-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: UK PM’s Troubles Grow, BoE Faces Comms Issues

EXECUTIVE SUMMARY

- FED'S BARKIN: RATES SHOULD MOVE TO PRE-PANDEMIC LEVELS, THEN ASSESS NEXT STEPS (RTRS)

- RUSSIA HAS PLAN TO STAGE ATTACK AS PRETEXT FOR UKRAINE INVASION, U.S. ALLEGES (NBC)

- DON'T ASK FOR A BIG PAY RISE, WARNS BANK OF ENGLAND BOSS (BBC)

- FOUR SENIOR AIDES TO BORIS JOHNSON RESIGN FROM NO 10 (BBC)

- NI FIRST MINISTER PAUL GIVAN ANNOUNCES RESIGNATION (BBC)

- RBA MAPS ROUTE TO FASTER INFLATION, STAYS PATIENT ON RATES (BBG)

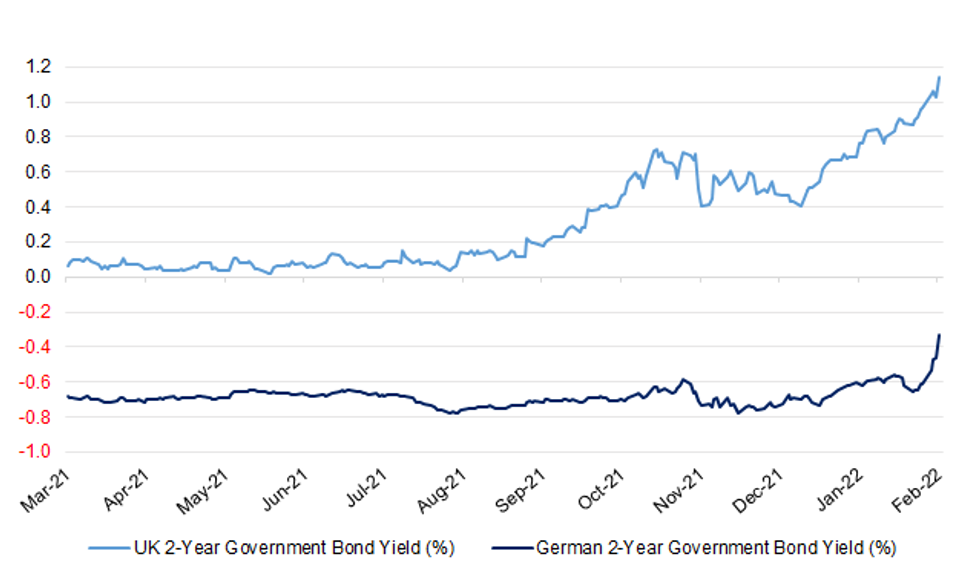

Fig. 1: UK vs. German 2-Year Government Bond Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Workers should not ask for big pay rises, to try and stop prices rising out of control, the Bank of England governor has told the BBC. Prices are expected to climb faster than pay, putting the biggest squeeze on household finances in decades. Andrew Bailey said the Bank raised rates to 0.5% from 0.25% to prevent rising prices becoming "ingrained". Asked if the Bank was also implicitly asking workers not to demand big pay rises, he said: "Broadly, yes". Inflation is on course to rise above 7% this year, leaving households facing the biggest income squeeze in decades. Pay increases are not expected to keep pace with rising prices. Post-tax incomes are forecast to fall 2% this year, after taking into account the rising cost of living. This represents the biggest fall in living standards since records began in 1990. Workers are currently enjoying pay rises of just below 5% on average, according to a Bank survey. However, in sectors with big labour shortages, such as IT, construction and engineering firms have started paying workers "ad-hoc" bonuses in order to keep them. Mr Bailey said that while it would be "painful" for workers to accept that prices would rise faster than their wages, he added that some "moderation of wage rises" was needed to prevent inflation becoming entrenched. (BBC)

