-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Core FI Under Pressure Overnight

EXECUTIVE SUMMARY

- LAGARDE PLEDGES ‘GRADUAL’ ADJUSTMENT AS ECB DEBATE HEATS UP (BBG)

- PUTIN SAYS RUSSIA WILL 'DO EVERYTHING TO FIND COMPROMISES' WITH WEST (AFP)

- FRANCE SAYS VLADIMIR PUTIN IS MOVING TOWARDS DE-ESCALATING UKRAINE CRISIS

- EX-RBA’S EDWARDS: RBA LIKELY TO RAISE CASH RATE FOUR TIMES BY YEAR (WSJ)

- CORE FI MARKET YIELDS CONTINUE RISE IN ASIAN HOURS

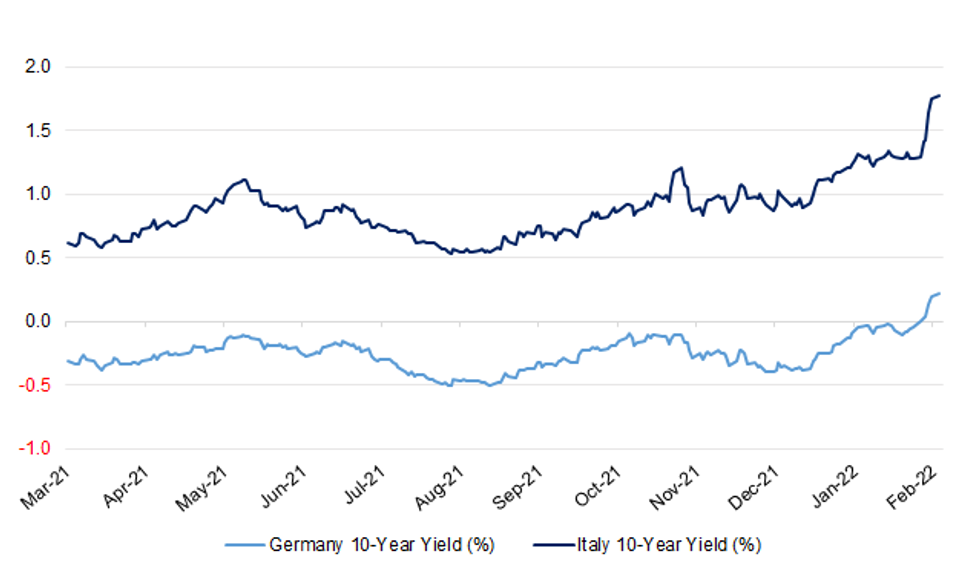

Fig. 1: Germany & Italy 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL/POLITICS: Boris Johnson's new policy unit head has said low taxes will be the key to Britain’s economic success - and that regaining backbench support for the Government’s policy agenda is crucial. (Telegraph)

ECONOMY: British consumers slowed the pace of their spending last month as the Omicron COVID-19 wave hit fuel sales and kept people away from bars and restaurants, according to a survey which also pointed to the impact of rising inflation. Consumer spending was 7.4% higher than in January 2020 - before the pandemic - the weakest increase since April last year, payments provider Barclaycard said. It said nine in 10 people it surveyed felt their household finances and discretionary spending were being impacted by the recent jump in prices. (RTRS)

POLITICS: Two people have been arrested amid clashes as protesters surrounded Labour leader Sir Keir Starmer. Sir Keir was protected by police and removed by car near Parliament shortly after 17:00 GMT on Monday. Protesters could be heard shouting "traitor" and criticising his record on Covid, and there were some cries of "Jimmy Savile". Some Tory MPs urged Boris Johnson to withdraw his false claim that Sir Keir failed to prosecute Savile. Labour has not commented but it is understood Sir Keir, a former director of public prosecutions, returned safely back to his office and was not harmed during the incident. (BBC)

