-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI EUROPEAN MARKETS ANALYSIS: Signs Of Demand For Some Core FI Overnight, PBoC Fix Catches Eye

- Signs of some regional demand for U.S. Tsys and long dated JGBs evident overnight

- The PBoC fixed USD/CNY notably above broader expectations as China returned from LNY break.

- German industrial output & comments from ECB President Lagarde take focus from here.

BOND SUMMARY: Latest Leg Of Cheapening Seemingly Results In Some Regional Demand In Asia

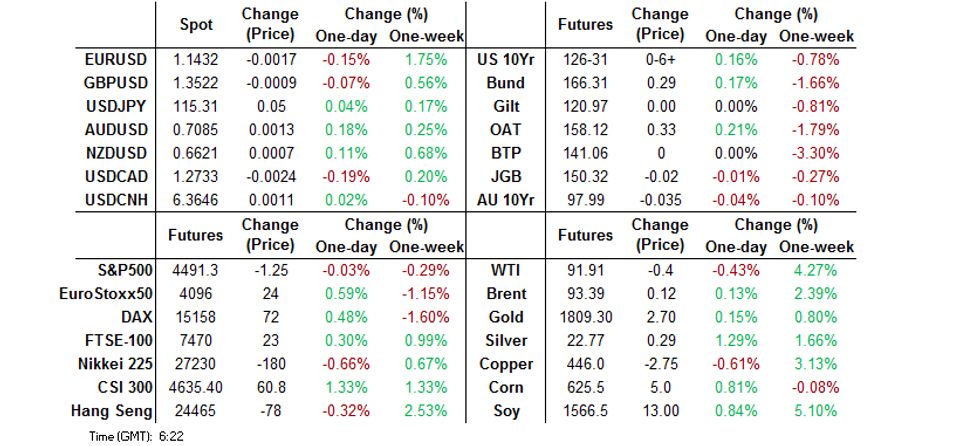

Friday’s post-NFP cheapening in global core FI markets seemed to draw money from the sidelines, resulting in a bid during early Tsy future and JGB dealing.

- Cash Tsys run little changed to 2bp richer across the curve as a result, bull flattening, with TYH2 last +0-06 at 126-30+, 0-01 off the peak of the contract’s 0-09 Asia range. The contract did register an incremental fresh multi-year low at the re-open, before the aforementioned demand supported the space. TYH2 operates on solid volume of over 130K. Note that flow was headlined by 20K of block sales in FVH2 118.75 put options vs. 14K of block lifts in FVJ2 117.50 puts, in what looked to be some profit taking coupled with rolling down & out. Looking ahead, the NY docket is virtually empty.

- JGB futures benefited from the broader core FI bid and expectations that the BoJ will act to defend the 0.25% upper boundary of its permitted 10-Year JGB yield trading range (perhaps pre-emptively), if required. This left JGB futures -2 at the bell, with most of the overnight session losses unwound. The super-long end led the richening, which pointed to Japanese lifer-driven demand given their already expressed preference for that zone of the curve. Major benchmarks across the curve were little changed to ~3bp richer on the day, as the bull flattening.

- Outside of the wider spread gyrations in core global FI markets, Aussie bonds looked to have a modest, delayed downtick on the back of the formalisation of the Australian international border re-opening (which will kick in on 21 February, for the double vaccinated), after weekend press reports pointed to an imminent announcement re: the matter. YM -7.0 and XM -3.5 come the bell, off worst levels after the space sold off post-NFP.

