-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Stand Pat, Change Price Risk Assessment

EXECUTIVE SUMMARY

- BOJ STAND PAT ON POLICY SETTINGS, STICK TO ULTRA-LOOSE POLICY STANCE

- BOJ UPGRADE FY2022 CORE CPI OUTLOOK, CHANGE PRICE-RISK BALANCE VIEW

- EUROGROUP SEEKS PATH BETWEEN HIGH INFLATION, SLOWER GROWTH (AP)

- BORIS JOHNSON CONTINUES TO FACE “PARTYGATE” HEADWINDS

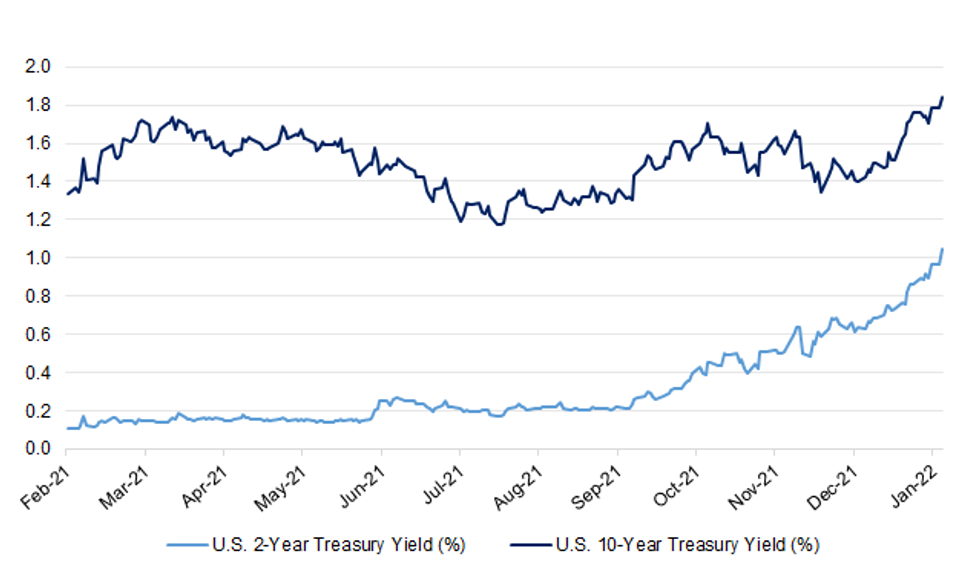

Fig. 1: U.S. 2-Year vs. 10-Year Treasury Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: There is “massive anger” among grassroots Conservative party supporters over the Downing Street parties scandal, the head of a leading group has said as its survey found 40% thought Boris Johnson should resign. Ed Costelloe, chairman of Grassroots Conservatives, said it had been years since the group last polled its supporters and followers but it felt compelled by the “unique” nature of the public mood. (Guardian)

POLITICS: Boris Johnson’s leadership has been openly questioned by a serving minister, who said he was “shocked and flabbergasted” by revelations of Downing Street parties. George Freeman, the science minister, said that stories of “boozy” gatherings in No 10 had caused “serious damage” to public trust in the government. He questioned why some Downing Street staff had been holding parties when members of the public “couldn’t see dying loved ones”. (Times)

POLITICS: Boris Johnson's former chief adviser has said the prime minister knew in advance about a Downing Street drinks party during the first coronavirus lockdown and agreed that it could go ahead, claims that have been confirmed to Sky News by a second source. In an updated post on his Substack page, Dominic Cummings said he raised his concerns about the event in the Number 10 garden in May 2020 directly with the PM and would "swear under oath this is what happened". But Downing Street said earlier on Monday it was not true that Mr Johnson was warned about it in advance and repeated the PM's assertion to MPs last week that he "implicitly" believed it was a work event. Number 10 has repeated this denial in the wake of Mr Cummings' latest post. (Sky)