EUROPE

ECB: European Central Bank President Christine Lagarde said any adjustment to monetary policy will be “gradual” as the debate over the euro region’s first interest-rate increase in more than a decade heats up. The need to remain “data-dependent” is even more important as the economy emerges from the coronavirus pandemic and officials must maintain flexibility and optionality “more than ever,” she said Monday. “We will remain attentive to the incoming data and carefully assess the implications for the medium-term inflation outlook,” Lagarde told European Parliament lawmakers. “Any adjustment to our policy will be gradual.” (BBG)

ITALY/BTPS: Italy to sell the following at Feb 10 auction: EUR6.5bn of new 12-month Feb 14, 2023 BOT (IT0005482929). (MNI)

SWEDEN: Swedish apartment prices rose by 6% in January from a year earlier, while house prices increased by 13%, according to statement from Svensk Maklarstatistik. Apartment prices rose 1% on a 3-month basis and gained 1% m/m. House prices fell 1% on a 3-month basis and were unchanged m/m. (BBG)

U.S.

FISCAL: Democratic Senator Sherrod Brown and colleagues urge Treasury Secretary Janet Yellen to provide tax relief to auto dealers experiencing inventory shortages due to supply chain disruptions. “The automotive industry continues to face dramatic and unprecedented inventory shortages due to the pandemic and foreign supply chain disruptions, and it will take many months for affected local businesses, employees, and their customers throughout our states and across the country to recover,” the senators wrote in a letter. (BBG)

CORONAVIRUS: California will lift its universal mask mandate for indoor public places next week, the LA Times reported, citing state officials. State officials are also working to update school masking requirements. (BBG)

CORONAVIRUS: Connecticut Governor Ned Lamont recommended the state end its mask mandate for schools and day-care centers on Feb. 28. Mayors and school superintendents will be able to make decisions on masks themselves to reflect local conditions, Lamont said in a news conference on Monday. He cited the availability of vaccines, boosters and a declining infection rate as reasons for his recommendation. (BBG)

OTHER

GLOBAL TRADE: The U.S. and Japan reached a truce that will allow most steel shipments from the Asian nation to enter tariff-free for the first time since 2018 and sees the countries working together to combat Chinese trade practices that harm the industry. Washington will suspend the 25% levy on incoming steel imports from Japan up to 1.25 million metric tons a year, officials from the Commerce Department and U.S. Trade Representative’s office told reporters on Monday. Anything beyond that will still be subject to additional charges. The agreement will take effect April 1, the officials said. (BBG)

U.S./CHINA/TAIWAN: The United States has approved a possible $100 million sale of equipment and services to Taiwan to "sustain, maintain, and improve" the Patriot missile defense system used by the self-ruled island claimed by China, the Pentagon said on Monday. A statement from the U.S. Defense Security Cooperation Agency said it had delivered the required certification notifying Congress following State Department approval for the sale, which was requested by Taiwan's de facto embassy in Washington. (RTRS)

JAPAN: Japan’s government plans to extend the Covid-19 quasi-state of emergency covering Tokyo and 12 other prefectures until March 6, Mainichi reported, citing unidentified officials. The measures, including restaurants closing early and limits on event attendance, had been slated to end Feb. 13. A formal decision could come as soon as Thursday, the report said. (BBG)

RBA: The Reserve Bank of Australia could raise interest rates four times in quick succession late in 2022 given the current upward trajectory of the economy, according to economist John Edwards, a former member of the central bank’s policy-setting board. At present, the RBA has the luxury of waiting to see how economic data evolves, but will be on the move by August, embarking on a steady stream of increases to the Official Cash Rate, Mr. Edwards said in an interview. “There is no point in one increase, it will be slow and incremental,” he said. The scenario painted implies the cash rate will reach 1.0% by December from a record low of 0.10% now, a climb which matches moves expected by government bond traders, but one that easily outpaces current thinking at the RBA. RBA Gov. Philip Lowe conceded last week that a tightening of the monetary policy screws in 2022 was a “plausible scenario.” Still, the central bank’s guidance remains focused on 2023, meaning the first interest rate increase since 2010 could still be a year away. (WSJ)

