-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: North American Data Eyed

EXECUTIVE SUMMARY

- OMICRON HOSPITALIZATION RISK BELOW DELTA’S IN EARLY STUDIES (BBG)

- FDA AUTHORIZES PFIZER’S COVID TREATMENT PILL, THE FIRST ORAL ANTIVIRAL DRUG CLEARED DURING THE PANDEMIC (CNBC)

- DUP TO PRESSURE LIZ TRUSS TO TRIGGER 'NUCLEAR OPTION' IN BREXIT NEGOTIATIONS (TELEGRAPH)

- PBOC TO MAINTAIN AMPLE LIQUIDITY THROUGH EARLY 2022 (CSJ)

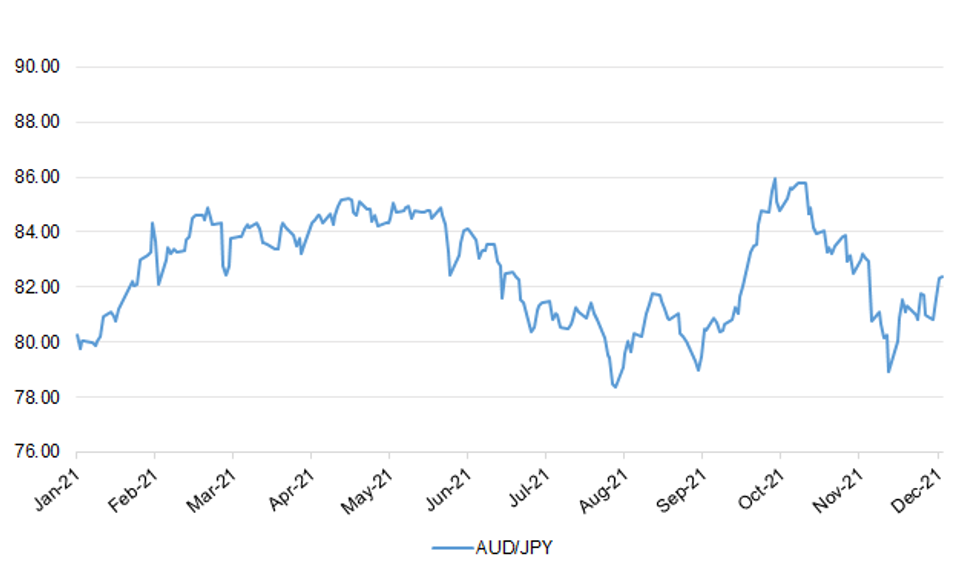

Fig. 1: AUD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain is considering the rollout of a fourth round of vaccinations against Covid-19 after both Israel and Germany gave the green light to a second set of boosters. Experts on the Joint Committee on Vaccination and Immunisation (JCVI) will examine evidence on levels of immunity given by three jabs as well as data on hospitalisations for the new omicron variant before making any decision on a fourth. In a further development, the JCVI said it required more real-world evidence before recommending the mass vaccination of children as young as five. The committee found that a million doses among five to 11-year-olds would prevent only two healthy children from requiring intensive care. (Telegraph)

CORONAVIRUS: Britain should not be subjected to further Covid restrictions, senior Government sources said on Wednesday night after the first UK real-world data revealed that people infected with omicron are up to two thirds less likely to end up in hospital. (Telegraph)

BREXIT: The Democratic Unionist Party will heap pressure on Liz Truss to trigger Article 16 of the Northern Ireland Protocol in the new year, The Telegraph can reveal. The move would risk a trade war with Brussels and the Government has recently dialled down its rhetoric over the so-called “nuclear option” of unilaterally overriding parts of the protocol. DUP sources said the move was necessary ahead of Stormont elections next year, which are likely to be dominated by the dispute over the protocol and the Irish Sea border. Sir Jeffrey Donaldson, the DUP leader, has repeatedly threatened to collapse the Stormont Assembly unless the protocol is significantly overhauled in ongoing talks. (Telegraph)

