-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Assess Putin's Latest Move

- There hasn’t been much in the way of game changing headline flow since the Asia-Pac re-open, with some of the Western nations still clearly cognisant of the risks surrounding the potential for Russia to push deeper into Ukraine. Early Asia trade saw some quarters suggest that the Russian-backed separation of Luhansk and Donetsk (accompanied with the official movement of the Russian military into the separatist regions, on “peacekeeping” business) may represent the end game when it comes to the standoff, which may have helped the pullback from early extremes when it came to broader risk aversion. Still, the lack of finality that is apparent at present means that headline risk re: the matter remains at the forefront of participants’ minds, leaving a defensive imprint on U.S. Tsy/e-mini trade.

- Note that expectations are seemingly building re: the imposition of symbolic sanctions in the wake of the aforemntioned move from Putin & the Ukrainian separatists.

- While Russia/Ukraine headlines are poised to remain front & centre, Tuesday's global data docket features German Ifo survey as well as U.S. Conf. Board Consumer Confidence & PMI figures. Speeches are due from Fed's Bostic, BoE's Ramsden & Norges Bank's Olsen.

BOND SUMMARY: Russia-Related Angst Extends In Asia

U.S. Tsys were well bid in Asia, gapping higher on the open on worry re: Ukraine. The space was subjected to several rounds of upward pressure in Asia, but sits shy of best levels ahead of European trade. TYH2 last dealing +0-13 (vs. Friday’s settlement) at 127-02+. Meanwhile, cash Tsys run 1.5-7bp richer across the curve after the elongated weekend, with 10s leading. There hasn’t been much in the way of game changing headline flow since the Asia-Pac re-open, with some of the Western nations still clearly cognisant of the risks surrounding the potential for Russia to push deeper into Ukraine. Early Asia trade saw some quarters suggest that the Russian-backed separation of Luhansk and Donetsk (accompanied with the official movement of the Russian military into the separatist regions, on “peacekeeping” business) may represent the end game when it comes to the standoff, which may have helped the pullback from early extremes when it came to broader risk aversion. Still, the lack of finality that is apparent at present means that headline risk re: the matter remains at the forefront of participants’ minds, leaving a defensive imprint on U.S. Tsy/e-mini trade. 2x block buys of FVJ2 118.25 calls (+5K apiece) headlined on the flow side, with TYH2 operating on over 280K lots since the re-open. House price data, flash Markit PMI readings, Richmond Fed m’fing data and the latest round of conference board consumer confidence readings are all due during Tuesday’s NY session. Elsewhere, we will also see the latest round of 2-Year supply, in addition to Fedspeak from Bostic (’24 voter).

- Tokyo trade saw JGBs richen, with futures closing +20, just shy of best levels. Meanwhile, cash JGBs run 0.5-3.5bp richer on the day, as flattening remains in play, building on the theme observed in the last couple of sessions after the pronounced steepening witnessed in early ’22. There hasn’t been much in the way of meaningful domestic news flow. Services PPI data met broader expectations, while Finance Minister Suzuki mentioned the need to monitor the impact of overseas bond markets on JGBs. Decent enough demand at the latest liquidity enhancement auction covering off-the-run 5- to 15.5 year JGBs would have done the space no harm.

- Aussie bond futures drifted lower throughout the session, after trading higher early on. The bid was certainly less “sticky” when compared to other core FI markets. Some downward pressure crept into the space in the wake of RBA Assistant Governor Kent’s latest address (see full text here: https://www.rba.gov.au/speeches/2022/sp-ag-2022-02-22.html) as he outlined less favourable, on net, OMO terms i.e. floating rate & shorter tenor. This meant that the short end led the space lower, with YM unchanged XM +2.0 come the bell, while the IR strip was flat to 2 ticks lower at settlement.

STIR: What Is Priced For The Fed?

A quick look at FOMC dated OIS markets in the wake of the latest Russia-Ukraine developments. March FOMC dated OIS currently prices in ~29bp of tightening, while Dec ’22 FOMC dated OIS prices in ~145bp of cumulative tightening over that horizon. These levels compare to the respective 50bp & cumulative ~175bp of tightening that was briefly priced into markets less than 2 weeks ago (with the hawkish extremities coming on the back of slightly firmer than expected CPI data and ’22 FOMC voter Bullard calling for 100bp of tightening by the start of July, while he also pointed to the potential for an inter-meeting hike).