NEW ZEALAND: A convoy of cars and campervans blocked streets around New Zealand’s parliament in Wellington on Tuesday to protest Covid-19 restrictions, attempting to mimic the truckers who have gridlocked the Canadian city of Ottawa. About 2,000 protesters descended on downtown Wellington from around the country, parking their vehicles in streets around parliament buildings, disrupting traffic and holding speeches on parliament grounds. (BBG)

NORTH KOREA: North Korea launched hacking attacks against the International Atomic Energy Agency as well as a key South Korean defense contractor, according to a draft United Nations report obtained by Nikkei on Monday. Kimsuky, a hacking group backed by North Korean intelligence authorities, is described as capable of staging phishing attacks that mimic well-known websites and software applications to trick victims into entering their credentials. "In one of the cases the actor collected email addresses of not only government entities but also of those associated with a security officer at the IAEA," the report says. The group is also suspected of attempting to hack the virtual private network devices of Korea Aerospace Industries, one of South Korea's largest defense companies, in order to steal technological data, according to the report. (Nikkei)

NORTH KOREA: North Korea has denied allegations it has carried out a series of cryptocurrency thefts and cyberattacks on other countries, calling them a "creation" by the United States. It also denounced the U.S. as a "hacking empire and country of intelligence theft." (Yonhap)

NORTH KOREA: North Korea had a two-day session of its rubber-stamp legislature earlier this week to discuss budgetary and other pending issues, with the country's leader Kim Jong-un not present, according to its state media Tuesday. The sixth session of the 14th Supreme People's Assembly (SPA) was held in Pyongyang on Sunday and Monday, attended by senior ruling party and Cabinet officials, the North's official Korean Central News Agency (KCNA) reported. (Yonhap)

CANADA: Protests against vaccine mandates and Covid-19 restrictions have temporarily closed the Ambassador Bridge, the busiest land connection for trade between the U.S. and Canada. The bridge, the largest crossing point between Detroit and Windsor, Ontario, is closed in both directions, according to a Canadian government website. (BBG)

CANADA: Canadian Prime Minister Justin Trudeau on Monday implored protesters to end their demonstration that has blocked roads and disrupted life across the country for more than a week. "Individuals are trying to blockade our economy, our democracy, and our fellow citizens' daily lives. It has to stop," Trudeau said in parliament, his first public appearance since testing positive for Covid-19. (CNN)

CANADA: Public Safety Minister Marco Mendicino says the federal government will be in a position to act should law enforcement detect nefarious financial support of the “Freedom Convoy.” His comments come amid speculation that the convoy received American-backed financing as it pursued its occupation of the nation’s capital in an attempt to convince elected officials to remove all vaccine mandates and other public health restrictions. American crowdfunding platform GoFundMe, where the convoy’s more than $10 million were raised, removed the group’s fundraising page last Friday after stating it violated the platform’s terms. (CTV News)

CANADA: MNI INTERVIEW: Build Up To Beat Canada Housing Squeeze-CMHC

- Canada's housing squeeze that has sent prices soaring may persist unless the supply shortage is addressed by shifting away from traditional single-family suburban housing in big cities that are increasingly squeezed for space, the federal housing agency's chief economist told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

TURKEY: Turkish Finance Minister Nureddin Nebati said on Monday that his meetings with investors in London, where they discussed the country's new economic model, were very positive. The meetings will continue on Tuesday, Nebati also said on Twitter. (RTRS)

RUSSIA: U.S. President Joe Biden said the controversial Nord Stream 2 natural gas pipeline between Russia and Germany would be stopped if President Vladimir Putin orders an invasion of Ukraine. “We will bring an end to it,” Biden said at a joint news conference at the White House on Monday with German Chancellor Olaf Scholz in a short answer to a question about whether he had received assurances from Scholz. “The notion that Nord Stream 2 is going to go forward with an invasion by the Russians -- that’s not going to happen.” (BBG)

