-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fedspeak Dominates Overnight, Support For March Hike Grows

EXECUTIVE SUMMARY

- BRAINARD SAYS INFLATION FIGHT IS THE FED’S TOP TASK (MNI)

- FED'S BULLARD: FOUR INTEREST RATE RISES IN 2022 NOW APPEAR LIKELY (WSJ)

- FED’S MESTER SAYS ECONOMY ON TRACK FOR A MARCH RATE RISE (WSJ)

- HARKER OFFICIAL OPEN TO MORE THAN THREE US RATE RISES THIS YEAR (FT)

- FED’S DALY TIPS HAT TO POTENTIAL FOR MARCH RATE HIKE

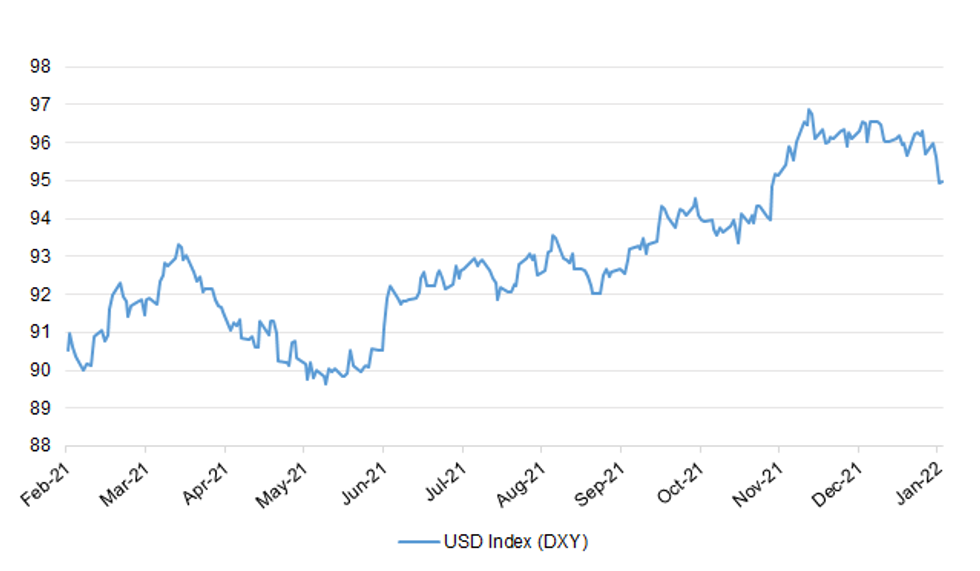

Fig. 1: USD Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Covid infection rates are falling in London, raising hopes that the omicron outbreak is in retreat. Infections for the U.K. increased to 4.3 million in the first week of January, up from 3.7 million a week earlier, the Office for National Statistics said. England accounted for the bulk, at just over 3.7 million, and the highest infection rate at 1-in-15. But cases in London, which has been at the epicenter of the U.K. outbreak, dropped from 1 in 10 to 1 in 15. The hot spots are now the North West of England and Yorkshire and the Humber, where 1 in 10 people have Covid. (BBG)

ECONOMY: British job vacancies grew at the slowest pace in eight months in December, according to a survey of recruiters, but overall labour market conditions remained tight as many employers struggled to find staff. The Recruitment and Employment Confederation (REC) said demand for staff had eased only slightly since record levels in the autumn of 2021. Staff absences due to the Omicron variant of coronavirus had boosted demand for temporary workers, especially in the healthcare sector. "2022 will be the year we discover staff shortages will outlive the pandemic as an economic issue," REC chief executive Neil Carberry said. (RTRS)

FISCAL: UK hospitality operators have stepped up calls for a permanent reduction in value added tax and business rates after a 40 per cent drop in sales over the normally busy festive season eroded the cash reserves many businesses need to see them through the quieter winter months. Sales figures due to be published on Thursday by the trade body UKHospitality and industry tracker CGA show that restaurants, pubs and bars recorded a £3bn decline in revenue during December compared to the same month in 2019. (FT)

BREXIT: The UK and EU will resume talks on the Northern Ireland Protocol on Thursday. Foreign Secretary Liz Truss will act as the UK's lead negotiator for the first time since she replaced Lord Frost. "There is a deal to be done but it will require a pragmatic approach from the EU," she said. The UK is seeking fundamental changes to the operation and oversight of the protocol, while the EU has offered limited changes aimed at reducing the impact on Northern Ireland businesses. Ahead of the talks, which are being billed as a potential "reset", Ms Truss said the EU has "a clear responsibility" to fix problems. She added that she would put forward "practical, reasonable solutions… with a view to agreeing a plan for intensive negotiations". (BBC)