JGBS AUCTION: Japanese MOF sells Y497.5bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.5bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.017% (prev. -0.020%)

- High Spread: -0.016% (prev. -0.017%)

- % Allotted At High Spread: 29.3070% (prev. 10.1289%)

- Bid/Cover: 3.895x (prev. 3.516x)

AUSSIE BONDS: The AOFM sells A$150mn of the 3.00% 21 Sep 2025 I/L Bond, issue #CAIN407:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 3.00% 21 September 2025 I/L Bond, issue #CAIN407:

- Average Yield: -1.1400% (prev. -0.9733%)

- High Yield: -1.1300% (prev. -0.9700%)

- Bid/Cover: 4.8667x (prev. 5.7533x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 80.0% (prev. 96.2%)

- Bidders 48 (prev. 51), successful 14 (prev. 11), allocated in full 12 (prev. 8)

FOREX: RUB Round Trips From 15-Month Low As Geopolitical Musings Dominate

Initial risk-off moves related to Russia-Ukraine standoff were unwound, before G10 FX space moved into a waiting mode and consolidated in familiar ranges. Headline flow failed to offer much in the way of substantial news that could move the dial on geopolitical risk but a degree of reassurance may have been provided by speculation that the deployment of Russian troops into the breakaway regions in eastern Ukraine could mark a pause in the escalation of conflict. Source reports suggesting that the most severe sanctions prepared by the White House will be contingent on Russian incursion deeper into Ukraine's territory lent support to this theory, with a measured speech from President Zelensky pointing to Kyiv's continued willingness to utilise diplomatic channels. It also appeared that U.S. chief diplomat Blinken was still poised to meet his Russian counterpart Lavrov this Thursday, even as Western leaders continued to warn against potential for a broader Russian military intervention and rushed to compile fresh packages of sanctions.

- The Antipodeans found some poise as initial risk aversion moderated, with participants looking ahead to the monetary policy decision from the RBNZ. Governor Orr will announce the outcome of the MPC meeting on Wednesday, with policymakers widely expected to raise the OCR.

- The yen gave away its initial gains and wavered thereafter, as participants assessed geopolitical goings-on. The Swedish krona (eyed due to its sensitivity to the crisis in eastern Europe) briefly caught a bid but then eased off.

- Spot USD/RUB surged past RUB80.00 to its best levels since November 2020 in the U.S./Asia crossover but the rouble stabilised later on. Implied USD/RUB vols remain elevated across the maturity curve.

- While Russia/Ukraine headlines are poised to remain front & centre, the global data docket features German Ifo survey as well as U.S. Conf. Board Consumer Confidence & PMI figures. Speeches are due from Fed's Bostic, BoE's Ramsden & Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-05(E788mln), $1.1330-35(E998mln), $1.1350-60(E817mln), $1.1400(E614mln)

- USD/JPY: Y115.20-25($1.8bln)

- EUR/JPY: Y115.20-25($1.3bln)

- AUD/USD: $0.7200(A$1.6bln), $0.7300(A$805mln)

- USD/CAD: C$1.2600-10($1.1bln), C$1.2700($1.2bln), C$1.2800($747mln)

- USD/CNY: Cny6.3600($700mln)

ASIA FX: Risk Aversion Takes Toll On Asia EM FX As Russia Ups Ante In Conflict With Ukraine

Selling pressure hit Asia EM space as a consequence of aggravation of Russo-Ukraine tensions around the Donbas area. Monday saw President Putin recognise the self-proclaimed "republics" in eastern Ukraine as sovereign states and order the deployment of Russian troops into the region.

- CNH: Offshore yuan went offered against the greenback as the Asia-Pacific timezone reacted to escalation in Russo-Ukrainian standoff. China's ambassador to the UN delivered a remarkably brief and unsubstantial statement on the matter, calling for a diplomatic solution of the crisis. Concerns over the local tech sector resurfaced after China told state-owned companies & banks to check their exposure to Ant Group.

- KRW: The won bore the brunt of risk-off flows inspired by Russia's moves re: LPR/DPR, becoming one of the worst performing Asia EM currencies. Local officials pledged to monitor market developments and international security situation.

- IDR: Risk aversion pushed spot USD/IDR higher at the re-open. The rupiah held its initial losses.

- MYR: Likewise, the ringgit remained on the back foot, amid reduced willingness to take risk.

- PHP: Spot USD/PHP moved closer to key resistance from PHP51.500 but fell short of testing that level.

- THB: The baht sold off sharply as a flare up in Covid-19 cases amplified the impact of broader risk-off impetus. Officials raised alert level across the country but said they wouldn't implement lockdowns.

