-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Russia Retains Access To SWIFT, For Now

EXECUTIVE SUMMARY

- WEST UPS SANCTIONS ON RUSSIA, DOESN’T REVOKE SWIFT ACCESS, FEAR OF CAPTURE OF KYIV EVIDENT

- MORE RUSSIAN MISSILES HIT KYIV

- FED’S WALLER: FED SHOULD LIFT RATES A FULL PERCENTAGE POINT BY MID-YEAR (RTRS)

- FED’S MESTER: MARCH HIKE APPROPRIATE BARRING UNEXPECTED TURN (BBG)

- FED'S BARKIN: SUSTAINED HIGH OIL PRICES COULD 'DAMPEN' CONSUMPTION, GROWTH (RTRS)

- KISHIDA TO TEAM UP WITH BANK OF JAPAN TO CONTAIN UKRAINE FALLOUT (BBG)

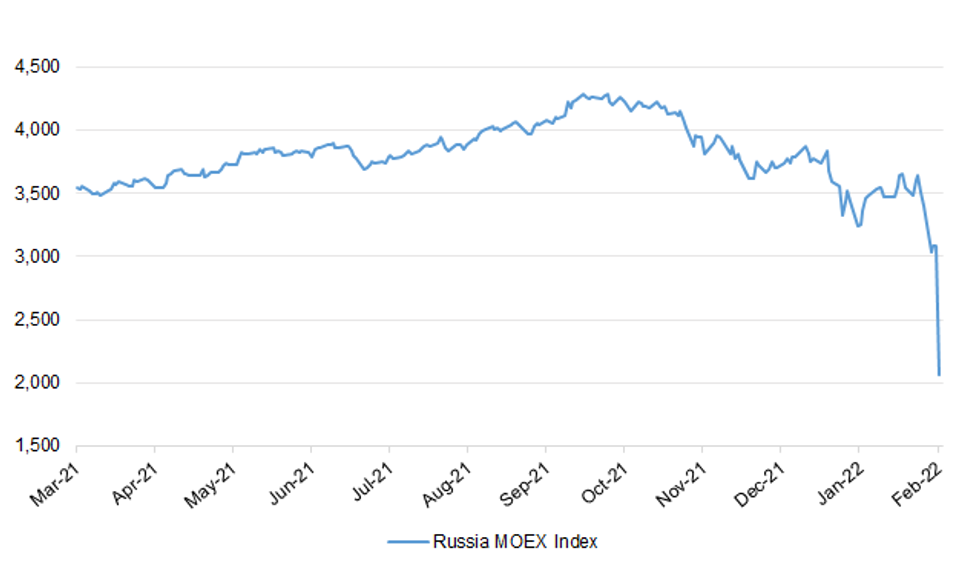

Fig.1: Russia MOEX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak has been accused of breaking lockdown laws, as it emerged he has been issued with a Metropolitan Police questionnaire over his attendance at a gathering in Downing Street during the pandemic.

EUROPE

ECB: European Central Bank President Christine Lagarde and finance chiefs will hold a news conference Friday afternoon after a meeting in Paris where they’ll address the economic impact of Russia’s invasion of Ukraine. Her comments will be closely watched by investors trying to gauge how the crisis will affect the ECB’s plans to gradually exit stimulus measures and move toward rate hikes. Austrian Governing Council member Robert Holzmann told Bloomberg News earlier that the conflict may slow the ECB’s action. EU finance ministers rewrote their agenda for the previously scheduled Paris meeting to focus on the Ukraine crisis. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for Friday include:

- Fitch on Estonia (current rating: AA-; Outlook Stable)

- Moody’s on Belgium (current rating: Aa3; Outlook Stable)

- S&P on Austria (current rating: AA+; Outlook Stable)

- DBRS Morningstar on Portugal (current rating: BBB (high), Stable Trend) & Slovakia (current rating: A (high), Stable Trend)

U.S.