POLITICS: A YouGov poll for The Times found that six in ten voters believed that Johnson should resign, including 38 per cent of those who voted Tory at the last general election. Johnson’s approval ratings are at their lowest level yet. The Tories have fallen ten points behind Labour, the biggest gap since December 2013. (The Times)

POLITICS: Boris Johnson is facing calls from senior Tories to stand down as prime minister after he admitted attending a drinks party during lockdown. The PM apologised for the way he handled the event in the Downing Street garden in 2020 and said he understood the public's "rage" over it. Cabinet members including deputy PM Dominic Raab rallied round Mr Johnson. But Scottish Tory leader Douglas Ross and MPs William Wragg, Caroline Nokes and Roger Gale called on him to go. (BBC)

POLITICS: Rishi Sunak declined on Wednesday night to fully endorse Boris Johnson until he had seen the results of the probe into allegations of lockdown-breaking parties in Downing Street. After eight hours of public silence following the Prime Minister's apology to the House of Commons, the Chancellor issued a carefully worded message on Twitter. Mr Sunak, widely tipped by colleagues as a potential successor as Tory leader, said that Mr Johnson “was right to apologise” for attending a gathering on May 20 2020. The Chancellor added: “I support his request for patience while Sue Gray carries out her inquiry.” Ms Gray is the civil servant carrying out the investigation into rule-breaking parties. (Telegraph)

EUROPE

ITALY: Italy’s government is working on a spending package that won’t require revising the budget to expand the deficit, people familiar with the matter said. The measures could be announced as early as next week and would bring targeted relief to sectors hit by the surge in Covid-19 infections, such as tourism, the people said, asking not to be named discussing confidential plans. The package will also be used to refinance furlough programs for workers hit by the pandemic. (BBG)

SWEDEN: Sweden's PES unemployment rate was unchanged at 3.5% in December from November, according to the Public Employment Service. (BBG)

SWEDEN: Swedish apartment prices rose by 7% in December from a year earlier, while house prices increased by 13%, according to statement from Svensk Maklarstatistik. (BBG)

U.S.

FED: MNI: Brainard Says Inflation Fight Is The Fed’s Top Task

- Federal Reserve Governor Lael Brainard said Wednesday that high inflation is the biggest problem facing the U.S. central bank at the moment, with policymakers focused on slowing that rise on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of St. Louis President James Bullard said the U.S. central bank will need to move more aggressively on rate rises this year as it seeks to stem an inflation surge, amid a job market that could see the unemployment rate fall below 3% by the end of the year. “We want to bring inflation under control in a way that does not disrupt the real economy, but we are also firm in our desire to get inflation to return to 2% over the medium term,” Mr. Bullard said in a Wall Street Journal interview Wednesday. (WSJ)

FED: Federal Reserve Bank of Cleveland President Loretta Mester said Wednesday the U.S. central bank is on track to raise its short-term interest-rate target at its March policy meeting. With inflation high right now, “the case is very compelling” for the Fed to move toward raising its short-term target rate, Ms. Mester said in a virtual appearance Wednesday at The Wall Street Journal’s CFO Network Summit. “We need to take action to make sure” that inflation goes down and the public’s expected path of inflation remains consistent with the Fed’s 2% target, Ms. Mester said. “If things looked like they do today in March I would support raising, lifting off from zero at that point,” she said. The official reiterated she believes the Fed will raise rates three times in 2022. (WSJ)

FED: Patrick Harker, president of the Philadelphia branch of the Federal Reserve, said he would support more than three interest rate rises this year if inflation surges higher as he became the latest US central bank official to throw his weight behind an increase in March. “I currently have three increases in for this year, and I’d be very open to starting in March,” Harker said in an interview with the Financial Times. “I’d be open to more if that’s required.” The Fed official’s comments follow inflation data for December that showed the US consumer price index jumping 7 per cent year-on-year for the first time since 1982 — a reading Harker described as “very high, very bad”. (FT)

FED: Calling inflation "uncomfortably high," San Francisco Federal Reserve Bank President Mary Daly on Wednesday said it's time for the U.S. central bank to start removing some of its policy accommodation. "I definitely see rate increases coming, as early as March even," Daly said in an interview on the PBS NewsHour. (RTRS)

