-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI EUROPEAN MARKETS ANALYSIS: Tsys Pressured In Asia, Chinese Tech Nudges Higher

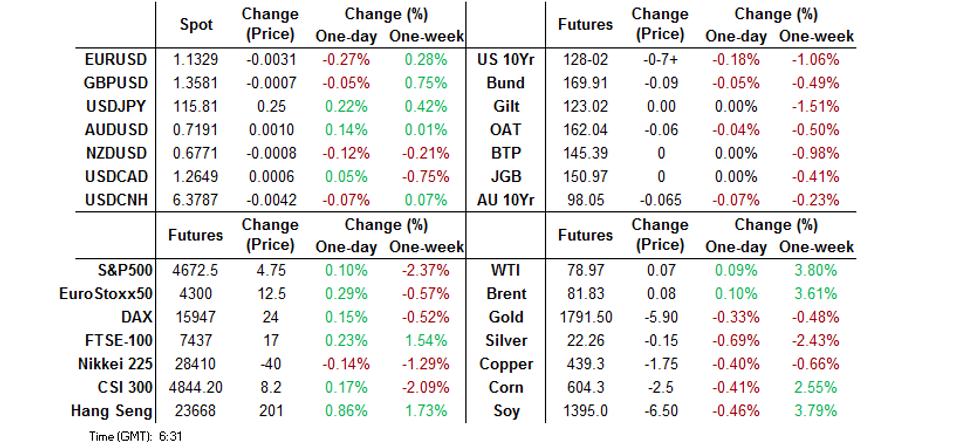

- U.S. Tsy futures struggled in Asia, with cash markets closed for the observance of a Japanese holiday.

- Chinese tech shares extended the uptick witnessed at the backend of last week.

- Russia-related discussions in Geneva headline on Monday.

BOND SUMMARY: Lower Tsy Futures Drive Broader Price Action

Tsy futures were pressured from the off in Asia-Pac trade (cash markets are closed until the London open owing to a Japanese holiday), as Asia reacted to Friday’s post-NFP moves and greater chances of further fiscal stimulus in the U.S. This outweighed China-related COVID worry and reports out of Cyprus pointing to several cases of a combination of the Delta & Omicron COVID strains. The latter had little lasting impact on broader risk appetite, with the scientist that flagged the developments having to downplay speculation that the combination came about on the back of contamination in the testing lab. TYH2 -0-07+ at 128-02 as of typing, after the contract threatened to test the psychological 128-00 at one point overnight. On the sell side, Goldman Sachs frontloaded their Fed rate hike view (now looking for 4 25bp hikes in ’22 vs. 3 previously), while they rolled forward their call re: the start of B/S normlisation on the part of the central bank. A screen seller of the EDH4/M4/U4 butterfly {~5K) headlined on the flow front. There isn’t much of note on the U.S. docket on Monday, which may mean that any rumblings from the Russia-related discussions in Geneva may receive higher scrutiny vs. the norm.

- The Aussie bond space traded at the whim of the broader Tsy-driven impetus, leaving YM -2.0 & XM -6.5 at settlement, as the weakness observed in the final overnight session of last week extended. The 10- to 12-Year zone provided the weak point on the cash ACGB curve. In local news, Australian PM Morrison tipped his hat to the already known dampening of consumer demand, while stressing that it is too early to make predictions re: the economic impact of Omicron. We also saw the RBA return to ACGB buying operations, as scheduled. A$IG supply continues to tick over, with CBA & the AIIB providing the deals of note after flagging the potential for such issuance last week.

US TSYS: Overview Of Projected Cash Tsy Opening Changes

BBG calculations point to ~2.5-4.5bp worth of cheapening across the curve at the cash Tsy open on Monday (which will take place at 07:00 UK time, 02:00 Eastern, owing to the observance of a national holiday in Japan). Note that this is based on the change in the price of benchmark futures since Friday’s close, with reference to the CtD for each futures contract. The curve is set to bear flatten, if current futures prices provide an accurate representation of early cash Tsy price action. The TU-TY area has provided the most notable degree of weakness in overnight trade, with yields in that zone set to open 4.0-4.5bp higher today, based on the aforementioned calculations.

FOREX: Aussie Dollar Takes Lead, Japanese Holiday Saps Liquidity

The Aussie dollar clawed back its opening losses and climbed to the top of the G10 scoreboard, even as Australia's daily Covid-19 cases topped 100k for the first time on record, while iron ore futures retreated on fears surrounding demand from China in light of the community outbreak of Omicron there. A beat in Australian building permits helped the local currency extend gains, while a BBG trader source pointed to additional support from exporter demand. AUD/USD rose past Friday's peak but struggled to take out the $0.7200 mark.

- The broader high-beta FX space traded on a firmer footing amid an apparent improvement in sentiment, with participants still trying to forecast the Fed tightening path. The monthly CPI report, due out of the U.S. on Wednesday, may provide a notable data input.

- Liquidity was thinned out and market activity was limited by a public holiday in Japan. The yen weakened, with USD/JPY recouping the bulk of losses registered last Friday.

