-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. CPI Front & Centre

EXECUTIVE SUMMARY

- WHITE HOUSE: JAN INFLATION DATA TO SHOW HIGH YEAR-ON-YEAR FIGURE (RTRS)

- BOSTON FED NAMES SUSAN COLLINS AS ROSENGREN'S SUCCESSOR (MNI)

- MORE ECB OFFICIALS ARE SAID TO DISTRUST INFLATION FORECASTS (BBG)

- INFLATION SEEN BELOW ECB’S GOAL IN 2023 IN DRAFT EU FORECASTS (BBG)

- RBNZ WOULD LOSE DUAL MANDATE IF OPPOSITION WINS 2023 ELECTION (BBG)

- CHINA BAD-DEBT MANAGERS MOVE TO SUPPORT STRESSED DEVELOPERS (BBG)

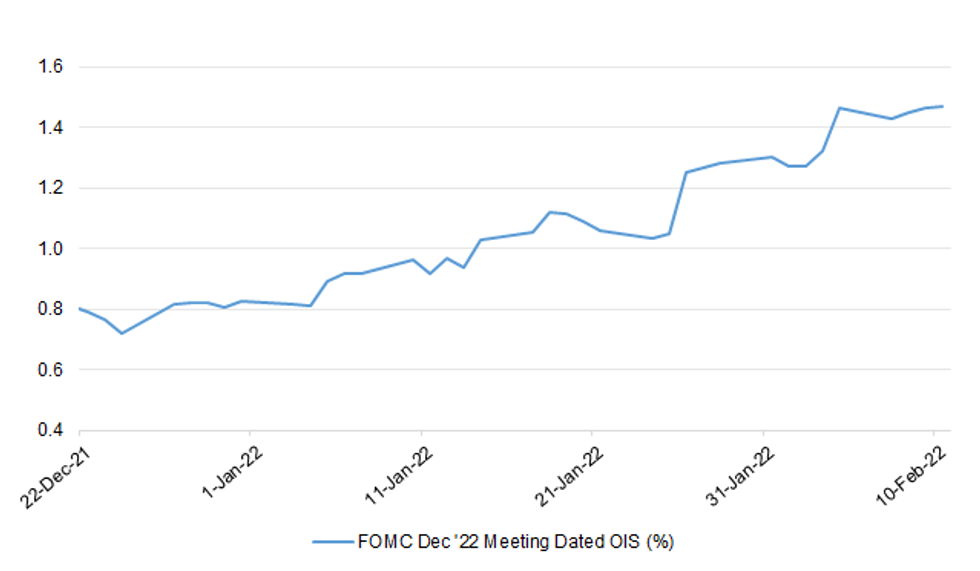

Fig. 1: FOMC Dec '22 Meeting Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY/INFLATION: Worries about inflation and a shortage of workers pushed U.K. starting salaries up by their third-fastest pace on record in January, according to a survey that may add to Bank of England concerns over rampant wage gains. Demand for workers continued to climb as pandemic restrictions eased, though the growth of vacancies cooled to the slowest pace in nine months, the Recruitment and Employment Confederation and KPMG said Thursday. A separate report from the British Chambers of Commerce found that 63% of firms faced pressure to increase prices because of bigger wage bills. (BBG)

INFLATION: Around three quarters of firms say they are putting up prices in response to surging costs such as wages, energy and raw materials, according to a new survey. The British Chambers of Commerce (BCC), which conducted the poll, said it highlighted the intense pressure creating a "cost of doing business crisis" for firms across the country. It called for the chancellor to introduce a temporary energy price cap for small businesses and to extend to those firms the financial support announced for households last week. (Sky)

POLITICS: The Metropolitan Police will email more than 50 people as part of its inquiry into lockdown parties at Downing Street and Whitehall. A questionnaire will be sent to people alleged to have been at events on eight dates between May 2020 and April 2021. It will ask for their account of what happened and "must be answered truthfully", the Met said. Prime Minister Boris Johnson and his wife Carrie are expected to be among the people being emailed. The Met Police said the email must be answered in seven days, but being contacted did not mean a fine would always be issued. The police inquiry, called Operation Hillman, is examining 12 gatherings on the eight dates over the course of the pandemic - some of which the PM attended - to see if Covid regulations were broken. (BBC)

BREXIT: European Union and U.K. attempts to jump-start negotiations over the post-Brexit trading relationship in Northern Ireland have so far failed to make any progress, and diplomats see little chance for any substantial progress until they get past a key election scheduled for May. The two sides haven’t moved at all on the substance of their differences over cross-border trade in Northern Ireland, even though the tone has been more constructive, according to people familiar with the discussions. (BBG)

EUROPE

ECB: A growing number of European Central Bank policy makers are losing faith in the institution’s current inflation forecasting, emboldening their shift toward hiking interest rates later this year, according to officials with knowledge of the matter. While Chief Economist Philip Lane robustly defends the ECB’s projections and insists his staff’s modeling is reliable and state-of-the-art, several governors are cautioning against depending too much on them in a quickly changing, uncertain environment where the recent run of price increases has persistently confounded expectations. Such doubts on the forecasting process emerged in multiple conversations with officials on the discussions behind last week’s surprisingly hawkish shift unveiled by President Christine Lagarde. They spoke on condition of anonymity because ECB deliberations are private. (BBG)