FED: MNI BRIEF: US Economy Grew Modestly At End Of '21 - Beige Book

- Supply chain bottlenecks and labor shortages kept a lid on U.S. economic growth as last year drew to a close, the Federal Reserve's latest Beige Book survey said Wednesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI: Fed Could Give Nod to March Hike This Month - Ex-Officials

- The Federal Reserve could signal a March liftoff of interest rates from near-zero as soon as this month's meeting as the labor market verges on full employment amid a persistent shortage of workers and inflation continues to soar, several former Fed officials and staffers told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Biden administration is working with lawmakers to finalize his three remaining picks for the Federal Reserve, said White House National Economic Council Director Brian Deese. “We are working closely with congressional leadership to finalize those additional nominees and are confident that we can move them on a schedule that will mean that they can be in place at the appropriate cadence,” Deese told reporters Wednesday at the White House. (BBG)

FED: Some Senate Republicans are open to voting for Lael Brainard, the president’s nominee to serve as vice chair of the Federal Reserve, but sound more concerned about Sarah Bloom Raskin, Axios' Hans Nichols and Neil Irwin write. GOP support for Brainard, a Fed governor whose confirmation hearing will be tomorrow, would all but assure her confirmation. But questions about Raskin, Biden’s likely choice to serve as the Fed's top bank regulator, raise doubts for her. (Axios)

INFLATION: Top White House economic adviser Brian Deese on Wednesday addressed new data that showed inflation at a nearly 40-year high, telling reporters that increasing prices are a "global phenomenon" that's connected to the COVID-19 pandemic. Deese, director of the National Economic Council, said the unique strength of the U.S. economic recovery makes the nation "well-positioned to attack the challenges of prices and costs head-on." He also said there has been "some welcome deceleration" in price increases in some areas such as grocery items, but the increases are still too high. (MarketWatch)

INFLATION: Inflation in the United States is expected to decline in the second quarter of this year, International Monetary Fund Managing Director Kristalina Georgieva said on Wednesday. "This is subject to dealing with supply chain constraints, and what we are seeing are some promising signs that some progress is being made in that regard," Georgieva said in an interview with CNBC. (RTRS)

FISCAL: The U.S. government posted a $21 billion budget deficit for December 2021, the smallest monthly gap in two years as individual income tax receipts surged with increased employment, the Treasury Department said on Wednesday. The December deficit was 85% lower than the year-ago deficit of $144 billion, and was the smallest since a December 2019 deficit of $13 billion, just before the COVID-19 pandemic threw the global economy into a tailspin. (RTRS)

CORONAVIRUS: The federal government is sending medical teams to six states – New York, New Jersey, Ohio, Rhode Island, Michigan and New Mexico – to help hospitals overburdened by COVID-19, USA TODAY has learned. President Joe Biden is expected to announce the deployments Thursday when discussing steps the administration is taking to address a surge in infections driven by the omicron variant,according to a White House official. (USA Today)

POLITICS: President Joe Biden will attend a special caucus meeting with Senate Democrats Thursday as the party struggles over how and whether to weaken the filibuster to pass elections reform. Chuck Schumer will bring elections and voting legislation to the Senate floor in the coming days, using existing congressional rules to evade an initial GOP filibuster. Instead, the Senate will confront its raging debate over the filibuster when Majority Leader Schumer moves to shut down debate. (POLITICO)

POLITICS: House Minority Leader Kevin McCarthy (R-Calif.) said Wednesday he will not participate with the Jan. 6 select committee's request to interview him about his communications with former President Trump. McCarthy, the highest-ranking elected official the panel has asked for information, said that he had nothing to add and criticized the panel's "abuse of power." (Axios)

EQUITIES: Republican Sen. Josh Hawley of Missouri and Democratic Sen. Jon Ossoff of Georgia are introducing competing bills to end stock-trading by members of Congress. "Members of Congress should not be playing the stock market while we make federal policy and have extraordinary access to confidential information," Ossoff said in a press release. Ossoff is teaming up with Democratic Sen. Mark Kelly of Arizona, who said the proposal would "put an end to corrupt insider trading." (Business Insider)

OTHER

U.S./CHINA: The Biden administration on Wednesday criticized China's decision to cancel a growing number of flights from the United States to China because of passengers who later tested positive for COVID-19 and warned it could take action in response. "China’s actions are inconsistent with its obligations under the U.S.-China Air Transport Agreement. We are engaging with the (Chinese government) on this and we retain the right to take regulatory measures as appropriate," a U.S. Transportation Department (USDOT) spokesperson said. (RTRS)