RUSSIA: Russia continues to add military forces along its border with Ukraine, including over the weekend, the Pentagon said on Monday. “Even in just over the course of the weekend, we saw Mr. Putin add to his force capability along that border with Ukraine and in Belarus,” Pentagon spokesman John Kirby said. Kirby said that none of the Russian forces appeared to be directly aimed at NATO’s eastern flank at this time. “He is well north of 100,000 and it continues to grow,” Kirby said. He added that no additional US troops had been given prepare-to-deploy orders at this time. (France 24)

RUSSIA: Russian leader Vladimir Putin said after talks Monday with French President Emmanuel Macron that Moscow would do its best to find compromises in the crisis with the West over Ukraine. "As far as we are concerned, we will do everything to find compromises that suit everyone," Putin said, adding that there would be "no winners" if war breaks out on the European continent. The Russian leader also stressed that NATO and the United States had ignored Moscow's demand of security guarantees including NATO's non-expansion and would press them for a firm commitment. "I don't think that our dialogue is over," he said, adding that Russia would soon send a response to NATO and Washington. He also insisted that Ukrainian authorities should respect Western-brokered Minsk agreements on the country's separatist conflict. "I believe that there's simply no alternative," Putin said. (AFP)

RUSSIA: The coming days will be crucial in the Ukraine standoff, French President Emmanuel Macron said after a meeting on Monday with Russia's Vladimir Putin, who suggested some progress had been made in the talks. Putin said the first Moscow summit he has held with a Western leader since the Kremlin began massing troops near its neighbor had been substantive, but also repeated warnings about the threat of war were Ukraine to join NATO. (RTRS)

RUSSIA: French officials said Vladimir Putin had moved towards de-escalating the Ukraine crisis by promising not to undertake any new “military initiatives” and agreeing to withdraw thousands of Russian troops from Belarus after the completion of planned exercises. If the agreement — brokered during talks with his French counterpart Emmanuel Macron on Monday — is confirmed by Putin it could ease tensions in the region after Russia amassed more than 100,000 troops on Ukraine’s borders. Kremlin spokesperson Dmitry Peskov told the Financial Times that Putin and Macron were “prepared to continue dialogue” on the French proposals but that the discussions had yet to fully assuage Moscow’s concerns. “All these subjects require agreement from France’s EU and Nato allies, first and foremost the US,” Peskov said. “It’s too early to speak about anything else.” Neither Putin nor Macron referred directly to such a deal at a news conference after five hours of talks on Monday, although France’s president said his Russian counterpart had assured him of his willingness to talk about de-escalation. (FT)

RUSSIA: President Biden repeatedly and vigorously defended Germany's reliability as an ally at a press conference with Chancellor Olaf Scholz on Monday, insisting that "there is no need to win back trust" when it comes to Berlin's approach to NATO and Ukraine. (Axios)

RUSSIA: Germany and US are "absolutely united" on Russia sanctions, German Chancellor Olaf Scholz said in Washington after his meeting with US President Joe Biden on Monday. (AP)

RUSSIA: Boris Johnson is warning President Putin of Russia that invading Ukraine would only strengthen Nato as he prepares to deploy Royal Marines, RAF Typhoons and Royal Navy warships to eastern Europe. Writing in The Times, the prime minister says that Britain will not “flinch” and that its support to Europe and Nato will remain “unconditional and immovable”. (The Times)

RUSSIA: Russia’s Economy Ministry raised inflation estimation for 2022 to 5.9% from 4%, Vedomosti reports, citing unidentified people familiar with details. (BBG)

