million euros ($1.8 million) to the budget to promote regional languages such as Catalan and Basque. Earlier in December, Esquerra dropped plans to block the budget after it reached a deal with the government over demands to set language quotas for content broadcast by streaming platforms. (BBG)

PORTUGAL: Schools, bars, and clubs will all close in Portugal starting on Dec. 26 in a bid to tackle rising Covid-19 cases in the country, Portuguese Prime Minister António Costa announced Tuesday. People have also been told to work from home, and negative tests will be required for ceremonies such as weddings as well as all cultural and sporting events. The prime minister said these measures will be in place until January 10. (CNN)

PORTUGAL: The European Commission approved 2.55 billion euros ($2.9 billion) of restructuring aid for TAP SA intended to help the ailing Portuguese airline become viable. The EU Commission also approved 107.1 million euros to compensate the Lisbon-based carrier for damages suffered as a result of the coronavirus pandemic, it said in a statement on its website Tuesday. (BBG)

U.S.

FISCAL: President Biden said Tuesday that he and Sen. Joe Manchin (D-W.Va.) "are going to get something done" despite Manchin's opposition to the Build Back Better agenda. (Axios)

FISCAL: President Joe Biden said there’s still a chance he can strike a deal with Senator Joe Manchin to get his Build Back Better economic plan through Congress, despite the West Virginia Democrat’s rejection of the measure. “I still think there’s a possibility of getting Build Back Better done,” Biden told reporters at the White House on Tuesday. (BBG)

FISCAL: The Biden administration is considering extending the payment pause and interest waiver for most federal student loan borrowers once again. Since March 2020, borrowers have been given the option to press the pause button on their monthly bills without interest accruing on their debt. Almost all borrowers have accepted the relief, research shows. The pause is currently scheduled to expire at the end of next month. (CNBC)

FISCAL: Criminals have stolen close to $100 billion in pandemic relief funds, the U.S. Secret Service said Tuesday. The stolen funds were diverted by fraudsters from the Small Business Administration’s Paycheck Protection Program, the Economic Injury Disaster Loan program and another program set up to dole out unemployment assistance funds nationwide. (CNBC)

CORONAVIRUS: President Biden told unvaccinated Americans Tuesday that getting the COVID vaccine is "your patriotic duty" and "an obligation to your country." (Axios)

CORONAVIRUS: U.S. health officials are weighing whether to change isolation recommendations for some vaccinated people so that they could return to work sooner after a breakthrough case of Covid-19. The omicron variant of coronavirus carries mutations that are believed to enable it to more easily evade human antibodies. That may mean more breakthrough infections among the vaccinated. But for vaccinated people, Covid-19 is almost always a mild and brief disease, raising the question whether a 10-day isolation is necessary. (BBG)

CORONAVIRUS: Chicago will require proof of coronavirus vaccination at restaurants, bars, gyms and other indoor venues, as the rapidly spreading omicron variant drives a spike in Covid-19 infections. Mayor Lori Lightfoot said the requirement will take effect Jan. 3, and will apply to places where food and beverages are served — including sport and entertainment venues — and fitness centers. Chicago is reporting an average of about 1,700 cases per day, up from about 300 per day just weeks ago. (CNBC)

CORONAVIRUS: Delta Air Lines CEO Ed Bastian on Tuesday asked the Centers for Disease Control and Prevention to halve its recommended quarantine time for vaccinated people who contract Covid-19, saying the current isolation period could negatively affect the airline’s operations. (CNBC)

OTHER

GLOBAL TRADE: The Canadian government on Tuesday launched a challenge against American duties on Canadian softwood lumber under the terms of the U.S.-Mexico-Canada (USMCA) trade deal, Canadian Trade Minister Mary Ng said in a statement. (RTRS)

CORONAVIRUS: Oxford university and AstraZeneca have begun work to produce an Omicron-targeted version of their coronavirus vaccine, joining the ranks of their peers who are studying the potential for adapting formulations of their shots in case they become necessary to tackle the variant. When asked about Omicron, Sandy Douglas, a research group leader at Oxford, told the Financial Times: “Like with many previous variants of concern, and together with our partners AstraZeneca, we have taken preliminary steps in producing an updated vaccine in case it is needed.” (FT)

GEOPOLITICS: The U.S. State Department has approved the potential sale of Javelin anti-tank missiles to the government of Lithuania in a deal valued at up to $125 million, the Pentagon said on Tuesday. The sale comes as tensions are running high in Eastern Europe with Russia massing troops. (RTRS)

GEOPOLITICS: Germany may not follow Lithuania and the telephone conversation between the two leaders on Tuesday will “help the German government take a cautious, objective and calm stance on the issue of the Winter Olympic Games,” the Global Times reported citing Sun Keqin, a researcher at the government-run China Institutes of Contemporary International Relations. President Xi Jinping spoke with Germany’s new Chancellor Olaf Scholz on Tuesday, in which the two leaders pledged to inherit and advance China-Germany friendship and cooperation. Germany would like to take the 50th anniversary of diplomatic ties next year as an opportunity to hold talks and it hopes the EU-China Investment Agreement will be implemented at an early date, Scholz was cited as saying.

