-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY Moves To Fresh Multi-Year Highs

EXECUTIVE SUMMARY

- WHITE HOUSE LIKELY TO NOMINATE PHILIP JEFFERSON FOR FED SEAT (BBG)

- U.S. SETS NEW GLOBAL DAILY RECORD OF OVER 1 MILLION VIRUS CASES (BBG)

- CHINA’S ZHENGZHOU SETS PARTIAL LOCKDOWN (BBG)

- CAIXIN MANUFACTURING PMI TOPS EXPECTATIONS

- CHINA EVERGRANDE RESUMES TRADE

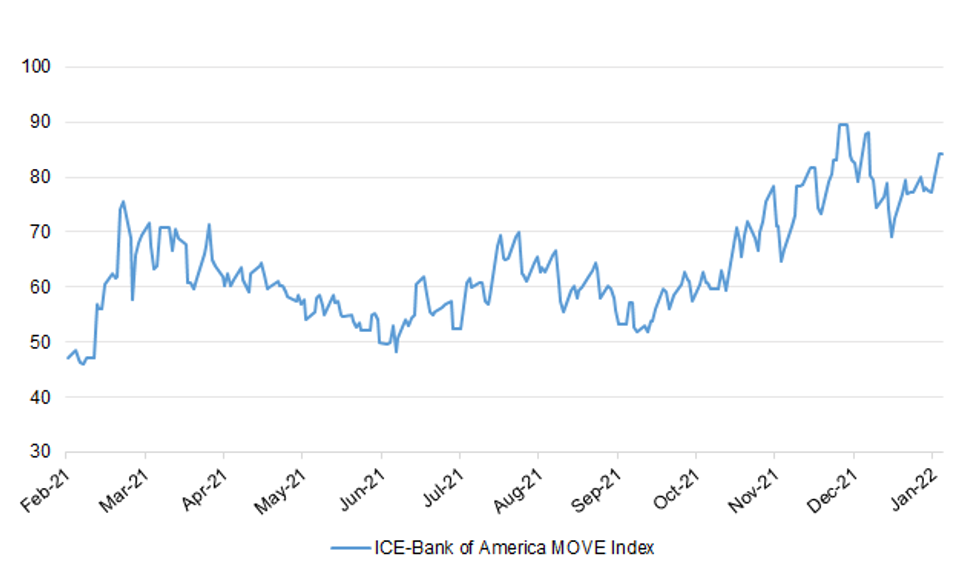

Fig. 1: ICE-Bank of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Cabinet ministers have been told to draw up plans for when sectors in their brief will need military support caused by the unprecedented level of key workers forced into self-isolation. The pace at which Omicron, albeit a milder strain of Covid-19, is spreading through the UK is threatening to wipe out more key workers than ever before during the pandemic, government sources have said. Omicron is hitting multiple regions at the same time, unlike during previous points in the pandemic when regional services under particular strain were able to rely on help from other areas of the country that were coping better, an arrangement known as mutual aid. (The Times)

ECONOMY: U.K. companies are gearing up to hire more workers to satisfy growing demands from consumers to buy products and services instantly online, a survey showed. Lloyds Bank Plc said 47% of the 600 businesses it surveyed plan to add staff in the medium term, with more than a third saying it’s a priority to develop new products and services. At least 30% expect to increase sales through the internet. The research marking the 20th anniversary of the Business Barometer survey indicates most companies think the next two decades will be more difficult than the last, weighed down by the rising cost of recruiting staff, tighter credit and Britain’s exit from the European Union. “They are gearing up for growth and expect to increase headcount, enhancing their service offering or utilizing new technologies,” Paul Gordon, a director at Lloyds for SME and mid-corporates, said in a report released Tuesday. (BBG)

ECONOMY: Economists expect UK living standards to deteriorate in 2022 as inflation and rising taxes hit poorer households, while supply-chain blockages and Brexit-related trade underperformance will limit economic growth. The Financial Times’s annual survey of nearly 100 economists revealed that most expect inflation to outpace wages, while Covid-19 will continue to disrupt production and consumption. At the same time, high energy costs and the increase in National Insurance contributions will hit those on lower incomes hardest. A majority of respondents also said that the UK’s recovery would lag behind that of comparable economies, with many of them blaming this underperformance on political instability and a lack of any credible long-term economic strategy. Although many countries are experiencing high inflation, supply-chain disruptions and labour shortages, Brexit would make these problems more severe in the UK, economists said, potentially prompting the Bank of England to raise interest rates more rapidly than other central banks. (FT)

