-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Putin Recognises DPR & LPR, What Next?

EXECUTIVE SUMMARY

- WEST TEES UP SANCTIONS FOR RUSSIA AFTER PUTIN BACKS LPR & DPR SEPARATION IN UKRAINE

- PUTIN ORDERS RUSSIAN PEACEKEEPERS TO EASTERN UKRAINE'S TWO BREAKAWAY REGIONS (RTRS)

- FED'S BOWMAN KEEPING OPEN MIND ON POSSIBLE HALF PERCENTAGE POINT RATE HIKE IN MARCH (RTRS)

- ECB’S VILLEROY: MUST TAKE TIME ON RATE DECISION TO AVOID ERROR (BBG)

- CHINA MAY CUT INTEREST RATE, RESERVE RATIO FURTHER (CSJ)

- CHINA VOWS LOCAL GOVERNMENT AID AS TAX CUTS TO EXCEED LAST YEAR (BBG)

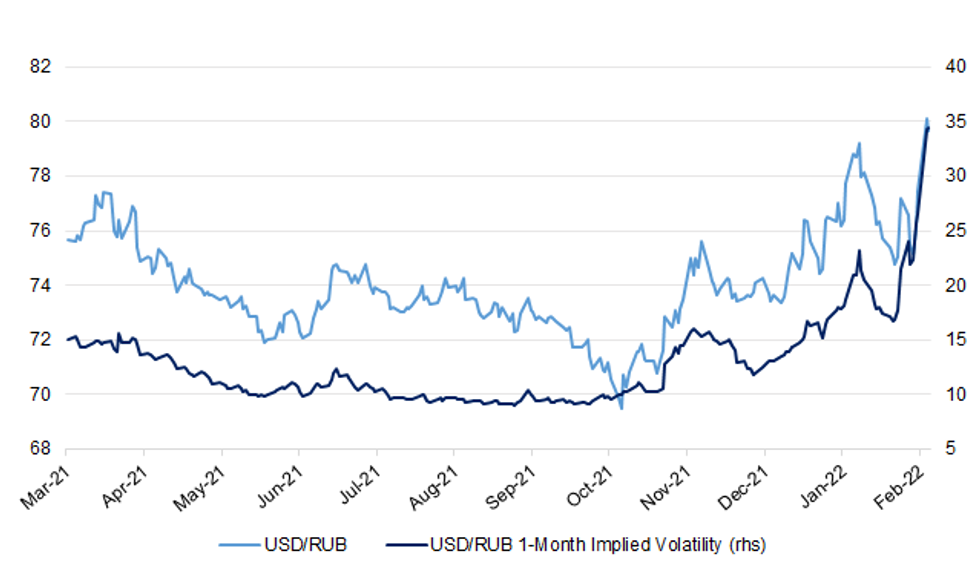

Fig.1: USD/RUB Vs. USD/RUB 1-Month Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Johnson confirmed coronavirus rules will end in England as he became the first major Western leader to scrap government restrictions relating to the pandemic. From Thursday, people who have the virus will no longer be legally required to self-isolate, though they will still be advised to stay at home, Johnson said in the House of Commons on Monday. From April 1, the universal and free availability of coronavirus testing will end, he said. Johnson’s announcement of a “Living with Covid” plan comes against a backdrop of declining daily infections, hospitalizations and deaths relating to the disease, though critics say he is moving too fast. (BBG)

CORONAVIRUS: The next coronavirus variants "could be more severe" than Omicron and future winters will be "tricky", the government's top medical advisers have warned. Speaking at a Downing Street news briefing, England's chief medical officer Professor Sir Chris Whitty stressed that new COVID variants may cause "significant problems" - including potentially a higher risk of hospitalisation than Omicron. Meanwhile, England's chief scientific adviser Sir Patrick Vallance added that "the virus will continue to evolve and it will probably will be quite fast for the next five years". (Sky)

