-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden & Putin To Meet… As Long As Russia Doesn’t Invade Ukraine

EXECUTIVE SUMMARY

- BIDEN AGREES TO MEET WITH PUTIN ‘IN PRINCIPLE’ IF RUSSIA HAS NOT INVADED UKRAINE (CNBC)

- BIDEN BELIEVES PUTIN HAS DECIDED TO ATTACK UKRAINE IN COMING DAYS (CNBC)

- U.S. SAYS RUSSIA MIGHT TARGET CITIES BEYOND KYIV (BBG)

- RUSSIA, UKRAINE & OSCE TO SPEAK MONDAY

- ECB GOVERNING COUNCIL TO HOLD 'INFORMAL' MEETING ON FEB 24 (BBG)

- CHINA SHOULD USE MORE MONETARY TOOLS TO STABILIZE GROWTH (CSJ)

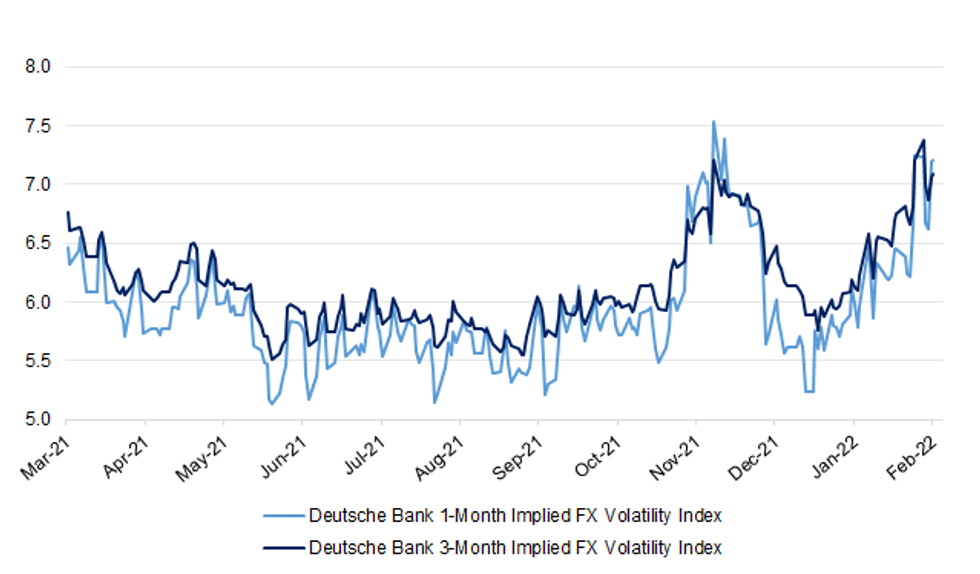

Fig. 1: Deutsche Bank 1- & 3-Month Implied FX Volatility Indices

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson’s government reiterated his intention to end the U.K.’s remaining Covid-19 restrictions, saying he would lay out a plan this week for “living with Covid.” The primve minister is expected to confirm “all regulations that restrict public freedoms will be repealed,” according to a statement on Saturday. Johnson earlier this month said he plans to end the legal requirement for people in England to self-isolate if they test positive. (BBG)

CORONAVIRUS: The over-75s and those who are clinically vulnerable will be given a fourth coronavirus jab within weeks as ministers prepare to outline plans for Britain to live with Covid-19 in the long term. (Sunday Times)

CORONAVIRUS: Queen Elizabeth II, the U.K.’s 95-year-old monarch, has tested positive for Covid-19, Buckingham Palace confirmed. The queen is experiencing mild “cold-like symptoms” but expects to continue “light duties” at Windsor over the coming week, the palace said. Concerns about the queen contracting Covid heightened this month after her son and heir to the throne, Prince Charles, tested positive after having had contact with her. (BBG)

POLITICS: Boris Johnson has refused to say whether he will resign if police say he has broken lockdown laws. The prime minister has returned his questionnaire to the Metropolitan Police who are investigating Downing Street parties. Asked in a BBC interview whether he would resign if police decide to take action, the PM said: "I can't comment about a process that is under way." (BBC)

POLITICS: Boris Johnson will be among the first to learn his fate in the "partygate" scandal, insiders believe, as Scotland Yard seeks to resolve the trickiest cases first. (Telegraph)

FISCAL: London’s transport authority could declare bankruptcy in a matter of days if the government fails to provide continued financial support. Transport for London (TfL) saw its income severely reduced during the Covid-19 pandemic because of the sudden lack of passengers travelling on the network. The government bolstered the public body, which relies on fare revenue to fund its operations, with a series of short-term funding deals. However, the latest ran out at midnight on Friday, and an extension is yet to be agreed. (Guardian)

IRELAND: Sinn Fein deputy leader Michelle O'Neill is urging the Irish government to prepare for a united Ireland as a result of Brexit. She says the Tories and DUP need to recognise that the controversial Irish Sea border is the consequence of their own decisions. Ms O'Neill, who could be the next first minister of Northern Ireland, believes the UK's exit from the EU will lead to a referendum on reunification. (Sky)

EUROPE

ECB: ECB President Lagarde tweeted the following on Friday: I will meet my fellow Governing Council members in Paris on 24 Feb for an informal get-together afternoon, a day before we meet with EU finance ministers. This is the first gathering in person for a long time and a chance to discuss a wide range of topics. I look forward to it. (MNI)

GERMANY: Germany spent about 42 billion euros ($48 billion) on a program to secure jobs threatened by the coronavirus pandemic. A government program to pay most of an employee’s wages when they can’t work because of operational issues like lockdowns was worth the cost, Germany’s Labor Minister Hubertus Heil said in an interview with Tagespiegel on Sunday. (BBG)

