-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: War Worry Back From Peak, Risks Still Evident

EXECUTIVE SUMMARY

- DIPLOMATIC CHANNELS CENTRAL AS RUSSIA-UKRAINE WORRY DOMINATES

- FED'S DALY: BEING TOO AGGRESSIVE ON RATE HIKES COULD BE DESTABILIZING

- ECB’S REHN: ECB OVERREACTION ON PRICES COULD STYMIE GROWTH (BBG)

- ECB'S VISCO: FLEXIBLE APPROACH NEEDED IN UNWINDING STIMULUS (RTRS)

- IRISH CENTRAL BANK CHIEF DAMPS DOWN ‘UNREALISTIC’ JUNE RATE RISE TALK (FT)

- BOE SAID TO BEGIN TALKS WITH DMO, TREASURY ON ACTIVE QE SALES (BBG)

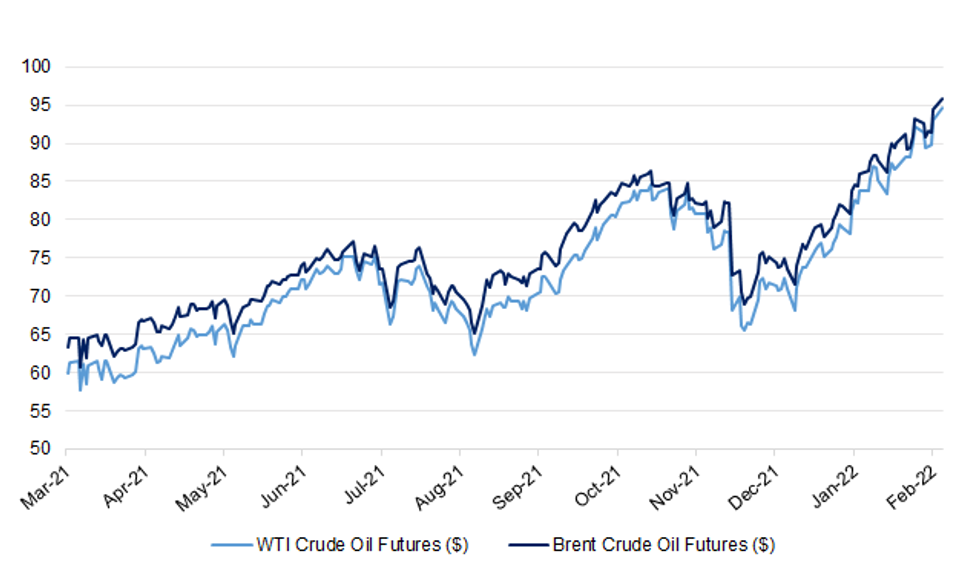

Fig. 1: WTI vs. Brent Crude Oil Futures ($)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England has begun talks with the U.K. Debt Management Office and the Treasury over how to handle active sales of bonds held in its quantitative easing portfolio, according an official with knowledge of the matter. The discussions come as the central bank last week said it would begin running down its 875 billion pounds ($1.2 trillion) of government bond holdings for the first time by letting expired gilts fall off its balance sheet, and reiterated it would consider active sales once interest rates hit 1%. Markets expect borrowing costs to hit that level in May, from 0.5% currently, putting pressure on officials to formulate a plan. The BOE declined to comment. The Treasury, of which the DMO is part, also declined to comment. The sales would mark a milestone for monetary policy after years of using QE to help stimulate the economy and stabilize financial markets. (BBG)

BOE: The Bank of England will raise interest rates faster than previously thought to tame surging inflation, according to economists polled by Reuters who significantly upgraded their forecasts for consumer price rises. A near 30-year high inflation rate in December pressured Britain’s central bank to raise rates for a second meeting in a row earlier this month, taking Bank Rate to 0.50%. But nearly half of the Monetary Policy Committee (MPC) members voted for a hike to 0.75%, making further tightening next month more likely. Nearly two-thirds of respondents in the Feb. 7-11 poll, or 25 of 40, expected a 25 basis points increase in Bank Rate to 0.75% at the conclusion of the next MPC meeting on March 17. That would mark the first time the Bank has raised rates at three meetings in a row since 1997. A slim majority, 21 of 41, forecast a further increase to 1.00% next quarter. That is well behind financial markets, which are pricing in the bank to make a cumulative 75 basis points of increases at its March and May meetings. (RTRS)

ECONOMY: British employers are expecting to award pay rises of 3% in 2022, the highest in at least a decade, though well below the rate of inflation, as they try to recruit and retain workers, according to a new survey of businesses. The expected pay rise comes amid persistent signs of a tight labour market, with almost two-thirds of employers expecting to have difficulties filling job vacancies in the coming six months, according to a survey of more than 1,000 recruitment and human resources workers by YouGov for the Chartered Institute of Personnel and Development (CIPD). Pay growth has risen sharply higher than it was before the pandemic, thanks in part to the pace of the economic recovery following coronavirus lockdowns at the start of the pandemic in 2020. (Guardian)

POLITICS: Boris Johnson has received a questionnaire from the Metropolitan Police as part of the inquiry into parties at Downing Street and Whitehall during the Covid lockdowns. No 10 confirmed that the prime minister had been contacted by the police and said he would "respond as required". Police are sending the questionnaire by email to more than 50 people. The Met has said the questionnaires will ask what happened and "must be answered truthfully". (BBC)

