-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: COVID Headlines Dominate In Asia, NFP Eyed

EXECUTIVE SUMMARY

- CHINA MAY EASE MONETARY POLICY IN 1Q DESPITE HAWKISH FED (CSJ)

- SHENZHEN REQUIRES NEGATIVE COVID RESULTS FOR LEAVING CITY (BBG)

- FED'S BULLARD WANTS MARCH HIKE, WARNS OF MORE TIGHTENING (MNI)

- XI’AN LOCKDOWN RATTLES WORLD’S LARGEST CHIPMAKERS (CAIXIN)

- CHINA PLANS TO RELAX "THREE RED LINES" TO ENCOURAGE STATE-LED PROPERTY M&A (REDD)

- JAPAN FINMIN: CLOSELY WATCHING FOREX IMPACT ON ECONOMY (RTRS)

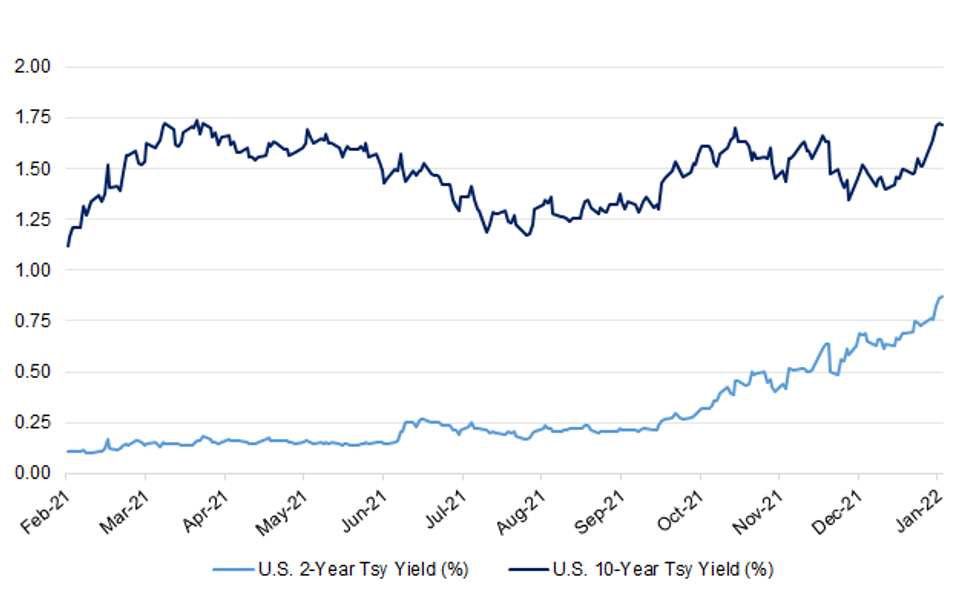

Fig. 1: U.S. 2- & 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Some 200 Armed Forces personnel are being deployed to support the NHS in London as hospitals grapple with staff shortages. Military medics will assist NHS doctors and nurses with patient care, while general duty personnel will help fill gaps caused by other absences. The Royal College of Nursing has said the deployment means the government can no longer deny there is a "staffing crisis" within the NHS. (Sky)

POLITICS: Boris Johnson has been accused of corruption after it emerged that he sought funds for his flat refurbishment from a Conservative donor while promising to consider plans for a mystery “great exhibition”. The prime minister is facing fresh questions after newly published WhatsApp messages with the Tory peer David Brownlow show Johnson called parts of his Downing Street residence a “tip” and asked for “approvals” so his decor designer, Lulu Lytle, could “get on with it” in November 2020. (Guardian)

U.S.