ECONOMY: Uncertainty caused by the emergence of Omicron is already weighing heavy on the economy, the latest figures from the CBI show. Its survey of 516 firms between November 22 and December 14 produces an index score of just +21, down from +32 last month. That’s the slowest rate of growth since last April, and indicates that the economy is slowing. The slowdown coincided with the introduction by the government of Plan B measures to curb the spread of Omicron. On Wednesday, official figures from the ONS showed the economy was slowing even before the impact of Omicron was felt. GDP for the quarter to September was rising at just 1.1%, lower than previous estimates. (Evening Standard)

ECONOMY: UK car production in November hit its lowest level since 1984 as Covid continued to affect supply chains, a motoring industry group has said. Output fell by 28.7% to 75,756 units, marking the fifth consecutive month of decline, the Society of Motor Manufacturers and Traders (SMMT) said. It called the figures "incredibly worrying", blaming a continuing shortage of semiconductors. The start of full Brexit customs controls could also hit firms, it said. The UK has been short of semiconductors - which are commonly used components in cars - for the past year. Under Covid restrictions, Asian factories have struggled to keep up with demand as economies have reopened. SMMT boss Mike Hawes said the problem was "likely to affect the sector throughout next year", and called for more government support. (BBC)

POLITICS: Liz Truss has "gone too early" in her bid for the Conservative Party leadership, insiders said after Downing Street accused her of using her position on Covid regulations to woo Tory backbenchers. (Telegraph)

EUROPE

ECB: The European Central Bank sees euro-area inflation slowing in the course of next year and settling below the 2% target in 2023 and 2024, President Christine Lagarde says in video message. “So more work on that, and we will do it, and we stand ready to act one way or the other.” Successful vaccination campaigns have allowed recovery to take hold, and “the outlook for economic growth looks strong over the coming years.” Seeing some headwinds including energy prices, supply bottlenecks -- factors that are pushing up inflation. (BBG)

GERMANY: Bundesbank Vice President Claudia Buch warned of “increasing vulnerabilities” in the financial system and said she’s concerned banks may be too focused on profit, according to Handelsblatt. Buch said the system could “come under stress again” if market interest rates rise abruptly and called for the “countercyclical capital buffer” to be rebuilt as a precaution. “This conserves existing capital so that it can be used in the event of a crisis,” Buch said in an interview with Germany’s Handelsblatt newspaper. “Because at the moment we are seeing increasing vulnerabilities and a declining risk awareness in the financial system,” she added. (BBG)

SPAIN: Spain will reintroduce compulsory use of masks outdoors. The decision was announced in a meeting by Prime Minsiter Pedro Sanchez in a meeting with the leaders of the country’s leaders Wednesday, and will first need approval by the government’s Cabinet, a formality. The government has also said it will assign members of the armed forces to vaccination tasks, as it seeks to massively roll out third jabs. (BBG)

SPAIN: Spanish Prime Minister Pedro Sanchez said his government won’t impose lockdowns used at the start of the pandemic to curb the surge in coronavirus cases. “We fear returning to that situation of March 2020, but the situation today is different, and therefore we will not apply the same measures,” Sanchez said in a briefing after meeting the leaders of regional governments. March 2020, the government declared a state of alarm, imposing tough movement curbs nationwide. (BBG)

BELGIUM: Belgium stopped short of a new nationwide lockdown as it imposed sweeping curbs including bans on fans at sports games to halt the rapid spread of the omicron variant of Covid-19. New measures will take effect from Dec. 26, including the cancellation of most indoor cultural events, such as movies and plays. Some venues will remain open, including fitness centers and museums, according to Wednesday’s decision. “We’re not going into a lockdown,” Minister of Health and Social Affairs Minister Frank Vandenbroucke told reporters in Brussels on Wednesday. “We’re taking these measures precisely because we want to prevent that lockdown.” Countries across Europe are introducing new measures to combat the advance of the omicron variant, which is now about 30% of cases in Belgium. (BBG)

U.S.