BREXIT: The government is to set out plans to overhaul regulation of the insurance industry post-Brexit in a move that ministers hope will encourage companies to invest billions in infrastructure. John Glen, economic secretary to the Treasury, said last night that the European Union’s Solvency II rules would be reformed to cut red tape. The government hopes that the reforms will make it easier for insurance companies to free up capital to make investments in long-term projects, such as green energy schemes. (The Times)

EUROPE

ECB: The European Central Bank must take time to decide on interest-rate hikes so as to avoid errors when determining policy, Governing Council member Francois Villeroy de Galhau says. Villeroy comments in interview with French newspaper Liberation. Bank of France Governor repeats his call for ECB to end net asset purchases “around the third quarter” but then keep its options open “depending on how inflation evolves.” “Time is essential to avoid errors: action must neither be taken too late, at risk of letting inflation get out of control, not too early, at risk of putting the brakes on the recovery.” “There’s no point deciding now on the future date of interest-rate increases.” Villeroy says euro-area inflation hump is “higher and longer” than expected, but mainly attributable to energy prices. (BBG)

GERMANY/BUNDS: A board of independent economic advisers said the German government should break out of its tendency to issue mainly short-term bonds, arguing that the strategy offers few cost benefits and changing it would improve fiscal stability. “Debt maturities should be extended moderately in order to increase planning security in the budget and reduce risks -- this is currently possible at comparatively low additional costs,” the advisory board to Germany’s finance ministry said in a special feature of the institution’s monthly report. The body, which is made up of numerous high-profile German economists, is independent and doesn’t necessarily have any impact on the federal finance agency’s issuance policy. (BBG)

ITALY/BTPS: Italy plans to sell up to EU5.5 billion ($6.24 billion) of bills due Aug. 31 in an auction on Feb. 24. (BBG)

U.S.

FED: Federal Reserve Governor Michelle Bowman said on Monday that she will assess incoming economic data over the next three weeks in deciding whether a half percentage point interest rate rise at the central bank's next meeting in March is needed, a stance that underscores divisions among policymakers on how aggressively to begin its tightening cycle. (RTRS)

OTHER

JAPAN: Japan’s government is considering bringing back eased Covid-19 restrictions for people who have been vaccinated or provide negative test results, broadcaster NHK reports without attribution. “Vaccine and test package” would return after progress in administering booster shots. (BBG)

JAPAN/JGBS: Suzuki also told reporters after a cabinet meeting that he would closely watch any impact from rising interest rates in western countries on Japan's economy. (RTRS)

RBA: Australia's central bank is shaking up the way it provides liquidity to the banking system as it ceases quantitative easing and prepares for the day when it will eventually raise interest rates. Speaking at an online event, Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent emphasised changes to its open market operations (OMO) were not a signal on the future course of monetary policy. "Rather, they will ensure that OMO remains fit for purpose as liquidity conditions, the economic outlook and the Bank's monetary policies evolve," Kent said. RBA Governor Philip Lowe recently said it was plausible the 0.1% cash rate could rise later this year if the economy continues to improve, while financial markets are wagering on a rise as early as June. (RTRS)

RBNZ: Bob Buckle and Peter Harris have been reappointed as external members of the Reserve Bank of New Zealand’s Monetary Policy Committee (MPC), Grant Robertson said. The MPC is responsible for the monetary policy decisions needed to support maximum sustainable employment and price stability. Dr Buckle and Mr Harris were appointed as external members in 2019 for terms of three years. On the recommendation of the Board of the Reserve Bank of New Zealand, they have both been reappointed for terms of three years from 1 April 2022. “It was important to retain Dr Buckle’s and Mr Harris’ experience and expertise as external members of the MPC which responded to a one-in-100 year economic shock and provide continuity as the pandemic evolves,” Grant Robertson said. The Reserve Bank’s Assistant Governor/General Manager Money Group Karen Silk has been appointed as an internal member of the MPC for a five year term from 16 May 2022. The Manager of Central Banking Analytics at the Reserve Bank Adam Richardson has been appointed as an internal member for a six month term from 11 March 2022. Mr Richardson is an interim member of the MPC while the Reserve Bank recruits for the role of Chief Economist/Director of Economics. He will be the acting Chief Economist/Director of Economics when Yuong Ha, the current Chief Economist and an internal member of the MPC, leaves the Reserve Bank on 10 March 2022. “The internal candidates have the appropriate knowledge, skills and experience to assist the MPC,” Grant Robertson said. (RBNZ)