ECONOMY: The Times annual economic survey, now in its fifth year, remains dominated by a single issue. The endless to and fro of the Brexit saga, which shaped economists’ concerns until 2020, has been replaced by a worrying jump in the cost of living. The UK heads into 2022 with a toxic cocktail of slowing growth and rising inflation after the economy’s bounce back from the peak of coronavirus restrictions last year began to falter in December. Scientists have long argued that we will have to learn to live with Covid and their predictions were proven correct by the emergence late last year of a new and more transmissible variant that threatened to suppress the gains made over the past year. (The Times)

POLITICS: Boris Johnson has been accused of failing to self-isolate last January despite coming into close contact with a Downing Street aide who tested positive. The Prime Minister recorded his official New Year message on December 31, 2020, as the nation was on the brink of a devastating second wave of Covid. No 10’s videographer, who sources claimed stood “close” to Mr Johnson during the recording, later tested positive for coronavirus. They informed Downing Street chiefs and other colleagues in the room at the time were asked to self-isolate at home for 10 days. But the PM was not among them. Just five days later, on January 4 last year, Mr Johnson announced the country would be plunged into its third national lockdown. (The Mirror)

POLITICS: Sir Keir Starmer is beginning the New Year with an ambitious speech putting patriotism at the heart of the Labour Party's strategy to win support from voters. Welcoming the Queen's Platinum Jubilee and the Commonwealth Games later this year, he claims it is not unpatriotic to criticise things that are going wrong in the country. He says it is "precisely because we are patriotic" that Labour wants to correct things like the rising cost of living, tax rises, fear of crime and difficulty getting a quick appointment with a GP. (Sky)

M&A: Ministers have greater powers to block foreign takeovers of British firms after new rules came into effect on Tuesday giving them more scope to unpick deals that have the potential to harm national security. The National Security and Investment Act, which enhances existing powers, is described by the government as the “biggest shake-up of the UK’s national security regime for 20 years”. Ministers have already been able to intervene in deals where a foreign-led takeover could affect economic stability, media plurality, the UK’s pandemic response, or national security. However, the act builds on the government’s ability to deploy the national security rationale for “calling in” a takeover. (Guardian)

EUROPE

ITALY: Italy's budget deficit was EUR3b in December, according to the Italian Treasury. (BBG)

U.S.

FED: The White House is likely to nominate economist Philip Jefferson for a seat on the Fed board of governors, according to people familiar with the matter, an appointment that would make him just the fourth Black man to hold the position in the central bank’s more than 100-year history. With a doctorate in economics from the University of Virginia, Jefferson is the vice president for academic affairs, dean of faculty and an economics professor at Davidson College in North Carolina. He has worked at the Federal Reserve twice before, serving as an economist in the board’s monetary affairs division from 1996 to 1997, and as a research assistant in the fiscal analysis section from 1983 to 1985. (BBG)

FED: Sarah Bloom Raskin has emerged as the leading candidate to be President Biden’s choice for vice chair of supervision at the Federal Reserve, with an announcement as early as this week, people familiar with the matter tell Axios' Hans Nichols. By settling on Raskin, a former deputy Treasury secretary, for the powerful bank regulator position, Biden is giving progressive senators like Elizabeth Warren (D-Mass.) a policy and personnel win on a position about which they care deeply. (Axios)

INFLATION: President Joe Biden met virtually with family farmers and ranchers on Monday to highlight his administration’s ongoing effort to support independent meat processors, and to pressure the four biggest meatpacking companies into easing prices for consumers. With meat and poultry prices leading the broader nationwide increase in the cost of groceries, the White House has spent months arguing that anti-competitive consolidation within the meatpacking industry is to blame for the soaring prices. Four companies – Tyson, JBS, Marfrig and Seaboard – control as much as 85% of the nationwide meatpacking business, according to a White House estimate. (CNBC)

