-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fedspeak, Russia & European Politics Dominate News Flow

EXECUTIVE SUMMARY

- BOSTIC: FED COULD USE HALF-POINT RATE RISES IF NEEDED (FT)

- PENTAGON: PUTIN STILL ADDING RUSSIAN TROOPS AROUND UKRAINE (BBG)

- CHASTENED DRAGHI BUYS TIME TO FIX ITALY AFTER PRESIDENTIAL CHAOS (BBG)

- PORTUGAL’S PREMIER WINS ELECTION, TAKES MAJORITY IN PARLIAMENT (BBG)

- CHINESE PMIS SLOW IN JAN

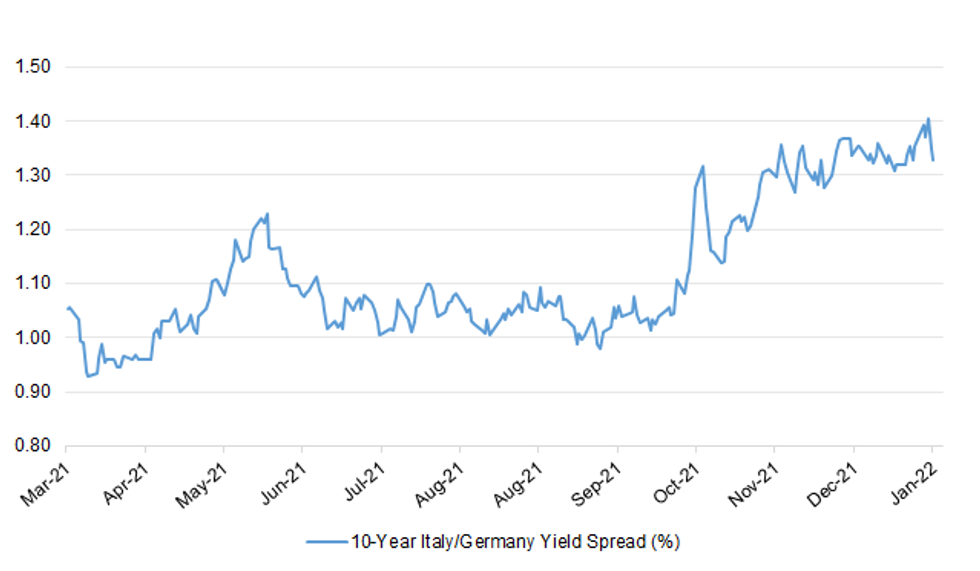

Fig. 1: 10-Year Italy/Germany Yield Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K.’s health service will start to vaccinate children between the ages of five and 11 who are most at risk of Covid-19 starting this week. Children who are particularly vulnerable or who live with someone whose immune system is suppressed will be able to get their first dose, according to an NHS statement. Around 500,000 children will be eligible. (BBG)

POLITICS: Sue Gray is expected to deliver her report on No 10 parties to the PM without waiting for the police inquiry to conclude, the BBC has been told. The senior civil servant is set to hand her report to Downing Street shortly - though no exact date has been given. But police have asked for "minimal reference" to be made to events they are looking at, in order to "avoid any prejudice to our investigation". Opposition parties have insisted the report is published in full. (BBC)

POLITICS: Senior Tories have joined opposition MPs in demanding the report on No 10 lockdown parties be published in full. (BBC)

POLITICS: Rishi Sunak is putting the finishing touches to a PR-led leadership campaign after telling allies he believes Partygate could be “unsurvivable” for Boris Johnson, The Independent has learnt. The chancellor is understood to have built a draft version of a campaign website, taking inspiration from his weekly No 11 newsletter, and developed a marketing strategy. (Independent)

POLITICS: Tom Tugendhat has become the first MP to say he would run to replace Prime Minister Boris Johnson in a Tory leadership contest. The ex-soldier and Foreign Affairs Select Committee chairman told Times Radio it would be a "huge privilege". He said he had not been "canvassing support", but "of course, you should have a go". (Sky)

POLITICS: The government has been accused of trying to manipulate announcements on extra funding for poorer parts of the UK in a desperate attempt to save Boris Johnson’s premiership. (Observer)

BOE: MNI INSIGHT: A BOE Feb Hike Set To Start Full-Pace Gilt Runoff

- The Bank of England is widely expected to hike Bank Rate to 0.5% in February, the point at which the Monetary Policy Committee has made it pretty clear that it will press ahead with all-out non-reinvestment of maturing assets rather than attempting any fine-tuning of its natural run-off policy. The natural run-off will move slowly in fiscal year 2022/23 starting in April, with only GBP9.13 billion of gilts at purchase value set to mature. But on March 7, there is a chunky GPB27.49 billion maturing, leading some analysts to speculate that the Bank could announce only partial non-reinvestment of those proceeds. That, however, looks implausible as the Bank's guidance -- outlined in last August’s quarterly statement -- has been that a natural run-off will be automatic, with the only exception an economic conditions test which would include stressed markets, which is not applicable at present - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: A planned £12bn rise in National Insurance from April is "the right plan" and "must go ahead", Boris Johnson and Rishi Sunak have said. (BBC)