FED: MNI: Fed's Bullard Wants March Hike, Warns of More Tightening

- The Federal Reserve could start raising interest rates rates in March and potentially allow for some balance sheet runoff later in response to an inflation surge late last year, St. Louis Fed President James Bullard said Thursday. “The FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation,” Bullard said in prepared remarks - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Federal Reserve Bank President Mary Daly on Thursday said the U.S. economy is “closing in” on the U.S. central bank’s two goals of full employment and 2% inflation, at least in the short run. “There’s a difference in the short run and the long run...balancing those things as we move forward in 2022 will be the critical point of business for monetary policy,” Daly said at an Irish central bank virtual event. While the labor market “looks like it’s very strong,” she said, the economy is supporting millions of jobs fewer than it did pre-pandemic as women and older workers stay out of the labor force due to COVID constraints. (RTRS)

FED: Federal Reserve Vice Chair Richard Clarida sold at least $1 million of shares in a U.S. stock fund in February 2020 before buying a similar amount of the same fund a few days later on the eve of a central bank announcement, according to an amended financial disclosure. While the purchase transaction was previously disclosed and reported by Bloomberg News in October, the sale of the fund shares was first included in an amended financial-disclosure form filed with the government last month. The New York Times reported the latest filing earlier Thursday. The new form showed Clarida sold $1 million to $5 million of the iShares MSCI USA Min Vol Factor exchange-traded fund on Feb. 24, then invested a similar range in the fund on Feb. 27. (BBG)

ECONOMY: MNI: St. Louis Fed Model Sees 1M+ Jobs Added in December

- U.S. hiring in December likely picked up strongly from a month earlier, according to the St. Louis Fed's analysis of real-time employment data from scheduling software company Homebase, showing a seasonally-adjusted rise of over 1 million jobs, economist Max Dvorkin told MNI on Thursday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Service Inflation Seen Staying Elevated - ISM

- U.S. service costs will remain elevated for most of this year as firms resort to extraordinary incentives to draw in new workers, ISM survey chair Anthony Nieves told MNI Thursday. Prices in the monthly ISM services survey rose 0.2 points to its third-highest reading ever at 82.5 in December as backlogs continue to grow. "It will take two or three months for pricing to come down but it will still be high; well above 50. We're not going to see any contraction of pricing anytime soon" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The White House and U.S. Postal Service are making final plans to deliver 500 million coronavirus test kits to households, the Washington Post reported, citing four unidentified people familiar with the plans. The Biden administration will launch a website to let individuals request rapid tests, and officials aim to begin shipments by mid-January, the newspaper said. (BBG)

OTHER

GLOBAL TRADE: Two of the world’s largest memory chip manufacturers are feeling the pinch as stringent Covid-19 lockdown measures hamper production in southwest China’s industrial hub Xi’an. Samsung Electronics and Micron Technology are experiencing staff shortages at their manufacturing sites as the city imposes strict controls on people’s movement amid its worst outbreak. The companies together account for 67% of the global dynamic random access memory (DRAM) chips market and 45% of the supply of NAND flash chips. (Caixin)

GLOBAL TRADE: Taiwan’s China Airlines and Eva Airways will increase freight rates by as much as 20%, Taipei-based Economic Daily News reports, citing companies’ announcements. (BBG)

USMCA: The Mexican government has requested a panel under the U.S.-Mexico-Canada Agreement to resolve a dispute with the U.S. over the interpretation of rules of origin for the auto industry, the Economy Ministry said Thursday. Rules of origin specify how much of a product must originate in the region covered by the trade agreement to be eligible for tariff-free status. (WSJ)

U.S./CHINA: A Chinese national pleaded guilty on Thursday in Missouri federal court to conspiring to steal trade secrets from agricultural company Monsanto to benefit the Chinese government, the U.S. Justice Department said. Xiang Haitao, who was employed by Monsanto and a subsidiary from 2008 to 2017, pleaded guilty to one count of conspiracy to commit economic espionage and is scheduled to be sentenced on April 7, the Justice Department said in a statement. He faces a maximum penalty of 15 years in prison. (RTRS)

GEOPOLITICS: The United States and Japan will sign a new research and development agreement to make it easier to collaborate on countering new defense threats, including hypersonics and space-based capabilities, U.S. Secretary of State Antony Blinken said on Thursday. Foreign and defense ministers of the United States and Japan met virtually to discuss stepping up security ties amid a focus on Japan's role as tensions rise over Taiwan and North Korean missile threats continue. (RTRS)