FISCAL: Conversations with Senator Joe Manchin's office will continue, the White House said on Wednesday after the key conservative Democrat earlier this week rejected the president's Build Back Better plan. "We believe that Senator Manchin has been engaging with us over the course of time and months in good faith," spokeswoman Jen Psaki told reporters. "There will be more negotiations, no doubt about it. Everybody stay tuned and settle in." Psaki said there was still broad agreement among President Joe Biden and his fellow Democrats to enact the legislation targeting social benefits and climate change. (RTRS)

FISCAL: Amid concerns about the new omicron variant of the Covid-19 virus, the Biden administration will extend the payment pause for federal student loan borrowers until May 1. “We know that millions of student loan borrowers are still coping with the impacts of the pandemic and need some more time before resuming payments,” President Joe Biden said in a statement on Wednesday. (CNBC)

CORONAVIRUS: The Food and Drug Administration granted emergency authorization Wednesday to Pfizer’s Covid treatment pill, a major milestone that promises to revolutionize the fight against the virus. The medication, which is recommended for people at a high risk of developing severe Covid-19, could be available to patients as early as this weekend. Pfizer CEO Albert Bourla told CNBC earlier this month the company has already shipped some of the pills to the U.S. so they can be prescribed as soon as the FDA authorization comes through. The Centers for Disease Control and Prevention is expected to quickly follow suit with its seal of approval, authorizing its distribution. (CNBC)

CORONAVIRUS: Top U.S. infectious disease expert Anthony Fauci said on Wednesday that attending large gatherings of over 40 people is not considered safe for vaccinated people, even those who got a booster dose. (RTRS)

CORONAVIRUS: Rather than close classrooms as omicron infections surge, California will provide one or two rapid coronavirus tests for every public school student returning from winter break, Governor Gavin Newsom said Wednesday. California also will extend hours at state-run testing facilities and require booster shots for health-care workers to stem rising infections. (BBG)

CORONAVIRUS: The Supreme Court late Wednesday agreed to hear legal challenges to the Biden administration’s mandates that employees of large companies and health-care workers be vaccinated against Covid-19. The court, in an order, said that its consideration for requests to stay those mandates would be deferred until oral argument on Jan. 7. There are two separate cases asking for such a stay. The Supreme Court consolidated the applications of those cases, both of which will be heard on Jan. 7. (CNBC)

CORONAVIRUS/POLITICS: President Joe Biden received a negative coronavirus test result on Wednesday, days after he was exposed to a staffer who later test positive for the virus. Biden came in close contact Friday with a “mid-level staffer” who later tested positive on Monday morning. The aide spent about 30 minutes near the president on Air Force One on the way from South Carolina to Philadelphia, White House press secretary Jen Psaki said on Monday. (CNBC)

OTHER

CORONAVIRUS: The omicron variant of Covid-19 may be less likely to land patients in the hospital than the delta strain, according to a trio of studies of preliminary data. Researchers in Scotland suggest omicron is associated with a two-thirds reduction in the risk of hospitalization when compared with the earlier variant, though omicron was 10 times more likely than delta to infect people who’d already had Covid. An Imperial College London team working with a larger set of data from England found that people with omicron were 15% to 20% less likely to visit the hospital and 40% to 45% less likely to require an overnight stay. The fresh data add to earlier findings Wednesday showing that South Africans contracting Covid-19 are 80% less likely to be hospitalized if they catch the new variant, compared with other strains. Omicron infections are also associated with a 70% lower risk of severe disease than delta, the study by the National Institute for Communicable Diseases showed. Although preliminary, the body of research could provide reassurance that omicron may be substantially less likely to result in severe outcomes than delta, at least in places where large numbers of people already have some immunity. (BBG)

CORONAVIRUS: Novavax Inc's COVID-19 vaccine is effective in generating an immune response against the Omicron variant, and an additional booster dose produces further immune resistance to the new variant, according to early data published on Wednesday. Novavax said the data was taken from its ongoing studies of its vaccine's effectiveness in adolescents and as a booster. Novavax's two-dose, protein-based vaccine was authorized for use this week by European Union regulators and the World Health Organization. It has previously been approved by countries including Indonesia and the Philippines but not the United States. Novavax is working on developing an Omicron-specific vaccine and said Wednesday it expects to begin manufacturing doses of the variant-specific shot in January. (RTRS)

