-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Blinken & Lavrov To Meet Next Week

EXECUTIVE SUMMARY

- BLINKEN, LAVROV TO MEET NEXT WEEK OVER UKRAINE CRISIS IF NO RUSSIAN INVASION (FRANCE 24)

- UKRAINE REBELS ACCUSE GOVT OF FRESH MORTAR ATTACKS (RTRS)

- BRITAIN IS CONVINCED RUSSIA IS ABOUT TO INVADE UKRAINE (THE TIMES)

- MESTER BACKS REDUCING FED BALANCE SHEET 'SOON', MBS SALES

- CHINESE FINANCE MINISTER: 2022 FISCAL DEFICIT RATIO TO BE ‘APPROPRIATE’ (BBG)

- CHINA NPC STANDING COMMITTEE TO HOLD MEETING FEB. 27-28 (XINHUA)

- RBA'S HARPER BACKS REVIEW; AUSTRALIAN CENTRAL BANK WON'T FOLLOW FED ON RATE INCREASES (WSJ)

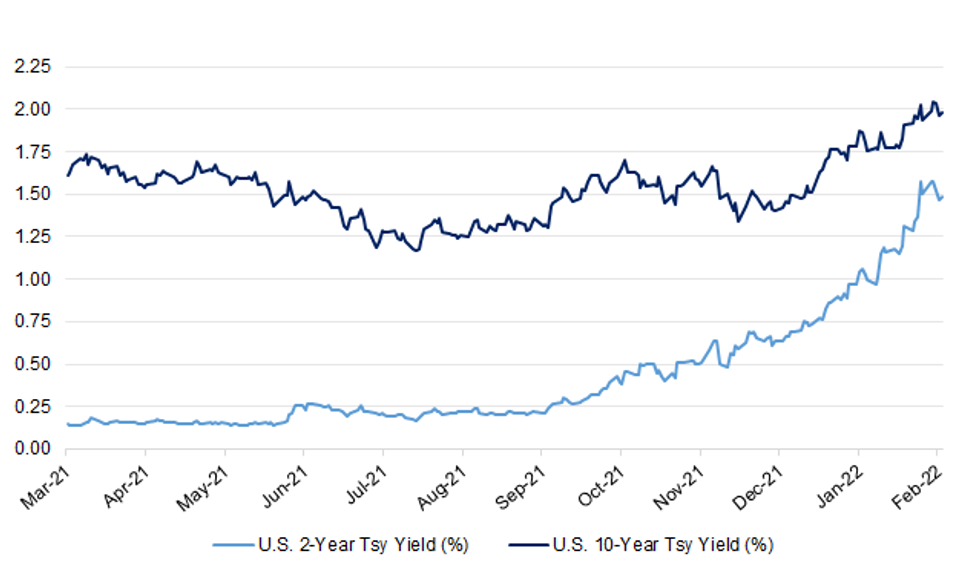

Fig. 1:U.S. 2- & 10-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPE

ITALY: Italy's government is finalising new measures worth at least 5 billion euros ($5.68 billion) to help consumers and firms hit by the rise in energy bills, two sources told Reuters. The package, expected to be approved by the cabinet on Friday, comes on top of some 10 billion euros already budgeted since July last year to offer relief to households and businesses. Rome also plans to introduce simplification measures to speed up the construction of solar power plants, one of the sources said. (RTRS)

NORWAY: Norway's central bank governor warned the government on Thursday to rein in spending from the country's $1.3 trillion sovereign wealth fund, the world's largest, or otherwise risk seeing its capital dwindle in coming years. In his final policy speech before retiring later this month, Governor Oeystein Olsen also said activity had firmly recovered from the pandemic and that ultra-low inflation was a thing of the past, leading to continued hikes in interest rates. A quarter of Norway's government spending last year came from the wealth fund, more than double the level when Olsen took office in 2011, reflecting rapid asset growth and a need to counter the pandemic, but also posing risks if markets fall. "I think the politicians understand that spending from the wealth fund must be reduced now that society has reopened," Olsen said in an interview ahead of the annual policy address. "If we go too far in raising spending when markets rise and the value of the fund grows, we will be forced to make unnecessary and painful cutbacks when the value drops," he told Reuters. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on France (current rating: AA; Outlook Negative) & Poland (current rating: A-; Outlook Stable)

- Moody’s on Cyprus (current rating: Ba1; Outlook Stable)

- S&P on Estonia (current rating: AA-; Outlook Positive) & France (current rating: AA; Outlook Stable)

U.S.

