-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: What Will The Latest (Near) Minsk Meeting Bring?

EXECUTIVE SUMMARY

- UKRAINE'S DELEGATION HAS LEFT FOR SECOND ROUND OF TALKS WITH RUSSIA, OFFICIAL SAYS (RTRS)

- EQUITY INDEX PROVIDERS REMOVE RUSSIA FROM INDICES

- RUSSIA CLASSED AS JUNK AT ALL 3 MAJOR CREDIT RATING AGENCIES

- LANE: ECB WILL DO WHAT’S NEEDED FOR ECONOMY AMID UKRAINE WAR (BBG)

- ECB'S CENTENO WARNS OF 'STAGFLATION' FROM RUSSIA-UKRAINE CONFLICT (RTRS)

- BOE'S CUNLIFFE: RUSSIA CRISIS WILL ADD TO RISKS FROM RATES SHIFT (RTRS)

- BOE'S TENREYRO: UKRAINE INVASION WORSENS UK INFLATION TRADE-OFF (RTRS)

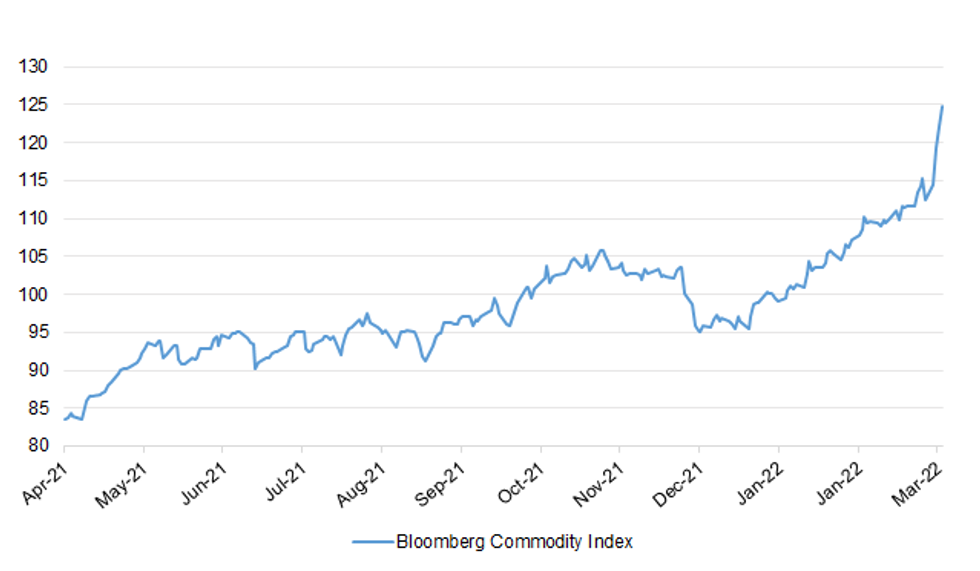

Fig. 1: Bloomberg Commodity Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Deputy Governor Jon Cunliffe said the crisis triggered by Russia's invasion of Ukraine would add to risks in financial markets which have already been made volatile by a shift to higher interest rates. "The heightened perception of geopolitical risks, and the potential impacts on growth and inflation, can only increase risks around the adjustment away from riskier assets that is already underway," Cunliffe said. "And this comes during a period of relatively low market liquidity," he said in a speech at Oxford Union debating society on Wednesday. (RTRS)

BOE: The surge in energy prices caused by Russia's invasion of Ukraine will hurt British economic growth as well as raising short-term inflation pressures, Bank of England policymaker Silvana Tenreyro said on Wednesday. Tenreyro said it was too soon to know how the trade-off would play out, and that policymakers would begin to review this at March's Monetary Policy Committee meeting and when the BoE next updates its forecasts in May. "Recent developments will intensify the terms of trade shock that we were already experiencing, so will push up inflation and have a negative impact on activity. How exactly? That's the job we will start next week," she said at a discussion hosted by Britain's Economic Research Council. (RTRS)

BOE: MNI INSIGHT: BOE’s Falling Energy Price Scenario Fades Away

- Bank of England policymakers are once again placing more weight on their central inflation forecast, after the Russian invasion of Ukraine rendered a more optimistic alternative scenario based on a fall in energy prices in line with market expectations much less relevant - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

EUROPE

ECB: The European Central Bank is closely monitoring the economic consequences of the war in Ukraine and will do whatever’s necessary to support the continent’s rebound from the pandemic as the impact becomes clearer, according to Chief Economist Philip Lane. In his final public remarks before the weeklong quiet period that precedes ECB policy meetings, Lane said Russia’s invasion and the latest record euro-zone inflation reading, released earlier Wednesday, will be taken into account in upcoming economic projections. (BBG)

ECB: European Central Bank Governing Council member Mario Centeno warned on Wednesday that Russia’s invasion of Ukraine could lead to a combination of low growth and high inflation, known as stagflation, in Europe. “There are stagflation scenarios in front of us,” he said at an event in Lisbon. “It will obviously depend on the duration of the conflict and the more or less concerted response (in fiscal policy) of the Europeans.” (RTRS)

IRELAND: Growth in the country's service sector picked up strongly in February, as the recovery from the pandemic gained momentum following the lifting of Covid-19 restrictions. The AIB Services PMI rose sharply to 61.8 from 56.2 in January and 55.4 in December. Readings above 50 indicate overall rises in activity. The latest reading signalled the fastest increase in service sector output since last October. The month-on-month acceleration in growth was the sharpest on record, according to the data. (RTE)

U.S.