INFLATION: Euro-area inflation will ease below the European Central Bank’s 2% target next year, according to new draft projections from the European Union that will feed the growing debate about how quickly to raise interest rates. Consumer prices will advance by an average 1.7% in 2023 after surging 3.5% in 2022, according to a European Commission draft seen by Bloomberg. The predictions aren’t finalized and may still change before they are published by the EU executive on Thursday. They compare with a November forecast for increases of 2.2% and 1.4%. (BBG)

ITALY: Italy views an offer from private equity fund KKR & Co. for Telecom Italia SpA as too low, people familiar with the matter said, as the government led by Mario Draghi reviews plans to create a single national ultra- broadband network. State-backed lender Cassa Depositi e Prestiti SpA, which owns 10% of Telecom Italia, currently has a value of 82 euro cents on its books for each of its shares in the company, and would therefore be reluctant to accept KKR’s 50.5 cent per share offer, the people said, asking not to be named discussing confidential matters. French media conglomerate Vivendi SE, which owns about 24% of the former phone monopoly, has already said the KKR offer does not adequately reflect the company’s value. (BBG)

U.S.

FED: MNI: Fed's Mester Wants Faster Hikes If Inflation Stays

- Interest rates should rise in March followed by potentially faster hikes in the second half of the year to get inflation under control if price rises don't show signs of slowing by mid-year, Cleveland Fed President Loretta Mester said Wednesday, adding that she also wants to start shrinking the balance sheet soon. "Barring an unexpected turn in the economy, I support beginning to remove accommodation by moving the funds rate up in March," she said in remarks prepared for The European Economics and Financial Centre. Inflation readings in the U.S. are at their highest levels in four decades and nominal wages are accelerating at a faster pace than seen in decades, she said. Labor markets are "very strong" and the demand for workers is "well outstripping supply" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Mester Sees No Compelling Case for 50BP Fed Hike

- Federal Reserve Bank of Cleveland President Loretta Mester on Wednesday downplayed the likelihood of a half-point interest rate increase next month without entirely ruling it out. "I don't think there's any compelling case to start with a 50bp hike," she told a European Economics and Financial Centre forum. Whether to start with a 50bp increase or doing consecutive quarter-point hikes is "something to talk about and decide" at each FOMC meeting, she added - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI: Boston Fed Names Susan Collins as Rosengren's Successor

- The Boston Federal Reserve on Wednesday named Susan Collins as its president and the newest U.S. monetary policymaker, making her the first black woman to oversee a regional Fed bank. Collins will be an FOMC voter in 2022 after taking office July 1, following the completion of the academic year at the University of Michigan where she is currently provost and executive vice president for academic affairs. Collins succeeds Eric Rosengren, who left the position in September last year citing a kidney ailment after being at the regional central bank branch for 14 years - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Sarah Bloom Raskin tried again Wednesday to assuage Republicans’ concerns about her hawkish stances on mitigating climate risks ahead of a vote on her nomination to be Wall Street’s top bank regulator. Raskin, in written responses to senators’ questions, reiterated earlier remarks that it isn’t the Fed’s job to pick winners or losers or to allocate capital. And she said she saw “no path” for the Fed to diminish the role of the oil and gas industry. (BBG)

INFLATION: An upcoming government consumer price report will likely show another lofty spike in US inflation in the first month of the year, the White House warned on Wednesday. Consumer prices rose by seven percent throughout 2021, their fastest pace in four decades, and the Labor Department's consumer price index (CPI) data set for release Thursday is anticipated to show a large increase compared to January 2021. "We expect a high yearly inflation reading in tomorrow's data," White House Press Secretary Jen Psaki told reporters. "Above seven percent, as I think some are predicting, would not be a surprise." (AFP)

FISCAL: Sen. Richard Shelby (Ala.), the senior Republican on the Senate Appropriations Committee, announced Wednesday that negotiators have reached a "breakthrough” agreement on the framework for an omnibus spending package that he predicts will help the two sides agree to the spending top lines very soon. “We have reached an agreement on framework,” Shelby told The Hill shortly before noon. He said the top-line spending numbers for defense and nondefense discretionary programs, which have been a major sticking point in the talks, “will come from that” framework. He called the development “big.” (The Hill)

FISCAL: White House press secretary Jen Psaki said President Joe Biden would consider rebranding his signature Build Back Better legislation to help kick start negotiations on his stalled socail safety net bill. 'Sure,' she said in her press briefing on Wednesday when asked if the administration would consider a name change. (Daily Mail)

FISCAL: Reaching agreement with the U.S. Congress on a package of climate and social spending will be a challenge, but the Biden administration remains upbeat it can be done, White House National Economic Council Director Brian Deese said on Wednesday. Deese told an online event hosted by the Council on Foreign Relations he was optimistic given the degree of alignment seen on issues ranging from clean energy to lowering prescription drug costs and lowering child care costs. If the proposals were fully paid for, as intended by the Biden administration, the spending package would not have a net impact on aggregate demand or inflation, he said. (RTRS)