POLITICS: The government has suffered a series of defeats in the House of Lords over its plans to clamp down on disruptive and noisy protesters. Opposition peers voted against a range of measures in the Police, Crime, Sentencing and Courts Bill, with Labour calling some of the plans "outrageous". Peers also voted to make misogyny a hate crime in England and Wales in another government defeat. The bill will now go back to the Commons for MPs to have their say. (BBC)

CORONAVIRUS: The end of the pandemic is in sight for Britain, the World Health Organisation’s Covid chief has suggested after cases fell by more than a third in a week. As ministers prepare to lift most remaining restrictions in England next week, David Nabarro said the country could see light at the end of the tunnel”. Facemasks are likely to remain a legal requirement on public transport and indoors but work from home guidance and vaccine passports are expected to be scrapped at the end of the month. (Times)

CORONAVIRUS: No 10 is drawing up plans to phase out England’s remaining pandemic restrictions from as early as March as a beleaguered Boris Johnson signals to his backbenchers that he is prepared to let the UK live with the virus. A senior source confirmed that the government was looking at ending mandatory self-isolation for positive Covid cases, saying it would be “perverse” to keep the measure in the long term. It could be replaced by guidance. (Guardian)

ECONOMY: The UK is exploring a radical intervention in the power market under which the state would make payments to energy suppliers when wholesale gas prices rise sharply in a bid to soften the blow to consumers. The proposal, which is being promoted by energy companies, is described by government insiders as “plausible” and “logical”, but they admit there are also many downsides to such a step. Under the initiative, energy suppliers would receive payments from government when wholesale gas prices exceeded a certain threshold so they would not then have to pass the hike on to consumers. (FT)

EUROPE

EU: Euro finance chiefs on Monday ventured into a high-wire political balancing act prompted by conflicting economic forces: a weaker growth outlook and stronger inflation. Finance ministers from the 19 nations that share the euro currency pledged continued budgetary stimulus for the European economy amid headwinds caused by the highly transmissible omicron variant. At the same time, they sought to reassure voters by vowing vigilance over sharp price rises. “Am I concerned about inflation? Obviously so,″ Dutch Finance Minister Sigrid Kaag told reporters in Brussels where she attended a meeting with her euro zone counterparts. “The purchasing power of the individual citizens will be affected.” (AP)

EU: Roberta Metsola will surge to the European Parliament presidency on Tuesday, capping off a campaign where she pitched herself as a young but experienced female leader who can inspire and build consensus across Europe’s fractious political divides. Yet it took until the final moments for the 42-year-old Maltese politician to guarantee she would be elected, as a cohort of socialist MEPs continued to express fears their newly gained power in Europe would not be fairly represented under Metsola and that her more conservative record on abortion was out of step with the Continent’s political direction. Ultimately, the path cleared Monday afternoon after the socialists were promised a slate of prominent positions in return for backing Metsola. (Politico)

EU: Fines for violations of the European Union’s landmark privacy law have soared nearly sevenfold in the past year, according to new research. EU data protection authorities have handed out a total of $1.25 billion in fines over breaches of the bloc’s General Data Protection Regulation since Jan. 28, 2021, law firm DLA Piper said in a report published Tuesday. That’s up from about $180 million a year earlier. Notifications of data breaches from firms to regulators climbed more modestly, by 8% to 356 a day on average. (CNBC)

GERMANY/RUSSIA: German Foreign Minister Annalena Baerbock arrives late on Monday in Moscow, where she is scheduled for talks with Russian counterpart Sergey Lavrov on Tuesday. Her working visit will continue until Tuesday evening, the press service of the German Embassy in Moscow told TASS. (TASS)

GERMANY/UKRAINE: German foreign minister Annalena Baerbock is seeking to revive the four-nation “Normandy” format to de-escalate tensions over Ukraine, as she visited Kyiv en route to Moscow to push for European-led negotiations. Baerbock warned Russia would pay a “high price” should it attack, and said she was in Kyiv to make it “clear that we are not discussing Ukraine without Ukraine”. (FT)