IRAN: Talks on Iran nuclear program are on the finish line, and the final document is already on the table, Kommersant reports, citing Russia’s chief negotiator at Iran talks Mikhail Ulyanov. Sides, however, still have several issues to resolve, including some of them quite fundamental. Preliminary scheme envisions, that once the final agreement is reached, a period of preparation for its implementation will begin; it may take a month or two Intermediate solution at this stage is completely irrelevant, and not considered; all attention is focused on restoring the original JCPOA. (BBG)

ENERGY: The United States and the European Union pledged on Monday to work to ensure gas supplies can respond to disruptions in pipeline gas flows, as tensions rise over the massing of troops on Ukraine’s borders by Russia, Europe’s biggest gas supplier. “We’re working together right now to protect Europe’s energy supply against supply shocks, including those that could result from further Russian aggression against Ukraine,” U.S. Secretary of State Antony Blinken told reporters in Washington, alongside Josep Borrell, the EU foreign policy chief. (RTRS)

CHINA

PBOC: China still has more room to tweak its monetary policies to aid growth even after the cuts to reserve ratios and interest rates, but it will use its abundant policy reserve at the “right time and rhythm,” the official China Securities Journal said in a column citing experts’ opinions including a previous comment by PBOC Deputy governor Liu Guoqiang. With overall demand weak, the government first needs policies that generate immediate impacts, such as technological and urban infrastructure investment, the newspaper said citing analyst Wen Bin of China Merchant Bank. These measures will optimize the economic structure in the longer term, Wen was cited as saying.

ECONOMY: China needs to tackle its supply shortages, including the lack of microchips, raw material and shipping containers, which limit its economic growth, the official Economic Daily said in an editorial. It should immediately boost its domestic production of resources such as iron ore and crude oil to reduce reliance on imports, boost the reserves of key products and supplies and better utilize its strategic reserves, the newspaper said. China should also promote domestic production of microchips and other industrial components that rely on imports, such as high-end generators and machine tools, the newspaper said. (MNI)

ECONOMY: China’s GDP is expected to grow about 5.5% year on year in the first quarter of 2022 as the economy seen to recover further amid policy support, Securities Daily reports, citing Citic Securities chief economist Ming Ming. Growth of fixed-asset investment may exceed 5% in Jan. as the government aims to front-load infrastructure push, according to Liu Xiangdong, a researcher with state think tank China Center for International Economic Exchanges. China’s consumer prices may post moderate growth of 1% in Jan, Liu was cited as saying. (BBG)

ECONOMY: Authorities should not only strengthen supervision according to the law to prevent “barbaric growth of capital”, but also support and guide standardized and healthy development of capital, People’s Daily, the flagship newspaper of the Communist Party, says in a commentary. Capital should pursue profits, and taking measures to avoid a “disorderly expansion of capital” doesn’t mean China no longer wants capital, commentary says. China needs to strengthen industry regulations in order to guide companies to obey the leadership of the Chinese Communist Party and serve the socialist market economy. (BBG)

INFLATION: China will start purchasing pork for state reserves after price declines for three consecutive weeks until Jan. 28, the nation’s economic planning agency says in statement. Statement doesn’t give details of the planned pork reserve purchases. (BBG)

BANKING/CREDIT: China’s commercial banks are likely to increase overall credit growth in 2022, with more lending to infrastructure, manufacturing and supporting SMEs, the PBOC-run Financial News reported citing experts including researcher Du Yang at the Bank of China. The newspaper highlighted a recent meeting by the China Banking and Insurance Regulatory Commission, which voiced support for infrastructure, technology and green finance. Banks will support local governments, tasked by the central government to help stabilize growth, Financial News said. (MNI)