FISCAL: Two Senate Democrats up for reelection proposed a bill on Wednesday to temporarily suspend the federal gas tax through the end of 2022, as millions of Americans grapple with the economic impacts of surging oil prices. The Gas Prices Relief Act from Sens. Maggie Hassan, D-N.H., and Mark Kelly, D-Ariz., would suspend the $18.4 cents per gallon federal gas tax through Jan. 1, 2023, according to a summary of the proposal shared with ABC News. (ABC News)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention is working on guidance for governors on how to relax mask-wearing measures, Director Rochelle Walensky said at a press briefing. But hospitalizations and deaths remain high, she said. “So as we work toward that and as we are encouraged by the current trends, we are not there yet,” Walensky said. New York state lifted its indoor mask mandate for businesses on Thursday, following similar moves by other states. (BBG)

CORONAVIRUS: New York will lift its statewide mask-or-vaccine requirement for indoor businesses -- but not for schools -- on Thursday, Gov. Kathy Hochul said. "Given the declining cases, given the declining hospitalizations, that is why we feel comfortable to life this in effect tomorrow," she said Wednesday. "We want to make sure that every business knows, this is your prerogative. And individuals who want to continue wearing masks, continue wearing masks." (CNN)

CORONAVIRUS: Ten counties in the San Francisco Bay Area -- including San Francisco, Napa and San Mateo in Silicon Valley -- will drop most indoor mask requirements as of Feb. 16. Unvaccinated people will continue to need facial coverings. The move follows California’s decision to let its statewide mandate expire. Counties were able to set their own rules, and the Bay Area has often imposed stricter requirements. (BBG)

CORONAVIRUS: Illinois Governor J.B. Pritzker on Wednesday announced that he intends to lift the state’s mask mandate for indoor public places that went into effect about five months ago. The mandate, which will be lifted Feb. 28, will still apply to public schools. (BBG)

POLITICS: Servers for former President Trump’s Truth Social app are online and will have the platform operational by the expected end of March launch date, Fox Business reported, citing sources. Beta testing for the social network created by the Trump Media & Technology group is underway. Truth Social is partnering with Rumble for cloud services. The app is available for pre-order in the Apple App Store. Description says app is expected on Feb. 21. (Fox Business)

POLITICS: Rudy Giuliani and other legal advisors to then-President Donald Trump asked a Republican prosecutor in Michigan to give his county’s voting machines to Trump’s team in the wake of his loss to Joe Biden in the 2020 election, The Washington Post reported Wednesday. James Rossiter, the prosecuting attorney for Antrim County in northern Michigan, told the Post that the request from Giuliani and his colleagues came during a phone call after the county had misreported its initial election results in favor of Joe Biden. (CNBC)

POLITICS: The National Archives and Records Administration has asked the Justice Department to investigate former President Donald Trump's handling of White House records, the Washington Post reported on Wednesday. The National Archives has said it retrieved 15 boxes of official materials from Trump's Florida resort and that aides to the former president were looking for more. (RTRS)

EQUITIES: Legislation to tighten controls on U.S. lawmakers' financial transactions, including possibly banning them from buying and selling stocks, could be put on a fast track toward passage, House of Representatives Speaker Nancy Pelosi said on Wednesday. (RTRS)

OTHER

GLOBAL TRADE: The biggest assembler of iPhones said component shortages that have plagued electronics production for more than a year are showing signs of easing, a potentially encouraging signal for manufacturers across industries. There will be a major improvement in parts shortages in the first quarter, with “overall supply constraints” set to ease in the second half, James Wu, a spokesman for Hon Hai Precision Industry Co., said during a company event in Taipei on Thursday. (BBG)

GLOBAL TRADE: Truckers blocking U.S-Canada border crossings risk hurting the auto industry and agriculture, the White House said on Wednesday as Ottawa urged an end to the 13-day demonstration against coronavirus mandates. "I think it's important for everyone in Canada and the United States to understand what the impact of this blockage is - potential impact - on workers, on the supply chain, and that is where we're most focused," White House spokesperson Jen Psaki said on Wednesday. "We're also looking to track potential disruptions to U.S. agricultural exports from Michigan into Canada." (RTRS)

U.S./CHINA: The ballooning trade deficit with China recorded by the U.S. last year showed it has no alternative to replace China’s manufacturing powerhouse, the Global Times said in an editorial after data released by the Department of Commerce. The deficit with China last year was $355 billion, up from $310 billion in 2020, the newspaper said. The key to narrowing China-U.S. trade deficit is relaxing restrictions on exports to China, and allowing China to buy what it needs, Global Times said. The U.S. inflation crisis has to do with heavy tariffs on Chinese imports, and if the Biden administration keeps record prices, it is likely to ruin the Democratic Party in the midterm elections, the newspaper said. (MNI)

JAPAN: The businessman and activist who helped inspire Japanese Prime Minister Fumio Kishida’s “new capitalism” policy framework for distributing the fruits of growth more widely, also wants public spending ramped up to bolster growth. According to George Hara, author of a 2009 book also entitled “New Capitalism,” the next step after initial efforts to better distribute wealth should be government spending. Speaking in an interview with Bloomberg News this week, he said he expected the idea to gain traction with Kishida. (BBG)