FED: Federal Reserve Governor Christopher Waller on Thursday laid out the case for a "concerted" effort to rein in inflation, calling for raising interest rates a full percentage point by mid-year, starting with a half-percentage-point hike in March if data in coming weeks continues to point to an "exceedingly hot" economy. "I believe appropriate interest rate policy brings the target range up to 1 to 1.25 percent early in the summer," Waller said in remarks prepared for delivery to the University of California, Santa Barbara, Economic Forecast Project. The Fed should also start trimming its $9 trillion balance sheet "no later than" its July meeting, he said. (RTRS)

FED: Federal Reserve Bank of Cleveland President Loretta Mester said that barring an “unexpected turn in the economy,” she still supports kicking off a series of interest-rate hikes in March, and starting to reduce the size of the central bank’s balance sheet soon. “There are risks and uncertainty around the outlook, including those engendered by the geopolitical events unfolding today,” Mester said in prepared remarks for an event Thursday hosted by Lyons Companies and the University of Delaware. Asked after the speech how the Ukraine crisis will affect policy decisions, Mester said, “I don’t think it changes the need of the Fed to remove accommodation from the emergency levels” it currently has. (BBG)

FED: If the conflict in Ukraine leads to sustained high oil prices it could hit U.S. consumer spending and pose a possible risk to U.S. economic growth, said Richmond Federal Reserve President Tom Barkin. "If oil prices do continue to go up … It absolutely is going to increase recorded inflation. But it also constrains spending," Barkin said at an economic symposium mapping out one way that the conflict could influence the U.S. economic outlook. "A lot of people, especially lower income folks, a huge amount of their income goes towards gasoline. So if those prices go up it dampens consumer spending and dampens the economy.” (RTRS)

FED: MNI: Fed Asset Sales To Rein In Inflation Seen As Risky

- Some Fed officials favor using active sales of longer-dated Treasuries and MBS to fight inflation, but the potential for market disruption and political optics of possible losses for the central bank could keep such a plan grounded, former Fed staffers told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Senate Banking Chair Sherrod Brown said Thursday he will try again next week to advance President Joe Biden’s five Federal Reserve picks past a blockade led by ranking Republican Pat Toomey on Sarah Bloom Raskin’s nomination to vice chair of supervision. “We’re going to have another meeting next Wednesday morning. I am hopeful Republicans show up,” Brown said. (BBG)

INFLATION: MNI INTERVIEW: US Car Prices To Start Flattening Later In '22

- National Independent Automobile Dealers Association President Joe McCloskey told MNI he sees auto prices on the path to begin leveling off starting in the second half of the year, even as he expects demand to stay resilient in the face of rising interest rates - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

OTHER

JAPAN/BOJ: Japan’s Prime Minister Fumio Kishida said his government needs to work with the central bank to monitor for fallout from Russia’s invasion of Ukraine and signaled potential coordination in any policy response. “There is a need to cooperate more closely,” Kishida said in answer to questions in parliament on Friday. “The government and Bank of Japan must be fully prepared in conducting economic and fiscal policies appropriately while closely watching financial markets and the economy.” (BBG)

RBA: Australia’s central bank will probably tighten monetary policy “several” times this year to stave off inflation, with surging oil costs fueled by the Russia-Ukraine conflict further adding to price risks, former Reserve Bank board member Warwick McKibbin said. “The inflation numbers in Australia, although much lower than the rest of the world, are still towards the top end” of the RBA’s 2-3% target, said McKibbin, who served on the board from 2001-2011 and is a professor of economics at Australian National University. “And the oil price shocks will obviously put upward pressure on that.” (BBG)

RBNZ: New Zealand’s central bank aims to raise interest rates as quickly as possible to contain inflation and avoid the need for even greater policy tightening in future, Governor Adrian Orr said. “By getting on top of inflation pressures quickly, by raising interest rates sooner, we aim to prevent the need for even higher rates,” Orr said in a speech to the Waikato University Economics Forum on Friday. “We are taking our foot off the accelerator as quickly as possible to avoid having to use the brake unnecessarily in the future.”