FED: The U.S. Federal Reserve should implement a full percentage point of rate increases over its next three meetings between now and July 1, St. Louis Fed president James Bullard said on Thursday, reiterating his calls for strong action from the Fed against stubbornly high inflation. "We are missing our inflation target on our preferred measure... and policy is still at rock bottom lows and we’ve still got asset purchases going on," Bullard said in a television interview with CNN. "This is a moment where we need to shift to less accommodation." (RTRS)

FED: MNI: Mester Backs Reducing Fed Balance Sheet 'Soon', MBS Sales

- Cleveland Federal Reserve President Loretta Mester said Thursday she wants to start shrinking the central bank's USD8.9 trillion balance sheet soon, and foresaw a faster pace of rate hikes for the U.S. economy than seen in the last rate-hiking cycle started in 2015 on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS/FISCAL: The White House is warning lawmakers that the U.S. doesn’t have enough money on hand to respond to future Covid-19 variants, stockpile vaccines or develop new technologies. Biden administration funds for pandemic response – including testing, vaccine distribution and other medical supplies -- have been either spent or set aside already for purchases, according to a document obtained by Bloomberg News. All funds provided so far have been spent or earmarked for use. (BBG)

CORONAVIRUS: California on Thursday laid out a plan that manages Covid as a permanent aspect of life, anticipating future surges and new variants that may require temporary public health measures such as facemasks depending on how much the virus is disrupting economic and social activity. Gov. Gavin Newsom said California, the largest state economy in the U.S., is shifting out of the crisis mentality that has characterized the pandemic response for the past two years. Newsom said the Golden State must learn to live with the virus by preparing as much as possible for an uncertain future using the tools developed over the past two years. (CNBC)

CORONAVIRUS: North Carolina Governor Roy Cooper urged local governments and school districts to drop mask mandates. “It’s time to focus on getting our children a good education and improving our schools, no matter how you feel about masks,” the Democratic governor tweeted. (BBG)

FISCAL: The Senate passed a short-term government funding bill, sending it to President Joe Biden’s desk hours before a shutdown deadline. The measure, which passed with a 65-27 vote, will keep the government running through March 11. Congress had to approve a spending plan before the end of the day Friday. (CNBC)

POLITICS: A New York judge ruled that Donald Trump and two of his children, Ivanka Trump and Donald Trump Jr, must comply with a subpoena from the state’s attorney general Letitia James to sit for a civil disposition. Trump is likely to appeal the decision. (The Guardian)

OTHER

JAPAN: Japan's government stands ready to deploy more fiscal stimulus "without hesitation" as the country is still in the midst of the COVID-19 crisis, Finance Minister Shunichi Suzuki said on Friday (Feb 18). "If inflation accelerates before full-fledged improvements in the job market and wage hikes kick in, that could affect consumption," Suzuki told a news conference. (RTRS)

RBA: A detailed review of the Reserve Bank of Australia's operation of monetary policy would be welcome, allowing the central bank to freely answer critics about its failure in recent years to achieve its inflation target, said Ian Harper, dean of Melbourne Business School. Mr. Harper, who doesn't speak on behalf of the RBA but is a member of its policy-making board, said separately that financial markets are misguided in thinking Australia's central bank will follow the U.S. Federal Reserve when raising interest rates, adding that the RBA has good reasons to wait. (WSJ)

CANADA: Ottawa police made several arrests Thursday evening on Parliament Hill as hundreds of 'Freedom Convoy' protesters continued to ignore demands they leave the city's downtown core. (CTV)

CANADA: Canadian banks have started to freeze a small number of accounts connected to people whom police say have been involved in illegal protests, acting on orders from Prime Minister Justin Trudeau’s government. But the banks won’t be going after donors who collectively gathered millions of dollars to help the truckers and demonstrators who’ve blockaded downtown Ottawa and other sites. Trudeau invoked an emergency law Monday that requires financial institutions in Canada to examine customer records and take action against people involved with the protest, or those aiding them. The law also grants the government other extraordinary powers, such as the right to ban public assembly in certain locations. The Canadian Civil Liberties Association said it plans to challenge the government’s decision in court. (BBG)