JAPAN: The Japanese government is making final preparations to raise its fiscal 2022 growth rate projection to the 3% range from ~2.2%, NHK reports, citing an unidentified person. New outlook based on effects of government’s new economic measures. Cabinet expected to approve projection on Thurs. Also set to cut this fiscal year’s growth rate to 2% range from current ~3.7%. (BBG)

BOJ: MNI BRIEF: BOJ Minutes: Board Sees Downside Risk to Economy

- Bank of Japan board members shared the economy may deviate from the baseline scenario at the Oct. 27-28 meeting, minutes released on Wednesday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The Prime Minister has urged Australians to wear masks in indoor public settings as part of a suite of new measures to tackle rising Covid cases rise across the nation. He gathered with state and territory leaders today as part of an emergency national cabinet meeting to discuss the growing Omicron threat. Previously, national cabinet was not scheduled to meet until February 2022, but rising Covid-19 cases, particularly in NSW, prompted Prime Minister Scott Morrison to call a snap meeting. The meeting was held virtually, with booster vaccinations and the reintroduction of key restrictions, such as masks, the main topics of discussion. Following the meeting, Morrison said they “had a positive meeting” and that they are taking Omicron very seriously. (News Australia)

AUSTRALIA: National Australia Bank has hiked its fixed interest mortgage rates for the second time in December on Wednesday, this time by up to 0.1 per cent and comes on top of an increase of 0.5 per cent on December 2. The move is the latest in a slew of rate hikes from the Big Four banks to close out 2021, as inflationary pressures lead to growing expectations for a hike in the official cash rate from the Reserve Bank of Australia next year. But financial comparison site Canstar said the spectre of rising rates has not deterred home buyers, with the October ABS Lending Indicators data showing the average owner-occupier mortgage size increased by 16 per cent, or $74,054 in the past year to reach $524,257. (AFR)

SOUTH KOREA: Finance Minister Hong Nam-ki said Wednesday the government will closely monitor foreigners' real estate transactions in a bid to prevent cross-border flows of illegal funds and crack down on dubious deals. The government unveiled a set of measures to prevent foreigners from illegally buying real estate as some non-residents are found to have taken undue profits from property transactions. To monitor any illegal money flows, the Bank of Korea (BOK) and the Korea Customs Service will set up an information-sharing system by March next year. The BOK will collect information about foreigners' purchases of real estate and deliver it to the state customs agency. (Yonhap)

SOUTH KOREA: South Korea’s economy will continue to improve next year thanks to a global economic recovery, while still facing uncertainties including employment, prolonged supply chain issues and unstable prices, according to a joint statement by finance and other ministries. (BBG)

TURKEY: The Turkish central bank said on Tuesday it has decided to support foreign currency deposit accounts converted to lira deposit accounts in a move to encourage reverse dollarization. "In the event that resident real persons, who already had an FX deposit account ... convert their accounts into Turkish lira time deposit accounts will be eligible to benefit from the incentive," the central bank said. In a statement, the central bank also said it will cover the gap after interest rate and exchange rate difference at the opening and closing of lira deposit accounts are calculated. The account owner will be paid whichever is the highest, it said. The accounts that are converted to lira deposit accounts can have three, six or 12-month maturities, the central bank said. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan appoints Murat Zaman as deputy Treasury and Finance Minister, according to Official Gazette. (BBG)

MEXICO: The Bank of Mexico's recent interest rate hikes underline its "commitment" to bringing prices pressures under control as soon as possible, as inflation hits its highest level in two decades, outgoing governor Alejandro Diaz de Leon said on Tuesday. Banxico, as the bank is called, stepped up efforts to rein in surging inflation, raising its benchmark interest rate by 50 basis points to 5.50% on Dec. 16, outpacing market expectations and pushing up the peso currency against the dollar. It was the fifth consecutive meeting in which Banxico hiked rates. (RTRS)