FRANCE: A French court on Monday found far-right presidential hopeful Eric Zemmour guilty of racist hate speech for a tirade against unaccompanied child migrants. Zemmour drew widespread outrange in September 2020 when he told the CNews channel that child migrants were "thieves, killers, they're rapists. That's all they are. We should send them back". (France24)

ITALY: League leader Matteo Salvini said Monday that it will be necessary to verify whether ex-premier Silvio Berlusconi has the necessary support to become Italy's next president before lawmakers from both houses of parliament and regional representatives start voting for a new head of State on January 24. Salvini and Giorgia Meloni, the leader of the right-wing Brothers of Italy party (FdI) party, have said they are in favour of the Forza Italia leader and media billionaire succeeding President Sergio Mattarella, whose seven-year term is coming to an end. But Berlusconi has not confirmed he will stand amid doubts whether he has enough votes among the 'grand electors'. (Ansa)

EAST EUROPE: Russia has begun moving troops to Ukraine’s northern neighbour Belarus for joint military exercises, in a move likely to increase fears in the west that Moscow is preparing for an invasion. The joint military exercises, named United Resolve, are to take place as Russia also musters forces along Ukraine’s eastern border, threatening a potential invasion that could unleash the largest conflict in Europe for decades. (Guardian)

POLAND: Poland is likely to have had more victims of phone hacking using spyware developed by Israel-based NSO Group, a researcher told a commission, after allegations that Polish special services used the technology against government opponents. Canadian researchers said late last year that phones of a senior opposition politician and two prominent government critics were hacked using Pegasus software. (RTRS)

UKRAINE: Petro Poroshenko, Ukraine’s former president, flew back to Kyiv on Monday to face treason charges which he claims are part of a politically motivated witch-hunt orchestrated by his successor Volodymyr Zelensky. The charges were announced late last year as Poroshenko travelled abroad for the holiday period and involve coal purchases from Russian-backed breakaway eastern regions while Poroshenko was president from 2014 to 2019. (FT)

U.S.

POLITICS: Facing stark criticism from civil rights leaders, senators return to Capitol Hill under intense pressure to change their rules and break a Republican filibuster that has hopelessly stalled voting legislation. The Senate is set to launch debate Tuesday on the voting bill with attention focused intently on two pivotal Democrats — Kyrsten Sinema of Arizona and Joe Manchin of West Virginia — who were singled out with a barrage of criticism during Martin Luther King Jr. Day events for their refusal to change what civil rights leaders call the “Jim Crow filibuster.” (AP)

INFRASTRUCTURE: The chief executives of major U.S. passenger and cargo carriers on Monday warned of an impending "catastrophic" aviation crisis on Wednesday when AT&T and Verizon are set to deploy new 5G service. The airlines warned the new C-Band 5G service could potentially make a significant number of widebody aircraft unusable and "could potentially strand tens of thousands of Americans overseas." "Unless our major hubs are cleared to fly, the vast majority of the traveling and shipping public will essentially be grounded," wrote the chief executives of American Airlines, Delta Air Lines, United Airlines , Southwest Airlines and others. (RTRS)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Monday it is still too soon to predict whether the omicron Covid-19 variant will mark the final wave of the coronavirus pandemic. “It is an open question whether it will be the live virus vaccination that everyone is hoping for,” Fauci said via videoconference at The Davos Agenda virtual event. (CNBC)

CORONAVIRUS: One year into her tenure as director of the Centers for Disease Control and Prevention, Rochelle Walensky acknowledged that she hasn’t been clear enough with the American public. She says the pandemic threw curveballs that she should have anticipated. She thinks she should have made it clearer to the public that new rules and guidelines were subject to change if the nature of the fight against Covid-19 shifted again. (WSJ)

OTHER

CORONAVIRUS: The chief executive of Moderna said a combined booster shot for Covid-19 and flu could be available towards the end of 2023, as the pharmaceutical company edged closer to an Omicron specific vaccine. “Our goal is to be able to have a single annual booster so that we don’t have compliance issues where people don’t want to get two to three shots a winter,” said Stéphane Bancel during a streamed panel at the World Economic Forum’s annual meeting. (FT)

