-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Countdown To Fed Decision

EXECUTIVE SUMMARY

- BIDEN WARNS PUTIN WITH PERSONAL SANCTIONS (RTRS)

- BIDEN SAYS NO AMERICAN FORCES MOVING INTO UKRAINE (Hill)

- U.S. AND EU CLOSE IN ON AGREEING RUSSIAN FINANCIAL SANCTIONS (FT)

- DOWNING STREET AWAITS “PARTYGATE” REPORT

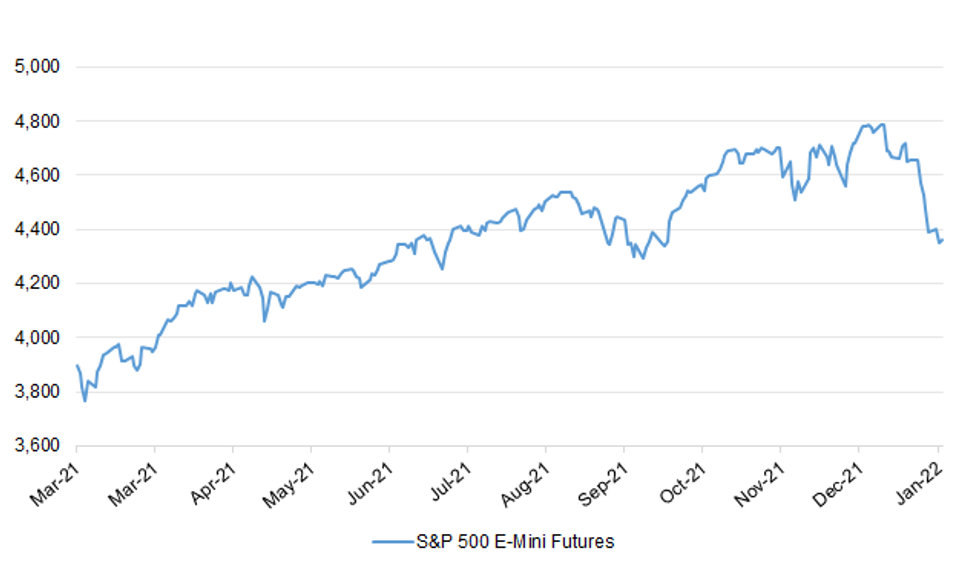

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: The Financial Times understands Gray’s investigation could be published as soon as Wednesday, according to several officials. “Sue is determined it comes out soon,” one said. The prime minister is expected to receive the report on Wednesday with publication to follow, government insiders said. (FT)

POLITICS: Boris Johnson has still not received a report by Sue Gray into lockdown parties in Downing Street and across Whitehall despite expectations being raised last night that he would address its findings in the Commons this lunchtime. On Tuesday afternoon, it was understood that Number 10 would publish the report compiled by the senior civil servant around midday today and then the PM would make a statement in the Commons after PMQs. But it is now believed the document will not be released for publication until later this afternoon at the earliest, with the chances of this being delayed until Thursday growing. The prime minister has vowed to make a statement and answer questions in the House of Commons after the Gray report has been made public. (Sky News)

POLITICS: Boris Johnson faces being interviewed by police after Scotland Yard said Downing Street parties crossed the threshold for a “serious and flagrant” breach of lockdown rules. Sue Gray, a senior civil servant who is overseeing an inquiry into the events, triggered the formal investigation when she handed evidence to detectives. (Times)

POLITICS: Sue Gray has received photos of Downing Street parties which include Boris Johnson and others close together with wine bottles, Sky News understands. (Sky)

POLITICS: Almost two thirds of Brits think Boris Johnson should resign as Prime Minister, YouGov polling has revealed. Some 62 per cent of adults surveyed today answered Mr Johnson should resign – six points higher than the same survey on 11 Jan. A quarter of the 3550 adults questioned said he should remain in his role and 13 per cent were undecided. (i)

CORONAVIRUS: An English COVID-19 study reported record prevalence in January after an Omicron-fuelled spike in infections, Imperial College London said on Wednesday, adding that infections had dropped back from their peak but were now plateauing. (RTRS)