GERMANY: Travelers from the U.S., the U.K., Spain and Ireland and a dozen other countries won’t have to quarantine if they travel to Germany. The country’s public-health institute removed the nations from a list of high-risk countries as of Sunday. (BBG)

ITALY: Italy’s government approved almost 8 billion euros ($9 billion) in aid to shield consumers and companies from soaring energy prices that are weighing on the economic outlook. Some 6 billion euros were allocated for energy aid, while other funds will support industries including the automotive sector, Prime Minister Mario Draghi told reporters on Friday. (BBG)

IRELAND: Ireland will drop most remaining restrictions at the end of this month. Masks will no longer be mandatory in shops and public transport, while Covid precautions in schools including masks and social distancing will be removed. The outlook for the virus is “positive,” health minister Stephen Donnelly said in a statement. The move comes as the number of people with Covid-19 in hospital continues to decline. While there were 8,593 new cases registered on Friday, the number of people in hospital has dropped by almost half in the last month. (BBG)

SWEDEN: Swedish residential property prices rose 2.7% on the month in January, according to the Nasdaq OMX Valueguard-KTH Housing Index. HOX Sweden index rose 2.9% in the 3 months through January and rose 10.5% y/y. Adjusted for seasonal effects, the index rose 0.6% m/m in January. (BBG)

RATINGS: Rating reviews of note from Friday include:

- Fitch affirmed the European Union and Euratom at AAA; Outlook Stable

- Fitch affirmed Poland at A-; Outlook Stable

U.S.

FED: Federal Reserve Governor Lael Brainard said the U.S. central bank is ready to raise interest rates next month and begin shrinking its balance sheet in coming meetings. “Given we have seen quite strong data, I do anticipate it will be appropriate at our next meeting to initiate a series of rate increases,” Brainard said Friday during a panel discussion at a conference in New York hosted by the University of Chicago Booth School of Business. (BBG)

FED: Federal Reserve Bank of New York President John Williams is on board with the U.S. central bank starting to raise rates next month, but he leaned against the idea that the effort will need to start with big increases to bring down “far too high” levels of inflation. “With today’s strong economy and inflation that is well above our 2% longer-run goal, it is time to start the process of steadily moving the [Fed’s benchmark interest-rate] target range back to more normal levels,” Mr. Williams said in a virtual appearance Friday. (WSJ)

FED: Federal Reserve chief Jerome Powell will testify before Congress on March 2 and 3 in what are likely to be his final public remarks on monetary policy before the U.S. central bank begins raising interest rates to fight decades-high inflation. Powell will deliver his regular semiannual monetary policy update to the U.S. House Financial Services Committee on March 2 and appear before the Senate Banking Committee on March 3. (RTRS)

FED: Federal Reserve officials won’t be able to trade a slew of assets including stocks and bonds — as well as cryptocurrencies — under new rules that became formal Friday. Following up on regulations announced in October, the policymaking Federal Open Market Committee announced that most of the restrictions will take effect May 1. (CNBC)

CORONAVIRUS/POLITICS: U.S. Capitol Police are preparing for a possible protest by a convoy of truckers arriving in Washington around the date of President Biden’s State of the Union address. In a statement Friday, the Capitol Police said local, state and federal law enforcement agencies as well as the District of Columbia National Guard are “aware of plans for a series of truck convoys” arriving in the city around the time of Biden’s March 1 address and are coordinating security planning. The officials briefed congressional staff on the status of those plans Friday afternoon. (BBG)

OTHER

GLOBAL TRADE: The Pentagon plans to boost the stockpile of rare earth minerals, cobalt and lithium it manages for the U.S. government to reduce its long-term dependence on China, two people familiar with the plan said. RTRS)

BOJ: MNI INTERVIEW: BOJ Must Defend Yields Despite Price Surge - Masai

- Higher prices hitting some businesses do not warrant any policy adjustment by the Bank of Japan, which should curb undesirable rises in interest rates via its yield curve control framework even if inflation briefly passes 2%, former BOJ board member Takako Masai told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA/CHINA: Australian Prime Minister Scott Morrison branded a Chinese navy vessel pointing a laser at one of his nation’s surveillance aircraft off the northern coast an “act of intimidation.” The incident occurred three days ago when a P-8A Poseidon patrol plane detected a laser from a Chinese naval ship sailing east through the Arafura Sea, Australia’s Department of Defense said in a statement late Saturday. Morrison responded early Sunday in televised comments in Melbourne. “I’m very concerned about the actions of using the lasers,” he said. “That is, I can see it no other way than an act of intimidation, one that was unprovoked, unwarranted and Australia will never accept such acts of intimidation.” (BBG)

RBNZ: The Shadow Board is calling for a sharp increase in the official cash rate (OCR) over the coming year in the face of intensifying inflation pressures. There was an overwhelming call for the OCR to be increased by 25 basis points to 1 percent at the upcoming meeting, with some appetite for a 50 basis points OCR increase. Beyond the February meeting, there was a wider range in views of how high the OCR needs to go in twelve months’ time. (NZIER)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern said she will start to ease Covid-19 restrictions after the current omicron outbreak has peaked, including the removal of some vaccine mandates that are the main complaint of protesters occupying parliament’s grounds. The government expects the wave of omicron cases sweeping through the population to peak in three to six weeks, Ardern told a news conference Monday in Wellington. “At that point, if we follow the pattern of other countries, we’ll likely see a rapid decline, followed by cases stabilizing at a lower level,” she said. “That is the point when we can start to do things differently.” (BBG)