FISCAL: Boris Johnson and Rishi Sunak will this week seek to finalise a package of measures to help millions of low income UK households with a looming big increase in their energy bills. The prime minister and chancellor have agreed to prioritise “targeted support” for less affluent families struggling with rising energy costs rather than the same relief for all households, according to government insiders. (FT)

ECONOMY: British businesses grew at the slowest pace since April 2021 during the past three months, after demand for face-to-face services slumped due to the Omicron variant of coronavirus, the Confederation of British Industry said on Sunday. Britain's economy only recovered to its pre-pandemic size in November, before being hit by the highly infectious Omicron variant which led to government advice to work from home and restrictions on hospitality in Scotland and Wales. "Consumer services have borne the brunt of 'Plan B' restrictions and general Omicron caution, with activity here shrinking sharply," CBI economist Alpesh Paleja said. (RTRS)

BREXIT: The government has set out a plan to overhaul "outdated" EU laws copied over after Brexit - a move it says will cut £1bn of red tape for businesses. Downing Street said a Brexit Freedoms Bill will change how Parliament can amend or remove thousands of EU-era regulations that remain in force. Boris Johnson said the move would "unleash the benefits of Brexit" and make British business more competitive. But the plan was criticised by the devolved administrations. A source said Scottish, Welsh, and Northern Irish ministers believe the plans undermine the devolution settlement. They added that a meeting between the Attorney General Suella Braverman and devolved ministers on Saturday was "last-minute, fractious, and cack-handed". (BBC)

EUROPE

GERMANY: German Finance Minister Christian Lindner said the government should prepare the ground for a loosening of coronavirus restrictions. While the peak of the current wave may still be weeks away, business sectors like trade fairs and events require a “planning horizon,” Lindner said in an interview with Der Spiegel. Recent measures have focused on reducing social contacts and limiting access to public spaces for those who haven’t been vaccinated. The country reported 118,970 new infections on Sunday and the 7-day incidence rate reached a record of 1,156.8 per 100,000 people. (BBG)

FRANCE: A top aide to French nationalist leader Marine Le Pen is seeking to unite her supporters and those of far-right firebrand Eric Zemmour behind a common candidate. Nicolas Bay, a Le Pen campaign spokesman, on Sunday called for the camps to be united under a single banner. (BBG)

FRANCE: The French far-right leader Marine Le Pen finally secured a bank loan for her financially struggling campaign to challenge President Emmanuel Macron. The candidate in the April presidential election obtained a 10.6 million euro loan ($11.8 million) from a European bank, Jordan Bardella, president of her National Rally party, told Agence France-Presse. (BBG)

FRANCE: A group of French voters picked former justice minister Christiane Taubira as their preferred presidential candidate, ramping up pressure on the fractured parties of the political left to unite behind her in the April election. Taubira won an unofficial poll organized by a grassroots initiative called Primaire Populaire, or People’s Primary, followed by Green leader Yannick Jadot, and far-left candidate Jean-Luc Melenchon. (BBG)

ITALY: Sergio Mattarella was re-elected as Italy’s president, offering relief to investors by setting up former European Central Bank head Mario Draghi to remain prime minister. After almost a week of failed votes to elect an alternative candidate, Italy’s deadlocked parliament turned to Mattarella as a last resort to end the political impasse. The 80-year-old president received 759 votes out of 983 cast in the lower house, following a deal between Draghi and Italy’s main parties to back the incumbent. (BBG)

ITALY: The Italian economy likely expanded 6.5% in 2021, more than initially forecast, according to a representative of Prime Minister Mario Draghi’s government. The economy probably grew 0.6% in the fourth quarter from the previous three months, Renato Brunetta, public administration minister, wrote in a statement. (BBG)

ITALY: Italy's Treasury is pushing for a change at the helm of Monte dei Paschi of which it owns 64%, as the bailed-out lender gears up to tap markets for cash, three sources close to the matter said. (RTRS)

PORTUGAL: Socialist Prime Minister Antonio Costa won Portugal’s general election and will now have an absolute majority in parliament, meaning far-left parties are no longer needed to back his budgets. Costa’s center-left Socialists took about 42% of the vote and increased the number of seats held in the 230-seat chamber to at least 117 from 108, based on 99% of voting districts reporting, according to the government’s election results website. The last time the Socialists won an absolute majority in parliament was in 2005. The opposition center-right PSD party garnered about 28% of the vote. (BBG)

GREECE: Greek Prime Minister Kyriakos Mitsotakis survived a motion of censure Sunday night initiated by the main opposition leader and former premier Alexis Tsipras following criticism of the government’s handling of a heavy snowstorm and the pandemic. The blizzard that blanketed Athens last week triggered power outages in many areas of the capital region for days, grounded flights and stranded drivers for as long as 24 hours on a major highway around the city. Mitsotakis secured 156 votes in a 300-seat parliament, while 142 voted against his administration, avoiding the motion of censure where his government would have lost power and setting the process for a new one to be formed. (BBG)

SWITZERLAND: Swiss Health Minister Alain Berset is seeking a “turbo” reopening of the Swiss economy next month, according to SonntagsZeitung. On Wednesday, Berset asked the Swiss Federal Council to lift the country’s Covid-19 restrictions -- including the work from home requirement and the obligation to show a vaccination certificate. The reopening process could begin as soon as Feb. 16, the report said. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Hungary at BBB; Outlook Stable

- Fitch upgraded Ireland to AA-; Outlook Stable

- S&P affirmed Lithuania at A+; Outlook Stable

- DBRS Morningstar confirmed Austria at AAA, Stable Trend

- DBRS Morningstar confirmed Estonia at AA (low), Stable Trend

U.S.

