-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Inflation Misses, Increasing Chances Of Further PBoC Easing

EXECUTIVE SUMMARY

- BIDEN'S FED NOMINEES IN LIMBO AFTER REPUBLICAN VOTE BOYCOTT (RTRS)

- ECB’S VILLEROY: INFLATION UNCERTAINTY MEANS ECB'S OPTIONS NEED TO BE KEPT FULLY OPEN (RTRS)

- ECB’S SCHANBEL: ECB ‘CANNOT IGNORE’ HOUSE PRICE SURGE IN INFLATION ASSESSMENT (FT)

- PBOC’S YI VOWS SUPPORTIVE POLICY AS GROWTH RETURNS TO POTENTIAL (BBG)

- CHINESE INFLATION SLOWS FURTHER, OPENING DOOR WIDER FOR FURTHER EASING

- BIDEN SAYS THREAT TO UKRAINE REMAINS, AWAITS RUSSIA PULLBACK (BBG)

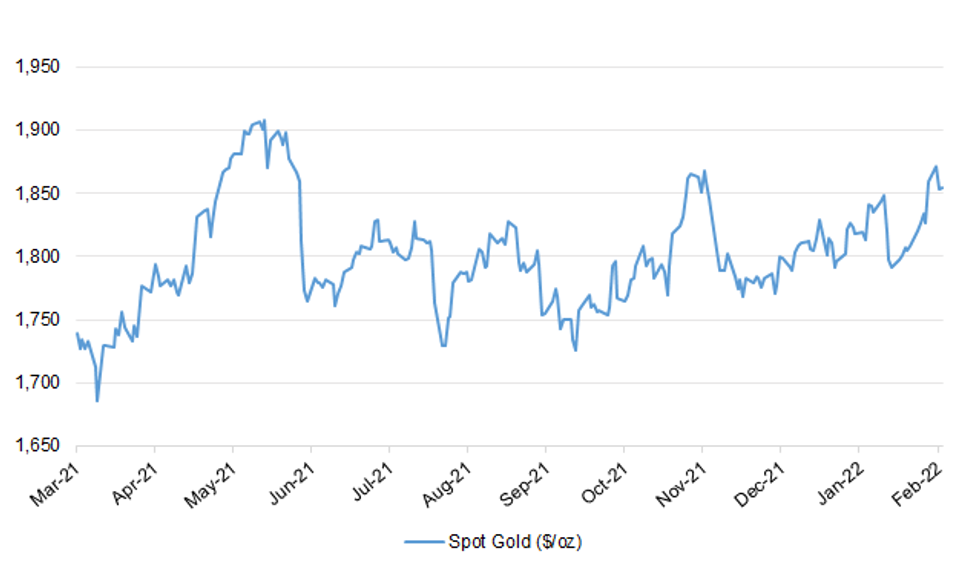

Fig. 1: Spot Gold ($/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Corporate insolvencies in England and Wales began to return last month to levels last seen before the pandemic as more businesses failed over debts. The number of companies going bust reached 1,560, more than double the figure of a year ago and similar to that of January 2020, before the onset of Covid-19. Businesses were protected from certain forms of creditor action during the pandemic, resulting in a significant drop in insolvency levels. (The Times)

POLITICS: Boris Johnson must resign if he attended a lockdown-breaking party, a former Conservative attorney-general said. Jeremy Wright, who held the role under both David Cameron and Theresa May, said that the prime minister should be removed from office if he attended a party or was aware that one had taken place. In a letter to his constituents seen by The Times, the MP for Kenilworth and Southam said he found it “frustrating” that the Metropolitan Police had failed to take action sooner and there was no need for a “lengthy investigation” into Downing Street parties. (The Times)

EUROPE

ECB: Increased uncertainty about the inflation outlook means the European Central Bank needs to keep its options fully open, especially on future interest rate hikes, ECB policymaker Francois Villeroy de Galhau said on Tuesday. In the face of growing inflation risks, the ECB has opened the door to an interest rate hike later this year and flagged plans to decide at a March 10 meeting how quickly its long-running bond purchases are wound down. In a speech to the London School of Economics, Villeroy said it would be useful to have a transition between the end of exceptional pandemic-era bond purchases in March and the end of its more traditional Asset Purchase Programme, which he said could end in the third quarter. (RTRS)

ECB: The European Central Bank must consider the “unprecedented” rise in house prices when assessing the high level of inflation and deciding how fast to tighten monetary policy, said one of its senior executives. In the most “hawkish” comments by an ECB executive board member ahead of next month’s meeting at which it will decide when to withdraw its stimulus in response to record inflation in the eurozone, Isabel Schnabel told the Financial Times: “We cannot ignore this.” “If this [rise in the costs of home ownership] were included, it would have a substantial effect on measured inflation, in particular on core inflation, where the weight of owner-occupied housing is larger,” she said. “It has to be part of our general considerations.” (FT)

U.S.