NEW ZEALAND: Finance Minister Grant Robertson announces targeted Covid Support Payment for businesses struggling with revenue during the omicron outbreak. “We can see that the majority of the economy is operating close to normal, but in some sectors, like hospitality and events, there has been a significant drop-off in business”. “It is clear that the impact is putting a number of viable businesses at risk of not being able to operate”. Support payment will be NZ$4,000 per business plus NZ$400 per full-time employee, capped at 50 FTEs or NZ$24,000. Firms must show a 40% drop in seven consecutive days within the six weeks prior to the shift to Phase 2 of the omicron response on Feb. 15. (BBG)

SOUTH KOREA: Ruling Democratic Party and main opposition People Power Party agreed to convene a plenary session Monday to push through extra budget aimed to support self-employed small enterprises, Yonhap News says, citing the two parties. Size of extra budget may be raised to about 17.5t won from govt’s initial proposal of 14t won. PPP had previously opposed to pass the measure, but agreed with the ruling party to revise the draft and submit to the session. (BBG)

BOC: Bank of Canada said Friday Deputy Gov. Lawrence Schembri is retiring. He's scheduled to leave the central bank on June 17. He was appointed deputy governor in 2013, after joining the central bank in 1997. As deputy governor, he is a member of the council that decides on interest-rate policy. Since 2016, Mr. Schembri has had responsibility over domestic-economic developments. "His contributions to central banking, here in Canada and internationally, have been innumerable," said Bank of Canada Gov. Tiff Macklem in a statement. (dow Jones)

CANADA: Police said they have largely cleared downtown Ottawa of the anti-vaccine protests that have roiled Canada and its capital for the last three weeks, as a financial crackdown widened to help prevent similar disturbances. “The number of unlawful protesters has dramatically declined in the last 24 hours,” Ottawa’s interim police chief, Steve Bell, said in a press conference Sunday. Though still facing pockets of protest, the police have made 191 arrests, with 107 people charged so far. Much of the city’s downtown is still ringed with fencing and subject to checkpoints to ensure protesters don’t return. (BBG)

RUSSIA: President Joe Biden has accepted “in principle” a meeting with Russian President Vladimir Putin in what could represent a last-ditch effort at diplomacy over tensions surrounding Ukraine and a possible avenue to avert a looming invasion directed by Moscow. Jen Psaki, the White House press secretary, said Sunday evening that the summit between the two world leaders would happen following a meeting between Secretary of State Antony Blinken and his Russian counterpart, Foreign Minister Sergey Lavrov. That meeting is scheduled for later this week. Psaki noted that the agreement is conditioned on Moscow holding off on an invasion. (CNBC)

RUSSIA: President Joe Biden said Friday that the United States believes that Russian President Vladimir Putin has decided to carry out an attack on Ukraine “in the coming days.” “We have reason to believe the Russian forces are planning and intend to attack Ukraine in the coming week, in the coming days,” Biden said in remarks at the White House. “We believe that they will target Ukraine’s capital, Kyiv, a city of 2.8 million innocent people.” (CNBC)

RUSSIA: U.S. President Biden tweeted the following on Friday: "We're calling out Russia’s plans. Not because we want a conflict, but because we are doing everything in our power to remove any reason Russia may give to justify invading Ukraine. If Russia pursues its plans, it will be responsible for a catastrophic and needless war of choice." (MNI)

RUSSIA: President Joe Biden's administration has prepared an initial package of sanctions against Russia that includes barring U.S. financial institutions from processing transactions for major Russian banks, three people familiar with the matter said. The measures, which would only be implemented if Russia invades Ukraine, aim to hurt the Russian economy by cutting the "correspondent" banking relationships between targeted Russian banks and U.S. banks that enable international payments. While U.S. authorities have said banking restrictions would be part of a package of possible sanctions, the administration's plan to cut correspondent banking ties - which underpin global money flows - has not previously been reported. The United States will also wield its most powerful sanctioning tool against certain Russian individuals and companies by placing them on the Specially Designated Nationals (SDN) list, effectively kicking them out of the U.S. banking system, banning their trade with Americans and freezing their U.S. assets, the same sources said. (RTRS)

RUSSIA: Multiple US and western government officials tell CNN that the US has intelligence that Russia has drawn up lists of current political figures that it would target for removal in the event it invades Ukraine and topples the current government in Kyiv. Sources familiar with the intelligence say the target lists are part of Russian planning to replace the current administration in Kyiv with a more Russia-friendly government, bolstering a previous disclosure by the British government identifying pro-Moscow figures it said Russia planned to install. (CNN)

RUSSIA: The U.S. has told allies that any Russian invasion of Ukraine would potentially see it target multiple cities beyond the capital Kyiv, according to three people familiar with the matter. Cities that could also come under attack include Kharkiv in the northeast and Odessa and Kherson in the south, said the people, all Western officials who asked not to be identified talking about such sensitive matters. They did not provide details on the intelligence they said underlined these calculations. (BBG)

RUSSIA: The trilateral contact group -- Russia, Ukraine and the OSCE -- will hold talks Monday to work toward a restoration of the cease-fire in Ukraine’s Donbas region, a French official said. Presidents Emmanuel Macron and Vladimir Putin agreed to the talks during their call on Sunday, the official said. (BBG)

RUSSIA: U.S. intelligence on Russia’s intentions toward Ukraine and a potential invasion within days is solid, Vice President Kamala Harris told reporters on Sunday. “Putin has made his decision. Period,” Harris said as she prepared to return to the U.S. from two days of high-level meetings at the Munich Security Conference. Russia has said repeatedly it has no plans to attack Ukraine. (BBG)