EUROPE

ITALY: Italy’s lawmakers attempting to elect a new president in a secret ballot on Tuesday failed to agree on a consensus candidate for the second day in a row. Of 976 ballots cast, 527 were left empty by lawmakers. Voting is set to resume Wednesday at 11 a.m., and talks between party leaders to reach consensus on a candidatewill continue. (BBG)

ITALY/RUSSIA: The top executives of some of Italy’s largest companies including Eni, Pirelli and Generali are due to have a video meeting with Vladimir Putin on Wednesday to discuss economic ties, even as Europe and the US threaten to impose punishing sanctions on Russia if it invades Ukraine. The meeting, which the Kremlin said would cover “the potential for further expanding ties between the two countries’ businessmen”, comes as the US and Europe have warned Russia’s president against an invasion of Ukraine. (FT)

FINLAND: Finland has enhanced its military readiness as international tensions rise over Russia's military build-up near Ukraine. Finland, which is not a member of NATO and has a long border and a difficult history with Russia, has provided no details of how its military readiness has changed. "Readiness (of the Finnish Defence Forces) has been enhanced due to the fact that the situation in nearby areas has become more unstable," said Colonel Petteri Kajanmaa, head of the warfare department at the Finnish National Defence University, referring to the Baltic Sea region. (RTRS)

U.S.

ECONOMY: The House of Representatives unveiled its legislation to bolster U.S. research and development to better compete with China and aid the domestic semiconductor industry, in a bid to negotiate a final bill this year with the Senate. “Major components of this package have already passed the House with overwhelmingly bipartisan votes, and we look forward to conferencing this bill with the Senate to get legislation to the President’s desk as soon as possible,” House Speaker Nancy Pelosi said in a statement. (BBG)

ECONOMY: The U.S. Commerce Department said Tuesday a global survey of semiconductor chip producers and users shows a shortage will persist, sparked primarily by wafer production capacity constraints. The voluntary survey of 150 companies last fall in the supply chain confirmed "there is a significant, persistent mismatch in supply and demand for chips, and respondents did not see the problem going away in the next six months." "Demand for chips is high. It is getting higher," Raimondo said, adding demand is now about 20% above 2019 levels. "There is not a lot of good news" in this survey, she added. Raimondo said the survey did not show evidence of hoarding. The department said median inventory for consumers for key chips has fallen from 40 days in 2019 to less than 5 days in 2021. "Five days of inventory. No room for error," Raimondo said. "That tells you how fragile this supply chain is." (RTRS)

CORONAVIRUS: An appeals court judge on Tuesday granted a stay in an appeal over mask mandates in New York, keeping the rule in effect during the legal process, New York Attorney General Letitia James said. A day earlier, a judge had struck down the state's mask mandate, one week before it was due to expire. The state attorney general had filed a motion to stay the ruling in an attempt to put it on hold while the state filed a formal appeal. (RTRS)

POLITICS: U.S. House of Representatives Speaker Nancy Pelosi said on Tuesday she will run for a 19th term in office, without saying whether she would seek to remain in her Democratic leadership role. The 81-year-old California lawmaker was the first woman to serve as speaker and had been expected to step down, particularly as her party braces for a possible loss of its majority in the Nov. 8 midterm elections. (RTRS)

POLITICS: Reps. Richard Hudson (R-N.C.) and Darin LaHood (R-Ill.) are both telling colleagues they plan to run for chair of the National Republican Congressional Committee for the 2024 cycle, people familiar with the matter tell Axios. Why it matters: Republicans are confident they'll win the House majority back this fall, and the early jockeying to lead the caucus' fundraising apparatus is just another indicator of their optimism. (Axios)

OIL: The U.S. Department of Energy announced the loan of 13.4 million barrels of crude oil from its strategic reserve as part of a renewed effort by the Biden administration to contain oil prices that have surged to their highest level since 2014. The awards to seven companies -- part of a previously announced move -- mark the second-largest exchange of oil from the Strategic Petroleum Reserve ever, and bring the total amount of oil released from the cache to nearly 40 million barrels, according to the Energy Department. (BBG)