FED: The Fed could supersize a rate increase to half a percentage point if inflation remains stubbornly high, a leading US central bank official said. Raphael Bostic, president of the Fed’s Atlanta branch, stuck to his call for three quarter-point interest rate increases in 2022, with the first coming in March, in an interview with the Financial Times. But he said a more aggressive approach was possible if warranted by the economic data. That could mean rate rises at each of the seven remaining policy meetings in 2022, or even the possibility of the Fed increasing the federal funds rate by half a percentage point, double its typical amount and a tool it has not used in roughly two decades. (FT)

ECONOMY: The Trimmed Mean PCE inflation rate over the 12 months ending in December was 3.0 percent. According to the BEA, the overall PCE inflation rate was 5.8 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.9 percent on a 12-month basis. The tables below present data on the Trimmed Mean PCE inflation rate and, for comparison, overall PCE inflation and the inflation rate for PCE excluding food and energy. The tables give annualized one-month, six-month and 12-month inflation rates. (PCE)

ECONOMY: The White House on Friday warned that the omicron-fueled spike in Covid-19 cases in early January could skew the data in next week’s jobs report, as millions of Americans left work due to illness or to care for family members. Brian Deese, President Joe Biden’s top economic advisor, told CNBC on Friday that the way the Labor Department collects employment data may have a pronounced effect on the January 2022 data and could show a greater number of unemployed people. (CNBC)

OTHER

GLOBAL TRADE: The U.S. House of Representatives will take up a bill next week aimed at increasing competitiveness with China and supporting the U.S. chip industry, including $52 billion to subsidize semiconductor manufacturing and research. House Majority Leader Steny Hoyer said on Friday that the House would vote on the 2,900-page bill, called the "America Competes" act, saying it would "make further strides in innovation, technology, and advanced manufacturing." The bill also authorizes $45 billion to support supply-chain resilience and manufacturing of critical goods, industrial equipment, and manufacturing technology. (RTRS)

GLOBAL TRADE: Rishi Sunak is pursuing a "complete sea change" in relations with China with the relaunch of a major trade summit that has been suspended for two years amid tensions over Hong Kong and Covid. The Chancellor has asked Treasury officials to revive the UK-China Economic and Financial Dialogue, last held in 2019. They are working to deliver the summit in the coming months after an uptick in trade with China during the pandemic despite diplomatic rows over the telecoms equipment maker Huawei and human rights abuses in Xinjiang. It is thought that major financial institutions including HSBC and Standard Chartered will be vying for commercial deals at the talks. A source said: "The realisation from ministers is that, whether they like it or not, you can't ignore the China trade opportunity." (Telegraph)

GLOBAL TRADE: Australia will seek to be included in consultations about a trade dispute between the European Union and China launched by the EU at the World Trade Organisation, the Australian trade minister said on Saturday. (RTRS)

GLOBAL TRADE: Brussels wants powers to intervene during future semiconductor supply crunches as part of a broad package of measures aimed at building up Europe’s domestic industrial capacity, the EU’s internal market commissioner said. Thierry Breton said that as part of the EU’s planned Chips Act the commission is discussing tools to respond to shortages and “shore up our security of supply” in the industry. He pointed to US emergency powers to prioritise domestic industrial needs contained in America’s Defense Production Act as a possible model. (FT)

U.S./CHINA: U.S. Trade Representative Katherine Tai is working to repair her relationship with National Security Adviser Jake Sullivan after a Situation Room confrontation in which she accused him — in front of colleagues — of undermining her in the press, people familiar with the matter tell Axios. The rare window on personal clashes inside the Biden White House also illuminates the tension between the president's trade and national security advisers about how and when to execute aspects of their China strategy. The dispute centers more on tactics and turf, and is unlikely to derail Biden's pursuit of a digital trade deal with Indo-Pacific allies after the Trump administration scuttled Obama-era plans for a Trans-Pacific Partnership (TPP). (Axios)

U.S./CHINA/TAIWAN: The Chinese ambassador to Washington has warned that the US and China could end up at war over Taiwan, in stark comments illustrating the rising tensions between the powers over the fate of the island. “If the Taiwanese authorities, emboldened by the United States, keep going down the road for independence, it most likely will involve China and the United States, the two big countries, in a military conflict,” Qin Gang told NPR in his first one-on-one interview since arriving in the US last July. Beijing has often reprimanded the US over its stance on Taiwan, a self-governed country over which China claims sovereignty, but Chinese officials rarely talk directly about war. While Qin warned about possible conflict, he also said China was striving for peaceful unification. (FT)

