-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: NASDAQ 100 Losses Set The Tone, BoE & ECB Eyed

- Earnings-related weakness drove the NASDAQ 100 e-mini contract lower overnight, as it registered losses of over 2.0% vs. settlement.

- BoJ Deputy Governor Wakatabe became the latest BoJ board member to push back against speculation re: tightening/alterations to the Bank's YCC policy.

- Monetary policy decisions from the ECB & BoE headline today's economic docket, with a slew of global Services PMI readings as well as U.S. weekly jobless claims, factory orders & final durable goods orders also due. In addition to scheduled press conferences with ECB Pres Lagarde & BoE Gov Bailey, it may be worth following parliamentary testimonies from Fed nominees Raskin, Cook & Jefferson.

BOND SUMMARY: Core FI Supported By NASDAQ Weakness, JGB Futures Lag

Earnings-driven weakness for NASDAQ 100 e-minis provided some modest support for U.S. Tsys overnight, although there has been a move away from session extremes. TYH2 last +0-01 at 128-05, trading a touch shy of the peak of a 0-06+ range. Meanwhile, cash Tsys run 0.5-1.5bp richer across the curve, with very modest bull steepening in play. Thursday’s busy NY docket includes the ISM services survey, factory & durable goods data, weekly jobless claims, unit labour costs and challenger job cuts. We will also get the testimonies of Fed Governor nominees Raskin, Cook & Jefferson (the pre-released initial comments from the 3 didn’t reveal any major talking points, with a focus on inflation front & centre). Further afield, monetary policy decisions from the ECB & BoE will provide interest during early NY hours.

- JGB futures underperformed within the broader core FI space for most of the session, but manged to finish +1, while cash JGBs run little changed to 1.5bp richer across the curve, with some modest twist flattening in play. There was a lack of headline catalysts to facilitate the aforementioned underperformance in futures. Meanwhile, the super-long end drew support from a smooth round of 30-Year JGB supply (low price topped wider exp. while cover ratio dipped vs. prev. auction, but remained above the 6-auction average). Elsewhere, BoJ Deputy Governor Wakatabe was the latest BoJ board member to overtly push back against tightening/YCC tweak speculation.

- Aussie bonds drew support from the NASDAQ driven risk aversion, with YM +2.5 & XM +4.5, as the cash ACGB curve bull flattened. Local data had no tangible impact on the space. Bills finished unch. to +4 through the reds.

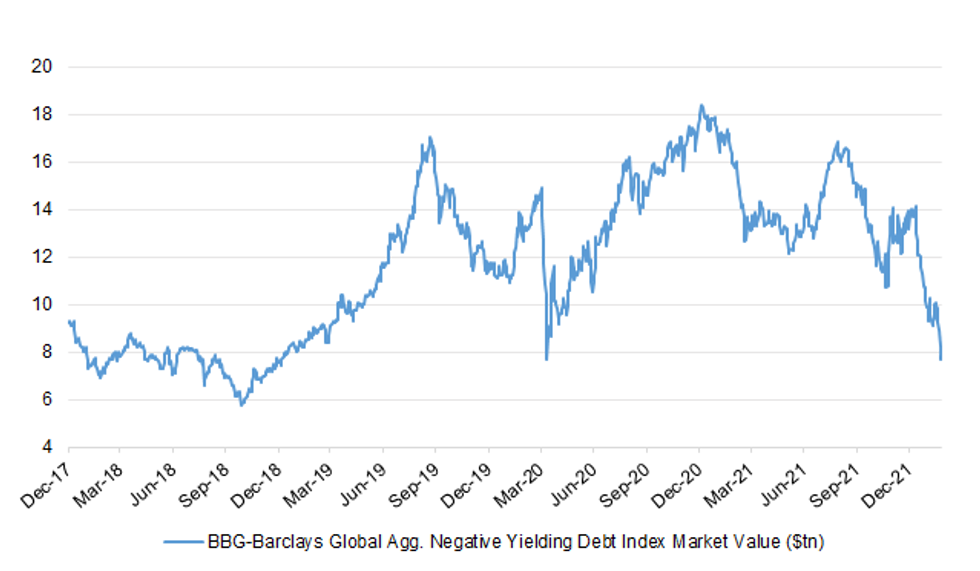

BONDS: Negative Yielding Global Debt Pile Moves Below March ’20 Levels

The recent sell off in global bond markets has driven the value of the BBG-Barclays global aggregate negative yielding debt index back below Mar ’20 COVID vol.-related lows (the index value stands at US$7.665tn). The next major milestone for the metric, in the case of an extension of the recent bond market sell off, is the ’18 low (US$5.733tn). Note that this particular index peaked at US$18.380tn in Dec ’20.