OTHER

GEOPOLITICS: NATO will send a written proposal to the Kremlin later this week to "try to find a way forward" amid growing tensions over Russia's troop build-up on Ukraine's border, Secretary General Jens Stoltenberg told CNN's Christiane Amanpour on Tuesday. "We will outline that we are ready to sit down ... and discuss arms control, disarmament, transparency on military activities, risk reduction mechanisms, and other issues which are relevant for European security. And also to sit down and listen to Russian concerns," Stoltenberg said. (CNN)

GEOPOLITICS: US officials said there was growing “convergence” with the EU on financial sanctions aimed at crippling Russian banks in the event of an invasion of Ukraine, as western countries sought to settle on a package of economic countermeasures to a possible attack. “His tolerance for economic pain may be higher than other leaders. But there is a threshold of pain above which we think his calculus can be influenced,” said one senior Biden administration official. An EU official said on Tuesday that “further work behind the scenes” was needed to “get absolute clarity on” what the “triggers for sanctions” might be — referring to the nature and scale of Russian attack that would result in punishment. But on the substance of the measures, Biden administration officials on Tuesday stressed that there had been a “really encouraging convergence” between the allies, particularly on financial sanctions being contemplated on both sides of the Atlantic. That alignment focused on “the size of the financial institutions and state-owned enterprises” to be targeted, as well as the “severity” and “immediacy” of the measures, and “the extent to which the prohibitions would affect existing stocks of risk in addition to new flows of financing”, one US official said. (FT)

GEOPOLITICS: The German government has pushed for an exemption for the energy sector if there is a move to block Russian banks from clearing U.S. dollar transactions, according to documents seen by Bloomberg. People familiar with recent discussions said other major western European nations hold similar views. One official said that conversations since the documents were circulated suggest the exemption is likely to be part of a final package of penalties agreed with the U.S. that would be deployed in the event that Moscow invaded Ukraine. (BBG)

GEOPOLITICS: U.S. President Joe Biden said on Tuesday he would consider personal sanctions on President Vladimir Putin if Russia invades Ukraine, as Western leaders stepped up military preparations and made plans to shield Europe from a potential energy supply shock. The rare sanctions threat came as NATO places forces on standby and reinforces eastern Europe with more ships and fighter jets in response to Russia's troop build-up near its border with Ukraine. (RTRS)

GEOPOLITICS: President Joe Biden is considering publicly outlining his Ukraine strategy, explaining to Americans how a U.S. response to any Russian invasion could affect this country, according to four senior administration officials. The White House has discussed having Biden lay out his administration’s policy in a speech or other platform, such as an interview. But the timing has been in flux, in part because some administration officials are concerned that Russian President Vladimir Putin might use the moment to ramp up his aggression toward Ukraine or otherwise publicly undermine Biden, officials said. (NBC)

GEOPOLITICS: President Biden on Tuesday said there will be no American forces moving into Ukraine as tensions flare over the urgent threat of a Russian military incursion. “There is not going to be any American forces moving into Ukraine,” Biden told reporters. (Hill)

GEOPOLITICS: The US has helped prepare for the diversion of natural gas supplies from around the world to Europe in the event that the flow from Russia is cut, in an effort to blunt Vladimir Putin’s most powerful economic weapon. As fears of an invasion of Ukraine have grown, US officials said on Tuesday that they had been negotiating with global suppliers, and they were now confident that Europe would not suffer from a sudden loss of energy for heating in the middle of winter. (Guardian)

GEOPOLITICS: French President Emmanuel Macron will speak by phone with Russian President Vladimir Putin on Friday, the French leader said Tuesday, vowing to “never give up dialogue with Russia.” Macron was speaking in Berlin alongside German Chancellor Olaf Scholz, who also called for continued talks with Moscow as fears grow that Russia is plotting an invasion of Ukraine after amassing over 100,000 troops at the border. The French president linked his call for dialogue to his pitch for a new European security proposal, which he unveiled last week as a potential longer-term negotiation channel to defuse tensions with Moscow. (Politico)

GEOPOLITICS: Ukraine "will not allow anyone to impose any concessions on us" as part of efforts to de-escalate the threat of conflict with Russia, Ukrainian Foreign Minister Dmytro Kuleba told CNN in an exclusive interview Tuesday. Kuleba emphasized that the country would not accept any compromises aimed at placating Russian President Vladimir Putin, amid fears Russia may be planning to invade Ukraine -- something Moscow denies. "If anyone makes a concession on Ukraine, behind Ukraine's back, first, we will not accept that. We will not be in the position of the country that picks up the phone, hears the instruction of the big power and follows it," said Kuleba. (CNN)

