-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Rocketman Returns

EXECUTIVE SUMMARY

- FED’S KASHKARI: INFLATION SHOULD EASE WITH PANDEMIC (MNI)

- WHITE HOUSE: BIDEN IS PRIORITIZING DIVERSITY IN FED PICKS (RTRS)

- MANCHIN SAYS HE HAS HAD NO TALKS ABOUT RESURRECTING BIDEN’S BUILD BACK BETTER PLAN (CNBC)

- BORIS JOHNSON PLANS TO 'RIDE OUT' OMICRON WAVE WITH NO MORE CURBS (BBC)

- PBOC MAY BOOST LIQUIDITY INJECTION BEFORE SPRING FESTIVAL (CSJ)

- NORTH KOREA FIRES UNIDENTIFIED PROJECTILE, SOME POINT TO BALLISTIC MISSILE

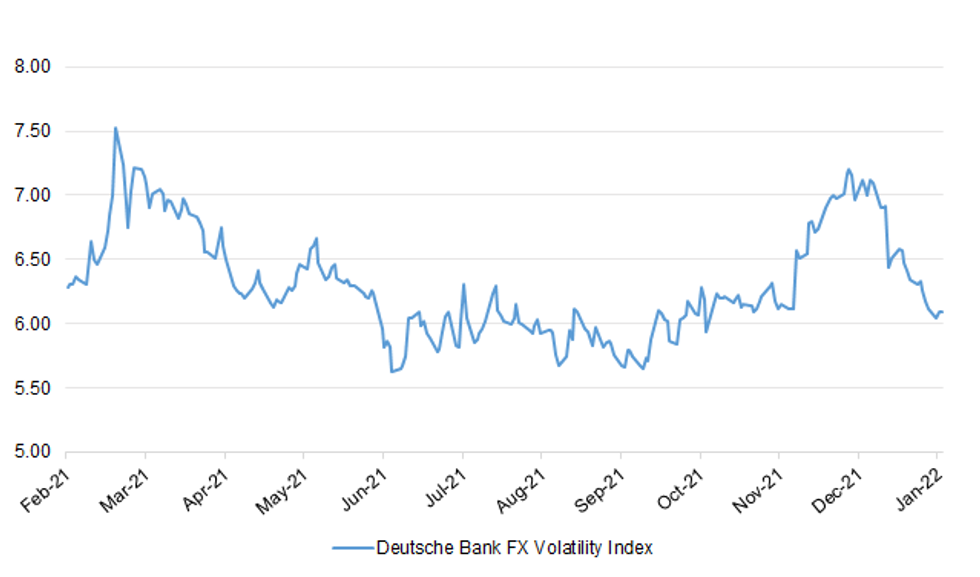

Fig. 1: Deutsche Bank FX Volatility Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson says he hopes England can "ride out" the current wave of Covid-19 without further restrictions. But he acknowledged parts of the NHS would feel "temporarily overwhelmed" amid a surge of Omicron cases. The prime minister said there was a "good chance" he would not impose fresh measures and would recommend continuing the government's "Plan B" strategy in England to ministers on Wednesday. He also announced plans for 100,000 critical workers to take daily tests. The testing regime from 10 January will be for key industries including food processing, transport and the border force, in order to reduce the spread of the virus to colleagues. The PM said at a Downing Street briefing he will recommended England sticks with Plan B restrictions, when cabinet ministers meet to discuss extending them. (BBC)

CORONAVIRUS: Key workers across several industries that keep the country running will be required to take COVID tests daily, the prime minister has announced. Boris Johnson said 100,000 workers in England, "from food processing to transport to Border Force", will have to test every day they are working from 10 January. The government will send lateral flow tests to those industries directly and will help organise the logistics. Its aim is to ensure infections are caught as early as possible to minimise spreading COVID to colleagues, which has been causing major staff shortages. (Sky)

CORONAVIRUS: Covid testing rules will be relaxed as part of efforts to shorten isolation periods and ease the staffing shortages crippling Britain, The Telegraph understands. Fears are growing that staff absences have become as big a problem as Covid itself, with bin collections delayed, trains cancelled and 17 hospitals in Greater Manchester announcing on Tuesday that they would be suspending some non-urgent surgery, with 15 per cent of staff off sick. Millions of people who test positive on lateral flow devices will be told they do not need to take follow-up PCR tests, which currently delay the official start of isolation for hundreds of thousands of people. Health officials have drawn up plans to limit PCR tests to those with symptoms of Covid, allowing people who are asymptomatic – around 40 per cent of cases – to return to work more quickly. More than 1.2 million people are isolating after testing positive for Covid in the last week, with hundreds of thousands more waiting for tests or results. (Telegraph)