POLITICS: Boris Johnson will argue that he attended a series of lockdown-breaching parties in Downing Street as part of his working day, The Times has been told. The prime minister is being questioned by police over his participation in as many as six events that were held in Downing Street while coronavirus restrictions were in place. (The Times)

POLITICS: A Cabinet minister has insisted that Boris Johnson will lead the Tory party into the next election, whatever the outcome of a police investigation into the “partygate” row. (Telegraph)

POLITICS: Boris Johnson is making his first visit to Scotland since the leader of the Scottish Conservatives called for him to quit over the Downing Street partygate allegations. The prime minister is using parliament's half-term break to embark on a "levelling up" tour of the UK, starting in Scotland with visits to a manufacturing site and research and development projects. (Sky)

POLICY: Government will take a "step back" from people's lives and pursue "a smaller state", the PM's new top aide has said. Steve Barclay told the Sunday Telegraph that while public health interventions and vast amounts spent in the pandemic were the right decisions, it was time for "a more enabling approach". Mr Barclay, who is a cabinet minister, was handed the key role a week ago. No 10 says the prime minister will focus on domestic policy on a tour of parts of the UK this week. It comes as Boris Johnson faces continued criticism and concern from some Conservative MPs about his leadership. (BBC)

BREXIT: Democratic Unionist Party (DUP) leader Sir Jeffrey Donaldson has said he does not believe problems with the Northern Ireland Protocol will be resolved before May's Assembly election. The party's first minister Paul Givan resigned over the issue, causing the suspension of the Stormont Executive. The protocol puts a trade border in the Irish Sea. He told the BBC's Today programme getting back to power sharing depends on whether that border is removed. "I think that the likelihood of agreement being reached is actually quite small," he said. "That was confirmed to me by the prime minister. "He doesn't expect, unless something changes dramatically, that agreement will be reached this side of an election to remove the Irish Sea border. "I wish it were otherwise. I want to see the political institutions restored and operating fully restored - we're committed to that. "But we want to see Northern Ireland's place within the UK internal market fully restored." (BBC)

EUROPE

ECB: The European Central Bank needs to look beyond the current spike in inflation as it sets monetary policy, to avoid choking off economic growth, Governing Council member Olli Rehn said. “If we reacted strongly to inflation in the short term, we would probably cause economic growth to stop,” Rehn said in an interview on Finland’s YLE TV1 on Saturday. “It’s better to look beyond short-term inflation and look at what inflation is in 2023, 2024,” he said, adding that price growth in the coming years could be “close to the 2% target.” Wage development in the euro area remains subdued and inflation is unlikely to remain permanently high unless spurred by labor costs, said Rehn, who also is the governor of the Finnish central bank. (BBG)

ECB: The European Central Bank (ECB) will keep a flexible approach as it unwinds its ultra-expansionary monetary policy, monitoring not only inflation threats but also risks of uneven financing conditions across euro zone countries, a top policymaker said. ECB Governing Council member Ignazio Visco told a conference that the impact of the energy price shock should gradually wane in 2023, provided inflation expectations remain anchored and in the absence of a wage-price spiral. Visco, also Bank of Italy governor, said inflation pressures had turned out to be more prolonged than initially envisaged and, in the short term, risks of higher consumer prices had increased. But so had risks of slower economic activity. "The council's March meeting must carefully examine and discuss these developments and their possible consequences," he said at the annual ASSIOM-FOREX conference on Saturday. (RTRS)

ECB: The head of Ireland’s central bank has said investors are wrong to bet on eurozone interest rates rising in June, predicting policymakers will be careful to avoid “killing off the recovery”. Gabriel Makhlouf told the Financial Times that “the path to normalisation” of eurozone monetary policy had become clearer, after inflation hit a record high in the bloc while unemployment dropped to an all-time low. The European Central Bank could stop its net bond purchases in June or a few months later, and would only raise rates after that, said Makhlouf, who is a member of the Frankfurt-based bank’s governing council. “The idea that we could hike interest rates in June looks very unrealistic to me,” said Makhlouf. “I certainly think there’s a bit of difference between the calendar we’re working to and the one some market participants may have in mind.” “I’m reasonably confident net asset purchases will end this year,” he added, referring to the ECB’s bond-buying programme, which has hoovered up €4.8tn of assets since it started in 2015. “The question is what is the pace at which my foot sits on the accelerator, and am I talking about June or am I talking about the third quarter.” (FT)

GERMANY: Frank-Walter Steinmeier was re-elected to a second five-year term in the mainly ceremonial post of German president. Steinmeier, 66, won the backing of about two-thirds of the Federal Assembly, a body convened solely for the purpose comprising all lawmakers from the lower house and representatives from the German states. He was supported by Chancellor Olaf Scholz’s three-party coalition as well as the conservative opposition, ensuring he easily defeated three nominees put forward by smaller parties in Sunday’s vote. (BBg)

FRANCE: French police began removing demonstrators and towing away cars as they cracked down on attempts by protesters inspired by Canada’s “freedom convoys” from blockading Paris. (BBG)

FRANCE: French presidential candidate Valerie Pecresse, seeking to revitalize her prospects in the coming election, voiced support for border walls and raised the specter of a “great replacement” of the population by non-White immigrants. Addressing thousands of supporters in Paris on Sunday, Pecresse, who is running for the mainstream center-right Republicans party, suggested that France had lost much of its clout under President Emmanuel Macron and that it would sink further if he were re-elected. (BBG)