BOK: The Bank of Korea will operate a 24 hour monitoring system to closely watch the impact of Ukraine tensions on Korea’s economy and markets, the central bank says in statement after meeting hosted by Governor Lee Ju-yeol. The nation’s real economy including growth and inflation may be impacted, and volatility in financial markets may increase depending on how geopolitical risks related to Ukraine unfold, statement cites Lee Ju-yeol as saying. (BBG)

CANADA: Canada's parliament on Monday backed Prime Minister Justin Trudeau's decision to invoke rarely-used emergency powers to end pandemic-related protests that have blocked streets in the capital Ottawa for more than three weeks. The Emergencies Act was approved in parliament by 185 to 151, with the minority Liberal government getting support from left-leaning New Democrats. The special measures, announced by Trudeau a week ago, have been deemed unnecessary and an abuse of power by some opposition politicians. (RTRS)

BRAZIL: Brazil and Russia are the only emerging countries with benchmark interest rates above their neutral stances which is needed to bring inflation back to target, said Brazil’s central bank chief Roberto Campos Neto during an online event. Global inflation trend is still growing, with persistent energy shocks. Brazil’s core inflation measures rising consistently. “Brazil’s energy inflation has been the highest in the world,” said Campos Neto. Brazil’s high inflation rate also had an important component of imported inflation. (BBG)

RUSSIA: Russian President Vladimir Putin announced Monday evening that he would recognize the independence of two breakaway regions of eastern Ukraine, a development that could undermine Western hopes of a diplomatic resolution to the ongoing crisis. During his hour-long remarks, Putin aired historical grievances against NATO and the U.S. and accused Western governments of hostile activities that threaten Russian security. Putin also made the case for involvement in the region to the Russian people. “I deem it necessary to make a decision that should have been made a long time ago and to immediately recognize the independence and sovereignty of Donetsk People’s Republic and Luhansk People’s Republic,” Putin said. Ahead of Putin’s address, the Kremlin said that the Russian president discussed his decision with French President Emmanuel Macron and German Chancellor Olaf Scholz. Both leaders expressed their disappointment with Putin’s decision but indicated their readiness to continue diplomatic talks, the Kremlin added. (CNBC)

RUSSIA: President Vladimir Putin ordered his defence ministry to despatch Russian peacekeepers to eastern Ukraine's two breakaway regions, according to a decree published early on Tuesday after he said Moscow would recognise their independence. Putin earlier signed decrees to recognise the two breakaway regions -- the self-proclaimed Donetsk People's Republic and the Lugansk People's Republic -- as independent statelets defying Western warnings that such a step would be illegal and kill off long-running peace negotiations. (RTRS)

RUSSIA: Russia has acquired the right to build military bases in Ukraine's two breakaway regions under new agreements with their separatist leaders, according to a copy of an agreement signed by President Vladimir Putin published on Monday. Russia and the breakaway regions also plan to sign separate agreements on military cooperation and protection of borders, according to draft laws that Russia's State Duma lower house of parliament will consider on Tuesday. (RTRS)