MEXICO: Mexico’s central bank isn’t committed to a pace of half-point increases to its benchmark interest rate after delivering a hike of that magnitude in December, according to outgoing Governor Alejandro Diaz de Leon. The bank announced a bigger-than-expected increase to borrowing costs last week, following four straight quarter-point hikes, in an effort to combat skyrocketing inflation. Diaz de Leon, who leaves office at year-end, said policy makers are navigating “uncharted territory” and shouldn’t constrain themselves before future decisions. “There’s this view that there’s either the 25 or the 50 basis-point lane, either you are in one or the other -- and I don’t see it that way,” Diaz de Leon told Bloomberg News during an interview in his office. “You would find it costly rather than beneficial to commit to something.” (BBG)

BRAZIL: Lawmakers in Brazil's lower house on Tuesday approved the 2022 budget, sending it to the Senate. The upper house is also expected to vote on the bill on Tuesday, which foresees 4.9 billion reais ($853 million) in electoral funding ahead of next year's presidential vote. (RTRS)

BRAZIL: Brazil's National Energy Policy Council (CNPE) has decided that state-controlled power firm Eletrobras will have to pay the government 67 billion reais ($11.66 billion) to continue operating its hydroelectric dams after its privatization, the company said on Tuesday. The privatization of Centrais Eletricas Brasileiras SA, as the company is formally known, is expected to occur by mid-2022. Initially, the government had estimated the value at 62.47 billion reais. (RTRS)

RUSSIA: U.S. officials are considering tough export control measures to disrupt Russia’s economy should Russian President Vladmir Putin invade Ukraine, a Biden administration official told Reuters. The measures, to be discussed in a meeting of senior officials on Tuesday, would be in addition to economic sanctions the Biden administration is contemplating should Russia invade, after massing tens of thousands of troops along the Ukrainian border. U.S. President Joe Biden has threatened devastating actions against Russia, to try to warn Putin off any possible military incursion. Putin has denied that Russia plans an invasion. (RTRS)

RUSSIA: Secretary of State Antony Blinken said the U.S. expects to hold talks with Russia next month to try to defuse tensions over the country’s military buildup near Ukraine as Russian President Vladimir Putin hardened his rhetoric toward the West. Mr. Blinken, in remarks Tuesday, appealed to Moscow to de-escalate its military presence near Ukraine to establish a productive setting for the proposed January discussions. Washington is proposing to hold those talks directly with Russia and through parallel discussions that involve the North Atlantic Treaty Organization and the Organization for Security and Cooperation in Europe. “I think you will see relatively early in the new year engagements in all of those areas,” Mr. Blinken told reporters at the State Department. “We also want to see Russia de-escalate, to move forces back from the border with Ukraine, to take down the tension.” (WSJ)

IRAN: The time left to revive the 2015 nuclear deal with Iran is running out and raising the risk of an "escalating crisis," the United States Special Envoy for Iran, Rob Malley, told CNN's Becky Anderson on Tuesday. "At some point in the not-so-distant future, we will have to conclude that the JCPOA is no more, and we'd have to negotiate a wholly new different deal, and of course we'd go through a period of escalating crisis," Malley, who is indirectly negotiating with Iran a return to the Joint Comprehensive Plan of Action, the formal name for the agreement. (CNN)

CHINA

ECONOMY: China must actively increase effective investments and implement supports for industries to keep a stable economy and counter slowing demand, Xinhua News Agency reported citing Vice Chairman Ning Jizhe of the National Development and Reform Commission. China will continue with proactive fiscal measures coupled with monetary policies to effectively carry out investments as well as unveil new strategies boosting internal demand, said Ning. China will stabilize consumer prices by ensuring supplies of food and energy, and it will promote the sales of new-energy vehicles, green appliances as well as service consumption, said Ning. (MNI)

ECONOMY: China is revising its accounting method of the country's gross domestic product (GDP) to better reflect the conditions of the national economy and proportional relationships, the Securities Times said citing a release by the National Bureau of Statistics on Tuesday. The bureau's plan is in line with China's development goals under the 14th Five-Year Plan. (MNI)

CREDIT: China’s RiseSun Real Estate Development Co. said most creditors have given a positive response so far to its offer to swap two dollar bonds, as the cash-strapped developer seeks more time to repay debt. A majority of holders have provided verbal consent to its proposal to exchange the bonds maturing next year for new notes with longer durations, RiseSun said in response to questions from Bloomberg, without giving specific figures. Investors holding less than 10% of the notes have indicated opposition to the plan, the company said. (BBG)