Fig. 1: BBG-Barclays Global Agg. Negative Yielding Debt Index Market Value ($tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JAPAN: Limited Net International Security Flows, But Directional Changes Seen

Net investor flows witnessed in Japan’s latest round of weekly international security flow data were relatively limited in absolute size, but there were some interesting changes in net direction.

- Japanese investors were net sellers of foreign bonds, ending a streak of 3 consecutive weeks of net purchases, as hawkish central bank worry accelerated.

- Japanese investors were also net buyers of foreign equities, ending a streak of 3 consecutive weeks of net selling (buying the latest leg of the dip).

- Foreign investors reverted to net purchases of Japanese bonds after the largest round of weekly net sales since September was observed in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -555.8 | 15.8 | 1016.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 690.2 | -86.7 | -760.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 561.8 | -1720.0 | -739.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -120.6 | 9.6 | 659.2 |

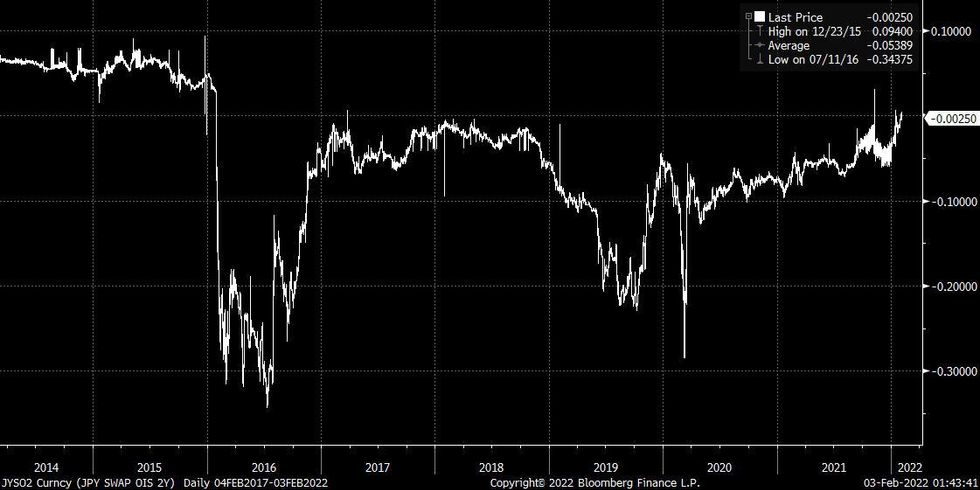

BOJ: Deputy Governor Wakatabe Pushes Back Against Idea Of Tightening

BoJ Deputy Governor Wakatabe plays down speculation re: the need for the BoJ to adjust its monetary policy settings noting that “under the floating exchange rate system, central banks should basically focus on stabilizing their own economy, and the normalization of monetary policy in Japan is associated with achieving the Bank's price stability target in a stable and sustainable manner. Given the current situation where Japan's economy has finally started to pick up from the pandemic, it is definitely too early for the Bank to start tightening monetary policy when the target has not yet been achieved as this could hinder the economic recovery.”

- The speech also covers thoughts on what the attainment of the central bank’s inflation goal would look like.

- Note that the BoJ has not been insulated from the broader hawkish repricing when it comes to major global central banks. Japan’s 2-Year OIS rate has been testing 0% in recent weeks, a level that has not been sustainably broken since early ’16 (when the BoJ adopted negative interest rates).

- A reminder that BoJ Governor Kuroda has pushed back against speculation surrounding tweaks to the Bank’s YCC scheme in recent weeks.

Fig. 1: Japan 2-Year OIS Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Tech Equity Weakness Generates Risk Aversion, Which Then Moderates

Risk aversion was the order of the day in Asia, albeit it gradually moderated as the session progressed. Riskier currencies went offered in early trade on the back of tech weakness in U.S. equity space, with NASDAQ 100 e-minis in retreat after disappointing earnings reports from Meta and Spotify.

- The AUD was the worst performer in the space, with AUD/USD extending its pullback from a one-week high printed Tuesday. Its Antipodean cousin clawed back some of its initial losses, which allowed AUD/NZD to come off a fresh seven-month high.

- USD/JPY regained poise after an initial downtick, as participants gradually lost some interest in the yen. The DXY continued to trade on a slightly firmer footing and may snap its three-day losing streak.

- Monetary policy decisions from the ECB & BoE headline today's economic docket, with a slew of global Services PMI readings as well as U.S. weekly jobless claims, factory orders & final durable goods orders also due.

- In addition to scheduled press conferences with ECB Pres Lagarde & BoE Gov Bailey, it may be worth following parliamentary testimonies from Fed nominees Raskin, Cook & Jefferson.