FED: The U.S. Federal Reserve will kick off its tightening cycle in March with a 25-basis-point interest rate rise, a Reuters poll of economists found, but a growing minority say it will opt for a more aggressive half-point move to tamp down inflation. While inflation is rising across the globe, it is particularly hot in the United States, hitting a 40-year high last month. That is putting pressure on the Fed to not only raise rates from a record low but also to reduce its nearly $9 trillion balance sheet, drastically inflated by emergency bond purchases as the Fed resuscitated the economy from COVID-19 pandemic damage. Now that the economy has recovered its pre-pandemic level, all 84 respondents in a Reuters poll taken Feb. 7-15 expected the Fed to raise the federal funds rate by at least 25 basis points at its upcoming March 15-16 meeting. Almost a quarter of those respondents, 20, forecast a 50-basis-point move to 0.50-0.75% following debate in markets over the past week after Fed officials discussed the merits of such a move. Rate futures are pricing in more than a 50% likelihood of a half-point hike. (RTRS)

FED: U.S. Senate action on President Joe Biden's five nominees to the Federal Reserve stalled Tuesday after Republicans boycotted a key vote over objections to Sarah Bloom Raskin, the White House's pick to be the central bank's Wall Street regulator. Senate Banking Committee Chair Sherrod Brown delayed a vote on the slate, which includes Fed Chair Jerome Powell, after none of the 12 Republicans showed up for a scheduled vote Tuesday afternoon. Senator Pat Toomey, the top Republican on the committee, had called on fellow Republicans to skip the vote, citing what he said were unanswered questions about Raskin's past role on the board of a fintech company. (RTRS)

FED: The Colorado Division of Banking on Tuesday objected to the Federal Reserve Bank of Kansas City’s description of how it came to classify fintech company Reserve Trust as a bank. The dispute represents another headache for President Joe Biden Fed nominee Sarah Bloom Raskin and Democrats hoping to confirm her to be one of the most powerful bank regulators in the world. The Colorado agency told CNBC that a statement issued by the Kansas City Fed last week “misrepresented” its role in Reserve Trust’s quest in 2017 to eventually acquire a “master account” at the central bank. (CNBC)

FISCAL: Democrats, particularly those in hotly competitive races, just introduced legislation that would suspend the federal 18-cents-per-gallon gas tax until next year and are drafting a bill that would reduce insulin prices. Other options include pulling out popular pieces of President Joe Biden’s stalled economic agenda addressing prescription drug prices and child care costs. The goal, several Democrats said, is to address inflation as soon as possible after the chamber’s recess next week. “We are focused on getting costs down and you’re going to see a lot of activity in March from us on that issue,” Majority Leader Chuck Schumer said after a closed-door lunch with all Senate Democrats. (BBG)

FISCAL: The White House and Democratic congressional leaders are discussing a pause on federal taxes on gasoline to help offset rising prices, lawmakers said Tuesday. “We’re having a caucus discussion on it. We haven’t yet taken a caucus position but it’s one of many things we’re looking at in terms of reducing costs,” Senate Democratic Leader Chuck Schumer said. (RTRS)

FISCAL: Republicans aren’t likely to support the gasoline tax holiday, according to Senator John Thune. Thune cites concerns with the depriving highway fund, which is funded by the gasoline levy. “I think this is an attempt to provide some political cover for Democrats who are running for re-election this year, and don’t want to have to defend the administration or their party’s position on energy,” he says. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention is expected to loosen its indoor masking guidelines to states soon, according to several people familiar with the matter. The agency’s update could come as early as next week. Dr. Rochelle Walensky, the director of the CDC, is expected to discuss masking guidance Wednesday at a White House Covid-19 Response Team briefing. Nothing has been finalized yet, but the CDC is considering a new benchmark for whether masks are needed, basing it on the level of severe disease and hospitalizations in a given community, two people familiar with the situation said. (NBC)