CORONAVIRUS: More than 1 million people in the U.S. were diagnosed with Covid-19 on Monday as a tsunami of omicron swamps every aspect of daily American life. (BBG)

CORONAVIRUS: New York City might expand its vaccine mandates in April to require booster shots, Mayor Eric Adams said on Bloomberg TV. (BBG)

POLITICS: The attorney general, Letitia James, has subpoenaed Donald Trump Jr. and Ivanka Trump as part of a civil investigation. The New York State attorney general’s office, which last month subpoenaed Donald J. Trump as part of a civil investigation into his business practices, is also seeking to question two of his adult children as part of the inquiry. The involvement of the children, Donald Trump Jr. and Ivanka Trump, was disclosed in a court document filed on Monday as the Trump Organization sought to block lawyers for the attorney general, Letitia James, from questioning the former president and his children. The subpoenas for the former president and two of his children were served on Dec. 1, according to a person with knowledge of the matter. Eric Trump, another of Mr. Trump’s sons, was already questioned by Ms. James’s office in October 2020. (New York Times)

EQUITIES: Apple briefly hit a market cap of $3 trillion during intraday trading on Monday, before dropping back under the mark shortly afterwards. Apple broke the barrier when its share price hit $182.86. Apple rose 2.5% on Monday to close at $182.01, just missing closing the trading day at the $3 trillion mark. The milestone is mostly symbolic but it shows investors remain bullish on Apple stock and its ability to grow. At a market value of $3 trillion, Apple tripled its valuation in under four years. And analysts see plenty of room to run. (CNBC)

OTHER

GLOBAL TRADE: The largest free trade agreement Regional Comprehensive Economic Partnership (RCEP) coming into force since Jan. 1 will drive the regional GDP by 2035, as well as boost exports and imports of the region, Yicai.com reported citing a think tank affiliated with the Ministry of Commerce. The Asia-focused trade bloc covering 15 countries will see more than 90% of goods trade in the region gradually achieve zero tariffs. Among which, 57% of China’s export to Japan will immediately enjoy zero tariffs for the first time, and both sides have significantly reduced tariffs on machinery and equipment, electronic information, chemicals and textiles, which is expected to largely buoy trade, the newspaper said citing Ren Hongbin, vice-minister of commerce. (MNI)

U.S./CHINA: The U.S. allegation that China is expanding its nuclear arsenal is untrue, Fu Cong, director general of the Foreign Ministry’s arms control department, says Tuesday at a regular briefing in Beijing. (BBG)

CORONAVIRUS: A string of new studies has confirmed the silver lining of the omicron variant: Even as case numbers soar to records, the numbers of severe cases and hospitalizations have not. The data, some scientists say, signal a new, less worrying chapter of the pandemic. “We’re now in a totally different phase,” said Monica Gandhi, an immunologist at the University of California, San Francisco. “The virus is always going to be with us, but my hope is this variant causes so much immunity that it will quell the pandemic.” (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday that uncertainty in the global economy was heightening due to "fairly high" U.S. and European inflation, as well as rising Omicron coranavirus cases. But Kuroda added that he expected the global economy to recover driven by solid expansion in advanced economies. He made the remarks at a meeting with the Japanese Bankers Association, the country's banking sector lobby. (RTRS)

AUSTRALIA: National Australia Bank chief executive Ross McEwan has called on the government to open borders to fill labour shortages or risk crimping Australia’s economic recovery. A NAB business insight survey revealed about four in 10 businesses are suffering “very significant” impacts from labour shortages, with little confidence the issue will be resolved in the next 12 months. (Australian Financial Review)

BOK: South Korea's central bank chief Tuesday urged local financial institutions to brace for the possibility of growing credit risk from heavily indebted households and self-employed as the country will continue to tighten loose financial and monetary policy put in place to prop up the pandemic-hit economy. Lee Ju-yeol, governor of the Bank of Korea (BOK), made the remarks in his written New Year's greetings for the financial community, adding that such credit risk could get worse amid rising external uncertainty. "First and foremost, efforts should be made for thorough risks management," Lee said. "There is the possibility of growing credit risk mainly among some households and self-employed with excessive leverage and facing a slowdown in business in the process of normalizing loose financial measures." "With external uncertainty very high, in particular, such internal vulnerable factors could develop into a weak ring in the financial system, which warrants heightened monitoring to brace for potential danger," he added. (Yonhap)