AUSTRALIA: Payroll jobs rose 1.0 per cent in the fortnight to 15 January 2022, following a fall of 6.8 per cent in the last two weeks of December, according to figures released today by the Australian Bureau of Statistics (ABS). Bjorn Jarvis, head of Labour Statistics at the ABS, said: “Similar to last year, payroll jobs fell to a seasonal low point at the end of December before increasing in January. However, the week-to-week changes over the period showed a slower pick up in January than last year. “This slower increase in payroll jobs in 2022 likely reflects a range of factors, including some businesses and employees delaying their return from Christmas and New Year holidays, early impacts on businesses and employees from Omicron infections and related disruption, and weather events in some regions. “This delay meant that, while payroll jobs fell by a similar amount in the last two weeks of December (6.4 per cent in 2020 and 6.8 per cent in 2021), the increase in the first two weeks of January was slower in 2022 (1.0 per cent) compared to a year ago (3.7 per cent).” (ABS)

NEW ZEALAND: New Zealand’s central bank would lose its dual mandate if the main opposition National Party ousts Prime Minister Jacinda Ardern’s government at the 2023 election. National leader Christopher Luxon said he would restore the Reserve Bank’s sole focus on inflation if he leads the next administration. He would also remove the need for the RBNZ to take house prices into account, Luxon said in an interview with Bloomberg Thursday in Wellington. “I’m not supportive of the dual mandate, I’d move it back to price stability,” Luxon said. “There’s been too much mission creep. You’ve got to be ruthlessly focused on price stability, that’s the phase we’re going to be in for the next few years.” (BBG)

SOUTH KOREA: South Korean Finance Minister Hong Nam-ki says he’ll discuss risk factors, policy mix, financial imbalance, market stabilization, bond and FX markets when he meets BOK Governor Lee Ju-yeol on Friday, according to a statement. Hong, Lee to also discuss countermeasures in case of rising tension in Ukraine. South Korea to focus on stabilizing prices in Feb. Hong says uncertainty on economy, inflation and financial sector is rising. (BBG)

NORTH KOREA: North Korea is stepping up preparations for military parade that could come as soon as next week, ratcheting up tensions after a January barrage of missile tests forced Kim Jong Un’s nuclear arsenal back on the Biden administration’s agenda. (BBG)

NORTH KOREA: A resumption of North Korea's nuclear weapon or long-range missile tests would "instantly" send the peninsula back into crisis, outgoing South Korean President Moon Jae-in said this week, calling for measures to prevent that from happening. A record month of North Korean missile testing in January highlighted failures of Moon's efforts to engineer a breakthrough as his term ends in May, and North Korean leader Kim Jong Un has suggested he could order new nuclear tests or intercontinental ballistic missile (ICBM) launches for the first time since 2017. (RTRS)

NORTH KOREA: President Moon Jae-in said Thursday he believes U.S. President Joe Biden and North Korean leader Kim Jong-un will meet eventually to discuss Pyongyang's nuclear weapons program despite an ongoing impasse between the two countries. Moon made the remark in a written interview with Yonhap News Agency and seven other news wire services from around the world, saying the Biden administration has repeatedly expressed its commitment to reengaging the North in dialogue. "Since dialogue is the only way to resolve problems, a meeting between President Biden and Chairman Kim is expected to take place eventually. It is just a matter of time," Moon said. (Yonhap)

BOC: MNI STATE OF PLAY: BOC Says More Normal Balance Sheet is Coming

- Bank of Canada Governor Tiff Macklem said Wednesday he will seek to restore a more normal balance sheet after beginning to lift interest rates, declining to say if he can go further than other central banks that failed to fully unwind QE after the 2008 financial crisis. "An important element of sort of completing this first use of quantitative easing will be to, when the time is right, let the balance sheet move down and get back to more normal levels, so yes, that is certainly something that is coming,” he said in response to a question from MNI at a press conference following a speech - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOC: The corroded relationship between the Bank of Canada and the main opposition Conservatives took a turn for the worse after a former leader of the party launched an effort to increase parliamentary oversight of the central bank. Andrew Scheer, who led the Conservatives between 2017 and 2019, introduced a private member’s bill Wednesday that would remove the Bank of Canada’s exemption from scrutiny by the nation’s auditor general. Speaking in the House of Commons, the Saskatchewan lawmaker said the move would allow for “performance audits,” citing the central-bank’s purchasing of government and corporate bonds during the Covid-19 crisis. “Since the beginning of the pandemic, the Bank of Canada has massively expanded the money supply in Canada,” Scheer said. “As a result, we’re seeing runaway inflation.” (BBG)

CANADA: The city of Windsor has asked for federal assistance with the blockade partially blocking access to the Ambassador Bridge. “While we are hopeful this situation can be resolved in the near term, we need to plan for a protracted protest and have requested additional personnel to be deployed to Windsor to support our hard working local police service,” Windsor Mayor Drew Dilkens said at a press conference today. (The Financial Post)