CORONAVIRUS: As the number of hospitalized coronavirus-positive patients continues to fall, Los Angeles County will relax its outdoor masking rules just after midnight Wednesday, a top health official confirmed. The revised guidance will allow people to go without face coverings outdoors at K-12 (including transitional kindergarten) schools and child-care facilities, and will apply to exterior areas of "mega" events, such as those at the Hollywood Bowl, Dodger Stadium, SoFi Stadium and Los Angeles Memorial Coliseum. Mask rules at these settings will be lifted at 12:01 a.m. Wednesday, according to L.A. County Public Health Director Barbara Ferrer. (LA Times)

CORONAVIRUS: Massachusetts officials loosened their recommendation on masks indoors, saying they’re necessary only for those who are at high risk of being infected with Covid-19. People should continue to protect themselves if they have a weakened immune system, underlying medical conditions or are unvaccinated, according to an updated advisory by the state Department of Public Health. Masks are still required on public transit and in health-care facilities. Previously, the state had asked all residents to wear a mask indoors no matter their vaccination status. (BBG)

EQUITIES: U.S. authorities are examining the involvement of one of Morgan Stanley’s top equities executives in block trades as part of an investigation into whether banks improperly alerted certain clients to market-moving transactions, according to people with knowledge of the matter. Pawan Passi, who ran Morgan Stanley’s U.S. equity syndicate desk and led the firm’s communications with investors for equity transactions, is among people whose activities are facing scrutiny, the people said, asking not to be identified describing the confidential inquiry. Bloomberg reported in November that Morgan Stanley had put Passi on leave. (BBG)

OTHER

GLOBAL TRADE: Neil Bradley, chief policy officer for the U.S. Chamber of Commerce, said the group has grown increasingly concerned that a fledgling global tax deal may “fundamentally disadvantage U.S. companies.” Bradley’s remarks, in an interview Tuesday at Bloomberg News in Washington, cast doubt on Treasury Secretary Janet Yellen’s view that U.S. corporate leaders would eventually support the historic deal, and urge Congress to pass the legislation necessary to implement it. There is interest among U.S. companies in the tax agreement’s broad goals -- especially with regard to the elimination of so-called digital services taxes that many believe unfairly target U.S. firms, Bradley said. But, he added, as chamber officials dig into the details of the yet-unfinished accord, they’re finding more red flags. (BBG)

G7: This week's meeting of finance officials from the Group of Seven advanced economies has been delayed until March 1, two sources familiar with the plans said on Tuesday night. Finance minister and central bankers from the United States, Britain, Germany, France, Italy, Canada, Japan and the European Union were due to meet later this week on the sidelines of this week's meeting of Group of 20 officials. Their meeting was delayed since most of the finance officials are not attending the G20 meeting in person, one of the sources said. Germany is chairing the G7 this year.

G20: U.S. Treasury Secretary Janet Yellen will urge her G20 counterparts this week to work towards ending the COVID-19 pandemic in developing countries and ensuring they have the resources needed to support an equitable recovery, a U.S. Treasury official said on Tuesday. (RTRS)

BOJ: The Bank of Japan could temporarily suffer losses on its huge asset holdings if it were to end its ultra-loose monetary policy, governor Haruhiko Kuroda said on Wednesday. The BOJ holds huge amount of government bonds, which means reducing the size will take a long time if it decides to exit from ultra-easy policy in the future, Kuroda said. "As the BOJ takes a long time adjusting its balance sheet, it could temporary suffer losses (on its balance sheet). We can't rule out the chance. But we also cannot say for sure this will indeed happen," he told parliament. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida will hold a press briefing Thurs. on the gradual easing of border controls from March, broadcaster NHK reports without attribution. To resume new arrivals of foreigners excluding tourists. Daily cap on arrivals including Japanese nationals to be raised to 5,000 from 3,500. Quarantine period to be shortened to 3 days with negative test result; waived entirely for those who have received third vaccine shot and are coming from non-high-risk areas. Yomiuri separately reports those arriving from high-risk areas without a booster shot will still be required to quarantine for 7 days. (BBG)

JAPAN: Japan's government must respond to any damage recent rising prices inflict on consumption and the economy, Finance Minister Shunichi Suzuki said on Wednesday. "While the recent rises in prices are driven partly by currency moves, they are predominantly due to increasing global fuel costs," Suzuki told parliament. "If prices rise before wages ... that could hurt household income and affect consumption," he said. (RTRS)

JAPAN: Japanese consumers' one-year forward expected inflation rate rose to 2.43% in February, a Consumer Affairs Agency survey showed on Wednesday, the highest since the survey started in December 2014. It followed a reading of 2.16% in the previous month. According to the preliminary result of the February survey of 2,000 consumers in Japan, 89.8% of respondents said the prices of everyday goods will rise in a year, also the highest percentage on record. (RTRS)

