-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Modest Pressure On Broader Sentiment In Asia

- Caution surrounding the negative Russia-Ukraine situation provided a modest defensive tinge to Asia-Pac trade.

- Iron ore tumbled as China looks to rein in prices.

- UK labour market data, the German ZEW survey, flash EZ GDP as well as U.S. PPI & Empire M'fing take focus from here. Comments are due from ECB's Villeroy, as well as Riksbank's Floden & Ingves.

BOND SUMMARY: Tsys A Touch Richer Overnight, Broader Core FI Off Lows

Russia-Ukraine standoff worry applied a very modest bid to U.S. Tsys overnight. Social media circulation of images re: the Russian troop movements flagged on Monday (into an “attack formation”), coupled with some commentary from various U.S. military watchers, seems to have applied very modest pressure to e-minis in recent trade. Still, there didn’t seem to be much new information in the tweets. We also saw the U.S. State Department issue travel warnings/guidance to leave re: the likes of Belarus & Moldova overnight, which applied light pressure to broader sentiment. Still the overall bid was modest, and at least partially tempered by the PBoC’s move to leave the interest rate applied to its MLF operations steady (although this was consensus, 11 of the 27 surveyed by BBG looked for some form of cut). TYH2 +0-05+ at 126-05 as a result (sticking within a 0-05+ range in Asia), with cash Tsys running 1-2bp richer. On the flow side, it was a TU block buyer (+5K) that headlined in Asia. NY hours will see the release of U.S. PPI data and the Empire Manufacturing print.

- JGB futures moved away from fresh cycle lows (lodged in the most recent overnight session) given the negative tinge when it came to broader sentiment. That left the contract -1 at the Tokyo close, after it regained the 150.00 handle. Cash JGBS were 1bp cheaper to 1bp richer, with the 7- to 10-Year zone being the only area of the curve that managed to richen on the day, likely linked to the aforementioned uptick in futures. Note that the latest round of Japanese GDP data provided modest downside surprises at a headline level. Elsewhere, BoJ Governor Kuroda reaffirmed the Bank’s willingness to maintain its current easing stance.

- Aussie bond futures initially showed lower in early Sydney dealing, but the broader, modest risk aversion allowed the space to edge away from Sydney lows. That left YM & XM -5.0 come settlement, comfortably off of overnight lows that came on the back of hope that a diplomatic situation can be reached when it comes to the Ukraine standoff.

US TSYS: MOVE Hits Highest Levels Seen Since Initial COVID Vol.

The ICE-Bank of America MOVE index has moved to the highest level observed since the COVID-driven vol. in early ’20, with the hawkish Fed re-pricing and geopolitical tension surrounding the Russia-Ukraine situation the obvious driving forces. Note that although the index level isn’t elevated in a historical sense, it has punched back above its 200-Month Moving Average.

Fig. 1: ICE-Bank of America MOVE Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS: Curve Continues To Register Fresh Multi-Year Steeps

Just to highlight that the long end of the JGB curve hasn’t been able to escape from the broader pressure witnessed in global core FI markets.

- A quick reminder that 10-Year JGB yields are of course restricted by the 0.25% upper limit of the BoJ’s permitted trading band, which the Bank stepped in to enforce at the start of this week (pre-announcing the fixed rate operation covering 10-Year JGBs on Thursday of last week, as 10-Year JGB yields crossed above the 0.23% mark).

- This also limits yields in sub-10-Year maturities, promoting curve steepening.

- The likes of the 5-/20-Year, 5-/30-Year and 5-/40-Year JGB yield spreads have moved to the steepest levels observed since late ‘19/early ’19 on the back of the previously outlined dynamic.

- The steepening has taken place even with several of the notable Japanese life insurers pointing to an interest in lifting their super-long JGB exposure via the most recent round of semi-annual investment intention releases.

- The BoJ will not have an issue with a steeper curve, as it promotes the financial health of life insurers and pension funds (as Governor Kuroda has noted in several recent addresses).

- As such, global market gyrations will likely remain at the core when it comes to the direction of these spreads, at least in the medium term.

Fig. 1: 5-/20-Year, 5-/30-Year And 5-/40-Year JGB Yield Spreads (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS AUCTION: Japanese MOF sells Y2.0153tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0153tn 5-Year JGBs:

- Average Yield 0.040% (prev. -0.041%)

- Average Price 99.83 (prev. 100.23)

- High Yield: 0.044% (prev. -0.037%)

- Low Price 99.81 (prev. 100.21)

- % Allotted At High Yield: 89.0225% (prev. 73.6701%)

- Bid/Cover: 3.386x (prev. 3.336x)

EQUITIES: Asia Mixed As China Outperforms

The Nikkei 225, ASX200 and Kospi sit 0.4% to 1.0% softer following a limited negative lead from Wall St., with the major Asia-Pac equity indices trading at, or near, the bottom of their respective ranges.