BONDS: A Chinese regulator has tightened rules regarding use of messaging tools in the nation’s local bond and derivative markets, clamping down on anonymous accounts following similar moves globally in recent years. Institutions must use an instant messaging tool that requires real-name authentication and stores a record of their trading of bonds and derivatives in the interbank market, the National Association of Financial Market Institutional Investors said in a notice. The interbank market is the country’s dominant one and hosts corporate papers issued by the largest state-run firms as well as short- and medium-term company notes. (BBG)

OVERNIGHT DATA

AUSTRALIA NOV WESTPAC LEADING INDEX +0.12% M/M; OCT +0.27%

The six-month annualised growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, rose to –0.2% in November from–0.5% in October. The Index growth rate has been in negative territory for three consecutive months, partly reflecting the lockdowns in NSW and Victoria, but only marginally below zero compared to the deeply negative reads seen during the last year’s COVID shock. Moreover, reopening rebounds should eventually lift growth back above trend. There is considerable uncertainty around the growth outlook for the next few years. Westpac looks to strong employment and household income growth and an accumulated ‘war chest’ of over $200 billion in excess household savings to boost household spending by up to 9% in 2022. This boost may now be delayed by the arrival of the Omicron variant, but our base case is that it will not be derailed. For full financial years this has GDP growth of 3.6% in 2021/22 followed by 5.6% in 2022/23. (Westpac)

NEW ZEALAND DEC ANZ CONSUMER CONFIDENCE INDEX 98.3; NOV 96.6

The ANZ-Roy Morgan Consumer Confidence Index lifted 1 point to 98 in December, remaining well under its long-term average of just shy of 120. But on the plus side, the decline since the middle of the year has been arrested, with the index very stable over the past three months. (ANZ)

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY10 billion via 14-day reverse repo with the rate unchanged at 2.2% and 2.35% respectively on Wednesday. This operation has injected net CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0656% at 09:44 am local time from the close of 2.0449% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday vs 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3703 WEDS VS 6.3729 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3703 on Wednesday, compared with 6.3729 set on Tuesday.

MARKETS

SNAPSHOT: Headline Watching Ahead Of Christmas

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 44.62 points at 28562.21

- ASX 200 up 9.753 points at 7364.8

- Shanghai Comp. up 1.119 points at 3626.323

- JGB 10-Yr future down 19 ticks at 151.89, yield up 0.9bp at 0.061%

- Aussie 10-Yr future up 1.5 ticks at 98.360, yield down 1.5bp at 1.584%

- U.S. 10-Yr future up 0-06 at 130-24, yield down 0bp at 1.4617%

- WTI crude up $0.12 at $71.25, Gold down $1.56 at $1787.88

- USD/JPY up 3 pips at Y114.13

- BIDEN: "SEN. MANCHIN AND I ARE GOING TO GET SOMETHING DONE" (AXIOS)

- UK PM JOHNSON: NO NEW RESTRICTIONS IN ENGLAND BEFORE CHRISTMAS (BBC)

- UK REDUCES COVID-19 SELF-ISOLATION TO 7 DAYS FOR MOST IN ENGLAND (RTRS)

- GERMANY IMPOSES TIGHTER CURBS AS NATION BRACES FOR OMICRON (BBG)

- OXFORD & ASTRAZENECA LAUNCH WORK ON OMICRON-TARGETED VACCINE (FT)

- TURKISH CENTRAL BANK TO SUPPORT FX DEPOSIT CONVERSION TO LIRA DEPOSITS (RTRS)

BONDS: Collateral Shortage Impacts AU Bonds, Tsys Fade From Best Levels

The early Asia Tsy bid has faded, leaving TYH2 +0-06 at 130-24, with cash Tsys dealing 0.5bp richer to 1.0bp cheaper across the major benchmarks, as the curve comes under some light twist steepening pressure. Headline flow remains light, Asia-Pac cash traders have seemingly been willing to sell into the late NY/early Asia 20-Year Tsy auction-inspired strength.

- In Australia, YM & XM finished at best levels, +7.5 & +1.5 respectively. The well-documented collateral shortage is seemingly impacting price action in YM as markets thin out ahead of Christmas, with the early twist steepening giving way to bull steepening. Some spill over from the U.S. Tsy space likely provided the initial impetus for the bid.

- JGB futures nudged higher at the Tokyo re-open, given the recovery from NY lows in U.S. Tsys, before pressure came back in as core fixed income markets softened. This pushed JGB futures below their overnight trough, hitting closing bell -18, a little above worst levels, while cash JGBs sit little changed to 1.5bp cheaper, with the belly leading the weakness, mimicking Tuesday’s developments on the U.S. Tsy curve and reflecting a bit of a futures driven move. Local headline flow has been modest, with stale minutes from the BoJ’s October meeting and familiar speculation re: the government’s GDP exp. & FY22 budget proposals doing the rounds.

