-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Modest Amount Of RBA Hike Premium Unwound As Bank Stresses Patience Re: Hikes

- The RBA came down on the dovish side of expectations, reaffirming its willingness to be patient re: rate hikes given the lack of notable momentum when it comes to wage growth, while it announced the cessation of its QE purchases, as expected.

- Broader headline flow was limited owing to widespread holidays in the Asia-Pac region.

- Manufacturing PMI readings from across the globe headline the data docket today, with Eurozone unemployment & Canadian GDP also due.

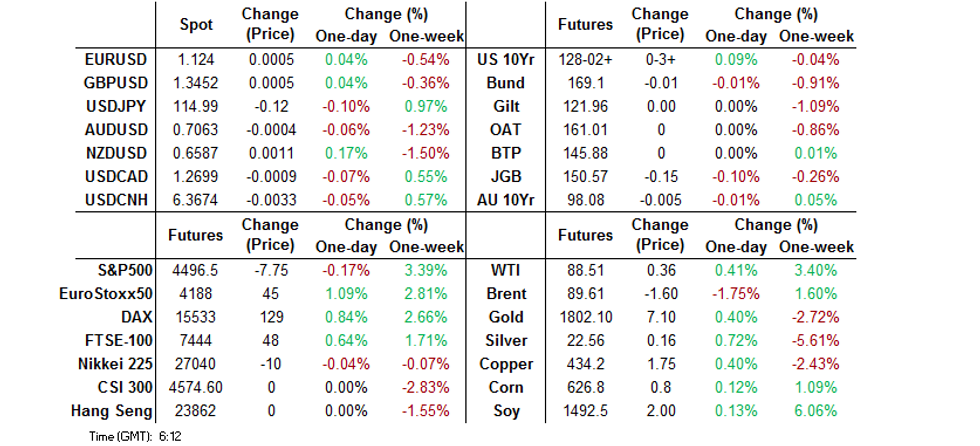

BOND SUMMARY: ACGBs Benefit From Lack Of RBA Policy Pivot, TYH2 Flows Eyed

A modest downtick in e-minis, spill over from the ACGB space, as well as light screen & block buying (+3,310 on block) of TYH2 futures allowed the Tsy space to firm at the margin in Asia. TYH2 last +0-03+ at 128-02+, while cash Tsys run little changed to ~1.5bp richer, with light bull steepening in play. Looking ahead to the NY session, the ISM m’fing survey & JOLTS jobs data headline.

- JGB futures initially benefited from the broader bid in the core global FI space, before that impulse faded ahead of the Tokyo close. The latest round of 10-Year JGB supply was absorbed smoothly, with the cover ratio perhaps hampered by worries re: further cheapening in the international bond space & speculation re: tweaks to the BoJ’s YCC scheme. Still, several relative value plays (identified pre-auction) likely helped when it came to the smooth digestion. There wasn’t a clear catalyst for the modest cheapening witnessed during the latter rounds of Tokyo trade. JGB futures -15 come the bell, with cash JGBs running 0.5-1.0bp cheaper across the curve.

- Aussie bonds firmed in the wake of the RBA decision, with the continued inclusion of the willingness to be patient in the Bank’s forward guidance passage re: interest rates providing a bit of a surprise/dovish tinge to the statement. Note that the Bank marked its expectations higher when it comes to the peak of underlying inflation in the near-term and the underlying inflation profile for ’23, but continues to expect wage growth to be the limiting factor when it comes to inflationary pressures (although it did highlight several well-documented risks/uncertainties surrounding its view). The Bank seemingly failed to make any meaningful adjustment when it comes to GDP growth expectations, while it marked its unemployment forecasts lower in the wake of the recently observed dynamic in that space. YM -1.5 & XM -0.5 at the bell, off the RBA-reaction highs, but comfortably off early Sydney lows. Bills were -1 to +8 through the reds, twisting steeper on the day, with some of the front-end rate hike premium wound out of the strip post-RBA.