BOE: MNI: Covid Revives Phillips Curve-Former Fed, BOE Officials

- The long-dormant Phillips Curve between inflation and unemployment may be about to return with a vengeance, with price rises taking off even when joblessness is at or above pre-Covid levels, according to former senior officials at the Bank of England and the Federal Reserve, whose research is now attracting the attention of the BOE’s Monetary Policy Committee - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLITICS: Four senior aides to Boris Johnson have resigned from Downing Street within hours of each other amid growing pressure on the prime minister. Director of communications Jack Doyle confirmed his exit shortly after the departure of policy head Munira Mirza. They were followed by the chief of staff Dan Rosenfield and senior civil servant Martin Reynolds. The top aides' resignations come as Mr Johnson faces increasing questions over his leadership from within his party. Mr Doyle told staff that "recent weeks have taken a terrible toll on my family life", but that he had always intended to leave after two years. A statement from a No 10 spokeswoman said Mr Rosenfield had offered his resignation to the prime minister earlier on Thursday, but would stay on while his successor was found. And Mr Reynolds - the prime minister's principal private secretary - will do the same, but then return to a role at the Foreign Office. (BBC)

POLITICS: Cabinet ministers believe there is a “50/50” chance that Boris Johnson will be forced out of office after four of his most senior aides quit Downing Street and his chancellor publicly rebuked him. (The Times)

POLITICS: The Conservatives have retained the seat of Southend West in a Parliamentary by-election triggered by the fatal stabbing of Sir David Amess MP. Anna Firth won with 12,792 votes in a contest that saw a low turnout of 24%. The election was not contested by Labour, the Liberal Democrats or the Greens. Jason Pilley of the Psychedelic Movement came second with 512 votes. UKIP's Steve Laws was third with 400. (BBC)

BREXIT: Paul Givan has announced his resignation as first minister of Northern Ireland, effective from midnight. The move is part of the Democratic Unionist Party's (DUP) protest against the Northern Ireland Protocol. Mr Givan's resignation automatically means Deputy First Minister Michelle O'Neill, of Sinn Féin, also loses her position. Sinn Féin has called for an early assembly election as a result. The protocol was agreed by the UK and EU to ensure free movement of trade across the Irish land border after Brexit. But unionist politicians have been critical of the arrangements, saying they are damaging Northern Ireland's place in the UK. DUP minister Edwin Poots ordered officials on Wednesday to halt post-Brexit checks at Northern Ireland's ports on goods arriving from Great Britain, but those checks were continuing on Thursday. (BBC)

FISCAL: Motorists will have to pay by the mile to make up a £35bn tax shortfall that will arise from the shift to electric vehicles, MPs have warned, calling on the government to act urgently to bring in a national road pricing scheme. (Guardian)

ECONOMY: Retailers endured a slow start to the year, with shopper numbers falling to 17 per cent below pre-pandemic levels last month, according to research for the British Retail Consortium. The lack of customers was cited this week by Joules, the high street casual fashion retailer, as one of the reasons for a profit warning that sent its shares down by more than 40 per cent. High street footfall was 24.2 per cent lower in January compared with the same month in 2020, according to the BRC-Sensormatic IQ report. (The Times)

EUROPE

SPAIN: Spain’s Parliament approved a labor reform that will unlock billions of euros in European pandemic aid after a tight vote that saw Prime Minister Pedro Sanchez having to rely on the support of political opponents to get the law passed. Deputies approved the legislation by a razor-thin margin of 175 votes to 174. With some regional parties which normally back him voting against the reform, Sanchez’s Socialists had to rely on a medley of smaller groups, including center-right Ciudadanos, to give him the numbers he needed. The tight vote highlighted the political obstacles the government has faced in tapping 140 billion euros ($160 billion) of European Union funds set aside to help Spain repair its pandemic-hit economy. (BBG)

NORWAY: Worth flagging that Jens Stoltenberg was seen in Oslo Thursday evening, ahead of the announcement of the new Norges Bank, according to a source report by Aftenposten (Norway's largest newspaper by circulation). Aftenposten reached out to NATO asking for Stoltenberg's schedule for Friday, but the request was rejected. "We cannot assume that Stoltenberg's presence in Oslo means that he will be appointed on Friday," the newspaper noted. * Stoltenberg, the current NATO Secretary General and former Prime Minister of Norway, is one of the two frontrunners to replace Oystein Olsen as Norges Bank Governor. The other major candidate is Ida Wolden Bache, the current Deputy Governor of Norges Bank and a seasoned central banker. The appointment of the new Norges Bank chief will be announced during their press conference with Finance Minister Vedum at 12:30 CET/11:30 GMT. (MNI)

RATINGS: Potential sovereign rating reviews of note slated for after hours on Friday include:

- Fitch on Norway (current rating: AAA; Outlook Stable)

- Moody’s on Czech Republic (current rating: Aa3; Outlook Stable) & Russia (current rating: Baa3; Outlook Stable)

- S&P on the EFSF (current rating: AA; Outlook Stable), the ESM (current rating: AAA; Outlook Stable), Latvia (current rating: A+; Outlook Stable), Luxembourg (current rating: AAA; Outlook Stable) & Sweden (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Luxembourg (current rating: AAA; Stable Trend) & Sweden (current rating: AAA; Stable Trend)

U.S.