OVERNIGHT DATA

JAPAN DEC LABOUR CASH EARNINGS –0.2% Y/Y; MEDIAN +0.9%; NOV +0.8%

JAPAN DEC REAL CASH EARNINGS -2.2% Y/Y; MEDIAN -0.8%; NOV -0.8%

JAPAN DEC HOUSEHOLD SPENDING -0.2% Y/Y; MEDIAN 0.0%; NOV -1.3%

JAPAN DEC BOP CURRENT ACCOUNT BALANCE -Y370.8BN; MEDIAN +Y106.4BN; NOV +Y897.3BN

JAPAN DEC BOP CURRENT ACCOUNT ADJUSTED +Y787.5BN; MEDIAN +Y1.1201TN; NOV +Y1.3695TN

JAPAN DEC TRADE BALANCE BOP BASIS -Y318.7BN; MEDIAN -Y200.7BN; NOV -Y431.3BN

JAPAN JAN BANK LENDING INCL TRUSTS +0.6% Y/Y; DEC +0.6%

JAPAN JAN BANK LENDING EX-TRUSTS +0.6%; DEC +0.5%

JAPAN JAN BANKRUPTCIES -4.64%; DEC -9.67%

JAPAN JAN ECO WATCHERS SURVEY CURRENT 37.9; MEDIAN 48.2; DEC 57.5

JAPAN JAN ECO WATCHERS SURVEY OUTLOOK 42.5; MEDIAN 45.8; DEC 50.3

AUSTRALIA JAN NAB BUSINESS CONDITIONS +3; DEC +8

AUSTRALIA JAN NAB BUSINESS CONFIDENCE +3; DEC -12

Business conditions deteriorated in January as the Omicron variant caused COVID-19 cases to reach unprecedented levels, triggering consumer caution and staff shortages. Profitability, trading conditions, and employment all fell, with the impact felt across almost all states and industries. Recreation & personal services continues to be hardest hit but retail, transport, and construction all saw large negative impacts. Nonetheless, business confidence rebounded to positive territory after the initial outbreak caused a sharp fall in confidence in December. The confidence rebound signals that, despite the disruption, firms were optimistic that the outbreak would be short-lived, and consistent with this, forward orders remained steady. There was also a rise in capacity utilisation, driven by manufacturing, transport, and wholesale. Cost pressures remained elevated, with purchase cost growth reaching a record 3.4% in quarterly terms. Strong wage bill growth continued while on the output side, final product price inflation remained elevated, although retail price inflation eased somewhat. With case numbers appearing to have peaked in late January, some staffing constraints should ease and conditions should improve in in the coming months, but uncertainty remains about how quickly wider supply chain issues will be resolved. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 99.9; PREV. 101.8

Consumer confidence decreased 1.9% last week, falling back below neutral. This coincided with much publicised commentary from the RBA Governor that there was now a “plausible scenario” in which the cash rate went up in 2022. That is a big shift from Lowe’s previous statements that interest rates may not go up until 2024. Ratings of both ‘current’ and ‘financial’ conditions dropped to levels last seen in late 2020. Among the states, WA suffered the biggest loss, with sentiment 8.1% lower, which could be influenced by COVID numbers and bushfires close to the towns of Bridgetown and Denmark. Confidence also dropped in NSW (-1.7%), Queensland (-3.4%) and SA (-1.9%), while it rose in Victoria (+1.5%). (ANZ)

UK JAN BRC SALES LIKE-FOR-LIKE +8.1% Y/Y; DEC +0.6%

CHINA MARKETS

PBOC DRAINS NET CNY130 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY130 billion after offsetting the maturity of CNY150 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:26 am local time from the close of 2.0898% on Monday.

- The CFETS-NEX money-market sentiment index closed at 43 on Monday vs 58 before Chinese New Year holiday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3569 TUES VS 6.3580

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3569 on Tuesday, compared with 6.3580 set on Monday.