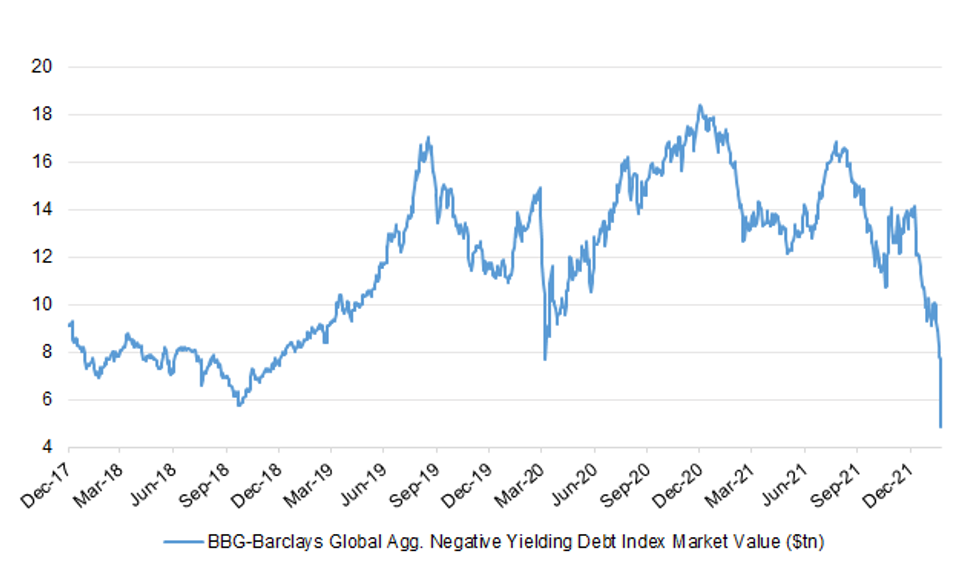

BONDS: That Was Quick, Negative Yielding Debt Value Takes Out ’18 Low

Last week we flagged that the value of the Bloomberg-Barclays global aggregate negative yielding debt index had fallen below the March ’20 trough. Back then, we noted that the next level to watch to the downside was the ’18 trough. That level has now been breached, and the index now prints at US$4.8756tn. Note that it is hard to determine when the index last sat at this level, given the lack of frequent updates before January ‘17 (when it started to be updated daily).

- A reminder that hawkish turns at last week’s BoE & ECB meetings, plus Friday’s firmer than expected U.S. NFP print (with fear of a softer than exp./negative print in play pre-release) were the driving forces behind the extension of the global core FI sell off at the backend of last week.

- Last week’s most notable moves in the negative yield space saw 5-Year JGB and 5-Year German Schatz yields cross and close above the 0% mark. This was the first time that the former managed that feat since ’16, while it was the first time that the latter managed the feat since ’18.

- Speculation remains rife: the potential for the BoJ to tweak its YCC scheme/protect the top end of its permitted 10-Year JGB yield trading band ahead of a test of the 0.25% level.

BBG-Barclays Global Agg. Negative Yielding Debt Index Market Value ($tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 May ‘41 Bond, issue #TB156:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 May 2041 Bond, issue #TB156:

- Average Yield: 2.4864% (prev. 2.0511%)

- High Yield: 2.4900% (prev. 2.0575%)

- Bid/Cover: 2.1440x (prev. 2.8500x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.4% (prev. 53.3%)

- Bidders 69 (prev. 59), successful 35 (prev. 24), allocated in full 25 (prev. 19)

FOREX: AUD Gains With Australia Set To Ease Border Rules, PBOC Signals Preference For Softer Yuan

High-beta G10 currencies showed resilience against the familiar combination of global monetary policy tightening/geopolitical tensions. The Aussie dollar was among the best performers, drawing further support from the announcement that Australia will re-open its international border to vaccinated visa holders within two weeks. Appetite for the AUD may have been fuelled by a record-breaking Q4 retail sales print, although the initial reaction was limited.

- The Eurozone's single currency traded on a softer footing, despite hawkish comments from ECB Governing Council Member Knot, who said he expected an interest-rate hike in Q4 this year. The geopolitical tension surrounding Russia's military build-up on the Ukrainian border may have sapped some strength from the EUR.

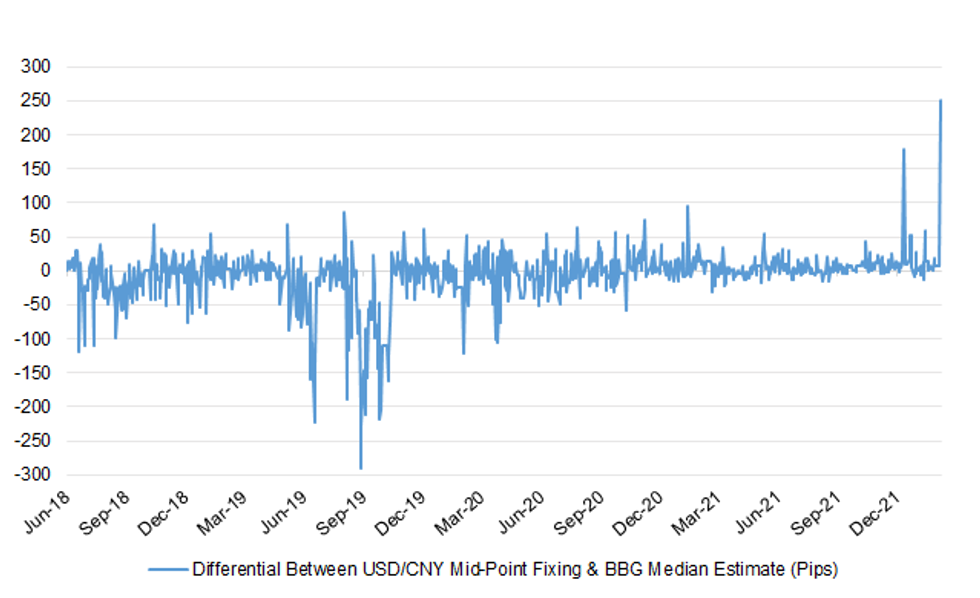

- Upon return from Lunar New Year holiday, the PBOC reached for its daily fixing of yuan reference rate to knock the redback on its head. China's central bank set the mid-point of the permitted USD/CNY band at CNY6.3580, 252 pips above consensus estimate, which represents the widest miss since June 2018. Spot USD/CNH posted a leg higher after the fixing, but eventually pulled back toward neutral levels.