MEXICO: Mexican President Andres Manuel Lopez Obrador suggested pausing relations with Spain, stepping up the attacks on the government of Prime Minister Pedro Sanchez after disagreements over the role of Spanish investment in the country. AMLO, as the president is known, said on Wednesday that the engagement between the two countries could be restored once Sanchez’s government ends its term. He stopped short of officially announcing an end to diplomatic relationship with the European nation. “We’re going to give ourselves some time to respect one another, so that they don’t see us as a land of conquest. We want to have good relations with all government, with all the people of the world, but we don’t want them to rob us,” AMLO told reporters during his daily press briefing. “I’d wish for the relationship to not be the same as it was before.” (BBG)

MEXICO/CREDIT: Credito Real SAB was declared in default by Fitch Ratings after the Mexican payroll lender failed to come up with the cash to pay off a maturing bond. The troubled company had said earlier in the day that it wasn’t able to secure a loan that would have allowed it to refinance the debt, a 170 million Swiss franc ($184 million) note. It hired DLA Piper and FTI Consulting to help evaluate restructuring options. Credito Real’s default caps a swift downfall for a financial firm that had been a market darling for the past decade, and comes just six months after a bankruptcy filing from rival Alpha Holding SA. The companies’ troubles have cast a harsh light on an industry that relied on issuing small loans -- and charging double-digit interest rates -- to the millions of traditionally unbanked across the country. The missed payment may trigger cross-default clauses on some of Credito Real’s other obligations, Fitch said in a statement. The company had just $80 million of cash on hand at the end of the third quarter, and has overseas bonds totaling almost $2 billion, according to data compiled by Bloomberg. (BBG)

BRAZIL: Former Leftist President Luiz Inacio Lula da Silva, who is leading early polls ahead of October elections, said on Wednesday he would propose less taxation on the poor and more on the rich if he wins, and reduce fuel prices. (RTRS)

RUSSIA: Pentagon press secretary John Kirby on Wednesday said decisions about limitations on coverage are part of a broader U.S. government strategy for managing the Ukraine crisis on the “geo-political stage” in search of a diplomatic solution. “Any decision to provide media access to our troops, whether it’s in an operational environment or a training environment, is a decision that we take seriously,” Kirby said. “We’re just not at a point now where we are able to provide that kind of access.” Kirby noted that it’s a sensitive moment diplomatically as the U.S. and its allies try to prevent a Russian invasion. “We believe there is still time and space for diplomacy,” he said. “We still believe that there’s headspace with Mr. Putin that can be operated inside. We still believe that he hasn’t made a final decision” to invade Ukraine. (AP)

RUSSIA: US officials have warned that Russia has continued to ramp up its military activity around the Ukrainian border, despite a flurry of diplomatic efforts to defuse the crisis including a high-profile visit to Moscow this week by French president Emmanuel Macron. The White House and the Pentagon on Wednesday said Russia was increasing its military presence near Ukraine, even though Macron earlier this week said Russian president Vladimir Putin had assured him there would be no “deterioration or escalation” in the stand-off. “We have continued to see even over the last 24 hours additional capabilities flow from elsewhere in Russia to that border with Ukraine and Belarus,” John Kirby, the Pentagon spokesperson, said. (FT)

RUSSIA: Russia's vast military exercises in Belarus are an "escalatory" action in the conflict over Ukraine, the White House said on Wednesday. "As we look at the preparation for these military exercises, again, we see this as certainly more an escalatory and not a de-escalatory action," said White House spokesperson Jen Psaki, regarding the Joint Allied Resolve drills that NATO has described as Russia's biggest deployment to ex-Soviet Belarus since the Cold War, which are set to launch on Thursday. (RTRS)

RUSSIA: The UK has said it will project a tougher stance than Emmanuel Macron when its foreign minister meets her Russian counterpart in Moscow on Thursday, in a move highlighting the difficulty of shaping a common approach in Europe over how to prevent another Russian invasion of Ukraine. While France’s president insisted on dialogue after his five-hour meeting with Russia’s leader Vladimir Putin on Monday, Liz Truss, UK foreign secretary, will seek to emphasise the “severe costs” of another invasion of Ukraine when she meets Sergei Lavrov, British officials said on Wednesday. “We will be taking slightly different messages,” said one UK diplomat. “We all believe in deterrence and dialogue. We are just keen to emphasise the deterrence line a bit more.” (FT)

RUSSIA: Boris Johnson has issued a warning to Russia that NATO member states will "draw lines in the snow" over the Ukraine crisis. (Sky)

RUSSIA: The U.K is putting 1,000 additional troops on standby to help NATO allies in eastern Europe, saying the soldiers would “support a humanitarian response in the region should it be needed,” according to a statement from 10 Downing Street. The extra troop commitment comes ahead of a meeting between British Premier Boris Johnson and NATO Secretary General Jens Stoltenberg in Brussels on Thursday, before Johnson meets Poland’s President Andrzej Duda and Prime Minister Mateusz Morawiecki. (BBG)