MEXICO: Mexico lacks an "economic growth engine" for 2022, Bank of Mexico Deputy Governor Jonathan Heath said on Thursday. Speaking at a public event, Heath also said core inflation in Mexico was "persistent" and had a clear upward trajectory. (RTRS)

BRAZIL: Former Brazilian President Luiz Inácio Lula da Silva said on Thursday he would seek to strengthen state-owned companies such as power company Eletrobras and postal service Correios if elected, potentially complicating current plans to privatize the enterprises. (RTRS)

RUSSIA: US Secretary of Antony Blinken has accepted an invitation to meet with Russian Foreign Minister Sergei Lavrov late next week provided Russia does not invade Ukraine, the US State Department said on Thursday. Blinken said earlier on Thursday he had sent a letter to Lavrov proposing a meeting next week in Europe. (France 24)

RUSSIA: Russian-backed separatists in Ukraine's eastern province of Luhansk accused government forces on Friday of two more mortar attacks, the Interfax news agency said, after a flare-up in the region further fuelled tension between Russia and the West. Kyiv and the rebels accused each other of stepping up artillery and mortar fire along the line of contact on Thursday, while the Kremlin said it was "deeply concerned" by the escalation. (RTRS)

RUSSIA: Biden said the U.S. believes Russia is “engaged in a false-flag operation to have an excuse to go in” to Ukraine. In remarks to reporters as he left the White House for a speech in Cleveland, Biden offered no further details or evidence. But he spoke after U.S. officials said the Kremlin had reinforced a buildup around Ukraine by as many as 7,000 troops. Biden added he had no plans to call President Vladimir Putin. Kremlin spokesman Dmitry Peskov dismissed Biden’s warning, saying “unfortunately, the whipping up of tensions is continuing with such statements,” state-run RIA Novosti reported. (BBG)

RUSSIA: The Kremlin accused U.S. President Joe Biden on Thursday of stoking tension by saying he expected Russia to invade Ukraine within days, RIA news agency reported. Kremlin spokesman Dmitry Peskov was responding to Biden's comment that an invasion was likely "in the next several days". Russia has massed a huge force near Ukraine's borders but continues to assert that it is Western actions and statements that are fuelling the crisis. (RTRS)

RUSSIA: Russia has expelled Bart Gorman, the No. 2 U.S. official in Moscow, the State Department said on Thursday, with Washington warning that it would respond to the "unprovoked" move amid heightened fears of a Russian invasion of Ukraine. Russia's Foreign Ministry said Gorman was forced to leave Moscow in response to what it called the "unreasonable expulsion" of a senior Russian official by Washington, accusing the United States of unleashing a "visa war." (RTRS)

RUSSIA: Some Russian troops that took part in military drills in Crimea, the peninsula that Russia annexed from Ukraine in 2014, have returned to their base in Russia’s southern region of Chechnya, Interfax news agency has quoted the defence ministry as saying. Russia said this week some troops were returning to their bases after completing drills in areas adjacent to Ukraine but the US and NATO said Moscow had added new forces. (Al Jazeera)

RUSSIA: Several Russian mechanised infantry units have returned to their bases in the regions of Dagestan and Chechnya after completing drills in Crimea, the Interfax news agency cited Russia's defence ministry as saying on Friday. Russia said this week it has started pulling back some troops from areas adjacent to Ukraine. But Kyiv and the West have disputed that, saying some units and equipment appeared to be replaced by others. (RTRS)

RUSSIA: President Putin has made up his mind to invade Ukraine, senior government figures believe, with western leaders accusing Moscow of orchestrating “false flag” attacks in the east of the country. In Washington President Biden warned that an invasion could take place within “several days”, describing the risk as “very high”. (The Times)