CORONAVIRUS/POLITICS: MPs are returning to Westminster after their Christmas break and plunging straight into a potentially fiery Prime Minister's Questions and a Commons showdown over COVID-19. (Sky)

BREXIT: Liz Truss will demand “rapid progress” to break the Northern Ireland Protocol deadlock by the end of January when she holds her first face-to-face meeting with the European Union, the Telegraph can disclose. (Telegraph)

ENERGY/FISCAL: Chancellor Rishi Sunak has warned colleagues that there is a limit to how much help the government can give to offset soaring energy prices, and that support should be targeted at UK households that need it most. Kwasi Kwarteng, business secretary, will meet industry leaders on Wednesday to discuss several options that could help households contending with the spike in energy prices and the broader cost-of-living crisis. Options being considered by the business department and the Treasury include cutting value added tax on energy bills, increasing the warm homes discount available to vulnerable households, as well as providing loans to energy companies so that they can in turn help consumers. Industry executives admitted that there were drawbacks with all the options but insisted that action was needed both to assist households and to prevent further collapses of energy suppliers. (FT)

EUROPE

FRANCE: French President Emmanuel Macron late on Tuesday after being asked about a need for new health restrictions amid a surge in COVID infections ahead of a government meeting on Wednesday said that the relevant decisions had already been taken last week. Asked about how to refinance France's heavy debt due to the pandemic, the president said that this would be possible through increased economic activity, adding that as long as he was in office, there would be no tax hikes. France registered around 270,00 new daily cases earlier on Tuesday, a new record. (RTRS)

FRANCE: Emmanuel Macron said he wants to run again for president in France’s April election but stressed that he hasn’t fully made up his mind. “There is no false suspense. I want to,” Macron told Le Parisien newspaper when asked if he intends to run again. Before committing himself, he’ll consider the Covid-19 situation and the “political equation.” “This decision is consolidating deep down inside. I need to be sure to be able to go as far as I want,” the president said. While there’s little doubt Macron will seek a second five-years term, this is the closest the president has come to announcing. He’s so far declined to directly answer questions regarding the election, but his teams are working on the campaign and he’s spoken of the “major choices” France must make in 2022. (BBG)

PORTUGAL: Portuguese government debt agency IGCP says the central government’s net borrowing needs for 2022 are expected to be about EU10.9b, according to an emailed statement. EU17.7b to be obtained through gross issuance of government bonds, combining syndicated operations and auctions. Auctions will be held on the second or fourth Wednesday of each month. Issuance of treasury bills in 2022 should have a positive impact of EU3b on net financing. During 1Q, bill auctions to be held on Jan. 19, Feb. 16, March 16. (BBG)

GREECE: The Greek government reached an agreement with the country’s association of private clinics to use 10% to 15% of their ordinary beds for managing Covid patients when needed, Health Minister Athanasios Plevris said. Greece reported 50,126 new coronavirus cases Tuesday, the highest daily increase since the start of the pandemic. Despite the jump, the country’s schools will reopen as scheduled on Jan. 10 with stricter testing protocols. (BBG)

U.S.

FED: MNI BRIEF: Kashkari Says Inflation Should Ease With Pandemic

- Minneapolis Federal Reserve President Neel Kashkari said Tuesday inflation pressures are likely to subside as the pandemic is brought under control, rather than a scenario of more permanent rapid price gains - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Senate Banking Committee will consider the renomination of Jerome Powell for Federal Reserve chair on Jan. 11 at 10 a.m. Eastern (1500 GMT), the panel said on its website. The panel will hold a separate hearing to consider the nomination of Fed Governor Lael Brainard to be vice chair, Politico said earlier on Tuesday, citing a person familiar with the schedule.