FED: The U.S. economy expanded at a modest to moderate pace from mid January through mid February while inflation pressures broadened and employers continued to struggle to find workers, a Federal Reserve report showed on Wednesday. The mixed picture illustrated in the U.S. central bank's latest survey of business contacts across the country mirrors wider economic data that showed a booming jobs market and resilient economic activity in January despite a surge in COVID-19 cases, inflation running at a 40-year high, and a scramble for workers with wages rising at the fastest pace in many years. Worryingly, there appeared few indications that price pressures will soon ease with rising input costs felt across a range of industries. "Prices charged to customers increased at a robust pace across the nation...firms reported they expect additional price increases over the next several months as they continue to pass on input cost increases," the Fed said in its survey, known as the "Beige Book," which was conducted across its 12 districts through Feb. 18. (RTRS)

FED: MNI: NY Fed's Logan - Administered Rates To Rise With Fed Funds

- The Federal Reserve will likely keep its administered rates at similar ranges relative to the federal funds rate when the central bank lifts interest rates later this month, New York Fed's market chief Lorie Logan said Wednesday, suggesting it is possible higher interest rates could cause the overnight reverse repo facility to grow in the short-term - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: St. Louis Fed Model Signals 450k Gain For Feb Jobs

- U.S. employment likely rose by 450,000 in February as measured by the BLS's household survey, according to St. Louis Fed economist Max Dvorkin's analysis of real-time employment data from scheduling software company Homebase. Annual revisions to the BLS's population estimates at the start of the year complicate how to read the model's output for February. The St. Louis Fed model had undershot the better-than-expected January jobs report, but the improvement in the household survey at the start of the year largely reflected a 1 million increase in U.S. population and less so the growing share of employed people, Dvorkin said. Using January as a base, the model expects a seasonally adjusted increase of 1.5 million employed for February. But with December as a base, the model sees a 184,000 decline in employed. "My personal forecast is in between these two numbers," Dvorkin said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

OTHER

BOJ: MNI INSIGHT: BOJ Fears Inflation Will Erode Demand Bounce-Back

- Bank of Japan officials are worried that consumption will receive much less of a boost than previously expected from pent-up demand as Covid restrictions are lifted, and higher food and energy prices resulting from the Russian invasion of Ukraine erode purchasing power, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: Bank of Japan policy makers are increasingly emphasizing the significance of higher wages in a possible effort to tamp down speculation that a bump in inflation will prompt moves to pare back stimulus. “I don’t think that simply hitting 2% inflation is sufficient,” Junko Nakagawa, one of nine board members, said in a speech Thursday, referring to the central bank’s price stability goal. “We are aiming for a virtuous economic cycle where wages and inflation rise in a sustainable manner.” (BBG)

RBA: MNI INTERVIEW: RBA's Harper Says Wages Need 4% Growth

- Reserve Bank of Australia board member and academic Ian Harper says that wages growth needs to be “about 4%” to drive inflation sustainably within the RBA’s target range and create the conditions for interest rates to rise - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

NEW ZEALAND: The cooling real estate market took its toll on Barfoot & Thompson's sales in February, with the number of sales and average and median selling prices all falling sharply. The real estate agency, which is by far the largest in the Auckland market, sold just 750 residential properties in February, down from 801 in January and 911 in December. It was also exactly a third less (-33.3%) than the 1124 properties Barfoots sold in February last year. Prices were also lower with the median selling price declining for the third month in a row to $1,122,500 in February, which is $117,500 (-9.4%) lower than its November 2021 peak of $1,240,000. The average selling price declined for the second month in a row to $1,196,036, down by $82,611 (-6.5%) from its December peak of $1,278,647. Underscoring the slowness of the market was the fact that the total number of residential properties the agency had available for sale at the end of February (4385) was at its highest level for any month of the year since April 2019. (Interest NZ)

SOUTH KOREA: Minor South Korean presidential candidate Ahn Cheol-soo halted his campaign and threw his support to the main conservative candidate Yoon Suk-yeol, a move that could increase the chances of the right-leaning bloc winning next week’s election. The race for the March 9 election has been neck-and-neck between Yoon of the People Power Party and progressive Lee Jae-myung of the ruling Democratic Party. Final polls published Wednesday showed them both in the 40% range, with Yoon slightly ahead and conservative Ahn at about 10%. “We’ve decided to come together for the change of presidential power,” Ahn said Thursday at a news conference alongside Yoon. “We are now in the same boat.” (BBG)

CHINA/TAIWAN: Three Chinese warships sailed 50 nautical miles southeast of Taiwan’s Lanyu Island after 10 p.m. Wednesday, Taipei-based Central News Agency reports, citing unidentified people from the military. The ships left and had entered the Bashi Channel as of 8am Thursday. It was the third time Chinese ships were seen off Lanyu this week. Taiwan’s navy is closely monitoring the situation, CNA reports. (BBG)

MEXICO: Mexico’s central bank cut its growth forecast by almost a full percentage point for this year, saying that the Covid-19 pandemic and geopolitical conflicts has deteriorated the economic outlook for the country. Banxico, as the central bank is known, sees gross domestic product expanding by 2.4% for this year, down from the 3.2% seen in its previous report three months ago. For 2023, it’s expected to reach 2.9%, according to the bank’s quarterly inflation report released Wednesday. Growth rates in Mexico continue to lag behind those seen in the U.S., despite a boom in demand from its biggest trading partner. The country narrowly dodged recession in the fourth quarter amid supply chain snarls and a lack of fiscal stimulus. (BBG)