SOUTH KOREA: Ahead of a presidential election in March, the ruling Democratic Party’s presidential candidate Lee Jae-myung called Tuesday for an extra budget of up to 30 trillion won ($25 billion) to be put together before the lunar new year holiday. (BBG)

CANADA: Ontario will delay the return to in-person school and will move to online learning, as well as close all restaurants, gyms and movie theaters due to the rapid spread of the Omicron COVID variant, Ontario's Premier Doug Ford announced on Monday. (Axios)

TURKEY: President Tayyip Erdogan said on Monday he was saddened by Turkey's 2021 annual inflation after it soared to 36.1%, adding his government was determined to lower it to single digits. Speaking after a cabinet meeting, Erdogan also said the rise in inflation was due to an increase in global commodity prices and a decline of the lira, which lost nearly 44% of its value last year. He also said authorities would inspect exorbitant price rises and announced additional support for civil servants' and pensioners' wages. (RTRS)

TURKEY: Turkish state lender Halkbank to provide loans to artisans, shopkeepers, trademen with 50% discount on interest rates, according to presidential decree published in official gazette. Turkey Treasury to compensate Halkbank’s losses from the loans. (BBG)

BRAZIL: Brazil President Jair Bolsonaro showed clinical improvement after nasogastric intubation and has no fever or abdominal pain, according to a statement from Sao Paulo’s Vila Nova Star hospital, where he is being treated. Bolsonaro took a short walk and remains in clinical treatment There is still no decision regarding the need of surgery, Vila Nova Star hospital said. (BBG)

OIL: OPEC and its allies are poised to revive more halted oil production when they meet on Tuesday after giving a tighter outlook for global markets. The 23-nation alliance led by Saudi Arabia and Russia is on track to ratify another modest output revival of 400,000 barrels a day, restoring supplies shuttered during the pandemic, delegates said. At a preliminary meeting on Monday, the group’s analysts cut estimates for the surplus expected in the first quarter, predicting weaker supply growth from its rivals. The Organization of Petroleum Exporting Countries and its partners have restarted about two-thirds of the production they halted in 2020, and are seeking to drip-feed the remainder at a pace that will satisfy the recovery in fuel consumption -- and stave off any inflationary price spike -- without sending the market into a new slump. So far they’ve succeeded, with international crude prices trading near $78 a barrel. (BBG)

OIL: OPEC's secretary general-elect said on Monday that global oil demand should return to its pre-pandemic levels by the end of 2022, Al Arabiya news channel reported. (RTRS)

CHINA

PBOC/LIQUIDITY: A wall of maturing debt and a surge in seasonal demand for cash will test China’s financial markets this month, putting pressure on the central bank to ensure sufficient liquidity. Demand for liquidity may total about 4.5 trillion yuan ($708 billion) in January, 18% more than the amount seen last year, according to calculations by Bloomberg based on official data and analysts’ estimates. An increase in the amount of policy loans coming due and demand for cash to be spent during the Lunar New Year, which takes place earlier in 2022, are drivers. A recent reduction in the reserve-requirement ratio for banks could provide relief but some market watchers predict the central bank could ease again to avoid a liquidity crunch. That comes after policy makers indicated a shift from deleveraging the economy to supporting growth. (BBG)

PBOC: Chinese banks will likely issue more new loans in the first quarter than the same period last year, China Securities Journal reports Tuesday, citing analysts. Citic Securities analyst Ming Ming estimates new loans would exceed 8.5t yuan in 1Q, compared with 7.67t yuan a year earlier. Banks could rush to lend in January after top officials urged to “front load” policy support. Lenders are also expected to maintain “steady growth” in new loans for the full year, with green financing among key areas for lending. (BBG)

FISCAL: Local governments in China are planning to kick off major projects in Q1, with 16 provinces seeking to issue over CNY550 billion new infrastructure-back special bonds in Q1, China Securities Journal reported. This compares to a total of CNY36.4 billion of new local government bonds issued same period last year. Infrastructure investment is expected to grow 6.5% y/y in 2022 to drive the economy, the newspaper said citing analysts with CITIC Securities. Local authorities will increase project reserve and halve the processing time from approval to start of construction, with investment in new energy, green buildings, pipeline networks and parking lots to increase significantly, the newspaper said.

