-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI EUROPEAN MARKETS ANALYSIS: Another Round Of Fresh Cycle Highs For Oil

- Brent briefly topped $111.00 overnight, as crude oil futures tagged fresh cycle highs, before easing back from best levels.

- US Tsys initially showed lower in Asia before recovering as crude pulled back from aforementioned cycle highs and a little more Fed rate hike premium was wound out of the OIS strip.

- U.S. ADP employment change, German unemployment & flash EZ CPI as well as a monetary policy decision from the BoC take focus from here. The central bank speaker slate is tightly packed, with a congressional testimony from Fed Chair Powell providing the highlight

BOND SUMMARY: Squeezing Higher Into European Hours

Fresh cycle highs for crude oil futures (Brent printed above $111.00) applied pressure to U.S. Tsys in early Asia dealing, although the space has since recovered from session cheaps. This came as crude futures moved off their peak (although WTI & Brent are still ~$5/bbl firmer on the session), while reports of Russian troops entering Kharkiv through the air did the rounds (with Ukraine pointing to an attack on a hospital). U.S. President Biden’s assertions re: Russia e.g. “Putin will pay a high price over the long run,” having a limited impact on wider price action. Biden also tried to assure the U.S. public that he will do everything he can to combat inflation, in what was his first State of the Union address. We have also seen Russian banks start to wind up some of their European entities. TYM2 -0-03 at 128-20+, moving to fresh session highs into European hours (aided by a 3K block buy in the contract). Cash Tsys run 2.5bp richer to 1.0bp cheaper, twist steepening. Note that FOMC dated OIS now prices ~23bp of tightening at the Fed’s March meeting i.e. a 25bp hike is not fully priced in, while ~118bp of tightening is priced in for calendar ’22 i.e. less than 5x 25bp rate hikes. ADP employment data headlines the economic release docket during NY hours (ahead of Friday’s NFP reading, cue discussions/debate re: correlation between the two), with Fedspeak from Powell (day 1 of his testimony on the Hill), Bullard & Evans, as well as commentary from NY Fed’s Logan (on asset purchases), also due.

- JGB futures went out at best levels, adding 62 ticks on the day, although it wasn’t all one-way traffic after a solid round of richening during the overnight session. Cash JGB trade saw the major benchmarks richen by 2-5bp on the day, with 7s outperforming, owing to the bid in futures.

- ACGBs ticked higher into the close, with Tsys off worst levels, although the space had been a little more reluctant to go offered than its U.S. counterpart, perhaps pointing to some early signs of cross market demand. YM +10.0 & XM +11.5 at the close, with the 7- to 10-Year zone of the cash curve outperforming on the day. The space looked through virtually in line with exp. Q4 domestic GDP data.

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 2.6294% (prev. 2.4794%)

- High Yield: 2.6325% (prev. 2.4825%)

- Bid/Cover: 2.8167x (prev. 1.9400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 76.9% (prev. 80.0%)

- Bidders 64 (prev. 44), successful 25 (prev. 25), allocated in full 17 (prev. 18)