FED: The U.S. Federal Reserve needs to begin raising interest rates but it is too soon to say how far or fast that process will need to go to bring inflation under control, Richmond Federal Reserve president Thomas Barkin said Thursday. He said it remained uncertain, given the ongoing pandemic and the tangled state of global supply chains, whether U.S. inflation would dip on its own back towards the Fed's 2% target, or be driven persistently higher by rising wages, higher input costs, and businesses developing more aggressive pricing strategies. "It is a straightforward call to say we ought to get rates back into better position," Barkin said, but with so much unknown, "it does not feel to me like there is enough information to say holy cow we have to restrain the economy right now." (RTRS)

FED: Two of President Joe Biden’s nominees to the Federal Reserve face a likely tough battle for confirmation after Republicans questioned their commitment to price stability and to keeping the Fed away from climate rules. During heated testimony Thursday, Sarah Bloom Raskin was pushed to defend past remarks about the role of regulation in mitigating climate risk and Lisa Cook -- a Ph.D. economist and the first Black woman nominated to the Fed -- to defend her knowledge of monetary policy and how she would respond to inflation. (BBG)

FED: A Republican senator urged her colleagues to scrutinize the role played by President Joe Biden’s nominee to be Federal Reserve vice chair for supervision when she was a director of a financial-technology company that subsequently gained access to the central bank’s payments system. Wyoming Republican Cynthia Lummis, during a confirmation hearing before the Senate Banking Committee Thursday, confronted Sarah Bloom Raskin over what she’d done on behalf of fintech firm Reserve Trust when she was on its board of directors between 2017 and 2019. Lummis questioned whether Raskin had used her influence to help Reserve Trust gain a master account at the Fed -- a vital step that any financial institution needs to gain access to the Fed’s payment system -- and that she called the Kansas City Fed in August 2017 in regard to the application. The company is based in Colorado, which lies in the regional Fed bank’s district. (BBG)

FED: Senate banking panel plans to vote on all Federal Reserve nominees on Feb. 15, Senator Sherrod Brown, who chairs the panel, says. That would mean committee will consider renominating Jerome Powell as Fed Chair, Sarah Bloom Raskin as vice chair of supervision. (BBG)

POLITICS: President Joe Biden's public approval rating fell to the lowest level of his presidency this week, a danger sign for his Democratic Party which risks losing control of Congress in the Nov. 8 elections, according to a Reuters/Ipsos opinion poll. The national poll, conducted Feb. 2-3, found that 41% of U.S. adults approved of Biden's performance in office, while 56% disapproved and the rest were not sure. The prior week's poll had put Biden at a 45% approval rating and 50% disapproval. (RTRS)

ECONOMY: MNI INTERVIEW: US Services Prices To Stay Higher Longer - ISM

- U.S. service costs appear set to stay near record highs longer into 2022 than previously expected and may not see much quick relief from Fed interest rate increases in the spring, ISM services survey chair Anthony Nieves told MNI Thursday. "It's definitely going to be more toward the latter part of the year in the third or fourth quarter at best," Nieves said about when to expect cooling prices. "Most of the prices will be buoyed in the first half of the year versus the second half, but it could take longer in the latter half of the year if we see any relief" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Governor Kim Reynolds said she would allow Iowa’s public health emergency declaration, first issued near the start of the pandemic in March 2020, to expire on Feb. 15. “The flu and other infectious illnesses are part of our everyday lives, and coronavirus can be managed similarly,” the Republican governor said in a statement. Health emergencies were declared at the start of the pandemic in all 50 states, and the expanded power of governors proved contentious in many of them. Roughly half of U.S. states have revoked them, and more are expected to do so as the surge caused by the omicron variant eases. Maryland, which includes part of the Washington metro area, allowed a 30-day state of emergency to expire on Thursday. (BBG)