ITALY: Italy’s debt load decreased more than anticipated last year helped by low borrowing costs and the fastest economic expansion in decades. “The strong recovery of the economy has been decisive in halting the increase of the public debt-to-GDP ratio, which might have fallen to around 150% at the end of 2021,” Bank of Italy Governor Ignazio Visco said during his speech at an annual Assiom Forex event in Parma. The result “clearly shows the importance of economic growth in gradually bringing down the debt burden.” That beats previous estimates predicting debt at 154% of gross domestic product last year, and is much lower than the 156% of output hit in 2020. Visco also confirmed a growth target of more than 4% this year. (BBG)

SPAIN: Spain’s hard-right Vox party has marked up big gains in a vote that could serve as a template for general elections next year and the group now plans to enter a regional government for the first time. The hardline party, which says it wants to “repopulate Spain with Spaniards” instead of immigrants, more than tripled its share of the vote to 18 per cent in polls for the Castile-León region, with over 99 per cent of ballots counted. The centre-right People’s party, which has ruled Castile-León for 35 years, called the elections a year ahead of schedule in the hope of securing an outright victory, but will instead depend on Vox to form a government. (FT)

GREECE: Greece wants to regain investment grade status in early 2023, said Prime Minister Kyriakos Mitsotakis, who pledged not to deviate from fiscal targets already set. (BBG)

BELGIUM: The prospect of Canada-inspired motor convoy protests spreading from Paris to Brussels has led the Belgian federal police to warn against traveling to the capital by car on Monday. In a tweet Sunday afternoon, they advised against driving to Brussels and that protesting with vehicles was banned except for one parking spot at an exhibition center on the outskirts of the city. It came as local and French news reports suggested that around 100 autos would be heading North from Paris to protest vaccine passports. (BBG)

AUSTRIA: Austria is expected to decide on further steps to ease coronavirus restrictions at a meeting on Wednesday, to take effect Feb. 19, according to local media. “We have always said that we will only maintain restrictions for as long as absolutely necessary. Each of us wants back the freedoms we’ve been without for so long,” Chancellor Karl Nehammer said, according to Der Kurier newspaper. As of Saturday Austria’s retail sector is back on a 3G regime, which means anyone vaccinated, recently recovered from Covid or with a negative test can enter stores. Masks are still required in many indoor settings. Austria is still pushing ahead with a vaccine mandate, with authorities set to start imposing fines in March. Vienna saw another large protest Saturday against the mandate. (BBG)

NORWAY: Norway removed the remaining virus restrictions because it considers their effects more damaging than higher infection rates. Norway joins neighbors Denmark and Sweden in making those changes, expecting the coronavirus to turn endemic. “We are well protected, and aren’t served by pushing the pandemic out in time,” Prime Minister Jonas Gahr Store said in Oslo. Face masks are no longer needed, and people no longer need to maintain a 1-meter (3-foot) distance or isolate after being infected, he said. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Latvia at A-; Outlook Stable

- Fitch affirmed Luxembourg at AAA; Outlook Stable

- Fitch downgraded Turkey to B+; Outlook Negative

- DBRS Morningstar confirmed Belgium at AA (high), Trend Negative

U.S.

FED: Being too "abrupt and aggressive" with interest rate increases could be counter-productive to the Federal Reserve's goals, San Francisco Federal Reserve Bank President Mary Daly said on Sunday, signaling she is not yet prepared to come out of the gate with a half-percentage-point interest rate hike next month. (RTRS)

FED: Senator Joe Manchin said the Federal Reserve needs to “stop pussyfooting around” and “tackle inflation head-on,” renewing his call for the central bank to act against the fastest pace of price increases since the early 1980s. The West Virginia Democrat has warned for months about the impact of U.S. government spending on inflation. In December, he pulled the plug on negotiations on President Joe Biden’s plan for expanded social programs and tax increases, citing rising prices among his concerns. He’s a crucial voice in the U.S. Senate, which is split 50-50 between Democrats and Republicans with Vice President Kamala Harris as the tie-breaking vote if all Democrats hold together. (BBG)

FED: Sarah Bloom Raskin, President Joe Biden’s pick to be the Federal Reserve’s banks regulator, called Kansas City Fed President Esther George in 2017 to advocate for a fintech company that had been denied special access to the central bank’s payments system, according to a new letter from Republican Sen. Pat Toomey. At the time, Raskin had just joined the board of the firm, Reserve Trust. The fintech company — like many others — had hoped the Fed would grant it access to a master account. (Axios)

OTHER

U.S./CHINA: The Biden administration is intensifying its campaign to persuade Equatorial Guinea to reject China’s bid to build a military base on the country’s Atlantic Coast. A delegation of senior U.S. diplomatic and military personnel plans to visit the small Central African nation next week, according to government officials, and is expected to discuss American counter-piracy assistance and other inducements intended to convince Equatorial Guinean President Teodoro Obiang Nguema Mbasogo to spurn Beijing’s advances. The delegation will be led by the State Department’s top Africa official, Molly Phee, and Maj. Gen. Kenneth Ekman of the military’s Africa Command. (WSJ)

GEOPOLITICS: The Biden administration increasingly believes that China is gauging the U.S. response to the Ukraine crisis as a proxy for how America would deal with more aggressive action by Beijing against Taiwan, according to three senior officials. Secretary of State Antony Blinken’s decision to go forward with plans to visit Australia this week despite surging Russia-Ukraine tensions was driven by a couple of issues. One was to emphasize that the administration’s efforts to reorient its policies toward Asia won’t be deterred even by the prospect of war in Europe. The other came from a recognition that America’s longer-term security interests in the Indo-Pacific -- where it has sought to bolster new alliances -- are also tied to how effectively it can respond to crises elsewhere, according to the officials. (BBG)