CORONAVIRUS: A fourth dose of the Pfizer-BioNTech vaccine was insufficient to prevent infection with the omicron variant of Covid-19, according to preliminary data from a trial in Israel released Monday. Two weeks after the start of the trial of 154 medical personnel at the Sheba Medical Center in Tel Aviv, researchers found the vaccine raised antibody levels. (BBG)

JAPAN: Japan’s government is preparing social restrictions in Tokyo and other regions as the omicron variant of the coronavirus infects more people. Japan has never had a lockdown during the pandemic but has focused instead on asking restaurants and bars to close early. Crowds are back in many parts of Japan, with people packing stores and events, while COVID-19 cases jump. The order will be finalized this week and is likely to take effect Friday for Tokyo and nine other regions, including Chiba, Kanagawa, Aichi and Kumamoto, the government spokesman said Tuesday. An order was issued earlier this month for Okinawa, Yamaguchi and Hiroshima prefectures. Other areas seeing surging infections, such as Osaka, may be added later. (AP)

JAPAN/FRANCE: The foreign and defense ministers of Japan and France will hold security talks virtually on Thursday, with cooperation in the Indo-Pacific region, where China's rise has stoked concern among many countries, expected to top the agenda. (Kyodo)

AUSTRALIA: Soaring virus infections have fuelled a backlash against Prime Minister Scott Morrison over his handling of the pandemic, slashing the Coalition’s primary vote from 39 to 34 per cent and vaulting Labor into a strong position ahead of this year’s federal election. The dramatic shift has cut the government’s standing on every key measure of its performance, with voters losing confidence in Mr Morrison and the Coalition on the economy, jobs, health and the response to the coronavirus. Labor has increased its primary vote from 32 to 35 per cent since November, generating a powerful boost for Opposition Leader Anthony Albanese ahead of the election due by May, while the Greens have held their support at 11 per cent. (SMH)

AUSTRALIA: Australia suffered its deadliest day of the pandemic on Tuesday as a fast-moving Omicron outbreak continued to push up hospitalisation rates to record levels, even as daily infections eased slightly. (RTRS)

SOUTH KOREA: There is need to strengthen monitoring of capital flows, as well as the foreign exchange market, as the South Korean won is affected by various drivers including U.S. inflation, global commodity prices, China’s economy and the chip industry cycle, the Bank of Korea says in a monthly report. The won has weakened despite strong economic fundamentals, and the extent of its weakness is seen greater compared to the period between Dec. 2012-July 2013 when circumstances were similar to today. (BBG)

NORTH KOREA: North Korea said Tuesday it conducted the test-firing of a tactical guided missile a day earlier to confirm the accuracy of the weapons system under production. On Monday, South Korea's military said the North fired two suspected short-range ballistic missiles eastward from the Sunan airfield in Pyongyang, marking its fourth show of force this month. "The test-fire was aimed to selectively evaluate tactical guided missiles being produced and deployed and to verify the accuracy of the weapon system," the North's official Korean Central News Agency (KCNA) said. North Korean leader Kim Jong-un did not attend the firing. (Yonhap)

ISRAEL: Israel's defence ministry said on Tuesday it had completed a planned flight test of the Arrow weapons system, and would release further test details throughout the day. Last year, Israel said it was developing a new ballistic missile shield, the Arrow-4, with the United States. Its Arrow-2 and Arrow-3 interceptors are already operational as part of a multi-layered system to destroy incoming missiles in the atmosphere and in space. (RTRS)

MIDDLE EAST: An air strike killed about 14 people in a building in the Yemeni capital of Sanaa, residents said on Tuesday, during strikes across the city launched by the Saudi-led coalition fighting the Houthi group. The alliance strikes on Houthi-held Sanaa followed an attack claimed by the Iran-aligned Houthis on Monday on coalition partner the United Arab Emirates, in Abu Dhabi, in which three people were killed. The coalition also said it intercepted eight drones launched toward Saudi Arabia on Monday. (RTRS)