US/CHINA: The U.S. House of Representatives is preparing to move forward on a China competitiveness bill that would authorize billions of dollars in funding to boost U.S. research and development as well as aid for the domestic semiconductor industry, according to a leadership aide. The move comes after Senate Majority Leader Chuck Schumer and House Speaker Nancy Pelosi in November announced a deal to find a way to get the U.S. Innovation and Competition Act through Congress after the Senate had passed it in June. The legislation, which has bipartisan support, is a major legislative priority for Schumer and the Biden administration. (BBG)

USMCA: Deputy U.S. Trade Representative Jayme White expressed Washington's ongoing concern about Canada's proposed digital services tax in talks on Wednesday with Canada's deputy trade minister, David Morrison, USTR said in a statement. (RTRS)

BOJ: The Bank of Japan is expected to stand pat on policy, but adjust its view of inflation risks for the first time since 2014 to account for the global price spikes pushing other central banks to rein in stimulus. All 48 economists surveyed by Bloomberg see the BOJ keeping its negative interest rate and asset purchases unchanged at the end of next week’s meeting on Tuesday. Despite Japan’s weak inflation pulse, 77% of analysts say it’s likely or very likely the bank will adjust how it characterizes the risks to its price forecasts. The change would imply officials now see the possibility that price gains could also outstrip their projections, not just undershoot them. (BBG)

JAPAN: A vast majority of Japanese firms want fiscal support to keep flowing at least through this year, a Reuters poll showed, while two-thirds want help to ease the pain from rising commodity prices and a weaker yen. The results of the Reuters Corporate Survey show companies in the world's third-largest economy feeling the need for further support, even as major economies from Europe to the United States dial back crisis-mode economic stimulus programmes. The survey also highlights how the weak yen and rising commodity costs are putting the squeeze on Japanese companies already saddled with slow growth and an ageing domestic population. (RTRS)

JAPAN: The Tokyo metropolitan government raised its COVID-19 alert to the second highest of four levels Thursday as the rapid spread of the Omicron variant of the coronavirus continues to drive up infections. (Kyodo)

JAPAN: Japan will allow medical workers who have been identified as close contacts of omicron cases to keep working, after staff absences caused by a 14-day quarantine period stressed the health system in an area suffering from a large outbreak. The health-care staff can continue working as long as they pass daily tests, the country’s health minister Shigeyuki Goto told reporters on Wednesday. The government is moving to allocate resources to those who need them the most as cases surge in Japan, which had all but snuffed out its wave of the delta variant. (BBG)

JAPAN: The Japanese government will “quickly consider” any request from prefectural governments to implement stronger coronavirus prevention measures as cases surge nationwide, Chief Cabinet Secretary Hirokazu Matsuno says in a regular briefing. Measures currently apply in Okinawa, Hiroshima and Yamaguchi Prefectures. (BBG)

AUSTRALIA: Australia on Thursday reported its biggest pandemic caseload with a runaway Omicron outbreak driving up hospitalisation rates as the surge put severe strain on supply chains forcing authorities to ease quarantine rules for more workers. After successfully containing the virus earlier in the pandemic, Australia has reported nearly a million cases over the last two weeks as people slowly get adjusted to living with the coronavirus amid fewer restrictions. Total infections detected since the pandemic began neared 1.4 million. More than 147,000 new cases have been recorded so far on Thursday in Australia, with about 92,000 in the most populous state of New South Wales (NSW), although that includes a backlog of positive at-home results dating back to the beginning of January. (RTRS)

RBNZ: The Reserve Bank of New Zealand said Deputy Governor Geoff Bascand left his role earlier than planned after breaching protocol by sharing information about the bank’s leadership reorganization. Bascand departed on Dec. 17 rather than in early January as originally intended, an RBNZ spokesperson said in an emailed statement Thursday in Wellington. His departure was first reported by the National Business Review. “Bascand disclosed that he had shared information about the RBNZ’s leadership reorganization to a third party which was unauthorized and a breach of protocol,” the spokesperson said. “Bascand apologized for his actions and accepts it was a lapse in judgment. The RBNZ Board and the Minister of Finance have been informed.” (BBG)