GEOPOLITICS: Foreign and defence ministers from the United States and Japan expressed their concerns over China's ongoing efforts to undermine rules based-order, a joint statement said on Friday. "They resolved to work together to deter and, if necessary, respond to destabilising activities in the region," the statement said. The ministers said they had "serious and ongoing concerns" about human rights issues in China's Xinjiang and Hong Kong regions and underscored the importance of peace and stability in the Taiwan Strait. Top officials from the two countries met virtually to discuss modernizing and strengthening their security alliance and to launch a new research and development collaboration agreement to meet emerging threats such as hypersonic missiles. (RTRS)

CORONAVIRUS: Moderna CEO Stephane Bancel on Thursday said the efficacy of boosters against Covid-19 will likely decline over time, and people may need a fourth shot in the fall to increase their protection. Bancel said people who received their boosters last fall will likely have enough protection to get them through the winter, when new infections surge as people gather indoors to escape the cold. However, Bancel said the efficacy of boosters will probably decline over the course of several months, similar to what happened with the first two doses. The Moderna chief was interviewed by Goldman Sachs during the investment bank’s health-care CEO conference. (CNBC)

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday that he was closely watching any impact of currency moves on the Japanese economy and that foreign exchange stability was important. He was speaking to reporters after a cabinet meeting. (RTRS)

JAPAN: Tokyo is set to lower the limit on number of people allowed to dine together at restaurants to 4 from 8 as coronavirus cases surge, FNNreports, citing an unidentified person. (BBG)

JAPAN: A Japanese government panel put forward a formal request on Friday to declare quasi-emergency measures to stem a surge in coronavirus cases. The measures would affect the southern prefecture of Okinawa and the western prefectures of Hiroshima and Yamaguchi, lasting from Jan. 9 until the end of the month. (RTRS)

JAPAN: The Japanese government is planning to delay resumption of its “Go To” travel subsidy program until after Feb. as coronavirus infections surge, Kyodo reports on Thurs., citing an unidentified person. Program had been slated to resume as soon as late Jan. (BBG)

AUSTRALIA: New South Wales authorities suspended non-urgent elective surgery, and banned singing and dancing in hospitality venues as omicron cases surge. The changes follow 70,000 infections in two days in the state and a jump in hospitalizations. NSW Premier Dominic Perrottet urged people to minimize mingling. (BBG)

RBA: Treasurer Josh Frydenberg has committed to a broad-based, independent review of the Reserve Bank of Australia and the nation's monetary policy settings after this year's election, in a move backed by leading economists. In an exclusive year-ahead interview with The Australian Financial Review, Mr Frydenberg said it was timely to hold a review after the election, which is scheduled for sometime between March and May. Shadow Treasurer Jim Chalmers is also committed to an examination of the RBA if Labor forms government, noting the bank's persistent pre-pandemic failure to hit its 2 per cent to 3 per cent inflation target, but is open-minded about how the review should be structured. (Australian Financial Review)

NORTH KOREA: The recent missile test by North Korea highlights the destabilizing impact of Pyongyang's illicit weapons program, state department spokesperson Ned Price said Thursday. Price also urged North Korea to refrain from further provocations and instead engage in dialogue. U.S. Indo-Pacific Command earlier said the missile launch did not pose an immediate threat to the U.S. or its allies in the region. However, a state department spokesperson later told Yonhap while speaking on condition of anonymity that the U.S. was assessing the "specific nature" of the launch when asked if the test did in fact involve a hypersonic missile. (Yonhap)

RUSSIA: U.S. officials are pinning their hopes for common ground in upcoming talks with Russia on issues such as arms control, given President Vladimir Putin’s main demand for security guarantees to avert a potential war with Ukraine is already a non-starter. With the clock ticking as Putin sends even more troops to the Ukraine border, the U.S. delegation led by Deputy Secretary of State Wendy Sherman will come to Geneva this weekend ready to engage on the positioning of weapons in Europe, according to officials familiar with the administration’s thinking. (BBG)