PROPERTY: Chinese property developers will remain cautious about expanding investment in 2022, as it would take three-to-six months for investment after the RRR cuts and other easing signals for real estate financing released at end-2021, said Quanshang China, a social media outlet under the Securities Times. The total land purchase by top 100 developers dropped by 21.5% y/y in 2021, with the ratio of land purchase to sales dropping to a record low in the past five years, the newspaper said citing the China Index Academy. Developers were facing greater debt repayment and cash flow pressure since end-Q3 amid successive financial regulation, and most developers failed to acquire any land in Q4 last year, the newspaper said. (MNI)

EVERGRANDE: Indebted property developer China Evergrande’s contracted sales plunged last year as the real estate giant struggled to repay creditors. A filing Tuesday showed the company’s contracted sales of properties totaled 443.02 billion yuan ($69.22 billion) last year, down 38.7% from the 723.25 billion yuan in contracted sales reported for 2020. Evergrande said it applied for shares to resume trading in Hong Kong at 1 p.m. on Tuesday, according to the filing. Trading was halted as of 9 a.m. Monday. The company added it “will continue to actively maintain communication with creditors, strive to resolve risks and safeguard the legitimate rights and interests of all parties.” (CNBC)

KAISA: Some holders of Kaisa Group Holdings Ltd. dollar bonds said they’ve yet to receive interest payments due last week, after the Chinese developer defaulted on other obligations in December. The company owed $48.75 million of interest on Dec. 30 on an 8.5% bond due 2022 and $105.35 million on a 9.375% 2024 note. Kaisa has 30-day grace periods to make those payments, before an event of default could be declared. Two investors who hold both of those bonds said they hadn’t received the interest as of 12 p.m. Monday New York time, speaking on condition of anonymity to discuss private investments. One of the investors also holds a third dollar security that had a $17.5 million coupon due by the end of a grace period Dec. 31, and hadn’t gotten that interest payment either. (BBG)

CORONAVIRUS: Zhengzhou, capital city of central province of Henan, locked down some neighborhoods in two districts from Tuesday after two Covid infections were reported Monday. Henan reported a total of 24 local Covid infections Monday, and the province’s Yuzhou, a city of 1.3 million people, earlier this week barred people from leaving the city and put downtown districts in lockdown. (BBG)

CORONAVIRUS: China may keep its border restrictions for the rest of the year as it prepares to host the Winter Olympics and a series of political events in 2022, Goldman Sachs Group Inc. said. Reports that vaccines made by domestic firm Sinovac Biotech Ltd. offer limited protection against the omicron variant will likely reinforce China’s resolve to stick with its Covid Zero strategy, analysts led by Andrew Tilton wrote in a note Tuesday. (BBG)

EQUITIES: China's cyberspace regulator on Tuesday said it would implement rules that require any company with data for more than 1 million users to undergo a security review before listing its shares overseas from Feb. 15. It also said such firms should apply for cybersecurity reviews before submitting listing appliation to foreign securities regulators. Companies will not be allowed to list abroad if they are found by the reviews to affect national security, it said in a statement on its official WeChat account. It said in a separate statement it will also implement new rules on algorithm recommendation technology from March 1. (RTRS)