SOUTH KOREA: President Moon Jae-in orders government to swiftly prepare measures to reduce burden of pandemic-hit small merchants, using excess tax revenue which is larger than previous est., presidential spokeswoman says in briefing. (BBG)

NORTH KOREA: U.S. Secretary of State Antony Blinken tweeted the following on Wednesday: “The U.S. is sanctioning individuals and entities that support the DPRK’s weapons programs. We are committed to preventing the DPRK from accessing technology and resources that advance these destabilizing programs.” (MNI)

NORTH KOREA: The United States is pushing the United Nations Security Council to impose more sanctions on North Korea following a series of North Korean missile launches, the U.S. ambassador to the UN, Linda Thomas-Greenfield, said on Wednesday. "The U.S. is proposing U.N. sanctions following North Korea's six ballistic missile launches since September 2021, each of which were in violation of U.N. Security Council resolutions," Thomas-Greenfield posted on Twitter. (RTRS)

CANADA: Canada will allow unvaccinated Canadian truck drivers to cross in from U.S., reversing a decision requiring all truckers to show proof of vaccination, Reuters reported, citing a Canada Border Services Agency spokesperson. (BBG)

BRAZIL: Brazil’s President Jair Bolsonaro said the omicron strain that’s causing a surge in Covid cases at home and abroad could be called a “vaccine virus” and is a “welcome” variant. “Some studious and serious people -- and not linked to pharmaceutical companies -- say that omicron is welcome and can in fact signal the end of the pandemic,” Bolsonaro said Wednesday in an interview with Gazeta Brasil website. (BBG)

RUSSIA: The U.S. Senate will vote on Thursday on a bill being pushed by Republican Ted Cruz to slap sanctions on the Nord Stream 2 natural gas pipeline in Europe, although it is not expected to garner enough support to pass. The bill is scheduled for a vote at around 2:45 p.m. ET (1945 GMT), according to Democratic Senator Jon Ossoff. (BBG)

RUSSIA: The new top Republican on the House Intelligence Committee called Wednesday on President Joe Biden’s administration to ramp up military and intelligence support for Ukraine. “I believe that the administration should be actively arming Ukraine so it can defend itself,” Rep. Mike Turner of Ohio said in an interview. “They want to defend themselves. They should be given every opportunity to do so.” (AP)

OIL: Valero Energy Corp. and Marathon Petroleum Corp. were the biggest buyers in the Biden Administration’s first sale of crude from U.S. emergency stockpiles in a bid to bring down gasoline pump prices. Six companies bought 18.1 million barrels of high-sulfur crude from the Strategic Petroleum Reserve caverns in a sale tender that closed Jan. 4, the U.S. Energy Department said Wednesday. The U.S. had earlier offered 32 million barrels in a crude loan program. (BBG)

CHINA

INFLATION: China’s CPI is expected to rise moderately this year from 2021’s 0.9% gain, as pork prices enter an upward cycle and higher energy and raw material prices further affect consumer prices, the China Securities Journal reported citing analysts. PPI will continue to ease from the 8.1% gain in 2021 as commodity prices had peaked, the newspaper said. CPI and PPI are seen at 2.5% and 5.0% in 2022, respectively, with the gap between the two largely narrowing which will help ease the cost pressure of downstream manufacturers, the newspaper said citing a report by the Chinese Academy of Social Sciences. (MNI)

MONEY SUPPLY: China’s new yuan loans and aggregate financing are expected to surge this month as credit demand picks up with banks’ increased lending capacity following RRR cuts as well as accelerated infrastructure investment amid the early issuance of government bonds, the China Securities Journal reported citing Zhou Maohua, a researcher at China Everbright Bank. The growth rate of aggregate financing has risen for a second month in December with monetary policies supporting carbon emission and tech innovation as well as increased fiscal spending, the newspaper said citing analysts. (MNI)

ECONOMY: China’s steady jobless rate is masking pain in the labor market that leaders will find hard to ignore as they look to stimulate the economy in a crucial political year. Alternative indicators and anecdotal reports suggest unemployment is worse than the official monthly figures show. From weak consumer spending to strict Covid control measures to the government’s regulatory crackdown on the edutech and property industries, the labor market is under considerable strain, economists say. Jobs are an overriding consideration for government officials as the Communist Party prepares for a twice-a-decade leadership meeting later this year. Beijing has already signaled a pro-growth bias in its policies, with economists expecting interest rate cuts and a pick-up in fiscal spending early in the year. (BBG)