MEXICO: Central bank Deputy Governor Jonathan Heath said he suggested a 75bp hike to Mexico’s key rate, but made clear he voted in favor of the 50 bp rise. A firm, consistent monetary posture is needed, Heath said in response to a question during the central bank’s quarterly report. (BBG)

RUSSIA: A Ukrainian delegation has departed for a second round of talks with Russia, Ukrainian presidential adviser Mykhailo Podolyak told Reuters on Wednesday. Earlier Russian news agencies reported that Russia's negotiators expect Ukrainian officials to arrive in Belarus to kick off the next round of peace negotiations on Thursday morning. As Russian forces laid siege to major Ukrainian cities on the seventh day of the invasion, Podolyak said he could not confirm the delegation's route for security reasons. After nearly a week, Russia has yet to achieve its aim of overthrowing Ukraine's government, but has, according to the Ukrainian emergency service, killed more than 2,000 civilians and destroyed hospitals, kindergartens and homes. Moscow denies targeting civilians and says it aims to disarm Ukraine, a country of over 40 million people, in a "special military operation". (RTRS)

RUSSIA: Russian forces appear to have become more aggressive in their targeting of infrastructure inside Kyiv, which has seen an increase of missile and artillery strikes, as well as throughout the country, a senior U.S. official said on Wednesday. (RTRS)

RUSSIA: Russia's ministry of defence has claimed 498 of its troops have been killed in Ukraine and a further 1,597 wounded - the first time it has admitted any casualties from its invasion of Ukraine. Major General Igor Konashenkov rejected reports about "incalculable losses" as "disinformation", as he revealed Russia's own count of military casualties in Ukraine for the first time since the attack began last Thursday. However, Ukraine's presidential advisor puts the figure much higher and claims more than 7,000 Russian troops have been killed. The advisor also said hundreds of Russian soldiers - including senior officers - have been taken as prisoners of war. More than 2,000 civilians have so far died in a week of war with Russia, according to Ukraine's state emergency service. Sky News has not been able to independently verify these numbers. The ministry also said more than 2,870 Ukrainian soldiers and "nationalists" have been killed, and about 3,700 wounded. (Sky)

RUSSIA: An unidentified missile struck a Bangladeshi vessel docked at the Ukrainian port of Olvia on the northern Black Sea, setting it a blaze and killing an engineer on board, the ship owner said. The vessel wasn’t carrying any cargo and had 29 crew on board. “The missile set the vessel ablaze, but it was not clear which side fired the missile - Russian or Ukrainian,” said Pijush Dutta, executive director of Bangladesh Shipping Corp. (BBG)

RUSSIA: The U.S. military said on Wednesday it will postpone a scheduled test launch of a Minuteman III intercontinental ballistic missile, in a bid to lower soaring tensions after Russia announced it was putting its nuclear forces on high alert. (RTRS)

RUSSIA: US Secretary of Defense Lloyd Austin said in an interview, “any rhetoric about the employment of nuclear weapons is dangerous.” Austin was asked if he has seen any actions backing up President Vladimir Putin’s recent statements regarding Russia’s nuclear weapons. (CNN)

RUSSIA: Russia’s government is “throttling Twitter, Facebook, and Instagram platforms that tens of millions of Russia’s citizens rely on to access independent information and opinions and to connect with each other and the outside world,” U.S. State Department spokesperson Ned Price said in a statement. Price added that “these partial blockages further limit where and how Russian citizens can see and share evidence of the truth of Russia’s invasion of Ukraine.” (BBG)

RUSSIA: Russia's foreign ministry on Wednesday denied reports Moscow had expelled the American ambassador, saying it was working on a response to the U.S. decision to kick out 12 Russian diplomats at the United Nations mission, RIA news agency said. (RTRS)

RUSSIA: The United Nations General Assembly on Wednesday overwhelmingly voted to reprimand Russia for invading Ukraine and demanded that Moscow stop fighting and withdraw its military forces, an action that aims to diplomatically isolate Russia at the world body. The resolution, supported by 141 of the assembly's 193 members, passed in a rare emergency session called by the U.N. Security Council while Ukrainian forces battled to defend the port of Kherson in the face of air strikes and a devastating bombardment that forced hundreds of thousands of people to flee. (RTRS)

RUSSIA: Four Russian fighter jets briefly entered Swedish territory over the Baltic Sea on Wednesday, the Swedish Armed Forces said, sparking a swift condemnation from Sweden's defence minister. Two Russian SU27 and two SU24 fighter jets briefly entered Swedish airspace east of the Swedish island of Gotland in the Baltic Sea, Sweden's Armed Forces said in a statement, adding that Swedish JAS 39 Gripen jets were sent to document the violation. "The Russian violation of Swedish airspace is of course completely unacceptable," Defence Minister Peter Hultqvist told news agency TT. "It will lead to a firm diplomatic response from Sweden. Swedish sovereignty and territory must always be respected." (RTRS)