RUSSIA: A US defence official is now estimating that 40% to 50% of Russian troops deployed in the vicinity of the Ukrainian border are now in attack positions. The number of Russian ground units in the area - known as battalion tactical groups - has also grown to between 120 and 125, compared with 83 two weeks ago. (Sky)

RUSSIA: The U.S. embassy in Moscow on Sunday issued a security warning regarding possible threats in Moscow and St. Petersburg. "According to media sources, there have been threats of attacks against shopping centers, railway and metro stations, and other public gathering places in major urban areas, including Moscow and St. Petersburg as well as in areas of heightened tension along the Russian border with Ukraine," according to the alert. (Axios)

RUSSIA: The U.S. embassy in Russia cautioned Americans on Sunday to have evacuation plans. "There have been threats of attacks against shopping centres, railway and metro stations, and other public gathering places in major urban areas, including Moscow and St. Petersburg as well as in areas of heightened tension along the Russian border with Ukraine," the embassy said. "Review your personal security plans," the embassy said. "Have evacuation plans that do not rely on U.S. government assistance." (RTRS)

RUSSIA: The White House believes Russia is responsible for recent cyberattacks targeting Ukraine's major banks and Ministry of Defense, a top administration official said Friday. Deputy national security adviser Anne Neuberger made the attribution at the White House, as tensions escalated between Russia and Ukraine. "We believe that the Russian government is responsible for widespread cyberattacks on Ukrainian banks this week," Neuberger said. "We have technical information that links the Russian Main Intelligence Directorate or GRU. GRU infrastructure was seen transmitting high volumes of communication to Ukraine based IP addresses and domains." Neuberger noted that the denial of service or "DDoS" and spam attack had "limited impact" within Ukraine, but said the most recent incident of malicious digital activity could precede "more disruptive cyberattacks accompanying a potential further invasion of Ukraine's sovereign territory." The U.S. has shared underlying intelligence with Ukraine and with European partners, Neuberger added. (CBS)

RUSSIA: Western countries repeatedly predicting dates for a Russian invasion of Ukraine is provocative and can have adverse consequences, Kremlin spokesperson Dmitry Peskov was quoted as saying by the Interfax news agency on Sunday. Russian President Vladimir Putin takes no notice of such Western statements, Peskov said, adding that Moscow appeals to Western partners' reason. (RTRS)

RUSSIA: The Russian Embassy in the U.S. tweeted the following on Saturday: "We have taken note of purely anti-Russian statements of Deputy National Security Advisor Anne Neuberger, who accused the Russian special services of cyberattacks on Ukrainian defense agencies and banks. We categorically reject these baseless statements of the administration and note that Russia has nothing to do with the mentioned events and in principle has never conducted and does not conduct any "malicious" operations in cyberspace." (MNI)

RUSSIA: German Chancellor Olaf Scholz's dismissal of Moscow's assertion of genocide in the east Ukraine region of Donbass held by pro-Russia rebels is "unacceptable," Interfax newsagency reported on Saturday, citing the foreign ministry. "This is not for German leaders to make a joke of genocide issues," the Russian foreign ministry said, according to Interfax. Earlier on Saturday, Scholz said Russian President Vladimir Putin's assertion that Ukraine was committing genocide in the Donbass region was ridiculous. (RTRS)

RUSSIA: Russia test-launched an array of ballistic and cruise missiles Saturday in a pointed display of its nuclear and conventional military might amid a standoff with the West over Ukraine. President Vladimir Putin oversaw the launches from a command center at the Kremlin alongside his Belarusian ally and counterpart Alexander Lukashenko. (WSJ)

RUSSIA: Russia will extend military drills in Belarus that were due to end on Sunday, the Belarusian defence ministry announced, in a step U.S. Secretary of State Antony Blinken said made him more worried about an imminent Russian invasion of Ukraine. The defence ministry said the decision was taken because of military activity near the borders of Russia and Belarus as well as the situation in eastern Ukraine's Donbass region. (RTRS)

RUSSIA: The head of the self-proclaimed Donetsk People's Republic, Denis Pushilin, said that he'd signed a decree on general mobilisation in the republic. "I urge fellow countrymen who are in reserve to come to the military commissariats. Today I signed a decree on general mobilisation," Pushilin said. (Sputnik)

RUSSIA: President Volodymyr Zelenskiy on Saturday said Ukraine would not respond to provocations in the eastern Donbass region and would strive to establish peace through diplomacy. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelensky told Western leaders gathered at a security conference in Munich on Saturday that he wants sanctions to be imposed against Russia before any potential invasion of his country, not after. "You're telling me that it's 100% that the war will start in a couple of days. Then what [are you] waiting for?" Zelensky said. "We don't need your sanctions after the bombardment will happen, and after our country will be fired at or after we will have no borders or after we will have no economy or parts of our country will be occupied. Why would we need those sanctions then?" (CBS)

RUSSIA: A blast was heard early on Monday in the centre of the city of Donetsk, which is held by Russian-backed separatists in eastern Ukraine, a Reuters witness said. The origin of the blast was unclear. Russian-backed rebels in eastern Ukraine said on Monday two civilians were killed in shelling by the Kyiv government forces, Russia's RIA news agency reported. RIA cited representatives of the self-proclaimed Luhansk People's Republic as saying that the incident occurred late on Sunday. (RTRS)

RUSSIA: Ukraine's military on Saturday said that mercenaries had arrived in separatist-held eastern Ukraine to stage provocations in collaboration with Russia's special services. "The purpose of these provocations will, of course, be to accuse Ukraine of further escalation," the military said in a statement. Ukraine has accused Russia of planning to stage provocations that could lead to civilian casualties in eastern Ukraine in order to give Moscow a pretext to attack its neighbour. (RTRS)