ECONOMY: China issued its first national plan for the digital economy, aiming to boost the added value of the industry to 10% of GDP by 2025 from 7.8% in 2020, the Securities Times reported citing policy paper by the government. The plan calls for upgrading digital infrastructure, accelerating the construction of information networks and vigorously promoting the digital transformation of major industries and enterprises, the newspaper said. The plan also calls China to be a world leader in digital economy by 2035, the newspaper said. (MNI)

PROPERTY: Sunac China Holdings Ltd. raised $580 million in a top-up share sale, easing fears of a liquidity crisis that had sent the Chinese real estate giant’s dollar bonds tumbling to record lows on Wednesday. The nation’s third-largest property developer by sales sold 452 million shares at HK$10 apiece, a 15% discount to Wednesday’s close, according to terms of the deal obtained by Bloomberg News. Shares of Sunac opened 15% lower in Hong Kong trading Thursday. (BBG)

CORONAVIRUS: A person who tested positive for Covid-19 in Dalian city Wednesday has been confirmed as infected with omicron variant, Xinhua News Agency reports, citing local Covid control authority. 28 people with close contacts with the person in Dalian tested negative for the virus. (BBG)

OVERNIGHT DATA

JAPAN DEC M2 MONEY STOCK +3.7% Y/Y; MEDIAN +3.8%; NOV +4.0%

JAPAN DEC M3 MONEY STOCK +3.4% Y/Y; MEDIAN +3.5%; NOV +3.5%

JAPAN DEC TOKYO AVERAGE OFFICE VACANCIES 6.33%; NOV 6.35%

JAPAN DEC BANKRUPTCIES -9.67% Y/Y; OCT -10.36%

NEW ZEALAND NOV BUILDING PERMITS +0.6% M/M; OCT -2.1%

SOUTH KOREA DEC EXPORT PRICE INDEX +23.5% Y/Y; NOV +25.5%

SOUTH KOREA DEC EXPORT PRICE INDEX -1.0% M/M; NOV -0.9%

SOUTH KOREA DEC IMPORT PRICE INDEX +29.7% Y/Y; NOV +35.0%

SOUTH KOREA DEC IMPORT PRICE INDEX -1.9% M/M; NOV -1.0%

SOUTH KOREA DEC BANK LENDING TO HOUSEHOLDS KRW1,060.7TN; NOV KRW1,060.9TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1872% at 09:43 am local time from the close of 2.0798% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 55 on Wednesday vs 44 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3542 THU VS 6.3658

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3542 on Thursday, compared with 6.3658 set on Wednesday, hitting the strongest level since Dec. 10, 2021.

MARKETS

SNAPSHOT: Fedspeak Dominates Overnight, Support For March Hike Grows

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 280.92 points at 28483.86

- ASX 200 up 35.495 points at 7474.4

- Shanghai Comp. down 29.913 points at 3567.519

- JGB 10-Yr future down 1 tick at 151.04, yield down 0.5bp at 0.126%

- Aussie 10-Yr future down 1.0 tick at 98.110, yield up 0.9bp at 1.860%

- U.S. 10-Yr future -0-04+ at 128-14, yield down 0.71bp at 1.736%

- WTI crude down $0.33 at $82.31, Gold up $0.91 at $1827.06

- USD/JPY down 14 pips at Y114.50

- BRAINARD SAYS INFLATION FIGHT IS THE FED’S TOP TASK (MNI)

- FED'S BULLARD: FOUR INTEREST RATE RISES IN 2022 NOW APPEAR LIKELY (WSJ)

- FED’S MESTER SAYS ECONOMY ON TRACK FOR A MARCH RATE RISE (WSJ)

- HARKER OFFICIAL OPEN TO MORE THAN THREE US RATE RISES THIS YEAR (FT)

- FED’S DALY TIPS HAT TO POTENTIAL FOR MARCH RATE HIKE

BOND SUMMARY: Core FI Coils In Asia

A lack of meaningful macro headline flow has made for a tight Asia-Pac session when it comes to core FI markets.

- TYH2 looked through Wednesday’s lows as Asia-Pac participants reacted to Wednesday’s hawkish Fedspeak, while Harker (’23 voter) & Daly (’24 voter) joined in during Asia hours, pointing to support for a March rate hike. TYH2 bounced from worst levels, operating at the top of the narrow-0-07 range observed ahead of London hours, last -0-04 at 128-14+. Cash Tsys sit ~1bp richer across the cruve. PPI and weekly jobless claims data headline the NY economic docket on Thursday. Elsewhere, Fedspeak will come from Brainard, Barkin & Evans, while Tsy supply comes in the form of 30-Year paper.

