-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: Light At The End Of The Tunnel?

- Weekend developments surrounding the Russia-Ukraine situation provided a risk-off start to Asia-Pac trade, with continued warnings from the U.S. re: the threat of an imminent Russian invasion of Ukraine (which could target multiple cities if it materialises, according to BBG sources) and the now indefinite stay of Russian troops in Belarus front and centre. The broader risk picture then became more constructive as we learnt that U.S. President Biden and Russian President Putin have struck an agreement in-principle re: a meeting, although that is contingent on no Russian invasion of Ukraine (it would seem that Thursday’s Blinken-Lavrov meeting will be used to flesh out the details of the Presidential level talks).

- The DXY finds itself at the bottom of the G10 FX table, while e-minis have more than unwound their early move lower. A quick reminder that the observance of the President's Day holiday in the U.S. will hamper broader market liquidity on Monday.

- Although geopolitical headlines are set to take centre stage, worth noting that PMI data from across Europe will be out today, while speeches are due from Fed’s Bowman, ECB's de Cos & Riksbank’s Floden.

BOND SUMMARY: Core FI Back From Early Highs, Asia Subjected To Broader Risk Swings

Core FI markets initially drew support from weekend developments surrounding the Russia-Ukraine situation, with continued warnings from the U.S. re: the threat of an imminent Russian invasion of Ukraine (which could target multiple cities if it materialises, according to BBG sources) and the now indefinite stay of Russian troops in Belarus front and centre. The broader risk picture then became more constructive as we learnt that U.S. President Biden and Russian President Putin have struck an agreement in-principle re: a meeting, although that is contingent on no Russian invasion of Ukraine (it would seem that Thursday’s Blinken-Lavrov meeting will be used to flesh out the details of the Presidential level talks). Still, core FI traded lower on the back of the Biden-Putin meeting news.

- TYH2 has been a little unwilling to probe meaningfully below neutral levels, with markets perhaps a little sceptical ahead of the Blinken-Lavrov meeting. TYH2 last dealing at 126-19+, -0-02 on the day, operating in a 126-18+ to 126-29+ range thus far, on over 145K lots. Note that the details of the White House read out re: the potential Biden-Putin meeting did not withdraw the idea that a Russian invasion of Ukraine is in the offing, which may have limited the downward impetus fleshed out above. A reminder that Cash Tsys will remain closed on Monday, while Tsy futures will be subjected to curtailed trading hours owing to the observance of the President’s Day holiday in the U.S.

- JGB futures followed the broader gyrations in risk appetite, with the Ukraine situation front and centre. Futures built on their overnight gains in early Tokyo dealing, before fading on the back of the Biden-Putin summit agreement in principle, hitting the bell +11. The long end of the curve led the bid for a second consecutive day, with participants seemingly happy to take the lead of Friday’s U.S. Tsy market bull flattening. That left the major JGB benchmarks little changed to 5.5bp richer late in the Tokyo day. A reminder that Friday’s Tokyo session saw some dip their toe into the longer end of the JGB curve after the notable steepening witnessed in recent weeks, resulting in bull flattening. This came after the 1.0% level held in 30-Year JGB yields. BoJ Rinban operations covering 1- to 10-Year JGBs may have offered some modest support, although a lack of movement in offer/cover ratios point to a lack of meaningful impact.

- Offshore dynamics remain front and centre for the Aussie bond space, with futures drifting lower into the Sydney bell. That left YM +2.0 & XM +3.0, with a chunk of the overnight/early Sydney gains pared. There hasn’t been much of note on the local news front, while the latest round of ACGB supply wasn’t a catalyst for wider market activity.

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 Jun ‘35 Bond, issue #TB145

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 June 2035 Bond, issue #TB145:

- Average Yield: 2.3456% (prev. 2.1526%)

- High Yield: 2.3475% (prev. 2.1550%)

- Bid/Cover: 3.1600x (prev. 2.2480x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 41.9% (prev. 27.8%)

- Bidders 48 (prev. 38), successful 15 (prev. 23), allocated in full 6 (prev. 12)

FOREX: Prospect Of Biden-Putin Summit Revives Sentiment

Initial risk aversion evaporated as the Élysée Palace released a statement noting that U.S. President Biden and his Russian counterpart Putin have agreed in principle to attend a security summit proposed by French President Macron, to be held on the condition that Russia does not invade Ukraine. The news came after a flurry of weekend headlines flagging the elevated risk of escalation, raising hopes that diplomatic efforts could lower the temperature of the standoff.