RUSSIA: The United States is closely monitoring reports that peacekeeping forces of the Russia-led Collective Security Treaty Organization have been deployed to Kazakhstan, State Department spokesman Ned Price has said. “The United States and, frankly, the world will be watching for any violation of human rights,” Price told reporters. “We will also be watching for any actions that may lay the predicate for the seizure of Kazakh institutions.” (Al Jazeera)

PERU: Peru raised interest rates for a sixth straight month as inflationary pressure mounts amid the economy’s strong rebound from the pandemic. The central bank increased its policy rate by half a percentage point to 3% in line with the forecasts of five of seven analysts surveyed by Bloomberg. Two economists had expected a bigger increase, to 3.25%. “With the information available, we consider it appropriate to continue with the normalization of monetary policy over the coming months,” the bank said in its statement. (BBG)

ARGENTINA: Argentina’s central bank on Thursday raised its “Leliq” interest rate by 2 percentage points to 40% and announced it would be redesigning its monetary policy to ensure macroeconomic stability. The bank had been weighing a rate hike since last year, amid high inflation domestically and abroad. The interest rate had remained unchanged at 38% for most of 2021. Inflation hovers at around 50%. (RTRS)

OIL: Texas and other states cannot proceed with a lawsuit aiming to revive a key permit for the 830,000 b/d Keystone XL crude pipeline because the project has been canceled, a federal judge ruled. (Argus Media)

OIL: EOG Resources Inc., one of the biggest U.S. shale oil producers, is ready to ramp up output as soon as this summer if the market demands it. The company has yet to resume pre-pandemic levels of production, but that could change this year under certain macroeconomic conditions, EOG Chief Executive Officer Ezra Yacob said in a virtual energy conference hosted by Goldman Sachs Group Inc. The driller is monitoring global oil demand, inventory levels and unused production capacity within OPEC+, Yacob said. If the conditions are right, potentially by the middle of 2022, “EOG would be in a position to return to pre-Covid levels of production,” he said. “If the world has a call on oil and there’s room to grow our low-cost, lower-emissions barrels into the market, we can certainly deliver on that.” (BBG)

CHINA

PBOC: The first quarter could be a “key window” for China to further ease monetary policy and make the yuan’s exchange rate more flexible before tapering picks up in the U.S., China Securities Journal reports, citing analysts. China highly likely to “marginally” loosen its monetary policy this year with possible cuts in rates and banks’ reserve ratios, the report said. Interest rate spreads between China and offshore markets could narrow further and impact capital flows and asset prices. (BBG)

YUAN: The Chinese yuan in 2022 will be largely dependent on the outlook of the country's exports, which may continue to be supported if the pandemic hinders recoveries of overseas economies, the Economic Daily reported citing Guan Tao, a former forex official. Guan also noted that the Federal Reserves may hike interest rates earlier than expected, while China still has room for easing given tamed inflation, though this may lead to narrowed China-U.S. interest rate spread and a weaker yuan, the newspaper said. (MNI)

POLICY: China should introduce countercyclical policies as soon as possible, as the decline in economic growth coupled with slower inflation seen in December may last up to a year without sufficient stimulus, said 21st Century Business Herald in a commentary. The cooling real estate sector has brought about a rapid economic slowdown, restrained industrial products prices, and dampened credit-based liquidity, the newspaper said. Net exports may weaken as major economies turn to monetary tightening, while high-end manufacturing and new energy are not enough to be the main driver, the newspaper said. (MNI)

POLICY: China will carry out timely pro-growth policies to keep the economy operating within a reasonable range, wrote He Lifeng, director of National Development and Reform Commission in a CPC-run magazine. The ministry will focus on expanding domestic demand, accelerating debt issuances to fund infrastructure projects, wrote He. The government will create a sound economic and social environment ahead of the 20th National Party Congress this year, wrote He. (MNI)

PROPERTY: Chinese policymakers plan to exclude debt accrued from acquiring distressed assets when calculating property developers' compliance with the "three red lines", financial intelligence provider REDD reported on Friday, amid unprecedented stress on the sector. (RTRS)