RUSSIA: The United States on Wednesday took aim at Russia's oil refining sector with new export curbs and targeted Belarus with sweeping new export restrictions, as the Biden Administration amps up its crackdown on Moscow and Minsk over the invasion of Ukraine. The new round of sanctions, announced by the White House, ban the export of specific refining technologies, making it harder for Russia to modernize its oil refineries. The White House also applied a sweeping set of export restrictions levied against Russia last month to Belarus, arguing the controls would help prevent the diversion of items, including technology and software, in the defense, aerospace, and maritime sectors to Russia through Belarus. "The United States will take actions to hold Belarus accountable for enabling Putin's invasion of Ukraine, weaken the Russian defense sector and its military power for years to come, target Russia’s most important sources of wealth, and ban Russian airlines from U.S. airspace," the White House said. (RTRS)

RUSSIA: The Biden administration is considering following Canada in barring Russian ships from U.S. ports, a government official said on Wednesday. A White House spokeswoman said no decision has been made. (RTRS)

RUSSIA: Congress is weighing imposing massive tariffs on imports from Russia by revoking Permanent Normal Trade Relations status the country achieved after joining the World Trade Organization in 2012. Senator Ron Wyden, the chairman of the Senate Finance Committee that oversees trade bills, introduced draft legislation to revoke PNTR for Russia. If passed, the bill would allow the imposition of tariffs far above currently allowable levels. The U.S. has historically imported raw materials from Russia including iron, steel and minerals in addition to oil and gas. (BBG)

RUSSIA: The United States will continue to address potential sources of “leakages” in the sweeping sanctions imposed on Russia over its invasion of Ukraine, U.S. Treasury Secretary Janet Yellen said on Wednesday during a visit to Chicago. Sanctions imposed last Sunday and Monday have so far restricted 80% of the Russian banking sector’s assets and “immobilized” about half of the Russian central bank’s assets, she said. (RTRS)

RUSSIA: The U.S. Department of State tweeted the following remarks from the U.S. Secretary of State Blinken on Wednesday: “Today, we are also imposing sweeping sanctions on Russia’s defense sector. All told, these sanctions and restrictions have had a powerful effect on Russia’s economy. The value of President Putin’s “war fund” has vanished.” (MNI)

RUSSIA: Russia will face further sanctions from the international community if it does not change course from its invasion of Ukraine, German Finance Minister Christian Lindner said on Wednesday after talks with European counterparts. "We will step up the pressure if the Russian leadership does not change course," Lindner said in a statement, adding the Russian economy was already feeling the impact of measures taken so far. "We should also take steps to prevent listed individuals and institutions from switching to unregulated crypto assets," he said, adding that war and sanctions would affect energy prices and supply chains in Europe but that it was prepared. (RTRS)

RUSSIA: The EU is discussing measures to prevent the use of cryptocurrencies to circumvent the sanctions on Russia as the bloc seeks to ensure its penalties hit the country’s financial system. Bruno Le Maire, the finance minister of France, which holds the EU’s rotating presidency, said steps were under consideration to “further increase the effectiveness” of the sanctions and avoid any circumvention of the measures. He spoke in a news conference after an emergency meeting of finance ministers to discuss the impact of the war in Ukraine and evaluate the effectiveness of the sanctions as well as their economic impact. (FT)

RUSSIA: UK cabinet minister Michael Gove is drawing up plans to seize British property owned by Russian oligarchs with links to President Vladimir Putin, without paying them compensation. Ukrainians fleeing their homeland could be housed in the lavish UK residences of oligarchs hit with sanctions under the proposals discussed by Gove, the levelling-up secretary, and other ministers, according to government insiders. Boris Johnson, UK prime minister, who was accused by Labour on Wednesday of failing to take sufficient action against Putin’s allies following his invasion of Ukraine, is said to be supportive of Gove’s plans to seize the land and property of sanctioned oligarchs. The proposals are likely to require legislation, and government lawyers have concerns the plans would be subject to legal challenges because they would undermine UK property rights. No final government decision has been reached on whether to proceed. (RTRS)

RUSSIA: Four New Zealand government-backed investment funds are to exclude Russian Federation sovereign debt and the securities of majority Russian state-owned enterprises. The New Zealand Superannuation Fund, Accident Compensation Corporation, Government Superannuation Fund and National Provident Fund said today they will sell their directly-held assets as market conditions allow. But they may continue to invest in companies domiciled in Russia. A number of KiwiSaver investment providers said they had already pulled out of their Russian investments in light of Russia declaring war on Ukraine. The four funds said their actions were in accordance with their responsible investment policies. (NZ Herald)

RUSSIA: Japan’s Government Pension Investment Fund, the world’s largest pension fund, said it’s checking the details of announcements by index firms, following MSCI and FTSE Russell’s decisions to cut Russian stocks from their indexes. When changes to indexes are made, in general the managers who handle GPIF’s assets will buy and sell based on those adjustments, spokeswoman Naori Honda says. Honda says the fund can’t comment on individual investments, but is continuing to gather information about the investing environment. (BBG)

RUSSIA: Kinross Gold Corp. will suspend its Russian operations, joining a slew of companies that have shunned business with the country following its invasion of Ukraine. The Canadian gold miner said it is suspending all activities at its Udinsk development project, and is also in the process of suspending operations at its Kupol mine, according to a statement on Wednesday. Russia accounted for almost a quarter of the company’s 2021 revenue. While natural resources have so far not been hit with direct sanctions,, traders, banks and shipowners are increasingly avoiding business with Russia. They’re concerned about getting embroiled in banking sanctions, worried that new measures will include commodities and fear reputational damage from trading with Vladimir Putin’s regime. Kinross said it would donate $1 million to the Canadian Red Cross Ukraine Humanitarian Crisis Appeal to assist those people most in need. (BBG)