U.S./CHINA/TAIWAN: Taiwan Vice President William Lai wrapped up his visit to the United States and Honduras with a virtual meeting with U.S. House of Representatives Speaker Nancy Pelosi, in a further show of support from Washington for the Chinese-claimed island. (RTRS)

CORONAVIRUS: An omicron subvariant appears to be even more contagious than the original fast-spreading strain, U.K. health authorities said, though vaccine booster shots remain an effective shield. Data from contact tracing showed the subvariant, BA.2, spread more frequently in households, the U.K. Health Security Agency said on Friday. Its rate of transmission among household contacts was 13.4%, compared to 10.3% for omicron. Though the data is a good indication of how transmissible the subvariant is, the agency cautioned that it’s preliminary and could fluctuate. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida is pushing to quicken the pace of booster vaccinations, as a poll showed his voter support slipping months ahead of a key upper house election. Kishida inspected a military-run vaccination center Monday, as a survey published by the Nikkei newspaper showed his support had dropped six percentage points to 59%, the first fall since he took office in October. Approval of his response to the coronavirus also fell six percentage points to 55%. The premier said he’s not considering declaring a Covid-19 state of emergency in Tokyo right now, even as cases jump and the hospital bed occupancy rate climbs. The capital currently is under a quasi-emergency state that calls on places such as eateries and bars to close early and limit alcohol sales. (BBG)

BOJ: The Bank of Japan shouldn’t view the issuing of a digital currency as a monetary policy option as doing so could severely damage the economy, according to a former BOJ official who led research into digital money. “Some say that negative interest rates could work more effectively with a digital currency, but I don’t think so,” said Hiromi Yamaoka, the former head of the BOJ’s financial settlement department. Yamaoka said that while it’s clear Japan’s payment systems need to change with the help of digital money, he was totally against the idea of the central bank using a digital yen to gain extra policy leverage. (BBG)

AUSTRALIA: Australian Prime Minister Scott Morrison's approval rating fell to its lowest level in nearly two years as he faces heat just months out from a federal election over his handling of the Omicron wave, a widely watched poll showed on Monday. A Newspoll conducted for The Australian newspaper showed satisfaction with Morrison's performance dropped 5 points to 39% in January, the lowest level since March 2020, when he fielded criticism over his response to devastating bushfires. (RTRS)

NEW ZEALAND: A new political poll shows Jacinda Ardern's approval ratings have dropped again, her lowest result since the ratings were first measured in October 2019. A pool of eligible voters were asked if they approve or disapprove of the way Ardern is handling her job as prime minister, in a new 1News Kantar Public poll. The poll, run between 22 and 26 January, showed 52 percent of eligible voters approve of the way Ardern is handling her job, compared to 37 percent who disapprove. A further 11 percent were unsure or refused to answer. The results bring Ardern's net approval rating, the proportion who approve of a politician minus those who disapprove, to 15 percent. Ardern's approval ratings have steadily dropped over the last two years as New Zealand continues to battle Covid-19. They sat at 62 percent in October 2019, 86 percent in May 2020, 72 percent in September 2020 and 74 percent in October 2020. In this latest poll, eligible voters were also asked if they approve or disapprove of the way Christopher Luxon is handling his job as leader of the National Party. The results show 42 percent approve of Luxon's performance, compared to 20 percent who disapprove. A further 37 percent were unsure or refused to answer, bringing Luxon's approval rating to 22 percent. The net approval result is twice that of Todd Muller's rating in the June 2020 poll, after he became National's leader. (Radio New Zealand)

NORTH KOREA: North Korea confirmed on Monday it had tested a Hwasong-12 intermediate-range ballistic missile (IRBM) on Sunday, according to state news agency KCNA, the first time a nuclear-capable missile of that size has been launched since 2017. The launch was first reported by South Korean and Japanese authorities on Sunday. Analysts and officials said the test appeared to involve an intermediate-range ballistic missile (IRBM), which North Korea has not tested since 2017 when it suspended testing its largest missiles and its nuclear weapons. (RTRS)

NORTH KOREA: The United States is concerned North Korea's escalating missile tests could be precursors to resumed tests of nuclear weapons and intercontinental ballistic missiles, a senior U.S. official said on Sunday, while urging Pyongyang to join direct talks with no preconditions. (RTRS)

BOC: Bank of Canada Governor Tiff Macklem said in an interview with the Globe and Mail there are a number of possible paths for the central bank’s policy rate as officials prepare to raise borrowing costs. Macklem said one option that he “doesn’t rule out” includes a few rate hikes that will be followed by a pause to “assess the situation” before moving again. The higher the policy rate becomes, the more data-dependent decisions will be. He also said in the interview that he’s not comfortable with the current level of inflation. (BBG)

