-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Move Lower, USD/JPY Sees Fresh Multi-Year Highs

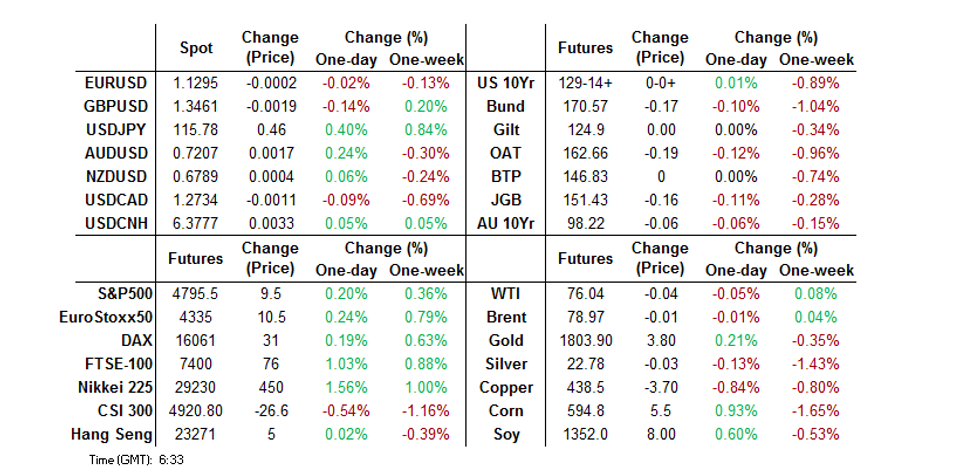

- COVID, liquidity & regulatory worry weighed on the Chinese equity space overnight, bucking the broader equity rally.

- USD/JPY registered fresh multi-year highs as Tokyo returned from its elongated weekend, with central bank divergence, Japanese reaction to Monday's Tsy move and technical breaks fuelling the move.

- It will be the latest ISM manufacturing survey and an address from Minneapolis Fed President Kashkari (dove, ’23 voter) that generate most of the interest when it comes to the remainder of Tuesday’s docket. We will also see the latest round of German retail sales data. We also note that London participants return after their NY break, which will further bolster liquidity.

BONDS: Asia Reacts To Monday’s Tsy Sell Off

The combination of news of the latest localised lockdown in China (covering some neighbourhoods in Zhengzhou, Henan) and regulatory driven pressure in Chinese equities was seemingly enough to allow Tsys to move off their Asia lows, leaving TYH2 +0-01+ at typing, printing 129-15+. Cash Tsys sit 0.5bp cheaper to virtually unchanged across the curve, with very modest twist flattening in play after yesterday’s bear steepening. Note that bears have so far failed to force a test of initial technical support (129-12+), with a low of 129-13+ registered overnight, as the contract stuck to a 0-05+ range on ~100K lots. On the flow side, a 15K block seller of the FVG2 120.50/120.00 put spread headlined, with modest downside interest in various TYH2 put strategies also observed. The US$ swappable issuance pipeline built (headlined by Nomura, NAB & Credit Agricole). Firmer than expected Chinese Caixin manufacturing PMI data had no impact on the space. Looking ahead, the NY docket will bring the release of the latest ISM manufacturing survey & JOLTS jobs data. Elsewhere, Minneapolis Fed President (dove, ’23 voter) will speak re: the economy.

- JGBs have followed the broader ebb & flow witnessed in U.S. Tsys since catching up to Monday’s weakness in the U.S. fixed income space. That left futures -16 at the bell, a touch above Tokyo lows. Meanwhile, the major cash JGB benchmarks run little changed to nearly 2bp cheaper on the day, with 7s leading the weakness on the curve. BoJ Governor Kuroda failed to introduce any new topics into the pool of familiar reference points when it comes to BoJ rhetoric. PM Kishida flagged hesitancy when it comes to the go to travel scheme owing to omicron, with a review re: border controls set for next week.

- Aussie bond futures also followed the broader gyrations in the Tsy space, with a lack of idiosyncratic news flow apparent. That left YM -4.5 & XM -6.0 at the bell.

FOREX: JPY Tumbles On C Bank Divergence As Liquidity Begins To Return To Markets

USD/JPY was the notable mover in Asia-Pac dealing, with momentum from Monday’s session and early ’22 plays surrounding Fed/BoJ policy divergence allowing the cross to top its ’21 high, printing at the highest level witnessed since early ’17 in the process. Outperformance for Japanese equity markets during Asia-Pac hours and some modest Tokyo fix-related demand for USD/JPY provided further sources of support for the rate at different times in the day, as Tokyo participants returned after the elongated weekend. The rate has traded as high as Y115.82, with our technical analyst noting that the next level of meaningful resistance is located at the 1.764 projection of the Apr 23 - Jul 2 - Aug 4 price swing (Y116.09).