RUSSIA: President Joe Biden on Monday signed an executive order restricting American business in Ukraine’s breakaway regions, in response to Russian leader Vladimir Putin’s recognition of those areas, a move that was widely interpreted as the prelude to an invasion of Ukraine. “President Putin’s action contradicts Russia’s commitments under the Minsk agreements, refutes Russia’s claimed commitment to diplomacy, and undermines Ukraine’s sovereignty and territorial integrity,” the White House said in a statement. The order is separate from sanctions the U.S. and European nations have pledged to impose to punish Russia. (MarketWatch)

RUSSIA: The U.S. will take further measures on Tuesday punishing Russia over its recognition of separatist areas in Ukraine, a senior administration official told reporters. The steps are likely to include economic sanctions but won’t be the more severe economic measures that the U.S. has warned it would impose should Putin move forward with an invasion. The official said the White House was open to a meeting between Biden and Putin -- predicated on Russia not proceeding with an attack. But Russia is continuing to prepare for military action that could occur in the coming hours or days, the official said. (BBG)

RUSSIA: President Vladimir Putin's decision to send troops he called peacemakers into breakaway regions of Ukraine did not constitute a further invasion that would trigger a broader sanctions package, a Biden administration official told Reuters on Monday, but the White House believes a full invasion could come at any time. (RTRS)

RUSSIA: Russian President Vladimir Putin's move to recognize breakaway eastern Ukrainian territories as independent could be the opening phase of a larger potential military operation targeting Ukraine, nearly a dozen US and western officials told CNN. (CNN)

RUSSIA: The U.S. is moving all State Department personnel and its embassy out Ukraine and into Poland after Russian President Vladimir Putin recognized two separatist regions in the eastern part of the country. The exodus was ordered citing security reasons, according to a person familiar with the matter and speaking on condition of anonymity. U.S. officials intend for the personnel to return Tuesday morning if there is no invasion by Russia, the person said. Spokespeople for the State Department and the National Security Council declined to comment. Russia denies it intends to invade. (BBG)

RUSSIA: Leaders from the European Union and the United Kingdom vowed Monday to impose sanctions over Russian President Vladimir Putin’s decision to recognize two separatist regions in eastern Ukraine as independent. In a brief statement, European Council President Charles Michel and European Commission President Ursula von der Leyen said they "condemn in the strongest possible terms the decision by the Russian President to proceed with the recognition of the non-government controlled areas of Donetsk and Luhansk oblasts of Ukraine as independent entities." “This step is a blatant violation of international law as well as of the Minsk agreements,” the two leaders said, referring to peace accords agreed in 2014 and 2015. “The Union will react with sanctions against those involved in this illegal act.” They did not provide any details of the sanctions to be imposed, nor the precise targets of the measures. (POLITICO)

RUSSIA: The recognition of the independence of Ukraine's breakaway regions by Russian President Vladimir Putin is just a first step after which more action from Russia is likely to follow, a European Union official said on Monday. "We know that what Putin decided today is the first step, and there will probably be next steps, so the situation may evolve by the hour," the official said. (RTRS)

RUSSIA: Boris Johnson will chair a meeting of the UK’s emergency Cobra committee on Tuesday morning to sign off a package of sanctions against Russia after its military occupation of the two breakaway states in eastern Ukraine. The initial signs were that the package would target “those complicit in the violation of Ukraine’s territorial integrity”, after Russian troops were ordered to enter the separatist regions of Donetsk and Luhansk for the first time overnight. Downing St said that Johnson would hold the emergency meeting to discuss the rapidly unfolding crisis – and to agree what a spokesperson said was “a significant package of sanctions to be introduced immediately”. (The Guardian)

RUSSIA: NATO chief Jens Stoltenberg on Monday condemned Russian President Vladimir Putin's recognition of rebel-held areas in east Ukraine, saying it violated international agreements Moscow had signed. "I condemn Russia's decision to extend recognition to the self-proclaimed 'Donetsk People's Republic' and 'Luhansk People's Republic'," Stoltenberg said in a statement. "This further undermines Ukraine's sovereignty and territorial integrity, erodes efforts towards a resolution of the conflict, and violates the Minsk Agreements, to which Russia is a party," he added. "Moscow continues to fuel the conflict in eastern Ukraine by providing financial and military support to the separatists. It is also trying to stage a pretext to invade Ukraine once again." He urged Russia "to choose the path of diplomacy" and to withdraw its more than 150,000 troops deployed to Ukraine's borders for what many western countries expect will be an imminent attack. (AFP)