CANADA: Dozens of trucks and other vehicles blocked the downtown area of Ottawa for a second day after thousands descended on Canada's capital city on Saturday to protest against Prime Minister Justin Trudeau and COVID-19 vaccine mandates. Trucks remained parked on the streets near parliament on Sunday, a day before lawmakers are due to resume work after the holiday break. Hundreds of protesters were out on Sunday, too. Some truckers said they will not leave until the mandate is overturned. Former U.S. President Donald Trump, speaking at a rally in Texas on Saturday, praised the Canadian protesters for "resisting bravely these lawless mandates", in a sign the politicization of the pandemic seen mostly south of the border has spread north. (RTRS)

CANADA: The U.S. and Canadian governments should reinstate a vaccine exemption for cross-border truckers to ease supply chain snarls, Alberta Premier Jason Kenney said as a protest convoy arrived in the Canadian capital. Kenney, speaking Friday in Washington ahead of a meeting of U.S. governors, said he believes cross-border truckers are a low risk to spread Covid-19. The rules, imposed this month by both nations, will further fuel inflation and constrain shipping, he warned. Alberta is “calling on the two federal governments to simply exercise a bit of common sense,” Kenney said in an interview with Bloomberg Television and BNN Bloomberg. (BBG)

TURKEY: President Tayyip Erdogan repeated his unorthodox economic policy on Saturday, saying interest rates would be lowered further and inflation would fall as a result. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan replaced the head of the state statistics agency weeks after it reported record inflation, which added to anger in the country over its economic woes, and appointed another member of the ruling party as justice minister. The presidential orders, published early Saturday, come as Mr. Erdogan narrows the circle of advisers around him during an economic crisis in which Turkey’s currency lost some 40% of its value last year. The Turkish president has fired a series of senior officials who opposed his unorthodox approach in which he has insisted on cutting interest rates to spur economic growth despite rampant inflation. The president of the Turkish statistical institute, Sait Dincer, was removed from office and replaced by Erhan Cetinkaya, who had been deputy president of Turkey’s Banking Regulation and Supervision Agency. (WSJ)

MEXICO: Mexico's Deputy Finance Minister Gabriel Yorio said that supply side shocks would limit economic growth and said he didn't believe the country was in "stagflation," or a period of weak growth paired with high inflation. (RTRS)

RUSSIA: The United Nations Security Council will be "unified" on Monday "in calling for the Russians to explain themselves," U.S. Ambassador to the United Nations Linda Thomas-Greenfield told ABC's "This Week." The meeting, called by the United States and which is expected to be broadcast live on Monday, will be "one more opportunity to find a diplomatic way out for the Russians," the ambassador said. (Axios)

RUSSIA: President Joe Biden said Friday he would be sending American troops to Eastern Europe as the threat of a Russian invasion of Ukraine continues to weigh on the U.S. and its allies. Biden, speaking to reporters on the tarmac at Joint Base Andrews upon returning from a trip to Pittsburgh, added that “not a lot” of soldiers would be involved “in the near term.” He did not name any countries where troops might be deployed or elaborate further in brief comments. (BBG)

RUSSIA: Biden administration officials will brief the Senate on Thursday on Ukraine and escalating tensions with Russia, which has amassed troops along the border. The briefing with senior administration officials, confirmed to The Hill by a Senate aide, comes amid growing concerns over a potential Russian invasion of Ukraine, with Moscow estimated to have 120,000 troops near the border. (The Hill)

RUSSIA: Russia further boosted troop levels on the Ukrainian border this weekend, adding to President Vladimir Putin’s options should he decide on a military incursion, Pentagon spokesman John Kirby said. “He can execute some of those options imminently,” Kirby said on “Fox News Sunday.” “Imminent means it could happen really, honestly, at any time. It depends on what Vladimir Putin might want to do.” (BBG)

RUSSIA: A US defence official late on Friday told the Financial Times that Russia had now moved blood supplies close to its border with Ukraine, in a move that US military experts previously said would be another sign that Putin was moving closer to an invasion. Russia needs blood supplies to help treat troops who suffer casualties. The move was first reported by Reuters. (FT)

RUSSIA: The Pentagon’s top officials warned Friday that a Russian invasion of Ukraine would result in a “horrific” aftermath. Chairman of the Joint Chiefs of Staff U.S. Army Gen. Mark Milley and Defense Secretary Lloyd Austin detailed the grim scenario as U.S. and NATO forces prepare for a potential Moscow attack on its ex-Soviet neighbor. “Given the type of forces that are arrayed, the ground maneuver forces, the artillery, the ballistic missiles, the air forces, all of it packaged together. If that was unleashed on Ukraine, it would be significant, very significant, and it would result in a significant amount of casualties and you can you imagine what that might look like in dense urban areas, all along roads, and so on and so forth,” Milley said. “It would be horrific,” added Milley, the nation’s highest-ranking military officer. (CNBC)

RUSSIA: The U.S. and the European Union are zeroing in on a package of sanctions against Russia should President Vladimir Putin decide to invade Ukraine, according to people familiar with the matter and documents seen by Bloomberg. The measures would broadly fall into several categories including: restrictions on the refinancing of Russian sovereign debt, financial sanctions, and the singling out of individuals and entities close to the Kremlin. Western allies are also working on a series of trade-related measures covering key goods and sectors. (BBG)