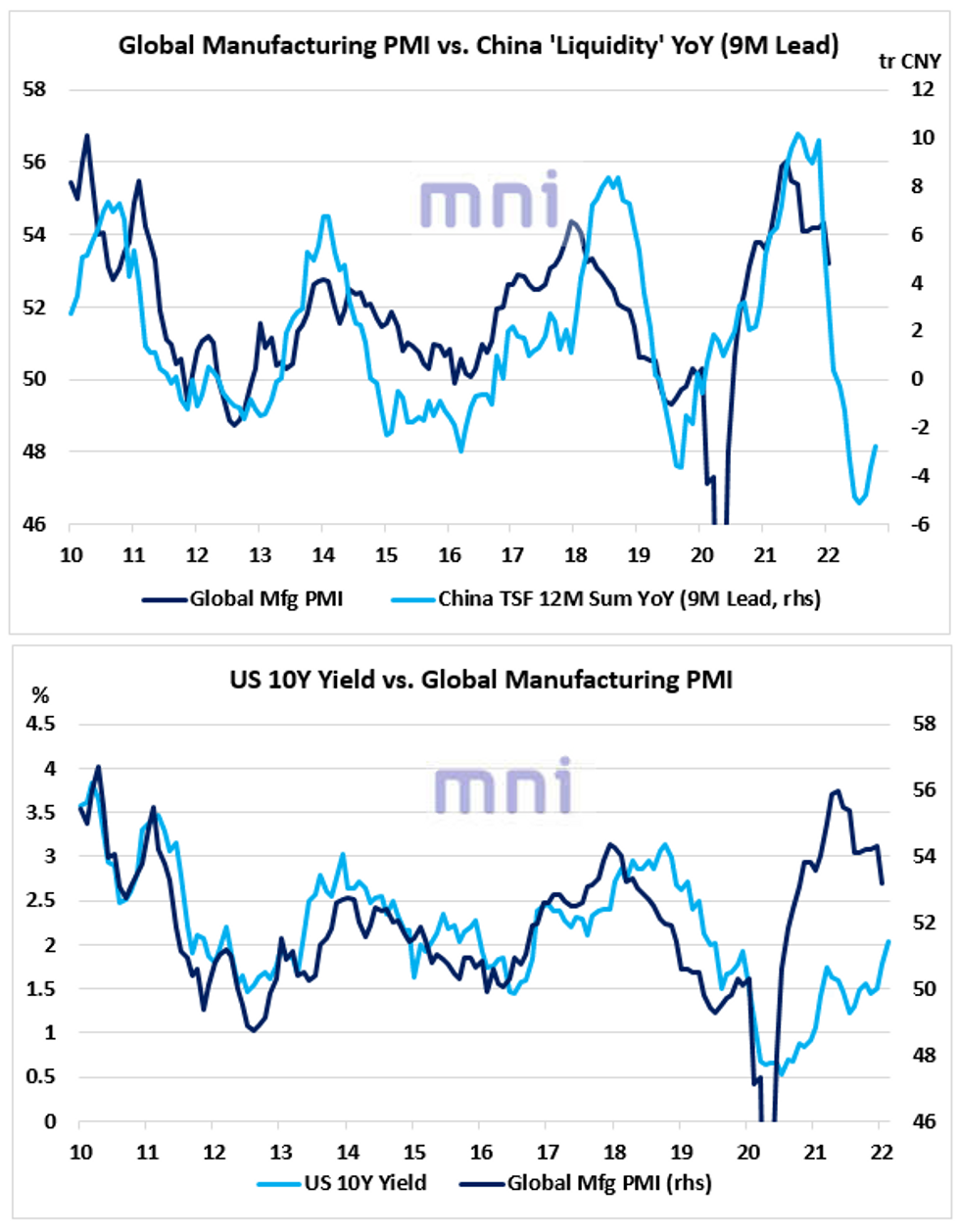

CHINA: Will The Sharp Contraction of ‘Liquidity’ in 2021 Continue Weigh on Global Activity in H1?

- We have seen that the sharp contraction in China ‘liquidity’ in 2021 has been weighing on domestic and (some) international asset prices in the past year, pricing in a significant slowdown in the global economic activity.

- The top chart shows that the annual change in ‘liquidity’, which define as the YoY change in China Total Social Financing (TSF) 12M sum, has acted a strong leading indicator of global manufacturing PMI in the past cycle.

- JPM global manufacturing PMI, which could be considered as a proxy for ‘real-time’ economic activity, peaked in May 2021 (56) and has been gradually testing new lows since then (declined to 53.20 in January).

- Even though China ‘liquidity’ seems to have reversed in recent months (with PBoC easing policy), periods of sharp 'tightening liquidity cycle' generally act with a lag of 9 to 12 months, therefore implying further economic slowdown in the near to medium term.

- Hence, constant downward revisions in growth expectations could limit the upside retracement in LT government bond yields.