RUSSIA: Alcoa Corp., the largest U.S. aluminum producer, said it will stop selling products to Russian companies and halt raw-material purchases from the country in response to the invasion of Ukraine. The decision makes Alcoa one of the world’s first major aluminum makers to shun Russia. Although the war on Ukraine has no direct impact on Alcoa’s business, Chief Executive Roy Harvey on Tuesday told investors the Pittsburgh-based company was assessing what to do about aluminum sales to Russian companies. (BBG)

RUSSIA: The Russian Central Bank is cutting reserve requirements for the country's banks, a move that could help shore up the balance sheets of Russian lenders as they grapple with Western sanctions. In a statement released late Wednesday Moscow time, the central bank said it was lowering an array of mandatory reserve ratios, effective Thursday. The measures will cumulatively lower banks' reserve obligations by 2.7 trillion rubles, or around $26 billion at current exchange rates, the central bank said. (WSJ)

RUSSIA: Russia is to suspend some budget rules relating to the use of extra oil and gas budget revenues in 2022, the finance ministry said in a statement on Wednesday. Russia has a policy of replenishing its state reserves by buying foreign currency on the domestic market when oil prices are high, creating downside pressure on the rouble. (RTRS)

RUSSIA: Trading on Moscow Exchange's stock section will remain largely closed on Thursday although a limited range of operations will be available, the central bank said in a statement. The central bank said it would make a statement about future operations on the exchange before 0600 GMT on Friday. (RTRS)

RUSSIA: FTSE Russell and MSCI are removing Russian equities from all their indexes, the equity index providers said on Wednesday. FTSE Russell said the decision will be effective from March 7, while MSCI said its decision will be implemented in one step across all MSCI indexes as of the close on March 9. MSCI also said it is reclassifying MSCI Russia Indexes from emerging markets to standalone markets status. (RTRS)

RUSSIA: Russia's central bank has imposed a 30% commission on foreign currency purchases by individuals on currency exchanges, brokers told Reuters, citing a letter from the regulator. The central bank has not immediately replied to a request for comment. (RTRS)

RUSSIA: Regulators are preparing for a possible closure of the European arm of Russia's second-largest bank, VTB Bank, amid growing concerns about the impact of Western sanctions on the bank following the invasion of Ukraine, according to two sources familiar with the matter. VTB Bank's European operations could be closed within days by regulators in Germany, where it chiefly operates on the continent, one person with direct knowledge of the situation said. The second source said BaFin, the German regulator, was on "high alert", monitoring the situation closely and ready to act if needed although no final decision had been taken. (RTRS)

RUSSIA/RATINGS: Moody's downgrades Russia's ratings to B3; ratings remain on review for further downgrade

RUSSIA/RATINGS: Fitch Downgrades Russia to 'B'; on Rating Watch Negative

IRAN: Rafael Grossi, the head of the International Atomic Energy Agency U.N. nuclear watchdog, will visit Iran on Saturday, a news agency affiliated with Iran's top security body reported on Wednesday. "If Grossi's trip could help the agency and Tehran to reach a roadmap to resolve existing safeguard issues, it can help revival of the nuclear deal in Vienna," Nournews, the security body, said in its report, without citing a source, referring to efforts to revive Iran's 2015 nuclear deal with major powers. (RTRS)

CHINA

INFLATION: China should pay close attention to the pressure of rising material costs in manufacturing and insufficient consumption amid soaring global commodity prices, said the 21st Century Business Herald in an editorial. It is however capable of ensuring food and energy security, the newspaper said. Global oil and gas prices may continue to rise after setting new records if geopolitical risks persist, as global crude oil inventories are already at very low levels and supply capacity is limited, the newspaper said. The risk of global recession will increase as major economies may encounter stagflation, the newspaper said. (MNI)

PROPERTY: The housing market is likely to see a significant rebound in March and April, especially in first- and second-tier cities amid looser housing regulations to boost home sales, the Securities Daily reported citing Zhang Dawei, chief Analyst of Centaline Property. Nearly 50 cities across the country have released different degrees of easing policies, with 15 cities lowering down payment ratio, the newspaper said. Lowering down payment is a substantive relaxation to stimulate the market in third- and fourth-tier cities, and bigger cities may follow, the newspaper said citing Yan Yuejin, director of E-house China Research and Development Institution. (MNI)

EQUITIES: Many European and American family offices are increasing their holdings of A-shares, taking yuan assets as an important safe-haven investment tool, the 21st Century Business Herald reported citing analysts. The low valuation of A-shares, along with China’s stable economic fundamentals, strong yuan and loose monetary policy amid the Russia-Ukraine conflict are attracting more global investors, the newspaper said citing unnamed sources. The proportion of yuan assets invested by many family offices in Europe and the U.S. is only 3-4%, which may rise to 8-10% with the risk-averse nature of yuan assets increasing, the newspaper said. (MNI)