RUSSIA: The Russian economy grew by 4.6% as of 2021 year-end, the Ministry of Economic Development said in its review. "According to the estimate of the Russian Ministry of Economic Development, GDP gained 4.6% in 2021, fully compensating the drop by 2.7% in 2020. Annual growth of GDP remained at high levels in December: 4.3% annually (after 5.3% year-on-year in November, 4.9% in annual terms in October, and 4.3% year-on-year in the third quarter of 2021), despite the high base of December 2020," the Ministry said. (TASS)

IRAN: U.S. senators from both parties emerged from a closed-door briefing saying they were stunned about the progress Iran is making with its nuclear program even as talks continue in Vienna to revive a 2015 agreement that would restore limits on those efforts. The chief U.S. negotiator to the Iran talks, Robert Malley, was joined by Brett McGurk, the Middle East coordinator at the National Security Council and an intelligence official for the Capitol Hill briefing on Wednesday. A key issue was the “breakout time” it would take Iran to ramp up uranium enrichment and produce a nuclear weapon. “That was a sobering and shocking briefing about where we are right now,” said Senator Chris Murphy, a Connecticut Democrat. “The information we got on breakout time is something we all have to really think about.” (BBG)

IRAN: U.S. President Joe Biden and King Salman of Saudi Arabia spoke in a call on Wednesday and discussed developments in the Middle East, including in Iran and Yemen, the White House said in a statement. (RTRS)

PERU: The latest prime minister picked by Peru's embattled president, Pedro Castillo, pledged to pursue free-market policies in his first public remarks on Wednesday, a day after a new Cabinet was unveiled that aims for stability in the Andean nation. Speaking at a government news conference, Prime Minister Anibal Torres also emphasized that Castillo's leftist administration will promote a strong government that can prevent monopolies and other concentrations of economic power. (RTRS)

ENERGY: The U.S. government has asked to meet Eni , TotalEnergies and other energy companies operating in Algeria to see if more gas can be sourced from the country, sources familiar with the matter said. (RTRS)

OIL: The Canadian province of Alberta on Wednesday formally initiated a trade challenge to recover its investment in the Keystone XL oil pipeline, which was scrapped in 2021 after the United States cancelled a key permit. (RTRS)

CHINA

FISCAL: China’s local government debt issued in January totaled CNY699 billion, a rise of CNY337 billion from January 2021, which promises to boost investments in infrastructure projects and support growth, the Securities Times said citing Wind data. The so-called special-purpose bonds, geared toward infrastructure building, accounted for 69.3%, with further CNY975.6 billion remaining to be issued in the first quarter, the newspaper said. With the rapid issuances of debt, China’s infrastructure investment may rise as much as 10% in the first half, the newspaper said citing economist Ming Ming of Citic Securities. (MNI)

PROPERTY: China’s biggest bad-debt managers are moving to support cash-strapped real estate developers at the urging of policy makers in Beijing, according to people familiar with the matter, adding to official efforts to contain the fallout from a string of defaults. Regulators have told state-owned firms including China Huarong Asset Management Co. and China Cinda Asset Management Co. to participate in the restructuring of weak developers, acquire stalled property projects and buy soured loans, the people said, asking not to be identified discussing private information. Huarong is among financial institutions in talks with embattled developer Shimao Group Holdings Ltd., the people said. Cinda is part of a restructuring proposal for China Evergrande Group that calls for a group of investors to take over hard-to-sell property assets from the real estate giant, Bloomberg reported late last month. (BBG)

PROPERTY/CREDIT: China’s credit markets are ushering in the new year with a fresh bout of stress, as scrutiny of hidden debt among the nation’s developers adds to turmoil in a sector facing mounting bills and limited fundraising options. Transparency concerns are resurfacing ahead of earnings season, as investors try to avoid nasty surprises. After months of plunging sales, developers are preparing to open their books for the first time since a government clampdown on debt in the sector triggered a liquidity crisis. (BBG)

INFRASTRUCTURE: China will guide financial institutions to boost support for projects that deliver significant decarbonization, according to guidelines released by NDRC, nation’s top economic planner. The government encourages qualified companies to sell carbon neutral bonds and will roll out more innovative green financial products. Local governments can fund qualified clean energy projects with special bond proceeds. China will attract more foreign investments in clean and low-carbon energy sectors and support international firms to set up clean energy research centers in China. China to speed up construction of large wind and solar power generating bases and upgrade existing coal power units. (BBG)

POLICY: China's industry ministry on Thursday published revisions to draft rules on data security for the country's industrial and telecommunications sectors. The Ministry of Industry and Information Technology first published the draft rules in September which are aimed at bolstering the country's new data security law. (RTRS)

GRAFT: Cai Esheng, a former senior official at China's banking regulator, has been arrested on suspicion of taking bribes and abusing his authority, according to a report from state media on Thursday. Cai, born in 1951, was the vice-chairman of China Banking Regulatory Commission (CBRC) from 2005 to 2013. He was put under investigation in July. (RTRS)