SOUTH KOREA: South Korea’s main opposition party presidential candidate Yoon Suk-yeol widened lead over his ruling party competitor Lee Jae-myung by 7ppts, according to a Gallup Korea poll released Friday. Yoon of People Power Party led Lee at 41% to 34%. (BBG)

SOUTH KOREA: South Korea’s Financial Services Commission is reviewing possibility of making a stock market stabilization fund amid concerns of rising volatility following Russia’s attack on Ukraine, Korea Economic Daily says, citing unidentified financial authorities. Authorities are closely monitoring the situation including an option to review the stabilization fund, as the stock market plunges on Russia-Ukraine tension. South Korea had attempted to form a 10.7t won stock market stabilization fund with participation from state-run banks, financial holding companies and financial companies after the coronavirus outbreak in 2020. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said Russia resumed missile strikes at 4 a.m. on Friday, but its troops had been stopped from advancing in most directions. In a televised speech, Zelenskiy said the Russian strikes were aimed at both military and civilian targets. (RTRS)

RUSSIA: Kyiv may fall to Russian forces soon as Ukraine’s air defenses have been effectively eliminated, according to a senior Western intelligence official. Russian troops are advancing toward Ukraine down both sides of the Dnieper river and look set to take the capital, the official said. (BBG)

RUSSIA: President Vladimir Putin's forces have seized control of the former Chernobyl nuclear power station near Pripyat, around 60 miles from the capital Kyiv, following fierce clashes with government forces, according to the Ukrainian prime minister Denys Shmyhal. It was the site of the world's worst nuclear disaster in 1986 when a reactor exploded, and an adviser to the presidential office, Mykhailo Podolyak, said: "It is impossible to say the Chernobyl nuclear power plant is safe after a totally pointless attack by the Russians." (Sky)

RUSSIA: Russia wants to negotiate terms of surrender, Kremlin Press Secretary Dmitry Peskov said in a statement late Thursday amid Russia’s ongoing invasion of Ukraine. According to RT, Peskov said that Russian President Vladimir Putin wants Ukraine to promise to be neutral and not aspire to be a NATO member and not keep any Western weaponry on its territory, adding that those are conditions for Russia to sit on the negotiating table. The terms will enable “demilitarization and denazification” of Ukraine, Peskov alleged. (Daily Sabah)

RUSSIA: Russia's central bank is ready to support banks hit by Western sanctions, it said on Friday, promising to provide them with rouble and foreign exchange liquidity while saying claims to withdraw forex deposits would be fulfilled in full. "All banks have developed measures to ensure uninterrupted operations in the face of sanctions, and we assess these plans as adequate," the central bank said, adding it was ready to use additional tools to maintain banks' stability if needed.

RUSSIA: Russia remains part of the world economy and “for as long as it remains a part, we are not going to damage the system in which we feel we’re” involved, Putin told a meeting with billionaires and heads of leading Russian businesses. “Our partners should understand this and not set themselves the task of pushing us out of this system.” He urged Russian businesses to work “in solidarity” with the government against the impact of international sanctions, saying he’d been obliged to invade Ukraine because the West hadn’t “given a millimeter” in response to Russia’s demands for security guarantees. (BBG)

RUSSIA: Russia is preparing new wave of attacks, including using airborne troops, Ukraine’s Defense Minister Oleksiy Reznikov said in a Facebook post. “Heavy fighting occurring in Luhansk and Sumy, north of the capital,” he said, adding “it is not an easy situation in the south.” He said the Ukrainian army is ready to repel the new attacks, and is using “modern weapons.” At the Pentagon, spokesman John Kirby said Russia has launched more than 160 missiles, most of them short-range ballistic missiles. (BBG)

RUSSIA: Global farm commodities trader Cargill Inc said on Thursday that an ocean vessel it chartered was "hit by a projectile" on the Black Sea, but that the ship remained seaworthy and all crew were safe and accounted for. The incident occurred offshore from Ukraine on Thursday after Russia launched an invasion of the major grain-producing country where Cargill operates an export terminal. (RTRS)

RUSSIA: The White House said on Thursday that President Vladimir Putin has grander ambitions than Ukraine, when asked about the Russian leader's ultimate goals following an invasion of the neighboring country. (RTRS)