- The lack of domestic headline flow/overt macro market drivers left the cross-market impact from U.S. Tsys in the driving seat during Tokyo dealing. JGB futures were +1 at the bell, unwinding the early weakness, while operating within the confines of the recently observed range. Cash JGBs are little changed to 0.5bp richer across the curve. There wasn’t anything in the way of clear concession built ahead of tomorrow’s 20-Year JGB auction. Elsehwere on the issuance front, Hungary mandated for a potential round of multi-tranche samurai paper, which would include green bonds.

- Aussie bonds stuck to a narrow range given the lack of macro drivers, with YM -1.5 & XM -1.0 come the close.

EQUITIES: Mixed In Asia

Asia-Pac hours saw a lack of coherence when it came to the direction of travel for the major regional equity indices. The Nikkei 225 fell afoul of Wednesday’s downtick in the USD/JPY FX cross, while Chinese property developers struggled on the back of increasing focus on the bond payment hurdles that some of the major names in the space face during the current week. Elsewhere, the ASX 200 and Hang Seng nudged higher. U.S. e-mini futures were little changed to ~0.2% lower.

OIL: Holding Onto Most Of Wednesday’s Gains

WTI & Brent crude futures sit ~$0.15 below Wednesday’ settlement levels, with yesterday’s closing levels representing the highest levels observed since early November. Recent sessions have seen crude latch onto support from reduced Omicron worry, questions re: the ability of OPEC+ to meet heightened production quotas (without tweaking the county by country splits observed within the group’s production pact) and shrinking U.S. crude inventories.

GOLD: Gold Flat In Asia

Spot gold operates within the confines of the recently observed range, dealing just above $1,825/oz, with familiar technical parameters in play. The pullback in the USD has supported bullion over the last 24 hours or so, with hawkish Fed rhetoric offering little impetus for participants.

FOREX: NZD Atop G10 Pile, CNH Slips On Wider Weak Bias In PBOC Fix

Major currency pairs held tight ranges as the dust settled after Wednesday's release of broadly in-line U.S. CPI data. The DXY stabilised after Wednesday's rout, while the NZD narrowly outperformed its G10 peers, with NZD/USD attacking its descending 50-DMA as a result.

- Offshore yuan slipped after the PBOC set their central yuan reference rate 60 pips above sell-side estimate, which represented the largest weak bias in a month. The soft fixing came after market reaction to U.S. CPI prompted spot USD/CNH to extend its uninterrupted pullback from Jan 6 multi-week high towards the CNH6.3600 mark. With many reading the divergence in today's fixing vs. expectations as a sign of the PBOC's discomfort with a stronger redback, the rate ticked away from that round figure, snapping a four-day losing streak.

- U.S. PPI and weekly jobless claims headline today's global data docket. Elsewhere, comments are due from Fed's Barkin & Evans, ECB's de Guindos & Elderson as well as BoE's Mann.

- Worth noting that the Senate Banking Committee will hold Lael Brainard's nomination hearing for Fed Vice Chair today. In her pre-prepared remarks, Brainard said that fighting high inflation will be the Fed's "most important task."

FOREX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- USD/JPY: Y115.00($612mln), Y115.50($1.07bln), Y116.00($960mln)

- USD/CAD: C$1.2650($531mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 13/01/2022 | 0845/0845 |  | UK | BOE Mann at EIB Conference | |

| 13/01/2022 | 0900/1000 | * |  | IT | industrial orders |

| 13/01/2022 | 1030/1130 |  | EU | ECB de Guindos at UBS Q&A | |

| 13/01/2022 | 1300/0800 |  | US | Philadelphia Fed's Patrick Harker | |

| 13/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 13/01/2022 | 1330/0830 | *** |  | US | PPI |

| 13/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/01/2022 | 1430/1530 |  | EU | ECB Elderson at Climate Change Seminar | |

| 13/01/2022 | 1500/1000 |  | US | Fed Brainard's Senate Nomination Hearing | |

| 13/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 13/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/01/2022 | 1700/1200 |  | US | Richmond Fed's Tom Barkin | |

| 13/01/2022 | 1800/1300 |  | US | Chicago Fed's Charles Evans | |

| 13/01/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.