FED: Biden is making diversity a priority in his selection of other Fed leaders, White House spokesperson Jen Psaki said on Tuesday, even as she declined to specify when an announcement about filling more Fed seats would be made. "I expect we will have more soon," she said. Biden is said to be considering former Fed Governor Sarah Bloom Raskin for vice chair of supervision, as well as two Black economists - Michigan State University's Lisa Cook and Davidson College's Philip Jefferson - to round out the seven-member Board. If those are his picks, it would make the Fed Board more diverse than it has ever been. The Board has only had three Black governors since the Fed's founding in 1913, and has never had a Black female member. Of the five members of the current Fed Board, all are white; two are women. (RTRS)

ECONOMY: MNI INTERVIEW: US Factories Face New Backlogs From Omicron - ISM

- U.S. manufacturers will likely face renewed bottlenecks as the Omicron variant spreads, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday. "I'm definitely expecting problems," he said. "I'm expecting problems on the supplier delivery number," Fiore said, "and the employment numbers are going to to sag quite a bit, maybe even contract" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Sen. Joe Manchin has not had any talks about reviving President Joe Biden’s proposed investments in social programs and climate policy since he torpedoed the Build Back Better Act, Manchin said Tuesday. The West Virginia Democrat said in December that he would oppose the House-passed bill, his party’s top priority. Speaking to reporters as the Senate returned for the new year, Manchin said he has not reengaged in discussions about the plan. “There is no negotiations going on at this time,” he said, adding that he feels “as strongly today” as he did in December about his concerns that the plan could exacerbate high inflation. (CNBC)

FISCAL: As Democrats work to pass some form of President Joe Biden’s Build Back Better legislation, Senator Joe Manchin, D-W.V., said Tuesday that he will not support an extension of the enhanced child tax credit (CTC), a key component of the bill, without the addition of a work requirement for parents. Manchin told Business Insider that his position on the requirement has not changed for some time. Democrats need all 50 senators on board to pass their legislation via the reconciliation process, and the West Virginia senator has been a holdout in getting the social spending bill to Biden’s desk. Other Democrats, including Biden, oppose the requirement because it would leave out the neediest children. (CNBC)

CORONAVIRUS: Omicron made up 95% of all sequenced Covid-19 cases in the U.S. in the week ending Jan. 1, up from a revised 77% in the previous week, according to a model by the Centers for Disease Control and Prevention. Previously, the CDC estimated that the variant accounted for 58.6% of cases in the week ending Dec. 25. The omicron variant is accounting for the lion’s share of new coronavirus cases as Americans return to work and school following the holiday season, according to estimates from federal health officials. (BBG)

CORONAVIRUS: The U.S. is reporting a weekly average of 485,363 cases, about twice the peak of last winter, and true prevalence is projected to be far higher. But U.S. hospitals have just 64% of the Covid patients in adult intensive-care beds as they did at last winter’s peak, and hospital deaths with Covid are around 52% of last winter’s worst period. U.S. hospitals are so far seeing significantly fewer severe outcomes from the omicron wave than they saw in past Covid-19 spikes, mirroring the experience of South Africa and the U.K. Even New York, the uber-dense site of one of the nation’s worst outbreaks, is seeing similar results. (BBG)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention (CDC) on Tuesday backed its week-old guidance for people seeking to end their COVID-19 isolation at five days, adding they could take a rapid antigen test if they want to and can access one, but is not requiring that. The agency had been pressured by health experts to institute a test requirement after it cut in half its guidance last week for people to isolate after a COVID-19 infection to 5 days from 10. It said the move was based on science around transmission of the virus. (RTRS)

CORONAVIRUS: The language around what constitutes fully vaccinated against Covid-19 is being replaced, in the strongest indication by White House chief medical adviser Anthony S. Fauci that two shots of a messenger RNA vaccine fall short of protection amid the highly transmissible omicron variant. “We’re using the terminology now ‘keeping your vaccinations up to date,’ rather than what ‘fully vaccinated’ means,” Fauci said during a National Institutes of Health lecture Tuesday. “Right now, optimal protection is with a third shot of an mRNA or a second shot of a J&J.” The Centers for Disease Control and Prevention called Tuesday for third shots of Pfizer-BioNTech’s Covid-19 vaccine to be administered within five months of the initial two-shot series, shortening the time frame before a booster by a month. A CDC advisory panel is expected to recommend boosters for teenagers in a meeting Wednesday. (BBG)