RUSSIA: German Foreign Minister Annalena Baerbock said on Saturday comments by Ukrainian separatists in the past 24 hours appeared to follow the false flag script many people had predicted, warning that this must not become a justification for war. (RTRS)

RUSSIA: Western allies were still determined to dissuade Russia from invading Ukraine and were worried reports of explosions in eastern Ukraine looked similar to pretexts of this kind used by Russia before, a French presidential official said on Friday. (RTRS)

RUSSIA: Vladimir Putin will keep waging war on neighbouring countries if he is allowed to invade Ukraine, Foreign Secretary Liz Truss has warned. As the Russian President put on a huge show of military strength with nuclear drills involving ballistic missiles, submarines and tank convoys yesterday, Ms Truss issued a last-ditch plea for the international community to unite to face down Moscow's aggression. Ms Truss used an exclusive interview with The Mail on Sunday to argue that if Putin attacked Ukraine it would be a precursor to Russia using force to annex more former Soviet states. 'We need to stop Putin because he will not stop at Ukraine. (Mail On Sunday)

RUSSIA: German Chancellor Olaf Scholz on Saturday rejected calls from Ukraine’s president to sanction Russia now, saying that Moscow should not be sure “exactly” how the West will respond to a potential invasion. Speaking to CNBC’s Hadley Gamble at Germany’s annual Munich Security Conference, Scholz said that Western allies were “well prepared” to sanction Russia — and quickly — if it were to invade Ukraine. But he said that such measures should remain a last resort in the hopes finding of a peaceful resolution to ongoing tensions. (CNBC)

RUSSIA: Chinese Foreign Minister Wang Yi on Saturday called the Minsk Agreement the "only way out" for resolving the Ukraine situation, and said Ukraine should not be a frontline for competition among major powers. (RTRS)

RUSSIA: European Commission President Ursula von der Leyen has told CNBC that energy sanctions against Russia are still an option if the country invades Ukraine. When asked about the possibility of imposing sanctions on Russian gas giant Gazprom, von der Leyen said Saturday, “everything is on the table.” (CNBC)

RUSSIA: Any sanctions that may be imposed on Russia by the European Union should not include energy imports, Italian Prime Minister Mario Draghi said on Friday. Draghi told reporters that the European Union was studying various sanctions options if Russia pushes ahead with a feared invasion of Ukraine. (RTRS)

RUSSIA: German Chancellor Olaf Scholz has told CNBC that the West has to work “very hard” to find alternative sources of energy beyond Russia as talks of potential sanctions intensify. Speaking to CNBC’s Hadley Gamble at the annual Munich Security Conference, Scholz stressed that much of the West is reliant upon Russia’s energy supplies. (CNBC)

RUSSIA: Germany fears Russia could retaliate against western sanctions in the event of war with Ukraine by cutting off gas supplies, its finance minister has said, a move that could cripple Europe’s largest economy. Christian Lindner told the Financial Times that Russia had always been a reliable supplier of natural gas to Germany, even at the height of the cold war. But that could change if Russia invaded Ukraine and the west punished Moscow with a swingeing sanctions package. (FT)

RUSSIA: Russian gas supplies to Europe were not affected after part of a gas pipeline near Luhansk in eastern Ukraine caught fire late on Friday, a Ukrainian gas official said. (RTRS)

RUSSIA: A state of emergency has been introduced in the Kursk region in connection with the arrival of internally displaced persons from Donbass, the Ministry of Emergency Situations reported. "At present, due to the arrival of a large number of citizens of Donbass , a regional emergency regime has been declared in a number of regions of the Russian Federation - Rostov, Voronezh and Kursk regions ," the ministry said. (RIA)

RUSSIA: Britain's foreign ministry said on Friday the country's embassy in Ukraine was moving away from the capital Kyiv and it told British nationals to leave the country while commercial means of travel were still available. The embassy office in Kyiv was relocating temporarily and staff were operating from an embassy office in the city of Lviv, the ministry said. "Any Russian military action in Ukraine would severely affect the British government’s ability to provide consular assistance in Ukraine," the ministry said. "British nationals should not expect increased consular support or help with evacuating in these circumstances." (RTRS)

IRAN: Efforts to revive Iran’s nuclear agreement with world powers are still bogged down over disagreements despite high-level diplomacy on Saturday, with Germany’s chancellor warning that it’s now or never to save the accord. Negotiations in Vienna to rekindle the 2015 deal -- which traded sanctions relief for limits on Iran’s nuclear work -- are in their 10th month, with diplomats suggesting talks should wrap up by the end of February. (BBG)

IRAN: Iran is ready to swap prisoners with the United States, Iran's foreign minister said on Saturday, adding that talks to revive a 2015 nuclear deal could succeed "at the earliest possible time" if the United States makes the necessary political decisions. (RTRS)

IRAN: Iranian lawmakers have laid out six conditions for the revival of the 2015 Iran nuclear deal with global powers in a letter to President Ebrahim Raisi published on Sunday, the country's official IRNA news agency reported. The letter, signed by 250 out of 290 parliamentarians, stated that U.S. and European parties should guarantee that they would not exit a restored agreement, nor trigger the "snapback mechanism" under which sanctions on Iran would be immediately reinstated if it violates nuclear compliance. (RTRS)

IRAN: Iran is ready to swap prisoners with the United States, Iran's foreign minister said on Saturday, adding that talks to revive a 2015 nuclear deal could succeed "at the earliest possible time" if the United States makes the necessary political decisions. (RTRS)