JAPAN: MNI: Japan Cabinet Sees Record GDP Growth Of 3.2% In FY22

- Japan's economy could expand at a record 3.2% pace next fiscal year, the Cabinet Office forecast on Thursday, as the Liberal Democratic Party led by Prime Minister Fumio Kishida gears up for the biggest budget in history that includes a massive stimulus package and recovers from pandemic lockdowns - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japan is set to unveil another record annual budget this week as Prime Minister Fumio Kishida adds to the world’s heaviest debt load with more spending ahead of an election next summer. The budget for the year starting in April will increase to around 107.6 trillion yen ($943 billion), according to documents obtained by Bloomberg Thursday that confirm earlier reports. The number represents a 0.9% rise from the current year’s initial spending plan, though final expenditure is typically inflated by extra budgets as the year goes on. Tax income is expected to rise to a record 65.2 trillion yen, enabling the issuance of new bonds to be limited to 36.9 trillion yen, the documents show. The current fiscal year’s initial budget required issuances of 43.6 trillion yen. (BBG)

BOJ: A weak yen may be hurting Japan's household income more than before, by pushing up the cost of living, central bank chief Haruhiko Kuroda said on Thursday. Overall the weak currency continues to help boost economic growth, however, Kuroda, the governor of the Bank of Japan, added in a speech. "For Japan, the benefits of a yen decline generally exceed the costs," he said. (RTRS)

JGBS: Japan plans to issue 4.2 trillion yen ($37 billion) of 40-year government bonds in the new fiscal year, two sources with direct knowledge of the matter said, a 17% increase that comes even as the government plans to cut its bond issuance overall. It marks a third straight year of increases in issuance of the 40-year bonds, which are closely watched by the market, and reflects solid demand from life insurers at the long end of the yield curve, said the sources. Prime Minister Fumio Kishida's inaugural debt issuance plan will see overall calendar-based sales of Japanese Government Bonds (JGBs) at around 200 trillion yen, or down about 20 trillion yen from this year, the sources said, reflecting the new premier's push to keep a lid on debt. The sources declined to be identified because the information has not been made public. The finance ministry declined to comment. The increase in the 40-year bonds would mean sales of around 700 billion yen at auctions every other month, from auctions of 600 billion yen now, the sources said. While increasing the issuance of 40-year bonds, the government also ditched an idea that it had been considering of issuing the super-long bonds every month, the sources said. To reduce the cost of rolling over debt, issuance of Treasury discount bills will be trimmed in the next fiscal year by more than 10 trillion yen, the sources said. Details of the plan for debt issuance have not been previously reported. The government will keep issuance steady of five-year, 20-year, 30-year and inflation-linked 10-year bonds, the sources said. The government also plans to boost liquidity-enhancing auctions by 600 billion yen in the next fiscal year, the sources said. In liquidity enhancing auctions, the Ministry of Finance issues additional amounts of existing JGBs to improve liquidity. (RTRS)

AUSTRALIA: A mask mandate for indoor public settings will be reintroduced from midnight tonight along with new density limits in venues, NSW Premier Dominic Perrottet announced. From midnight tonight, mask-wearing will be mandatory in indoor public settings across the state. Density limits in hospitality venues will be reintroduced from December 27, with one person per two square metres allowed in indoor hospitality sites. (9 News)

SOUTH KOREA: South Korea's central bank said on Thursday it would join the U.S. Federal Reserve's repurchase agreement facility for foreign and international monetary authorities in a pre-emptive move aimed at boosting its access to dollar liquidity when needed. (RTRS)

BOK: South Korea’s financial systems have stabilized since 1H, but rising house prices and high level of household debt remain vulnerable factors, bringing up the need to uphold corresponding policies, the Bank of Korea says in a report on financial stability. (BBG)

CANADA: Quebec expects its daily Covid infections tally to jump 40% in just 24 hours, confirming its status as Canada’s virus hot spot once again as it multiplies measures to slow down hospitalizations. Premier Francois Legault said indoor gatherings at homes and restaurants will be limited to six people starting Sunday, the latest addition to a string of restrictions announced over the past week. A report on daily infections Thursday should probably show about 9,000 new cases, up from 6,361, he said. “Our goal remains the same, to protect our hospitals so that we can continue to treat all those who need it,” Legault said during a news conference. “We believe that the measures in place will keep the situation under control, but if we think that we need to do more, we won’t hesitate to do it.” Legault is trying to salvage Christmas in a province that this year followed some of the toughest rules in North America, including a months-long curfew. (BBG)