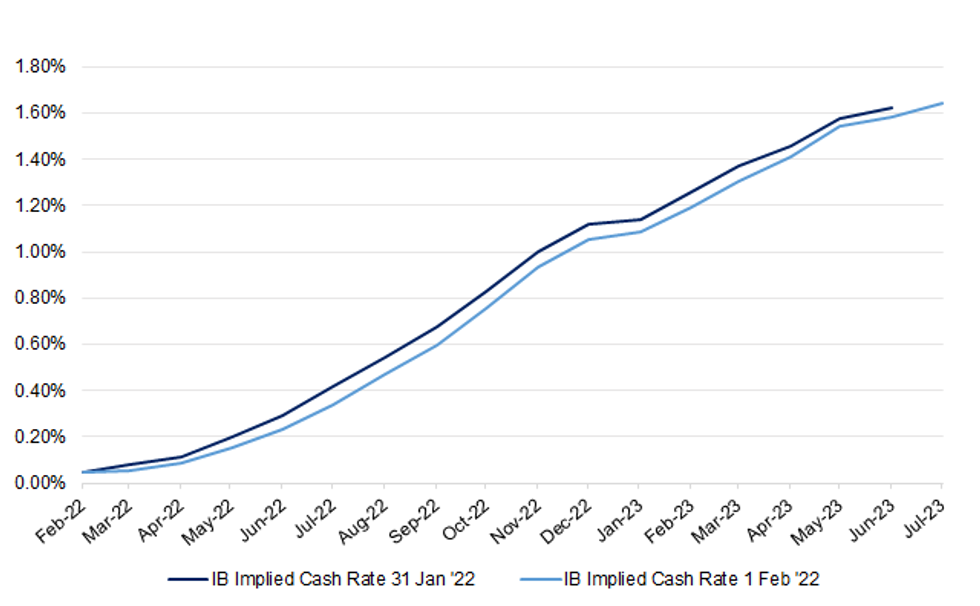

STIR: Lack Of RBA Policy Pivot Sees Modest Amount Of Rate Hike Pricing Unwound

The lack of RBA policy pivot re: rate hikes in today’s statement (see earlier bullets for greater colour) allowed the IB strip to unwind a very modest amount of the rate hike premium that was priced in pre-RBA. Still, IB volumes were light, with the biggest move coming in the Jul-Oct ’22 zone of the strip, which saw ~8bp of the tightening pricing unwound. A 15bp rate hike is now fully priced for June ’22 vs. May ’22 pre-RBA. Focus moves to RBA Governor Lowe’s first address of ’22, which will take place on Wednesday.

Fig. 1: RBA Cash Rate Pricing Implied By The IB Strip

Source: MNI - Market News/ASX/Bloomberg

Source: MNI - Market News/ASX/Bloomberg

FOREX: AUD Takes Hit As RBA Stays Patient On Rates

The Aussie dollar went offered as the RBA signalled patience as it monitors inflation dynamics. The Bank called quits on its QE programme (as expected), but stressed that "ceasing purchases under the bond purchase programme does not imply a near-term increase in interest rates." The RBA's pushback against market wagers for earlier cash rate hikes provided a bit of a surprise, pulling the rug from under the AUD in otherwise muted Asia-Pac trade.

- AUD/NZD took a nosedive after printing a fresh seven-month high at NZ$1.0758 earlier in the session. The round figure of NZ$1.0700 limited post-RBA losses.

- Apart from post-RBA price swings, G10 currency pairs stuck to tight ranges, as widespread Lunar New Year market closures weighed on activity in Asia.

- Manufacturing PMI readings from across the globe headline the data docket today, with EZ unemployment & Canadian GDP also due.

FOREX OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-70(E2.0bln), $1.1215-25(E2.9bln), $1.1300(E1.5bln), $1.1350-55(E1.2bln)

- USD/JPY: Y112.75($708mln), Y113.20-40($1.3bln), Y114.65($600mln), Y115.00-25($1.1bln), Y116.50-65($1.4bln), Y117.00($940mln)

- USD/CAD: C$1.2705($570mln)

- USD/CNY: Cny6.3600-15($1.2bln)

JGBS AUCTION: Japanese MOF sells Y2.1080tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1080tn 10-Year JGBs:

- Average Yield 0.175% (prev. 0.096%)

- Average Price 99.27 (prev. 100.03)

- High Yield: 0.176% (prev. 0.097%)

- Low Price 99.26 (prev. 100.02)

- % Allotted At High Yield: 97.0987% (prev. 38.3637%)

- Bid/Cover: 3.269x (prev. 3.458x)

EQUITIES: E-Minis Nudge Lower Overnight

The ASX 200 and Nikkei 225 added ~0.5% apiece, benefitting from Monday’s uptick on Wall St. (which was seemingly a function of month-end rebalancing and less worry re: the prospect of an imminent 50bp rate hike from the Federal Reserve). A reminder that the remainder of the major regional financial centres were closed during Asia-Pac hours, owing to the observance of the Lunar New Year holiday period.

- Elsewhere, U.S. e-minis shed ~0.3% apiece after the impulse from the month-end rebalancing flows faded and continued geopolitical worry surrounding Russia weighed (this limited the bid in the major Asia-Pac equity indices that were open).

GOLD: $1,800/oz Caps

A softer DXY and a steady to slightly lower U.S. real yield environment (on net) provided some support for bullion on Monday (with the day’s Fedspeak not pointing to any need for an imminent 50bp rate hike), before gold meandered through holiday-impacted Asia-Pac trading. Spot last deals little changed, just below the $1,800/oz mark that has capped price action during early trade this week. Familiar technical parameters remain in play, with the recently observed range intact.

OIL: Crude Marginally Higher

WTI & Brent sit ~$0.30 higher on the day at typing. This comes after a more supportive risk environment, geopolitical tension centring on Russia, a bid in U.S. natural gas futures and a softer DXY supported crude on Monday. The weekly API & DoE U.S. crude inventory figures will provide some interest over the next ~36 hours, but it will be Wednesday’s OPEC+ meeting that garners most of the attention (note that consensus looks for the group to press ahead with the pre-prescribed 400K bpd cumulative monthly output lift).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/02/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (f) |

| 01/02/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2022 | - | *** |  | US | Domestic Made Vehicle Sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (f) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS Jobs Opening Level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS Quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.