RUSSIA: The Biden administration plans to spare everyday Russians from the brunt of U.S. export controls if Russia invades Ukraine, and focus on targeting industrial sectors, a White House official said. "Key people" will also face "massive sanctions," a top Commerce official said in a separate speech on Friday. The comments narrow the scope of potential curbs on imports to Russia that had previously been described as disrupting Russia's economy more broadly, hitting industrial sectors and consumer technologies like smartphones. (RTRS)

RUSSIA: If Russia invades Ukraine, the Biden administration will consider sanctions and other economic consequences "the likes of which we have not looked at before," Pentagon spokesperson John Kirby said on Sunday. (Axios)

RUSSIA: U.S. senators are very close to reaching a deal on legislation to sanction Russia over its actions on Ukraine, including some measures that may take effect before any invasion, two leading senators said on Sunday. (RTRS)

RUSSIA: Russian oligarchs with links to President Vladimir Putin and who have UK investments will be hit by tough new sanctions if Moscow invades Ukraine, British foreign secretary Liz Truss will tell the House of Commons on Monday. Truss on Sunday said she would set out legislation that would give Moscow notice of a “severe economic cost” for any incursion into Ukraine, by strengthening Britain’s ability to target Russian assets in the UK. (FT)

RUSSIA: The UK is considering offering to double its number of troops deployed in Eastern Europe, as ministers weigh up options to increase pressure on Russia amid heightened tensions over Ukraine. Prime Minister Boris Johnson said the possible deployment would send a "clear message to the Kremlin". The defence and foreign secretaries are preparing to meet their counterparts in Moscow to encourage de-escalation. Mr Johnson will phone Russian President Vladimir Putin in the coming days. (BBC)

RUSSIA: Canada will temporarily withdraw non-essential Canadian employees and remaining dependents from its embassy in Ukraine, the foreign ministry said on Sunday, amid an international standoff over Russian troops massed on the country's borders. (RTRS)

RUSSIA: Russia will relocate planned naval exercises to outside of Ireland’s exclusive economic zone, according to its ambassador in Dublin, Yuriy Filatov, in a what he described as a gesture of goodwill toward the Irish government and local fishermen. (BBG)

RUSSIA: President Volodymyr Zelenskiy on Friday did not rule out a full-blown war with Russia but said Ukraine was not a sinking Titanic and accused Washington and media of fuelling panic that weighed on the economy while there were "no tanks in the streets". (RTRS)

RUSSIA: The chairman of Ukraine's parliament has sent a letter to eight U.S. senators outlining four specific requests for security assistance and sanctions that Kyiv believes will help deter a Russian invasion, Axios has learned. The Ukrainian government is leaning on Congress — and a bipartisan group of senators negotiating compromise language on sanctions that could pass the Senate — in an effort to push the U.S. posture beyond the Biden administration's approach. (Axios)

OIL: OCP Ecuador, the operator of Ecuador's privately held heavy crude pipeline, suspended pumping crude on Saturday as a preventative measure after it ruptured in the Amazon, and began cleaning and repairs. (RTRS)

CHINA

ECONOMY: The China Securities and Regulatory Commission (CSRC) met this week with executives at top western banks and asset managers to reassure them about the country's economic prospects after regulatory crackdowns in 2021, three people with direct knowledge of the matter said on Friday. CSRC Vice Chairman Fang Xinghai hosted the virtual meeting with more than a dozen foreign financial institutions on Tuesday, said the people, who declined to be identified as they were not authorised to speak to the media. Senior executives from firms including BlackRock, Credit Suisse, Fidelity International, Goldman Sachs, JPMorgan, Morgan Stanley and UBS attended the meeting, said two of the sources. Fang reassured the meeting participants that China will achieve "respectable growth" in 2022, one of the people said. (RTRS)

POLICY: China will toughen law enforcement to curb monopoly practices and unfair competition in the pharmaceutical industry as the government seeks to foster a good business environment, the industry ministry said on Sunday. (RTRS)

PROPERTY: MNI: China Gears Policy To Urge Home Buyers Into The Market

- China’s policymakers are in a rush to get buyers back into the property market by lowering lending rates and relaxing mortgage terms, with the related goals of keeping developers rolling and boosting (a pillar of the economy), advisors told MNI, with some suggesting delaying pilot plans for property taxes - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

PROPERTY: China’s property loan growth stabilized in the fourth quarter of 2021, even before authorities called on banks to increase lending to the struggling sector to ease a liquidity crisis. The country’s outstanding loans in the property sector increased to 52.17 trillion yuan ($8.2 trillion) at the end of 2021, according to the People’s Bank of China. The year-over-year growth was 7.9%, faster than the 7.6% pace seen at the end of September, which was the slowest rate since the PBOC started analyzing the data in 2010. Outstanding individual mortgages were 38.32 trillion yuan at the end of 2021, up 11.3% year-on-year, with the pace unchanged from September. Outstanding property development loans, however, declined for the third consecutive quarter to 12.01 trillion yuan. (BBG)