CANADA: Canada will temporarily expand support programs to help people whose livelihoods are being hit by the Omicron variant of COVID-19, Prime Minister Justin Trudeau said on Wednesday. "We are adapting our measures to make sure that no one is left behind," Trudeau told a televised briefing. Ottawa said in October it would wind down many supports in late October, citing the recovering economy and the success of vaccination efforts. (RTRS)

RUSSIA: Russia hopes the Baltic Sea Nord Stream 2 gas pipeline, which was completed in September but remains idle, will eventually be certified, Kremlin spokesman Dmitry Peskov said on Wednesday. Peskov also said that the Nord Stream 2 operating company was ready to comply with all requirements from the regulators and that its certification should not be politicized. Nord Stream 2 is awaiting regulatory clearance from Germany. (RTRS)

IRAN: Four senior Israeli officials who attended meetings in Jerusalem with national security adviser Jake Sullivan tell me they came away reassured that the U.S. is ready to take a harder line on Iran if necessary and to take Israel’s views into account. (Axios)

IRAN: The United States and its partners are discussing time frames for nuclear diplomacy with Iran, U.S. National Security Adviser Jake Sullivan said on Wednesday, adding that current efforts to achieve a new nuclear deal may be exhausted within weeks. "We're not circling a date on the calendar in public, but I can tell you that behind closed doors we are talking about time frames and they are not long," he told reporters during a visit to Israel. Asked to elaborate on the time frame, Sullivan said: "Weeks." (RTRS)

METALS: Peruvian community protesters who have blocked a key transport road used by MMG Ltd's Las Bambas copper mine will clear the route until at least Dec. 30 following talks with the government, an adviser to the group told Reuters on Wednesday. (RTRS)

ENERGY: Russian gas giant Gazprom has not booked gas transit capacity for exports via the Yamal-Europe pipeline for Dec. 23, auction results showed on Thursday. Gas via the Yamal-Europe pipeline to Germany continued to flow in reverse mode for a second day on Wednesday, data from German network operator Gascade showed, keeping European gas prices high. (RTRS)

ENERGY: Cold-stricken Europe is drawing a flotilla of U.S. liquefied natural gas cargoes amid an energy crisis that has sent gas prices to record levels. Facing a winter shortage and little relief from the continent’s main supplier Russia, natural gas in Northwest Europe is trading for about $57.54 per million British thermal units, up almost a third from a week earlier. That’s roughly $24 higher than Asian prices and more than 14 times higher than gas being sold on U.S. benchmark Henry Hub. (BBG)

OIL: South Korea will release 3.17 million barrels of crude and oil products from its strategic stockpiles from January to March as part of a joint effort with the U.S. and other major consumers to rein in higher prices. The nation will release 2.08 million of crude to South Korean refiners and 1.09 million barrels of oil products will be released via auctions, the nation’s energy ministry said in a statement on Thursday. The decision comes as the price of fuels such as gasoline soar in the U.S., and major oil importing nations grapple with rising inflation. The U.S. began lobbying Asian consumers to tap their reserves after OPEC+ rebuffed requests to return supply to the market more quickly. (BBG)

CHINA

PBOC: The People’s Bank of China may cut the medium-term lending facility rate in Q2 next year to guide a further reduction of the benchmark Loan Prime Rate, the China Securities Journal reported citing Liu Yu, chief fixed income analyst of GF Securities. The 5bps cut to LPR on Monday means a lower possibility for a further policy rate cut soon, as the central bank observes whether financing costs for the real economy are effectively reduced and demand is stabilised, the Journal said citing analysts. Liquidity conditions should be worry-free across the year as the PBOC has added 14-day reverse repos this week and about one trillion yuan of fiscal funds is expected to be released by the end of December, the newspaper said citing analysts. (MNI)

ECONOMY: China should focus on the growing income gap to expand domestic demand and stabilise economic growth, said Yicai.com in an editorial. The epidemic has exacerbated income divergence as retail sales growth lags, while spending by the wealthy on luxury cars and expensive homes rose against the trend, the newspaper said. It is necessary to reduce the value-added tax of consumer goods paid by low- and middle-income groups and strengthen tax inspections on practitioners of Internet businesses to regulate excessively high incomes, the newspaper said. It is also important to boost credit, financing, and tax support for SMEs to safeguard the employment of lower income groups and guide companies to optimise employee incomes through equity incentives, the newspaper said. (MNI)