BONDS: The world’s poorest countries face a $10.9bn surge in debt repayments this year after many rebuffed an international relief effort and instead turned to the capital markets to fund their responses to the pandemic. A group of 74 low-income nations will have to repay an estimated $35bn to official bilateral and private-sector lenders during 2022, according to the World Bank, up 45 per cent from 2020, the most recent data available. (FT)

CHINA

PBOC: The People's Bank of China may cut by 10 bps its 1-year and 5-year Loan Prime Rates on Jan. 20, a stronger easing signal than a 10-bps cut to 1-year LPR alone in December, China.com.cn reported citing Wen Bin, the chief researcher at China Minsheng Bank. The reduction in loan references became expected by the market after the central bank on Monday cut both the 7-day reverse repo rate, a short-term interbank borrowing reference, and the 1-year medium-term lending facilities (MLF). The expected move will implement policymakers’ call for urgent countermeasures to arrest the current slowdown, which must rely on investments, it said. Thursday’s reduction in 5-year LPR will help lower medium-to-long term loan costs, which fund major infrastructure investments, the report said citing Zeng Gang, the deputy director of the National Institution for Finance & Development. (MNI)

ECONOMY: China’s economy, currently at its slowest, should begin to rebound in H2 after stabilizing in Q2, helped by the slew of monetary and fiscal policies that have been introduced, Sheng Songcheng, a former director of the statistics department at the People's Bank of China, told China National Radio after the central bank on Monday cut both medium and short-term loan benchmarks. China should introduce more forceful countercyclical measures, including rate cuts, before March, when the Federal Reserve probably begins rate hike, expected to pressure the yuan and draw capital away from China markets, Sheng said. (MNI)

CORONAVIRUS: The Chinese municipality of Tianjin reported fewer COVID-19 cases on Tuesday as its outbreak showed early signs of easing, while the daily case count in the city of Anyang hit a record. Tianjin, a key port in the northern China, reported 18 domestically transmitted cases with confirmed symptoms for Monday, the National Health Commission (NHC) data showed on Tuesday. That marks the lowest daily number in a week. (RTRS)

CORONAVIRUS: China’s zero tolerance approach to Covid has idled Toyota Motor Corp. and Volkswagen AG factories the past week, a troubling sign for global carmakers as the omicron variant begins to spread in the world’s biggest auto production hub. The two top-selling carmakers’ factories in Tianjin, 108 kilometers (67 miles) southeast of Beijing, have been halted since Jan. 10 as the local government carries out multiple rounds of mass testing for the city’s 14 million residents. The disruptions caused by China’s strict Covid-Zero policy are sparking broader concerns about what the months ahead will look like for manufacturers operating in China, which has imposed strict quarantines and mass testing to stamp out infections. The clash between those policies and the omicron variant could put further stress on already strained supply chains, given the country’s role as a manufacturing powerhouse. (BBG)

INFRASTRUCTURE: China Three Gorges Corp., the world’s largest hydropower company, is adding wind and solar capacity under plans to diversify its business as the era of mega-dam projects fades. The state-owned firm currently has capacity to generate about 26 gigawatts of electricity using solar panels or wind turbines, according to a statement, from 16 gigawatts in 2020. It aims to hit a target of 70 to 80 gigawatts by 2025. China is likely to see zero growth in power generation from hydroelectric plants this year, while solar and wind jump as much as 30%, Bloomberg Intelligence analysts including Chia Chen wrote in a Monday note. There are also limited options for major hydro developments, with most of the easiest locations already utilized and costs of rival energy sources declining faster. (BBG)

PROPERTY: China’s property investments may shrink by as much as 10% in 2022, dragging down overall growth, Yicai.com reported citing a research organization it didn’t identify. Including development, construction materials and all other segments, the property account for 20% of the country’s GDP, Yicai said. Should the total property investment decline by 8% this year, it can shave 2.7 percentage points off overall growth, given the effect of declining wealth and fiscal revenues, etc., Yicai said. The situation will worsen from last year, when the property sector still contributed to 0.4 pp growth in full-year GDP despite a rapid slowdown in H2, the news site said citing official data. (MNI)