AUSTRALIA: “The unusual episode of macroeconomic policy is now coming to an end,” Secretary to the Treasury Steven Kennedy says in remarks to a parliamentary panel in Canberra Wednesday. “The fiscal policy impulse is receding, reflecting the temporary and targeted nature of the policy response”. “After two very strong years of growth in commonwealth payments, in MYEFO payments in 2022 and 2023 are forecast to fall by 6.3% and 4.8%”. “In real terms, as a share of GDP, commonwealth payments are estimated to fall across each of the budget and forward estimate years from 31.6% in 2021 to 26.5% in 2024/25”. Kennedy also says Treasury should taper fiscal stimulus in order to allow monetary policy to begin to normalize. Also warned that premature tightening could prevent the economy reaching full employment; says it’s unclear how low unemployment can fall before wages take off. Says broad tightness in the labor market is likely to persist even after the reopening of international borders. (BBG)

CANADA: A blockade that paralyzed a United States border crossing for more than two weeks ended Tuesday as trucks and other vehicles with horns blaring rolled away from a southern Alberta town. Protesters had been restricting access to the busy crossing near Coutts since Jan. 29 to rally against COVID-19 vaccine mandates for truckers and broader pandemic health restrictions. Canada Border Services Agency said operations had resumed at the crossing. (Global News)

CANADA: Canada will ease entry for fully vaccinated international travelers starting on Feb. 28 as COVID-19 cases decline, allowing a rapid antigen test for travelers instead of a molecular one, officials said on Tuesday. Antigen tests are cheaper than a molecular test and can provide results within minutes. The new measures, which include random testing for vaccinated travelers entering Canada, were announced by federal government ministers at a briefing. Canada will monitor conditions with an eye on dropping coronavirus testing requirements for fully vaccinated Canadians who make short trips - less than 72 hours - abroad, usually to the United States, Health Minister Jean-Yves Duclos said. (RTRS)

RUSSIA: President Joe Biden said it remains possible that Russia will invade Ukraine because its troops remain in a “threatening position,” and said that the U.S. has not verified Moscow’s claims that it has withdrawn some forces. The American president agreed with a Kremlin declaration Monday that diplomacy is still possible but vowed he would not “sacrifice basic principles” that countries -- including Ukraine -- should have the right to keep their own borders. “We should give the diplomacy every chance to succeed, and I believe there are real ways to address our respective security concerns,” Biden said at the White House on Tuesday. “To the citizens of Russia: You are not our enemy. And I do not believe you want a bloody, destructive war against Ukraine.” (BBG)

RUSSIA: U.S. Secretary of State Antony Blinken told Russian Foreign Minister Sergei Lavrov on Tuesday that the United States has ongoing concerns about Russia's ability to launch an invasion of Ukraine and needs to see "verifiable, credible, meaningful de-escalation." The two spoke by phone after Russia said some of its troops were returning to base after exercises near Ukraine and President Vladimir Putin said he was willing to continue dialogue. Blinken told Lavrov that Washington was committed to pursuing a diplomatic solution to "the crisis Moscow has precipitated" and looks forward to Russia's written response to U.S. and NATO papers on European security, State Department spokesperson Ned Price said in a statement. (RTRS)

RUSSIA: The United States has not seen evidence yet of any Russian troop pullback near Ukraine, but any such action would be welcome, Washington’s ambassador to the United Nations said on Tuesday. “It would be welcome news if it is legitimate. We have not seen evidence of that yet,” U.S. Ambassador to the United Nations Linda Thomas-Greenfield said in a statement provided by her spokesperson. (RTRS)

RUSSIA: In a rare bipartisan accord, Senate leaders issued a joint statement Tuesday signaling solidarity with an independent Ukraine and issuing a stern warning that Russia would pay a “severe price” of sanctions if President Vladimir Putin attacks across its border. Senators of both parties have been eager to show a unified front from the U.S. as tensions rise on Ukraine's border with Russia. But they shelved for now their own sanctions legislation, unable to resolve differences over the scope and timing and deferring to the White House strategy for edging Russia away from the crisis. “In this dark hour," the 12 Democratic and Republican senators declared, they wanted to make sure the strong U.S. position was clear to the people of Ukraine and to Putin. (BBG)