GEOPOLITICS: Political advisers to the leaders of the "Quartet of Normandy" - Germany, France, Ukraine and Russia - are scheduled to meet on Wednesday, January 26, in Paris. During the consultations "they want to determine the date when Ukraine will hold talks with the separatists on the special status of Donbass ," the dpa news agency reported, citing sources at the Elysee Palace on January 25. (Deutsche Welle)

GEOPOLITICS: The Ukrainian side will not conduct direct negotiations with the separatists, said Andriy Yermak, head of the Office of the President of Ukraine, who will represent the Ukrainian side at the talks in Paris. "The position of Ukraine, which has been expressed many times at different levels, is unchanged. There have been and will not be any direct negotiations with the separatists.” (RBC-Ukraina)

GEOPOLITICS: On January 26th, the European Court of Human Rights (ECtHR) in Strasbourg will hear the grand Donbas case lodged by Ukraine and the Netherlands against Russia. In his interview with the European Pravda, Minister of Justice Denys Maluska explains how Ukraine plans to prove that Russia is responsible for the human rights violations in the occupied territories and make it foot the bill. (European Pravda)

U.S./CHINA: The U.S. State Department is weighing whether to authorize departures for American diplomats and their families in China who wish to leave due to the U.S. government's inability to prevent Chinese authorities from subjecting them to intrusive pandemic control measures, sources told Reuters. Two sources familiar with the issue said the U.S. Embassy on Monday had sent the request to Washington for formal sign off, as China ramps up COVID-19 containment protocols ahead of the opening of the Beijing Winter Olympics in less than two weeks. (RTRS)

WHO: U.S. financial contributions to the World Health Organization (WHO) have fallen by 25% during the coronavirus pandemic, provisional data show, with Washington's future support to the United Nations agency under review. The large drop in funding versus the previous two-year period arose from cuts decided by former U.S. President Donald Trump that reveal for the first time the scale of the Trump administration's retreat from the U.N. body. (RTRS)

CORONAVIRUS: Data from people infected with SARS-CoV-2 early in the pandemic add to growing evidence suggesting that vaccination can help to reduce the risk of long COVID. Researchers in Israel report that people who have had both SARS-CoV-2 infection and doses of Pfizer–BioNTech vaccine were much less likely to report any of a range of common long-COVID symptoms than were people who were unvaccinated when infected. In fact, vaccinated people were no more likely to report symptoms than people who’d never caught SARS-CoV-2. (Nature)

NEW ZEALAND: The Government will reduce self-isolation requirements for Covid-19 cases as part of a plan to manage an expected surge in Omicron cases. The three-stage plan will also loosen testing requirements to allow for Covid-19 cases to release themselves from isolation after going 72 hours without symptoms, and prioritise PCR lab testing for “priority populations” when daily cases are in their thousands. The three stages of the plan correspond to the rate of Omicron’s spread through the community. (Stuff)

SOUTH KOREA: South Korea's daily coronavirus cases have exceeded 13,000 as the omicron variant has driven a surge in infections, Prime Minister Kim Boo-kyum said Wednesday. Kim made the remark at a COVID-19 response meeting, saying the spread of the highly contagious omicron has begun in full force. Kim also announced a new testing regime to go into force Saturday, which will focus on administering rapid antigen tests. (Yonhap)

HONG KONG: Hong Kong’s zero-tolerance approach to Covid-19 could keep the Asian financial hub cut off from most of the world until 2024 and fuel a large-scale exodus of international workers and executives, according to a draft report by the European Chamber of Commerce in the city. The most likely scenario for Hong Kong’s exit from its isolation is to wait for China to finish developing a powerful messenger RNA vaccine and immunize its 1.4 billion people, the business group said in an internal document seen and verified by Bloomberg. (BBG)