RUSSIA: President Joe Biden hit Russia with a wave of sanctions on Thursday after Moscow invaded Ukraine, measures that impede Russia's ability to do business in major currencies along with sanctions against banks and state-owned enterprises. Biden described Russian President Vladimir Putin as an aggressor with a "sinister vision of the world" and a misguided dream of recreating the Soviet Union. But he held back from imposing sanctions on Putin himself and from disconnecting Russia from the SWIFT international banking system, amid differences with Western allies over how far to go at this juncture and criticism from Republicans that he should have done more. The sanctions are aimed at limiting Russia's ability to do business in dollars, euros, pounds and yen. Among the targets were five major banks, including state-backed Sberbank and VTB, as well as members of the Russian elite and their families. Sberbank, Russia's largest lender, will no longer be able to transfer money with the assistance of U.S. banks. The White House also announced export restrictions aimed at curbing Russia's access to everything from commercial electronics and computers to semiconductors and aircraft parts. (RTRS)

RUSSIA: The idea of sanctioning Russia’s Putin personally was “not a bluff” and remains “on the table” as the U.S. ratchets up its response to the invasion of Ukraine, Biden said in his appearance at the White House on Thursday. But the U.S. leader also conceded that even the sweeping sanctions targeting Russia’s financial sector imposed Thursday would take time to have an impact, and that he didn’t believe their announcement would cause Putin to stand down his invasion. “They are profound sanctions – let’s have a conversation in another month or so to see if they’re working,” Biden said. (BBG)

RUSSIA: The United States and the European Union have opted not to cut Russia off from the SWIFT global interbank payments system as part of their sanctions against Moscow for invading Ukraine, but could revisit that issue, U.S. President Joe Biden said on Thursday. Asked why that step was not taken, Biden told reporters the sanctions imposed against Russian banks exceeded the impact of cutting Russia off from SWIFT, and other countries had failed to agree on taking the additional step at this point. (RTRS)

RUSSIA: The Biden administration defended its decision not to sanction Russia’s energy sector on Thursday, with an official saying it was reluctant to disrupt an area “where Russia has systemic importance in the global economy.” “We’re not going To do anything which causes an unintended disruption to the flow of energy as a global economic recovery is still underway,” Deputy National Security Advisor Daleep Singh told reporters at the White House. (BBG)

RUSSIA: European Union leaders are putting on a united front after a six-hour meeting during which they agreed on a second package of economic and financial sanctions on Russia. The EU Council president accuses Russia of using “fake pretexts and bad excuses” for justifying its invasion of Ukraine and says sanctions will hurt the government. The legal texts for the sanctions agreed on are expected to be finalized overnight and be submitted for approval to EU foreign affairs ministers Friday. EU Commission president Ursula von der Leyen says the package includes targeting 70% of the Russian banking market and key state-owned companies. She says Russia’s energy sector also will be targeted “by making it impossible for Russia to upgrade its refineries.” And there will be a ban on sales of software, semiconductors and airliners to Russia. (AP)

RUSSIA: Prime minister Boris Johnson unveiled a tough package of penalties including an asset freeze against all major Russian banks and a plan to ban Russian companies from raising finance on U.K. markets. The sanctions involve an immediate ban on the export of dual-use civilian and military items to Russia, and a plan to limit the amount that Russian nationals can deposit in U.K. banks. Johnson pushed for Russia to be ejected from the international Swift payments system on a call earlier with Group of Seven leaders, according to his spokesman Max Blain. “Nothing is off the table,” Johnson said in the House of Commons, when discussing Swift. Some nations in Europe have been highly cautious about doing so, given the economic and financial impact it would cause their companies and economies in turn. (BBG)

RUSSIA: Japan will impose additional sanctions targeting Russia following its invasion of Ukraine, Prime Minister Fumio Kishida said Friday, joining the United States and Europe in piling pressure on Moscow. The new package of sanctions include export controls on high-tech products such as semiconductors, a freeze on assets held by Russian financial institutions and a suspension of visa issuance for certain Russian individuals and entities. (Kyodo)

RUSSIA: Canada announced more sanctions against Russia on Thursday, targeting 62 individuals and entities, including members of the elite and major banks, and cancelled all export permits following Russia's attack on Ukraine. (RTRS)

RUSSIA: The United Nations Security Council is expected to vote on Friday on a U.S.-drafted resolution that condemns Russia for invading Ukraine and requiring Moscow to 'immediately, completely, unconditionally,' withdraw from Ukraine, a senior U.S. administration official said on Thursday. Russia, one of the five veto-wielding members of the Security Council, will likely veto the resolution, the U.S. official said, but Washington and others view the council as a critical venue where Moscow must be forced to explain itself. "We're not going to stand by and do nothing," the official briefing reporters in a call said. (RTRS)