JAPAN: Japan will consider gradually raising the entry limit on arrivals to 5,000 after it eases border controls for foreign workers and students next month, Japanese media reported, citing government officials. The details will be finalized as early as this week, and the trend of virus infections and public opinion will to taken into account, the Asahi newspaper cited authorities as saying. The easing of the curbs does not apply to foreign tourists, it said. (BBG)

BOJ: Japan's chief cabinet secretary Hirokazu Matsuno voiced hope on Monday that the central bank will continue to make efforts to accelerate inflation to its 2% target. "Specific monetary policy means falls under the jurisdiction of the Bank of Japan. We hope the BOJ continues to strive toward achieving its price goal," Matsuno told a news conference. (RTRS)

AUSTRALIA: Ten million low and middle-income earners face a tax increase as the federal government debates whether to extend its $1080-a-year tax offset in next month’s pre-election budget or risk adding to growing inflation pressures that could force the Reserve Bank to lift official interest rates. There are increasing concerns within the government, which faces budget deficits for the rest of the decade and gross debt surpassing $1 trillion by 2024-25, that while extending the offset for another year may be vital to the Coalition’s re-election chances, it could come at a huge economic cost. The offset, worth up to $1080 and available to people earning less than $126,000 a year, has been extended by Treasurer Josh Frydenberg in his past two budgets. On both occasions, he said the offset would be important to supporting the economy through the COVID-19 recession, describing it as a stimulus measure. The measure, which costs more than $7 billion, had been widely expected to be extended to the 2022-23 financial year as an election sweetener in the March 29 budget. (The Age)

NEW ZEALAND: Prime Minister Jacinda Ardern says New Zealand will move to phase 2 of our Omicron response from 11.59 PM tomorrow. A phase of "greater self-management" would soon commence, she said, as New Zealand entered the second phase of the Omicron response. It comes after 981 new Covid-19 cases were reported in the community today – under the Government's three-phase plan for the outbreak, it was expected phase 2 would kick in once numbers topped 1000 cases. (NZ Herald)

SOUTH KOREA: South Korea will begin offering a fourth Covid vaccine to people with weakened immune systems and nursing home patients as breakthrough cases among the vaccinated elderly have started to rise. (BBG)

NORTH KOREA: U.S. Secretary of State Antony Blinken met his Japanese and South Korean counterparts Saturday in Hawaii to discuss the threat posed by nuclear-armed North Korea after Pyongyang began the year with a series of missile tests. Blinken said at a news conference after the meeting that North Korea was “in a phase of provocation” and the three countries condemned the recent missile launches. “We are absolutely united in our approach, in our determination,” Blinken said after his talks with Japanese Foreign Minister Yoshimasa Hayashi and South Korean Foreign Minister Chung Eui-yong. He said the countries were “very closely consulting” on further steps they may take in response to North Korea, but didn't offer specifics. The three released a joint statement calling on North Korea to engage in dialogue and cease its “unlawful activities.” They said they had no hostile intent toward North Korea and were open to meeting Pyongyang without preconditions. (AP)

CANADA: Hours after Canadian police removed protesters camped nearly a week near the Ambassador Bridge, a critical U.S.-Canadian border crossing, the bridge reopened for traffic and commerce, the company that owns the bridge said. (Detroit News)

TURKEY: The leaders of six opposition parties in Turkey have met to strategize about the future of the country’s governing system — a move that aims to unseat the country's longtime ruler. In a statement following the dinner Saturday night, the party leaders said Turkey was experiencing “the deepest political and economic crisis” of its history and blamed it on the executive presidential system. They said their joint goal was to transform Turkey’s governance to a “strengthened parliamentary system.” They did not mention President Recep Tayyip Erdogan by name, but their clear aim is to find a way to work together to unseat him. (AP)

BRAZIL: Central Bank President Roberto Campos Neto said that the peak of Brazilian inflation is expected to occur in April or May this year. "I think now [the peak] will happen between April and May. Then we will see a somewhat faster drop in inflation," he said on Friday, February 11, at an event sponsored by Esfera Brasil. The head of Brazil's monetary authority reinforced that the fight against inflationary pressure in Brazil is more developed than in other countries. (New York Times)

RUSSIA: The U.S. and allies will "respond decisively and impose swift and severe costs" if Russia invades Ukraine, President Biden told Russian President Vladimir Putin in a phone call on Saturday. Driving the news: A senior administration official told reporters on a briefing call that the White House sensed "no fundamental change" in Russia's posture from the last several weeks. Biden warned Putin that Russia would face "severe economic costs" and "irrevocable reputational damage caused by taking innocent lives for a bloody war," the official said. The two sides agreed to stay engaged in the coming days, but the official cautioned that Russia may decide to invade anyway. (Axios)