CORONAVIRUS: President Joe Biden said long lines for Covid-19 tests -- fueled by surging cases of the omicron variant -- should start to ease as the federal government increases capacity. Biden told reporters at the White House on Tuesday that the U.S. has opened new testing sites around the country and that drug stores are restocking home test kits. “With more capacity for in-person tests, we should see waiting lines shorten and more appointments freed up,” Biden said. The U.S. had faced a shortage of tests, leaving many unable to make appointments, particularly as Americans traveled during the holidays. “Believe me, it’s frustrating to me,” Biden said. (BBG)

CORONAVIRUS: After being asked by a reporter Tuesday if the White House has "lost control" of the COVID-19 pandemic, press secretary Jen Psaki refuted the claim and listed measures the Biden administration has taken to combat the recent COVID surge. (RTRS)

CORONAVIRUS: Florida Governor Ron DeSantis’s administration plans to release new guidance on coronavirus testing that will be tied to risk factors, as state officials criticized efforts to mandate screening broadly. The Republican governor and the state’s surgeon general, Joseph Ladapo, criticized what they see as over-testing, such as for those seeking to engage in social events or for children to return to in-person education. (BBG)

CORONAVIRUS: Texas Governor Greg Abbott sued the Biden administration over its effort to impose a coronavirus vaccine mandate on National Guard troops, saying it violates state sovereignty to require the shots when the troops are not on active federal duty. Under U.S. law, National Guard units answer to the states where they are domiciled unless they are called into active duty by the federal government. Abbott’s lawsuit also cites Texas’s state constitution, saying its governor serves as the national guard’s commander-in-chief except when the troops are called into federal service. (BBG)

POLITICS: Former U.S. President Donald Trump said on Tuesday that he was canceling a news conference scheduled for Jan. 6, which would have taken place on the one-year anniversary of when his supporters rioted and stormed the U.S. Capitol. (RTRS)

OTHER

USMCA: Canada violated a trade accord with the United States and Mexico by reserving most of its preferential dairy tariff-rate quotas for Canadian processors, a dispute panel found, and Washington warned it could retaliate if Ottawa did not change course. (RTRS)

GEOPOLITICS: Australia and Japan will sign a “historic” treaty that will further strengthen defense and security cooperation during a virtual leaders’ summit on Thursday, in a move that could further inflame tensions with China. The agreement is the first of its type for Japan, other than with the U.S. and the UN, and marks a step closer in a relationship that is often referred to as a “quasi alliance.” (BBG)

NEW ZEALAND: Rising interest rates, tighter bank lending criteria and investor tax changes did not dent house sales by Auckland's biggest agency last month. Peter Thompson, Barfoot & Thompson managing director, has announced that further price records were set and more than 200 properties were sold for $2 million-plus. December's average $1,278,647 was up 7.4 per cent for the quarter and 17 per cent annually. But the $1,235,000 median was up 22.9 per cent annually, he said. "The market took news of rising interest rates, tighter bank lending criteria and changes to investor taxation restrictions in its stride, with strong buyer interest right up to Christmas Eve," Thompson said. (NZ Herald)

NORTH KOREA: North Korea fired an unidentified projectile into waters off its east coast Wednesday, South Korea’s military said, while Japan’s Coast Guard said the object appeared to be a ballistic missile and seems to have already landed. The launch is North Korea’s first of the year and comes days after leader Kim Jong Un urged his state to focus on easing food shortages and containing Covid, in a downbeat New Year’s policy assessment that suggested nuclear talks with the U.S. were a low priority for the coming months. (BBG)

MEXICO: Mexico central bank deputy governor Jonathan Heath said he finds the optimism of business owners in the country’s commerce sector regarding the future performance of their companies “striking,” according to a Twitter message. Heath referred to the national statistics institute’s business confidence indicator for Dec. saying it showed commerce sector optimism near a record high. Heath cited the study in an earlier tweet: “It’s interesting to observe that the confidence of the manufacturing and construction sectors have returned to pre-Covid levels while commerce is well above that of previous years,” Heath wrote. (BBG)

BRAZIL: The medical team treating Brazil’s Jair Bolsonaro has ruled out the need for intestinal surgery for now as the president’s condition improved after a day of clinical treatment. The Vila Nova Star Hospital, where the president was admitted in the early hours of Monday after feeling abdominal pain, said in a statement Tuesday morning that Bolsonaro’s intestinal obstruction “disappeared” and there was no need for surgery. It later added that he had a nasogastric tube removed and was receiving a liquid diet, although there was no date for his discharge yet. (BBG)