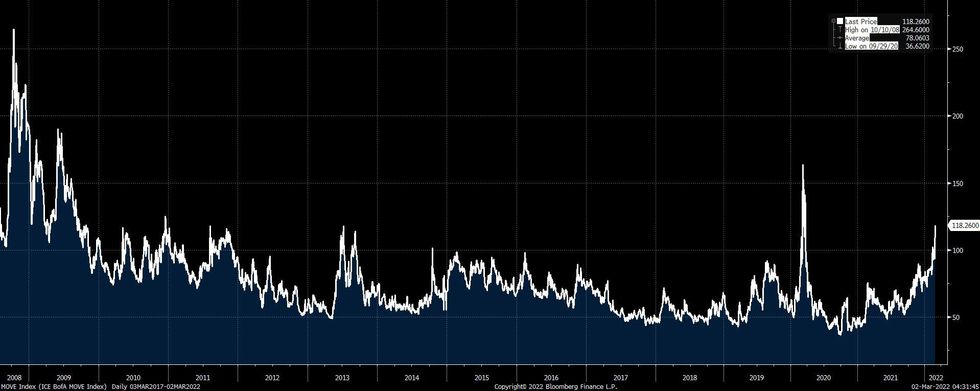

US TSYS: On The MOVE

Tuesday’s stagflation worry & the market unwinding some of its expectations re: FOMC tightening pushed vol. higher, with the ICE-Bank of America MOVE index extending further away from the historically suppressed levels that were observed during H220. Still, the index remains some way shy of its March ’20 multi-year extremes (which were of course a product of the wider COVID outbreak).

Fig. 1: ICE-Bank of America MOVE index

Source: MNI - Market News/ICE/Bank of America/Bloomberg

Source: MNI - Market News/ICE/Bank of America/Bloomberg

FOREX: Oil Fuels Rally In Commodity Currencies, Safe Havens Lose Appeal

Major commodity-tied currencies staged a rally as crude oil prices extended gains amid supply concerns fuelled by the ongoing Russian assault on Ukraine. The Antipodeans led gains overnight, with CAD and NOK breathing down their necks.

- Safe havens lost their allure as U.S. e-mini futures operated in the green. The yen and franc were among the worst G10 performers, while the greenback was little changed.

- This is not to say that the Russo-Ukrainian war was forgotten. The rouble was indicated lower in offshore trading, with USD/RUB adding more than 1.5 figure and oscillating around the RUB110 mark.

- Contagion risk continued to sap strength from the SEK, which landed at the bottom of the G10 pile. EUR/SEK came within a whisker of its near two-year high printed on Tuesday.

- U.S. ADP employment change, German unemployment & flash EZ CPI as well as a monetary policy decision from the BoC take focus from here. The central bank speaker slate is tightly packed, with a congressional testimony from Fed Chair Powell providing the main highlight.

ASIA FX: Yuan Gains With Things Back To Normal With PBOC Fix, Most EM FX Remain Vulnerable

Russia's escalating invasion of Ukraine remained a factor discouraging participants from buying EM currencies, albeit the redback managed to eke out some gains.

- CNH: Offshore yuan appreciated a tad as the bearish bias in daily PBOC fixing narrowed to a typical, insignificant level.

- KRW: Spot USD/KRW operated in positive territory as onshore markets in South Korea re-opened after a holiday. The won came under pressure from the escalation in Russia's invasion of Ukraine (with familiar implications for energy markets) and a continued surge in daily Covid-19 cases, which topped 200k for the first time.

- IDR: Spot USD/IDR crept higher as the ongoing war in Ukraine undermined appetite for riskier EM currencies.

- MYR: Spot USD/MYR oscillated around unchanged levels amid limited local news flow.

- PHP: The Philippine peso retreated on Wednesday. Pressure on the currency may have been amplified by recent comments from BSP Gov Diokno, who reiterated that the central bank wants to maintain its loose policy stance.

- THB: Spot USD/THB trimmed some of its initial gains after failing to test its 200-DMA. Thailand's business leaders convened to discuss the implications of the Russo-Ukrainian war.

EQUITIES: Lower As Inflationary Concerns Weigh

Most of the major Asia-Pac equity indices trade lower at writing, following a negative lead from Wall St. High-beta stocks across several sectors bore the brunt of the downward pressure, amidst intensifying concerns re: higher inflation. Conversely, broad gains were witnessed in energy stocks across the region, as the major crude oil benchmarks registered another round of fresh multi-year highs.

- The Hang Seng is 1.1% worse off at typing, taking the index back to two-year lows as the fallout from a widening COVID-19 outbreak in Hong Kong weighs on sentiment. The financials sub-index leads losses (-2.0%), with steep declines witnessed in large caps such as HSBC (-5.0%) and Hong Kong Exchanges and Clearing (-2.2%).