IRAN: Iran is demanding during the nuclear talks in Vienna that the U.S. remove the Islamic Revolutionary Guard Corps (IRGC) from a blacklist of foreign terrorist organizations as a condition for a nuclear deal, Israeli Prime Minister Naftali Bennett said on Sunday. (Axios)

OIL: OPEC+ should stick to its current agreement to add 400,000 barrels per day a month to output, Arab oil and energy ministers said on Sunday as they gathered in Riyadh for the 2022 International Petroleum Technology Conference (IPTC). (RTRS)

OIL: Saudi Arabia’s energy minister said that OPEC+ must stay together for the long-term stability of the oil market. “We need to keep this consensus building approach to be with us permanently because without it we will lose sight of our collective ambition,” Saudi Energy Minister Prince Abdulaziz bin Salman said at an energy conference in Riyadh Sunday. “Ask any producer of oil and gas today, if it were not for OPEC+ would they be the chairmen and the CEOs of today? And the answer: they would have vanished.” (BBG)

OIL: Canada said on Friday it will halt any further public funding for the Trans Mountain oil pipeline expansion, after the government-owned company behind the project said costs had surged 70% to C$21.4 billion ($16.8 billion). (RTRS)

CHINA

PBOC: China should take further monetary measures such as cutting reserve requirement ratio or interest rates, or strengthening flexibility of yuan exchange rate, to boost demand and market confidence, China Securities Journal says in a front-page report, citing unidentified experts. External environment is becoming more complex, severe and uncertain. In order to stabilize the economy, stabilize market expectations and boost the confidence of all parties, counter-cyclical and cross-cyclical adjustment measures should be strengthened firmly. In terms of fiscal policy, China should boost spending on employment and continue to reduce fees for small companies, while speeding up investment of proceeds raised from issue of local government special bonds. (BBG)

PBOC: The People’s Bank of China could make small cuts to the reserve requirement ratios in Q1 to achieve a desirable level of growth in credit and aggregate finance throughout the year, so as to meet the funding demand of rising infrastructure investment, Lian Ping, the chief economist of Zhixin Investment Research Institute, wrote in an article published by news service Yicai.com. By Lian’s calculation, there could be about CNY1.3 trillion extra funds from local government special bonds to be invested in infrastructure projects this year when compared to 2021, which may create as much as CNY5.2 trillion social financing needs. Failing to meet these needs may reduce fiscal policy's pro-growth impact, Lian said. (MNI)

YUAN: The yuan, which traded near a four-year high against the dollar last week, may lose some steam pressured by liquidity tightening measures outside China, a rising U.S. dollar index, and the narrowing China-U.S. interest spread, the China Securities Journal reported citing analysts. Support from exports and forex settlement could also be weakening, and the currency will again be close-related to the dollar index movement, the newspaper said. However, a strong inventory of the dollar inside China and businesses' needs to convert their forex to yuan could help lessen the yuan's depreciation, the newspaper said. The Chinese currency surged past 6.33 last week. (MNI)

INVESTMENT: China’s newest project to build eight national computing hubs and 10 data centers is expected to create over CNY400 billion yuan of investments each year, the China Securities Journal reported. The project aims to channel more computing resources from the country's eastern regions to the less-developed west. This will better empower the development of the digital economy, as the demand for computing power is growing by more than 20% annually, the newspaper said. (MNI)

BONDS: China’s securities regulator vowed to prevent and resolve bond default risks and improve regulatory regime in the debt market. The country will also deepen reforms of bond issuance, registration systems and open up further to foreign investors, the China Securities Regulatory Commission said in a statement, citing a 2022 working meeting held on Friday. It didn’t elaborate further. (BBG)

OVERNIGHT DATA

CHINA JAN NEW HOME PRICES -0.04% M/M; DEC -0.28%

JAPAN FEB, P JIBUN BANK M’FING PMI 52.9; JAN 55.4

JAPAN FEB, P JIBUN BANK SERVICES PMI 42.7; JAN 47.6

JAPAN FEB, P JIBUN BANK COMPOSITE PMI 44.6; JAN 49.9

Activity at Japanese private sector businesses contracted sharply during February as the Omicron variant of COVID-19 led to record case numbers and renewed restrictions in Japan. The decline was the second in successive months though was the sharpest recorded for 20 months and came amid the steepest downturn in the services sector since the first wave of the pandemic in May 2020. Moreover, manufacturers signalled a reduction in output for the first time in five months, though the rate of contraction was considerably softer than that seen in the dominant services sector, and was only mild overall. Private sector firms also noted a decrease in aggregate new business for the first time since September, largely driven by domestic reductions while new export orders broadly stagnated. Firms continued to report that rising input prices and material shortages, notably in fuel and metals continued to dampen private sector activity. In fact, February saw the strongest rise in average cost burdens since August 2008. Companies were optimistic that activity would improve in the year ahead, though the continued resurgence of COVID-19 had clouded the outlook and drove optimism to a six-month low. (IHS Markit)

AUSTRALIA FEB, P MARKIT AUSTRALIA M’FING PMI 57.6; JAN 55.1

AUSTRALIA FEB, P MARKIT AUSTRALIA SERVICES PMI 56.4; JAN 46.6

AUSTRALIA FEB, P MARKIT AUSTRALIA COMPOSITE PMI 55.9; JAN 46.7

The Australian economy bounced back quickly in February, according to the IHS Markit Flash Australia Composite PMI, after contracting sharply at the start of 2022, hit by the COVID-19 Omicron wave. Demand and output both returned to growth, boding well for hiring activity in February. That said, shortages of input materials and labour persisted as issues for private sector firms. This led to input prices continuing to increase sharply while selling price inflation hit a record according to the latest PMI survey. While this perhaps comes as no surprise in the initial recovery phase from the latest COVID-19 wave, the lingering impact on overall inflation and wages will have to be closely followed. Business confidence amongst private sector firms improved once again in February after briefly dipping in January, reflecting the short-lived nature of the latest COVID-19 wave, which was a positive sign. (IHS Markit)