SOUTH AFRICA: A South African corruption inquiry pointed to systemic graft during former President Jacob Zuma's tenure in the first part of its report published on Tuesday, after more than three years of investigations involving more than 300 witnesses. The inquiry chaired by senior judge Raymond Zondo was established in 2018 to examine allegations of high-level graft during Zuma's nine years in power from 2009, after scandals and sleaze had overshadowed South Africa's politics for years. (RTRS)

MIDDLE EAST: The U.S.-led coalition on Tuesday carried out strikes against rocket sites in Syria that posed a threat, a coalition official said. The official, speaking on condition of anonymity, said the coalition saw several launch sites near the Green Village in Syria. The official did not specify from which country the coalition carried out the strike. (RTRS)

IRAN: Nuclear deal talks with Iran in Vienna have shown modest progress and the United States hopes to build on that this week, State Department spokesman Ned Price said on Tuesday amid efforts to revive a 2015 agreement. The Joint Comprehensive Plan of Action (JCPOA) lifted sanctions against Tehran in exchange for restrictions on its atomic activities but Donald Trump pulled Washington out of the deal in 2018, a year after he took office. “Sanctions relief and the steps that the United States would take… when it comes to sanctions together with the nuclear steps that Iran would need to take if we were to achieve a mutual return to compliance with the JCPOA – that’s really at the heart of the negotiations that are ongoing in Vienna right now." (RTRS)

IMF: The International Monetary Fund has delayed the release of its World Economic Outlook by one week to Jan. 25 to factor in the latest COVID-19 developments, a spokesperson for the global lender said on Tuesday. “The World Economic Outlook update will be launched on January 25 to allow our teams to incorporate the latest developments related to the COVID-19 pandemic into the economic forecasts," the spokesperson said. IMF spokesperson Gerry Rice had told reporters last month the update to the fund's forecast would come on Jan. 19. (RTRS)

OIL: The White House on Tuesday welcomed a decision by top oil producers to stick with their plans to raise crude production and touted "close" coordination with Saudi Arabia and the United Arab Emirates. "The administration is focused on making sure supply rises to match demand as the global economy recovers and that Americans see lower prices at the pump - where we have seen progress in recent weeks," said a spokesperson for the White House's National Security Council who declined to be named. (RTRS)

OIL: Kuwaiti Oil Minister Mohammad Al-Fares voiced optimism for continued recovery of the global economy despite concerns about the Omicron coronavirus variant, the state news agency said late on Tuesday. Earlier in the day, the OPEC+ group agreed to stick to its planned increase in oil output for February because it expects the Omicron coronavirus to have a short-lived impact on global energy demand. "OPEC+ strategy to raise production is successful amid market challenges" the agency quoted the minister as saying. (RTRS)

CHINA

PBOC: The People’s Bank of China is expected to increase liquidity injection in the second half of January via reverse repos and medium-term lending facilities to fill a gap of about CNY2 trillion, the China Securities Journal reported citing analysts. The tighter liquidity this month is largely due to major tax collection at the beginning of the year, up to CNY700 billion of government bond issuance as well as residents’ increased cash demand before the Spring Festival in February, the newspaper said citing analysts. The PBOC is unlikely to cut reserve requirement ratios for the second month, the newspaper said. (MNI)

PBOC: Chinese banks rushed to meet their annual state-imposed lending quotas last month by buying up low-risk financial instruments rather than issue loans, a surge that bankers and analysts said reflected financial institutions’ wariness about the country’s slowing economy. The rise in demand for banker’s acceptances, which are guaranteed by their issuers and technically classified as loans, reduced the interest banks paid to close to zero percent in the second half of December. A record low of 0.007 percent was reached on December 23. That was far lower than Chinese banks’ average 2.5 percent cost of capital over the same period, implying that they preferred to lose money on low-yielding banker’s acceptances rather than risking greater losses by issuing their own loans at higher rates of interest. (FT)

POLICY: China must stand against financial risks including those stemming from some real estate developers that expanded blindly, local government debt and bond market credit issues, the official Economic Daily said in an editorial. China is also under pressure from shrinking demand, supply impact and weakened outlook, it said. The financial markets' valuations face rising risks of correction, as the U.S. Federal Reserves begin to taper, causing more volatilities in global capital movement and exchange rates, said the daily. (MNI)