INDONESIA: Indonesia's central bank will keep its key interest rate low until it sees signs of rising inflation, its deputy governor Dody Budi Waluyo told a seminar on Wednesday, adding that the bank will try to be "ahead of the curve" with its policy. Dody said Bank Indonesia expected to see pressure on inflation and the exchange rate this year, but he said if there is no risk to its inflation outlook, "I think we will keep our interest rate (level) as (it is) today." (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Tuesday that a proposed amendment to the Constitution being drafted by the government along with Congress will allow the reduction of federal and state taxes on fuel, electricity and cooking gas. (RTRS)

KAZAKHSTAN: Kazakhstan will end counterterrorism operation restrictions in Almaty and Almaty and Jambyl regions from January 26, the country’s last areas that still have them, the National Security Committee said on Tuesday. That means the restrictions will be lifted throughout the entire territory of Kazakhstan. (TASS)

AFGHANISTAN: President Biden's advisers are crafting a plan to accelerate bringing potentially thousands of Afghans to the U.S. from Qatar, according to a source with direct knowledge of the administration's internal deliberations on the subject. (Axios)

CHINA

ECONOMY: China's economy can grow 5.5% in 2022, and policymakers could set a higher economic growth target as long as inflation and systemic financial risks are under control, wrote Yu Yongding, a former member of PBOC’s monetary policy committee at a blog post run by China Finance 40 Forum. Boosting growth relies on infrastructure investment given the continuing economic downturn and weak expectations, so as to further drive manufacturing investment and lift consumption, said Yu. China should consider expanding the issuance of treasury bonds to raise funds for infrastructure projects, as local governments are short of funds to undertake investment tasks, said Yu. (MNI)

ECONOMY: Local governments in China are trying to raise weak consumer spending by promoting purchases of new energy vehicles and smart home appliance sales in the countryside, the Securities Times reported. Most local governments showed cautious expectations towards consumer spending by maintaining or even lowering annual targets of retail sales growth from last year given to severe employment situation, high inflation pressure and insufficient consumer confidence amid epidemic uncertainty and income pressure, the newspaper said. (MNI)

ECONOMY: China's state planner has given its blessing for the southern city of Shenzhen to pursue reforms in areas such as relaxed market access for cross border data trading and an electronics trading platform, guidelines published on Wednesday show. President Xi Jinping has given Shenzhen greater autonomy for pursuing reforms, praising it for "achieving miracles" while on a visit two years ago to mark the establishment of the country's first economic zone in the southern city four decades earlier. Shenzhen would become a "model city for a strong socialist country," Xi said in October 2020. The new guidelines from the National Development and Reform Commission (NDRC) further spell out where the city should pursue reforms, across finance, data, medicine, education and elderly care. (RTRS)

POLITICS: Zhou Jiangyong, the former Communist Party secretary of China's eastern technology hub of Hangzhou, has been expelled from the party and his public posts, the Central Commission for Discipline Inspection said on Wednesday. (RTRS)

PROPERTY: China Evergrande Group will hold an investor call at 9 pm (1300 GMT) on Wednesday joined by its financial advisers, sources said, the first such call since it defaulted on some dollar bond payments last month. Evergrande, once China's top selling real estate developer, has more than $300 billion in liabilities, including nearly $20 billion of international bonds all deemed to be in default. (RTRS)

YUAN: The Chinese yuan may face periodic depreciation pressure when domestic companies' strong seasonal demand for forex settlement eases, the Shanghai Securities News reported citing analysts. The yuan may remain strong against the U.S. dollar in Q1, as the market has already priced in China’s rate cut and U.S.’s expected rate hike, the newspaper said citing Wang Dan, the chief economist at Hang Seng China. The PBOC may increase counter-cyclical tools around the Spring Festival in February should the yuan still appreciates excessively after FX settlement demand is fully met, the newspaper said citing CIB Research. On Tuesday, the onshore yuan once strengthened to as high as 6.3235 against the dollar, hitting a new high since April 2018, the newspaper added. (MNI)