FX OPTIONS: Expiries for Feb03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E1.9bln), $1.1195-00(E654mln), $1.1220-25(E720mln) $1.1275-00(E1.9bln), $1.1310-25(E1.2bln), $1.1335-40(E542mln)

- USD/JPY: Y112.35-50($965mln), Y113.00-20($657mln), Y113.80-00($606mln), Y114.90-00($1.9bln)

- GBP/USD: $1.3300(Gbp593mln), $1.3400(Gbp779mln), $1.3500-05(Gbp635mln)

- AUD/USD: $0.7100-20(A$1.1bln), $0.7130-50(A$1.4bln), $0.7200-08(A$755mln)

- NZD/USD: $0.6750-60(N$532mln)

ASIA FX: Regional Risk Proxies In Retreat

More Asia markets re-opened after Lunar New Year holidays, albeit China, Hong Kong and Taiwan remained shut. Market sentiment was undermined by weakness in U.S. tech equities, which took its toll on the yuan and the main risk proxies from the Asia EM basket.

- CNH: Spot USD/CNH ground higher as the greenback caught a bid amid weakness in U.S. tech equity space.

- KRW: The won went offered as risk-off flows kicked in. Spot USD/KRW erased initial losses, despite starting on the back foot as onshore markets re-opened after a holiday. The BoK & Finance Ministry delivered their usual post-holiday comments re: monitoring market volatility.

- IDR: Risk aversion took its toll on another regional risk proxy IDR. The rupiah came under additional pressure from the continued spread of Covid-19 infections in Indonesia, confirmed by the spokesman of a national Covid-19 Task Force.

- MYR: The ringgit advanced even as expansion in Malaysia's manufacturing sector slower, as per the latest reading of Markit PMI. Still, it may have provided some reassurance that the sector dodged contraction, despite the outbreak of Omicron.

- PHP: The Philippine peso rose to its strongest levels in almost a month, with participants awaiting the release of local CPI data tomorrow. The news that lawmakers passed a bill allowing full foreign ownership of telecoms & railway services may have supported the currency, raising hopes for a boost to FDI in the Philippines.

- THB: Thailand also reports CPI data tomorrow. Spot USD/THB slipped to its lowest point in a week.

EQUITIES: Earnings Pressure On NASDAQ E-Minis Weighs On Broader Sentiment

Weakness in the NASDAQ 100 (on the back of disappointing earnings releases from both Facebook parent Meta & Spotify) weighed on broader risk appetite during Asia-Pac hours. This meant that the Nikkei 225 shed a touch over 1.0%, while the ASX 200 registered marginal losses. A reminder that broader Asia-Pac liquidity remains crimped by the ongoing observance of the LNY holiday period in both China & Hong Kong. The NASDAQ 100 led the losses in e-minis, last -2.2%, while the S&P 500 is -0.9% and the DJIA contract is marginally lower on the day (loosely as you would expect, based on relative tech sensitivity).

GOLD: Flat In Asia, Upcoming Event Risk Eyed

Bullion is little changed, printing just above $1,805/oz, sticking to a very narrow range in Asia-Pac hours, after a downtick in the broader DXY supported gold on Wednesday. Softer than expected U.S. ADP employment data & continued focus on geopolitical tension surrounding Russia dominated yesterday’s headline flow, doing gold bulls no harm. Still, a familiar range remains in play, meaning the technical parameters that we have fleshed out in recent days remain intact.

- Looking ahead, Thursday’s BoE & ECB monetary policy decisions will provide some interest for participants, although more focus will be afforded to Friday’s U.S. NFP release.

OIL: Crude Futures Marginally Lower In Asia

Some tech-driven weakness in U.S. e-mini futures has applied light weight to crude oil futures since Wednesday’s settlement, although both WTI & Brent have recovered from worst levels, to trade down ~$0.30 & ~$0.20, respectively, at typing. A reminder that Wednesday’s OPEC+ meeting resulted in the widely expected and pre-prescribed 400K bpd cumulative production hike for March, with plenty of questions apparent re: some of the pact’s participants’ ability to meet their individual production quotas.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/02/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (f) |

| 03/02/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/02/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/02/2022 | 1230/1230 |  | UK | BOE post-MPC Press Conference | |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 03/02/2022 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 03/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/02/2022 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/02/2022 | 1330/1430 |  | EU | ECB post-policy meeting presser | |

| 03/02/2022 | 1345/0845 |  | US | Senate Hearing On Federal Reserve Nominees | |

| 03/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (f) |

| 03/02/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/02/2022 | 1500/1000 | ** |  | US | Factory New Orders |

| 03/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/02/2022 | 1630/1130 | ** |  | US | US Bill 4 Week Treasury Auction Result |

| 03/02/2022 | 1630/1130 | * |  | US | US Bill 8 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.