OVERNIGHT DATA

CHINA FEB CAIXIN SERVICES PMI 50.2; MEDIAN 50.7; JAN 51.4

CHINA FEB CAIXIN COMPOSITE PMI 50.1; JAN 50.1

The Caixin China General Services Business Activity Index came in at 50.2 in February, down from 51.4 the previous month but still in expansionary territory. Over the past month, Covid-19 flare-ups in several regions had a relatively large impact on the services sector. Demand for services contracted, while supply expanded at a limited pace. The spread of Covid-19 in several regions hurt business operations of service companies. The business activity index managed to remain in expansionary territory in February, but fell to its lowest point in six months. The Covid flare-ups had a larger impact on demand than on supply. The gauge of total new business fell into contractionary territory in February for the first time in six months. Surveyed enterprises said the latest wave of the pandemic also impacted foreign trade, with new export business contracting for the second straight month in February. The job market for services continued to shrink. The resurgence of Covid and the largely weakened market demand took a toll on the labor market. The measure of employment remained in negative territory for the second month in a row, though the rate of contraction was limited. Impacted by the epidemic and weakening market demand, outstanding business rose only slightly. Input costs and prices charged both continued to rise. Input costs of service enterprises grew at the slowest pace since August. High prices of raw materials and energy, as well as high labor costs, put pressure on suppliers in the services sector, which passed along a portion of their higher costs to customers. As a result, prices charged rose further. The gauge of input costs was higher than the gauge of prices charged, indicating the survival pressure facing service enterprises. Market sentiment remained positive. Companies in the services sector grew more confident that the domestic epidemic will be kept under control. The measure of future activity expectations rose further into positive territory, hitting its highest in three months. (IHS Markit)

JAPAN FEB, F JIBUN BANK SERVICES PMI 44.2; FLASH 42.7

JAPAN FEB, F JIBUN BANK COMPOSITE PMI 45.8; FLASH 44.6

Japanese service sector firms reported that activity fell at a sharp pace in the face of the latest surge in COVID-19 infections related to the Omicron variant. Both activity and new business declined at the sharpest pace since last August, when the Japanese economy was dampened by the Delta variant of COVID-19. Firms made attempts to stimulate demand by engaging in price discounting measures for the first time in six months, despite a renewed acceleration in average cost burdens. Service providers remained confident regarding the outlook for activity however, with employment levels rising for the first time since last October and optimism strengthening from the previous survey period. Overall private sector activity fell midway through the first quarter, and at the quickest rate since last August. The aforementioned reduction in services activity was coupled with a renewed reduction in manufacturing output which was the first for five months. Concerns surrounding intensifying price pressures remained elevated, with aggregate input prices rising at the fastest pace since August 2008, amid raw material shortages continued to hinder demand. Private sector firms continued to report optimism regarding the year-ahead outlook, however, as firms expected the pandemic to recede and stimulate a recovery in demand in line with easing restrictions. As a result, IHS Markit estimates the Japanese economy will expand 2.9% in 2022. (IHS Markit)

JAPAN FEB CONSUMER CONFIDENCE INDEX 35.3; MEDIAN 35.0; JAN 36.7

AUSTRALIA FEB, F MARKIT SERVICES PMI 57.4; FLASH 56.4

AUSTRALIA FEB, F MARKIT COMPOSITE PMI 56.6; FLASH 55.9

Australia’s service sector exhibited a strong rebound in February, according to the IHS Markit Australia Services PMI, as the Omicron wave subsided. At the same time, the easing of international border restrictions in late-February also boosted demand and activity and is expected to continue supporting the recovery. That said, price pressures surged to record levels in February, though not entirely a surprise given the unleashing of the pent-up demand as COVID-19 disruptions eased. Supply and manpower constraints had a part to play as well, however, and it will be important to see these issues smoothened or result in persistent price pressures. Business confidence improved once again in February, which was a positive sign, though it has some way to go before returning to a level above the series average. (IHS Markit)

AUSTRALIA JAN BUILDING APPROVALS -27.9% M/M; MEDIAN -3.0%; DEC +9.8%

AUSTRALIA JAN PRIVATE SECTOR HOUSES -17.5% M/M; DEC -0.3%

AUSTRALIA JAN TRADE BALANCE +A$12.891bN; MEDIAN +A$9.050BN; DEC +A$8.824BN

AUSTRALIA JAN EXPORTS +8% M/M; MEDIAN +6%; DEC +1%

AUSTRALIA JAN IMPORTS -2% M/M; MEDIAN +3%; DEC +5%

NEW ZEALAND FEB ANZ COMMODITY PRICE INDEX +3.9% M/M; JAN +1.0%

SOUTH KOREA Q4, P GDP +4.2% Y/Y; MEDIAN +4.1%; Q3 +4.1%

SOUTH KOREA Q4, P GDP +1.2% Q/Q; MEDIAN +1.1%; Q3 +1.1%

SOUTH KOREA 2021 GDP +4.0% Y/Y; MEDIAN +4.0%; PREV +4.0%

CHINA MARKETS

PBOC NET DRAINS CNY190 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY190 billion after offsetting the maturity of CNY200 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:24 am local time from the close of 2.0078% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday vs 44 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3016 THURS VS 6.3351

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3016 on Thursday, compared with 6.3351 set on Wednesday.