- The yen lost its earlier allure and retreated along safe haven peers. The greenback landed at the bottom of the G10 pile, with U.S. markets closed in observance of a public holiday. The gauge of USD strength (DXY) gave away the bulk of its Friday gains.

- Major high-beta FX were in demand on the back of fresh risk-on flows. The Swedish krona outperformed, demonstrating its typical sensitivity to the Russia-Ukraine crisis.

- Spot USD/CNH oscillated as the sense of geopolitical threat moderated while the PBOC kept its Loan Prime Rates unchanged. The yuan reference rate was fixed at CNY6.3401, 13 pips above sell-side estimate.

- The Russian rouble caught a bid as trading in Moscow got under way. Spot USD/RUB pulled back sharply from a one-week high.

- Although geopolitical headlines are set to take centre stage, worth noting that PMI data from across Europe will be out today, while speeches are due from Fed’s Bowman, ECB's de Cos & Riksbank’s Floden.

EQUITIES: Most Asia Benchmarks Lower Despite Easing In Russia-Ukraine Tensions

Most of the major Asia-Pac equity index benchmarks look set to close lower, despite bouncing from worst levels following news that U.S. President Biden and Russian President Putin have agreed to meet in-principle re: Ukraine. This came after most Asia-Pac equity indices opened sharply lower on a negative lead from Wall St.

- The CSI300 trades 0.5% lower, led by broad losses in infrastructure, materials, and new energy stocks. The PBoC kept benchmark lending rates for corporate and household loans unchanged, providing no surprises to market participants.

- The Hang Seng is 0.6% worse off, led by a 1.6% decline in the Hang Seng Tech Index. To elaborate, high-beta Chinese-linked tech struggled amidst renewed regulatory worry arising from the Chinese authorities ordering food delivery platforms to lower fees last Friday. The Hang Seng Properties Index fell by 1.1% as well, following a worsening in Hong Kong’s COVID-19 situation that has seen property developers engaged in pandemic measures such as the provision of rooms for quarantine purposes. Meanwhile, worry surrounding Chinese property developer debt has re-emerged, seeing China-based (but Hong Kong-listed) developers such as Sunac China Holdings and Zhenro Properties Group bearing the brunt of losses (note that the latter has flagged a potential problem when it comes to meeting debt repayment obligations due in March).

- The Australian ASX200 was the only major regional equity index to trade higher, adding 0.2%.

- E-minis surged on news of the aforementioned Biden-Putin summit agreement in-principle, and now deal 0.5-0.6% higher ahead of European hours.

FOREX OPTIONS: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-20(E820mln), $1.1340-50(E1.2bln), $1.1485-00(E735mln)

- EUR/JPY: Y130.00(E625mln), Y132.80(E587mln)

- USD/CNY: Cny6.2500($1.1bln)

ASIA FX: Risk Reprieve Favours Asia EM FX, Peso Lags On Dovish BSP Remarks

Improving risk environment lent support to Asia EM FX space as risk assets breathed a sigh of relief in response to a confirmation that leaders of the U.S. & Russia have agreed in principle to hold a security summit (date tba), provided that Moscow does not attack Ukraine.

- CNH: Spot USD/CNH oscillated as participants weighed improvement in the broader risk backdrop against the PBOC's decision to keep its Loan Prime Rates unchanged this month.

- KRW: South Korean won swung to a gain, receiving a fillip from improving risk appetite. Domestic fiscal matters continued to draw attention as Yonhap reported that lawmakers from both sides of the aisle agreed to hold a plenary vote on extra budget today.

- IDR: The rupiah held a tight range, even as Gov Warjiyo suggested that Bank Indonesia could begin to unwind its debt monetisation programme next year. On the interest rate front, Warjiyo noted that an adjustment to the main policy rate could come in Q3 or Q4.

- MYR: Spot USD/MYR erased its initial gains on aforesaid risk dynamics. Malaysia's Health Ministry said it is preparing guidelines for re-opening international borders, possibly as soon as at the beginning of Q2.

- PHP: The Philippine peso traded on the back foot. BSP Gov Diokno noted that the Philippines has "room to manoeuvre" despite looming Fed tightening as the inflation outlook "looks good."

- THB: The baht caught a bid after latest data showed that Thailand's Q4 economic growth surpassed expectations. In their post-release statement, the NESDC kept its 2022 GDP forecast unchanged at +3.5%-4.5% Y/Y, while lifting the CPI projection to +1.5%-2.5% Y/Y (prev. +0.9%-1.9%).