RUSSIA: Senior U.S. officials on Sunday said they could not confirm reports that U.S. intelligence indicates that Russia is planning to invade Ukraine on Wednesday, but said they would try to prevent any "surprise attack" by sharing what they knew of Russia's plans. White House National Security Adviser Jake Sullivan repeated that a Russian invasion could begin any day and President Joe Biden has said he will support Ukraine after any invasion and defend NATO territory. "We cannot perfectly predict the day, but we have now been saying for some time that we are in the window, and an invasion could begin -- a major military action could begin -- by Russia in Ukraine any day now. That includes this coming week before the end of the Olympics," Sullivan told CNN's "State of the Union" when asked about the possible Wednesday timing. "We will defend every inch of NATO territory, every inch of Article Five territory and Russia we think fully understands that message," Sullivan said in a separate interview with CBS' "Face the Nation" program. (RTRS)

RUSSIA: The United States said the diplomatic path remained open to end a standoff with Moscow over Ukraine but said the risk of Russian military action was high enough to warrant pulling U.S. embassy staff out of Kyiv. Secretary of State Antony Blinken spoke after talks on Saturday with Japanese and South Korean counterparts, following Washington’s warning that Russia’s military, which has more than 100,000 troops massed near Ukraine, could invade at any moment. “The diplomatic path remains open. The way for Moscow to show that it wants to pursue that path is simple. It should de-escalate, rather than escalate,” Blinken said after his meetings in the U.S. Pacific archipelago of Hawaii. (NBC)

RUSSIA: Speaking about his call Saturday with Russian Foreign Minister Sergey Lavrov, Blinken said he raised the United States' "serious concerns that Moscow may be considering launching a military attack against Ukraine in the coming days" and stressed that the diplomatic path remains open. "On our call, Foreign Minister Lavrov said that Russians are working on a response to the paper that we sent to Moscow more than two weeks ago, proposing concrete areas for discussion," Blinken said. "It remains to be seen if they'll follow through on that, but if they do we'll be ready to engage together with our allies and partners," he said. (CNN)

RUSSIA: The Russian foreign ministry said late on Friday that Western countries, with help from the media, were spreading false information by suggesting that Moscow may be planning to invade Ukraine. The ministry said in a statement on its website that Western countries were trying to distract attention from their own aggressive actions. The United States said earlier on Friday that Russia has massed enough troops near Ukraine to launch a major invasion, which would likely to start with an air assault. (RTRS)

RUSSIA: There’s been no “pivotal change” in the situation along Ukraine’s border and occupied territories in the past few days, Ukrainian Foreign Minister Dmytro Kuleba said Sunday. Ukraine “continues to actively work with our partners and inside the country,” Kuleba said, adding that diplomacy remains the only way to resolve the crisis. “Ukraine is not alone. The situation remains under control, and Ukraine is ready for to any scenarios.” Ukrainian President Volodymyr Zelenskiy spoke Saturday with France’s Emmanuel Macron and Canada’s Justin Trudeau about allied efforts to de-escalate the border tension. (BBG)

RUSSIA: Ukraine has called for a meeting with Russia and other members of a key European security group over the escalating tensions on its border. Foreign Minister Dmytro Kuleba said Russia had ignored formal requests to explain the build-up of troops. He said the "next step" was requesting a meeting within the next 48 hours for "transparency" about Russia's plans. (BBC)

RUSSIA: Ukraine pledged funds on Sunday to try to keep its airspace open to commercial flights, as some carriers reviewed their services to the country after the United States warned that Russia could invade at any time. (RTRS)

RUSSIA: Viktor Zhora proudly showed off the new facilities at one of Ukraine’s cyber security agencies, where opposing teams stage mock battles to prepare for the real thing. The training is paying off, said Zhora, deputy chair of the State Service of Special Communications and Information Protection, the country’s security and intelligence service. An attack last month that targeted government websites was quickly contained by his staff with the help of IT companies including Microsoft, he said. “We need to align our activities with risk and threats that have been increasing in past years . . . We should always be ready for the worst.” Zhora said. Ukraine said “all evidence” pointed to Russian responsibility, with officials and analysts saying this was just the tip of the iceberg. (FT)

RUSSIA: Ukraine's President Volodymyr Zelenskiy invited U.S. President Joe Biden to visit Ukraine soon when they spoke by phone on Sunday, Zelenskiy's office said. (RTRS)

RUSSIA: The Pentagon denied Russia’s claim that a U.S. submarine was intercepted in Russian waters near the Kuril Islands, which prompted the Defense Ministry in Moscow to summon the U.S. military attache. “There is no truth to the Russian claims of our operations in their territorial waters,” Navy Captain Kyle Raines, a spokesman for the U.S. Indo-Pacific command, said by email. While declining to comment on the precise location of U.S. submarines, he said “we do fly, sail, and operate safely in international waters.” (BBG)

RUSSIA: The United States said on Saturday it was ordering most staff at its embassy in Kyiv to leave Ukraine immediately due to the threat of an invasion by Russia. An updated travel advisory said the State Department had ordered the departure of most employees at the embassy in Kyiv, adding to its call earlier this week for private U.S. citizens to leave Ukraine immediately. A senior State Department official said the Biden administration would continue diplomatic efforts to "ensure that Ukraine does not become a war zone." (RTRS)

RUSSIA: The Pentagon is pulling a contingent of about 160 U.S. military trainers out of Ukraine, officials said on Saturday, reflecting growing concern in Washington that a Russian invasion of the Eastern European nation is imminent. Defense Secretary Lloyd J. Austin III has ordered a “temporary” repositioning of the trainers, who are members of the Florida Army National Guard and have been operating out of a Ukrainian base near the Polish border, to “elsewhere in Europe,” the Pentagon spokesman, John F. Kirby said in a statement. (NYT)