RUSSIA: U.S. Representative Adam Schiff, chairman of the House of Representatives Intelligence Committee, said on Thursday there was "pressing concern" that Russian cyber attacks would extend beyond Ukraine but he had not seen evidence of such attacks on the United States related to the conflict. "In warfare there is always the risk of escalation," the Democratic lawmaker told reporters at the U.S. Capitol. (RTRS)

RUSSIA: MSCI will not implement changes for Russian securities that it had previously announced as part of its February review, following U.S. sanctions targeting Russia, the index provider said in a statement on Thursday. MSCI also said it welcomed feedback from market participants on the impact of the U.S. sanctions on their investment processes, including whether any additional changes to MSCI indexes may be necessary or helpful “to maintain the investability of relevant MSCI indexes.” The changes, which were announced earlier this month, as part of MSCI’s regular review process, had been due to be implemented as of the market’s close on Feb. 28. (RTRS)

RUSSIA: UBS Group AG triggered margin calls on some wealth management clients that use Russian bonds as collateral for their portfolios after marking down the value of debt issued by the country and its corporations. The Swiss wealth manager is calling on some investors to add eithe cash or securities to their portfolio after cutting the lending value of some Russian bonds to zero, people with knowledge of the matter said. While the sovereign bonds still trade around 50 cents on dollar, and many Russian corporate bonds are well above that, UBS’s move signals it essentially will no longer accept them as collateral. (BBG)

IRON ORE: The world’s No. 2 iron ore supplier maintains a positive outlook for the steel raw material, citing the global economic recovery amid vaccination progress and the less-harmful effects of new variants. In an earnings statement that didn’t mention Russia’s invasion of Ukraine, Vale said it expects world steel production to grow slightly this year amid a reduction in supply chain bottlenecks, pent-up demand and rising business and consumer confidence. (BBG)

ENERGY: Biden said he’s seeking to shield Americans from higher energy costs by exempting energy payments from sanctions and through a potential additional release of emergency crude stockpiles. “I will do everything in my power to limit the pain the American people are feeling at the gas pump. This is critical to me,” Biden said in his address from the White House. “But this aggression cannot go on. If it did, the consequences for America would be much worse.” The U.S. already authorized the release of 50 million barrels of crude from the U.S. Strategic Petroleum Reserve last year. Biden said the U.S. will release additional supplies as conditions warrant, and is “actively working with countries around the world” on a potential collective discharge of emergency supplies. He also warned U.S. oil and gas companies not to “exploit this moment to hike their prices, to raise profits.” (BBG)

CHINA

TSF: MNI: China's Total Social Financing To Grow Faster In 2022

- Chinese total social financing, a broad measure of credit, is set to grow more quickly this year as the People’s Bank of China looks past previous concerns over excessive leverage and boosts loans to real estate and infrastructure spending in line with the government’s upcoming economic growth target, policy advisors and analysts told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: Chinese provinces are selling special bonds at a faster pace this month than in previous years, fueling optimism that infrastructure construction will soon pick up to give the economy a long-awaited boost. Nearly 340 billion yuan ($54 billion) of new special local notes, which are mostly used to fund government investment in infrastructure, was scheduled to be issued this month, 80% and 88% more than the same period in 2020 and 2019, respectively, Bloomberg-compiled data show. Very little such debt was sold early last year as no quota was granted before the parliament session in March. (BBG)

YUAN: The yuan is expected to appreciate to 6.30 against the U.S. dollar as investors seek to divert from the risks of the Russia-Ukraine conflict, the China News Service reported citing analysts. The recent rapid appreciation of the yuan may be supported by the inflow of foreign funds to Chinese assets, given the China-U.S. interest spread has been falling all the way in January and the geopolitical tension failed to disturb the pace of foreign investment in yuan bonds, the newspaper said citing an analysis by CICC. Both onshore and offshore yuan had reached an intraday high of 6.3095 and 6.3016 yesterday, the highest in nearly four years, the newspaper said. (MNI)