MARKETS

SNAPSHOT: Core FI Under Pressure Overnight

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 42.83 points at 27291.7

- ASX 200 up 75.85 points at 7186.7

- Shanghai Comp. down 12.938 points at 3416.643

- JGB 10-Yr future down 17 ticks at 150.15, yield up 1.4bp at 0.211%

- Aussie 10-Yr future down 12.5 ticks at 97.865, yield up 12.5bp at 2.120%

- U.S. 10-Yr future -0-09+ at 126-19+, yield up 3.08bp at 1.947%

- WTI crude up $0.07 at $91.4, Gold up $0.27 at $1820.74

- USD/JPY up 34 pips at Y115.44

- LAGARDE PLEDGES ‘GRADUAL’ ADJUSTMENT AS ECB DEBATE HEATS UP (BBG)

- PUTIN SAYS RUSSIA WILL 'DO EVERYTHING TO FIND COMPROMISES' WITH WEST (AFP)

- FRANCE SAYS VLADIMIR PUTIN IS MOVING TOWARDS DE-ESCALATING UKRAINE CRISIS

- EX-RBA’S EDWARDS: RBA LIKELY TO RAISE CASH RATE FOUR TIMES BY YEAR (WSJ)

- CORE FI MARKET YIELDS CONTINUE RISE IN ASIAN HOURS

BOND SUMMARY: No Let Up For Core FI In Asia

Core FI markets continued to leak lower during Asia-Pac hours, with FT reports pointing to the potential for de-escalation when it comes Russia-related geopolitical tensions potentially aiding the cheapening.

- TYH2 took out Monday’s Asia lows, with focus now switching to nearby Fibonacci support (126-16), as the contract trades -0-09+ at 126-19+, just off worst levels of the day. Cash Tsy trade saw 10-Year yields register fresh multi-year highs (with the same holding true for 2s & 5s), with the major benchmarks cheapening by 2-4bp, as the front end led the way lower. A 2.5K block sale FVH2 118.50 puts headlined on the flow side in Asia. NFIB small business optimism data and the latest round of 3-Year Tsy supply headline the NY docket on Tuesday.

- JGB trade saw the curve bear steepen, with the major benchmarks cheapening by 0.5-3.0bp on the day. Participants remain wary of the potential for BoJ enforcement when it comes to the top end of the Bank’s permitted trading band (0.25%), with that particular benchmark operating around the 0.21% level. JGB futures respected post-NFP lows, closing -18 on the day.

- Broader core FI weakness, trans-Tasman impetus from NZ bonds (although part of that reflected a degree of catchup after the long weekend in NZ), a couple of major sell-side institutions pointing to hawkish risks re: their RBA calls and an ex-RBA board member pointing to cash rate lift off by August and the likelihood of a 1.00% cash rate target at year end (which is a little less hawkish than market pricing at present) all applied pressure to the ACGB space, after futures steepened in overnight dealing. That left YM -8.5 & XM -12.5 at the close (as steepening came back to the fore as we moved through Sydney trade). Meanwhile, the IR strip bear steepened, finishing unchanged to 10 ticks cheaper on the day.

JGBS AUCTION: Japanese MOF sells Y199.9bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y199.9bn 10-Year JGBis:

- High Yield: -0.388% (prev. -0.357%)

- Low Price 103.70 (prev. 103.50)

- % Allotted At High Yield: 48.3443% (prev. 23.9819%)

- Bid/Cover: 4.198x (prev. 3.314x)

AUSSIE BONDS: The AOFM sells A$150mn of the 1.25% 21 Aug ‘40 I/L Bond, issue #CAIN413:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 1.25% 21 August 2040 I/L Bond, issue #CAIN413:

- Average Yield: 0.2498% (prev. 0.1663%)

- High Yield: 0.2550% (prev. 0.1700%)

- Bid/Cover: 5.0867x (prev. 5.5333x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 81.2% (prev. 50.0%)

- Bidders 50 (prev. 47), successful 9 (prev. 12), allocated in full 7 (prev. 7)

EQUITIES: Asia-Pac Mixed As Chinese & Hong Kong Equities Struggle

Australian equities led gains in Asia-Pac dealing, adding 1.1%, while the KOSPI and Nikkei 225sit flat & 0.2% higher, respectively, near the end of Tuesday trade.