SMES: China will support high-tech SMEs in several Free Trade Zones to independently borrow foreign debts, as well as pilot qualified foreign limited partners (QFLP) and qualified domestic limited partners (QDLP) in the areas to broaden companies’ cross-border financing channels, Xinhua News Agency reported citing the State Administration of Foreign Exchange. The new policy includes nine capital account reform measures, including steadily opening cross-border asset transfer business, and piloting integrated domestic and foreign currency fund pools for multinational companies, Xinhua said. (MNI)

PROPERTY: The local government of Yulin, a city in Southern Chinese province of Guangxi, offers up to 10,000 yuan of subsidy for first-home purchases in 2022, according to a government statement. It will also offer 50% discount in tax payment for first-home purchases. Home buyers will also enjoy up to 20,000 yuan of discount in home appliance purchases. The incentives are aimed at increasing urban population in the city. (BBG)

PROPERTY: Two Chinese real estate firms are delaying interim dividend payments by months, the latest step by companies in a sector facing mounting bills and limited fund raising options. Zhongliang Holdings Group Co. and DaFa Properties Group Ltd. Both said in Hong Kong stock exchange filings dated Tuesday that the payments were being pushed back to preserve cash. Shanghai-based Zhongliang, ranked as China’s 26th biggest builder by contracted sales according to China Real Estate Information Corp., said that its interim dividend expected Jan. 25 will be paid around the end of August instead. Zhongliang would need to pay about HK$659 million ($84.6 million), according to Bloomberg calculations based on company filings.

EVERGRANDE: China Evergrande Group said on Wednesday it will hold an online meeting with bondholders on Jan. 7-10 to vote on proposals including one on delaying the redemption date of some bonds to July 8 from Jan. 8. Trading in Evergrande bonds will be halted from Jan. 6 ahead of the meeting with bondholders, the property group said in a statement. (RTRS)

CORONAVIRUS: China’s central province of Henan, which reported four confirmed cases on Wednesday, locked down another city of 7.9 million people after it detected one patient who didn’t show symptoms. Municipal government of Shangqiu has asked all residents not to leave the city unless necessary, and tightened restrictions including shutting down indoor public venues, according to local authorities. The lockdown order came after the province shut Yuzhou city and its capital Zhengzhou earlier this week. A total of 41 domestically transmitted cases were reported across the country, according to the National Health Commission. Meanwhile, Tonggu county in the east Chinese province of Jiangxi found traces of coronavirus in batch testing of 10 people returning from other provinces, according to a statement from local government. (BBG)

CORONAVIRUS: China’s Covid-19 health code system that strictly governs people’s movements crashed in Xi’an this week, worsening conditions in the locked-down city where the country’s worst outbreak since Wuhan has been unfolding. The crash has complicated efforts to weed out cases through mass testing, created hurdles for people seeking care at hospitals and led to the suspension of a top official, the latest among a slew of bureaucrats to be punished as Beijing fumes over the situation. (BBG)

EQUITIES: China's top market regulator said on Wednesday it has fined units of Alibaba Group Holding Ltd, Tencent Holdings Ltd, and Bilibili Inc for failing to properly report about a dozen deals. (RTRS)

EQUITIES: China's cyberspace regulator on Wednesday issued draft rules governing mobile apps, stating that apps with functions that could influence public opinion will need security reviews. The regulator added that mobile app providers must not conduct activities that endanger national security. (RTRS)

OVERNIGHT DATA

JAPAN DEC MONETARY BASE +8.3% Y/Y; NOV +9.3%

JAPAN DEC CONSUMER CONFIDENCE INDEX 39.1; MEDIAN 39.9; NOV 39.2

JAPAN DEC VEHICLE SALES -10.2% Y/Y; NOV -13.4%

AUSTRALIA DEC ANZ JOB ADVERTISEMENTS -5.5% M/M; NOV +9.9%

ANZ Australian Job Ads fell 5.5% m/m in December following an upwardly revised 17.2% jump over the previous two months as Delta lockdowns eased. The record employment gain of 366,100 in November was likely a significant factor behind the fall, but we can’t rule out some dampening effect from Omicron. Still, Job Ads are 4.2% above the pre-Delta-lockdown peak in June 2021 and 36.8% above the pre-COVID level. (ANZ)