RUSSIA: Britain believes that nearly half of Russian forces that have massed near Ukraine are now within 30 miles of the border, in contrast to statements from Moscow that its forces were being sent back to barracks. Reinforcements from 14 battalions were in the process of arriving, officials added, while highlighting a pontoon bridge that had been briefly set up in Belarus in the past few days as an example of unusual military activity. There was evidence, a defence source said, “of Russian forces leaving the deployment sites for staging areas closer to the border”. A couple of hours later, the US president, Joe Biden, warned that an attack could take place “in the next several days”. (RTRS)

RUSSIA: Britain said a request by Russia's parliament that President Vladimir Putin should recognise the breakaway Ukrainian regions of Donetsk and Luhansk as independent showed "flagrant disregard" for Moscow's peace process commitments. "If this request were accepted, it would represent a further attack on Ukraine’s sovereignty and territorial integrity, signal an end to the Minsk process and demonstrate a Russian decision to choose a path of confrontation over dialogue," British foreign minister Liz Truss said on Thursday. (RTRS)

RUSSIA: Russia has amassed 45,000 soldiers in Belarus and their presence is threatening to Baltic states and Poland, Lithuanian President Gitanas Nauseda said on Thursday. (RTRS)

RUSSIA: European Union countries including Germany, France and Italy are pressing the bloc behind closed doors to find ways to shield their economies in the event the Western alliance hits Russia with sanctions over aggression related to Ukraine. Prime Minister Mario Draghi’s government is holding talks with EU partners about how to mitigate the impact punitive measures could have on key sectors of Italy’s economy, including discussions on potential exemptions for the energy sector from some financial measures under discussion, according to people familiar with the talks. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa is fending off accusations that he has created a shadow cabinet within the presidency because he mistrusts some of his ministers. Ramaphosa announced several additions to his personal office in his state-of-the-nation address last week, bringing the count of advisers, task teams and special envoys to more than 20 since he took office in 2018. The new appointments include advisers on climate change financing, small business regulation and visa reform. (BBG)

OIL: U.S. officials held discussions with Saudi Arabia about a "collaborative approach" to managing potential market pressures stemming from a possible Russian invasion of Ukraine, the White House said on Thursday. "In Saudi Arabia, State Department Special Envoy for Energy Affairs Amos Hochstein joined Brett McGurk (coordinator for the Middle East and North Africa) to discuss a collaborative approach to managing potential market pressures stemming from a possible Russian invasion of Ukraine," the White House said in a statement. (RTRS)

CHINA

POLICY: China NPC Standing Committee to hold meeting Feb 27-28. (Xinhua)

PBOC: China should conduct monetary easing in the first quarter, a window before the expected rate cuts by the U.S. Federal Reserve beginning in March, which will widen differences in the two economies' policies, the Securities Daily said citing analyst Fan Ruoying of Bank of China research. China’s economy needs further monetary support given shrinking demand, supply disruptions and weakening outlook, the daily said citing economist Luo Zhiheng with Yuekai Securities. (MNI)

FISCAL: China will fully utilize fiscal policy in stabilizing investment and boosting consumption, as the central government will increase infrastructure investment and guide private capital to invest in transportation, ecological environment and social services, wrote Minister of Finance Liu Kun in the official People’s Daily. China will advance fiscal policy efforts early this year to maintain a stable economic environment and prepare for the CPC's 20th Congress later this year, wrote Liu. (MNI)

PROPERTY: More cities in China, especially smaller cities facing prolonged weak real estate markets, may lower the required down payment on home mortgages, with the latest move introduced in Heze city in Shandong province, the China Securities Journal reported citing analyst Chen Wenjing with China Index Academy. Heze, home to about 9 million, cut down payment requirement to 20% from 30% for first-time homebuyers, a clear easing signal by the authorities, the newspaper said citing Yan Yuejing, the director of E-house China Research and Development Institution. New home sales in Hezhe fell about 42% y/y in January, the newspaper added. (MNI)

CORONAVIRUS: China has multiple teams looking into how the country can optimize its Covid response in a way that could deviate from the current Covid Zero strategy while also avoiding lifting most curbs to prevent the virus spreading unchecked, local media the Cover reported, citing Wu Zunyou, the chief epidemiologist at the Chinese Center for Disease Control and Prevention. Such a strategy should realign the country with the rest of the world to normalize international exchange and economic development while keeping Covid under control, Wu said. (BBG)