- Worth noting that while markets in China and Taiwan re-opened after Lunar New Year holidays, those in New Zealand were shut in observance of the Waitangi Day.

- German industrial output & comments from ECB Pres Lagarde take focus from here.

FOREX OPTIONS: Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E633mln)

- USD/JPY: Y115.00($568mln)

- GBP/USD: $1.3400(Gbp591mln)

- AUD/NZD: N$1.0600(A$1.4bln)

- USD/CAD: C$1.2730-50($560mln)

ASIA FX: Talk Of Looser Covid-19 Rules Helps Baht Defy Regional Trend, Post-LNY PBOC Fix Surprises

The first post-LNY PBOC fix took focus in Asia and was worth watching indeed, as China's central bank showed its predilection for a weaker redback. Elsewhere, most currencies from the Asia EM basket slipped on familiar headwinds to risk appetite, although the baht managed to eke out some gains.

- CNH: The PBOC set the mid-point of permitted USD/CNY trading band at CNY6.3580, 252 pips above sell-side estimate, which was the largest upside surprise since at least June 2018. Offshore yuan took a hit and swung to to a loss, but then returned toward neutral levels.

- KRW: Spot USD/KRW crept higher, with the won undermined by continued upsurge in South Korea's daily Covid-19 infections. PM Kim flagged the possibility of an increase in the extra budget recently submitted to parliament.

- IDR: The rupiah lost ground on broader risk aversion, even as Indonesia's Q4 annual GDP growth proved faster than expected. Note that Bank Indonesia will hold their monetary policy meeting on Thursday.

- MYR: Spot USD/MYR climbed in Asia-Pac trade, with Malaysian Health Min Khairy sounding the alarm on rising daily Covid-19 cases.

- PHP: Spot USD/PHP caught a bid, as the peso led losses in Asia EM FX space, even as local headline flow was fairly thin.

- THB: The Thai baht was among few regional currencies which outperformer the greenback, drawing support from the government's plans to relax Covid-19 restrictions and form travel bubbles with China and Malaysia provided.

CNY: PBoC Starts New LNY With Much Softer Than Expected CNY Bias In Fixing

The PBoC opens the new LNY with the largest upside surprise in the daily USD/CNY fixing vs. broader consensus (a weaker than expected CNY fixing) since at least Jun '18.

Fig. 1: Differential Between USD/CNY Mid-Point Fixing & BBG Median Estimate (Pips)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: China Plays Catchup Following LNY Holiday

The CSI 300 trades 1.6% better off at midday, moving higher as mainland China returns from the LNY holiday, playing catchup to gyrations witnessed in broader equity markets over the last week.

- Meanwhile, the remainder of the regional benchmark indices, namely the Nikkei 255 (-0.7%) and the Hang Seng (-0.3%), ticked lower. E-minis are little changed on the day, paring early losses.

- The post-holiday rally in the CSI 300 is a little more subdued than that seen on the Hang Seng’s first day back (the Hang Seng added 3.2% on Friday), with continued worry re: the Chinese economy perhaps limiting the upside impetus (the latest instance of such worry came in the form of LNY tourism and spending figures).

- The ASX 200 was little changed at the close, recovering from worst levels following PM Morrison’s formal announcement re: Australia’s border re-opening to double-vaccinated international travellers (as of 21 Feb).

GOLD: Intraday Vol., But No Range Breaks

A narrow round of Asia-Pac trade sees spot gold deal little changed, hovering around ~$1,810/oz. To recap, Friday’s firmer than expected U.S. NFP release provide a second consecutive day of volatility for bullion, but spot failed to break out of the recently observed range, in a session that looked very much like Thursday in terms of price action. A pullback from intraday highs in both U.S. real yields (as proxied by our weighted monitor) and the USD (as measured by the DXY) allowed bullion to stabilise and then recover pre-NFP losses, with well-trodden technical parameters remaining untouched.

- Thursday's U.S. CPI print presents the major event risk for participants this week.

OIL: Lacking Clear Direction In Asia

WTI is -$0.40, while Brent is +$0.10 at typing. The benchmarks have traded either side of unchanged during Asia-Pac dealing.

- Crude markets were subjected to conflicting signals during Asia hours, with weight from lower U.S. e-mini equity futures at least partially offset by the familiar stories of tightness in crude supply, cold weather snaps and questions re: the ability of some OPEC+ members to raise production to meet their new quotas.

- In oil-specific news, the weekend saw Saudi Aramco raise its March prices for customers in Asia, the U.S., and Europe by $0.30-$2.30 per barrel (within wider expectations).

- Elsewhere, Libyan state operators disclosed a 100K bpd reduction in oil production on Friday (Platts estimated Libyan oil production of 1.11mn bpd in 2021) due to reduced storage capacity surrounding damaged oil tanks.

- WTI futures remain in backwardation with front month futures trading at a ~$1.60 premium to the second contract at writing, with that dynamic aided by supply uncertainty and familiar geopolitical risks e.g. Ukraine/Russia matters and Middle Eastern tensions.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.