RUSSIA: The Russian announcement that some of its troops would return to base after completing recent drills around Ukraine is “encouraging” and in line with what Russian President Vladimir Putin agreed with French President Emmanuel Macron during their meeting in Moscow on Feb. 7, an Élysée source told journalists Tuesday following a call between Macron and US President Joe Biden. “The sign is encouraging, but we must verify the intentions of Putin” the source said, warning that “we must hold back from overanalyzing; we must be prudent.” (CNN)

RUSSIA: Ukraine has demanded an urgent meeting with Russia and the OSCE security body, after Russia’s parliament called for Moscow to recognise the independence of rebel-held areas in Ukraine, the Interfax Ukraine news agency has reported. Interfax said Ukraine had called for an urgent meeting of the so-called trilateral contact group, comprising Ukraine, Russia and the OSCE, the Vienna-based body that has acted as an observer in the eastern Ukraine conflict since 2014. (Al Jazeera)

RUSSIA: The online networks of Ukraine's defence ministry and two banks were overwhelmed on Tuesday and Ukraine's information security centre pointed the finger at neighbouring Russia. "It is not ruled out that the aggressor used tactics of little dirty tricks because its aggressive plans are not working out on a large scale," the Ukrainian Centre for Strategic Communications and Information Security, which is part of the culture ministry, said in a statement. (RTRS)

RUSSIA: The White House on Tuesday said it is aware of reports of cyber attacks in Ukraine and has offering support to Kiev in the investigation of and response to the denial-of-service incidents. (RTRS)

RUSSIA/ENERGY: President Biden said today that while he wants diplomacy to prevail in the Ukraine-Russia crisis, the US is prepared to impose serious sanctions against Russia if it decides to invade Ukraine. This includes not allowing the Nord Stream 2 pipeline to function. "We'll impose long term consequences that will undermine Russia's ability to compete economically and strategically. And when it comes to Nordstream 2, the pipeline that will bring natural gas from Russia to Germany, if Russia further invades Ukraine, it will not happen," Biden said during his remarks from the White House on Tuesday. (CNN)

RUSSIA: Russian President Vladimir Putin has said Moscow does not want a war in Europe amid rising tensions over Ukraine but demanded that the issue of Kyiv’s relationship with NATO be resolved in its entirety immediately. Speaking at a joint news conference on Tuesday after talks with German Chancellor Olaf Scholz, Putin said Russia had been informed by Western powers that its neighbour would not join the transatlantic military alliance in the near future. But he warned that was not a satisfactory assurance. (Al Jazeera)

PERU: Peru’s public prosecutor Zoraida Avalos Rivera is expanding a preliminary investigation into the executive’s alleged interference in police promotions. The public prosecutor announced the investigation on Twitter. Peruvian Defense Minister Walter Ayala resigned in November amid a scandal over allegations of government interference in the military. (BBG)

OIL: Japan will sell about 260,000 kiloliters of crude oil from its national reserves as part of oil replacement measures, according to an announcement from the trade ministry. Auction to run between today and March 9; delivery to be made from April 20. Japan will sell roughly 110,000 kiloliters of Hout crude from its Tomakomai Eastern National Oil Reserve Base and 150,000 kiloliters of Khafji crude from Eneos Holdings’ Kiire Terminal. (BBG)

CHINA

PBOC: China’s economic growth will return to its potential level in 2022, though various challenges will require the central bank to maintain a supportive monetary policy stance, Governor Yi Gang said. “We will keep our accommodative monetary policy flexible and appropriate, and increase support for key areas and weak links in the economy,” Yi said in a videotaped speech Wednesday ahead of a meeting of central bank chiefs and finance ministers from the Group of 20 nations in Jakarta. (BBG)

PBOC: The People’s Bank of China is likely to pause the pace of easing by maintaining its loan prime rate, the Securities Daily reported citing analyst Wang Qing of Golden Credit Rating. LPR is updated on the 20th of each month. The central bank signaled its stable policy intention yesterday by leaving unchanged the rate of renewing both MLF and 7-day reverse repo, the newspaper said citing analyst. China may still conduct marginal easing given its controllable inflation, depending on how the economy and the property market perform, Wang was cited as saying. (MNI)

INFRASTRUCTURE: China’s Q1 infrastructure investment may rise by 8% from a year ago given strong fiscal policies backed by CNY1.79 trillion early-issued local government bonds, Yicai.com reported citing researchers. China’s infrastructure investment grew by only 0.4% in 2021, down from 3.8% registered before the pandemic. If China sets a 5.5% growth target this year, infrastructure spending needs to be at least 5.4% higher, Yicai said citing Sheng Songcheng, a former PBOC official. Many local governments have announced their significant projects mainly in transportation and energy, while 5G and data centers are also expected to receive a boost, Yicai said. (MNI)