OVERNIGHT DATA

JAPAN JAN PPI +8.6% Y/Y; MEDIAN +8.2%; DEC +8.7%

JAPAN JAN PPI +0.6% M/M; MEDIAN +0.4%; DEC +0.0%

JAPAN JAN TOKYO AVG OFFICE VACANCIES 6.26; DEC 6.33

AUSTRALIA FEB CONSUMER INFLATION EXPECTATIONS +4.6%; JAN +4.4%

SOUTH KOREA DEC BOP CURRENT ACCOUNT BALANCE +$6.0620BN; NOV +$6.8207BN

SOUTH KOREA DEC BOP GOODS BALANCE +$4.4817BN; NOV +$6.0683BN

SOUTH KOREA JAN BANK LENDING TO HOUSEHOLDS KRW1,060.2TN; KRW1,060.7TN

UK JAN RICS HOUSE PRICE BALANCE 74%; MEDIAN 69%; DEC 70%

CHINA MARKETS

PBOC DRAINS NET CNY180 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY180 billion after offsetting the maturity of CNY200 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:27 am local time from the close of 1.9886% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday vs 41 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3599 THURS VS 6.3653

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3599 on Thursday, compared with 6.3653 set on Wednesday.

MARKETS

SNAPSHOT: U.S. CPI Front & Centre

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 88.23 points at 27666.94

- ASX 200 up 20.167 points at 7288.5

- Shanghai Comp. down 12.621 points at 3468.043

- JGB 10-Yr future down 8 ticks at 150.12, yield up 1.5bp at 0.225%

- Aussie 10-Yr future unch. at 97.880, yield down 0bp at 2.105%

- U.S. 10-Yr future -0-01+ at 126-22+, yield down 1.65bp at 1.925%

- WTI crude up $0.01 at $89.67, Gold up $1.31 at $1834.66

- USD/JPY up 7 pips at Y115.60

- WHITE HOUSE: JAN INFLATION DATA TO SHOW HIGH YEAR-ON-YEAR FIGURE (RTRS)

- BOSTON FED NAMES SUSAN COLLINS AS ROSENGREN'S SUCCESSOR (MNI)

- MORE ECB OFFICIALS ARE SAID TO DISTRUST INFLATION FORECASTS (BBG)

- INFLATION SEEN BELOW ECB’S GOAL IN 2023 IN DRAFT EU FORECASTS (BBG)

- RBNZ WOULD LOSE DUAL MANDATE IF OPPOSITION WINS 2023 ELECTION (BBG)

- CHINA BAD-DEBT MANAGERS MOVE TO SUPPORT STRESSED DEVELOPERS (BBG)

BOND SUMMARY: U.S. Tsys Muted Pre-CPI, JGBs Cheapen

E-minis moved away from their late NY session highs, lending modest support to U.S. Tsys during Asia-Pac trade. TYH2 last -0-02 at 126-22 as a result, 0-01+ off the peak of its 0-05 Asia-Pac range and away from Wednesday’s late NY lows. Cash Tsys run 0.5-1.5bp richer across the curve. There hasn’t been much to move the broader macro needle, with the latest round of headlines surrounding China’s management of the troubled property sector failing to generate a market reaction. Participants largely remain sidelined ahead of today’s U.S. CPI print. However, it wasn’t completely quiet on the flow front, a 6K block sale of TU futures and 40K delta hedged block buy of FVJ2 117.25 puts headlined overnight. On top of CPI, wage data and 30-Year Tsy supply provide further points of interest during NY hours.

- The latest round of cheapening didn’t lure participants into picking up off-the-run 15.5- to 39-Year JGBs at today’s liquidity enhancement auction, with spreads witnessed at auction widening, alongside a widening in the gap between the average and high spread observed when compared to the previous auction. The cover ratio held steady, just above 2.00x, although that is by no means firm. Some had suggested that the recent cheapening of super-long JGBs may draw increased lifer demand into the fold at today’s auction, that didn’t seem to occur. The super-long end led the cheapening post-supply, while JGB futures came under selling pressure, although that contract failed to break below its recent cycle low, subsequently recovering from worst levels of the day. 10-Year yields have registered a fresh cycle high, printing 22.8bp, with the major JGB benchmarks 0.5-4.0bp cheaper on the day, bear steepening. BoJ Governor Kuroda stressed that he sees no chance of a reduction in easing via a Mainichi interview that hit late in the Tokyo session.

- Aussie bond futures stuck to narrow ranges. There was a distinct lack of domestic news flow to provide any impetus. YM finished +1.5, with XM unch., after showing lower in early Sydney dealing. Cash ACGBs are flat to 1.5bp richer across the curve, with the long end underperforming. A reminder that today’s RBA ACGB purchases represented the final round of outright purchases under the RBA’s QE scheme (a decision surrounding the reinvestment of maturing bonds held under the scheme will come in May).