OVERNIGHT DATA

CHINA DEC CAIXIN MANUFACTURING PMI 50.9; MEDIAN 50.0; NOV 49.9

The Caixin China General Manufacturing PMI came in at 50.9 in December, up from 49.9 the previous month. The index returned to expansionary territory and reached the highest level since June. Supply was strong and demand rebounded. With the easing of supply constraints, output expanded for the second month in a row and at a faster pace. Total new orders increased, the third expansion over the past four months, as the impact of scattered Covid-19 flare-ups was under control. Overseas demand remained sluggish because of the pandemic’s impact in foreign countries and rising logistics costs due to a shortage of containers. The gauge for new export orders stayed in contractionary territory for the fifth consecutive month. Employment pressure intensified. Despite better demand and supply, firms were still cautious about hiring. The subindex of employment stayed in negative territory for the fifth consecutive month in December and hit the lowest point since February. Surveyed enterprises were not enthusiastic about filling the vacancies left by staff resignation or retirement. Inflationary pressure eased as costs rose at a slower clip. The gauge for input costs remained in expansionary territory but was lower than the previous month. Prices of some raw materials such as steel dropped considerably as government measures to ensure supply and to stabilize prices took effect. Output prices dropped for the first time since April 2020 as enterprises cut prices to promote sales. The decline in factory-gate prices of investment goods was more obvious than that of consumer goods and intermediate goods. Inventories increased slightly. With the recovery of the market, manufacturers’ purchases increased significantly compared with the previous month. Inventories of finished goods and raw materials both rose. The survey shows that some manufacturers with brisk sales began to actively replenish inventory. Entrepreneurs became less optimistic. Manufacturers remained overall upbeat on the market outlook but the gauge for future output expectations hit the lowest point since April 2020. Surveyed enterprises were worried about the negative impact of the pandemic and its shock to supply chains. To sum up, manufacturing demand and supply improved in December with easing inflationary pressure. But the job market was still under pressure and businesses were less optimistic, indicating unstable economic recovery. The repeated Covid-19 flare-ups and sluggish overseas demand were factors of instability. As policymakers said at the Central Economic Work Conference that China’s economic growth is facing triple pressures of “demand contraction, supply shock and weakening expectation,” stabilizing the economy will become the key priority of economic work in 2022. We are aware that the employment subindex under the Caixin manufacturing PMI and the official surveyed unemployment data both indicated a weakening momentum of the job market. Policymakers should focus on shoring up employment as well as on targeted support to small and midsize businesses. They should make policies more consistent, stable and predictable. (Caixin)

JAPAN DEC, F JIBUN BANK MANUFACTURING PMI 54.3; PRELIM 54.2; NOV 54.5

Latest PMI data pointed to a sustained expansion in the Japanese manufacturing sector at the end of 2021. Despite easing slightly from November, firms continued to note moderate growth in both production and new orders, with both measures reading above their respective annual averages in December. Domestic markets were buoyed by a gradual recovery from the COVID-19 pandemic however a sharp rise in cases, particularly in South Korea hindered international demand and continued to disrupt supply chains across the sector. Delivery delays and material shortages remained a dampener on production and sales, as manufacturers commented on sustained difficulty in sourcing and receiving inputs. Average lead times across the final quarter of 2021 deteriorated further compared to the previous quarter, and registered the worst quarterly performance since the survey began. Though still optimistic, Japanese goods producers were wary of the continued impact of the pandemic and supply chain disruption, which resulted in confidence dipping to the softest since August. (IHS Markit)

AUSTRALIA DEC CORELOGIC HOUSE PRICE INDEX +0.6% M/M; NOV +1.1%

AUSTRALIA DEC, F MANUFACTURING PMI 57.7; PRELIM 57.4; NOV 59.2

Some growth momentum was lost for the Australian manufacturing sector in December as the reopening boost faded and supply constraints hampered production according to panellists. While some green shoots are spotted with regards to supply constraints, such as in the form of suppliers’ delivery times lengthening at a slower rate, price pressures have continued to worsen. This invited some concerns from manufacturers in December and will be worth watching into the new year. That said, current growth momentum remains strong by historical standards and firms have maintained an optimistic view with regards to future output. IHS Markit forecasts for Australia’s GDP to expand by 2.7% in 2022. (IHS Markit)

UK DEC BRC SHOP PRICE INDEX 0.8% Y/Y; NOV +0.3%

CHINA MARKETS

PBOC NET DRAINS CNY260 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via seven-day reverse repos with the rate unchanged at 2.2% on Tuesday. This operation has drained net CNY260 billion after offsetting the maturity of CNY270 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions fell to 2.2018% at 09:37 am local time from the close of 2.2916% on Dec. 31.

- The CFETS-NEX money-market sentiment index closed at 39 on Dec. 31 vs 49 on the previous day.

PBOC SETS YUAN CENTRAL PARITY AT 6.3794 TUES VS 6.3757 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3794 on Tuesday, compared with 6.3757 set before New Year holiday.