EQUITIES: Amazon.com Inc. is giving the market back what Meta Platforms Inc. just took away - or at least some of it. The e-commerce giant is poised to add nearly $200 billion in market value if the stock’s 14% gain in after-hours trading following the company’s fourth-quarter earnings report holds to Friday’s close. That what would be the biggest single-day gain in stock market history, coming just a day after Facebook parent Meta Platforms Inc. entered the other end of the record book with a $251 billion wipeout. (BBG)

OTHER

GLOBAL TRADE: The Japanese government is set to propose a scheme to promote data-sharing among companies in Asia to strengthen supply chains in the region, Nikkei has learned. (Nikkei)

JAPAN: Japan’s government will unveil relaxed border control measures as soon as next week, broadcaster TBS reports, without attribution. Report didn’t elaborate on how or when measures would be relaxed. (BBG)

JAPAN: Japan is not considering reviewing future national sales tax rates as the current 10% levy provides a vital source of funding the social security spending to support its ageing population, the finance minister said on Friday. Shunichi Suzuki told reporters after a cabinet meeting that Japan must tackle spending and revenue reform to win market trust in its fiscal position, which he said was severe. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda on Friday reiterated the central bank's resolve to keep monetary policy ultra-loose to support the economy's recovery from the COVID-19 pandemic. "In Japan, nominal wages haven't risen much. It's hard to see inflation sustainably reach our 2% target unless wages rise in tandem with prices," Kuroda told parliament.

RBA: Australia’s central bank upgraded its inflation and employment outlook, while still seeing wage pressures building only gradually, a key reason Governor Philip Lowe is prepared to be patient on raising interest rates. The Reserve Bank now sees core inflation breaching 3% for the first time since 2010, before settling around 2.75% through to mid-2024, its quarterly Statement on Monetary Policy showed Friday. Still, the wage price index is only expected to advance to 2.75% this year, then edge up to 3% over 2023. (BBG)

AUSTRALIA: SEEK new job ads rose 4.9% m/m in January, more than retracing December’s fall. The increase in the month took job ads to a new high in the 23 year history of SEEK. Overall, ads are 54.2% higher than pre-pandemic levels. The record level of Job Ads suggests labour demand has been very resilient as the Omicron wave impacts Australia, no doubt because much of the economy has not been locked down. Job Ads remained very elevated over the past few months in Victoria and NSW even as rehiring occurs coming out of lockdowns and employment in those states recaptured earlier highs. That points to ongoing strong labour demand even at the current historically low unemployment rate. (NAB)

NEW ZEALAND: Ministry of Business, Innovation and Employment publishes jobs online report for three months through December, on website. Trend measure of all vacancies index rises ~1% q/q. Follows revised 0.8% gain in 3q -- was previously reported as a 0.2% increase. Four of nine industries posted q/q increases led by healthcare and manufacturing. From a year earlier, index rises 36%. (BBG)

NEW ZEALAND: The slow spread is giving more people the opportunity to receive boosters, New Zealand Prime Minister Jacinda Ardern said. The strategy has to ensure the health system isn’t overwhelmed, she said. Taken as a whole there is a range of factors that are making a difference to New Zealand’s experience of omicron versus other countries,” she said. “That’s a sign of success. (BBG)

NEW ZEALAND: Any thoughts that job ads were losing their puff at the end of 2021 were well and truly put to bed with SEEK’s January job ads. They jumped a seasonally adjusted 8.5%. This gain was also significant in that it vaulted the level of job ads above the high it marked back in June 2021 (soon before community transmission of the Delta variant of COVID-19 triggered lockdowns, starting August). Job ads started 2022 at a record high, is the message. Of course, New Zealand is now facing disruption from the Omicron variant of COVID, so it will be interesting to see how job ads fare as this plays out. The reality for the meantime is that the labour market is exceptionally tight. This was highlighted by the fact the New Zealand’s unemployment rate plumbed a record low of 3.2% in the December quarter of 2021. This was corroborated by the SEEK index of candidate availability, which was cyclically very low in December. Staff remain very short in supply. The uplift in job ads in January reflected reasonably widely, geographically speaking. Trends in both Full-time and Part-time job advertising were upbeat in January although for Contract/Temp positions it was a bit flat. The industry picture remained mixed when assessing the trend measures. (BNZ)