CORONAVIRUS: China is set to begin rolling out different booster shots for people fully vaccinated with inactivated Covid-19 inoculations to enhance protection against variants, local media the Paper reported, citing the China Preventive Medicine Association. Adults who have been fully vaccinated for over six months with the inactivated vaccines -- one from Sinovac Biotech Ltd and another two from state-owned Sinopharm -- will be eligible for a booster shot based on the adenovirus vector from CanSino Biologics Inc or protein subunit from Chongqing Zhifei Biological Products Co. (BBG)

OVERNIGHT DATA

JAPAN JAN CPI +0.5% Y/Y; MEDIAN +0.6%; DEC +0.8%

JAPAN JAN CORE CPI +0.2% Y/Y; MEDIAN +0.3%; DEC +0.5%

JAPAN JAN CORE-CORE CPI -1.1% Y/Y; MEDIAN -1.0%; DEC -0.7%

NEW ZEALAND Q4 PPI INPUT +1.1% Q/Q; Q3 +1.6%

NEW ZEALAND Q4 PPI OUTPUT +1.4% Q/Q; Q3 +1.8%

CHINA MARKETS

PBOC DRAINS NET CNY10 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1034% at 09:33 am local time from the close of 1.9735% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3343 FRI VS 6.3321

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3343 on Friday, compared with 6.3321 set on Thursday.

MARKETS

SNAPSHOT: Blinken & Lavrov To Meet Next Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 89.22 points at 27143.65

- ASX 200 down 74.477 points at 7221.7

- Shanghai Comp. up 10.387 points at 3478.422

- JGB 10-Yr future up 3 ticks at 149.96, yield down 0.5bp at 0.221%

- Aussie 10-Yr future down 4 ticks at 97.74, yield up 4.1bp at 2.247%

- U.S. 10-Yr future -0-03+ at 126-10, yield up 1.74bp at 1.979%

- WTI crude down $0.54 at $91.22, Gold down $5.49 at $1892.94

- USD/JPY up 26 pips at Y115.20

- BLINKEN, LAVROV TO MEET NEXT WEEK OVER UKRAINE CRISIS IF NO RUSSIAN INVASION (FRANCE 24)

- UKRAINE REBELS ACCUSE GOVT OF FRESH MORTAR ATTACKS (RTRS)

- BRITAIN IS CONVINCED RUSSIA IS ABOUT TO INVADE UKRAINE (THE TIMES)

- MESTER BACKS REDUCING FED BALANCE SHEET 'SOON', MBS SALES

- CHINESE FINANCE MINISTER: 2022 FISCAL DEFICIT RATIO TO BE ‘APPROPRIATE’ (BBG)

- CHINA NPC STANDING COMMITTEE TO HOLD MEETING FEB. 27-28 (XINHUA)

- RBA'S HARPER BACKS REVIEW; AUSTRALIAN CENTRAL BANK WON'T FOLLOW FED ON RATE INCREASES (WSJ)

BOND SUMMARY: Up & Down For Bonds In Asia

Early Asia trade saw flow-related regional reaction to Thursday’s NY risk-off price action (a reminder that risk-off moves pared back from their regional extremes as Asia went home on Thursday). Broader price action then flicked to risk-on as a meeting between U.S. Secretary of State Blinken & Russian counterpart Lavrov was confirmed (it will take place next week, providing there is no Russian invasion of Ukraine), which pressured core FI markets. Note that several overnight reports out of Russia pointed to a continued, partial pullback of troops and military equipment from the Ukrainian border.

- TYH2 pushed through its Thursday peak at the re-open, before the confirmation of the aforementioned Blinken-Lavrov meeting weighed. TYH2 -0-02+ at 126-11 as a result, 0-04 off worst levels, operating within a 0-15 range, on ~185K lots. Cashs Tsys sit 1.0-1.5bp cheaper across the curve. Friday’s NY docket will see the release of existing home sales data, as well as Fedspeak from Brainard, Waller, Williams & Evans (Evans is a ’23 voter, while the remainder hold permanent voting status).