INFLATION: China will continue to guarantee sufficient supply and stabilize the prices of commodities to ease the increasing costs on the downstream business sectors, the State Council said in a meeting on Tuesday chaired by Premier Li Keqiang, according to a readout by Xinhua News Agency. As industries, especially services, face a fragile recovery from the pandemic, the government will continue to reduce fees and taxes for businesses and boost lending to SMEs and financing to manufacturing, the government said. (MNI)

OVERNIGHT DATA

CHINA JAN CPI +0.9% Y/Y; MEDIAN +1.0%; DEC +1.5%

CHINA JAN PPI +9.1% Y/Y; MEDIAN +9.5%; DEC +10.3%

JAPAN DEC TERTIARY INDUSTRY INDEX +0.4% M/M; MEDIAN +0.3%; NOV +0.7%

JAPAN JAN TOKYO CONDOMINIUMS FOR SALE -14.9% Y/Y; DEC -9.7%

AUSTRALIA JAN WESTPAC LEADING INDEX +0.13% M/M; DEC 0.00%

This is the first positive, above trend, read on the Index growth rate since the ‘Delta’ lockdowns impacted in August last year. With the growth rate now in positive territory the Index is signalling that the growth outlook has improved with above trend growth over the next three to nine months likely. While Westpac expects that the contraction in spending in January due to the Omicron variant will see zero growth in GDP in the March quarter, the economy is likely to bounce back strongly over the remainder of 2022 registering a solid 5.5% growth rate for the year overall. Strong balance sheets and rising incomes will support both consumer spending and business investment while the unemployment rate is likely to fall to 3.75% – the lowest we have seen since the 1970s. The Australian housing market is likely to maintain momentum until near mid-year when the reality of rising interest rates in the second half of 2022 will impact confidence. As we have started to see with the Westpac Melbourne Institute Index of Consumer Sentiment, confidence is already being dented by prospects of rising inflation and higher interest rates. Although 2023 and 2024 are beyond the scope of the Leading Index we do expect material slowdowns in both years as higher interest rates take their toll. (Westpac)

SOUTH KOREA JAN UNEMPLOYMENT 3.6%; MEDIAN 3.7%; NOV 3.8%

CHINA MARKETS

PBOC NET INJECTED CNY10 BLN VIA OMOS WEDS

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1183% at 09:27 am local time from the close of 1.9721% on Monday.

- The CFETS-NEX money-market sentiment index closed at 42 on Monday, compared with the close of 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3463 WEDS VS 6.3605

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3463 on Wednesday, compared with 6.3605 set on Tuesday.

MARKETS

SNAPSHOT: Chinese Inflation Misses, Increasing Chances Of Further PBoC Easing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 591.05 points at 27454.16

- ASX 200 up 77.966 points at 7284.9

- Shanghai Comp. up 17.259 points at 3463.347

- JGB 10-Yr future down 9 ticks at 149.96, yield down 0.4bp at 0.215%

- Aussie 10-Yr future down 4.5 ticks at 97.755, yield up 4.5bp at 2.233%

- U.S. 10-Yr future +0-05 at 125-28+, yield down 1.4bp at 2.029%

- WTI crude up $0.16 at $92.23, Gold up $0.83 at $1854.41

- USD/JPY up 5 pips at Y115.66

- BIDEN'S FED NOMINEES IN LIMBO AFTER REPUBLICAN VOTE BOYCOTT (RTRS)

- ECB’S VILLEROY: INFLATION UNCERTAINTY MEANS ECB'S OPTIONS NEED TO BE KEPT FULLY OPEN (RTRS)

- ECB’S SCHANBEL: ECB ‘CANNOT IGNORE’ HOUSE PRICE SURGE IN INFLATION ASSESSMENT (FT)

- PBOC’S YI VOWS SUPPORTIVE POLICY AS GROWTH RETURNS TO POTENTIAL (BBG)

- CHINESE INFLATION SLOWS FURTHER, OPENING DOOR WIDER FOR FURTHER EASING

- BIDEN SAYS THREAT TO UKRAINE REMAINS, AWAITS RUSSIA PULLBACK (BBG)