MARKETS

SNAPSHOT: What Will The Latest (Near) Minsk Meeting Bring?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 206.45 points at 26599.48

- ASX 200 up 34.74 points at 7151.4

- Shanghai Comp. down 6.51 points at 3477.682

- JGB 10-Yr future down 42 ticks at 150.79, yield up 2.8bp at 0.168%

- Aussie 10-Yr future down 9.0 ticks at 97.83, yield up 9.0bp at 2.165%

- U.S. 10-Yr future +0-06 at 127-15, yield down 2.59bp at 1.851%

- WTI crude up $3.80 at $114.40, Gold down $2.9 at $1925.77

- USD/JPY up 12 pips at Y115.64

- UKRAINE'S DELEGATION HAS LEFT FOR SECOND ROUND OF TALKS WITH RUSSIA, OFFICIAL SAYS (RTRS)

- EQUITY INDEX PROVIDERS REMOVE RUSSIA FROM INDICES

- RUSSIA CLASSED AS JUNK AT ALL 3 MAJOR CREDIT RATING AGENCIES

- LANE: ECB WILL DO WHAT’S NEEDED FOR ECONOMY AMID UKRAINE WAR (BBG)

- ECB'S CENTENO WARNS OF 'STAGFLATION' FROM RUSSIA-UKRAINE CONFLICT (RTRS)

- BOE'S CUNLIFFE: RUSSIA CRISIS WILL ADD TO RISKS FROM RATES SHIFT (RTRS)

- BOE'S TENREYRO: UKRAINE INVASION WORSENS UK INFLATION TRADE-OFF (RTRS)

BOND SUMMARY: JGBs Twist Flatten, U.S. Tsys richen Slightly

Tsy Futures have pulled back from best levels, with crude oil futures also back from their fresh multi-year highs (crude still prints ~$4/bbl firmer on the day), after showing higher in early Asia trade. Cash Tsys run 1-4.5bp richer on the day, bull steepening, while TYM2 hovers around the middle of its overnight range, last +0-05 at 127-14. It was difficult to ascertain an outright driver of price action when it came to the early bid in the space, perhaps worry re: stagflation risk as oil surged again, perhaps some post-Powell short cover in thin liquidity. Headline flow was light in Asia, with markets remaining on the lookout for any developments surrounding the Ukraine-Russia conflict (note the latest meeting between delegations from the two coutnies is due to take place on Thursday). Looking ahead, the NY docket will be headlined by the ISM services PMI print, with weekly jobless claims data, Challenger job cuts, factory orders and final durable goods readings also due. On the Fedspeak front, Chair Powell will appear on the Hill again, while NY Fed President Williams and Richmond Fed President Barkin (’24 voter) will also speak.

- Cash JGBs run 3bp cheaper to 2bp richer, twist flattening, with 7s leading the cheapening, while 30+-Year rallied in the wake of a smooth round of 30-Year JGB supply. The auction saw the low price top broader dealer expectations, while the tail saw a very modest widening as the cover ratio moderated (slipping below the 6-auction average of 3.27x). We would suggest that some of the uncertainties we flagged ahead of the auction e.g. oil prices and questions surrounding global central bank dynamics in ’22, may have limited overall demand, but the pricing of the auction was firm enough, with demand generated by the well-documented recent steepening/cheapening in the space. Futures saw an extension of their overnight losses, but retraced from their early afternoon lows, hitting the bell -40. Early Price auction was dominated by spill over from Wednesday’s weakness in U.S. Tsys. Local headline flow was dominated by BoJ board member Nakamura reiterating the need for persistent monetary easing (with a focus on promoting wage growth, in addition to achieving the BoJ’s inflation target), while flagging the potential for a temporary approach towards the BoJ’s 2% price goal, given the wider inflationary dynamics in play at present.

- The uptick in U.S. Tsys since the Asia re-open has provided some light spill over support for the ACGB space, leaving YM & XM -9.0 at the bell, with the contracts moving away from their early Sydney trough. Local data saw much softer than expected building approvals data and a wider than expected headline monthly trade surplus (on firmer than expected exports and softer than expected imports). Cross-market demand may have been in play post-Powell (after some apparent hesitance in the wake of the recent vol.), with the AU/U.S. 10-Year spread tightening below 30bp, before nudging away from session tights.

JGBS AUCTION: Japanese MOF sells Y721.1bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y721.1bn 30-Year JGBs:

- Average Yield 0.893% (prev. 0.788%)

- Average Price 95.45 (prev. 97.86)

- High Yield: 0.895% (prev. 0.788%)

- Low Price 95.40 (prev. 97.85)

- % Allotted At High Yield: 32.1513% (prev. 90.1222%)

- Bid/Cover: 3.118x (prev. 3.447x)

JAPAN: Light Net Weekly Investment Flows Seen

Weekly international security flow data revealed relatively limited net flows when it comes to Japanese investors' participation in foreign assets, with a flip to light net selling of foreign bonds (for a 4th week in 5, with the one exception in that period seeing marginal net purchases), while there was a return to net buying of foreign equites, also for the 4th time in 5 weeks. Meanwhile, foreign investors flipped to selling of Japanese bonds, while registering the largest round of weekly net sales of Japanese stocks since December.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -332.9 | 18.0 | -2318.4 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 110.1 | -55.5 | 430.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -223.2 | 943.1 | 113.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -402.3 | -260.8 | -924.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Mostly Higher In Asia

Most major Asia-Pac equity indices are firmer at writing, following a positive lead from Wall St. The broad move higher was facilitated by comments from Fed Chair Powell on Wednesday, as he backed a measured 25bp rate hike in March. Lingering inflation/stagflation worry remained evident throughout the session, with high-beta stocks struggling once again. Commodity-linked stocks led gains across the region as commodities continued to rally in Asia, led by the major crude benchmarks, which hit another round of fresh cycle highs early in the session.