CHINA CFETS YUAN INDEX UP 0.04% IN WEEK OF DECEMBER 31

The CFETS Weekly RMB Index was 102.47 last Friday, December 31, compared with 102.43 in the week as of December 24. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has risen 8.05% this year, when compares to 94.84 on Dec. 31, 2020.

MARKETS

SNAPSHOT: USD/JPY Moves To Fresh Multi-Year Highs

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 510.08 points at 29301.79

- ASX 200 up 145.159 points at 7589.8

- Shanghai Comp. down 2.986 points at 3636.789

- JGB 10-Yr future down 17 ticks at 151.42, yield up 1.5bp at 0.086%

- Aussie 10-Yr future down 6 ticks at 98.220, yield up 7.8bp at 1.747%

- U.S. 10-Yr future up 0-01+ at 12915+, yield down 0.18bp at 1.6262%

- WTI crude up $0.28 at $76.36, Gold up $4.05 at $1805.5

- USD/JPY up 40 pips at Y115.72

- WHITE HOUSE LIKELY TO NOMINATE PHILIP JEFFERSON FOR FED SEAT (BBG)

- U.S. SETS NEW GLOBAL DAILY RECORD OF OVER 1 MILLION VIRUS CASES (BBG)

- CHINA’S ZHENGZHOU SETS PARTIAL LOCKDOWN (BBG)

- CAIXIN MANUFACTURING PMI TOPS EXPECTATIONS

- CHINA EVERGRANDE RESUMES TRADE

BONDS: Asia Reacts To Monday’s Tsy Sell Off

The combination of news of the latest localised lockdown in China (covering some neighbourhoods in Zhengzhou, Henan) and regulatory driven pressure in Chinese equities was seemingly enough to allow Tsys to move off their Asia lows, leaving TYH2 +0-01+ at typing, printing 129-15+. Cash Tsys sit 0.5bp cheaper to virtually unchanged across the curve, with very modest twist flattening in play after yesterday’s bear steepening. Note that bears have so far failed to force a test of initial technical support (129-12+), with a low of 129-13+ registered overnight, as the contract stuck to a 0-05+ range on ~100K lots. On the flow side, a 15K block seller of the FVG2 120.50/120.00 put spread headlined, with modest downside interest in various TYH2 put strategies also observed. The US$ swappable issuance pipeline built (headlined by Nomura, NAB & Credit Agricole). Firmer than expected Chinese Caixin manufacturing PMI data had no impact on the space. Looking ahead, the NY docket will bring the release of the latest ISM manufacturing survey & JOLTS jobs data. Elsewhere, Minneapolis Fed President (dove, ’23 voter) will speak re: the economy.

- JGBs have followed the broader ebb & flow witnessed in U.S. Tsys since catching up to Monday’s weakness in the U.S. fixed income space. That left futures -16 at the bell, a touch above Tokyo lows. Meanwhile, the major cash JGB benchmarks run little changed to nearly 2bp cheaper on the day, with 7s leading the weakness on the curve. BoJ Governor Kuroda failed to introduce any new topics into the pool of familiar reference points when it comes to BoJ rhetoric. PM Kishida flagged hesitancy when it comes to the go to travel scheme owing to omicron, with a review re: border controls set for next week.

- Aussie bond futures also followed the broader gyrations in the Tsy space, with a lack of idiosyncratic news flow apparent. That left YM -4.5 & XM -6.0 at the bell.

EQUITIES: Chinese Indices Lower, Bucking Broader Trend

There was no new year cheer for Chinese equities as ’22 trade got underway. The CSI 300 trades ~1% lower, while the ChiNext is ~2% worse off. News that China has released revised internet security check rules for large tech cos when it comes to overseas equity listings, which will come into play next month, likely weighed on risk appetite in China. Such a move has been in the pipeline for some time, but the confirmation of increased regulatory burden for the Chinese tech space will be worrying some investors in a headline-light session. Elsewhere, the PBoC started to remove some of the year-end OMO liquidity that it provided, which may have hampered the space further.