- Mainland Chinese benchmarks and the Hang Seng diverged from their major regional counterparts, with the CSI 300 and Hang Seng both printing 1.6% worse off on the day at typing. The CSI 300 now sits at levels not witnessed since Sep 2020, as continued headwinds for the Chinese economy weigh on sentiment. Chinese-linked high beta tech struggled on the day. The Hang Seng Tech Index sits 2.2% worse off, while the ChiNext is ~4% lower on the session. This comes on the back of a negative lead from the U.S. tech space (although Monday’s NASDAQ losses weren’t as severe)

- E-minis are virtually unchanged at typing, paring early gains.

OIL: Marginally Lower Overnight

WTI & Brent crude futures are ~$0.20 and ~$0.30 below their respective settlement levels at typing, ~$0.25 off worst levels of the day.

- There hasn’t been much in the way of major news catalysts during Asia-Pac hours, although FT reports pointing to the potential for a moderation in Russia-related geopolitical tensions may be weighing on crude. Still, losses have seemingly been limited by the fact that global crude and distillate inventories continue to show signs of tightness.

- From a technical perspective, WTI and Brent trade below their recent multi-year highs, but remain above their respective 4 Feb lows ($90.07 for WTI & $91.20 for Brent).

- Looking ahead, the latest round of Vienna talks re: the revival of the 2015 nuclear deal that Iran was party to will take place on Tuesday. In terms of the bigger picture surrounding these talks, while U.S.-Iranian tensions have cooled incrementally from extremes, Iran still refuses to meet directly with the U.S. As a result, other world powers continue to act as the middlemen in the indirect discussions.

GOLD: Gains Remain Corrective, Key Resistance Still Some Way Off

Spot gold has stuck to a narrow range during Asia-Pac hours, last dealing essentially flat at $1,822/oz. This comes after U.S. real yields and the DXY moved away from best levels on Monday, adding some support to the space. Worries re: Russia-centric geopolitical risks also helped support bullion. Note that meaningful technical resistance is not seen until the Jan 25 high/bull trigger ($1,853.9/oz), with any gains considered corrective if that level is not breached.

FOREX: Antipodeans Lead Gains, Yen Falters

The Antipodean currencies caught a bid, as the choir of RBA hawks grew further, while NZGB yields rallied on re-open after a local holiday. Ex-RBA board member Edwards told the WSJ that the Reserve Bank could raise the cash rate four times this year, while CBA & ANZ flagged hawkish risks to their central RBA scenarios.

- Broader recovery in risk appetite lent additional support to the Antipodeans, with an FT source report helping calm the nerves frayed by the Russia geopolitical tension. French officials told the newspaper that Russian President Putin appeared to be moving towards de-escalating the Ukraine crisis during his talks with President Macron.

- Oil-tied CAD and NOK failed to benefit from risk-on flows as crude oil futures slipped. They still outperformed the yen, which landed at the bottom of the G10 pile amid reduced demand for Asia's main safe haven currency.

- The PBOC fixed its central USD/CNY reference level just 14 pips above broader expectations, offering some stabilisation after showing a considerable upside bias yesterday. Offshore yuan was rangebound.

- U.S. trade balance headlines today's light data docked, while comments are due from ECB's Villeroy & de Cos.

FOREX OPTIONS: Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-65(E528mln), $1.1200(E1.2bln), $1.1250-60(E889mln), $1.1300-20(E2.3bln), $1.1380-00(E1.6bln)

- USD/JPY: Y115.50-65($636mln)

- GBP/USD: $1.3495-10(Gbp1.0bln), $1.3560(Gbp1.1bln)

- AUD/USD: $0.7100(A$732mln), $0.7125-35(A$645mln), $0.7150-55(A$521mln), $0.7165-75(A$893mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2022 | 0745/0845 | * |  | FR | current account |

| 08/02/2022 | 0745/0845 | * |  | FR | foreign trade |

| 08/02/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/02/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/02/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/02/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/02/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/02/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 08/02/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.