RUSSIA: Japan’s government is arranging to join the U.S. and other countries in restricting semiconductor exports to Russia as part of sanctions in the event of a Ukraine invasion, Yomiuri reports without attribution. Exports of artificial intelligence and robotics-related products also expected to be restricted. Sanctions would likely be stricter than those imposed in 2014 over Crimea annexation. Japan also considering its own financial sanctions. (BBG)

CHINA

PBOC: The People’s Bank of China may further lower the benchmark Loan Prime Rate in March if credit expansion falls short of expectations, the China Securities Journal reported citing Wang Yifeng, chief analyst of Everbright Securities. Though LPR was kept unchanged on Monday after two straight cuts in January and December, the window for easing is still open, the newspaper said. The PBOC may cut the reserve requirement ratios slightly before the expected first rate hike by the Federal Reserve around March 16, pushing the LPR further down, the Journal said citing Wang Yunjin, senior researcher of Zhixin Investment Research Institute. (MNI)

ECONOMY: China is expected to set the national growth target for 2022 at around 5.5%, after most regions and cities gave forecasts at between 5.5% and 7%, the Securities Times said in a report Tuesday, without providing a source. (BBG)

FISCAL: Chinese Finance Minister Liu Kun said on Tuesday that China will implement bigger cuts in taxes and fees this year while strengthening coordination between fiscal and monetary policy. China will also step up transfer payments from the central government to local governments in 2022, Liu said at a press conference. (RTRS)

YUAN: The yuan may continue its current strength before the Federal Reserve starts its expected rate hikes in March, as the recent Russia-Ukraine conflict increases the demand for alternative yuan assets and China’s economic fundamentals continue to support the currency, the Securities Times reported citing Wang Youxin, senior researcher at Bank of China Research Institute. The cross-border capital flow and the yuan may become more volatile after the Fed Reserve’s March meeting, and companies should not bet on any one-way movement of the currency but make reasonable use of forex derivatives and yuan for settlement, the newspaper cited Wang as saying. (MNI)

OVERNIGHT DATA

JAPAN JAN SERVICES PPI +1.2% Y/Y; MEDIAN +1.2%; DEC +1.1%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 101.8; PREV. 103.2

Inflation expectations rose 0.1ppt to 5.1% last week, its highest since December 2014. With petrol prices at record highs during the past few weeks the lift in inflation expectations is not surprising. Consumer confidence dropped 1.4% despite the easing of COVID restrictions in NSW and the imminent reopening of international borders to tourists. The expectations of higher inflation might have had a dampening effect on overall sentiment. Confidence dropped by 5.6% in NSW, 0.7% in QLD, 0.8% in SA and 2.8% in WA, while it increased in Victoria by 2.9%. (ANZ)

NEW ZEALAND JAN CREDIT CARD SPENDING +5.5% Y/Y; DEC +1.6%

NEW ZEALAND JAN CREDIT CARD SPENDING +0.7% M/M; DEC +0.7%

SOUTH KOREA FEB CONSUMER CONFIDENCE 103.1; JAN 104.4

SOUTH KOREA Q4 HOUSEHOLD CREDIT KRW1,862.1TN; Q3 KRW1,844.9TN

CHINA MARKETS

PBOC NET INJECTED CNY90 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY90 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to offset the impact of tax season and maintain stable liquidity at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1432% at 09:37 am local time from the close of 2.1154% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3487 TUES VS 6.3401

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3487 on Tuesday, compared with 6.3401 set on Monday.