PROPERTY: China should prevent excess credit from flooding the real estate markets again by directing resources to infrastructure and high-tech investment, the Shanghai Securities News reported citing Sheng Songcheng, a former director of the Statistics and Analysis Department of the People's Bank of China. Infrastructure investment can stabilize the economy and improve market expectations in a relatively short period of time, and China should continue with the building of traditional infrastructure in transportation, energy, water conservancy, agriculture, and logistics while promoting the digital upgrade with 5G and big data projects, the newspaper cited Sheng as saying. (MNI)

OVERNIGHT DATA

JAPAN FEB TOKYO CPI +1.0% Y/Y; MEDIAN +0.7%; JAN +0.6%

JAPAN FEB TOKYO CORE CPI +0.5% Y/Y; MEDIAN +0.4%; JAN +0.2%

JAPAN FEB TOKYO CORE-CORE CPI -0.6% Y/Y; MEDIA -0.7%; JAN -0.7%

JAPAN DEC, F LEADING INDEX CI 104.8; FLASH 104.3

JAPAN DEC, F COINCIDENT INDEX 92.7; FLASH 92.6

NEW ZEALAND JAN TRADE BALANCE -NZ$1.082BN; DEC -NZ$975MN

NEW ZEALAND JAN 12MTH YTD TRADE BALANCE -NZ$7.717BN; DEC -NZ$7.282BN

NEW ZEALAND JAN EXPORTS NZ$4.86BN; DEC NZ$6.10BN

NEW ZEALAND JAN IMPORTS NZ$5.94BN; DEC NZ$7.07BN

UK FEB GFK CONSUMER CONFIDENCE -26; MEDIAN -18; JAN -19

CHINA MARKETS

PBOC NET INJECTED CNY290 BLN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY300 billion via 7-day reverse repos with the rates unchanged at 2.10% on Friday. The operation has led to a net injection of CNY290 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain stable liquidity at month-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1652% at 09:30 am local time from the close of 2.1952% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 58 on Thursday vs 54 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3346 FRI VS 6.3280

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3346 on Friday, compared with 6.3280 set on Thursday.

MARKETS

SNAPSHOT: Russia Retains Access To SWIFT, For Now

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 456.72 points at 26429.97

- ASX 200 up 7.175 points at 6997.8

- Shanghai Comp. up 22.334 points at 3452.019

- JGB 10-Yr future down 20 ticks at 150.24, yield up 0.5bp at 0.206%

- Aussie 10-Yr future down 7.5 ticks at 97.76, yield up 7.5bp at 2.233%

- U.S. 10-Yr future -0-01 at 126-14, yield down 0.34bp at 1.958%

- WTI crude up $1.72 at $94.52, Gold up $10.28 at $1914.14

- USD/JPY down 32 pips at Y115.20

- WEST UPS SANCTIONS ON RUSSIA, DOESN’T REVOKE SWIFT ACCESS, FEAR OF CAPTURE OF KYIV EVIDENT

- MORE RUSSIAN MISSILES HIT KYIV

- FED’S WALLER: FED SHOULD LIFT RATES A FULL PERCENTAGE POINT BY MID-YEAR

- FED’S MESTER SAYS MARCH HIKE APPROPRIATE BARRING UNEXPECTED TURN

- FED'S BARKIN SAYS SUSTAINED HIGH OIL PRICES COULD 'DAMPEN' CONSUMPTION, GROWTH

- KISHIDA TO TEAM UP WITH BANK OF JAPAN TO CONTAIN UKRAINE FALLOUT

BOND SUMMARY: Waller Looking At Potential 50bp Hike, Ukraine Worry Still Elevated