NEW ZEALAND DEC CORELOGIC HOUSE PRICES INDEX +27.6% Y/Y; +28.4%

SOUTH KOREA DEC FOREIGN RESERVES $463.12BN; NOV $463.91BN

CHINA MARKETS

PBOC NET DRAINS CNY200 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via seven-day reverse repos with the rate unchanged at 2.2% on Wednesday. This operation has drained net CNY200 billion after offsetting the maturity of CNY210 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions rose to 2.1748% at 09:29 am local time from the close of 2.0168% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday vs 39 on Dec. 31.

PBOC SETS YUAN CENTRAL PARITY AT 6.3779 WEDS VS 6.3794 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3779 on Wednesday, compared with 6.3794 set on Tuesday.

MARKETS

SNAPSHOT: Rocketman Returns

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 30.37 points at 29332.16

- ASX 200 down 23.956 points at 7565.8

- Shanghai Comp. down 43.6 points at 3588.729

- JGB 10-Yr future down 1 tick at 151.42, yield down 0.2bp at 0.086%

- Aussie 10-Yr future down 3.5 ticks at 98.185, yield up 3.8bp at 1.785%

- U.S. 10-Yr future up 0-04+ ticks at 129-13+, yield down 0.7bp at 1.6403%

- WTI crude down $0.06 at $76.93, Gold up $1.29 at $1815.89

- USD/JPY down 17 pips at Y115.99

- FED’S KASHKARI: INFLATION SHOULD EASE WITH PANDEMIC (MNI)

- WHITE HOUSE: BIDEN IS PRIORITIZING DIVERSITY IN FED PICKS (RTRS)

- MANCHIN SAYS HE HAS HAD NO TALKS ABOUT RESURRECTING BIDEN’S BUILD BACK BETTER PLAN (CNBC)

- BORIS JOHNSON PLANS TO 'RIDE OUT' OMICRON WAVE WITH NO MORE CURBS (BBC)

- PBOC MAY BOOST LIQUIDITY INJECTION BEFORE SPRING FESTIVAL (CSJ)

- NORTH KOREA FIRES UNIDENTIFIED PROJECTILE, SOME POINT TO BALLISTIC MISSILE

BONDS: Tight Asia Ranges For Core FI

T-Notes operated in a narrow (0-04) range in Asia, drawing very modest support from the downtick in e-minis. The latter sit 0.3-0.6% lower, on the back of the latest North Korean missile launch and another round of weakness in Chinese equities (driven by further regulatory oversight on the tech sphere). TYH2 last +0-04+ at 129-13+. Cash Tsys run little changed to ~2bp richer, with 30s outperforming. Broader headline and market flow remains fairly limited. NY hours will see the release of ADP employment data and the minutes from the FOMC’s December meeting. Re: the latter, markets will be looking for any discussion on how soon the central bank may hike rates after the tapering process is concluded and further details surrounding balance sheet normalisation.

- The JGB space coiled during Tokyo trade, with cash yields -/+0.5bp vs. Tuesday’s closing levels come the bell (mostly richer). Futures unwound their overnight losses as U.S. Tsys nudged higher on the aforementioned drivers. The latest round of 10-Year JGB supply passed smoothly, with the low price topping broader dealer expectations as the tail narrowed incrementally vs. the Dec auction, while the cover ratio nudged higher, moving above its 6-auction average. JGB futures ticked higher in the wake of the auction, with demand no doubt supported by the carry and roll aspect that we flagged in our auction preview. Still momentum faltered a little into the close, with the contract finishing -1 on the day.

- Aussie bonds held onto the overnight steepening impetus, with a lack of notable local headline flow leaving the space at the mercy of broader macro drivers. YM unch. & XM -3.5 at the bell. The longer end of cash ACGB curve has cheapened by the best part of 5bp. Soft ANZ job ads data (accompanied by positive revisions) did little for the space, with the data provider noting that “the record employment gain of 366,100 in November was likely a significant factor behind the fall, but we can’t rule out some dampening effect from Omicron. Still, Job Ads are 4.2% above the pre-Delta-lockdown peak in June 2021 and 36.8% above the pre-COVID level.”