BOND SUMMARY: Mixed Performance For Core FI In Asia

U.S. Tsys have experienced some marginal richening in Asia dealing, with regional participants willing to buy Tuesday’s dip. Outright yield levels, questions re: the potential for further short-term hawkish Fed re-pricing, downside misses in the latest round of Chinese inflation data and questions in the West re: the apparent de-escalation in the Russia-Ukraine standoff (punctuated by U.S. President Biden’s continued alert re: the potential for a Russian invasion of Ukraine) are likely fostering the bid. Cash Tsys run 0.5-2.0bp richer across the curve, back from best levels, with the front end leading, facilitating some bull steepening. TYH2 prints +0-03+ at 125-26+, 0-03+ back from the peak of a 0-07+ range. TY block buys (+3,431/-3,431) and a block seller of the TYJ2 126.00/125.50 put spread (-20K), which looked like a rolldown of strikes, headlined on the flow side overnight. Looking ahead, NY hours will see the release of U.S. retail sales & industrial production data, as well as 20-Year Tsy supply. We will also get the minutes from the most recent FOMC meeting, in addition to Fedspeak from Kashkari (’23 voter, dove).

- JGB futures consolidated overnight losses during Tokyo trade, hitting the bell -15, sticking within a tight range. Cash JGBs are flat to ~3.5bp cheaper, steepening, with 30s providing the weak point on the curve. The early steepening extended on the back of a jump in the offer/cover ratio witnessed in the latest round of 25+-Year BoJ Rinban operations. 10s were little changed on the day, with participants seemingly unwilling to chase yields higher given the BoJ’s recent pre-emptive action to enforce the top end of its permitted 10-Year JGB yield trading band. Comments from BoJ Kuroda didn’t include any fresh points of note, with the same holding true when it comes to comments made by Japanese Finance Minister Suzuki.

- The impulse from U.S. Tsys provided a light bid for the Aussie bond space, with futures moving away from early Sydney lows, after bears failed to force a test of overnight troughs. YM -1.0 & XM -4.5 as a result, paring some of the overnight losses. Cash ACGB trade saw a fairly parallel shift in the 10+-Year zone, as the curve bear steepened. In local news, Australian Treasury Secretary Kennedy (who also sits on the RBA board) noted that fiscal stimulus should be tapered (a trend that is already in place) in order to facilitate the start of the monetary policy normalisation process. Kennedy did caution that premature tightening could prevent Australia from reaching full employment, while reaffirming the broader uncertainty when it comes to the required level of unemployment that would facilitate notable wage growth. The undertones of Kennedy’s remarks re: unemployment & the labour market were seemingly in line with wider RBA-think i.e. unemp. can (and needs) to be pushed lower.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.50% 21 Apr ‘33 Bond, issue #TB140:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.50% 21 April 2033 Bond, issue #TB140:

- Average Yield: 2.2592% (prev. 1.7480%)

- High Yield: 2.2600% (prev. 1.7500%)

- Bid/Cover: 3.1090x (prev. 2.7550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 95.5% (prev. 59.2%)

- Bidders 45 (prev. 38), successful 18 (prev. 20), allocated in full 9 (prev. 10)

EQUITIES: Higher In Asia As Geopolitical Tensions Ease

Major Asia-Pac equity indices sit 0.7% to 2.0% higher, tracking a strong lead from Wall St. following Tuesday’s apparent easing in Russia-Ukraine tensions. In local matters, the latest Chinese CPI and PPI prints provided downside surprises, lifting regional sentiment, as the dataset boosted hopes re: the prospects of further PBoC easing.

- The Nikkei 225 leads regional peers, lodging 2.0% gains, erasing losses made earlier in the week. Index heavyweights and blue chips such as Fast Retailing and Softbank led the way higher. These bellwethers broadly outperformed high-beta tech stocks, meaning the TOPIX trailed the Nikkei 225, although the former still added a more than healthy 1.5%.

- The CSI300 trails regional peers (even with the door to further PBoC easing opening further post-China inflation data), trading 0.7% higher, with the rare earth and real estate sub-indices providing the most notable gains. High-beta Chinese tech underperformed the broader market, with the ChiNext and STAR50 trading 0.5% and 0.1% higher, respectively.

- U.S. e-mini equity index futures are 0.1% to 0.2% softer as we type, a touch below Tuesday’s best levels. The continued scepticism from the West re: Russia’s outlined de-escalation on the Ukrainian border has capped the space since Tuesday’s settlement.