PROPERTY: Shanghai Pudong Development Bank Co. plans to sell bonds worth 30 billion yuan ($4.7 billion) to fund loans for property acquisitions, in a move aimed at easing stress in China’s struggling real estate industry. Some higher-rated developers saw their dollar notes rebound Tuesday, after the previous day’s turmoil in property bonds on concerns over the scale of hidden debt in the industry. Country Garden Holdings Co. notes gained after a record selloff, as the builder also disclosed $10 million of repurchases. A Logan Group Co. dollar bond also rose. (BBG)

OVERNIGHT DATA

JAPAN NOV, F INDUSTRIAL PRODUCTION +5.1% Y/Y; FLASH +5.4%

JAPAN NOV, F INDUSTRIAL PRODUCTION +7.0% M/M; FLASH +7.2%

JAPAN NOV CAPACITY UTILISATION +8.0% M/M; OCT +6.2%

AUSTRALIA ANZ 16 JAN ROY MORGAN CONSUMER CONFIDENCE 97.9; 7 JAN 106.0

Consumer confidence dropped 7.6% last week as Omicron case numbers surged. Confidence is now below the neutral level of 100 for all states, though it is above neutral in the Territories (on admittedly small samples). It is also lower than the level during the Delta surge. Consumer confidence readings are usually positive during the month of January and the level of 97.9 is the weakest January result since 1992, when the Australian economy was experiencing sharply rising unemployment. We don’t think the economy is as weak as these data might suggest, with the shock of the Omicron surge and strains on testing capability the key drivers of the fall rather than underlying economic conditions. But the result highlights that concerns about COVID have the potential to significantly impact the economy if they linger. (ANZ)

NEW ZEALAND DEC REINZ HOUSE SALES -29.4% Y/Y; NOV -18.0%

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS TUES

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. The operation has led to a net injected of CNY90 billion after offsetting the maturity of CNY10billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:27 am local time from the close of 2.1660% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3521 TUES VS 6.3599

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3521 on Tuesday, compared with 6.3599 set on Monday.

MARKETS

SNAPSHOT: BoJ Stand Pat, Change Price Risk Assessment

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 55.84 points at 28277.68

- ASX 200 down 8.504 points at 7408.8

- Shanghai Comp. up 21.096 points at 3562.762

- JGB 10-Yr future down 4 ticks at 150.79, yield down 0.3bp at 0.145%

- Aussie 10-Yr future down 3 ticks at 98.025, yield up 2.9bp at 1.947%

- U.S. 10-Yr future -0-19 at 127-19, yield up 5.34bp at 1.838%

- WTI crude up $1.28 at $85.1, Gold down $3.37 at $1815.86

- USD/JPY up 17 pips at Y114.80

- BOJ STAND PAT ON POLICY SETTINGS, STICK TO ULTRA-LOOSE POLICY STANCE

- BOJ UPGRADE FY2022 CORE CPI OUTLOOK, CHANGE PRICE-RISK BALANCE VIEW

- EUROGROUP SEEKS PATH BETWEEN HIGH INFLATION, SLOWER GROWTH (AP)

- BORIS JOHNSON CONTINUES TO FACE “PARTYGATE” HEADWINDS

BONDS SUMMARY: Continued U.S. Tsy Sales Spill Over, Lack Of Hawkish BoJ Surprises Fails To Offer Reprieve

Treasuries tumbled as cash trading resumed after a U.S. holiday, with voices pointing to a more aggressive policy tightening from the Fed growing louder still. Renewed weakness in U.S. Treasuries spilled over into the Asia-Pac core FI space, countering any potential impact of the BoJ's monetary policy decision announcement, as some of the more hawkish scenarios constructed based on recent source stories failed to materialise.