- The ASX200 was 0.5% better off, closing higher for a fifth consecutive session. The commodities-sensitive index has caught a strong bid on the well-documented widespread surge in commodity prices, with the ASX200’s materials and energy sub-indices 2.6% higher on the day, while the energy sub-group is ~8.6% firmer week-to-date.

- The CSI300 was the sole loser amongst major regional indices, sitting 0.3% worse off at writing. A broad rally in the energy (+1.8%) and utilities (+1.2%) sub-indices was unable to offset declines in the richly valued consumer staples sub-index (-2.0%), with steep losses seen in large cap liquor stocks such as Kweichow Moutai Co (-2.5%) and Luzhou Laojiao (-4.4%).

- U.S. e-mini equity index futures are virtually unchanged overnight after paring earlier losses.

OIL: Fresh Highs As Near-Term Alternatives To Russian Crude Remain Limited

WTI is +$3.20 and Brent is +$3.60 at typing, backing away from best levels after registering fresh cycle highs for a third consecutive day during early Asia dealing. Both benchmarks remain strongly bid, with the well-documented lack of demand for Russian energy exports set to further hamper wider global crude supply in ’22 (Russian crude export volumes are estimated to be ~5mn bpd) pushing the price of the major benchmarks higher (while Russian crude trades at an ever widening discount).

- Spot and front month prices for Brent and Middle Eastern grades of crude continue to rise against longer dated contracts, with deepening backwardation evident on the aforementioned shunning of Russian supply.

- EIA data released on Wednesday pointed to a decline in U.S. crude inventories (compared to Platts median estimates calling for an increase, although Tuesday’s API inventory estimates reportedly revealed a sharper drawdown than the EIA reading) while there were smaller than expected declines in gasoline and distillate stocks. Crude stocks at the Cushing hub declined as well, reaching levels not witnessed since Sep ’18.

GOLD: Flat In Asia

Gold sits virtually unchanged in Asia, printing ~$1,928/oz at writing, in very limited dealing. The precious metal sits clear of Wednesday’s trough (~$1,915/oz), as worry surrounding the Russia-Ukraine conflict re: inflation/stagflation lingers.

- To recap, gold closed ~$15/oz lower on Wednesday, as U.S. real yields moved away from multi-month lows. This dynamic was aided by Fed Chair Powell outlining his preference for a 25bp rate hike in March despite economic uncertainty re: Ukraine. Furthermore, Powell pointed to a series of rate hikes, while also signaling openness to deploying 50bp hikes later in ‘22 if inflation remains elevated.

- Looking to technical levels, conditions remain bullish for the yellow metal. Resistance is situated at $1,950.1/oz (Mar 2 high), while support is seen at $1,878.4/oz (Feb 24 low and key short-term support).

FOREX: Fedspeak & Russian Invasion In Focus

The familiar themes of cautious Fedspeak on policy tightening and the ongoing war in Ukraine remained front and centre in Asia. Risk sentiment got some reprieve as Fed Chair Powell expressed support for a measured, quarter-point rate hike in March, but continued geopolitical turmoil in Eastern Europe kept fuelling concerns about energy supply.

- Scandinavian FX came under pressure amid regional contagion risk. Press reports suggested that the Kremlin has asked Finland and Sweden for security guarantees amid their increasingly assertive military posture and growing alignment with NATO.

- The AUD and CAD gained in tandem with most regional equity indices and crude oil prices. Meanwhile, USD and CHF drew support from continued geopolitical jitters in Europe.

- EUR/GBP went offered, slid through the 2020 low and printed its worst levels since late Dec 2019.

- Spot USD/CNH has held a tight range, edging away from session highs after a slightly weaker than expected PBOC fix. China's central bank set the USD/CNY reference rate at CNY6.3016, 19 pips above sell-side estimate.

- U.S. durable goods orders, factory orders & weekly jobless claims, EZ unemployment & Services PMI readings from across the globe take focus from here.

- Central bank speaker slate features Fed's Powell, Williams & Barkin, BoC's Macklem, ECB's de Cos & Riksbank's Skingsley. The ECB will publish the minutes from last month's policy meeting.

FOREX OPTIONS: Expiries for Mar03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1075(E609mln), $1.1100-20(E994mln), $1.1200(E1.2bln), $1.1320-40(E855mln), $1.1350(E1.1bln), $1.1370-75(E1.2bln)

- USD/JPY: Y115.00-10($1.1bln), Y116.00-05($598mln)

- AUD/USD: $0.7250(A$741mln)

- USD/CAD: C$1.2585-00($511mln)

- USD/CNY: Cny6.3000($825mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/03/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 03/03/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 03/03/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/03/2022 | 1000/1100 | ** |  | EU | unemployment |

| 03/03/2022 | 1000/1100 | ** |  | EU | PPI |

| 03/03/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/03/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 03/03/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 03/03/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/03/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/03/2022 | 1500/1000 | ** |  | US | factory new orders |

| 03/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 03/03/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 03/03/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 03/03/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/03/2022 | 1630/1130 |  | CA | BOC Governor Macklem speech, "Economic Progress Report." | |

| 03/03/2022 | 2030/1530 |  | CA | BOC Governor Macklem testifies at House committee. | |

| 03/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2300/1800 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.