RUSSIA: More than a dozen countries have urged their citizens to leave Ukraine amid warnings from Western powers that an invasion by Russia could be imminent. The US, UK and Germany are among those who told their nationals to leave. (BBC)

RUSSIA: The Council of the European Union said on Saturday that “diplomatic missions are not closing” in Kyiv, Ukraine, despite what U.S. officials signal is an increasingly likely possibility that Russia will invade the neighboring country. (The Hill)

RUSSIA: Germany's vice chancellor Robert Habeck said today Europe may be on the brink of war due to the ongoing crisis in Ukraine.Mr Habeck, who represents the Green Party, told German broadcaster NTL: "We may be on the verge of war in Europe. "With large armies of tanks facing each other. It is absolutely oppressive and threatening." (LBC)

RUSSIA: France’s Emmanuel Macron spoke with Vladimir Putin for 100 minutes on Saturday, according to a French official. Macron told Putin a sincere dialogue wasn’t compatible with escalation and relayed the concerns of Europeans and allies, Macron’s office said. Putin told Macron he had no offensive intention, an official from France’s Elysee told reporters. France has no sign yet that Putin plans to go on the offensive, but is monitoring the situation carefully, the official said. Separately, the Kremlin said Putin and Macron discussed “provocative speculations” that Russia plans to invade Ukraine. The Kremlin also said that “prerequisites are being created for possible aggressive actions of the Ukrainian security forces” in Donbas. Putin also spoke Saturday with Belarusian President Alexander Lukashenko. (BBG)

RUSSIA: Olaf Scholz, German chancellor, is preparing to launch a fresh attempt to deter Vladimir Putin from further invading Ukraine, as US officials warned Russia was on the brink of launching a major attack on its western neighbour. His preparations came as western nations continued to withdraw diplomatic and military personnel from Ukraine and some airlines cancelled flights to the country. Some European countries are preparing to receive a flood of refugees in the event of military action. Scholz will travel to Kyiv on Monday before arriving in Moscow on Tuesday. The German leader is expected to urge Putin to de-escalate the situation on the Ukraine border, a senior government official said. He would also convey “how grave the consequences of an attack would be” in terms of sanctions on Russia, and stress “that one should not underestimate the unity of the EU, US and UK”. (FT)

RUSSIA: Members of NATO will not tolerate the "bullying" of Ukraine by Russia but still seek a diplomatic solution amid rising tensions at the border, Northern Ireland Secretary Brandon Lewis has said. Speaking on Sky News' Trevor Phillips On Sunday, Mr Lewis said the "threats" Russia is directing at Ukraine are "inappropriate", adding that the UK and other western countries are "not going to put up with" them. The Northern Ireland secretary also reiterated warnings that "an imminent incursion by Russia is entirely possible" after the country amassed 130,000 troops and heavy firepower along Ukraine's border. Mr Lewis' comments came after Defence Secretary Ben Wallace warned it is "highly likely" that Vladimir Putin will order an attack on Ukraine, despite ongoing talks to avert a war. (Sky)

RUSSIA: Austria is sticking with its opposition to including the Nord Stream 2 gas pipeline in a package of sanctions against Moscow that the European Union is preparing in the event Russia invades Ukraine, Foreign Minister Alexander Schallenberg said on Friday. (RTRS)

IRAN: Russia’s top diplomat at the Iran nuclear talks in Vienna said world powers had made “significant progress” as their negotiations to revive a landmark 2015 agreement enter their final stage. In a tweet on Sunday, Mikhail Ulyanov, who’s representing Russia in the talks, said that assessments of the current situation -- in which Iran and the U.S. remain in a tense standoff over how to restore the nuclear deal -- were “positive.” (BBG)

IRAN: A senior Iranian security official said on Monday that progress in talks to salvage Iran's 2015 nuclear deal was becoming “more difficult” as Western powers only “pretended” to come up with initiatives. The indirect talks in Austria between Iran and the US resumed last week after a 10-day break. Delegates have said the talks have made limited progress since they resumed in November after a five-month hiatus prompted by the election of hardline Iranian President Ebrahim Raisi. (Al Arabiya)

IRON ORE: A rally in iron ore prices in China is unlikely to continue as several Chinese regulators step in to curb what they see as excessive speculation and curb steel production, the Securities Daily said citing industry experts. The Dalian Commodities Exchange last week released a notice to raise transaction fees, tighten regulation and warned against “fabricating rumors,” the daily said. The Ministry of Industry also released an order to curb steel capacity expansion, which is likely to reduce demand for iron ore, the newspaper said. Global iron ore price rallied almost 50% since November on the prospect of faster economic recovery. (MNI)

CHINA

PBOC: The People’s Bank of China indicated its monetary policy will be even more proactive and continue to support growth in a report released on Friday, as it mentioned “greater force of cross-cycle adjustment” in its quarterly paper last week, the Financial News newspaper said citing analyst Xie Yunliang at Xinda Securities. January’s higher-than-expected credit data released last week also point to a short-term economic rebound, the newspaper said citing economist Li Chao of Zheshang Securities. (MNI)

ECONOMY: Confidence of China’s small businesses in their development prospect rose for a third month as the government drums up pro-growth policies, the Shanghai Securities News reported citing an index by the China Association of SMEs, which in January rose 0.2 percentage point to 89.4. More SMEs are also more confident about the macroeconomy as the central government laid out this year's pro-growth policy leaning, the newspaper said. However, SMEs are still hindered by a lack of liquidity and financing due to slow payments and rising payables, it said. (MNI)