MARKETS

SNAPSHOT: Putin Recognises DPR & LPR, What Next?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 474.27 points at 26436.6

- ASX 200 down 72.326 points at 7161.3

- Shanghai Comp. down 42.154 points at 3448.458

- JGB 10-Yr future up 20 ticks at 150.34, yield down 1.8bp at 0.195%

- Aussie 10-Yr future up 2.0 ticks at 97.790, yield down 2bp at 2.200%

- U.S. 10-Yr future +0-15 at 127-04+, yield down 6.4bp at 1.865%

- WTI crude up $2.79 at $93.86, Gold up $3.22 at $1909.49

- USD/JPY down 1 pip at Y114.73

- WEST TEES UP SANCTIONS FOR RUSSIA AFTER PUTIN BACKS LPR & DPR SEPARATION IN UKRAINE

- PUTIN ORDERS RUSSIAN PEACEKEEPERS TO EASTERN UKRAINE'S TWO BREAKAWAY REGIONS (RTRS)

- FED'S BOWMAN KEEPING OPEN MIND ON POSSIBLE HALF PERCENTAGE POINT RATE HIKE IN MARCH (RTRS)

- ECB’S VILLEROY: MUST TAKE TIME ON RATE DECISION TO AVOID ERROR (BBG)

- CHINA MAY CUT INTEREST RATE, RESERVE RATIO FURTHER (CSJ)

- CHINA VOWS LOCAL GOVERNMENT AID AS TAX CUTS TO EXCEED LAST YEAR (BBG)

BOND SUMMARY: Russia-Related Angst Extends In Asia

U.S. Tsys were well bid in Asia, gapping higher on the open on worry re: Ukraine. The space was subjected to several rounds of upward pressure in Asia, but sits shy of best levels ahead of European trade. TYH2 last dealing +0-13 (vs. Friday’s settlement) at 127-02+. Meanwhile, cash Tsys run 1.5-7bp richer across the curve after the elongated weekend, with 10s leading. There hasn’t been much in the way of game changing headline flow since the Asia-Pac re-open, with some of the Western nations still clearly cognisant of the risks surrounding the potential for Russia to push deeper into Ukraine. Early Asia trade saw some quarters suggest that the Russian-backed separation of Luhansk and Donetsk (accompanied with the official movement of the Russian military into the separatist regions, on “peacekeeping” business) may represent the end game when it comes to the standoff, which may have helped the pullback from early extremes when it came to broader risk aversion. Still, the lack of finality that is apparent at present means that headline risk re: the matter remains at the forefront of participants’ minds, leaving a defensive imprint on U.S. Tsy/e-mini trade. 2x block buys of FVJ2 118.25 calls (+5K apiece) headlined on the flow side, with TYH2 operating on over 280K lots since the re-open. House price data, flash Markit PMI readings, Richmond Fed m’fing data and the latest round of conference board consumer confidence readings are all due during Tuesday’s NY session. Elsewhere, we will also see the latest round of 2-Year supply, in addition to Fedspeak from Bostic (’24 voter).

- Tokyo trade saw JGBs richen, with futures closing +20, just shy of best levels. Meanwhile, cash JGBs run 0.5-3.5bp richer on the day, as flattening remains in play, building on the theme observed in the last couple of sessions after the pronounced steepening witnessed in early ’22. There hasn’t been much in the way of meaningful domestic news flow. Services PPI data met broader expectations, while Finance Minister Suzuki mentioned the need to monitor the impact of overseas bond markets on JGBs. Decent enough demand at the latest liquidity enhancement auction covering off-the-run 5- to 15.5 year JGBs would have done the space no harm.