SOUTH KOREA FEB 1-20 EXPORTS +13.1% Y/Y; JAN +22.0%

SOUTH KOREA FEB 1-20 IMPORTS +12.9% Y/Y; JAN +38.4%

UK FEB RIGHTMOVE HOUSE PRICES +9.5% Y/M; JAN +7.6%

UK FEB RIGHTMOVE HOUSE PRICES +2.3% M/M; JAN +0.3%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS MONDAY, LIQUIDITY UNCHANGED

- The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1154% at 09:44 am local time from the close of 2.0910% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 50 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3401 MON VS 6.3343

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3401 on Monday, compared with 6.3343 set on Friday.

MARKETS

SNAPSHOT: Biden & Putin To Meet… As Long As Russia Doesn’t Invade Ukraine

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 191.81 points at 26935.12

- ASX 200 up 11.886 points at 7233.6

- Shanghai Comp. down 4.46 points at 3485.943

- JGB 10-Yr future up 11 ticks at 150.14, yield down 0.6bp at 0.210%

- Aussie 10-Yr future up 3 ticks at 97.77, down 2.7bp at 2.220%

- U.S. 10-Yr future -0-01 at 126-20+, cash Tsys are closed

- WTI crude down $0.17 at $90.98, Gold down $4.5 at $1893.57

- USD/JPY down 4 pips at Y114.97

- BIDEN AGREES TO MEET WITH PUTIN ‘IN PRINCIPLE’ IF RUSSIA HAS NOT INVADED UKRAINE (CNBC)

- BIDEN BELIEVES PUTIN HAS DECIDED TO ATTACK UKRAINE IN COMING DAYS (CNBC)

- U.S. SAYS RUSSIA MIGHT TARGET CITIES BEYOND KYIV (BBG)

- RUSSIA, UKRAINE & OSCE TO SPEAK MONDAY

- ECB GOVERNING COUNCIL TO HOLD 'INFORMAL' MEETING ON FEB 24 (BBG)

- CHINA SHOULD USE MORE MONETARY TOOLS TO STABILIZE GROWTH (CSJ)

BOND SUMMARY: Core FI Back From Early Highs, Asia Subjected To Broader Risk Swings

Core FI markets initially drew support from weekend developments surrounding the Russia-Ukraine situation, with continued warnings from the U.S. re: the threat of an imminent Russian invasion of Ukraine (which could target multiple cities if it materialises, according to BBG sources) and the now indefinite stay of Russian troops in Belarus front and centre. The broader risk picture then became more constructive as we learnt that U.S. President Biden and Russian President Putin have struck an agreement in-principle re: a meeting, although that is contingent on no Russian invasion of Ukraine (it would seem that Thursday’s Blinken-Lavrov meeting will be used to flesh out the details of the Presidential level talks). Still, core FI traded lower on the back of the Biden-Putin meeting news.

- TYH2 has been a little unwilling to probe meaningfully below neutral levels, with markets perhaps a little sceptical ahead of the Blinken-Lavrov meeting. TYH2 last dealing at 126-19+, -0-02 on the day, operating in a 126-18+ to 126-29+ range thus far, on over 145K lots. Note that the details of the White House read out re: the potential Biden-Putin meeting did not withdraw the idea that a Russian invasion of Ukraine is in the offing, which may have limited the downward impetus fleshed out above. A reminder that Cash Tsys will remain closed on Monday, while Tsy futures will be subjected to curtailed trading hours owing to the observance of the President’s Day holiday in the U.S.

- JGB futures followed the broader gyrations in risk appetite, with the Ukraine situation front and centre. Futures built on their overnight gains in early Tokyo dealing, before fading on the back of the Biden-Putin summit agreement in principle, hitting the bell +11. The long end of the curve led the bid for a second consecutive day, with participants seemingly happy to take the lead of Friday’s U.S. Tsy market bull flattening. That left the major JGB benchmarks little changed to 5.5bp richer late in the Tokyo day. A reminder that Friday’s Tokyo session saw some dip their toe into the longer end of the JGB curve after the notable steepening witnessed in recent weeks, resulting in bull flattening. This came after the 1.0% level held in 30-Year JGB yields. BoJ Rinban operations covering 1- to 10-Year JGBs may have offered some modest support, although a lack of movement in offer/cover ratios point to a lack of meaningful impact.

- Offshore dynamics remain front and centre for the Aussie bond space, with futures drifting lower into the Sydney bell. That left YM +2.0 & XM +3.0, with a chunk of the overnight/early Sydney gains pared. There hasn’t been much of note on the local news front, while the latest round of ACGB supply wasn’t a catalyst for wider market activity.

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 Jun ‘35 Bond, issue #TB145

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 June 2035 Bond, issue #TB145:

- Average Yield: 2.3456% (prev. 2.1526%)

- High Yield: 2.3475% (prev. 2.1550%)

- Bid/Cover: 3.1600x (prev. 2.2480x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 41.9% (prev. 27.8%)

- Bidders 48 (prev. 38), successful 15 (prev. 23), allocated in full 6 (prev. 12)

EQUITIES: Most Asia Benchmarks Lower Despite Easing In Russia-Ukraine Tensions

Most of the major Asia-Pac equity index benchmarks look set to close lower, despite bouncing from worst levels following news that U.S. President Biden and Russian President Putin have agreed to meet in-principle re: Ukraine. This came after most Asia-Pac equity indices opened sharply lower on a negative lead from Wall St.