- The Hang Seng is 0.7% weaker as the COVID-19 outbreak in Hong Kong worsens, with the index trading at session lows. The move lower came even as Chief Executive Carrie Lam announced that Hong Kong had no plans for a citywide lockdown. High-beta tech mega caps listed on the Hang Seng Tech Index fell in lockstep with the broader Hang Seng.

- The CSI300 bucked the broader trend, trading 0.9% higher at writing, following a move by the PBoC to inject CNY100bn in net medium-term liquidity. Chinese CPI and PPI data, due Wednesday, will likely draw focus, as participants continue to assess the outlook for monetary policy easing amidst a slowing Chinese economy.

- Just worth noting that the circulation on social media of images re: the Russian troop movements flagged on Monday (into an “attack formation”), coupled with some commentary from various U.S. military watchers, seems to have applied very modest pressure to e-minis in recent trade. The 3 major e-mini contracts are now 0.1-0.3% lower on the day. There doesn’t seem to be much new information in the tweets. We also saw the U.S. State Department issue travel warnings/guidance to leave re: the likes of Belarus & Moldova overnight, which applied light pressure to broader sentiment.

FOREX: Asia-Pac Hours Bring Stabilisation, Selling Pressure Hits USD

A round of risk-off flows emerged in G10 FX space in the Asia/Europe crossover amid a lingering threat of escalation in the Russia-Ukraine crisis. The circulation of worrying interpretations of latest movements of Russian troops coupled with State Department travel advisory update asking U.S. citizens to leave Belarus and Transnistria immediately reignited a sense of concern after a spell of stabilisation in early Asia trade.

- The dollar index (DXY) ground lower, moving further away from yesterday's high, as U.S. Tsy yields slipped. Some have pointed to an analysis piece co-authored by NY Fed Pres Williams, which pointed to a decline in inflation expectations as a factor adding pressure to the greenback.

- The latest round of comments from BoJ Gov Kuroda was consistent with previous remarks, as he continued to play down policy exit talk. The official tipped hat to recent yen weakness, noting that it is not boosting import costs by much. USD/JPY slipped in early trade and extended those losses, even as it was a Gotobi Day in Japan.

- The yen firmed further as late-doors risk aversion took hold. Fresh selling pressure hit the Antipodeans, with the AUD landing at the bottom of the G10 pile, amid resurfacing geopolitical angst.

- Weaker crude oil prices sapped some strength from the CAD. Worth adding that Canadian PM Trudeau invoked emergency powers in response to trucker protests in Ottawa, as had been touted in earlier source reports.

- Spot USD/CNH edged lower on broader greenback weakness. The PBOC failed to move the needle, as they injected a net CNY100bn into the financial system via 1-Year MLF, while keeping the interest rate applied to the operations unchanged.

- UK jobs market data, German ZEW survey, flash EZ GDP as well as U.S. PPI & Empire M'fing take focus from here. Comments are due from ECB's Villeroy and Riksbank's Floden & Ingves.

FOREX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1295-00(E691mln), $1.1340-50(E981mln), $1.1395-00(E617mln)

- USD/JPY: Y114.85-00($900mln), Y115.45-50($650mln), Y115.70-75($800mln), Y115.90-00($1.3bln)

- USD/CAD: C$1.2695-00($2.3bln)

ASIA FX: Optimism On Covid Front Lends Support To IDR & THB

Fading geopolitical worry related to the Russia-Ukraine standoff shifted focus to domestic catalysts in Asia EM space. While there has been no breakthrough in the security crisis unfolding in Eastern Europe, there has been no material escalation either, with all sides pointing to the need for continued diplomatic talks.

- CNH: Spot USD/CNH has slipped, probing the water below yesterday's worst levels. The PBOC injected a net CNY100bn into the financial system via 1-Year MLF and kept the interest rate applied to the operations unchanged at 2.85%, refraining from a continuation of recent rate cuts.

- KRW: South Korean won led losses in the Asia EM basket, as daily Covid-19 cases hit another historic record. Meanwhile, officials pledged to take all available policy steps to stabilise markets if the Russia-Ukraine situation escalates.

- IDR: The rupiah staged a rally after Indonesia said that it eyes lifting all quarantine requirements for inbound travellers in April and is shortening the mandatory quarantine period in the meantime. Elsewhere, Indonesia's trade surplus shrank less than forecast, but shipments missed expectations by a fair margin.

- MYR: Spot USD/MYR ground lower as the sense of broader geopolitical risk receded somewhat, while Malaysian headline flow offered nothing to rock the boat.

- PHP: Spot USD/PHP erased its initial gains. Participants are on the lookout for December overseas cash remittances data. The Philippines downgraded its Covid-19 risk classification Monday, as Covid-19 cases ease.

- THB: Spot USD/THB plunged to its lowest point since early September, as national Covid-19 task force suggested that nationwide Covid-19 cases should begin levelling off and falling this week, even if several provinces see "brief spikes" in infections.

GOLD: Fresh Multi-Month Highs

Asia-Pac trade saw gold add ~$6/oz, registering fresh multi-month highs in the process, with the lingering worry surrounding the Russia-Ukraine situation underpinning bullion (even with a diplomatic solution re: the standoff remaining on the table). That leaves spot a touch shy of $1,880/oz, with the next level of technical resistance located at the Jun 11 high ($1,903.1/oz), after the November highs were breached as the overnight bid accelerated on a break through Monday’s session high.