OIL: Narrow Asia Trade After Tuesday’s Pullback

WTI is unchanged and Brent is ~-$0.15 at typing, with the Ukraine situation remaining front and centre. Note that the market has looked through the latest Japanese announcement re: a release from the country’s strategic stockpiles.

- To recap, the benchmarks shed over $3.00 on Tuesday following an easing in Russia-Ukraine tensions, with crude’s direction of travel facilitated by the Russian government announcing partial troop pullbacks from the Ukrainian border.

- Still, Ukrainian and U.S. officials have reiterated the need to verify the Russian claims, while NATO Secretary General Jens Stoltenberg flagged that NATO hasn’t “seen any sign of de-escalation on the ground,” yet. The caution from the West allowed crude futures to pull back from worst levels of the day on Tuesday, before tight ranges were observed during Asia-Pac dealing.

- Ultimately, hope remains when it comes to a peaceful resolution re: the matter, with German Chancellor Scholz noting that “the diplomatic possibilities are far from being exhausted” following a meeting with Russian President Putin.

- Elsewhere, participants are likely keeping an eye on the progress of indirect Iran-U.S. talks in Vienna, with no notable changes observed since EU High Rep. Josep Borrell tweeted that an agreement was “in sight” on Monday.

- Tuesday’s API inventory estimates reportedly revealed declines in U.S. crude, gasoline, and distillate stockpiles (although the drawdowns in headline crude and distillate stocks apparently undershot analyst expectations). U.S. EIA inventory data is due later today (1530GMT), with the median estimates from the Platts survey calling for declines in all three of the aforementioned inventory measures as well.

- On the technical front, WTI and Brent trade comfortably above key short-term support at $88.41 (Feb 9 low) and $89.93 (Feb 8 low) respectively. Recent pullbacks remain relatively shallow, and resistance on the upside is seen at the Feb 14 highs of $95.82 (WTI) and $96.78 (Brent).

GOLD: Narrow Range After Tuesday Pullback

The apparent de-escalation in the Russia-Ukraine standoff allowed bullion to retrace from fresh multi-month peaks on Tuesday, although continued caution from the West when it comes to the touted Russian pullback from the Ukrainian border (several U.S. & NATO figures flagged uncertainty that such a move had taken place) limited the weakness in bullion. That leaves spot around the $1,850/oz mark after sticking to a tight range in Asia hours.

FOREX: Moderation In Russia Worry Saps Volatility

Market sentiment improved at the margin as latest headlines surrounding the Russia-Ukraine standoff raised hopes about potential de-escalation. Moscow's announcement of a partial withdrawal of troops from the Ukrainian border has met with initial scepticism of both Kyiv and NATO, as they await credible evidence of the promised pullback. Still, Russia's pro-diplomacy rhetoric has taken the edge off earlier geopolitical angst.

- Antipodean currencies eked out some gains, while the yen slipped in muted Asia-Pac trade. GBP led gains in G10 FX space, with EUR landing at the bottom of the pile. Major currency pairs generally held very tight ranges in the absence of fresh developments on the Russia crisis.

- Chinese inflation figures failed to move the dial for offshore yuan. Both consumer and factory gate prices grew slower than forecast in January, opening up some space for China's central bank to ease policy further. PBOC Gov Yi pledged to "keep accommodative policy flexible and appropriate."

- Inflation data from the UK and Canada will be published today, while other data highlights include U.S. retail sales & industrial output as well as Norwegian GDP.

- On the central bank front, the Fed will publish the minutes from their most recent monetary policy meeting. In addition, comments are due from Fed's Kashkari, BoC's Lane & RBA's Bullock/Debelle.

FOREX OPTIONS: Expiries for Feb16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E860mln), $1.1280-00(E1.0bln), $ $1.1400-05(E1.1bln), $1.1425-30(E1.0bln)

- USD/JPY: Y114.40-50($1.6bln), Y115.00($619mln), Y115.25-40($1.0bln), Y116.00-05($1.0bln)

- EUR/JPY: Y128.50(E1.4bln)

- USD/CAD: C$1.2600($837mln), C$1.2785-90($630mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/02/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/02/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/02/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/02/2022 | 1000/1100 | ** |  | EU | industrial production |

| 16/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/02/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/02/2022 | 1330/0830 | ** |  | US | import/export price index |

| 16/02/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/02/2022 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/02/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/02/2022 | 1500/1000 | * |  | US | business inventories |

| 16/02/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/02/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 16/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/02/2022 | 1830/1330 |  | CA | BOC Deputy Lane speech | |

| 16/02/2022 | 1900/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.