SOUTH KOREA: South Korea to extend current social distancing curbs including limiting private gatherings to up to 6 people and 9pm closing hours for restaurants and cafes for another 2 weeks, Yonhap News reports, citing Prime Minister Kim Boo-kyum. The steps to be effective through Feb. 20. (BBG)

SOUTH KOREA: South Korea will consider extending fuel tax cut which is scheduled to expire at the end of April, while monitoring crude oil prices, Vice Finance Minister Lee Eog-weon says in meeting. To stably manage utility prices in 1Q. Sees strong upside factors in Feb. CPI. (BBG)

BRAZIL: Amendment bill to reduce taxes on fuel prices more widely than agreed with Economy Minister Paulo Guedes was filed at lower house by a lawmaker linked to the govt, Folha de S.Paulo newspaper reported without citing how it obtained the information. Lawmaker’s text included tax cut for diesel, ethanol, gasoline and cooking gas. Measure fiscal impact could reach 54b reais. Proposal was drafted by the Chief of Staff’s office and filed by lawmaker Christino Aureo. Economy Ministry doesn’t agreed with the proposal. (BBG)

BRAZIL: Brazil’s Central Bank will start accepting bank-backed voluntary deposits for monetary policy purposes as of Feb. 7, according to a bank statement. Bank aims to promote the use of voluntary deposits to manage excess bank reserves and control the short-term interest rate. (BBG)

RUSSIA: The U.S. has intelligence about a Russian plan to fabricate a pretext for an invasion of Ukraine using a fake video involving actors, Deputy National Security Adviser Jon Finer said Thursday. “We don’t know that this is the route they are going to take, but we know that this is an option under consideration that would involve actors,” Finer said in an interview on MSNBC’s “Andrea Mitchell Reports." He described the plan as "extremely elaborate." (NBC)

RUSSIA: The United States warned Chinese firms on Thursday they would face consequences if they sought to evade any export kesman Ned Price made the remark after China's Foreign Ministry said China and Russia had coordinated their positions on Ukraine during a meeting between their foreign ministers in Beijing on Thursday. (RTRS)

RUSSIA/GEOPOLITICS: The United States warned Chinese firms on Thursday they would face consequences if they sought to evade any export controls imposed on Moscow in the event of Russia invading Ukraine. (RTRS)

RUSSIA/GEOPOLITICS: The United States on Thursday said it was imposing visa restrictions on several Belarusians, citing the repression of athletes abroad including the attempted forced repatriation of a sprinter at the Tokyo Olympic Games. (RTRS)

CHILE: Chile President Sebastian Pinera named Rosanna Costa Costa as president of the central bank, according to a statement. Costa Costa, the first women to lead the bank, has worked there since 2017 and worked as budget director at the finance ministry during 2010-2014. (BBG)

PERU: Peru’s Partido Morado party won’t grant the vote of confidence to the new ministers cabinet, the party said on its Twitter account. Partido Morado has 3 seats in Congress. (BBG)

ENERGY: Qatar has not approached its Asian customers over diverting gas to Europe, QatarEnergy chief and minister of state for energy Saad al-Kaabi told Reuters, adding that if Russia does not supply the region the gap could not be filled by one country. (RTRS)

ENERGY: The Japanese government is looking at diverting some supplies of imported liquefied natural gas to Europe to prepare for a cutoff of gas flows to the region in the event of a Russian invasion of Ukraine, informed sources said Thursday. The government is responding to an approach by the administration of U.S. President Joe Biden, according to the sources. Japan will work with the United States and European nations to map out specific action plans in a contingency in Ukraine, the sources said. (Jiji Press)

OIL: Libya’s National Oil Corporation (NOC) said on Thursday it had halted exports from six ports due to bad weather. The temporary move had halted exports from Brega, Zueitina, Ras Lanuf, Zawiya, Mellitah and Sidra. (RTRS)