- That dynamic left JPY comfortably at the foot of the G10 FX table.

- There wasn’t much else to note within the G10 FX space, outside of the stabilisation in U.S. Tsys resulting in the broader DXY ticking away from Monday’s peak. This came after the greenback benefitted from higher U.S. Tsy yields as ’22 trading got underway.

- The commodity dollar bloc sat atop the G10 FX sphere, while GBP softened against all but the JPY.

- It will be the latest ISM manufacturing survey and an address from Minneapolis Fed President Kashkari (dove, ’23 voter) that generate most of the interest when it comes to the remainder of Tuesday’s docket. We will also see the latest round of German retail sales data. We also note that London participants return after their NY break, which will further bolster liquidity.

USD: DXY Higher On Rise In Tsy Yields, Recent Range Remains In Play

The shift higher in U.S. Tsy yields supported the greenback on Monday, with the broader DXY reclaiming the losses observed since the Dec 28 close. That leaves the horizontal support and resistance lines drawn off the extremes of the range in play since Nov 24 as the initial technical reference points.

Fig.1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Chinese Indices Lower, Bucking Broader Trend

There was no new year cheer for Chinese equities as ’22 trade got underway. The CSI 300 trades ~1% lower, while the ChiNext is ~2% worse off. News that China has released revised internet security check rules for large tech cos when it comes to overseas equity listings, which will come into play next month, likely weighed on risk appetite in China. Such a move has been in the pipeline for some time, but the confirmation of increased regulatory burden for the Chinese tech space will be worrying some investors in a headline-light session. Elsewhere, the PBoC started to remove some of the year-end OMO liquidity that it provided, which may have hampered the space further.

- Further afield, the major regional equity indices followed their U.S. counterparts higher during Asia-Pac hours (a reminder that the S&P 500 registered a fresh all-time closing high on Monday but failed to breach last week’s all-time intraday high), although the Hang Seng was limited by its exposure to China’s tech sector. China Evergrande resumed trading after making some key disclosures that didn’t really move the needle for the firm.

- A reminder Tesla was the notable U.S. outperformer on Monday, in lieu of its far better than expected Q4 deliveries data.

GOLD: Glued To $1,800/oz Overnight

Gold has held to a narrow range in Asia-Pac hours, with spot little changed on the session, hovering just above $1,800/oz. To recap, after threatening a clean break below the $1,800/oz mark during Monday’s U.S. Tsy sell off, the move away from intraday highs in real yields (facilitated by widening breakevens as opposed to a meaningful reversal in nominal Tsy yields), led by the short end and the belly, allowed bullion to stabilise around the round number. A quick reminder that downside technical parameters for gold remain well-defined. Initial support is seen at the Dec 21 low ($1,784.9/oz), followed by the channel base drawn off the Aug 9 low. To the upside, the 61.8% retracement of the Nov 16 - Dec 15 downleg has been breached in recent sessions, with the Jan 3 high ($1,831.9/oz) now representing initial resistance. Above there, more meaningful resistance comes in at the Nov 22 high ($1,849.1/oz).

OIL: Modestly Higher Overnight, OPEC+ Meeting Eyed

WTI & Brent crude futures have added $0.30-0.40 to Monday’s settlement levels, building on the incremental uptick witnessed during the first session of ’22.

- The latest OPEC+ gathering provides Tuesday’s focal point, with sell-side expectations looking for the group to raise cumulative output by 400K bpd during the month of February (aided by the usual run of pre-meeting source reports), as per the previous production guidance provided by the group. While there are worries regarding the ability of several participating nations when it comes to upscaling production (given the underproduction already apparent in some countries), talk of lowering quotas for some of the participating nations remains off the table at present, as the producers look to minimise cross-country tensions.

- A reminder that Monday saw OPEC's newly elected secretary general note that global oil demand should move back to its pre-COVID levels by the end of ’22. This pointed to perceptions re: a relatively short-term threat posed by the Omicron COVID strain, which allowed the OPEC+ JTC to provide a narrower estimate when it comes to its Q122 oil surplus, per source reports.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 04/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 04/01/2022 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 04/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 04/01/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2022 | 0930/0930 | ** |  | UK | BOE Lending To Individuals |

| 04/01/2022 | - | *** |  | US | Domestic Made Vehicle Sales |

| 04/01/2022 | 1330/0830 | * |  | CA | Industrial Product & Raw Material Price Index |

| 04/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS Jobs Opening Level |

| 04/01/2022 | 1500/1000 | ** |  | US | JOLTS Quits Rate |

| 04/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 04/01/2022 | 1630/1130 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.