INVESTMENT: China may need a total investment of CNY150-300 trillion to achieve its carbon emission peak and neutrality goals, so it requires many domestic and foreign investors to participate in the country’s green financial market, wrote Liu Guiping, vice governor of the People’s Bank of China in an article published on the PBOC-run magazine China Finance. The central bank will promote green finance in the Guangdong–Hong Kong–Macau Greater Bay Area by encouraging domestic and overseas green banks, securities and funds to set up headquarters for green business in the areas, as well as facilitating interconnection of the financial markets, wrote Liu. (MNI)

CORONAVIRUS: China’s Shenzhen city will require negative Covid test results from Saturday for anyone leaving the city, after two infections are found in regular tests Friday, according to a government statement. (BBG)

OVERNIGHT DATA

JAPAN DEC TOKYO CPI +0.8% Y/Y; MEDIAN +0.7%; NOV +0.5%

JAPAN DEC TOKYO CORE CPI +0.5% Y/Y; MEDIAN +0.5%; NOV +0.3%

JAPAN DEC TOKYO CORE-CORE CPI -0.3% Y/Y; MEDIAN -0.3%; NOV -0.4%

JAPAN NOV LABOUR CASH EARNINGS 0.0% Y/Y; MEDIAN +0.5%; OCT +0.2%

JAPAN NOV REAL CASH EARNINGS -1.6% Y/Y; MEDIAN -0.5%; OCT -0.7%

JAPAN NOV HOUSEHOLD SPENDING -1.3% Y/Y; MEDIAN +1.2%; OCT -0.6%

CHINA MARKETS

PBOC NET DRAINS CNY100BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via seven-day reverse repos with the rate unchanged at 2.2% on Friday. This operation has drained net CNY100 billion after offsetting the maturity of CNY110 billion reverse repos, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The seven-day weighted average interbank repo rate for depository institutions rose to 2.1135% at 10:13 am local time from the close of 1.9310% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 39 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3742 FRI VS 6.3728

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3742 on Friday, compared with 6.3728 set on Thursday.

MARKETS

SNAPSHOT: COVID Headlines Dominate In Asia, NFP Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 68.93 points at 28418.94

- ASX 200 up 94.986 points at 7453.3

- Shanghai Comp. up 17.203 points at 3603.282

- JGB 10-Yr future up 2 ticks at 151.14, yield down 0.3bp at 0.121%

- Aussie 10-Yr future up 1.0 tick at 98.115, yield down 1bp at 1.855%

- U.S. 10-Yr future +0-04+ at 128-21+, yield down 0.18bp at 1.719%

- WTI crude up $0.70 at $80.16, Gold down $0.01 at $1791.24

- USD/JPY up 8 pips at Y115.91

- CHINA MAY EASE MONETARY POLICY IN 1Q DESPITE HAWKISH FED (CSJ)

- SHENZHEN REQUIRES NEGATIVE COVID RESULTS FOR LEAVING CITY (BBG)

- FED'S BULLARD WANTS MARCH HIKE, WARNS OF MORE TIGHTENING (MNI)

- XI’AN LOCKDOWN RATTLES WORLD’S LARGEST CHIPMAKERS (CAIXIN)

- CHINA PLANS TO RELAX "THREE RED LINES" TO ENCOURAGE STATE-LED PROPERTY M&A (REDD)

- JAPAN FINMIN: CLOSELY WATCHING FOREX IMPACT ON ECONOMY (RTRS)

BOND SUMMARY: JGBs Sell Off At Bell, Markets Await NFPs

Tsys have moved away from best levels but remain in limited range. TYH2 +0-02+ at 128-19+ at typing, operating within a 0-05+ trading band, while cash Tsys sit little changed to 1.0bp cheaper across the curve. There has been a lack of meaningful news flow during asia hours, with participants focused on Friday’s NFP release. A block trade consisting of the sale of FVG2 120.00 puts (-15.0K) and FVH2 buying (+8K) headlined on the flow side. As mentioned, focus is squarely on Friday’s NFP report, with the recent hawkish repricing in the front end of the Tsy curve & STIRs providing the potential for increased volatility if the dataset disappoints. Elsewhere, Fedspeak will come from ’24 voters Bostic & Daly.