- Further afield, the major regional equity indices followed their U.S. counterparts higher during Asia-Pac hours (a reminder that the S&P 500 registered a fresh all-time closing high on Monday but failed to breach last week’s all-time intraday high), although the Hang Seng was limited by its exposure to China’s tech sector. China Evergrande resumed trading after making some key disclosures that didn’t really move the needle for the firm.

- A reminder Tesla was the notable U.S. outperformer on Monday, in lieu of its far better than expected Q4 deliveries data.

GOLD: Glued To $1,800/oz Overnight

Gold has held to a narrow range in Asia-Pac hours, with spot little changed on the session, hovering just above $1,800/oz. To recap, after threatening a clean break below the $1,800/oz mark during Monday’s U.S. Tsy sell off, the move away from intraday highs in real yields (facilitated by widening breakevens as opposed to a meaningful reversal in nominal Tsy yields), led by the short end and the belly, allowed bullion to stabilise around the round number. A quick reminder that downside technical parameters for gold remain well-defined. Initial support is seen at the Dec 21 low ($1,784.9/oz), followed by the channel base drawn off the Aug 9 low. To the upside, the 61.8% retracement of the Nov 16 - Dec 15 downleg has been breached in recent sessions, with the Jan 3 high ($1,831.9/oz) now representing initial resistance. Above there, more meaningful resistance comes in at the Nov 22 high ($1,849.1/oz).

OIL: Modestly Higher Overnight, OPEC+ Meeting Eyed

WTI & Brent crude futures have added $0.30-0.40 to Monday’s settlement levels, building on the incremental uptick witnessed during the first session of ’22.

- The latest OPEC+ gathering provides Tuesday’s focal point, with sell-side expectations looking for the group to raise cumulative output by 400K bpd during the month of February (aided by the usual run of pre-meeting source reports), as per the previous production guidance provided by the group. While there are worries regarding the ability of several participating nations when it comes to upscaling production (given the underproduction already apparent in some countries), talk of lowering quotas for some of the participating nations remains off the table at present, as the producers look to minimise cross-country tensions.

- A reminder that Monday saw OPEC's newly elected secretary general note that global oil demand should move back to its pre-COVID levels by the end of ’22. This pointed to perceptions re: a relatively short-term threat posed by the Omicron COVID strain, which allowed the OPEC+ JTC to provide a narrower estimate when it comes to its Q122 oil surplus, per source reports.

FOREX: JPY Tumbles On C Bank Divergence As Liquidity Begins To Return To Markets

USD/JPY was the notable mover in Asia-Pac dealing, with momentum from Monday’s session and early ’22 plays surrounding Fed/BoJ policy divergence allowing the cross to top its ’21 high, printing at the highest level witnessed since early ’17 in the process. Outperformance for Japanese equity markets during Asia-Pac hours and some modest Tokyo fix-related demand for USD/JPY provided further sources of support for the rate at different times in the day, as Tokyo participants returned after the elongated weekend. The rate has traded as high as Y115.82, with our technical analyst noting that the next level of meaningful resistance is located at the 1.764 projection of the Apr 23 - Jul 2 - Aug 4 price swing (Y116.09).

- That dynamic left JPY comfortably at the foot of the G10 FX table.

- There wasn’t much else to note within the G10 FX space, outside of the stabilisation in U.S. Tsys resulting in the broader DXY ticking away from Monday’s peak. This came after the greenback benefitted from higher U.S. Tsy yields as ’22 trading got underway.

- The commodity dollar bloc sat atop the G10 FX sphere, while GBP softened against all but the JPY.

- It will be the latest ISM manufacturing survey and an address from Minneapolis Fed President Kashkari (dove, ’23 voter) that generate most of the interest when it comes to the remainder of Tuesday’s docket. We will also see the latest round of German retail sales data. We also note that London participants return after their NY break, which will further bolster liquidity.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 04/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 04/01/2022 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 04/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 04/01/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2022 | 0930/0930 | ** |  | UK | BOE Lending To Individuals |

| 04/01/2022 | - | *** |  | US | Domestic Made Vehicle Sales |

| 04/01/2022 | 1330/0830 | * |  | CA | Industrial Product & Raw Material Price Index |

| 04/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS Jobs Opening Level |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS Quits Rate |

| 04/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 04/01/2022 | 1630/1130 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.