- The CSI300 trades 0.5% lower, led by broad losses in infrastructure, materials, and new energy stocks. The PBoC kept benchmark lending rates for corporate and household loans unchanged, providing no surprises to market participants.

- The Hang Seng is 0.6% worse off, led by a 1.6% decline in the Hang Seng Tech Index. To elaborate, high-beta Chinese-linked tech struggled amidst renewed regulatory worry arising from the Chinese authorities ordering food delivery platforms to lower fees last Friday. The Hang Seng Properties Index fell by 1.1% as well, following a worsening in Hong Kong’s COVID-19 situation that has seen property developers engaged in pandemic measures such as the provision of rooms for quarantine purposes. Meanwhile, worry surrounding Chinese property developer debt has re-emerged, seeing China-based (but Hong Kong-listed) developers such as Sunac China Holdings and Zhenro Properties Group bearing the brunt of losses (note that the latter has flagged a potential problem when it comes to meeting debt repayment obligations due in March).

- The Australian ASX200 was the only major regional equity index to trade higher, adding 0.2%.

- E-minis surged on news of the aforementioned Biden-Putin summit agreement in-principle, and now deal 0.5-0.6% higher ahead of European hours.

OIL: Off Best Levels In Asia

WTI and Brent are -$0.20 at typing, backing away from session highs after we learnt that U.S. President Biden and Russian President Putin have agreed to meet in-principle re: Ukraine. Both benchmarks continue to operate comfortably above Friday’s lows, as the lingering worry surrounding the Russia-Ukraine situation remains evident.

- White House spokesperson Psaki noted that “Russia appears to be continuing preparations for a full-scale assault on Ukraine very soon” in remarks re: the Biden-Putin summit, following Bloomberg source reports of the U.S. warning allies that a Russian invasion would target multiple cities beyond Kyiv.

- Elsewhere, hope surrounding a potential U.S-Iran nuclear agreement remains elevated, providing some counter to the impulse from the Russia-Ukraine standoff. To recap, a Reuters report on Friday carried remarks from a senior European Union official stating that an agreement could come “in the coming week, the coming two weeks or so”, and that the text of the agreement was now “very, very close to what is going to be the final agreement.”

- A note that both benchmarks notched lower weekly closes last Friday, breaking an 8-week streak of gains.

- Looking to technical levels, recent dips in WTI and Brent still leave them trading well above their respective support levels at $88.41 (Feb 9 low) and $89.93 (Feb 8), while resistance remains intact at Feb 14 highs ($95.82 for WTI and $96.78 for Brent).

GOLD: Pullback From Cycle Highs As Biden & Putin To Meet

Gold is ~$2/oz lower, printing $1,896.4/oz at writing. The precious metal has pulled back from fresh eight-month highs registered earlier in the session ($1,908.3/oz) after U.S. President Biden and Russian President Putin agreed to meet (in principle) at a summit brokered by French President Macron, as fluid developments surrounding the Russia-Ukraine situation continue to dominate price action.

- The early move higher was facilitated by a weekend Bloomberg source report which stated that the U.S. had informed allies that a Russian invasion would likely target “multiple cities beyond the capital Kyiv” in the case of an attack. Ultimately, risks re: the escalation of the situation in Ukraine remain apparent, with White House spokesperson Psaki stating that “we are always ready for diplomacy,” but “Russia appears to be continuing preparations for a full-scale assault on Ukraine very soon,” in remarks re: the Biden-Putin summit.

- Looking ahead, U.S. Secretary of State Blinken and Russian FM Lavrov are due to meet this Thursday to establish further details of the meeting between the Presidents of the two countries.

- On the technical front, the early move higher saw a push through initial technical resistance, which has allowed bulls to switch focus to medium-term resistance at $1,916.6/oz (Jun 1 ’21 high). Support remains in place at $1,844.7/oz (Feb 15 low).

FOREX: Prospect Of Biden-Putin Summit Revives Sentiment

Initial risk aversion evaporated as the Élysée Palace released a statement noting that U.S. President Biden and his Russian counterpart Putin have agreed in principle to attend a security summit proposed by French President Macron, to be held on the condition that Russia does not invade Ukraine. The news came after a flurry of weekend headlines flagging the elevated risk of escalation, raising hopes that diplomatic efforts could lower the temperature of the standoff.

- The yen lost its earlier allure and retreated along safe haven peers. The greenback landed at the bottom of the G10 pile, with U.S. markets closed in observance of a public holiday. The gauge of USD strength (DXY) gave away the bulk of its Friday gains.

- Major high-beta FX were in demand on the back of fresh risk-on flows. The Swedish krona outperformed, demonstrating its typical sensitivity to the Russia-Ukraine crisis.

- Spot USD/CNH oscillated as the sense of geopolitical threat moderated while the PBOC kept its Loan Prime Rates unchanged. The yuan reference rate was fixed at CNY6.3401, 13 pips above sell-side estimate.

- The Russian rouble caught a bid as trading in Moscow got under way. Spot USD/RUB pulled back sharply from a one-week high.

- Although geopolitical headlines are set to take centre stage, worth noting that PMI data from across Europe will be out today, while speeches are due from Fed’s Bowman, ECB's de Cos & Riksbank’s Floden.

FOREX OPTIONS: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-20(E820mln), $1.1340-50(E1.2bln), $1.1485-00(E735mln)

- EUR/JPY: Y130.00(E625mln), Y132.80(E587mln)

- USD/CNY: Cny6.2500($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 21/02/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 |  | SE | Riksbank minutes Feb 3 meet | |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 21/02/2022 | 1615/1115 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.