- Aussie bond futures drifted lower throughout the session, after trading higher early on. The bid was certainly less “sticky” when compared to other core FI markets. Some downward pressure crept into the space in the wake of RBA Assistant Governor Kent’s latest address (see full text here: https://www.rba.gov.au/speeches/2022/sp-ag-2022-02-22.html) as he outlined less favourable, on net, OMO terms i.e. floating rate & shorter tenor. This meant that the short end led the space lower, with YM unchanged XM +2.0 come the bell, while the IR strip was flat to 2 ticks lower at settlement.

JGBS AUCTION: Japanese MOF sells Y497.5bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.5bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.017% (prev. -0.020%)

- High Spread: -0.016% (prev. -0.017%)

- % Allotted At High Spread: 29.3070% (prev. 10.1289%)

- Bid/Cover: 3.895x (prev. 3.516x)

AUSSIE BONDS: The AOFM sells A$150mn of the 3.00% 21 Sep 2025 I/L Bond, issue #CAIN407:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 3.00% 21 September 2025 I/L Bond, issue #CAIN407:

- Average Yield: -1.1400% (prev. -0.9733%)

- High Yield: -1.1300% (prev. -0.9700%)

- Bid/Cover: 4.8667x (prev. 5.7533x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 80.0% (prev. 96.2%)

- Bidders 48 (prev. 51), successful 14 (prev. 11), allocated in full 12 (prev. 8)

EQUITIES: Lower In Asia As Ukraine Tensions, Chinese Regulatory Fears Weigh

Major Asia-Pacific equity indices trade 1.2% to 3.0% lower, with pressure from Monday’s escalation in the Russia-Ukraine situation mixing with widening concerns re: a fresh wave of regulatory scrutiny in China.

- To recap recent Chinese regulatory moves, the NDRC (China’s top planning agency) directed food delivery platforms to reduce fees charged to restaurants last Friday, while BBG source reports on Monday stated that Chinese regulators had begun a fresh round of inquiries into domestic bank & state firm financial exposure to Ant Group Co.

- The Hang Seng leads losses amongst regional equity indices, sitting 3.0% worse off at typing. The Hang Seng Tech Index also deals 3.0% softer, hitting the lowest levels observed since its inception (July ‘20).

- The CSI300 is 1.6% weaker at typing, led by losses in the consumer staples sub-index, with steep declines for large cap names such as Kweichow Moutai Co and Wuliangye Yibin Co observed. The PBoC’s latest liquidity boost (via short-term OMOs), the outline of impending fiscal support for struggling local governments and a PBoC directive re: support for Shanghai’s property market failed to turn the tide for the index.

- U.S. e-mini equity futures are off of their respective Asia-Pac lows, sitting 1.6% to 2.4% weaker at typing. Participants continue to debate Putin’s ultimate end game when it comes to Ukraine, in addition to assessing the impact of the impending round of sanctions that the west is tabling re: Russia.

OIL: Higher In Asia On Ukraine Standoff

WTI is +$2.50 (vs. Friday settlement) and Brent is +$1.50 (vs. Monday settlement). The benchmarks have pulled back from session highs after the early Asia shift higher, which was driven by the latest developments in the Russia-Ukraine situation.

- While western leaders (i.e. U.S., the U.K., and the EU) have announced the preparation of sanctions against Russia, a U.S. official told RTRS that Putin’s latest move will not trigger a broader sanctions package as Russia was simply moving into “territory that they’ve already occupied” (likely easing concerns among market participants re: a further escalation between various parties to the situation).

- To recap, both benchmarks moved higher on Monday after Russian President Putin announced Russia’s recognition of the sovereignty of Ukrainian separatist regions Donetsk and Luhansk, while ordering Russian troops into the territories for “peacekeeping operations”.

- On the technical front, Brent has broken through the bull trigger at $96.78 (Feb 14 high), and now sees resistance at $98.94 (2.764 projection of the Dec 2-9-20 price swing). Resistance for WTI remains unchanged at $95.82 (Feb 14 high).