JGBS AUCTION: 10-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0978tn 10-Year JGBs:

- Average Yield 0.096% (prev. 0.060%)

- Average Price 100.03 (prev. 100.38)

- High Yield: 0.097% (prev. 0.063%)

- Low Price: 100.02 (prev. 100.36)

- % Allotted At High Yield: 38.3637% (prev. 63.0466%)

- Bid/Cover: 3.458x (prev. 3.164x)

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.0667tn 3-Month Bills:

- Average Yield -0.1181% (prev. -0.1128%)

- Average Price 100.0285 (prev. 100.0303)

- High Yield: -0.1078% (prev. -0.1098%)

- Low Price 100.0260 (prev. 100.0295)

- % Allotted At High Yield: 26.3636% (prev. 77.3480%)

- Bid/Cover: 3.112x (prev. 4.470x)

EQUITIES: Tech Continues To Struggle

Tuesday’s tech share weakness (mostly driven by Chinese regulatory & U.S. Tsy-related pressure) continued in Asia-Pac trade, weighing on the Hang Seng & the KOSPI in particular. Note that the latest batch of regulatory fines dealt out to 3 Chinese tech giants and asset disposal from Tencent applied further pressure to the space.

- North Korea’s latest projectile launch applied further pressure, although the broader risk-off moves in the wake of that particular event weren’t particularly sharp.

- E-minis have nudged lower, shedding 0.2-0.4%, with the NASDAQ 100 leading the way lower there.

GOLD: Flatlining In Asia

Tuesday saw a divergence in U.S. nominal yields & breakevens, which resulted in an uptick in real yields. Still, the move was more notable in the longer end of the real yield space, which meant that the impact on gold prices was not particularly profound. This meant that bullion only managed a shallow showing below $1,800/oz, before correcting from worst levels. Spot then clung to a narrow range in Asia, last dealing unchanged at $1,815/oz, with familiar technical parameters in play.

OIL: Oil Little Changed In Asia, Brent Holds Below $80

WTI & Brent crude futures have shed ~$0.15 vs. Tuesday’s settlement levels. Early defensive posturing across broader markets applied some modest pressure to the crude benchmarks, which have since recovered from worst levels. Asia ranges were tight (~$0.60).

- This comes after OPEC+ lifted its cumulative February oil output target by 400K bpd, matching broader expectations. The group now sees a tighter oil market in Q122 when compared to its Dec projections, signalling a lack of worry when it comes to the impact of the Omicron COVID variant. Brent briefly showed above $80.00 on Tuesday but couldn’t hold the move.

- The latest round of weekly U.S. API inventory estimates reportedly revealed a sharper than expected headline drop in crude stocks, alongside wider than expected builds in gasoline and distillate stocks, in an addition to an uptick in stocks at the Cushing hub. The release had no tangible impact on crude futures.

- Weekly U.S. DoE inventory data will be eyed on Wednesday.

FOREX: KRW On The Defensive, Early JPY Strength Fades

Early Asia trade saw the JPY benefit from defensive flows surrounding the Chinese tech space and the latest North Korea projectile launch. That bid has faded a little, with USD/JPY printing back above Y116.00 after showing as low as Y115.90 in Tokyo dealing.

- Commodity-tied FX nudged lower on the back of those defensive flows, although broader FX trade was limited, with the major USD crosses trading within 10 pips of Tuesday’s closing levels ahead of European dealing.

- The KRW has traded on the backfoot, with the latest North Korean missile launch weighing on both the currency and KOSPI, with the downtick in the KOSPI (linked to the broader tech space woes) likely weighing on the KRW. USD/KRW is printing just shy of the KRW1,200 level as a result (a level not tested since October). Note that there is some market speculation that Korean authorities could step in to limit KRW weakness around this psychological level.

- Final services & composite PMI data from the Eurozone headlines the pre-NY docket, while U.S. ADP employment data and the minutes from the most recent FOMC decision will garner most of the attention later on Wednesday.

FX OPTIONS: Expiries for Jan05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1190-00(E673mln), $1.1285-90(E539mln)

- USD/JPY: Y113.45-55($960mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 05/01/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/01/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/01/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/01/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/01/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/01/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2022 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 05/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/01/2022 | 1900/1400 | * |  | US | FOMC Minutes |

| 06/01/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.