- The bottom chart shows that US 10Y yield, which has shown strong relationship with the global manufacturing PMI, has been rapidly converging towards its ‘fair’ value in the past few months.

- The chart shows that US 10Y yield was 'too low' in 2021 relative to the 'stance' of the economy.

Source: Bloomberg/MNI.

EQUITIES: Lower In Asia As Ukraine Tensions, Chinese Regulatory Fears Weigh

Major Asia-Pacific equity indices trade 1.2% to 3.0% lower, with pressure from Monday’s escalation in the Russia-Ukraine situation mixing with widening concerns re: a fresh wave of regulatory scrutiny in China.

- To recap recent Chinese regulatory moves, the NDRC (China’s top planning agency) directed food delivery platforms to reduce fees charged to restaurants last Friday, while BBG source reports on Monday stated that Chinese regulators had begun a fresh round of inquiries into domestic bank & state firm financial exposure to Ant Group Co.

- The Hang Seng leads losses amongst regional equity indices, sitting 3.0% worse off at typing. The Hang Seng Tech Index also deals 3.0% softer, hitting the lowest levels observed since its inception (July ‘20).

- The CSI300 is 1.6% weaker at typing, led by losses in the consumer staples sub-index, with steep declines for large cap names such as Kweichow Moutai Co and Wuliangye Yibin Co observed. The PBoC’s latest liquidity boost (via short-term OMOs), the outline of impending fiscal support for struggling local governments and a PBoC directive re: support for Shanghai’s property market failed to turn the tide for the index.

- U.S. e-mini equity futures are off of their respective Asia-Pac lows, sitting 1.6% to 2.4% weaker at typing. Participants continue to debate Putin’s ultimate end game when it comes to Ukraine, in addition to assessing the impact of the impending round of sanctions that the west is tabling re: Russia.

GOLD: Pullback From Cycle Highs

Gold is ~$3/oz higher, printing $1,909.4/oz at writing. The precious metal has backed away from fresh eight-month highs made earlier in Asia-Pac dealing ($1,914.3/oz), with the early risk-off impulse from the latest developments surrounding the Russia-Ukraine situation edging away from extremes, despite a lack of fresh headline flow (perhaps a case of some market participants being hopeful that a Russia-backed separation of Luhansk & Donetsk from Ukraine will be the end game in the standoff, although the U.S. and some of its allies are not onboard with that train of thought).

- To recap, gold closed slightly higher on Monday after news that Russian President Putin had officially recognised the sovereignty of the aforementioned Ukrainian separatist regions, while ordering Russian troops into those territories to “keep the peace”. The move immediately drew condemnation from western leaders, seeing the U.S. and UK announce plans for Russian sanctions on Tuesday, with the EU to follow in the coming days.

- A reminder that U.S. Secretary of State Blinken and Russian FM Lavrov had previously agreed to meet in Geneva this Thursday, where details of a Biden-Putin summit (which had been agreed to in principle) were set to be discussed.

- Looking to technical levels, gold remains well clear of support at $1,853.9 (Jan 25 high), while key resistance at $1,916.6 (Jun 1 ’21 high and bull trigger) remains untested. A break above the latter would expose further resistance at $1,935.8/oz, the top of a bull channel drawn from the Aug 9 ’21 low.

OIL: Higher In Asia On Ukraine Standoff

WTI is +$2.50 (vs. Friday settlement) and Brent is +$1.50 (vs. Monday settlement). The benchmarks have pulled back from session highs after the early Asia shift higher, which was driven by the latest developments in the Russia-Ukraine situation.

- While western leaders (i.e. U.S., the U.K., and the EU) have announced the preparation of sanctions against Russia, a U.S. official told RTRS that Putin’s latest move will not trigger a broader sanctions package as Russia was simply moving into “territory that they’ve already occupied” (likely easing concerns among market participants re: a further escalation between various parties to the situation).

- To recap, both benchmarks moved higher on Monday after Russian President Putin announced Russia’s recognition of the sovereignty of Ukrainian separatist regions Donetsk and Luhansk, while ordering Russian troops into the territories for “peacekeeping operations”.

- On the technical front, Brent has broken through the bull trigger at $96.78 (Feb 14 high), and now sees resistance at $98.94 (2.764 projection of the Dec 2-9-20 price swing). Resistance for WTI remains unchanged at $95.82 (Feb 14 high).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/02/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 22/02/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2022 | 1045/1045 |  | UK | BOE Ramsden speech at National Farmers Union | |

| 22/02/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/02/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 22/02/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 22/02/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/02/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/02/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 22/02/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 22/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 22/02/2022 | 2030/1530 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.