OVERNIGHT DATA

NEW ZEALAND DEC BUILDING PERMITS +0.6% M/M; NOV +0.6%

SOUTH KOREA JAN CPI +3.6% Y/Y; MEDIAN +3.4%; DEC +3.7%

SOUTH KOREA JAN CPI +0.6% M/M; MEDIAN +0.4%; DEC +0.2%

SOUTH KOREA JAN CORE CPI +3.0% Y/Y; MEDIAN +2.8%; DEC +2.7%

MARKETS

SNAPSHOT: UK PM’s Troubles Grow, BoE Faces Comms Issues

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 205.57 points at 27448.12

- ASX 200 up 42.089 points at 7120.1

- Shanghai Comp. is closed

- JGB 10-Yr future down 33 ticks at 150.33, yield up 2.5bp at 0.201%

- Aussie 10-Yr future down 9.0 ticks at 98.025, yield up 9.3bp at 1.960%

- U.S. 10-Yr future -0-05+ at 127-15, yield up 1.44bp at 1.845%

- WTI crude up $0.56 at $90.83, Gold up $1.83 at $1806.67

- USD/JPY down 6 pips at Y114.91

- FED'S BARKIN: RATES SHOULD MOVE TO PRE-PANDEMIC LEVELS, THEN ASSESS NEXT STEPS (RTRS)

- RUSSIA HAS PLAN TO STAGE ATTACK AS PRETEXT FOR UKRAINE INVASION, U.S. ALLEGES (NBC)

- DON'T ASK FOR A BIG PAY RISE, WARNS BANK OF ENGLAND BOSS (BBC)

- FOUR SENIOR AIDES TO BORIS JOHNSON RESIGN FROM NO 10 (BBC)

- NI FIRST MINISTER PAUL GIVAN ANNOUNCES RESIGNATION (BBC)

- RBA MAPS ROUTE TO FASTER INFLATION, STAYS PATIENT ON RATES (BBG)

BOND SUMMARY: Core FI Markets Cheapen Further In Asia

U.S. Tsys edged lower in Asia, with regional reaction to Thursday’s price action & related-JGB weakness applying pressure, keeping a lid on any buying interest at the same time. TYH2 last -0-05 at 127-15+, 0-01 off the base of a 0-06 range, while cash Tsys run ~1.0-2.5bp cheaper across the curve, bear flattening. The latest labour market report headlines the U.S. docket on Friday (BBG median looks for +125K in headline NFPs, current BBG whisper number is +22K, although there is plenty of speculation re: the potential for a negative print).

- Japanese participants pressured JGBs lower from the off, reacting to Thursday’s core FI market dynamic. This saw JGB futures print through their ’21 low, with that contract -32 come the bell, back from worst levels of the day. Meanwhile, 5-Year JGB yields topped 0% and 10-Year yields printed 0.20% for the first time since ‘16, with the latter moving closer to the peak of the BoJ’s permitted -/+0.25% trading range. Cash JGBs sit 0.5-3.5-bp cheaper across the curve, with 7s leading the weakness, pointing to the futures-driven nature of the move. Elsewhere, the majority of the major swap spreads widened, applying a further source of pressure to the space.

- Aussie bonds were also subjected to the aforementioned major sources of pressure, which pushed bond futures through their overnight session lows, leaving YM -8.0 & XM -9.0 at the bell. Meanwhile, the Bill strip bear steepened, ending 2-11 ticks lower on the day. Next week’s AOFM issuance slate includes an extra A$500mn of nominal ACGB issuance vs. the “standard” A$2.0bn of generic weekly ACGB supply (a reminder that next week represents the final week of RBA ACGB purchases under its QE scheme).

JGBS AUCTION: Japanese MOF sells Y4.0532tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0532tn 3-Month Bills:

- Average Yield -0.0968% (prev. -0.0923%)

- Average Price 100.0260 (prev. 100.0248)

- High Yield: -0.0930% (prev. -0.0893%)

- Low Price 100.0250 (prev. 100.0240)

- % Allotted At High Yield: 1.3166% (prev. 16.1165%)

- Bid/Cover: 3.252x (prev. 3.755x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2025 Bond, issue #TB161:

- Average Yield: 1.5056% (prev. 1.3250%)

- High Yield: 1.5075% (prev. 1.3275%)

- Bid/Cover: 4.3400x (prev. 5.2800x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 32.1% (prev. 40.5%)

- Bidders 42 (prev. 44), successful 11 (prev. 17), allocated in full 5 (prev. 11)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 7 February it plans to sell A$500mn of the 1.75% 21 November 2032 Bond.

- On Tuesday 8 February it plans to sell A$150mn of the 1.25% 21 August 2040 Indexed Bond.

- On Wednesday 9 February it plans to sell A$1.0bn of the 1.75% 21 November 2032 Bond.