- Spot USD/CNH edged lower, even as Tianjin reported China's first community transmission of the Omicron coronavirus variant, while the PBOC set their yuan reference rate 14 pips above sell-side estimate.

- EZ unemployment, Norwegian CPI & final U.S. wholesale inventories headline the thin global data docket today. The central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E1.1bln), $1.1350(E501mln), $1.1390-10(E552mln)

- USD/JPY: Y114.00($1.1bln), Y116.00($600mln), Y116.50($1.2bln)

ASIA FX: IDR Leads On Post-NFP Impetus, Local Covid Matters Weigh On THB & PHP

The broad-based USD sales observed after the release of the U.S. labour market report last Friday lent support to Asia EM FX, albeit domestic concerns about the spread of the Omicron coronavirus variant pulled the rug from beneath some regional currencies.

- CNH: Spot USD/CNH traded in negative territory and had a look below Friday's trough. Offshore yuan was unfazed by a slightly softer than expected PBOC fix and the detection of China's first community transmission of the Omicron coronavirus variant in Tianjin.

- KRW: Spot USD/KRW gapped higher at the re-open but trimmed those opening losses. The Bank of Korea are set to deliver their monetary policy decision later this week.

- IDR: The rupiah led losses in Asia EM FX space, as post-NFP greenback weakness provided a headwind for spot USD/IDR. Indonesian Investment Min Luhut said that the domestic coal crisis is over but Energy Min Tasrif said that the nation will need some more time before lifting coal exports ban.

- MYR: The ringgit traded on a firmer footing, aforementioned post-NFP impulse helped drag spot USD/MYR lower. Malaysia's Nov industrial output topped expectations in a welcome development for the MYR.

- PHP: The peso went offered as the Philippine's daily Covid-19 cases hit another all-time high, while the government ramped up efforts to ensure adequate supply of hospital beds.

- THB: The baht was comfortably the worst performer in the Asia EM basket, cementing its position as the main regional laggard this year. New virus countermeasures weighed on the THB amid expectations of a further decline in tourism confidence.

EQUITIES: U.S. Fiscal Hope & Chinese Tech Uptick Counter Early Pressure

Worry re: the prospect of speedier rate hikes and/or swifter balance sheet reduction at the Federal Reserve made for a cautious start to Asia-Pac trade on Monday, with a market holiday in Japan thinning out broader liquidity. Reports out of Cyprus pointing to a combination of the Delta & Omicron COVID strains had little lasting impact on broader risk appetite, with the scientist that flagged the developments having to downplay speculation that the combination came about on the back of contamination in the testing lab.

- The COVID situation in China provided another source of concern in early trade, although growing speculation surrounding the potential for fresh U.S. fiscal stimulus helped counter that.

- Volatile trade continued when it came to the Chinese property developer sphere, with troubles for some individual names mixed in with signs that Guangdong is looking to promote activity that would strengthen the sector (via M&A, supported by SOEs).

- Elsewhere, the Hang Seng Tech index is on course to register its third consecutive day of gains after tagging a fresh all-time low last week (some dipping their toe into the beaten down space).

- This made for outperformance in the Hang Seng, while the Shanghai Composite is on course to lodge its first positive session for calendar ’22.

- The strength in Chinese tech and U.S. fiscal speculation left e-minis little changed to 0.4% higher, with the NASDAQ 100 leading gains there.

GOLD: Bullion Under Modest Pressure To Start The Week

Spot gold has held to a ~$5/oz range during Asia-Pac hours, last trading a handful of dollars lower at $1,792.4/oz, as U.S. Tsy futures come under fresh selling pressure (cash Tsys are closed until London hours owing to a Japanese holiday).

- To recap, our weighted U.S. real yield monitor tested Thursday’s highs in the wake of Friday’s U.S. NFP release (solid prints in the supplementary metric outweighed a miss in the headline print), before backing off. The initial impulse allowed gold to challenge the channel base drawn off the Aug 9 low, bottoming at $1,782.8/oz, which held & continues to provide initial technical support.

- Wednesday’s U.S. CPI print is front and centre when it comes to the focus of market participants.

OIL: Crude Unwinds Early Losses

WTI & Brent crude futures sit ~$0.10 higher on the day, unwinding early Asia-Pac weakness which likely stemmed from the latest round of COVID worry re: China (with compulsory testing observed in the port city of Tianjin after new cases were detected there) and the partial resumption of previously halted crude production in both Libya & Kazakhstan. There wasn’t much in the way of overt triggers re: the recovery from lows, outside of the potential for spill over from the weakness observed in the U.S. Tsy futures space, which may be linked to the increased likelihood of fresh fiscal stimulus in the U.S. (which we have flagged elsewhere).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2022 | 0830/0930 | ** |  | SE | Private Sector Production |

| 10/01/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 10/01/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2022 | 1600/1100 | ** |  | US | NY Fed Survey Of Consumer Expectations |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result For 13 Week Bill |

| 10/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result For 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.