- Last week's RTRS piece noting that the BoJ were debating how to begin messaging an eventual (albeit not imminent) rate hike raised the perceived odds of the Bank dropping some hints re: potential departure from their ultra-loose policy stance. The statement contained no such indications, as the BoJ kept the main policy settings unchanged and altered their economic forecasts broadly in line with expectations. They upgraded the inflation projections for FY2022 & FY2023 and dropped their long-standing view that price risks are skewed to the downside, but struck some cautious notes on growth outlook and did not communicate any shift in policy. The decision came as local markets were shut for a lunch break, but JGB futures retreated once trading resumed, as post-BoJ musings failed to counter the spillover from retreating U.S. Tsys. JBH2 last trades at 150.80, 3 ticks shy of previous settlement, gradually edging away from its session low of 150.68. Cash JGB yields are marginally mixed as we type, off the slightly depressed levels seen in early trade. Focus turns to the press conference with BoJ Gov Kuroda, which may shed some more light on what we heard from the Bank today.

- T-Notes posted a fresh leg lower once the BoJ risk was out of the way, with cash Tsys taking a nosedive in tandem with the benchmark futures contract. TYH2 last changes hands -0-17+ at 127-20+, moving away from its session low of 127-15 over the last hour or so. Eurodollar futures run up to 7.5 ticks lower through the reds. Bear flattening remains evident in U.S. Tsy curve, with yields last seen 3.9-7.2bp higher, slightly off earlier highs & flats. The yield on 2-year notes punched crossed above the 1% mark, with fresh cycle highs also reached by 10-year (north of 1.85%) and 30-year (above 2.18%) yields. The U.S. docket is headlined by the monthly Empire Manufacturing Survey today.

- Offshore impetus was the primary driver of ACGBs in the absence of notable local catalysts. Aussie bond futures (YM last -4.0 & XM -3.5) followed in the footsteps of their major peers and have now moved away from lows printed in the wake of the downswing led by U.S. Tsys. Bills run 1-7 ticks lower through the reds. Cash ACGB yields trade 2.3-5.5bp higher across a flattened curve.

FOREX: Rising U.S. Tsy Yields Boost Greenback, Yen Retreats After BoJ Disappoints Hawks

The gauge of U.S. dollar strength (DXY) took a sudden upswing in sync with a jump in U.S. Tsy yields, with U.S. participants set to return to the market after a holiday. The moves have been attributed to continued hawkish chatter surrounding the most probable trajectory of Fed tightening.

- Firmer U.S. Tsy yields sapped strength from Antipodean currencies, key regional risk proxies. AUD/USD and NZD/USD each printed a fresh one-week low, with the former diving through the $0.7200 mark in the process. With the sudden upswing in U.S. Tsy yields pulling the rug from beneath the Antipodeans, they both gave up gains registered against JPY in the wake of the BoJ's monetary policy decision.

- The yen took a hit after the BoJ showed no appetite for tightening policy, even as RTRS last week reported that the Bank were debating how to begin communicating an eventual rate hike. Policymakers tipped hat to rising price pressures through expected upgrades to inflation forecasts & their assessment of risks to the price outlook, but they stopped short of offering any indications that they could start paring back stimulus anytime soon.

- Today's data highlights include UK jobs market data, German ZEW Survey, U.S. Empire Manufacturing Survey & Canadian housing starts. Speeches are due from ECB's Villeroy & Riksbank's Ingves, with BoJ Gov Kuroda set to hold a press conference.

FOREX OPTIONS: Expiries for Jan18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E1.7bln), $1.1370-75(E566mln)

- USD/JPY: Y114.00($1.5bln), Y115.00($566mln), Y116.00-25($1.4bln), Y117.00($1.6bln)

- AUD/USD: $0.7200(A$882mln)

- USD/CNY: Cny6.3500($775mln), Cny6.4100($505mln), Cny6.65($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 18/01/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/01/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/01/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 18/01/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 18/01/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 18/01/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/01/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.