ECONOMY: With North China's Tianjin Municipality releasing its GDP growth target for 2022 over the weekend, the nation's 31 provincial-level regions on the mainland have all announced their economic goals, which average about 6 percent - generally lower than for 2021, but still represents a relatively stable pace in the face of mounting pressure. Given these targets and the emphasis on stability for economic development this year amid multiple challenges, experts forecast that the nation might set its GDP target around 5-5.5 percent. The figure is usually announced in the government work report delivered at the two sessions. (Global Times)

OVERNIGHT DATA

NEW ZEALAND JAN BNZ-BUSINESSNZ PERFORMANCE SERVICES INDEX 45.9; DEC 49.8

Activity levels in New Zealand's services sector saw increased levels of contraction during the start of 2022, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for January was 45.9 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 3.9 points from December, and the lowest result since October 2021. BusinessNZ chief executive Kirk Hope said that despite the last two months of 2021 steadily building towards the no change mark of 50.0, the January result puts the sector squarely back in contraction that has now been the case for six consecutive months. Such a time series of contraction last occurred in 2008 at the height of the Global Financial Crisis. "The key sub-indexes of New Orders/Business (41.8) and Activity/Sales (44.1) both experienced a significant drop in activity levels, while Employment (48.1) was at its lowest point since January 2021." BNZ Senior Economist Craig Ebert said that "the PSI can jag around quite a lot from month to month – upwards and downwards. However, it’s also worth pointing out that the long-term average of the PSI is 53.6, which is starting to feel some distance away. So much for the new traffic light system releasing the brakes on activity." (BNZ)

NEW ZEALAND JAN FOOD PRICE INDEX +2.7%; DEC +0.6%

CHINA MARKETS

PBOC DRAINS NET CNY210 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY210 billion after offsetting the maturity of CNY220 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0821% at 09:24 am local time from the close of 1.9792% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3664 MON VS 6.3681

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3664 on Monday, compared with 6.3681 set on Friday.

MARKETS

SNAPSHOT: War Worry Back From Peak, Risks Still Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 563.99 points at 27132.09

- ASX 200 up 26.628 points at 7243.9

- Shanghai Comp. down 28.942 points at 3434.006

- JGB 10-Yr future down 2 ticks at 150.05, yield down 1.1bp at 0.220%

- Aussie 10-Yr future up 7.5 ticks at 97.850, yield down 7.3bp at 2.138%

- U.S. 10-Yr future -0-00+ at 126-12, yield up 1.39bp at 1.951%

- WTI crude up $1.39 at $94.49, Gold down $4.64 at $1854.15

- USD/JPY up 1 pip at Y115.43

- DIPLOMATIC CHANNELS CENTRAL AS RUSSIA-UKRAINE WORRY DOMINATES

- FED'S DALY: BEING TOO AGGRESSIVE ON RATE HIKES COULD BE DESTABILIZING

- ECB’S REHN: ECB OVERREACTION ON PRICES COULD STYMIE GROWTH (BBG)

- ECB'S VISCO: FLEXIBLE APPROACH NEEDED IN UNWINDING STIMULUS (RTRS)

- IRISH CENTRAL BANK CHIEF DAMPS DOWN ‘UNREALISTIC’ JUNE RATE RISE TALK (FT)

- BOE SAID TO BEGIN TALKS WITH DMO, TREASURY ON ACTIVE QE SALES (BBG)

BOND SUMMARY: Off Of War Worry Extremes

A lack of outright escalation surrounding the Russia-Ukraine situation, in addition to an apparent continued push for a diplomatic solution re: the matter saw core global FI markets back from late Friday/early Asia highs, with e-mini futures lodging gains of ~0.2% overnight after Friday’s sharp risk-off move surrounding the same Russia-Ukraine worry. TYH2 is unch. at 126-12+, with cash Tsys running 1.0-3.0bp cheaper across the curve (2s lead the weakness, while the 5- to 10-Year zone lags). Asia-Pac flow was headlined by a block buy of TU futures (+6,747). Looking ahead, Monday’s NY docket will be headlined by a television address from St. Louis Fed President Bullard (’22 voter, hawk). A reminder that Bullard pointed to the potential for an inter-meeting rate hike in the wake of Thursday’s CPI print, in addition to calling for 100bp of tightening by the start of July. There will of course be continued focus on the Russia-Ukraine situation, which adds the obvious source of headline risk.

- JGB futures pulled back from best levels, closing -1, with a lack of fresh upside catalysts apparent, while the lack of overt escalation surrounding the Russia-Ukraine situation is probably a source of downside pressure. The cheapening in super-long JGBs may give participants fresh ammunition to test the BoJ’s resolve re: the enforcement of its YCC programme after today’s fixed rate operation drew no offers to sell given yield dynamics in play since the 10-Year JGB operation was announced (a reminder that various senior BoJ officials, including Governor Kuroda, have pointed to no change in policy settings until the Bank achieves its inflation goal). Note that 10-Year JGB yields currently sit at 0.22%, while a close above 0.23% seemed to be the trigger for the announcement re: the BoJ’s fixed rate operations.

- There hasn’t been much to report for the ACGB space, with futures largely tracking gyrations witnessed in the wider core FI complex (albeit with a slightly different beta), allowing YM & XM to move away from their respective Friday peaks, before consolidating. YM +7.0 & XM +7.5 at the bell as a result. The 7- to 12-Year zone of the cash ACGB curve outperformed.