- On Thursday 10 February it plans to sell A$1.0bn of the 13 May 2022 Note & A$1.0bn of the 10 June 2022 Note.

- On Friday 11 February it plans to sell A$1.0bn of the 0.25% 21 November 2024 Bond.

EQUITIES: Tech-Driven Bid In Wake Of Amazon & Snapchat Earnings

Post-market earnings from Amazon & Snapchat allowed the U.S. tech space to erase a portion of Thursday’s losses, with the NASDAQ 100 e-mini contract last +~2% (after the cash version of the index shed ~4.2% on Thursday). The S&P 500 e-mini is +1.2% last, while the Dow contract trades ~0.6% above settlement levels (with the varied performance owing to relative sensitives to the tech space).

- Meanwhile, the Hang Seng benefitted from the relative stabilisation in broader equity indices in recent sessions as Hong Kong markets re-opened after the LNY holiday. While its large tech exposure allowed the index to benefit from the aforementioned uptick in NASDAQ e-minis. The Hang Seng is +3.1% last.

OIL: Fresh Cycle Highs For WTI

WTI & Brent crude futures have added ~$0.60 & ~$0.40 vs. their respective settlement levels, aided by the uptick in e-mini futures, weakness in broader core global FI markets and the impulse from fresh cycle highs in WTI on Thursday (which have been extended on overnight, with $91.00 now within touching distance). Note that WTI futures are on track for a seventh consecutive weekly gain, with questions continuing to do the rounds re: the ability of certain OPEC+ production pact participants to act on their increased output quotas.

GOLD: Softer USD Offsets Hawkish CBs, NFPs eyed

Thursday’s hawkish takeaways re: the latest BoE & ECB monetary policy decisions only provided fairly limited & brief downside impetus for bullion, with spot quickly reclaiming the $1,800/oz. Gold then stuck to a tight range during Asia-Pac trade, last dealing a touch above $1,805/oz, little changed on the day. It would seem that the weakness in the broader USD (qs measured by the DXY) offset the uptick in U.S. real yields on Thursday. Familiar technical parameters remain intact ahead of Friday’s U.S. NFP release.

FOREX: Greenback Remains Under Pressure, Kiwi Takes Lead

Most G10 currency pairs meandered within fairly tight ranges in muted pre-NFP trade, with all eyes on the widely watched U.S. labour market report. Modest risk-on flows materialised in early trade, as solid earnings reports from Amazon, Snapchat and Pinterest allowed U.S. tech equities to catch a breath in the wake of yesterday's sell-off. That being said, the spillover into FX space was marginal at best.

- The dollar index (DXY) extended its rout and is poised to mark a fifth day of losses, as the greenback underperformed all of its major peers. The index descended onto its 100-DMA, which limited losses in mid-Jan. The USD may have faced some further pressure from continued EUR purchases, following a relatively hawkish post-MonPol press conference with Pres Lagarde held Thursday.

- The kiwi dollar outperformed despite the absence of notable headlines. Some linked NZD strength to optimistic comments from PM Ardern, who pointed to a fairly slow spread of the Omicron variant across New Zealand. Meanwhile, government data showed that NZ job ads rose about 1.0% Q/Q in the final quarter of 2021, accelerating after an upward revised 0.8% gain recorded in Q3.

- Apart from U.S. jobs data, today's data highlights include Canadian labour market report, EZ retail sales & German factory orders. Central bank speaker slate features BoE's Bailey, Broadbent & Pill as well as ECB's Villeroy. Elsewhere, Norwegian FinMin will name the new Norges Bank Governor.

FOREX OPTIONS: Expiries for Feb04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.2bln), $1.1225-35(E514mln), $1.1300(E724mln), $1.1350(E656mln), $1.1400(E1.1bln)

- USD/JPY: Y113.80-00($1.3bln)

- GBP/USD: $1.3750(Gbp961mln)

- AUD/USD: $0.7100(A$701mln), $0.7195-00(A$549mln), $0.7300(A$1.1bln)

- USD/CAD: C$1.2500($1.6bln), C$1.2600-10($891mln), C$1.2695-10($1.5bln), C$1.2740($635mln), C$1.2940($2.5bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/02/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 04/02/2022 | 0745/0845 | * |  | FR | Industrial Production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | Retail Sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.