- The Chinese CSI300 deals 1.0% softer, as richly valued consumer staples, healthcare, and consumer discretionary stocks struggled on the day. The tech heavy ChiNext sits 1.8% lower at typing, with new-energy stocks dragging the index lower.

- The ASX200 broke the regional trend, lodging modest gains, with the high weighting of the buoyant materials and energy sectors resulting in outperformance for the index.

- U.S. e-mini equity index futures sit ~0.5% firmer apiece at writing, trading just below session highs ahead of European hours.

GOLD: Lower In Asia

Gold is ~$10/oz lower, printing ~$1,935/oz at writing. The precious metal has backed away from Tuesday’s best levels ($1,950.1/oz) in Asia-Pac dealing, with the move lower facilitated by U.S. real yields edging away from three-month lows.

- Gold continues to trade at elevated levels as worries rise re: the economic impact of the latest round of western sanctions on Russia, with a reduction in market expectations re: the pace of Fed tightening during ’22 evident in recent sessions (just under 25bp of tightening is now priced for the March FOMC, with a cumulative ~125bp of tightening priced for calendar ‘22 i.e. 5x 25bp rate hikes). Note that Fed Chair Powell is due to testify on the Hill later today (as well as on Thursday).

- The technical outlook remains bullish, resistance for gold is seen at $1,974.3/oz (Feb 24 high). Support is situated some distance away, at $1,878.4 (Feb 24 low and key short-term support).

OIL: Fresh Eight-Year Highs In Asia As Sanctions On Russia Bite

WTI and Brent are ~$5.00 higher at typing, back from best levels after briefly showing above $109.00 & $111.00, respectively, with crude registering another round of fresh cycle highs during Asia-Pac hours. Both benchmarks have caught a strong bid as it becomes clear to participants that western sanctions on Russia have had a larger than expected impact on Russian crude exports.

- To elaborate, Russia’s Ural oil grade trades at discounts to Brent not witnessed in the post-Soviet era, as several buyers have opted to avoid Russian oil altogether despite relevant carve-outs and exceptions in the current range of western sanctions. Reuters source reports have quoted traders in the U.S. as saying that “people are not touching Russian barrels”, citing concerns that they did not want to be seen as “buying Russian products and funding a war against the Ukrainian people.”

- Elsewhere, the IEA announced a release of 60mn bbls of crude from strategic stockpiles on Tuesday, but this has done little to curb rises in oil prices, keeping in mind that global oil consumption is estimated to be over 90mn bpd.

- The latest round of U.S. API inventory reports crossed on Tuesday, with reports pointing to a surprise drawdown in U.S. crude stocks, a wider than expected drawdown in gasoline stocks, as well as a drawdown in stocks at the Cushing hub. Meanwhile, there was a modest, surprise build in gasoline stocks..

- Looking ahead, EIA data is due later on Wednesday (1530GMT).

- OPEC+ meets later today as well, with the group set to stick to its pre-prescribed cumulative output increase of 400K bpd in April (keeping in mind that some members continue to face well-documented issues in hitting production quotas).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 02/03/2022 | 0855/0955 | ** |  | DE | unemployment |

| 02/03/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/03/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2022 | 1000/1100 |  | EU | ECB Schnabel at BMAS roundtable | |

| 02/03/2022 | 1100/1200 |  | EU | ECB de Guindos Q&A at Universidad Carlos III | |

| 02/03/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/03/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/03/2022 | 1400/0900 |  | US | Chicago Fed's Charles Evans | |

| 02/03/2022 | 1430/0930 |  | US | St. Louis Fed's James Bullard | |

| 02/03/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 02/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 02/03/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/03/2022 | 1600/1700 |  | EU | ECB Lane lecture at Hertie School Berlin | |

| 02/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/03/2022 | 1830/1830 |  | UK | BOE Tenreyro speech to Economic Research Council | |

| 02/03/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 02/03/2022 | 2000/2000 |  | UK | BOE Cunliffe speech at Oxford Union | |

| 02/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.