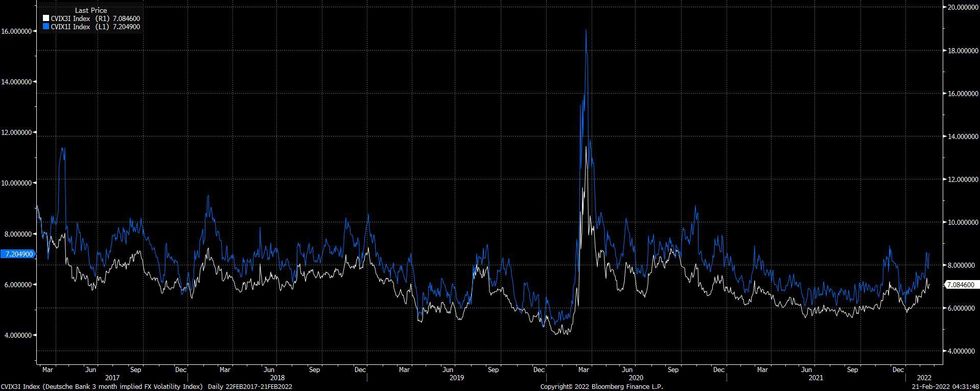

FOREX: DM FX Implied Vol. Nudges Higher But Remains Contained

When it comes to broader DM FX volatility measures, we highlight that both the Deutsche Bank 1- & 3-Month FX volatility indices are struggling to break above their respective November peaks, even with the elevated geopolitical tension surrounding Russia & Ukraine becoming embedded in at least the shorter end of the vol. curve spectrum. Note that the broader repricing when it comes to market-assumed levels of monetary policy tightening across the DM central bank space has supported implied vol. since the turn of the calendar year.

Fig.1: Deutsche Bank 1- & 3-Month Implied FX Volatility Indices

Source: MNI - Market News/Deutsche Bank/Bloomberg

Source: MNI - Market News/Deutsche Bank/Bloomberg

GOLD: Pullback From Cycle Highs As Biden & Putin To Meet

Gold is ~$2/oz lower, printing $1,896.4/oz at writing. The precious metal has pulled back from fresh eight-month highs registered earlier in the session ($1,908.3/oz) after U.S. President Biden and Russian President Putin agreed to meet (in principle) at a summit brokered by French President Macron, as fluid developments surrounding the Russia-Ukraine situation continue to dominate price action.

- The early move higher was facilitated by a weekend Bloomberg source report which stated that the U.S. had informed allies that a Russian invasion would likely target “multiple cities beyond the capital Kyiv” in the case of an attack. Ultimately, risks re: the escalation of the situation in Ukraine remain apparent, with White House spokesperson Psaki stating that “we are always ready for diplomacy,” but “Russia appears to be continuing preparations for a full-scale assault on Ukraine very soon,” in remarks re: the Biden-Putin summit.

- Looking ahead, U.S. Secretary of State Blinken and Russian FM Lavrov are due to meet this Thursday to establish further details of the meeting between the Presidents of the two countries.

- On the technical front, the early move higher saw a push through initial technical resistance, which has allowed bulls to switch focus to medium-term resistance at $1,916.6/oz (Jun 1 ’21 high). Support remains in place at $1,844.7/oz (Feb 15 low).

OIL: Off Best Levels In Asia

WTI and Brent are -$0.40 & -$0.60 respectively, backing away from session highs after we learnt that U.S. President Biden and Russian President Putin have agreed to meet in-principle re: Ukraine. Both benchmarks continue to operate comfortably above Friday’s lows, as the lingering worry surrounding the Russia-Ukraine situation remains evident.

- White House spokesperson Psaki noted that “Russia appears to be continuing preparations for a full-scale assault on Ukraine very soon” in remarks re: the Biden-Putin summit, following Bloomberg source reports of the U.S. warning allies that a Russian invasion would target multiple cities beyond Kyiv.

- Elsewhere, hope surrounding a potential U.S-Iran nuclear agreement remains elevated, providing some counter to the impulse from the Russia-Ukraine standoff. To recap, a Reuters report on Friday carried remarks from a senior European Union official stating that an agreement could come “in the coming week, the coming two weeks or so”, and that the text of the agreement was now “very, very close to what is going to be the final agreement.”

- A note that both benchmarks notched lower weekly closes last Friday, breaking an 8-week streak of gains.

- Looking to technical levels, recent dips in WTI and Brent still leave them trading well above their respective support levels at $88.41 (Feb 9 low) and $89.93 (Feb 8), while resistance remains intact at Feb 14 highs ($95.82 for WTI and $96.78 for Brent).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 21/02/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 |  | SE | Riksbank minutes Feb 3 meet | |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 21/02/2022 | 1615/1115 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.