OVERNIGHT DATA

JAPAN DEC SERVICES PPI +1.1% Y/Y; MEDIAN +1.0%; NOV +1.1%

JAPAN NOV, F LEADING INDEX CI 103.2; FLASH 103.0

JAPAN NOV, F COINCIDENT INDEX 92.8; FLASH 93.6

NEW ZEALAND DEC CREDIT CARD SPEND +0.2% M/M; NOV +3.1%

NEW ZEALAND DEC CREDIT CARD SPEND +1.2% Y/Y; NOV -0.4%

SOUTH KOREA JAN CONSUMER CONFIDENCE 104.4; DEC 103.8

CHINA MARKETS

PBOC INJECTS CNY100BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY200 billion via 14-day reverse repos with the rate unchanged at 2.25% on Wednesday. The operation has led to a net injection of CNY100 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1800% at 09:28 am local time from the close of 1.9918% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday vs 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3246 WEDS VS 6.3418

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3246 on Wednesday, compared with 6.3418 set on Tuesday, marking the biggest daily rise since Dec 21, 2021.

MARKETS

SNAPSHOT: Countdown To Fed Decision

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 95.67 points at 27035.92

- ASX 200 is closed

- Shanghai Comp. up 4.867 points at 3437.928

- JGB 10-Yr future down 1 tick at 150.95, yield down 0.2bp at 0.140%

- Aussie bonds are closed

- U.S. 10-Yr future +0-02+ ticks at 128-06+, yield up 0.36bp at 1.773%

- WTI crude down $0.36 at $85.24, Gold down $0.29 at $1847.7

- USD/JPY up 1 pip at Y113.89

- BIDEN WARNS PUTIN WITH PERSONAL SANCTIONS (RTRS)

- BIDEN SAYS NO AMERICAN FORCES MOVING INTO UKRAINE (Hill)

- U.S. AND EU CLOSE IN ON AGREEING RUSSIAN FINANCIAL SANCTIONS (FT)

- DOWNING STREET AWAITS “PARTYGATE” REPORT

BOND SUMMARY: Core FI In Standby Mode, Fed Decision Looms Large

There was little movement across core FI space in Asia hours, with an Australian holiday limiting activity. All eyes were on the imminent policy decision from the Fed, who are expected to pave the way for a rate hike in March.

- T-Notes edged higher, while staying comfortably within the confines of Tuesday's range. TYH2 last trades +0-02 at 128-06, amid very subdued volatility. Eurodollar futures sit 0.5-1.5 tick lower through the reds. The Tsy curve flattened at the margin, with yields last seen 0.5-1.2bp higher.

- JGB futures slipped into the Tokyo lunch break but regained poise in afternoon trade. JBH2 sits at 150.95, just shy of previous settlement. Cash JGB curve runs slightly steeper on the back of some marginal weakness in the super-long end. The space looked through the summary of opinions from the BoJ's monetary policy meeting held last week. A couple of members stressed the need to clearly communicate the Bank's intention to keep powerful monetary easing in place to the public, which Governor Kuroda did during his press conference.

- Daytime trading was closed in Australia owing to a public holiday down under.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y875bn of JGBs from the market:

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

FOREX: Major FX Pairs Rangebound On Fed Decision Day

Major currency pairs held tight ranges in muted Asia-Pac trade, with Australia off for a national holiday. Regional headline flow was fairly lacklustre, providing some breathing space ahead of the Fed's monetary policy decision today. The DXY moved sideways in Asia, with the FOMC expected to set the scene for a rate hike in March.

- The BoC will also deliver their monetary policy decision, but in the grand scheme of things, it will be understandably overshadowed by the Fed's announcement. The loonie led gains in G10 FX space amid potential for the BoC to hike rates today, even as crude oil futures showed some weakness.

- The NZD underperformed at the margin ahead of the release of New Zealand's CPI data on Thursday. A former RBNZ official told MNI that the current rate-hike cycle may peak lower than the previous ones.

FOREX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1225-40(E1.4bln), $1.1280-00(E978mln), $1.1350(E619mln)

- USD/CNY: Cny6.2800($500mln), Cny6.2855($590mln), Cny6.3500($830mln), Cny6.40($642mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2022 | 0700/0800 | ** |  | SE | PPI |

| 26/01/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 26/01/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 26/01/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/01/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 26/01/2022 | 1500/1000 |  | CA | BOC Monetary Policy Report | |

| 26/01/2022 | 1500/1000 | *** |  | US | new home sales |

| 26/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/01/2022 | 1600/1100 |  | CA | BOC Governor press conference after rate decision | |

| 26/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/01/2022 | 1900/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.