- Early outperformance in the super-long end of the JGB curve stuck, even with broader risk appetite flicked back to “on.” Indeed, super-long benchmarks hit the richest levels of the session into the Tokyo close, with 40-Year JGB yields back below 1.00%. A reminder that the Japanese curve has steepened aggressively in recent weeks, with a lack of interest in the super-long end on the part of life insurers apparent, even with super-long yields tapping multi-year highs (note that yesterday’s 20-Year JGB was well-received, which surprised most). Cash JGBs were ~1.0-5.5bp richer on the day, bull flattening. Meanwhile, futures tracked wider risk appetite before moving back towards their early Tokyo peak into the bell, closing +10.

- Aussie bonds marched to the beat of the wider drum, with YM -2.0 & XM down 4.0. A WSJ interview with RBA’s Harper largely stuck to the central RBA thought process i.e. a want to push unemployment lower to foster wage growth & sustainable underlying inflation. Harper also pushed back against market pricing when it comes to RBA rate hikes, pointing to the need for delineation between RBA & U.S. Fed policy given differences in inflation in Australia & the U.S. The latest round of ACGB issuance and the release of next week’s AOFM issuance slate had no tangible impact on the wider space.

JGBS AUCTION: Japanese MOF sells Y4.6209tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6209tn 3-Month Bills:

- Average Yield -0.0819% (prev. -0.0908%)

- Average Price 100.0220 (prev. 100.0244)

- High Yield: -0.0763% (prev. -0.0819%)

- Low Price 100.0205 (prev. 100.0220)

- % Allotted At High Yield: 1.7558% (prev. 4.5460%)

- Bid/Cover: 2.799x (prev. 2.502x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 3.25% 21 Apr ‘25 Bond, issue #TB139:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 3.25% 21 April 2025 Bond, issue #TB139:

- Average Yield: 1.5843% (prev. 1.3298%)

- High Yield: 1.5850% (prev. 1.3300%)

- Bid/Cover: 5.5050x (prev. 2.9433x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 50.7% (prev. 77.8%)

- Bidders 46 (prev. 45), successful 17 (prev. 9), allocated in full 6 (prev. 1)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 21 February it plans to sell A$500mn of the 2.75% 21 June 2035 Bond.

- On Tuesday 22 February it plans to sell A$150mn of the 3.00% 20 September 2025 Indexed Bond.

- On Wednesday 23 February it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 24 February it plans to sell A$1.0bn of the 27 May 2022 Note & A$1.0bn of the 24 June 2022 Note.

- On Friday 25 February it plans to sell A$500mn of the 2.75% 21 November 2029 Bond.

EQUITIES: Off Worst Levels In Asia

Major Asia-Pac equity indices are 0.2% to 0.7% softer at writing, rising from session lows following news of US Secretary of State Blinken agreeing to meet Russian FM Lavrov next week. Most Asia-Pac equity indices had opened sharply lower on a strong negative lead from Wall St. owing to heightened Russia-Ukraine tensions during Thursday’s session (with the aforementioned Blinken-Lavrov meeting subsequently unwinding some of the geopolitical risk priced into markets).

- While the CSI300 sits 0.3% lower, its real estate sub-index notched notable gains following reports of state-run banks in the city of Heze cutting mortgage down payments for some home buyers - in a move seemingly aimed at boosting demand in the property space. Real estate developers in Hong Kong also benefited from the news, with the Hang Seng Properties Index adding 0.7% at typing.

- High-beta Chinese tech struggled, with the tech-heavy ChiNext and STAR50 sitting 1.0% and 0.6% worse off, respectively.

- U.S. e-mini equity index futures turned bid on the Blinken-Lavrov meeting news, dealing 0.7%-0.8% higher heading into the European session. Note that the 3 major e-mini contracts struggled, or indeed failed, to print below their respective Thursday troughs in overnight trade.

OIL: Lower In Asia

WTI is ~-$0.70 and Brent is ~-$0.50 at typing. News of U.S. Secretary of State Blinken accepting an invitation to meet Russian FM Lavrov next week weighed on both benchmarks in Asia-Pac dealing. Note that the benchmarks still operate comfortably above their respective Wednesday troughs.

- Meanwhile, hope surrounding the potential for a U.S.-Iran nuclear deal remain elevated after a draft agreement re: the matter was flagged by Reuters on Thursday. The news agency suggested that most of the terms have been finalised, with some “thorny issues” still outstanding.