Overnight headline flow was dominated by Fed Governor Waller noting that he would be open to a 50bp rate increase in March if the incoming data continues to point to an exceedingly hot economy, while he followed St Louis Fed President Bullard (his former boss) in pointing to the need for 100bp of hikes by mid-year. Waller also noted that it is far too early to accurately assess the risk posed by the situation in Ukraine, while pointing to a potential moderation in tightening requirements if related downside risks developed. FOMC dated OIS now prices in 31.5bp of tightening for March, ticking higher overnight, but operating well within the recent range. Elsewhere, worry re: Russian advances towards the Ukrainian capital of Kyiv remained evident, offsetting some of the downward pressure. TYH2 -0-02 at 126-13 into European hours (note that OI has moved into TYM2 ahead of Monday’s first notice). Cash Tsy trade has seen some twist flattening, reflecting the balance between Fed pricing and worry re: Ukraine outlined above, with the major benchmarks running 2.5bp cheaper to 1.5bp richer. Liquidity has deteriorated in both futures and cash trading. Looking to the NY docket, we will get the latest round of PCE readings, durable goods data, pending home sales & UoM sentiment survey will all cross.

- The overnight impulse generally weighed on JGBs during Tokyo dealing, with futures ending -21, extending on overnight losses. Meanwhile, cash JGBs were little changed to 3.5bp cheaper, twist steepening. Payside swap flows also weighed on the space, as most swap spreads widened (super long swaps rates were 3.5-4.5bp higher on the day). A strong 2-Year JGB auction supported paper out to 10s during early afternoon dealing, but the move was very limited, and faded.

- Aussie bond futures looked lower in early Sydney dealing, extending on overnight losses, before following the broader ebb & flow of the session. That left YM -5.0 and XM -7.5 come the bell. The long end didn’t show anything in the way of material weakness after the AOFM noted that it will auction A$300mn of ACGB Jun-51 paper next week, with the 7- to 12-Year sector underperforming on the day.

JGBS AUCTION: Japanese MOF sells Y2.4188tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4188tn 2-Year JGBs:

- Average Yield -0.020% (prev. -0.054%)

- Average Price 100.051 (prev. 100.119)

- High Yield: -0.017% (prev. -0.049%)

- Low Price 100.045 (prev. 100.110)

- % Allotted At High Yield: 0.8465% (prev. 11.3799%)

- Bid/Cover: 4.559x (prev. 3.874x)

JGBS AUCTION: Japanese MOF sells Y4.6210tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6210tn 3-Month Bills:

- Average Yield -0.0904% (prev. -0.0819%)

- Average Price 100.0243 (prev. 100.0220)

- High Yield: -0.0837% (prev. -0.0763%)

- Low Price 100.0225 (prev. 100.0205)

- % Allotted At High Yield: 97.6211% (prev. 1.7558%)

- Bid/Cover: 3.096x (prev. 2.799x)

AUSSIE BONDS: The AOFM sells A$500mn of the 2.75% 21 Nov ‘29 Bond, issue #TB154:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.75% 21 November 2029 Bond, issue #TB154:

- Average Yield: 2.1648% (prev. 0.9238%)

- High Yield: 2.1650% (prev. 0.9250%)

- Bid/Cover: 3.7700x (prev. 4.8450x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 62.1% (prev. 60.0%)

- Bidders 37 (prev. 43), successful 10 (prev. 13), allocated in full 1 (prev. 4)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 28 February it plans to sell A$1.0bn of the 0.25% 21 November 2025 Bond.

- On Wednesday 2 March it plans to sell A$300mn of the 1.75% 21 June 2051 Bond.

- On Thursday 3 March it plans to sell A$1.0bn of the 10 June 2022 Note & A$1.0bn of the 8 July 2022 Note.

- On Friday 4 March it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

OIL: Underpinned In Asia As Ukraine Invasion Progresses

WTI is ~+$2.20 and Brent is ~+$2.40, printing ~$95.00 and ~$101.50 respectively. Both benchmarks trade well clear of Thursday’s troughs, with geopolitical matters remaining front and centre, as reports of Russian advances towards the Ukrainian capital did the rounds in Asia, with a fresh round of missile attacks also noted.

- To recap, Thursday saw WTI and Brent fall sharply away from fresh cycle highs (with the initial move higher facilitated by the commencement of the Russian invasion of Ukraine) as the U.S. announced a fresh round of sanctions that ultimately avoided targeting the Russian energy sector.

- The ongoing Iranian nuclear talks in Vienna have yielded no new developments of significance, although hope for a potential deal in the coming weeks remains elevated (data intelligence firm Kpler suggested that Iran has moved up to 100mn bbls of oil onto tankers in anticipation of a resumption in oil exports).