EVERGRANDE: China Evergrande Group said on Sunday that recievers have been appointed for a plot of undeveloped land in Hong Kong's rural Yuen Long district, in the latest development to hit the debt-laden developer. (RTRS)

BONDS: Foreign investors held 4.1 trillion yuan ($644.5 billion) of China’s bonds at the end of 2021, accounting for 3.1% of the country’s outstanding onshore bonds, according to the People’s Bank of China. Sovereign bond holdings made up 61.3% of foreign ownership of Chinese notes, and debt issued by policy financial institutions accounted for another 27.3%, the central bank said in a statement. Foreigners owned 3.3 trillion yuan of Chinese bonds as of the end of 2020, according to previous data released by the PBOC. China’s outstanding bonds totaled 133.5 trillion yuan at the end of 2021, up 16.5 trillion yuan from a year ago. (BBG)

CORONAVIRUS: Beijing officials said Sunday they had sealed off several residential communities north of the city center after two cases of COVID-19 were found. The Chinese capital is on high-alert as it prepares to host the Winter Olympics opening Friday. (AP)

OVERNIGHT DATA

CHINA JAN M’FING PMI 50.1; MEDIAN 50.0; DEC 50.3

CHINA JAN NON-M’FING PMI 51.1; MEDIAN 51.0; DEC 52.7

CHINA JAN COMPOSITE PMI 51.0; DEC 52.2

CHINA JAN CAIXIN M’FING PMI 49.1; MEDIAN 50.0; DEC 50.9

The recent uptick in COVID-19 cases in China, and subsequent round of fresh restrictions, weighed on manufacturing performance at the start of 2022. Companies registered renewed falls in output and new orders during January, though in both cases rates of reduction were only modest. New export business meanwhile fell at the quickest pace since May 2020, and supply chain delays worsened. Average input prices rose at a slightly quicker, but modest rate. Prices charged meanwhile increased following a slight reduction in December. Manufacturers were confident that output would increase over the next 12 months, often due to forecasts that market conditions will strengthen as the pandemic is brought under control. (Caixin)

JAPAN DEC, P INDUSTRIAL OUTPUT +2.7% Y/Y; MEDIAN +2.9%; NOV +5.1%

JAPAN DEC, P INDUSTRIAL OUTPUT -1.0% M/M; MEDIAN -0.6%; NOV +7.0%

JAPAN DEC RETAIL SALES +1.4% Y/Y; MEDIAN +2.8%; NOV +1.9%

JAPAN DEC RETAIL SALES -1.0% M/M; MEDIAN +0.3%; NOV +1.3%

JAPAN DEC DEPT STORE, SUPERMARKET SALES +1.4% Y/Y; MEDIAN +1.9%; NOV +1.5%

JAPAN JAN CONSUMER CONFIDENCE INDEX 36.7; MEDIAN 37.0; DEC 39.1

JAPAN DEC HOUSING STARTS +4.2% Y/Y; MEDIAN +8.1%; NOV +3.7%

JAPAN DEC ANNUALIZED HOUSING STARTS 0.838MN; MEDIAN 0.853MN; NOV 0.851MN

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +3.0% Y/Y; DEC +2.8%

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +0.4% M/M; DEC +0.2%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +7.2% Y/Y; MEDIAN +6.9%; NOV +6.6%

AUSTRALIA DEC PRIVATE SECTOR CREDIT +0.8% M/M; MEDIAN +0.6%; NOV +1.0%

UK JAN LLOYDS BUSINESS BAROMETER 39; DEC 40

MARKETS

SNAPSHOT: Fedspeak, Russia & European Politics Dominate News Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 281.25 points at 26998.25

- ASX 200 down 16.541 points at 6971.6

- Shanghai Comp. is closed

- JGB 10-Yr future down 8 ticks at 150.69, yield up 0.4bp at 0.175%

- Aussie 10-Yr future up 4.5 ticks at 98.085, yield down 4.5bp at 1.895%

- U.S. 10-Yr future -0-03 at 127-27+, yield up 1.43bp at 1.784%

- WTI crude up $0.99 at $87.81, Gold down $2.69 at $1788.84

- USD/JPY up 18 pips at Y115.44

- BOSTIC: FED COULD USE HALF-POINT RATE RISES IF NEEDED (FT)

- PENTAGON: PUTIN STILL ADDING RUSSIAN TROOPS AROUND UKRAINE (BBG)

- CHASTENED DRAGHI BUYS TIME TO FIX ITALY AFTER PRESIDENTIAL CHAOS (BBG)

- PORTUGAL’S PREMIER WINS ELECTION, TAKES MAJORITY IN PARLIAMENT (BBG)