GOLD: Pullback From Cycle Highs

Gold is ~$3/oz higher, printing $1,909.4/oz at writing. The precious metal has backed away from fresh eight-month highs made earlier in Asia-Pac dealing ($1,914.3/oz), with the early risk-off impulse from the latest developments surrounding the Russia-Ukraine situation edging away from extremes, despite a lack of fresh headline flow (perhaps a case of some market participants being hopeful that a Russia-backed separation of Luhansk & Donetsk from Ukraine will be the end game in the standoff, although the U.S. and some of its allies are not onboard with that train of thought).

- To recap, gold closed slightly higher on Monday after news that Russian President Putin had officially recognised the sovereignty of the aforementioned Ukrainian separatist regions, while ordering Russian troops into those territories to “keep the peace”. The move immediately drew condemnation from western leaders, seeing the U.S. and UK announce plans for Russian sanctions on Tuesday, with the EU to follow in the coming days.

- A reminder that U.S. Secretary of State Blinken and Russian FM Lavrov had previously agreed to meet in Geneva this Thursday, where details of a Biden-Putin summit (which had been agreed to in principle) were set to be discussed.

- Looking to technical levels, gold remains well clear of support at $1,853.9 (Jan 25 high), while key resistance at $1,916.6 (Jun 1 ’21 high and bull trigger) remains untested. A break above the latter would expose further resistance at $1,935.8/oz, the top of a bull channel drawn from the Aug 9 ’21 low.

FOREX: RUB Round Trips From 15-Month Low As Geopolitical Musings Dominate

Initial risk-off moves related to Russia-Ukraine standoff were unwound, before G10 FX space moved into a waiting mode and consolidated in familiar ranges. Headline flow failed to offer much in the way of substantial news that could move the dial on geopolitical risk but a degree of reassurance may have been provided by speculation that the deployment of Russian troops into the breakaway regions in eastern Ukraine could mark a pause in the escalation of conflict. Source reports suggesting that the most severe sanctions prepared by the White House will be contingent on Russian incursion deeper into Ukraine's territory lent support to this theory, with a measured speech from President Zelensky pointing to Kyiv's continued willingness to utilise diplomatic channels. It also appeared that U.S. chief diplomat Blinken was still poised to meet his Russian counterpart Lavrov this Thursday, even as Western leaders continued to warn against potential for a broader Russian military intervention and rushed to compile fresh packages of sanctions.

- The Antipodeans found some poise as initial risk aversion moderated, with participants looking ahead to the monetary policy decision from the RBNZ. Governor Orr will announce the outcome of the MPC meeting on Wednesday, with policymakers widely expected to raise the OCR.

- The yen gave away its initial gains and wavered thereafter, as participants assessed geopolitical goings-on. The Swedish krona (eyed due to its sensitivity to the crisis in eastern Europe) briefly caught a bid but then eased off.

- Spot USD/RUB surged past RUB80.00 to its best levels since November 2020 in the U.S./Asia crossover but the rouble stabilised later on. Implied USD/RUB vols remain elevated across the maturity curve.

- While Russia/Ukraine headlines are poised to remain front & centre, the global data docket features German Ifo survey as well as U.S. Conf. Board Consumer Confidence & PMI figures. Speeches are due from Fed's Bostic, BoE's Ramsden & Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-05(E788mln), $1.1330-35(E998mln), $1.1350-60(E817mln), $1.1400(E614mln)

- USD/JPY: Y115.20-25($1.8bln)

- EUR/JPY: Y115.20-25($1.3bln)

- AUD/USD: $0.7200(A$1.6bln), $0.7300(A$805mln)

- USD/CAD: C$1.2600-10($1.1bln), C$1.2700($1.2bln), C$1.2800($747mln)

- USD/CNY: Cny6.3600($700mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/02/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2022 | 1045/1045 |  | UK | BOE Ramsden speech at National Farmers Union | |

| 22/02/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/02/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 22/02/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/02/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 22/02/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 22/02/2022 | 2030/1530 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.