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 Nov ‘28 Bond, issue #TB152:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 November 2028 Bond, issue #TB152:

- Average Yield: 1.9903% (prev. 1.1425%)

- High Yield: 1.9925% (prev. 1.1475%)

- Bid/Cover: 3.1100x (prev. 5.2980x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.3% (prev. 10.1%)

- Bidders 41 (prev. 53), successful 19 (prev. 22), allocated in full 12 (prev. 11)

EQUITIES: Asia Mostly Lower, Friday’s Lows Hold In E-Minis

Benchmark east Asian equity indices trade lower amidst a negative lead from Wall St., after heightened worry re: the Russia-Ukraine situation weighed on risk assets at the backend of last week’s final NY session. The Nikkei 225, TAIEX and KOSPI are 1.7% to 2.2% worse off at typing, after edging away from worst levels observed earlier in the session. The Hang Seng and CSI300 fell less than their major Asia-Pac peers, dealing 1.2% and 0.7% softer respectively.

- Australia’s ASX 200 provided the lone bright spot amongst Asia-Pac equity indices, as gains in energy and heavily weighted financials countered sharper losses in tech stocks, helping the ASX200 to add 0.4% by end of Monday’s trade.

- E-mini equity futures are ~0.2% better off at typing, after Friday’s lows held in early Asia-Pac trade. The lack of outright weekend escalation surrounding the Russia-Ukraine situation probably facilitated such a move (it would have also facilitated the bounce from lows for some of the major Asia-Pac indices).

OIL: Still Underpinned

WTI is ~+$1.50, while Brent is ~+$1.40 at typing, with geopolitical unrest surrounding the Russia-Ukraine situation underpinning crude early this week. Both benchmarks hit fresh cycle highs in early Asia-Pac dealing ($94.94 for WTI & $96.16 for Brent), before backing off from best levels.

- Russia-Ukraine tensions remain elevated following Friday’s U.S. warning re: the potential for a Russian invasion “at any time.” Weekend calls between U.S. President Biden, Blinken (U.S. Secretary of State), Austin (U.S. Secretary of Defense), and their respective Russian counterparts produced no breakthroughs, but the continued push to find a diplomatic solution seems to have been welcomed by broader markets (and probably allowed crude to ease back after the early Asia bid).

- Elsewhere in the geopolitical sphere, an Iranian official noted that progress in the well-documented talks surrounding the discontinued nuclear accord was becoming “more difficult,” which may have provided another tailwind for oil early on.

- Crude specific news continues to be supportive. The IEA on Friday warned of “upward pressure” on oil prices due to OPEC+’s “chronic” issues with restoring production, highlighting increased strain on OECD oil inventories, which have declined to 7-year lows.

GOLD: Off Of Friday’s Peak, But Hangs Onto Most Of Russia-Related Gains

U.S. real yields operate off their late Friday base, with gold a touch shy of its late Friday peak as a result, last dealing ~$5/oz lower on the day, just shy of $1,855/oz. Russia-Ukraine tensions remain front and centre, with a lack of clear escalation evident over the weekend. This has allowed markets to breathe a mini sigh of relief after Friday’s late risk-off price action was driven by worry re: the prospect of a fairly imminent invasion of Ukraine by Russia, which supported gold. Still, bullion holds on to the bulk of Friday’s gains. Technically, Friday’s rally took spot through its Jan 25 high/bull trigger, with the next level of meaningful technical resistance located at the Nov 18 high ($1,871.0/oz).

FOREX: Cautious Mood Takes Hold As Diplomatic Efforts Fail To Allay Geopolitical Risk

Antipodean currencies led losses in G10 FX space as weekend headline flow failed to alleviate jitters related to the Russo-Ukrainian standoff. Intensified diplomatic activity continued, albeit to no avail so far, with all parties sticking to familiar narratives. While the continuation of broader diplomatic push to defuse the crisis may have proved reassuring at the margin, participants were unwilling to take more risk when faced by the prospect of a potential escalation.

- Weak PSI data for January amplified pressure to the kiwi dollar by showing that New Zealand's services sector has plunged deeper into contraction, with all sub-indices registering losses. Meanwhile, the number of new community cases of Covid-19 reached a record high as the new week got underway.

- The greenback and Swiss franc gained on the back of better appetite for safer currencies, but the yen struggled to jump onto that bandwagon. Its underperformance relative to safe haven peers came as Japan returned from a long weekend to witness BoJ JGB purchase operation intended to cap the recent rise in yields.

- CAD topped the G10 pile as crude oil prices hit fresh cycle highs at the start to the week, underpinned by the unfolding Russo-Ukrainian crisis.

- The Russian rouble extended losses as onshore Moscow markets re-opened, following its most aggressive sell-off since the onset of the Covid-19 pandemic last Friday.

- In the absence of notable data releases today, focus turns to comments from Fed's Bullard & ECB's Lagarde.

FOREX OPTIONS: Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E608mln), $1.1480(E1.1bln)

- USD/JPY: Y116.00($532mln)

- AUD/USD: $0.6900(A$1.0bln), $0.7100-10(A$1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/02/2022 | 1615/1715 |  | EU | ECB Lagarde Speech on anniversary of Euro at EU Parliament | |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/02/2022 | 1630/1730 |  | EU | ECB Lagarde Intro at ECB Annual Report 2020 Plenum | |

| 15/02/2022 | 2350/0850 | *** |  | JP | GDP (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.