POLICY: China is accelerating an upgrade to high-end industries while steadily advancing a low-carbon transformation, focusing on seven key areas including new energy, new materials, new energy vehicles, green smart shipment, environmental protection, high-end equipment, and energy electronics, the Economic Information Daily reported. Governments from ministerial to local levels are arranging policy and funding support and the output value of these related industries will reach CNY11 trillion by 2025, the newspaper said. It is also necessary to avoid repetitive low-level construction projects, and some provinces should suspend project planning in time, the newspaper said citing Mao Tao, an official from the Ministry of Industry and Information Technology. (MNI)

OVERNIGHT DATA

JAPAN OCT, F LEADING INDEX CI 101.5; PRELIM 102.1

JAPAN OCT, F COINCIDENT INDEX 89.8; PRELIM 89.9

AUSTRALIA NOV PRIVATE SECTOR CREDIT +0.9% M/M; MEDIAN +0.5%; OCT +0.5%

AUSTRALIA NOV PRIVATE SECTOR CREDIT +6.6% Y/Y; OCT +5.7%

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY10 billion via 14-day reverse repo with the rate unchanged at 2.2% and 2.35% respectively on Thursday. This operation has injected net CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1666% at 09:38 am local time from the close of 1.9617% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 47 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3651 THURS VS 6.3703 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3651 on Thursday, compared with 6.3703 set on Wednesday.

MARKETS

SNAPSHOT: North American Data Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 208.82 points at 28770.71

- ASX 200 up 22.834 points at 7387.6

- Shanghai Comp. up 3.135 points at 3625.753

- JGB 10-Yr future down 3 ticks at 151.87, yield down 0bp at 0.061%

- Aussie 10-Yr future down 0.5 tick at 98.355, yield up 0.7bp at 1.591%

- U.S. 10-Yr future up 0-00+ at 130-24, yield up 0.51bp at 1.4566%

- WTI crude up $0.21 at $72.97, Gold up $2.53 at $1806.2

- USD/JPY up 8 pips at Y114.18

- OMICRON HOSPITALIZATION RISK BELOW DELTA’S IN EARLY STUDIES (BBG)

- FDA AUTHORIZES PFIZER’S COVID TREATMENT PILL, THE FIRST ORAL ANTIVIRAL DRUG CLEARED DURING THE PANDEMIC (CNBC)

- DUP TO PRESSURE LIZ TRUSS TO TRIGGER 'NUCLEAR OPTION' IN BREXIT NEGOTIATIONS (TELEGRAPH)

- PBOC TO MAINTAIN AMPLE LIQUIDITY THROUGH EARLY 2022 (CSJ)

BONDS: Core FI Little Changed Overnight

Participants are understandably unwilling to take on risk ahead of Thursday’s U.S. data releases and the Christmas break, with limited headline flow also noted, resulting in limited ranges and volume when it came to Tsy trade in Asia. TYH2 last unch. at 130-23+, operating in a 0-02+ range on ~28K lots, while cash Tsys are ~0.5bp cheaper across the curve. U.S. hours will see the release of the PCE suite, durable goods data, weekly jobless claims, existing home sales and final UoM sentiment readings.

- RTRS sources noted that “Japan plans to issue Y4.2tn of 40-Year JGBS, a 17% increase that comes even as the government plans to cut its bond issuance overall.” The sources noted that the move reflects “solid demand from life insurers at the long end of the yield curve.” The report notes that the increased issuance of 40-Year paper will come via a Y100bn uptick in auction size on a bi-monthly basis, as opposed to more frequent issuance. Elsewhere, the piece pointed to an uptick in 10-Year issuance and a reduction in 2-Year supply. The piece suggested that total JGB issuance for the next FY will be somewhere in the region of Y200tn, down ~Y20tn vs. the current FY. There will also be a modest uptick (~Y600bn) in liquidity enhancement auctions during the next FY. That dynamic, coupled with a soft cover ratio at the latest liquidity enhancement auction covering 15.5- to 39-Year JGBs, promoted some twist steepening of the cash curve, with 20+-Year yields rising by ~1bp. JGB futures showed through their Wednesday/overnight trough in early Tokyo dealing, before recovering some poise. The weakness in the longer end of the curve then applied some pressure, meaning the contract hit the bell -3.