- CHINESE PMIS SLOW IN JAN

BOND SUMMARY: U.S. Tsys Bear Flatten, Aussie Bonds Spike Higher At Futures Close

Atlanta Fed President Bostic alluded to the risks of a swifter pace of rate hikes over the weekend (but stuck to his baseline call of 3 hikes in ’22), this, combined with a more hawkish Fed call from Goldman Sachs (looking for 5x 25bp hikes in ’22 vs. 4x prev.) applied some bear flattening pressure to cash Tsys overnight. Participants seemed to look through the continued geopolitical tension surrounding Russia. Still, the Lunar New Year holiday period curtailed broader activity, with TYH2 sticking to the 0-05 range established early on, last -0-03+ at 127-27. Cash Tsys run 1.5-3.5bp cheaper across the curve. TUH2 block activity headlined on the flow front in Asia (with price action pointing to a 6K block buy being followed up with a 6K block sale). Looking ahead, NY hours will see the release of the latest MNI Chicago PMI reading, in addition to the Dallas Fed manufacturing activity print. Meanwhile, Fedspeak will come from Kansas City Fed President George (’22 voter) & San Francisco Fed President Daly (’24 voter)

- 10-Year JGB yields ticked higher in early afternoon trade, topping 0.180%, hitting the highest level since early ’16 in the process. There wasn’t an outright trigger for the move, outside of technical breaks in both 10-Year JGB yields and JGB futures, although the space pared the move as we worked towards the Tokyo close. That left futures -5 at the bell, while cash JGBs were little changed to ~2.5bp cheaper, as the super-long end led the weakness.

- In the ACGB space, it looked like pre-RBA short covering came to the fore at the bond futures close, with YM spiking higher, making fresh session highs. That left the contract +10.0 at settlement, while XM was +4.5. ACGBs outperformed during Asia trade, with incumbent PM Morrison struggling in the polls (although he just about retained his preferred PM status in the most recent Newspoll offering) and some pre-RBA caution supporting the space for much of Sydney trade. The spike higher in YM also supported the IR strip into the bell.

EQUITIES: E-minis Unwind Losses, Chinese Tech Nudges Higher

U.S. e-mini futures unwound their early losses (which were linked to geopolitical worry surrounding Russia & questions re: the hiking trajectory of the U.S. federal Reserve) as we moved through Asia-Pac dealing. A bounce in Chinese tech names listed in Hong Kong aided broader sentiment, as that space benefitted from another round of hope that the worst is behind us when it comes to the regulatory clampdown on the sector, in addition to a technical bounce and some speculation re: month-end rebalancing flows. Japanese equities also ticked higher on the day, while Australia’s ASX 200 lodged modest losses. A reminder that Chinese markets were closed for the Lunar Year Holiday, with Hong Kong markets ceasing trade at lunch time, owing to the observance of the same holiday.

OIL: Geopolitics & Surging Natural Gas Prices Support Crude

WTI & Brent crude futures have added ~$1.20 vs. Friday’s settlement levels, with geopolitical tensions surrounding Russia remaining elevated (U.S. security officials pointed to a further increase in the number of Russian troops amassed on the Ukrainian border over the weekend, while U.S. & European sanctions targeting Russia remain in the offing) and a weather-driven surge in U.S. natural gas prices eyed. Wednesday’s OPEC+ meeting provides some event risk for participants this week.

GOLD: Marginally Lower To Start The Week

Gold remains comfortably within the confines of the recently established range, with spot dealing a handful of dollars lower in Asia-Pac hours, printing just above $1,785/oz at typing. Last week saw bullion print at the highest level witnessed since November, briefly topping $1,850/oz, before the hawkish reaction to Fed Chair Powell’s post-FOMC press conference saw gold finish the week ~$60/oz shy of Tuesday’s high. Technicals remain well-defined, in line with those portrayed at the backend of last week.

FOREX: High-Betas Gain In Risk-On Trade

Improvement in broader risk sentiment (U.S. e-mini futures turned green) and an uptick in crude oil prices supported high-beta FX space at the start to the week. Liquidity was drained by holiday market closures in China, South Korea and New Zealand's Auckland, with a couple of regional financial centres observing shortened trading hours.

- The AUD firmed ahead of the RBA's monetary policy decision due tomorrow. The Reserve Bank are expected to scrap their QE programme and update their forward guidance re: interest rates.

- The yen went offered amid reduced demand for safe havens. The fact that Sunday was a Gotobi day may have exacerbated the yen's woes. Risk barometer AUD/JPY briefly showed above the Y81.00 mark.

- The U.S. dollar index (DXY) lost steam after the Fed's hawkish pivot rattled markets last week. That being said, the extremes of last Friday's range remained intact.

- Advance EZ GDP, flash German CPI, U.S. MNI Chicago PMI & comments from Fed's Daly take focus from here.

FOREX OPTIONS: Expiries for Jan31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E1.3bln), $1.1370-90(E715mln)

- USD/JPY: Y114.00($850mln), Y114.95-05($1.1bln), Y117.00($1.2bln)

- AUD/USD: $0.7300-15(A$587mln)

- USD/CAD: C$1.2550-60($931mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 31/01/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/01/2022 | 1000/1100 | *** |  | EU | GDP (p) |

| 31/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 31/01/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2022 | 1530/1030 | ** |  | US | Dallas Fed Manufacturing Survey |

| 31/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2022 | 1740/1240 |  | US | Kansas City Fed's Esther George | |

| 31/01/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.