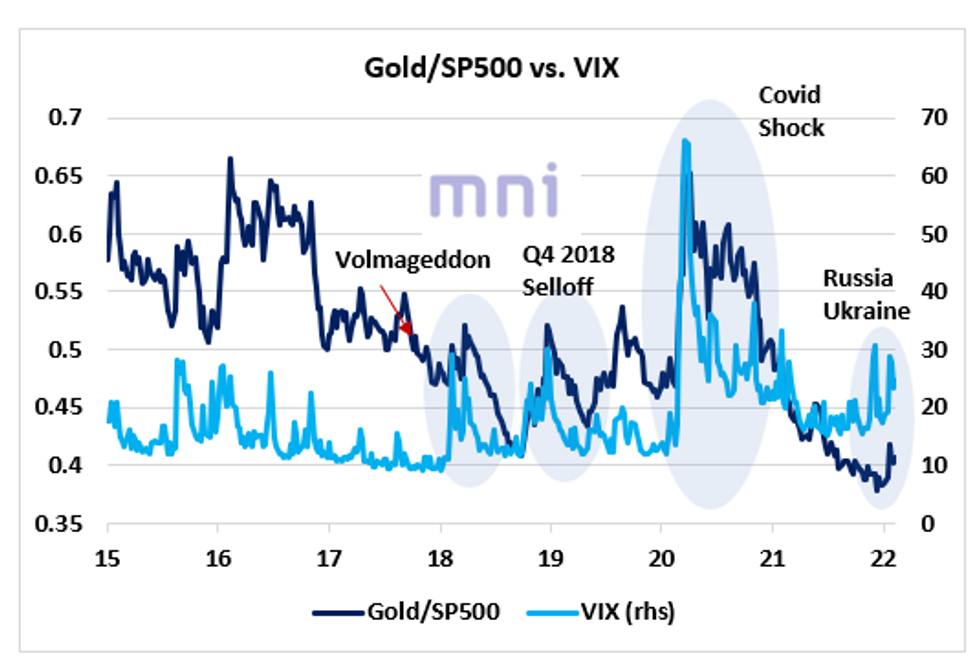

GOLD: Gold Confirmed (Once Again) its Status of ‘Safe-Haven’ in 2022

- Last year, the strong momentum in global equities have left gold prices vulnerable; the precious metal was down 3.6% in 2021 following a 25.1% appreciation in 2020.

- However, investors’ interest on gold has been rising this year amid surging geopolitical uncertainty.

- While equities have experienced tremendous volatility in recent weeks, gold confirmed once again its ‘safe-haven’ status.

- Momentum on precious metal has remained firm since the start of the year despite the strong USD and the surge in real yields; gold is up 1.5% against the USD since the beginning of January.

- Gold broke above its $1,850 resistance on Friday following strong rally that day; next level to watch on the topside stands at $1,877.15 (Nov. 16 high).

- The chart below shows that periods of surging price volatility (VIX) have been associated with a spike in the Gold/SP500 ratio.

Source: Bloomberg/MNI.

OIL: Marginally Lower

WTI and Brent trade ~$0.60 softer vs. their respective settlement levels at writing, with developments in the Russia-Ukraine situation continuing to dominate recent price action. This comes after the benchmarks added over $2.00 apiece on Monday.

- Both benchmarks have edged away from Monday’s cycle highs ($95.82 for WTI and $96.78 for Brent), following official confirmation that a statement by Ukrainian PM Zelensky re: a possible Russian attack on Wednesday was a purely sarcastic remark. More broadly, a possible diplomatic resolution to the Ukrainian standoff seemingly remains in play. Russian Foreign Minister Lavrov on Monday said that negotiations were “far from exhausted.”

- Still, WTI and Brent’s prompt spreads have surged to ~$2.00 and ~$2.20, respectively. This deepening level of backwardation points to continued, growing demand for the front crude contracts, a sign of lingering geopolitical tension, even with a diplomatic resolution re: the Ukraine situation remaining on the table.

- In crude-specific news, the EIA on Monday revised U.S. shale output forecasts upwards, with March ’22 output tipped to reach 8.71mn bpd. This would represent the highest level of output observed since March ‘20.

- Looking ahead, U.S. API crude inventory estimates are due later Tuesday, adding some crude-specific risk to the headline risk surrounding the Russia-Ukraine situation.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/02/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/02/2022 | 1000/1100 | * |  | EU | employment |

| 15/02/2022 | 1000/1100 | *** |  | EU | GDP (p) |

| 15/02/2022 | 1000/1100 | * |  | EU | trade balance |

| 15/02/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/02/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2022 | 1330/0830 | *** |  | US | PPI |

| 15/02/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/02/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 15/02/2022 | 1915/1415 |  | US | Senate Banking Committee votes on Federal Reserve nominees | |

| 15/02/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.