- JGB futures initially unwound their overnight weakness on local COVID worry (potential for a delay re: the Go To travel campaign & for a quasi state of emergency declaration in a handful of prefectures). That was before a sharp bout of selling hit the contract into the bell, leaving it -15 at the close. This was perhaps a result of some pre-U.S. NFP worry in thin markets ahead of elongated Tokyo weekend. Elsewhere, 30-Year JGB supply went well, with the tail narrowing and cover ratio moving higher when compared to last month’s auction. More granularly, the cover ratio hit the highest level seen at a 30-Year auction since July, residing comfortably above the 6-month average. Elsewhere, the low price also topped broader dealer expectations. Outright interest on the back of multi-month high yields and the previously outlined long end interest on the part of Japanese life insurers likely drove demand at the auction. Cash yields were marginally higher (<+1.0bp) across most of the curve.

- Aussie bonds benefitted from the reinstatement of some COVID-related limits in NSW, although the moves weren’t particularly pronounced. YM +2.0 and XM +1.0 at the bell as a result. There wasn’t anything in the way of a notable market reaction to the AOFM declaring that “a new November 2033 Treasury Bond will be issued by syndication in the final quarter of 2021-22 (subject to market conditions),” with a lack of Q122 syndication and a run of the mill extension of the 10-Year futures basket providing no headwinds for the space.

JGBS AUCTION: Japanese MOF sells Y732.1bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y732.1bn 30-Year JGBs:

- Average Yield 0.719% (prev. 0.673%)

- Average Price 99.51 (prev. 100.65)

- High Yield: 0.720% (prev. 0.677%)

- Low Price 99.50 (prev. 100.55)

- % Allotted At High Yield: 88.4482% (prev. 14.8255%)

- Bid/Cover: 3.629x (prev. 3.214x)

JGBS AUCTION: Japanese MOF sells Y4.0667tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0667tn 3-Month Bills:

- Average Yield -0.1054% (prev. -0.1181%)

- Average Price 100.0260 (prev. 100.0285)

- High Yield: -0.0993% (prev. -0.1078%)

- Low Price 100.0245 (prev. 100.0260)

- % Allotted At High Yield: 56.7007% (prev. 26.3636%)

- Bid/Cover: 2.937x (prev. 3.112x)

JAPAN: Little To Shout About In Weekly International Security Flow Data

Weekly international security flow data out of Japan provided the following observations:

- Japanese investors registered a third straight weekly round of net selling of foreign bonds, with the 4-week rolling sum of the measure remaining comfortably in negative territory, even as a Y1tn+ round of weekly net selling dropped out of the sample period.

- Foreign investors reverted to net purchases of Japanese bonds (albeit in a limited fashion, with liquidity thinned owing to the time of year) after shedding over Y1tn of Japanese paper in the previous week. This was the fourth week out of the last five which saw net purchases of Japanese bonds on the part of foreign investors.

- Japanese investors net purchased foreign equities for a sixth consecutive week, although the 4-week rolling sum fell as a large round of weekly net purchases fell out of the sample.

- Foreign investors registered another round of limited net purchases when it came to Japanese equities, with the 4-week rolling sum of that measure still residing comfortably in negative territory.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -416.5 | -310.0 | -1854.9 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 213.6 | 131.7 | 793.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 447.2 | -1221.6 | 1637.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 17.1 | 124.5 | -1306.1 |

EQUITIES: Japan Struggles On COVID Woes

The major Asia-Pac equity indices were mixed during the final session of the week, with participants keenly awaiting the impending U.S. NFP report.

- Local omicron worries weighed on Japanese equities, with reports pointing to the potential for a delay when it comes to the restart of the Go To travel campaign and rising chances re: the declaration of a quasi state of emergency in a handful of Japanese prefectures dominating Japanese headline flow. This allowed the Nikkei 225 to unwind its early gains, with the index trading in negative territory ahead of the close.