EQUITIES: Equities Little Changed

The major Asia-Pac regional equity indices sit flat to marginally higher at typing, aided by the positive lead from Wall St. Regional COVID worry e.g. further limitations surrounding entry to Singapore, have perhaps limited follow through after Tuesday’s Wall St. bid, with broader macro headline flow modest at best. U.S. e-minis are flat to a touch lower.

GOLD: Flat In Asia

Spot gold is flat, hovering around $1,790/oz at typing. Our weighted U.S. real yield monitor topped out ahead of Tuesday’s U.S. 20-Year Tsy auction, which allowed gold to form a base. The well received round of Tsy supply then allowed gold to nudge away from session lows. Note that spot traded in a ~$1,785-$1,800/oz range on Tuesday, with familiar technical parameters remaining untouched throughout. Thursday’s U.S. PCE release headlines the docket during the remainder of the week and may provide some impetus for bullion dealers.

OIL: Incrementally Higher In Asia

WTI & Brent crude futures sit ~$0.30 & ~$0.20 above their respective settlement levels at typing.

- This comes after the weekly API inventory estimates revealed a slightly deeper than expected drawdown in headline crude stocks, accompanied by a larger than expected build in gasoline stocks, a modest, surprise drawdown in distillate stocks and a build in stocks at the Cushing hub. The net immediate impact of the release was a very modest downtick for crude.

- A reminder, this comes after a turnaround Tuesday, in terms of risk appetite, which allowed the two benchmarks to add ~$2.50 come settlement time.

- Weekly DoE inventory data out of the U.S headlines on Wednesday.

FOREX: Antipodeans Bring Up The Rear In Asia

Participants continue to headline watch ahead of the Christmas break. There hasn’t been much in the way of notable news flow to decipher since Asia-Pac trade got underway, outside of Singapore tightening international access over the next month or so. The city state has noted that it will freeze all new ticket sales for flights and buses under its programme for quarantine-free travel.

- NZD & AUD have ticked downwards (AUD/USD & NZD/USD are ~20 pips lower on the day), with S&P 500 & NASDAQ 100 e-minis a touch lower on the session. Note that e-minis are off worst levels (which were printed ahead of the Singapore travel headlines), while AUD & NZD already traded lower pre-Singapore news, so we can’t really suggest that the headlines were a driver of the aforementioned moves.

- USD/JPY has traded either side of Y114.00, last +5 pips or so on the day, printing Y114.15. Note the rate was capped on Tuesday as long end U.S. Tsy yields topped out on the back of a well-received round of 20-Year U.S. Tsy supply, with subsequent spill over observed in early Asia dealing, before modest weakness crept back into Tsys, supporting the cross. The Dec 15 high (Y114.26) continues to present the initial technical resistance level, with the 61.8% & 76.4% retracements of the Nov 24-30 downleg (Y114.38 & Y114.81) layered in above there. Initial support comes in at the Dec 17 low (Y113.14). Our technical analyst notes that a break of the aforementioned Dec 15 high would allay developing bearish concerns. Wednesday’s Asia-Pac session is bereft of any notable tier 1 data release, which will leave headline flow at the fore.

- The USD is marginally firmer vs. the remainder of its G10 peers.

- There aren’t any tier 1 risk events on the broader docket on Wednesday.

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1190-05(E1.0bln), $1.1245-50(E939mln), $1.1280-00(E891mln), $1.1335-50(E1.3bln)

- GBP/USD: $1.3245(Gbp659mln), $1.3265-90(Gbp1.1bln)

- USD/JPY: Y113.00($638mln), Y113.45-50($870mln), Y113.70-85($711mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2021 | 0700/0700 | * |  | UK | Quarterly Current Account Balance |

| 22/12/2021 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 22/12/2021 | 0700/1500 | ** |  | CN | MNI China Liquidity Survey |

| 22/12/2021 | 0745/0845 | ** |  | FR | PPI |

| 22/12/2021 | 0800/0900 | ** |  | ES | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | PPI |

| 22/12/2021 | 0830/0930 | ** |  | SE | Retail Sales |

| 22/12/2021 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/12/2021 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2021 | 1500/1000 | *** |  | US | NAR Existing Home Sales |

| 22/12/2021 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/12/2021 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/12/2021 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.