- Aussie bonds oscillated within a tight range, with YM closing -1.0 and XM -0.5. A late, modest bid crept in as NSW confirmed that a mask mandate for indoor public venues will be reintroduced in the state as of tomorrow, along with new density limits in venues.

JAPAN: Bonds Continue To Dominate Weekly International Security Flow Data

The latest round of weekly international security flow data revealed that Japanese investors reverted to selling foreign bonds, racking up over Y1.0tn of sales for the third time in four weeks (note that the previous week saw a ~Y450bn round of net purchases). The latest week represented the largest round of net weekly sales of foreign bonds witnessed since February.

- Foreign investors lodged a third consecutive sizeable round of weekly net purchases when it came to Japanese bonds (~Y1.25tn), with the 4-week rolling sum of the measure moving to levels not witnessed since late ’18 in the process.

- Equity flows on both sides of the ledger maintained their respective trends, with the respective net weekly flows operating shy of their recent extremes.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1588.5 | 458.9 | -3645.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 247.4 | 196.2 | 1763.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1251.8 | 1157.6 | 3963.1 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -841.3 | -604.3 | -1830.9 |

EQUITIES: Equities Nudge Higher In Asia

A lacklustre round of Asia-Pac trade saw the major regional equity indices and e-minis trade flat to a touch higher (the benchmarks print unch. to +0.5% at typing), with the space aided by Wednesday’s rally on Wall St., which stemmed from positive developments when it comes to the broader fight against COVID. Still, a lack of notable headline flow and thinner pre-Christmas markets limited broader activity.

GOLD: U.S. PCE Eyed

Gold trades little changed on the day, just above $1,805/oz, after reclaiming the $1,800/oz level on Wednesday. To recap, Wednesday saw the metal draw support from a downtick in both the broader DXY & U.S. real yields. The immediate technical parameters are well defined and remain untouched. Initial resistance comes in at the Nov 26 high/near-term bull trigger ($1,815.6/oz), while support is seen at the bull channel base drawn off the Aug 9 low. U.S. PCE data provides Thursday’s major macro release.

OIL: A Touch Above Wednesday’s Settlement Levels

WTI & Brent crude futures sit ~$0.20 above their respective settlement levels, holding to sub-$0.50 ranges in Asia, with a lack of notable headline flow apparent ahead of the Christmas break.

- South Korea presented the details re: its short-term commitments under the well-documented joint strategic oil inventory release that some of the major oil consuming nations are deploying, but this had no impact on prices.

- A reminder that Wednesday saw the benchmark contracts draw support from positive news surrounding the broader omicron situation and a larger than expected drawdown in headline U.S. crude stockpiles in the weekly DoE inventory data

- The next OPEC+ meeting provides a focal point in early ’22 (scheduled for January 4).

FOREX: Tight Asia Trade Observed, North American Data Eyed

A lack of meaningful news flow & the proximity to the Christmas break combined to result in a lacklustre round of Asia-Pac trade.

- EUR sits at the top of the G10 FX table, challenging Wednesday’s high at typing, but EUR/USD is less than 15 pips higher on the day.

- USD/CNH looked through a softer than expected USD/CNY mid-point fixing.

- The major USD crosses are effectively unchanged.

- Thursday’s U.S. data dump will be headlined by the PCE suite and durable goods print, while the latest round of monthly Canadian GDP data will also cross.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/12/2021 | 0800/0900 | *** |  | ES | GDP (f) |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 23/12/2021 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 23/12/2021 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/12/2021 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 23/12/2021 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2021 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2021 | 1330/0830 | * |  | CA | Payroll Employment |

| 23/12/2021 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/12/2021 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2021 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/12/2021 | 1500/1000 | *** |  | US | New Home Sales |

| 23/12/2021 | 1500/1000 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/12/2021 | 1500/1000 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/12/2021 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/12/2021 | 2130/1630 | ** |  | US | Fed Weekly Money Supply Data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.