GOLD: Higher In Asia

Gold is ~$11/oz higher, printing ~$1,915/oz at writing. The precious metal has backed away from session highs around $1,920/oz, after Fed Governor Waller pointed to the potential for a 50bp rate hike in March (flagging data-dependence), in addition to the need for a total 100bp of tightening by mid-year (although he conceded that geopolitical risks may result in the need for a more moderate tightening cycle).

- Still, developments in Ukraine continue to dominate price action, with participants now monitoring the progress of the Russian military towards the Ukrainian capital city of Kyiv. Worry re: the potential for a regime change in Ukraine has been flagged.

- To recap, gold closed slightly lower on Thursday after large swings that peaked at ~$1,975/oz (on news of the Russian invasion of Ukraine), before plunging to ~$1,880/oz in the NY session (following the announcement of U.S. sanctions on Russia). Note that Western sanctions in the wake of the Russian military operations have been deemed less severe than initially feared e.g. Russia can still access the SWIFT payments system and there has been a lack of personal sanctions on Russian President Putin.

FOREX: Greenback Extends Pullback Even As Russian Invaders Approach Kyiv

Abundant but noisy headline flow surrounding Russia's ongoing invasion of Ukraine dominated as missiles rained down on Kyiv. General reporting suggested that that Russian troops were advancing into the outskirts of the capital with the aim of capturing the city and overthrowing the government. President Zelensky vowed to stay in Kyiv as his troops were mounting resistance on several fronts. Meanwhile, market participants assessed the barrage of sanctions against Moscow unveiled Thursday by Western leaders.

- The greenback underperformed even as Fed's Waller who flagged potential for a 50bp rate hike in March, if the data facilitates the need for such a move. The DXY extended its pullback from a multi-month high printed Thursday.

- The Antipodeans found some poise despite the absence of notable local catalysts, with broader risk sentiment stabilising after the Thursday session.

- Scandie FX remained under pressure owing to their exposure to the war in Ukraine, with SEK lagging all its G10 peers except USD.

- The rouble reversed initial losses after Moscow re-open as U.S. President Biden said the West will hold off on pulling the plug on Russia's access to the SWIFT payments system.

- U.S. personal income/spending, German & French GDP data and Norwegian unemployment will take focus on the data front. ECB Pres Lagarde will speak after Eurogroup meeting.

FOREX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.8bln), $1.1225(E627mln), $1.1245-55(E1.5bln), $1.1265(E548mln), $1.1290-00(E3.4bln), $1.1315-35(E2.3bln), $1.1345-50(E752mln), $1.1385-00(E1.4bln), $1.1425-35(E1.0bln)

- USD/JPY: Y113.50($715mln), Y114.30-50($592mln), Y115.25-30($781mln), Y116.40($1.4bln)

- EUR/GBP: Gbp0.8335-55(E807mln)

- EUR/JPY: Y128.65-70(E591mln)

- AUD/USD: $0.7225-35(A$2.7bln), $0.7270(A$541mln)

- USD/CAD: C$1.2645-50($1.5bln), C$1.2695-10($827mln), C$1.2800-10($849mln)

- USD/CNY: Cny6.3700($675mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/02/2022 | 0700/0800 | ** |  | SE | PPI |

| 25/02/2022 | 0700/0800 | *** |  | DE | GDP (f) |

| 25/02/2022 | 0700/0800 | *** |  | DE | GDP (f) |

| 25/02/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 25/02/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 25/02/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 25/02/2022 | 0745/0845 | ** |  | FR | PPI |

| 25/02/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/02/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/02/2022 | 0900/1000 | * |  | NO | Norway Unemployment Rate |

| 25/02/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 25/02/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 25/02/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 25/02/2022 | 1115/1215 |  | EU | ECB Lagarde at Eurogroup Press Conference | |

| 25/02/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup meeting | |

| 25/02/2022 | - |  | EU | ECB Lagarde & de Guindos at ECOFIN meeting | |

| 25/02/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 25/02/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 25/02/2022 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 25/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/02/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 25/02/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/02/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/02/2022 | 1800/1800 |  | UK | BOE Pill unwinding QE remarks at BEAR Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.