- In crude-specific news, the near-term supply outlook remains tight. U.S. shale producers continue to be wary when it comes to ramping up production, even in the wake of the recent surge in crude prices, with Devon Energy Corp. CEO Muncrief telling Bloomberg that the company has “had enough head fakes that we’re going to be very thoughtful in ramping activity up”.

- Looking to technical levels, recent dips in both benchmarks remain corrective. WTI and Brent sit above support at $88.41 (Feb 9 low) and $89.93 (Feb 8) respectively, while resistance remains situated at Feb 14 highs ($95.82 for WTI and $96.78 for Brent).

GOLD: Fresh Highs In Asia Amidst Ukraine Risk

Gold is ~$7/oz lower, printing $1,891.5/oz at writing, backing off from fresh eight-month highs made earlier in the session. The pullback came as Ukraine-induced safe haven demand eased a little overnight, following news of U.S. Secretary of State Blinken accepting an invitation to meet with Russian FM Lavrov late next week. Still, the proximity to multi-month highs points to continued worry when it comes to the Russia-Ukraine standoff.

- To recap, gold added the best part of $30/oz on Thursday as reports of indirect fire between Ukraine and pro-Russian separatists (within the separatist region of Luhansk) kicked geopolitical tensions higher. U.S. warnings of a possible Russian invasion of Ukraine continued to resonate, with spill over into early Asia trade evident, before the aforementioned pullback took place.

- Looking to technical levels, bullion remains a long way from support at $1,844.7 (Feb 15 low), while resistance at $1,903.1 (Jun 11 ’21 high) remains intact. A break through the latter would expose $1,916.6 (Jun 1 ’21 high).

FOREX: Safe Havens Lose Appeal On Prospect Of Blinken/Lavrov Talks Over Ukraine

Political risk pendulum swung towards optimism after the U.S. confirmed that its chief diplomat will meet with his Russian counterpart next week for diplomatic talks on the Ukraine crisis. The news assuaged fears of imminent military escalation, even as Western press reports continued to raise the prospect of Russian false flag operations, while the Donbas rebels blamed Kyiv for renewed shelling.

- High-beta currencies regained poise after headlines re: Blinken/Lavrov negotiations hit the wires, with the kiwi leading gains after showing resilience to geopolitical risk in early trade. Safe havens fell out of favour, with USD/JPY bouncing off its 50-DMA. The rouble edged higher but its appreciation was fairly limited in comparison with yesterday's sell-off.

- The data docket is headlined by UK & Canadian retail sales as well as U.S. existing home sales. Speeches are due from Fed's Evans, Williams & Brainard and ECB's Vasle & Panetta.

FOREX OPTIONS: Expiries for Feb18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E959mln), $1.1325-40(E1.6bln), $1.1345-55(E2.1bln), $1.1375-90(E3.6bln), $1.1450-60(E775mln)

- USD/JPY: Y113.95-05($1.7bln), Y114.20-40($1.5bln), Y114.45-60($2.2bln), Y115.00($635mln), Y115.45-50($1.1bln), Y117.00($1.9bln)

- EUR/GBP: Gbp0.8350(E1.3bln)

- EUR/JPY: Y132.00(E510mln)

- AUD/USD: $0.7045-55(A$705mln)

- AUD/NZD: N$1.0755(A$2.0bln)

- USD/CAD: C$1.2595-00($572mln), C$1.2615-35($1.5bln), C$1.2700($1.2bln), C$1.2740-60($1.2bln), C$1.2795-00($1.1bln)

- USD/CNY: Cny6.3500-20($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/02/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 18/02/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/02/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 18/02/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 18/02/2022 | 1000/1100 | ** |  | EU | construction production |

| 18/02/2022 | 1300/1400 |  | EU | ECB Elderson speech on industry climate risks | |

| 18/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 18/02/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 18/02/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/02/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/02/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 18/02/2022 | 1515/1015 |  | US | Chicago Fed's Charles Evans | |

| 18/02/2022 | 1515/1015 |  | US | Fed Governor Christopher Waller | |

| 18/02/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 18/02/2022 | 1830/1930 |  | EU | ECB Panetta on CB digital currencies | |

| 18/02/2022 | 1830/1330 |  | US | Fed Governor Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.