- The remainder of the major regional equity indices ticked higher. Chinese equities benefitted from another bout of reassuring rhetoric from the top Chinese regulatory body (delivered late Thursday). Elsewhere, Chinese state-owned developers supported the property sector, after reports suggested that M&A loans will not be included in China’s three red lines surrounding debt. It wasn’t all rosy in the developer space, after one of Shimao’s units missed payment on a domestic loan, triggering discussion re: the scope of contagion that could grip the sector.

OIL: Modest Gains In Asia

WTI & Brent futures added ~$0.50 overnight. Geopolitical risk surrounding Kazakhstan continues to garner attention, generating support for oil, even though there hasn’t been anything in the way of reports pointing to any meaningful disruption when it comes to the country’s crude supply. Elsewhere, Libyan crude production remains sub-par, with plenty of questions already apparent re: OPEC+’s ability to continually execute when it comes to higher output (without adjusting the country splits when it comes to quota allocations).

GOLD: Technicals Continue To Contain Broader Price Action

Gold remains in familiar territory, with spot dealing a touch above $1,790/oz at typing, holding a tight range during Asia-Pac dealing.

- Bullion continues to operate within the confines of well-defined technical parameters. As a reminder, support comes in at the channel base drawn from the Aug 9 low, while key near-term resistance is seen at the Jan 3 high ($1,831.9/oz).

- Friday’s NFP print provides the key risk event during the remainder of the week. Note that a softer than expected round of NFP data would provide the potential for increased volatility (at least intraday), owing to the hawkish repricing (re: the Fed) witnessed since the release of the minutes covering the FOMC’s December meeting.

FOREX: Dollar Slips With NFP Front & Centre

Thursday's risk aversion petered out as participants were preparing for the release of U.S. labour market data. The report will receive close scrutiny amid attempts to forecast the trajectory of policy tightening by the Federal Reserve, following this week's hawkish repricing on that front.

- The DXY slipped in Asia-Pac trade, indicating the dissipation of broader demand for the greenback. This helped drag USD/CNH lower, even as the ongoing outbreak of Covid-19 in several location across China continued to stoke concerns.

- NOK and CAD held firm, even as their commodity-tied peers AUD and NZD lost their initial appeal. The yen remained the worst G10 performer, albeit USD/JPY gave up almost all of its early gains.

- While U.S. NFP report provides the sole focal point today, flash EZ CPI, German industrial output and Canadian jobs data are also due. The central bank speaker slate features Fed's Daly & Bostic as well as BoE's Mann.

FOREX OPTIONS: Expiries for Jan07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E982mln), $1.1290-00(E1.5bln), $1.1350-53(E905mln)

- USD/JPY: Y116.00($2.5bln)

- AUD/USD: $0.7160(A$2.1bln), $0.7200(A$1.3bln), $0.7250-55(A$728mln)

- USD/CAD: C$1.2650($665mln), C$1.2675-90($1.3bln), C$1.2700($581mln), C$1.2800($639mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/01/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/01/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/01/2022 | 0700/0800 | ** |  | DE | trade balance |

| 07/01/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/01/2022 | 0730/0830 | ** |  | CH | retail sales |

| 07/01/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 07/01/2022 | 0745/0845 | * |  | FR | industrial production |

| 07/01/2022 | 0745/0845 | * |  | FR | foreign trade |

| 07/01/2022 | 0745/0845 | * |  | FR | current account |

| 07/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 07/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 07/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 07/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 07/01/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 07/01/2022 | 1000/1100 | ** |  | EU | retail sales |

| 07/01/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 07/01/2022 | 1330/0830 | *** |  | US | Employment Report |

| 07/01/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/01/2022 | 1500/1000 |  | US | San Francisco Fed's Mary Daly | |

| 07/01/2022 | 1600/1600 |  | UK | BOE Mann at CFR meeting | |

| 07/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 07/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/01/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/01/2022 | 1400/1500 |  | EU | ECB Schnabel at AEA meeting | |

| 08/01/2022 | 1500/1500 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 08/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.