JGBS AUCTION: Japanese MOF sells Y499.8bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.8bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.016% (prev. 0.000%)

- High Spread: +0.029% (prev. +0.004%)

- % Allotted At High Spread: 65.1006% (prev. 23.8095%)

- Bid/Cover: 2.012x (prev. 2.076x)

JGBS AUCTION: Japanese MOF sells Y4.6210tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6210tn 3-Month Bills:

- Average Yield -0.0908% (prev. -0.0968%)

- Average Price 100.0244 (prev. 100.0260)

- High Yield: -0.0819% (prev. -0.0930%)

- Low Price 100.0220 (prev. -0.0930%)

- % Allotted At High Yield: 4.5460% (prev. 1.3166%)

- Bid/Cover: 2.502x (prev. 3.252x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 2.1435% (prev. 1.8898%)

- High Yield: 2.1450% (prev. 1.8925%)

- Bid/Cover: 3.2250x (prev. 3.6550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 65.3% (prev. 4.9%)

- Bidders 45 (prev. 48), successful 20 (prev. 26), allocated in full 12 (prev. 15)

EQUITIES: Regional Benchmarks Mixed As U.S. CPI Approaches

Japanese, Korean, and Australian equity benchmarks outperformed in Thursday’s Asia-Pac session, lodging modest gains of 0.3%-0.4%, although the indices trade off of their respective session peaks.

- Chinese equities struggled. The CSI300 is 0.6% lower on the day, with little in the way of bullishness apparent in the wake of Tuesday’s “National Team” buying. Chinese tech leads the losses, with the ChiNext dealing 2.7% softer at typing.

- The Hang Seng edged 0.3% lower after retreating from three-week highs earlier in the session, led by losses in index heavyweight HSBC (-1.2%), as well as commerce and industry stocks.

- E-mini futures are flat to 0.3% lower, with the NASDAQ leading losses ahead of U.S. CPI data due later. Participants are wary of the potential for firmer than expected CPI readings.

OIL: Little Changed In Asia

WTI and Brent are a handful of cents below neutral levels at writing. A downtick in U.S. e-mini equity futures applied some weight to crude in Asia-Pac dealing, although both contracts operated comfortably above their respective Wednesday’s troughs.

- While geopolitical fears surrounding Russia & Iran have pulled back from their recent extremes (applying some pressure to crude in recent sessions), ultimate solutions to those matters are still not forthcoming.

- As a reminder, Wednesday’s U.S. DOE crude inventory data revealed a “surprise” ~4.8mn bbl drawdown in headline crude stocks, as U.S. crude stockpiles hit the lowest level witnessed since 2018

- Recent session lows provide technical support ($88.41 in WTI & $89.93 in Brent), while resistance is located WTI’s Jan 4 high ($93.17) and Brent’s Feb 7 high ($94.00).

GOLD: U.S. CPI Is Upon Us

Spot gold has stuck to a ~$3/oz range in Asia, operating just shy of yesterday’s NY session peak. This comes after Wednesday’s downtick in our weighted U.S. real yield monitor and the DXY (both of which finished off of session lows) provided support for bullion. Today’s U.S. CPI print provides the immediate material risk event, with the fears surrounding inflationary pressure well-documented. Technical resistance comes in at the 76.4% retracement of the Jan 25-28 down leg ($1,836.5/oz), which capped the rally on Wednesday. A break above there would expose the Jan 25 high/bull trigger ($1,853.9/oz). Initial support is seen at the Feb 7 low ($1,805.6/oz).

FOREX: Waiting Mode

High-beta currencies lost ground in Asia, with major FX pairs happy to hold tight ranges, as market participants shied away from taking too much risk ahead of the release of U.S. CPI data later today. Broader headline flow failed to provide notable catalysts ahead of that key data signal.

- Cautious mood music undermined commodity-tied FX, even as crude oil prices were broadly steady. The AUD ignored an uptick in domestic consumer inflation expectations.

- Modest initial yen strength dissipated, even as the spread between U.S. Tsy & JGB yields narrowed. Some might suspect that Gotobi Day flows played a role in sapping some strength from the yen.

- USD/CNH slipped amid a pullback in the DXY. The PBOC set the USD/CNY reference rate at CNY6.3599, perfectly in line with the average estimate based on a Blomberg survey of market participants.

- While U.S. CPI is set to steal the limelight, other notable data releases include U.S. weekly jobless claims & Norwegian CPI. The Riksbank will deliver its monetary policy decision, while comments are due from ECB's Villeroy, Lane & de Guindos as well as BoE's Bailey.

FOREX OPTIONS: Expiries for Feb10 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E560mln), $1.1280-00(E768mln), $1.1330-40(E1.3bln), $1.1410-30(E753mln), $1.1500(E1.7bln), $1.1600(E1.6bln)

- GBP/USD: $1.3500(Gbp564mln)

- AUD/USD: $0.7150-60(A$1.4bln), $0.7170-75(A$635mln), $0.7190-00(A$545mln)

- USD/CAD: C$1.2670-80($830mln), C$1.2810($1.2bln)

- USD/CNY: Cny6.3000($760mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2022 | 0700/0800 | * |  | NO | CPI |

| 10/02/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 10/02/2022 | 1000/1100 |  | EU | European Commission Winter Economic Forecasts | |

| 10/02/2022 | 1200/1300 |  | EU | ECB de Guindos on Europe post-covid at LSE | |

| 10/02/2022 | 1315/1415 |  | EU | ECB Lane on supply chain disruptions panel discussion | |

| 10/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/02/2022 | 1330/0830 | *** |  | US | CPI |

| 10/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/02/2022 | 1700/1700 |  | UK | BOE Bailey speech at TheCityUK Dinner | |

| 10/02/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.